Sleep Apnea Devices Market Size, Share & Industry Analysis, By Device Type (Therapeutic Devices [Positive Airway Pressure Devices {Continuous Positive Airway Pressure (CPAP) Devices, Bilevel Positive Airway Pressure (BiPAP) Devices, and Others}, Masks and Accessories, and Others] and Diagnostic Devices [Polysomnography Devices, Pulse Oximeter, Actigraphy Devices, and Others]), By End User (Sleep Laboratories & Clinics and Homecare & Other Settings), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

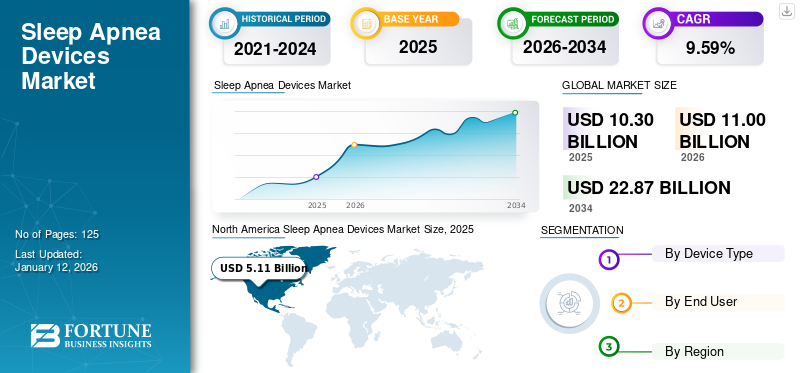

The global sleep apnea devices market size was USD 10.30 billion in 2025. The market is projected to grow from USD 11 billion in 2026 to USD 22.87 billion in 2034 exhibiting a CAGR of 9.59% during the forecast period. North America dominated the sleep apnea devices market with a market share of 49.55% in 2025.

Sleep apnea is referred to as a sleeping disorder that can be potentially serious, wherein the breathing of an individual demonstrates an abnormal pattern. People with untreated sleep apnea experience interrupted breathing in their sleep due to a lack of oxygen supply to the brain and the rest of the body parts. This condition is more common among elderly patients and people suffering from diseases such as diabetes, hypertension, cardiovascular disorders, and others. Globally, Obstructive Sleep Apnea (OSA) is the most prevalent type of sleep apnea, and to prevent this, early diagnosis and use of therapeutic devices are essential.

- For instance, according to the data published by the National Center for Biotechnology Information (NCBI) in 2023, approximately 936 million people are suffering from mild to severe obstructive sleep apnea, and 425 million people with moderate to severe OSA worldwide.

Thus, the globally increasing incidence of such disorders including cardiovascular disorders, hypertension, etc. coupled with the rising geriatric population and associated comorbidities is expected to fuel the demand for treatment and subsequently drive the market growth during the forecast period.

The outbreak of the COVID-19 pandemic positively impacted the global market. Key players reported a significant growth in revenue due to an increase in the number of patients suffering from sleep disorders due to excessive stress resulting from the COVID-19 pandemic.

Global Sleep Apnea Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 10.30 billion

- 2026 Market Size: USD 11 billion

- 2034 Forecast Market Size: USD 22.87 billion

- CAGR: 9.59% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a 49.55% share in 2025. This is due to the high prevalence of obstructive sleep apnea in the region, favorable reimbursement policies, and a high rate of adoption for sleep apnea devices.

- By Device Type: The therapeutic devices segment held the largest market share in 2024. The segment's growth is driven by a rising treatment rate among patients, especially in emerging countries, and a growing patient preference for at-home care.

Key Country Highlights:

- Japan: The market is driven by a high prevalence of obstructive sleep apnea, affecting an estimated 20% of the population, which fuels the demand for both diagnostic and therapeutic devices.

- United States: Growth is fueled by a large patient base, with approximately 39 million adults suffering from sleep apnea. The market is further supported by recent U.S. FDA approvals for new and innovative devices, such as advanced oral appliances and AI-powered diagnostic technology.

- China: As a key part of the fastest-growing Asia Pacific market, growth is attributed to an increasing number of sleep apnea patients and rising awareness campaigns regarding the importance of diagnosis and treatment.

- Europe: The market is propelled by a significant prevalence of sleep apnea among the geriatric population, with 13.0% to 32.0% of older adults affected. Growing awareness about the condition and available treatments is also driving demand.

Sleep Apnea Devices Market Trends

Growing Adoption of Advanced Devices for Sleep Apnea Management Among Patients

The growing preference towards technologically advanced devices has been pivotal in developing new alternatives for sleep apnea management. The increasing adoption of oral devices such as the mandibular advancement device (MAD) for OSA treatment is due to certain factors, including comfort, among others among patients. Furthermore, growing adoption is leading the key players to launch innovative oral appliances in the market that have proved to be effective and offer comfort to patients during the treatment of the disorder.

- For instance, in February 2024, the U.S. FDA approved AIO BREATHE, a new mandibular repositioning device, with an aim to cater to the growing demand among patients suffering from obstructive sleep apnea (OSA).

This, along with the actometer, a portable diagnostic device, is also gaining popularity owing to distinct factors, including low cost and non-invasive nature, among others. Therefore, the growing demand for cost-effective diagnostic devices for sleep apnea is augmenting the preferential shift towards actometers and oral appliances for the efficient management of sleep apnea among patients.

Download Free sample to learn more about this report.

Sleep Apnea Devices Market Growth Factors

Growing Prevalence of Obstructive Sleep Apnea to Spur Demand for Devices

Increasing prevalence of obstructive sleep apnea among patients due to certain factors, including sedentary lifestyle, poor sleep patterns, elevated stress, and obesity. According to a 2023 article published by the National Council on Aging (NCOA), it is reported that approximately 39 million adults are suffering from obstructive sleep apnea in the U.S.

- For instance, according to the article published by the American Heart Association, several cross-sectional studies have estimated that significant sleep apnea is present in 40% of the obese population, and 70% of the OSA patients are obese.

- Also, according to the data published by the European Respiratory Society, approximately 13.0% to 32.0% of the geriatric population in Europe was suffering from sleep apnea.

The increasing prevalence of obesity and other lifestyle disorders and rising healthcare expenditure are further supporting the growing diagnosis rate, thereby increasing the treatment rate among patients. This, along with a growing number of sleep clinics and technicians, is also supporting the growing adoption of these devices in the market. Additionally, increasing strategic initiatives and informative campaigns with the aim of raising awareness regarding the condition among the people is another factor expected to fuel market growth.

For instance, the National Sleep Foundation organizes an annual Sleep Awareness Week campaign to emphasize the importance of sleep to health and well-being. The benefits of these devices for the management of sleep disorders are anticipated to drive the global sleep apnea devices market growth.

RESTRAINING FACTORS

High Cost of Devices to Restrict the Growth of the Market

The technical advancements in sleep apnea diagnostic and therapeutic devices are further increasing the cost of these devices and is likely to hamper the adoption of these devices among patients in the market.

- The CPAP devices and PSG devices are the preferred choices for OSA management. A CPAP machine costs around USD 600.0 to USD 800.0 in the U.S., which makes it significantly cost-intensive without medical insurance.

Furthermore, significant out-of-pocket costs, coupled with limited reimbursement policies in developing countries, are further hampering the adoption of sleep apnea devices among patients. This, along with limited penetration of medical coverage in these countries, is further limiting the number of patients undergoing treatment in these countries.

Sleep Apnea Devices Market Segmentation Analysis

By Device Type Analysis

Increasing Adoption of Therapeutic Devices Led to Segment’s Dominance

Amongst device type, the market is segmented into therapeutic devices and diagnostic devices.

The therapeutic devices are further divided into positive airway pressure devices, oral appliances, masks and accessories, and others. Similarly, the diagnostic devices are further segmented into polysomnography devices, pulse oximeters, actigraphy systems, and others. The therapeutic device segment dominated the market share 63.36% in 2026. The growing number of treatment rates among patients, especially in emerging countries, is further likely to support the growing adoption of these devices, thus contributing to the growth of the market in 2024.

- In September 2023, according to an article published by SPRINGER NATURE, it was reported that adherence with CPAP therapy is approximately 30% to 60% among the patient population suffering from sleep apnea.

To know how our report can help streamline your business, Speak to Analyst

The presence of a large undiagnosed population and growing awareness among these patients are leading to higher diagnosis rates in developed and developing countries. This is creating demand for diagnostic devices, such as polysomnography devices, in these countries.

By End User Analysis

Increasing Preference towards Homecare & Other Settings Supported the Segmental Dominance in 2024

Amongst end-user, the market is segmented into homecare & other settings and sleep laboratories & clinics.

The growth for homecare & other settings segment is due to the growing focus on the introduction of novel portable devices to manage sleep apnea at home among patients. This led to the dominance of the segment share 53.83% globally in 2026. Along with this, the growing preferential shift towards treatment at home for obstructive sleep apnea is resulting in the growing demand for these devices globally.

- For instance, in May 2023, Acurable, a U.K.-based medical device company, is planning to launch an AcuPebble device for the efficient diagnosis of obstructive sleep apnea at home in the U.S. This combined with adequate reimbursement policies being implemented, which facilitate the home use of these devices is further facilitating the market growth.

Additionally, the sleep laboratories & clinics segment is also expected to grow during the forecast period. The growing number of sleep clinics and technicians, rising number of patient admissions, among others, are some of the factors contributing to the growth of the segment in the market. This, along with adequate reimbursement policies in these settings, is driving the growth of the segment.

REGIONAL INSIGHTS

Based on geography, the market is studied into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Sleep Apnea Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 4.78 billion in 2024. The dominance is due to the high prevalence of obstructive sleep apnea, favorable reimbursement policies, among others, resulting in the growing adoption of these devices in the market. The U.S. market is projected to reach USD 5.1 billion by 2026.

- For instance, according to the 2023 data published by the National Council on Aging (NCOA), it was reported that about 12.0% of men and 3.0% of women aged 30 – 49 years have sleep apnea in the U.S.

Asia Pacific

The market of Asia Pacific is anticipated to grow at a highest CAGR during the forecast period. The growth is due to the increasing demand for these devices in Japan and Australia and the growing number of sleep apnea patients in emerging countries. This, along with the increasing focus of key players to launch innovative devices and growing demand for home sleep apnea tests, is also likely to support the growth of the market in the region. The Japan market is projected to reach USD 0.47 billion by 2026, the China market is projected to reach USD 0.62 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

- According to 2024 data published by SPRINGER NATURE, it was reported that the prevalence of obstructive sleep apnea is 20.0% in Japan. Thus, the growing prevalence among patients is contributing to the growing adoption of sleep apnea devices in the region.

Europe

On the other hand, Europe is expected to grow at a significant CAGR owing to growing awareness about these devices, further resulting in growing demand for diagnostic tests in the region. This, along with the growing adoption of sleep apnea devices, is likely to support the growth of the market in the region. The UK market is projected to reach USD 0.47 billion by 2026, while the Germany market is projected to reach USD 0.73 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to grow at a moderate CAGR due to lack of awareness among the general population about sleep apnea and huge underpenetrated markets in both of these regions.

List of Key Companies in Sleep Apnea Devices Market

Increasing Product Launches by ResMed Led to its Market Dominance in 2023

The market is led by ResMed, accounting for the majority of the share in 2023. The robust and diverse sleep apnea devices portfolio, strong R&D investment, wide geographical presence, among others are some of the factors contributing to its global sleep apnea devices market share.

- For instance, in February 2024, ResMed launched its AirCurve 11 Series, a new bilevel device that offers two levels of support, inspirative positive airway pressure (IPAP) and expirative positive airway pressure (EPAP), with an aim to widen its product portfolio in PAP devices.

Other key players engaged in the market are Oventus, Cadwell Industries, Inc., Fisher & Paykel Healthcare Limited., Natus Medical Incorporated, SomnoMed, and Braebon Medical Corporation.

LIST OF KEY COMPANIES PROFILED:

- Koninklijke Philips N.V. (Netherlands)

- Openairway (Australia)

- Cadwell Industries, Inc. (U.S.)

- ResMed (U.S.)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Invacare Corporation (U.S.)

- SomnoMed (Australia)

- Compumedics Limited (Australia)

- Braebon Medical Corporation (Canada)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – EnsoData, a U.S.-based startup that utilizes artificial intelligence for data analysis in sleep medicine, received U.S. FDA approval for its AI-powered sleep diagnosis technology using pulse oximeters.

- November 2023 – Vivos received the U.S. FDA approval for Vivos CARE (complete airway repositioning and expansion) oral appliances for patients suffering from obstructive sleep apnea (OSA). This helped the company to widen its product portfolio for sleep apnea products.

- July 2023 – ResMed acquired Somnoware, a sleep and respiratory diagnostics software with an aim to increase its brand presence globally.

- January 2023 – Vivos received approval for a daytime-nighttime appliance named DNA as a Class II Device with an aim to increase its product offerings for mild-to-moderate obstructive sleep apnea among patients.

- October 2022 – Acurable, a U.K.-based wearable medical device company, raised USD 10.8 million with an aim to expand its product offerings for at-home sleep apnea testing devices globally.

REPORT COVERAGE

An Infographic Representation of Sleep Apnea Devices Market

To get information on various segments, share your queries with us

The global sleep apnea devices market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, device types, and end user. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.59% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Device Type

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 10.30 billion in 2025 and is projected to reach USD 22.87 billion by 2034.

In 2025, the North America market size stood at USD 5.11 billion.

Growing at a CAGR of 9.59%, the market will exhibit steady growth during the forecast period..

Therapeutic devices was the leading segment in this market.

The increasing prevalence of obstructive sleep apnea (OSA) and the growing number of product launches, among others, is fueling the demand for these devices.

ResMed, and Koninklijke Philips N.V., are major players of the global market.

North America held the highest revenue in 2025.

The launch of advanced and affordable devices by market players and increasing demand for sleep apnea treatment are expected to drive the adoption of these devices in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic