Sexually Transmitted Diseases (STD) Testing Market Size, Share & COVID-19 Impact Analysis, By Product Type (Instruments and Reagents & Kits), By Application (Chlamydia, Syphilis, Genital Herpes, Gonorrhea, Human Immunodeficiency Virus, Human Papillomavirus, and Others), By Setting (Laboratory Testing and Point-of-Care), By End User (Hospital & Clinics, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

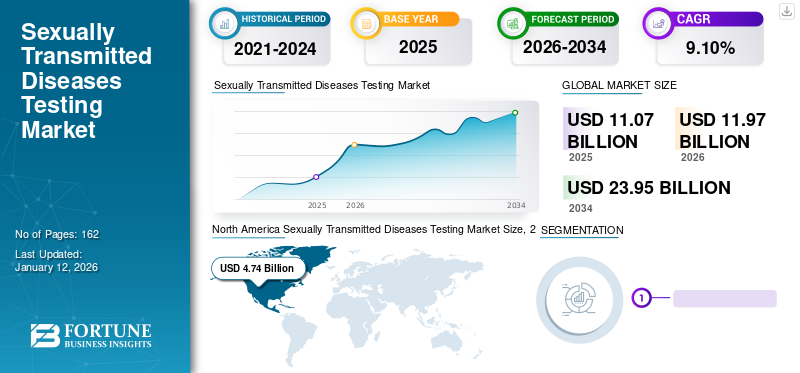

The global sexually transmitted diseases (STD) testing market size was valued at USD 11.07 billion in 2025. The market is projected to grow from USD 11.97 billion in 2026 to USD 23.95 billion by 2034, exhibiting a CAGR of 9.10% during the forecast period. North America dominated the sexually transmitted diseases testing market with a market share of 42.80% in 2025. Moreover, the U.S. sexually transmitted diseases testing market size is projected to grow significantly, reaching an estimated value of USD 6.87 billion by 2030, driven by improved testing drive due to increasing government initiatives.

Sexually Transmitted Diseases (STDs) are infections caused by bacteria, viruses, or parasites which are transmitted through sexual contact, including vaginal, anal, and oral sex. They can also be transmitted vertically, that is, from mother to child during pregnancy, childbirth, and breastfeeding.

- According to the World Health Organization (WHO), more than 30 million different causative agents are known to be transmitted, and out of these, eight pathogens are linked to the highest incidence of STDs.

- As per a study published by the Infectious Diseases of Poverty in 2021, the HIV prevalence among male sex workers was 32%, while the incidence rate of HIV was 5.23 per 100 person-years. In the study, it stated that the incidence rate of gonorrhea and syphilis was 3.93 and 13.04 per 100 person-years, respectively.

The diseases caused by these pathogens are asymptomatic, and thus, timely and accurate diagnosis can reduce further transmission. Moreover, to control the burden of these diseases, regional and national government agencies are making initiatives to increase awareness of sexually transmitted diseases testing to promote the importance of sexual health.

- For instance, Brazil’s health ministry has been offering free condoms and sex education for more than a decade in some schools as part of an AIDS-prevention program that has been recognized worldwide for its success in avoiding an epidemic of sexually transmitted diseases.

An increase in awareness about these diseases among the general population is leading to an increase in the number of people undergoing diagnosis. This, in turn, is driving the demand for instruments and kits for testing sexually transmitted diseases, especially in emerging countries of Asia Pacific and Africa. This, combined with market players focusing on the introduction of innovative products such as point-of-care tests at comparatively lower costs, is poised to drive the growth of the market during the forecast period.

Global Sexually Transmitted Diseases Testing Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 11.07 billion

- 2026 Market Size: USD 11.97 billion

- 2034 Forecast Market Size: USD 23.95 billion

- CAGR: 9.10% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a 42.80% share in 2025. The growth is attributed to public-private partnerships between market players and government bodies to improve disease detection and rising awareness that encourages regular testing.

- By Application: The Chlamydia testing segment accounted for the largest market share in 2026. This is due to its high incidence rate, rising awareness leading to more frequent testing, and the wide availability of low-cost diagnostic products.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, the market is driven by government initiatives focused on creating awareness, introducing new policies and regulations, and launching campaigns to promote sexual health.

- United States: Market growth is driven by government initiatives to improve testing and public-private partnerships to enhance detection of diseases like HIV. The market is also fueled by a large patient base and a high diagnosis rate for various STDs.

- China: The market is poised for high growth due to government efforts to raise awareness through new laws, policies, and campaigns. The high incidence of certain STIs in key populations is also driving the demand for testing.

- Europe: The market is propelled by the availability of advanced testing instruments and equipment, along with well-trained professionals. The introduction of technologically advanced services, such as delivering lab results via text message in the U.K., is increasing patient engagement and testing rates.

COVID-19 IMPACT

Decline in the Number of Reported Cases During COVID-19 Impacted the Market Growth Negatively

The outbreak of the COVID-19 pandemic impacted the market negatively due to a decline in STD testing, which led to an increase in underreported cases and surge in transmission of these diseases. Factors contributing to this decrease were reduced screening, limited resources, and social distancing measures imposed by government authorities.

As per the Centers for Disease Control and Prevention (CDC) data from April 2019 to April 2020, the total number of positive test results for sexually transmitted diseases in the U.S. through Electronic Laboratory Reporting (ELR) dropped by around 30%.

However, as the testing returned to its pre-pandemic level, the revenues of these market players witnessed an incline in FY 2021. Recovery was observed in the diagnostic business segment of Abbott by 3.9% in 2020-2021.

LATEST TRENDS

Download Free sample to learn more about this report.

Gradual Shift from Laboratory Testing to Point-of-Care Testing

One of the prevailing trends witnessed is the gradual shift of sexually transmitted diseases testing from laboratory to point-of-care. Accurate and timely diagnosis is essential for the patients to seek appropriate treatment and improve health outcomes by limiting the spread of infection.

Point-of-Care Testing (POCT) is an alternative to laboratory testing, and these tests can be performed in various healthcare settings such as hospitals, clinics, physician’s offices, pharmacies, and nursing & long-term care facilities. This, combined with faster turnaround time, is leading to an increase in the number of people preferring point-of-care testing over laboratory testing.

In addition, many laboratory tests have longer turnaround times, which can lead to delays in treatment, resulting in the ongoing transmission of STIs. These barriers contribute to the increasing incidence of these diseases. Point-of-care tests have demonstrated the potential to expand access to diagnosis and reduce overall turnaround time, which is anticipated to boost the treatment rate. These benefits and combined with comparatively lower costs of these tests and the elimination of barriers, such as social stigma, are pivotal in increasing the number of patients and healthcare providers shifting the focus from lab-based to point-of-care tests.

STD TESTING MARKET GROWTH FACTORS

Increasing Incidence of Sexually Transmitted Diseases to Drive the Market Growth

A critical driver that positively impacts the global market is the increasing incidence of sexually transmitted diseases, which is expected to increase the demand for testing kits, and instruments, especially in emerging countries.

- According to Global HIV & AIDS Statistics, 38.4 million people will be living with HIV in 2021, out of which 1.5 million were newly infected cases in the same year.

- As per the WHO 2023 Fact Sheet, an estimated 491 million people aged 15–49 (13%) worldwide have herpes simplex virus type 2 (HSV-2) infection, the main cause of genital herpes.

Some of the other contributing factors, such as the lack of focus on safer sexual intercourse methods, sharing of sex toys, and sharing of needles or equipment for injecting drugs or steroids, are increasing the risk of sexually transmitted diseases.

- According to the research by Trojan, a condom brand, in partnership with the Sex Information and Education Council of Canada (SIECCAN) and the University of Guelph, it was found that many young Canadians of 18 to 24 ages do not use condoms.

Moreover, the growing focus of industry players on the launch of testing kits is driving the global sexually transmitted diseases testing market growth.

- In October 2021, Transasia Bio-Medicals launched ErbaLisa HCV Gen 4 Ag+Ab kit in India for the hepatitis C virus.

Government Initiatives to Raise Awareness of STI Testing to Boost the Market

Another critical factor driving the market growth is the initiatives undertaken by regional and national government agencies and other non-profit organizations to increase the awareness related to the testing of sexually transmitted diseases and sexual health to reduce the burden of these diseases. The aim is to upsurge the diagnosis of these diseases to improve sexual health and drive market growth.

- For instance, developing countries such as India offer free-of-cost STI testing services in clinics called “Suraksha Clinics,” which is a simplified approach to diagnosis and treating symptomatic STIs in remote areas where adequate laboratory test facilities are seldom. It is staffed by a Medical Officer, Counsellor, Staff nurse, and Lab technician.

- In 2022, Brazil developed a new test for syphilis in partnership with Johns Hopkins University, Baltimore, U.S., and the University of Coimbra, Portugal to perform the diagnosis more effectively and at a lower cost, facilitating the use in the primary health network and fully integrated with the technological ecosystem of the Ministry of Health.

Such government initiatives and suggestions from healthcare professionals toward sexually transmitted diseases testing are anticipated to boost the market during the forecast period.

RESTRAINING FACTORS

Reluctance toward Sexually Transmitted Diseases Testing to Limit the Market Growth

Despite rising government initiatives toward awareness for sexually transmitted diseases testing, a large population group is reluctant toward testing due to barriers such as confidentiality and perceived stigma related to STIs. Lack of knowledge of providers and limited counseling skills are leading to a rise in the undiagnosed population suffering from these diseases across the globe.

Another factor that is affecting the testing provision is the lack of sexual behavior disclosure, especially in men who have sex with men (MSM), as they have a high burden of curable STIs.

- According to a study published in AIDS and Behavior in May 2022, several studies have found that among U.S. MSM, 39% to 67% reported testing for HIV in the last 12 months. It further concluded that even though this proportion is increasing, many MSM still test less than once a year.

Such reluctance toward sexually transmitted diseases among certain populations will lead to a decline in diagnosis rate and timely treatment for these diseases. This will limit the overall adoption rate of these products during the forecast timeframe.

SEGMENTATION

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Reagents & Kits Segment Dominated the Market Due to Rising Demand in 2026

Based on product type, the market is segmented into instruments and reagents & kits. The reagents & kits segment dominated the global sexually transmitted diseases testing market with a share of 79.32% in 2026. The growth is mainly attributed to the increasing incidence of sexually transmitted infections and is expected to increase the demand for testing kits and reagents.

- As per WHO estimates of the 2016-2021 report, there are annually 131 million and 78 million new cases of chlamydia and gonorrhea, respectively, reported in men who have sex with men (MSM) population.

The increasing incidence of these diseases is raising awareness, which will surge the number of patients undergoing testing. This is anticipated to upsurge the demand for testing kits and reagents which will drive the market growth.

The instruments segment is anticipated to grow with a significant CAGR during the forecast period. The growth of the segment is due to rising patient footfall in independent clinical laboratories for testing, where these instruments are widely required to run the test and provide accurate results. Moreover, these instruments can analyze multiple samples in one load, which reduces the overall expenditure and saves time for healthcare professionals, increasing their preference for kits. These factors are contributing to the segment’s growth.

By Application Analysis

Increasing Incidence of Chlamydia Led to Segment’s Dominance in 2026

By application, the market is segmented into chlamydia, syphilis, genital herpes, gonorrhea, human immunodeficiency virus, human papillomavirus, and others.

Chlamydia accounted for the largest share of the global market with a share of 24.47% in 2026. The increasing incidence rate is due to rising awareness, which is surging the diagnosis rate of this disease. A large number of products are available in the market at a lower cost for testing. It is one of the common diseases, so the testing frequency is high compared to other diseases. These factors contribute to the segment’s growth during the forecast period.

- In 2019, the total number of reported cases of Chlamydia was 1,808,703 in the U.S., as per the report of the 2019 STD Surveillance Report. In 2018, this number was 1,758,668 among the U.S. population.

Gonorrhea, human immunodeficiency virus, and human papillomavirus accounted for significant market share globally. Increasing awareness regarding testing for these diseases, coupled with growing government initiatives, is anticipated to drive the segment’s growth.

Syphilis and genital herpes comparatively held a lower market share. The lack of awareness about its testing frequency after a regular interval is declining the diagnosis rate of these diseases, which is responsible for its lower market share. The others segment held a comparatively lower share and is expected to grow at a lower CAGR during the forecast period.

By Setting Analysis

Higher Preference for Laboratory Testing Led to Market Dominance in 2026

By setting, the market is divided into point-of-care testing and laboratory testing.

The laboratory testing segment dominated the global market witha share of 78.33% in 2026. Laboratory testing or lab-based testing is a traditionally preferred model for testing due to its accuracy compared to point-of-care, which was recently introduced. Moreover, there are some techniques that cannot be implemented in point-of-care kits. This, along with the rising patient preference in independent clinical laboratories for diagnosis of these diseases, is driving the segment’s growth.

- According to an article published by the HHS Public Access Journal in 2022, a number of molecular tests exist for the diagnosis of STIs, predominantly nucleic Acid Amplification Tests (NAATs), and are primarily used in high-income countries and other well-resourced settings.

The point-of-care segment is anticipated to grow with the highest CAGR during the forecast period. The growth is attributed to benefits such as comparatively lower cost of kits and faster turnover around time of tests. This, along with the introduction of new kits with advanced technology and high-accuracy results, is expected to drive the segment’s growth during the forecast period.

By End User Analysis

High Patient Visits Led to Diagnostic Centers Dominance in 2026

By end user, the market is classified into hospitals & clinics, diagnostic centers, and others.

The diagnostic centers segment accounted for the largest share of the global market with a share of 52.34% in 2026. The segment's dominance is attributable to the growing number of patient visits in laboratories where waiting time in comparison to hospitals and clinics is less. Moreover, the availability of advanced instruments with well-trained professionals is increasing its preference among the general population of some developed regions.

The hospitals & clinics segment held the second-largest market share in 2024, owing to their wide preference in emerging countries where healthcare infrastructure is not well established and accessibility to healthcare facilities is limited.

The others segment is anticipated to grow at a steady rate during the forecast period. This includes home-based tests, research institutes. The growth is attributed to the increasing consumption of point-of-care tests that can be performed at home at low cost. Moreover, the sexually transmitted diseases testing in homecare settings can eliminate the concerns of consumers related to privacy and stigma associated with the test results. Hence, all these factors cumulatively will drive the global market growth.

REGIONAL INSIGHTS

In terms of region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Sexually Transmitted Diseases Testing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the STD testing market with a share of 42.80% and was valued at USD 4.74 billion in 2025. The market growth is attributed to public private partnerships between market players and government bodies to improve the detection of these diseases. This, along with the rising awareness about these diseases among various categories, is encouraging individuals to go for testing at regular intervals of time. Hence, this is increasing the adoption rate of products involved in these disease testing. The U.S. market is projected to reach USD 4.86 billion by 2026.

- In February 2023, F. Hoffmann-La Roche Ltd. entered into a public-private partnership (PPP), named Lab Networks for Health with the Centers for Disease Control and Prevention to improve HIV and TB detection, prevention, and treatment in countries in Africa, Eastern Europe, Central Asia, Latin America, and the Caribbean countries that have been affected the most by the HIV and tuberculosis (TB) epidemics.

Europe

The Europe market is expected to grow with a substantial CAGR during the forecast period. The growth in this region is attributed to the availability of advanced instruments and equipment required for testing with well-trained professionals. The UK market is projected to reach USD 0.62 billion by 2026, while the Germany market is projected to reach USD 0.67 billion by 2026.

- As per a study published by the PLOS One in 2022, sexual health services in the U.K. often deliver laboratory-based CT/NG results to patients via text message. The introduction of a CT/NG POCT allows healthcare professionals to provide patients with their results during their consultation.

Such introduction of technologically advanced products for delivering test results will increase the number of patients undergoing testing. This is projected to drive the adoption of kits and instruments in the region during the forecast period.

Asia Pacific

The Asia Pacific market is expected to grow with the highest CAGR during the forecast period. The respective government of this region is focusing on creating awareness regarding sexually transmitted diseases testing by introducing new laws, policies, and regulations coupled with campaigns and programs are some of the factors driving the market growth in this region. The Japan market is projected to reach USD 0.58 billion by 2026, the China market is projected to reach USD 0.77 billion by 2026, and the India market is projected to reach USD 0.33 billion by 2026.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa markets are estimated to grow at a comparatively lower CAGR during the forecast period. The government agencies, along with various non-profit organizations, are focusing on rising awareness about sexually transmitted diseases testing coupled with regulatory recommendations.

- In 2015, the National Committee for the Incorporation of Technologies approved the first Clinical Protocol and Therapeutic Guidelines (PCDT) for people with STIs in the Brazilian National Health System (Conitec). The document establishes criteria for diagnosis, advocates treatment, and sets clinical control mechanisms to be followed by the managers to increase awareness about asymptomatic infections. This was later re-examined and approved by Conitec in 2018.

Moreover, the strong emphasis of healthcare providers on the effectiveness of testing is some of the factors contributing to the market growth in these regions.

KEY INDUSTRY PLAYERS

Strong Distribution Channel and Active R&D Investment to Boost the Market Growth

The global market is fragmented, with the presence of many global and domestic market players offering a wide range of products for various indications. The tier 1 companies include Abbott, bioMerieux Inc., and Bio Rad Laboratories Inc., which account for a significant proportion of the global market. These companies have established their commercial presence across the globe and have a large customer base in emerging and developed countries. The increasing effort of these players to expand their brand presence and distribution network is a major factor supporting the growth of these players.

Some other key players of the market include DiaSorin S.p.A, Cepheid (Danaher), Hologic, Inc., and F. Hoffmann-La Roche Ltd., which are focusing on strategic collaborations to expand their geographical footprints in the market.

- For instance, in May 2022, F. Hoffmann-La Roche Ltd. expanded its diagnostic capacity through its global access program and raised global funds to fight AIDS, tuberculosis, and malaria in low and middle-income countries that are facing higher issues.

Furthermore, there are several market players that are focusing on expanding research and development activities to strengthen their portfolio. Some of them include Thermo Fisher Scientific Inc., BD, OraSure Technologies, and other companies.

LIST OF KEY COMPANIES PROFILED IN STD TESTING MARKET:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- BD (U.S.)

- Hologic, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- bioMerieux, Inc. (France)

- Cepheid (Danaher Corporation) (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- DiaSorin S.p.A (Italy)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: F. Hoffmann-La Roche Ltd. entered into a Public-Private Partnership (PPP) named Lab Networks for Health with the U.S. CDC to improve HIV and TB detection, prevention, and treatment in countries in Africa, Eastern Europe, Central Asia, Latin America, and the Caribbean countries that have been affected the most by HIV and tuberculosis (TB) epidemics.

- February 2023: Mylab Discovery Solutions Pvt. Ltd. launched three rapid kits for early and fast detection for STIs, which include Human Immunodeficiency Virus (HIV), Hepatitis C Virus (HCV), and Syphilis.

- August 2022: Thermo Fisher Scientific Inc. launched Applied Biosystems HIV-1 Genotyping Kit that detects drug resistant strains of HIV-1.

- June 2022: Chembio Diagnostics, Inc. launched SURE CHECK HIV Self-Test in Brazil and the U.K. through commerce platforms to broaden its availability in national pharmacy chains.

- May 2022: Chembio Diagnostics, Inc. entered into a manufacturing agreement with Reszon Diagnostics International to produce Chembio’s HIV 1/2 STAT-PAK Assay products in the Chembio Diagnostics Malaysia (CDM) facility.

REPORT COVERAGE

The global market research report provides qualitative and quantitative insights on the global market and a detailed analysis of global market size & growth rate for all possible segments in the market. Along with this, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are the incidence of key diseases, key industry developments, mergers, acquisitions & partnerships, new product launches, overview of regulatory scenario, technological advancements, and the impact of COVID-19 on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.10% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type, Application, Setting, End User, and Region |

|

By Product Type |

|

|

By Application |

|

|

By Setting |

|

|

By End User |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 11.07 billion in 2025 and is projected to reach USD 23.95 billion by 2034.

In 2025, the North America market stood at USD 4.74 billion.

The market will grow at a CAGR of 9.10% in the forecast period (2026-2034).

Reagents & kits segment is expected to be the leading segment in this market during the forecast period.

The rising incidence of sexually transmitted diseases and shifting preference toward point-of-care testing are some of the major factors driving the global market.

Abbott, bioMerieux, Inc., and Bio-Rad Laboratories, Inc. are the some of the leading market players in the global market.

North America dominated the sexually transmitted diseases testing market with a market share of 42.80% in 2025.

The growing government initiatives to increase awareness about STD testing and focus of market players on new product launches are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us