Specialty Fertilizers Market Size, Share & Industry Analysis, By Type (Controlled-release Fertilizer, Water-Soluble Fertilizer, Agricultural Micronutrient, and Customized Fertilizer), By Application Method (Soil, Foliar, and Fertigation), By Crop Type (Row Crops, Fruits & Vegetables, Turf & Ornamentals, and Others), and Regional Forecast, 2026– 2034

KEY MARKET INSIGHTS

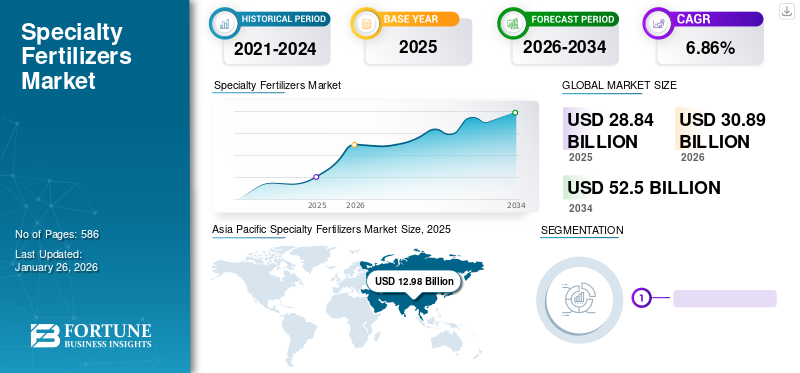

The global specialty fertilizers market size was valued at USD 28.84 billion in 2025 and is projected to grow from USD 30.89 billion in 2026 to USD 52.50 billion by 2034, exhibiting a CAGR of 6.86% during the forecast period. Moreover, the specialty fertilizers market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 6.79 billion in 2032, driven by the large application of specialty fertilizers in high-value crops, including fruits & vegetables. Asia Pacific dominated the specialty fertilizers market with a market share of 45.03% in 2025.

Controlled-release fertilizers, water-soluble fertilizers, agricultural micronutrients, and customized fertilizers are different specialty fertilizers in the global market. These fertilizers are applied to crops such as row crops, fruits & vegetables, turf & ornamentals, and others through soil, foliar, or fertigation.

Countries including the U.S., China, India, Brazil, Spain, Canada, Japan, the U.K., Turkey, and Australia are top consumers of fertilizers globally, owing to their high agricultural produce. For instance, as per International Fertilizer Association (IFO), in 2020, China’s total nitrogen fertilizer consumption accounted for around 23.36% of global nitrogen fertilizer consumption.

The lockdown and closing of borders caused major restriction in logistical and labor shortages which became top concerns for producers during the initial months of the pandemic onset. Many producers had to stop or halt production, particularly Small & Medium-sized Enterprises (SME). The production cost of the companies increased during the pandemic due to an increase in labor cost and raw material cost. For instance, as per the U.S. Department of the Interior, the price of potash mineral rose from USD 850 per ton to USD 1120 per ton from 2020 to 2021.

Although there was an initial shock that manufacturing companies and their respective supply chains faced during the initial outbreak of the pandemic, the agriculture and agri-input sector was moderately impacted by the rising input cost and supply chain disruption created by the higher demand and limited supply.

Specialty Fertilizers Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 28.84 billion

- 2026 Market Size: USD 30.89 billion

- 2034 Forecast Market Size: USD 52.50 billion

- CAGR: 6.86% from 2026-2034

Market Share:

- Asia Pacific dominated the specialty fertilizers market with a market share of 45.03% in 2025.

- Water-soluble fertilizers hold the highest market share due to availability and economical pricing, while controlled-release fertilizers are expected to grow at the fastest CAGR owing to new product launches and technological advancements.

Key Country Highlights:

- United States: Specialty fertilizers market expected to reach USD 6.79 billion in 2032, driven by high-value crops like fruits & vegetables and increasing adoption of controlled-release fertilizers.

- China: Accounted for around 23.36% of global nitrogen fertilizer consumption in 2020, with large-scale agriculture and growing investment in specialty fertilizers.

- India: Significant agricultural sector and increasing use of customized and micronutrient fertilizers to enhance productivity and crop quality.

- Brazil: Rapid growth in fruit and vegetable exports, especially to the EU, fueling demand for specialty fertilizers.

- France: Adopted Climate and Resilience Law in 2021 to reduce nitrogen fertilizer usage and greenhouse gas emissions by 15% by 2030.

- Canada: Growing turf grass management needs and large-scale cereal crop cultivation support increased fertilizer usage.

- Japan, U.K., Turkey, Australia: Major consumers due to high agricultural production, focus on turf management, and demand for efficient agri-inputs.

Specialty Fertilizers Market Trends

Escalating Focus on Innovative and Budget-friendly Crop-nutrition Products is a Vital Trend

The rising awareness toward the requirement of specific fertilizers for different crops and soil types to support plant growth under various environmental conditions is proliferating the demand for innovative agricultural solutions. Leading players and governments are focusing toward investments for development and technological advancement in manufacturing this type of fertilizers, including controlled-release fertilizers, micronutrient fertilizers, and customized fertilizers. Furthermore, manufacturers are launching new partnerships to expand their geographical reach. For instance, in July 2022, Nutrien Inc. accepted an agreement to acquire Casa do Adubo S.A. The acquisition includes 39 Casa do Adubo retail stores and 10 distribution centers for the Agrodistribuidor Canal brand in Acre, Bahia, Mato Grosso, Minas Gerais, Para, Rio de Janeiro, and Tocantins. This further supports Nutrien's retail growth strategy in Brazil.

Download Free sample to learn more about this report.

Specialty Fertilizers Market Growth Factors

Growing Area under Cereal Crops and Turf Grass Boosts Usage of Specialty Fertilizers

The poularity of sports such as golf has increased significantly over the past few years. As per data provided by the golf course industry, in 2022, the number of golfers has increased from 61 million to 66.6 million in a five-year growth period. Thus, the need to maintain the growth and health of turf grasses has increased significantly. The health and appearance of the golf courses depend on the weather conditions and different agriculture inputs including fertilizer used on the turfs. These type of fertilizers help to encourage the growth of turf grasses and make them resilient and stronger. Yara International, ICL, Haifa Group, Willbur-Ellis, Kingenta Ecological Engineering Co. Ltd., and Brandt are some of the key companies, which supply specialty fertilizers for use on turf grass.

The demand for cereal foods has been rising in developing countries much faster than in developed countries. Although the consumption of cereals is stable, the demand for these foods in animal feeds is rising steadily. For instance, as per the Food and Agriculture Association, the demand for cereals in livestock feed was around 16% of the total cereal demand. This demand is expected to rise up to 35% by 2100. Maize is one of the crops which has seen a rapid increase in its demand. For instance, as per the Food and Agriculture Association, the demand for maize has grown from 22 to 40 million tons from 1990 to 2010, and is expected to reach 86 million tons by 2050.

The demand for major food grains, such as corn, wheat, and pulses, is expected to continue to increase, and the harvested area is also increasing gradually. This growth in the area dedicated to cereal crop production is fueling the demand for agri-inputs. Furthermore, the extensive growth in demand for agricultural produce has resulted in a shifting trend for fertilizers with higher efficiency, such as controlled-release fertilizer, agricultural micronutrients, and customized fertilizers, among farmers. For instance, as per data provided by the FAOSTAT, the harvested area of rice increased from 163.09 million hectares in 2020 to 165.25 million hectares in 2021. Similarly, the harvested area of wheat and corn increased by 1.3% and 2.94%, respectively, in 2021 compared to 2020.

High Efficacy and Easier Applicability of Specialty Fertilizers Support the Market Growth

The rapid growth in population has resulted in increasing demand for nutritious food. Thus, increasing and maintaining higher crop yields has become essential to meet the growing global food requirements. On the contrary, the availability of arable land for crop cultivation is declining; owing to the excessive use of chemical fertilizers, climate change, and other significant factors. For instance, as per data provided by FAOSTAT, the arable land has declined by 0.3% in 2020 compared to 2017.

Applying fertilizers such as potassium nitrate on crops without considering the nutrient requirement and soil nutrient status leads to excess use of fertilizers resulting in soil erosion, depleting nutrient value of soil and micronutrient deficiency such as zinc, iron, boron, manganese, and others. For instance, as per data provided by the FAO "Status of the World's Soil Resources" 2022, there is an increasing incidence of zinc and sulfur deficiency in Asia. Furthermore, global warming-induced weather changes such as low levels of rainfall are impacting soil health and resulting in declining arable land. Thus companies are adopting advanced technology and launching innovative specialty fertilizer products for specific soil nutrient deficiencies in different countries.

For instance, in 2023, the Andersons Inc. launched MicroMark DG, a new specialty fertilizer that is made of advanced Dispersing Granule (DG) technology that helps to ensure easier blending, uniform spreading of fertilizers in the soil, and higher product efficacy.

RESTRAINING FACTORS

Fluctuation in Raw Material Availability and Premium Price Commanded by Specialty Fertilizers to Impact Adoption Rate among Farmers

The adoption rate of fertilizers is directly related to the net profit margin that the farmer accrues by selling the crops. Fluctuations in the crop market price significantly impact farmers' total investment in agricultural inputs. Hence, when the market price of the products drops, the farmers adopt cost-cutting measures, including switching to other cheaper agricultural inputs available in the market.

Natural gas is one of the major inputs used for fertilizer production. The Russia-Ukraine war has impacted natural gas availability, causing natural gas prices to soar. This gas price rise impacted ammonia production, which is one of the major inputs required for fertilizer production. For instance, as per World Bank, the natural gas prices in the U.S. rose from USD 3.85 billion barrels of petroleum liquids to USD 6.37 billion barrels of petroleum liquids from 2021 to 2022. Similarly, the export of fertilizer, such as potash, from Belarus has declined by 50% due to restrictions imposed by EU nations on the use of their territory for transit.

For instance, Lithuania, which handles around 90% of the potash transport from Belarus, banned the use of railway networks to transport Belarusian potash. As ammonia and potash are some of the essential nutrients required for specialty fertilizer production, the fluctuations in the availability of these products significantly hamper the production and availability of these type of fertilizers in the market.

Specialty Fertilizers Market Segmentation Analysis

By Type Analysis

Rising Demand for Water-Soluble Fertilizer and New Product Launch in Customized Fertilizer Segment to Boost Market Growth

Based on type, the market is classified into controlled-release fertilizer, water-soluble fertilizer, agricultural micronutrient, and customized fertilizer. Water-soluble fertilizer holds the highest share of 57.92% in 2026, the market owing to the availability of more products from manufacturers and economical pricing as compared to CRF, agricultural micronutrients, and customized fertilizers. For instance, from the total specialty fertilizer products of Coromandel International, around 40% are water-soluble, and 11%, 25%, and 20% are controlled-release fertilizers, agricultural micronutrients, and customized fertilizers, respectively.

In contrast, the controlled-release fertilizer has shown a higher CAGR growth owing to the new product launch by manufacturers and technological advancement in terms of targeted consumption and further reducing the environmental impact caused by excessive fertilizer consumption. For instance, in January 2023, Soilgenic Technologies based in Canada, announced the launch of its new product infused with higher percentage of the urease inhibitor NBPT which further reduces nitrogen loss. The new launch highlights its new technology called rapidly biodegradable release, designed for open-field agriculture. As per the company, this new technology shall reduce environmental impact by reducing nutrient loss and increasing efficiency by 80%.

To know how our report can help streamline your business, Speak to Analyst

By Application Method Analysis

Rising Investments in Development of High Capacity Irrigation System and Rising Adoption of Fertigation to Fuel Market Growth

The market is further classified by application method into soil, foliar, and fertigation. The fertigation segment has a higher share of 37.62% in 2026. The fertigation application method has significant popularity in the global market owing to the higher adoption of water-soluble fertilizers. In fertigation, the fertilizer is mixed with water and is applied through the irrigation system, typically with the help of a micro-sprinkler or a drip system. Furthermore, rising investments and initiatives in building new and advanced higher-capacity fertilizer sprinklers will further boost the market growth. For instance, in August 2021, Jain Irrigation and the Israel Consulate of India launched their new project of a smart irrigation system integrated with IoT in Ooty’s tea plantation. Furthermore, in October 2021, Netafim, one of the leading sustainable irrigation solution providers, launched multiple new products at EIMA Fair.

The foliar segment will witness the fastest CAGR from 2025 to 2032, owing to the rising popularity among farmers as it ensures uniform application of nutrients to the crops. Foliar application provides supplementary feeding to complete soil fertilization and increase productivity. In addition, foliar application can be applied at specific stages of crop development to boost yield and improve quality.

By Crop Type Analysis

Rising Demand for Consumption of Fruits to Fuel Market Growth

By crop type, the market is segmented into row crops, fruits & vegetables, turf & ornamentals, and others. The fruits & vegetables segment has a higher market share of 43.99% in 2026. The fruits & vegetables segment has a higher share in market due to the higher sales price of these products owing to their perishable nature and higher export quantity. For instance, as per the Food and Agriculture Organization, in 2020, the value of global fruits & vegetables export accounted for USD 282.67 billion, whereas the cereals and preparations accounted for USD 205.91 billion.

In addition, the fruits & vegetables segment is gaining significant popularity in the market owing to the rising demand for fruit consumption among individuals. Growing popularity and changing consumer preference toward a healthy diet have led to the increasing fruits & vegetables. This growing demand shall further fuel the demand for premium quality specialty fertilizer for fruits & vegetables.

By Crop Type Analysis

The row crops segment will show the fastest CAGR over the forecast period. The higher share in terms of production and larger area harvested of row crops has been a significant contributor to fertilizer consumption.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Specialty Fertilizers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to hold the largest specialty fertilizers market share in 2025 with a value of USD 12.98 billion, given that the region has the largest agriculture sector. For instance, as per the Organisation for Economic Co-operation and Development and Food and Agriculture Organization, Asia Pacific accounts for 30% of the global agricultural land. This is owing to the large agriculture practices in India, China, Thailand, and others. For instance, China is one of the world's largest producers and consumers of agri-inputs. As per data provided by the FAOSTAT in 2020, the country's arable land amounted for 119.474 million hectares, around 8% of the total global arable land. Furthermore, owing to the world's largest agriculture-based economies in this region specialty fertilizer manufacturers expand their footprint by launching new products, expanding their production capabilities, and others. The Japan market is projected to reach USD 0.31 billion by 2026, the China market is projected to reach USD 6.46 billion by 2026, and the India market is projected to reach USD 4.39 billion by 2026.

For instance, in December 2019, Mosaic China opened a new Yantai Port facility with different features and capabilities, including an advanced Soil Lab. The 25,000-sq. ft. plant is also equipped with a modernized logistics tracking system to continue cultivating safer and more efficient operations.

To know how our report can help streamline your business, Speak to Analyst

North America

North America and Europe have significant shares in the global market owing to the higher rate of production for potato, tomato, onion, and sweet corn. For instance, according to the FAOSTAT, in 2021, in the U.S., potato is the most produced vegetable accounting for nearly 38% of the total vegetable production. Furthermore, with the rising awareness of efficiency of controlled-release fertilizer due to the awareness created by the North America Fertilizer industry with the 4R Research Fund, the demand for controlled-release fertilizers and micronutrients is constantly rising in the U.S. for application on these vital vegetables. The U.S. market is projected to reach USD 4.74 billion by 2026.

Europe

Europe observed a growing demand for sustainable and efficient agriculture practices which is further fueling the demand for fertilizers including controlled-release, water-soluble, micronutrient, and customized due to its higher efficiency rate. For instance, in 2021, the government of France adopted the Climate and Resilience Law to reduce farmer's dependence on nitrogen fertilizers. As the use of such fertilizer has been associated with greenhouse gas emissions, the law is aimed to curb the nitrous oxide emissions by 15% in 2030. The UK market is projected to reach USD 0.35 billion by 2026, and the Germany market is projected to reach USD 0.53 billion by 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa are expected to grow over the forecast period which is fueled by many factors, including new farming techniques, fertilizers product, technology, advanced land and soil management, hybrid and disease-resistant seeds, and mounting global demand for agricultural commodities. South America has been observing a rise in specialty fertilizer demand owing to the increasing production and rising demand for cereals and vegetables. Owing to the high quality of soil and divergence of Brazilian fruit production, the fruits & vegetable industry experienced substantial growth in production and export. In 2021, Brazil's fruit export comprised more than 40 fruits. According to USDA data, the major destination of fruit exports from Brazil is the European Union, which accounted for more than 50% of total exports from Brazil. The Middle East & Africa is known for production of dates and citrus fruits, which has a higher consumption rate of fertilizers, thus the rising production is contributing toward the specialty fertilizers market growth. For instance, as per FAO, in 2021, the global dates production accounted for 9.65 million tonnes, from which around 90% were produced in the Middle East & Africa, accounting for around 8.87 million tonnes.

KEY INDUSTRY PLAYERS

Key Players Focus on Product Launches to Stay Competitive

The global market is highly competitive, with multinational companies and local players competing against each other to expand their market position. The major players include Israel Chemicals Ltd., Yara International ASA, OCP, K+S Aktiengesellschaft, and others. Mergers & acquisitions followed by base expansion are the two major strategies adopted by key players to achieve the market growth. For instance, in July 2022, Nutrien entered into an agreement to acquire Brazilian-based company, Casa do Adubo. With this acquisition, Nutrien will acquire 39 retail locations and 10 distribution centers in the states of Brazil.

List of Top Specialty Fertilizers Companies:

- Nutrien Ltd. (Canada)

- Yara International ASA (Norway)

- The Mosaic Company (U.S.)

- CF Industries Holdings, Inc. (U.S.)

- OCP SA (Morocco)

- SQM S.A. (Chile)

- Israel Chemicals Ltd. (Israel)

- OCI Global (Netherlands)

- K+S Aktiengesellschaft (Germany)

- Nouryon Chemicals Holding B.V. (Netherlands)

- Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India)

- Grupa Azoty S.A. (Poland)

- Wilbur-Ellis Holdings, Inc. (U.S.)

- Nufarm Ltd (Australia)

- Coromandel International (India)

- Compass Minerals International, Inc. (U.S.)

- Deepak Fertilizers and Petrochemicals Corporation Limited (India)

- Zuari Agro Chemicals Ltd. (India)

- Kugler Company (U.S.)

- Kingenta Ecological Engineering Group Co., Ltd. (China)

- Brandt, Inc. (U.S.)

- Agro Liquid (U.S.)

- Plant Food Company, Inc. (U.S.)

- Koch Industries, Inc. ((U.S.)

- Helena Agri-Enterprises, LLC (U.S.)

- Valagro SpA (Italy)

- Hebei Monband Water Soluble Fertilizer Co., Ltd. (China)

- Haifa Group (Israel)

- Uralchem (Russia)

- EuroChem Group (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- December 2022: Zuari Agro Chemicals Ltd. expanded its ag-tech subsidiary Zuari Farmhub Ltd., which is set to triple its retail footprint with around 2,000 stores across the country in two years. This expansion helps the company to increase its customer reach.

- February 2022: Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCL) launched an innovative solution, ‘Croptek’, which is India’s first crop-specific balanced nutrition product for onion, cotton, sugarcane, and corn.

- September 2021: Coromandel International Limited introduced a new fertilizer named GroShakti Plus, which is fortified with micronutrients in the market of Telangana and Andhra Pradesh in India. The product is suitable for use in crops such as cereals, pulses, oilseeds, vegetables, and fruits.

- December 2020: AgroLiquid launched a new liquid phosphate fertilizer, SpringuP, that boosts crop yields by supplying phosphorus (P), potassium, and nitrogen to the plants from the initial growth stage.

- October 2020: SQM launched Ultrasol K composed of 100% micronutrients readily available for plant uptake and an ideal source of nitrogen and potassium. It is chloride-free and 100 percent water-soluble, and can help growers increase crop quality and yield by ensuring more efficient use of water and nutrients.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, types of specialty fertilizers, application methods, and utilization for different crops. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.86% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application Method

|

|

|

By Crop Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 28.84 billion in 2025.

The market is likely to register a CAGR of 6.86% over the forecast period of 2026-2034.

The water-soluble fertilizer segment is expected to lead the market due to higher product availability and economical pricing.

Growing area under cereal crops and turf grass shall drive the global market size.

Some top market players are Nutrien Ltd. (Canada), Yara International ASA (Norway), The Mosaic Company (U.S.), CF Industries Holdings, Inc. (U.S.), and OCP SA (Morocco).

Asia Pacific dominated the market in terms of product sales in 2025.

Fluctuation in raw material availability and premium price commanded by specialty fertilizers to impact the adoption rate among farmers.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us