Seed Treatment Market Size, Share & Industry Analysis, By Type (Synthetic Chemicals, and Biologicals), By Function (Seed Protection and Seed Enhancement), By Application Technique (Seed Coating, Seed Dressing, and Seed Pelleting), By Stage of Seed (On-Farm and Off-Farm), By Crop Type (Cereals, Oilseeds, Fruits and Vegetables, and Others), and Regional Forecast, 2026-2034

Seed Treatment Market Size & Demand

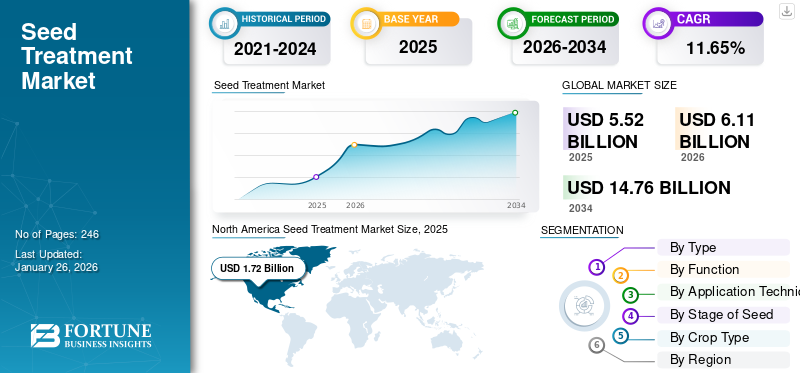

The global seed treatment market size was valued at USD 5.52 billion in 2025 and is projected to grow from USD 6.11 billion in 2026 to USD 14.76 billion by 2034, exhibiting a CAGR of 11.65% during the forecast period. North America dominated the seed treatment market with a market share of 31.10% in 2025.

Seed treatment, a novel and recent concept in agricultural inputs, has transformed the agricultural industry from a single-product paradigm to a systemic approach that addresses multiple challenges affecting crop yield and quality. Increasing sustainable agricultural practices and sustainable farming practices are additionally contributing to the adopt the seed treatment practices globally. The growth potential of the treated seeds remains promising in the matured markets of developed economies that are transitioning toward adequate, sustainable, and systemic products. Moreover, the future growth of the global market is expected to emerge from the development of novel solutions that are effective, economical, and assist in enhancing crop production. BASF SE, Bayer AG, UPL Ltd., and Corteva Agriscience are prominent players operating in the global market.

MARKET DYNAMICS

Market Drivers

Escalating Need to Increase the Crop Yield Owing to Increased Spending on Food

A robust increase in agricultural production primarily fuels the global industry. According to the Government of India, the agriculture sector accounts for 18.8 % of the Country's Gross Value Added (GVA) in 2021-22 and has experienced flexible growth in the past two years. It grew 3.9% in 2021-22 and 3.6% in 2020-21. The significant increase in producing agricultural products can be attributed to introducing new technologies, product innovations, and process enhancements in the farm sector.

The modern seed treatment consists of novel active substances and formulations, which provide long-lasting and broad-spectrum control of pests and diseases. Further, these new seed treatment products are precisely blended and consist of several active ingredients, different wetting agents, colorants, and sometimes bird repellents, which are strictly tested for their safety to the seed, the grower, and the environment. Thus, the modern seed treatments are safe for the growers and the environment in addition to their targeted pest control approach. Thus, these products are expected to meet efficacy, safety, and environmental standards.

Enabling Policy and Regulatory Framework to Reduce the Disease and Enhance Productivity

The global seed treatment market growth is fueled by the public sector's support for agricultural policies and efforts to make agriculture more lucrative. Governments and regulatory authorities around the globe have concretized their efforts toward their agrarian sector, which is already heavily subsidized in some agri-dependent emerging markets. The governments of different developed and developing economies have realized the importance of treating seeds to ensure optimum crop emergence. Compared to the foliar application of other conventional inputs, treating the seeds with synthetic or biological solutions is a well-targeted method for reducing the disease and enhancing the yield.

Market Restraint

Low Awareness and Modern Technological Challenges to Hinder the Market Growth

The major restraint for the market growth is its sub-optimal utilization in countries where it can play a pivotal role in yield enhancement and crop protection. Farmers in many developing countries are unaware of different aspects of treating the seeds. Modern agricultural challenges demand innovative solutions from eco-friendly inputs to protect and improve commodities. Moreover, producers must exercise greater caution about not mixing the biologicals with the products, drastically reducing the effectiveness of such solutions. The dominance of traditional crop protection methods and their wider availability among cultivators can crowd out the novel treated seeds released in the marketplace.

Market Opportunity

Rise in Demand for Biological Solutions to Provide Opportunity for Market Growth

The increasing need for biological solutions following trends of sustainable agriculture is a new opportunity in the market. They are a major leap forward in terms of the transition from chemical methods of crop protection and in terms of the new sourcing of crop inputs that will be embraced by farmers and consumers alike. Biological seed treatments derived from naturally occurring microbes, plant extracts, or beneficial bacteria offer a choice for seed protectants that can protect seed and foster healthy development, without depending on toxic chemicals.

Seed Treatment Market Trends

Incorporation of Innovative Technologies to Replace Manual Involvement

The focus of most agricultural policymakers is on organic and related integrated farming systems. This route to sustainability generally ignores the needs of conventional farming systems on the most fertile agricultural land. However, there has been analysis regarding the effects of national and international policy environments on innovation strategies of companies developing products in the areas of pesticides, such as insecticides and fungicides, biotechnology, and seeds, which could potentially reduce the environmental impact of all farming systems. Latest technologies such as controlled-release formulations, micro-encapsulation, and advanced polymers have been offering significant results for treatments to obtain more reliable performance in the fields, have multiple beneficial outcomes in one seed application, and adhere better to seeds. Technology has also offered traditional biological solutions, such as beneficial microbes, which help naturally enhance root development and plant health.

Download Free sample to learn more about this report.

Impact of Tariffs on the Market

U.S. tariffs on farm imports and counter-tariffs by trading partners have transformed the agricultural sector landscape. The trade measures have caused price instability, disrupted export markets, and strained alliances with major trading partners such as China, Mexico, and the EU. As per the International Food Policy Research Institute, the tariffs can result in a 3.3%-4.7% contraction of international agricultural trade and a decrease in international GDP by 0.3%-0.4%. Additional expenses related to raw materials, equipment, and shipping through tariffs can contribute to increased prices for seed treatment materials, impacting farmers and consumers. Trade disruptions also tend to cause supply chain problems and shifts in market forces, which may advantage some areas but damage others.

SEGMENTATION ANALYSIS

By Type

Synthetic Chemicals Hold the Largest Market Share Owing to the High Cost of GMO Seeds

Based on type, the market is segmented into synthetic chemicals and biologicals.

The synthetic chemical segment is projected to dominate the seed treatment market by type, accounting for 77.74% of the global market share in 2026. Synthetic chemicals are fungicides or insecticides applied to seeds to control seeds and seedlings from diseases. The synthetic chemicals segment is expected to witness a strong sales performance over biological treatment as it takes less time to control plant diseases and pests, making it the leading segment in the market. Several automatic treatment machineries with high accuracy are available, making them less labor-intensive. The high cost of genetically modified seeds is a significant factor in the demand for and growth of chemical treatments. Plants grown from seeds treated with resistance-inducing chemicals like salicylic acid, jasmonic acid, and others exhibit long-lasting effects on protection across the different developmental stages of crops.

The biological treatment segment is projected to exhibit substantial growth as this treatment is made up of renewable resources that contain naturally occurring active ingredients that offers protection against soil-borne pathogens, improve abiotic stress, and increase plant growth.

To know how our report can help streamline your business, Speak to Analyst

By Function

Seed Protection to Experience the Highest Growth Owing to Competitive Cost and Reduced Application Efforts

By function segment, the market is segmented into seed protection and seed enhancement.

The seed protection segment is expected to lead by function, contributing 72.18% globally in 2026. The seed protection segment is anticipated to witness the fastest growth as it provides a complete protection solution against various plant stressors in a single product that is grower-friendly, crop-friendly, and environmentally responsible. Moreover, compared to conventional crop protection products, seed protection treatments offer competitive costs, reduce application efforts, and saves time.

The growing popularity of physical seed enhancements is an alternative approach to other chemical treatments, which provide a better solution in the seed market and are expected to impact the market's growth. Magnetic field treatments are considered practical seed enhancement tools for horticultural crops; however, their application is limited to large-scale. Magnetic fields and ionizing radiations are the most favorable pre-sowing seed treatments among physical methods.

By Application Technique

Early Protection of Crop from Foliar Infection Drives the Seed Dressing Technique’s Growth

Based on application technique, the market is segmented into seed coating, seed dressing, and seed pelleting.

Seed dressing is the fastest growing segment, allowing the seed to germinate quicker than non-treated seeds. Seed dressings promote early relations with beneficial soil microorganisms, such as mycorrhizae, which help nutrient absorption. It controls seed infection and protects the crop from foliar infection, thereby reducing the disease pressures later in the season, making in-crop fungicides more effective, and reducing potential loss of yield and quality during grain fill.

Seed coating segment is projected to remain dominant by application technique, accounting for 53.52% of the global market share in 2026. Rising incidences of seed diseases that undesirably affect the overall crop growth and health are leading to an aggregate demand for seed coating ingredients to safeguard them from the attack of pests and other harmful microorganisms in the soil environment.

By Stage of Seed

Increasing Tolerance to Abiotic Stress Boosts the On-Farm Treatment Utilization

By the stage of the seed segment, the market comprises on-farm and off-farm.

In off-farm treatment is the leading segment due to the easy availability of seeds to the farmers and the manual mixing of pesticides saves time. Along with this, using already treated seeds helps in fueling agricultural productivity.

The on-farm segment is witnessing significant global demand due to an effective approach to alleviate adverse seedbed conditions such as soil crusting and limited soil moisture. On-farm treatment offers more substantial photosynthetic potential to plants which are tolerant to abiotic stresses.

By Crop Type

Cereals to Exhibit Highest Proportion in the Market due to their Rising Application in the Food Industry

Based on crop type, the market is segmented into cereals, oilseeds, fruits & vegetables, and others.

The cereals segment is expected to lead by crop type, holding 46.32% of the global market share in 2026, owing to the government's strong focus on food security in developing markets. Moreover, the demand for cereals is rising as they have a wide range of applications in the food industry.

Oilseeds are gaining significant traction in recent years as urbanization increases in developing countries, dietary habits, and traditional meal patterns are expected to shift toward processed foods, which increases the demand for vegetable oils. According to the OECD-FAO Agricultural Outlook 2021-2030, India is expected to uphold a high per capita vegetable oil consumption growth of 2.6% per year, reaching 14 kg per capita by 2030, necessitating a high import growth of 3.4% per year.

Seed Treatment Market Regional Outlook

Geographically, the global market report covers analysis across North America, Europe, Asia Pacific, South America, and Middle East & Africa.

North America

North America Seed Treatment Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America accounted for USD 1.72 billion in 2025. It is primarily driven by favorable agro-economic conditions, homogeneity in terms of intensification level and farmer profile, and a wide range of agro-climatic zones and crops. The U.S. and Canadian marketplaces seek to address the mounting challenge of optimizing natural resources and managing increasing labor costs. Treated seeds are poised to contribute to the efforts to address the challenges as mentioned earlier due to its high productivity while reducing the use of agrochemicals. Key players in the market have been focusing on expanding their biological range of seed treatment in order to meet the rising demand. For instance, in December 2024, UPL Corp., a comprehensive and sustainable agricultural solutions provider, launched NIMAXXA, a bionematicide. The new product is a triple-strain bionematicide seed treatment for season-long nematode protection in soybeans and corn, registered by the U.S. Environmental Protection Agency. The U.S. market reaching USD 1.61 billion by 2026.

Europe

The regional market for treated seeds in Europe is mainly driven by its robust demand, especially in Western Europe, which exhibits a proportionally high level of agrochemical usage compared to the plantation area. Seeds treated with solutions are predicted to contribute to resistance management and ease operational complexity. Central and Eastern Europe have high potential for intensifying demand as these regions lack technological interventions, which is further aggravated by irregular weather patterns and natural constraints. The region has been experiencing a growing shift towards integrated pest management and biological solutions, with farmers increasingly seeking eco-friendly alternatives to traditional chemical treatments, fueling the demand for biological seed treatments. Manufacturers operating in the region have been focusing on expanding their biological range in order to meet the rising demand. For instance, in October 2023, Syngenta AG, a global agricultural technology company, strengthened its focus on biologicals. It expanded its seed treatment leadership by opening its first biologicals service center at The Seedcare Institute in Maintal, Germany. The new centre would address growing farmer demand across the EU for biological seed treatment solutions. The UK market reaching USD 0.14 billion by 2026 and the Germany market reaching USD 0.34 billion by 2026.

Asia Pacific

The Asia Pacific market is expected to showcase the fastest growth rate compared to the global average. China and India are key markets, combining to dominate the Asia Pacific seed treatment market. The region has witnessed a steady demand for seed treatment in recent years, owing to the increasing modernization of agriculture and rising food demand. The region's production scenario for staples such as wheat and rice remains favorable. The seeds treated with pesticides are utilized to increase the productivity of such major crops, even in marginal land with low agricultural inputs. The region is also expected to contribute considerably to the global organic agriculture sector. The agricultural sector remains essential to individuals' livelihoods and global economic stability. Demand and consumption of crops for food, feed, and fuel proliferate, resulting in the surging need for increased crop yields. Moreover, the emergence of biodegradable seed coatings is expected to offer significant growth opportunities for players in this market. The Japan market reaching USD 0.09 billion by 2026, the China market reaching USD 0.46 billion by 2026, and the India market reaching USD 0.14 billion by 2026.

South America

The demand for seed-treated solutions is increasing in Brazil and Argentina in South America. Soybeans, corn, rice, beans, and sorghums are commodities whose seeds are increasingly being treated with chemical and biological solution blends, owing to their wider acceptance in the region. The chemicals segment offers early-season control, while microbial treatment exhibits extended control as it colonizes the developing roots. Moreover, the on-farm segment is expected to grow faster due to biological viability and stability factors.

Middle East & Africa

The demand for treated seed in the Middle East & Africa is anticipated to grow significantly. Increased tolerance to biotic and abiotic stresses makes the seed protection segment popular in the region. It is not only the dominating functionality associated with the treated seeds, but is also expected to exhibit faster growth in the upcoming years. Insecticides followed by fungicides are broadly utilized, with seed dressing being the most common method. Key players in the market have been focusing on expanding their business in the region and meet the rising demand for seed treatment. For instance, in May 2022, Corteva Agriscience invested in a new Centre for Seed Applied Technologies (CSAT) laboratory in Rosslyn, Pretoria. The new facility would utilise industry-leading equipment and focus specifically on recipe development and safety testing of seed-applied solutions, and meet the ongoing demands of grain producers across Africa Middle East.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Portfolio Expansion by Prominent Market Players to Support Market Growth

The global seed treatment market is moderately consolidated, with global agrochemical companies and established local players competing for market share. Syngenta AG is one of the major players with a huge clientele base, serving its products globally. The company is focused on new product innovation and expanding its market base to strengthen its market presence. For instance, in November 2023, Syngenta Canada Inc. launched Cruiser Maxx Vibrance Potato, a new insecticide and fungicide for potato seed treatment. The new product offers protection against pests and diseases.

Other key players, such as BASF SE, Bayer AG, UPL Ltd., and Corteva Agriscience, are focusing on strategic mergers, acquisitions, and partnerships to gain a further competitive landscapemarket . The entrance of niche players in the market contributes to intensifying competition, positively impacting the market's growth.

Key Players in the Seed Treatment Market

|

Rank |

Company Name |

|

1 |

Syngenta AG |

|

2 |

BASF SE |

|

3 |

Bayer AG |

|

4 |

UPL Ltd |

|

5 |

Corteva Agriscience |

List of Seed Treatment Companies Profiled

- Syngenta AG (Switzerland)

- BASF SE (Germany)

- Bayer AG (Germany)

- UPL ltd. (India)

- Corteva Agriscience (U.S.)

- NuFarm Ltd. (Australia)

- FMC Corporation (U.S.)

- Sumitomo Chemical Co., Ltd. (Japan)

- Croda Int. PLC (U.K.)

- Germain's Seed Technology, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2024 - Syngenta Vegetable Seeds inaugurated a new Seed Health Lab in Hyderabad, India. The inauguration strengthened the company’s continued investment in quality control capabilities, and the facility is one of the world's most advanced seed testing facilities.

- February 2024 - Locus Agriculture, an agricultural biological company, launched six new biological treatments to its Rhizolizer Duo product line, which included three in-furrow biologicals for corn, cotton, and legumes, and three seed treatments for wheat and cereals, soybeans, and corn.

- October 2023 - Corteva, Inc., an American company, launched Straxan, a fungicide seed treatment in Canada. The new product is a ready-to-use, easy-to-apply formulation targeting prominent seed and soil-borne diseases.

- August 2022 - BASF and Poncho Votivo announced a partnership with the Field of Dreams Movie Site, a famous cornfield in the U.S. With broad-spectrum insect control and strong nematode protection, Poncho Votivo delivers higher yields.

- May 2022 – Syngenta launched a new seed treatment product, VICTRATO. The new product helps to control nematodes and soil-borne fungal diseases, increasing the quality and yield of many crops, including soybeans, corn, cereals, cotton, and rice.

REPORT COVERAGE

The global seed treatment market report analyzes the market in depth and highlights crucial aspects such as market trends, market dynamics, prominent companies, and distribution channels. Besides this, the market statistics report also provides insights into the global market analysis and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.65% over 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Type

By Function

By Application Technique

By Stage of Seed

By Crop Type

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the value of the market size is projected to grow from USD 6.11 billion in 2026 to USD 14.76 billion by 2034.

At a CAGR of 11.65%, the global market will exhibit steady growth over the forecast period (2026-2034).

By function, the seed protection segment leads the market.

North America holds the largest market share in 2024.

The positive offering of seed treatment products to farmers, such as protecting high-value seeds and reducing the usage of active chemical ingredients, is expected to drive the market.

Key trends include the rise of integrated pest management practices, increased investment in R&D for innovative seed treatment formulations, and the incorporation of technologies like seed coating and dressing that enable early-stage crop protection.

The high cost of genetically modified seeds is shaping the industry.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us