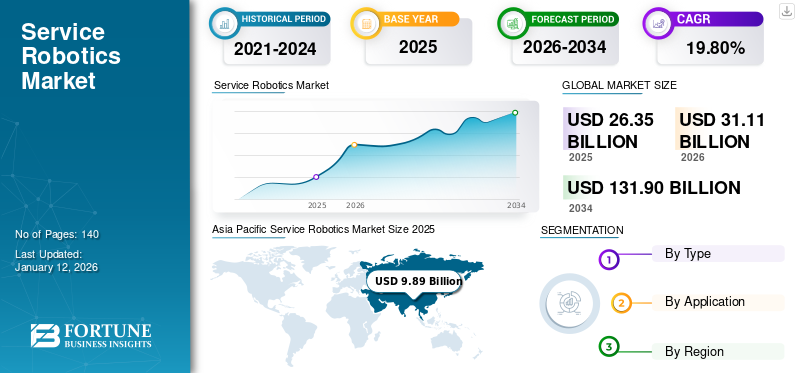

Service Robotics Market Size, Share & Industry Analysis, By Type (Professional and Personal) By Application (Domestic and Industrial/Commercial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global service robotics market size was valued at USD 26.35 billion in 2025 and is projected to grow from USD 31.11 billion in 2026 to USD 131.9 billion by 2034, exhibiting a CAGR of 19.80% during the forecast period. Asia Pacific dominated global market with a market share of 37.50% in 2025.

Service robots are machines that help humans by performing useful tasks for them. They are majorly classified as robots used for professional use and personal use. Further, according to application, they are categorized as domestic and industrial. The domestic segment consists of all the robots used for personal applications and indoor uses. The use of IoT-based devices in homes and the introduction of precise and more affordable home-use robots are the reasons behind the increasing adoption of domestic robots across geographies. The industrial/commercial segment deals with the equipment used in the industrial environment to perform industry-related tasks. Constant efforts toward the inculcation of automation at industrial facilities and reducing the expenditure on labor wages by reducing human intervention in industrial operations are driving the growth of this market.

Global Service Robotics Market Overview

Market Size:

- 2025 Value: USD 26.35 billion

- 2026 Value: USD 31.11 billion

- 2032 Forecast Value: USD 131.9 billion

- CAGR (2026–2034): 19.80%

Market Share:

- Regional Leader: Asia Pacific dominated the market in 2025 with a value of USD 9.89 billion.

- This growth is driven by expanding industrial automation, rising demand for logistics and medical service robots, and strong adoption in countries like Japan, China, and India.

- The professional robot segment led the market in 2026 due to widespread deployment in logistics, healthcare, defense, and construction.

Industry Trends:

- Integration of AI and machine learning into service robotics enhances autonomous navigation and task execution.

- Surge in demand for warehouse and delivery robots due to the growth of e-commerce and logistics automation.

- Increased use of service robots in hospitals for tasks such as disinfection, patient assistance, and medication delivery.

- Expanding adoption of cleaning and sanitation robots in commercial and public infrastructure post-pandemic.

Driving Factors:

- Labor shortages and rising labor costs in developed and emerging economies are pushing automation across sectors.

- Advancements in edge AI, sensors, and mobility systems improve robot performance and cost-efficiency.

- Governments and private investors are boosting R&D spending in robotics, particularly in Asia Pacific.

- The COVID-19 pandemic accelerated the need for contactless, autonomous service solutions in healthcare, retail, and logistics.

Furthermore, these robots find their applications in transportation & logistics, medical, defense, construction & demolition, agriculture, and retail sectors.

COVID-19 IMPACT ON SERVICE ROBOTICS INDUSTRY

Outbreak of COVID-19 Pandemic to Create High Demand for Medical Robots

The global market was subject to a considerable decrease in market growth due to the repercussions of economic downfall across numerous prominent countries. However, increasing demand for automation and increased social distancing practices across the globe were the two sustaining factors for the development of the sales of service robots during the pandemic. After the COVID-19 pandemic period, the introduction of robot-based operations and the advancement of automation increased the demand for industrial robotics to increase integration automation across industries.

An evolution of this technology and the application of Artificial Intelligence (AI) and Big Data systems in robotics is collectively spurring the demand for service robots throughout the forecast period. Further, post COVID-19 the incorporation of technologically advanced robots with robust built quality is projected to attract heavy demand, especially from the healthcare and hospitality sectors.

Service Robotics Market Trends

Download Free sample to learn more about this report.

Inception of Intuitive Technologies in Robotics Solutions to Accelerate Market Growth

Technological advancement is exponentially expanding the capabilities of service robots and has increased their ability to carry out multiple tasks in minimum duration.

The adoption of these robots across a diverse range of sectors such as healthcare, defense, logistics, agriculture, and others has radically changed the workflow process.

For instance, the deployment of service robots in the healthcare sector has allowed surgeons to perform minimally invasive surgeries. These robots are used as tools to achieve more precise incisions or movements that are difficult for human hands to achieve. For instance, a U.S. based medical device company, Johnson & Johnson’s launched a new robot-assisted surgical system for laparoscopic application as well as open surgery in 2020.

Service Robotics Market Growth Factors

Availability of Affordable Service Robots to Drive Market Growth

Due to rapid technological advancements and rise in production of robots, the cost of making robots has gone down significantly. Over the past 30 years, the average cost of a robot has reduced by half in real terms, and even further when compared to labor costs. Furthermore, owing to the rising demand for robots from emerging economies, it is anticipated that the production of robots will shift to low-cost regions, further reducing the manufacturing cost. In addition, rising labor costs as compared to the cost of robots in major manufacturing economies also contribute to increasingly attractive pricing dynamics, thus helping market growth.

Improved capabilities of robots as a result of the advancement of technology along with better productivity and quality achieved with the use of service robots aided the market growth.

Service Robotics Market Restraints

High Initial Cost of Investments to Hamper Market Growth

The initial capital expenditure required for procurement, programming, integration, and other accessories is quite high, and thus it is a challenging factor for the service robotics market growth. Further, as per the Robotic Industries Association, the maintenance cost of service robots is around USD 2,50,000 and USD 10,000 per annum. This creates a hindrance for enterprises, especially small and medium businesses to invest in these robots, as they find it hard to raise large amounts of capital due to the low volume of production and less ROI. The cost of upgrading software, replacement of sensors as well as other devices increases the cost of ownership of service robots, which then results in lowering the market growth rate. Hence, by virtue of all these factors, there has been a slowdown in the market growth of service robots.

Service Robotics Market Segmentation Analysis

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Professional Robots Segment to Show Higher CAGR Backed by Rising Labor Costs

Based on type, the market is bifurcated into personal and professional.

Between these two types, the professional service robots segment holds a greater market with a share of 69.30% in 2026 and is anticipated to grow rapidly over the forecast period majorly owing to the increasing demand for service robots across sectors such as defense, medical, construction, logistics, and others. Apart from this, the adoption of automation and mobility across the industrial sectors is also creating a significant impact on the overall market share for the service robot industry. In the forecasted period, the growth of this segment is further strengthened due to increasing labor costs, rising investments in R&D, shortage of skilled labor, and increasing awareness regarding service robots and industrial automation.

The personal robots segment is anticipated to grow remarkably across the residential home sector. These robots are usually used to help, teach, and tutor individuals in home settings. Apart from that, personal robots are useful for floor cleaning, vacuuming, pool cleaning, lawn mowing, as well as for entertainment. These types of robots are expected to have a higher prospect across the European, ASEAN, and American regions over the forecast period. However, presently, the demand is limited, owing to its operability and battery capacity.

By Application Analysis

Industrial/Commercial Segment to Showcase Majority Share during Forecast Period

Based on application, the market is segmented into domestic and industrial/commercial.

The industrial/commercial segment is anticipated to establish its dominance over the forecast period, accounting for a 69.69% market share in 2026, and is also expected to grow significantly over the forecast period. This segment is further divided into agriculture & forestry, defense, transportation & logistics, unmanned vehicles, construction & demolition, medical, retail, and others that include public relations.

Amidst these, the transportation & logistics segment holds a prominent share due to automation introduced in the process of storing and moving goods. Also, this sector is showcasing increasing demand for service robots to optimize supply chain processes across various industrial sectors. Medical robots are expected to show remarkable growth due to the increasing transformation of people toward integrating robotic solutions for crucial medical operations and the initiation of high-tech testing labs. UAVs are deployed across the agricultural and defense sectors owing to their ability to increase the existing capabilities of soldiers by safeguarding them from danger, determining product ripeness, inspection of crops, and gauging land fertility, respectively.

Besides these, the construction & demolition sub-segment is predicted to grow steadily due to the increasing number of residential and commercial projects across developed and developing economies. Moreover, huge investments by governments to reorganize the existing infrastructure would assist the growth. The domestic sub-segment is also expected to hold a considerable share across the residential sector since there has been a rise in the adoption of service robots for personal use at home.

Service Robotics Market Regional Analysis

The market’s scope comprises five major regions, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Service Robotics Market Size 2025 (USD Billion),

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is projected to experience significant growth due to advancements in technology and increasing automation across industrial manufacturing sectors in the region, with the market valued at USD 9.89 billion in 2025. The major and impactful economies of Japan, China, South Korea, and India are the driving forces of the Asia Pacific market. Besides, promising government policies in the manufacturing industry and increased focus on economic diversification in emerging countries are the two main growth propellers driving industrial automation. As a result, the demand for service robots has increased. The increasing robot density across the regional market can be identified as the most promising factor behind the substantial growth of the market over the forecast period in the region.

Asia Pacific is set to register a remarkable market growth due to the substantial surge in the technological advancements in the region. Moreover, establishment of automated and highly tech driven manufacturing facilities across different emerging economies is providing a positive growth to the region. The increasing manufacturing hub in the market of India and several countries in Southeast Asia and established manufacturing cluster in the developed economies of Japan and China can be attributed as the prominent driving force of the market. The Japan market is projected to reach USD 2.45 billion by 2026.

Numerous governmental authorities in the countries within Asia Pacific are trying to sketch promising regulatory norms and policies to support the market growth. Diversification of the economy, efforts to create a sustainable and shockproof supply chain and manufacturing setup post witnessing COVID-19 pandemic is a critical factor supporting market growth. Additionally, the facility operators and business owners are trying to integrate automation in order to reduce the expenditure of labor wages and increase their operational profit margin which is positively driving the market growth.

To know how our report can help streamline your business, Speak to Analyst

China is anticipated to showcase considerable growth and is also projected to showcase the highest CAGR over the forecast period. The country leads the market as a result of hefty investments conducted in the manufacturing sectors. As China is a manufacturing hub for low manufacturing costs, low labor cost and raw material costs, suppliers believe in mass production of electronic products and obtain a substantial profit yield from other parts of the region. However, despite having a sustainable and profitable manufacturing model, which helped them to develop an extensive manufacturing cluster in the market of the country, domestic manufacturers with local consumers as the target audience have a very weak position in the market. The China market is projected to reach USD 5.87 billion by 2026

For instance, by the end of 2017, the market share catered by local manufacturers in the market of China fell to nearly 25% from the earlier 31% in 2016. Increasing localized production of the global giants in the market of China can be cited as the main concerning reason behind the dismal performance of the local vendors in the regional market. In 2020, ABB Ltd. decided to build a manufacturing facility by the end of 2020. The India market is projected to reach USD 2.31 billion by 2026.

Europe

Following Asia Pacific, Europe held the second highest part in the service robotics market share in the global market majorly due to the high demand for personal and professional robots across various nations in the region. As per the International Federation of Robotics, Europe has the highest presence of service robot manufacturers owing to a rise in demand from sectors such as medical, logistics, retail, and defense. In addition, the U.K., Italy, France, and Germany are anticipated to significantly grow over the forecast period, thus increasing the service robots’ adoption in the region. The UK market is projected to reach USD 1.9 billion by 2026, while the Germany market is projected to reach USD 3.43 billion by 2026.

North America

Furthermore, North America also has a decent market share due to the strong presence of prominent global manufacturers in the region. Although the top four automation solution providers, ABB Ltd., FANUC, KUKA AG, and Yaskawa have a domestic market outside the region of North America, strong demand for their products in the regional market due to heavy technology innovation quotient is encouraging these manufacturers to operate more effectively across North America. The U.S. market is projected to reach USD 5.57 billion by 2026.

Additionally, the implicit efforts of these companies regarding technological developments through strong investments in research & development operations, strategic partnerships, acquisitions, entering into collaborations, and joint ventures are identified as pivotal factors boosting the development potential of North America. The U.S. market is projected to grow significantly, reaching an estimated value of USD 16.27 billion by 2032, driven by the surge in adoption of IoT in robotics for cost predictive maintainence.

Middle East & Africa

In the Middle East & Africa region, GCC holds the highest service robots market share due to the heavy application of automation and modernized techniques in manufacturing and warehouse management systems in the developed Gulf countries. Going forward, the increasing adoption of service robots in the healthcare and automotive sectors in the regional market is expected to emerge as the prime contributor to the market development prospects over the course of time.

Latin America

Latin America is expected to gradually extend its footprint toward the service robots sector owing to the moderate technological advancement in the region. Moreover, Brazil is projected to have majority of the market share. Further, the key growth factor of the Latin America market is the significant shift of consumers in the market toward automated solutions.

KEY INDUSTRY PLAYERS

Key Industry Players Are Emphasizing Integrating Advanced Robotic Technology

It has been observed that major market players are focusing on broadening the possibilities of interactive robots. For instance, TDK Corporation, in September 2019, integrated ultra-compact Micro Electro Mechanical Systems (MEMS) microphones using advanced semiconductors for improving the intelligence of interactive robots. Also, the integration of acoustic sensors and Application Specific Integrated Circuit (ASICS) is bringing a new wave in the service robots market.

LIST OF TOP SERVICE ROBOTICS COMPANIES:

- Ricoh (Japan)

- Honda Motor Co., Ltd. (Japan)

- iRobot Corporation (U.S.)

- KUKA AG (Germany)

- Intuitive Surgical (U.S.)

- Daifuku Co., Ltd. (Japan)

- SoftBank Robotics Group Corp. (Japan)

- Aethon (U.S.)

- Boston Dynamics (U.S.)

- Fetch Robotics, Inc. (U.S.)

SERVICE ROBOTICS INDUSTRY DEVELOPMENTS:

- September 2023 – Visual components has unveiled its newly developed Robotics OLP software. The company will try to provide its software solutions to customers operating across diverse industries.

- June 2023 – The British Automation and Robot Association has announced its decision to venture into a partnership with UK industrial vision association. The partnership will effectively work towards setting up an exhibition to substantially increase importance of system integration and service robotics.

- January 2023 – OhmniLabs has successfully developed OhmniClean UV-C robot which will provide automated disinfection at the healthcare facilities. The product launch will pave the way for the development of service robotics in healthcare sector.

- January 2023 – United Robotics Group GmbH has finalized proceedings for the acquisition of Robotnik Automation S.L.L. The acquisition will prove helpful towards strengthening its position as European robotics leader.

- November 2022 - Smart Robotics Inc. which is a designer and provider of logistics and warehouse robotics solution developed and launched a smart merchandise picker robot. This collaborative robot (Cobot) can handle lightweight merchandize such as office stationery and office supplies.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report provides a detailed analysis of the type, application, and region. It provides information about the leading service robots provider companies and their business overview, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

By Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 26.35 billion in 2025.

In 2034, the market is expected to be valued at USD 131.9 billion.

The global market is estimated to have a noteworthy CAGR of 19.80% during the forecast period.

Asia Pacific dominated global market with a market share of 37.50% in 2025.

Increasing use of cordless charging in automobile vehicles is the key trend in the global market.

The surge in demand for simultaneous charging technology is driving the market growth.

Within the type segment, professional segment is expected to be the leading segment in the market during the forecast period.

Ricoh, Honda Motor Co., Ltd., iRobot Corporation, KUKA AG, Intuitive Surgical, Daifuku Co., Ltd., SoftBank Robotics Group Corp., Aethon, Boston Dynamics, Fetch Robotics, Inc., and others are the top companies.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us