Robotic Surgical Procedures Market Size, Share & COVID-19 Impact Analysis, By Application (General Surgery, Gynecology, Urology, Orthopedics, and Others), Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

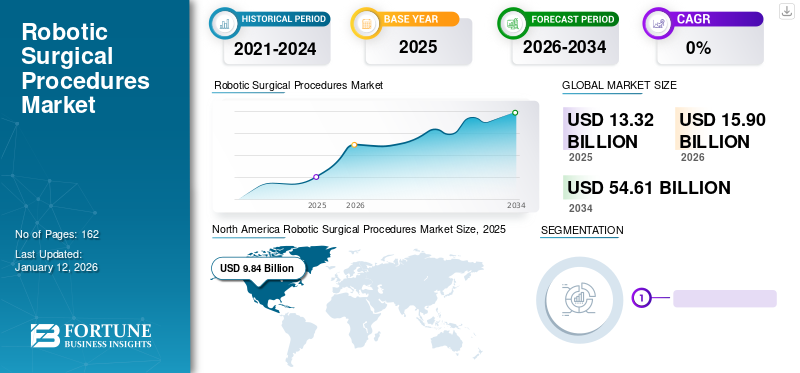

The global robotic surgical procedures market size was valued at USD 13.32 billion in 2025. The market is projected to grow from USD 15.9 billion in 2026 to USD 54.61 billion in 2034, exhibiting a CAGR of 16.68% in the 2026-2034 period. North America dominated the robotic surgical procedures market with a market share of 73.89% in 2025. Based on our analysis, the global market will exhibit a huge decline of -14.3% in 2020. The global impact of COVID-19 has been unprecedented and staggering, with robotic surgical procedures witnessing a negative demand shock across all regions amid the pandemic. The sudden rise in CAGR is attributable to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

Robotic surgery, also known as robot-assisted surgery, aids surgeons in performing different types of complex procedures with more precision, flexibility, and control. It is commonly associated with minimally invasive procedures. This procedure can be performed solely or simultaneously with traditional open surgery, depending upon the situation at hand. Recent technological advancements in surgical robots have propelled the shift of healthcare professionals and patients from traditional surgery to robotic surgical procedures for immediate treatment.

For instance, according to the National Centre for Biotechnology Information, in the U.S., an estimated 175,000 umbilical hernia repair surgeries are performed each year using surgical robots. This, along with the globally increasing prevalence of other chronic disorders including prostate cancer, cardiovascular diseases, and others, is one of the major factors anticipated to boost the adoption of these procedures during the forecast period.

Cancellation of Elective Surgical Procedures during COVID-19 Pandemic to Hinder Growth

The COVID-19 pandemic harmed the robotic surgical procedures market due to the cancellation or postponement of elective surgeries in major countries. According to the research study by CovidSurg Collaborative, based on 12 weeks of peak disruption in hospital services, an estimate of 28 million elective surgeries globally were cancelled or postponed due to the outbreak of coronavirus.

Also, the sales of surgical robots have been severely affected due to lockdowns in several countries, resulting in the disruption of supply chains. Additionally, few key market players have reported a decline in their revenues as compared to the previous year due to a reduction in the volume of elective robotic surgeries. For instance, Intuitive Surgical reported a decline of -6.0% in its first half of 2020 revenues as compared to the previous year due to the impact of COVID-19.

Global Robotic Surgical Procedures Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 13.32 billion

- 2026 Market Size: USD 15.9 billion

- 2034 Forecast Market Size: USD 54.61 billion

- CAGR: 16.68% from 2026–2034

Market Share:

- Region: North America dominated the market with a 73.89% share in 2025. This is attributed to the higher prevalence of chronic diseases, the surging adoption of advanced surgical devices, and the presence of favorable reimbursement policies for robotic surgical procedures.

- By Application: General Surgery held the largest market share in 2025. The segment's dominance is driven by the increasing number of procedures such as hysterectomy, nephrectomy, and cardiac valve repair performed using robotic systems, along with adequate reimbursement policies in both developed and emerging countries.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific market, growth is driven by the changing dynamics of its lucrative healthcare market and the realigning of reimbursement policies to support the adoption of robot-assisted procedures.

- United States: The market is fueled by a very high volume of procedures, with an estimated 175,000 umbilical hernia repair surgeries performed annually using surgical robots. Growth is also supported by continuous innovation and FDA approvals for new systems, such as Intuitive Surgical's da Vinci SP system for urology.

- China: The market is expanding due to a rising patient pool for chronic diseases, a modernizing healthcare infrastructure, and increasing awareness and adoption of minimally invasive surgical techniques, creating a high-demand environment for robotic systems.

- Europe: The market is propelled by an increasing number of patients with urological and orthopedic disorders. The launch of advanced surgical systems, such as the da Vinci X, which offers robotic-assisted technology at a comparatively lower cost, has also been a key factor in driving adoption across the region.

LATEST TRENDS

Download Free sample to learn more about this report.

Key Players Entering the Market by Adopting Inorganic Growth Strategies to be Observed as a Prominent Trend

The recent trends have reported increasing instances of mergers & acquisitions between manufacturers of medical robots. This allows players to explore the untapped markets, reduce entry barriers, and create awareness, which would further result in the increasing number of robotic surgical procedures, rapid growth of the market, and introduction of new technologies and applications.

- For instance, in March 2019, Smith & Nephew acquired Brainlab, a company that develops software-driven medical technology. It provides surgeons with digital workflow tools, from pre-operative planning to intraoperative navigation and postoperative evaluation. This acquisition was done in order to expand Smith & Nephew‘s surgical specialties.

Additionally, several market players have developed strong distribution networks through agreements and partnerships with local dealers and hospitals in emerging and developed countries in order to establish their foothold in the global market. Thus, such initiatives by players are expected to boost the adoption of surgical robots globally and subsequently propel the robotic surgical procedures market growth during the forecast period.

DRIVING FACTORS

Increasing Prevalence of Chronic Disorders to Result in Patients Undergoing Surgical Procedures

The rising prevalence of chronic diseases including cancer, cardiovascular diseases, and orthopedic disorders is presenting a large pool of patients undergoing surgical procedures globally. Additionally, the increasing number of geriatric patients with chronic diseases, and the rapid adoption of sedentary lifestyle, is a major factor primarily responsible for age and lifestyle-related chronic disorders. It is subsequently increasing the demand for robotic surgical procedures for emergency treatment.

- For instance, according to the World Health Organization (WHO), the global incidence of prostate cancer in 2018 was estimated to be around 1.3 million and in 2019, nearly 1.2 million new cases were reported. Also, the statistics and forecasts suggest that by 2025, there will be 1.5 million new prostate cancer cases globally. This is projected to drive the number of patients undergoing prostatectomy surgeries during the forecast period.

Hence, the increasing number of patients undergoing surgical procedures, and the rising adoption of surgical robotic systems, are some of the major factors estimated to boost the number of robot-assisted surgical procedures being performed globally during the forecast period.

Introduction of Advanced Robotic Surgical Systems by Key Players to Thrive Market Growth

The increasing adoption of robotic surgical systems globally due to factors, such as favorable reimbursement policies and growing awareness among healthcare professionals and patients for minimally invasive surgeries have attracted new players to enter the market. Also, established players, such as Intuitive Surgical and Stryker, are constantly focusing on innovation and upgrading their portfolios with new and advanced product offerings.

- For instance, in June 2018, Intuitive Surgical announced that the U.S FDA approved its Da Vinci SP system for urology. This approval allowed surgeons to perform a single-port approach in procedures requiring narrow access including urological procedures.

The introduction of such technologically advanced and innovative systems and favorable reimbursement policies for surgeries performed using surgical robots globally are resulting in the increasing shift of healthcare providers toward robot-assisted surgery for various indications.

RESTRAINING FACTORS

Higher Acquisition and Maintenance Cost of Robotic Surgical Systems to Limit Adoption in Emerging Countries

Robotic surgical systems are associated with higher acquisition and maintenance costs. For instance, the annual service and maintenance cost of the Da Vinci surgical system ranges from USD 100,000 to USD 150,000. Additionally, several clinical studies suggest that the cost of robotic surgical procedure is comparatively higher by an estimated USD 3,000 to USD 6,000 than the cost of a similar procedure performed by laparoscopy technique.

The primary reason for the comparatively higher pricing of these procedures is the additional cost of consumables per procedure for robotic systems. Hence, the high cost of the robotic system and the comparatively higher costs of its maintenance are among the major factors restraining the growth of the global market.

SEGMENTATION

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

General Surgery Segment to Dominate the Market during 2025-2032

On the basis of application, the market is segmented into general surgery, gynecology, urology, orthopedics, and others. The general surgery segment held the dominating share of 32.02% in 2026 owing to the increasing number of hysterectomy, nephrectomy, and cardiac valve repair procedures using robotic systems, and the presence of adequate reimbursement policies for these procedures in developed, as well as emerging countries.

The orthopedics segment is anticipated to grow at a higher CAGR during the forecast period owing to the increasing prevalence of orthopedic disorders and the introduction of surgical robots specially designed for such surgeries.

The urology and gynecology segments are expected to register a significant CAGR during the forecast period owing to the large patient population suffering from these disorders and the growing demand for robotic surgeries for urgent treatment.

REGIONAL INSIGHTS

North America Robotic Surgical Procedures Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The robotic surgical procedures market size in North America dominated the market with a valuation of USD 9.84 billion in 2025 and USD 11.58 billion in 2026. The dominance of the region is attributable to the higher prevalence of chronic diseases, surging adoption of advanced devices, and the presence of favorable reimbursement policies for robotic surgical procedures in the U.S. and Canada. The U.S. market is projected to reach USD 9.84 billion by 2026.

Europe is anticipated to register a significant CAGR during the forecast period owing to the increasing number of patients with urological and orthopedic disorders. In addition, the launch of advanced surgical systems in the European market is estimated to further enhance the growth. The UK market is projected to reach USD 0.17 billion by 2026, while the Germany market is projected to reach USD 0.19 billion by 2026.

For instance, in April 2017, Intuitive Surgical announced that its da Vinci X surgical system received CE approval in Europe. This new system was intended to offer some of the most advanced robotic-assisted surgery technology to surgeons and hospitals of Europe at a comparatively lower cost.

The market in Asia Pacific is expected to register a higher CAGR during the forecast period. The changing dynamics of lucrative markets in Japan, China, and India, and the realigning reimbursement policies for robot-assisted procedures in these counties are primarily responsible for the rapid growth of the region. The Japan market is projected to reach USD 0.52 billion by 2026, the China market is projected to reach USD 0.51 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

The rest of the world accounted for a comparatively lower robotic surgical procedures market share owing to the presence of lesser awareness among the population regarding robot-assisted surgeries.

KEY INDUSTRY PLAYERS

Intuitive Surgical Held a Dominant Share of the Market in 2024

In terms of revenue, the market for robotic surgical procedures is solely dominated by Intuitive Surgical owing to its diversified product offerings, strong brand image, and wide distribution networks in developed and emerging countries. Also, few other market players are adopting inorganic growth strategies, namely, joint ventures and acquisition of other companies in order to gain high market shares during the forecast period.

- For instance, in October 2018, Stryker entered into a strategic partnership with Synaptive Medical and Ziehm Imaging with an aim to fortify its position in surgical guidance.

Additionally, new entrants, such as avateramedical GmbH, and CMR Surgical Ltd., & are focusing on introducing advanced and cost-effective robotic systems in the market, which is expected to increase the adoption of robotic surgeries. It will subsequently strengthen their market positions during the forecast period. Other players operating in the market are Stryker Corporation, Zimmer Biomet, Accuray Incorporated, Smith & Nephew, Johnson & Johnson Services, Inc., and Medtronic.

LIST OF KEY COMPANIES PROFILED:

- Intuitive Surgical (Delaware, United States)

- Stryker (Michigan, United States)

- Smith & Nephew (London, United Kingdom)

- ZIMMER BIOMET (Warsaw, United States)

- Accuray Incorporated (Sunnyvale, U.S.)

- CMR Surgical Ltd. (Cambridge, United Kingdom)

- avateramedical GmbH (Jena, Germany)

- Johnson & Johnson Services, Inc. (New Brunswick, United States)

- Medtronic (Dublin, Ireland)

- Other Prominent Players

KEY INDUSTRY DEVELOPMENTS:

- February 2020- Medtronic acquired Digital Surgery, a London-based developer of artificial intelligence (AI), data, and analytics in order to strengthen the company’s robotic-assisted surgery platform.

- May 2017 – Intuitive Surgical launched its new da Vinci System i.e. da Vinci X in the market. It was capable of performing surgical procedures such as hernia repair, prostatectomy, and benign hysterectomy at lower costs.

REPORT COVERAGE

The market research report provides an in-depth analysis of the market and focuses on key aspects such as renowned companies and leading applications of the product. Besides this, it offers insights into the market dynamics and highlights key industry developments. In addition to the aforementioned factors, the report encompasses market trends that have contributed to the growth of the market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Application

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 13.32 billion in 2025 and is projected to reach USD 54.61 billion by 2034.

In 2025, the North American market value stood at USD 9.84 billion.

The market will exhibit steady growth at a CAGR of 16.68% during the forecast period (2026-2034).

By application, the general surgery segment will lead the market.

The rising prevalence of chronic disease and the introduction of advanced and innovative robotic surgical systems by market players are the key drivers of the market.

Intuitive Surgical, Stryker, and Medtronic are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us