The Japan market is projected to reach USD 2.91 billion by 2026, the China market is projected to reach USD 3.18 billion by 2026, and the India market is projected to reach USD 1.94 billion by 2026.

Video Conferencing Market Size, Share & Industry Analysis, By Component (Hardware and Software), By Conference Type (Telepresence System, Integrated System, Desktop System, Service-based System, and Others), By Application (Small Rooms, Huddle Rooms, Middle Rooms, and Large Rooms), By Deployment (Cloud and On-Premises), By Enterprises Type (Small and Medium Enterprises and Large Enterprises), By Industry (IT & Telecom, Government, Healthcare, Manufacturing, BFSI, Education, Media & Entertainment, and Others), and Regional Forecast, 2026-2034

Video Conferencing Market Analysis

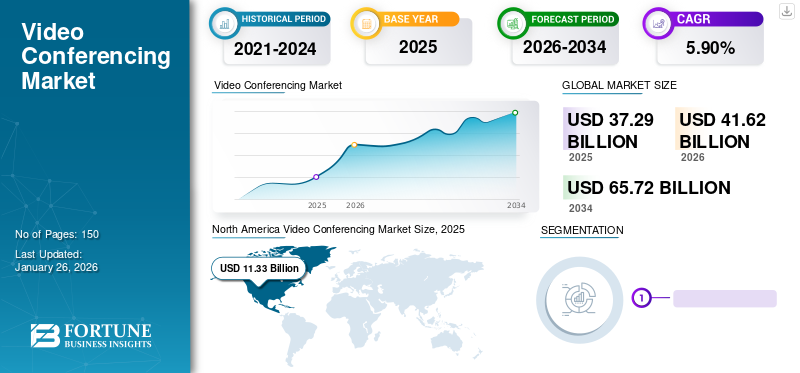

The global video conferencing market size was valued at USD 37.29 billion in 2025 and is projected to grow from USD 41.62 billion in 2026 to USD 65.72 billion by 2034, exhibiting a CAGR of 5.90% during the forecast period. North America dominated the global video conferencing market with a share of 30.40% in 2025. Additionally, the U.S. video conferencing market is projected to grow significantly, reaching an estimated value of USD 11,303.5 million by 2032, driven by increasing preference for remote and eLearning.

Video conferencing is a real-time visual meeting session between two or more participants. The integration of developed technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and cloud technology is expected to drive market growth in the near future. In addition, some of the main factors driving market growth include the increasing demand for video conferencing, cloud-based collaboration platforms, and virtual workforce management. Organizations and corporations are adopting video collaboration solutions to make faster decisions and avoid high travel costs. Moreover, there is an increasing demand for remote learning. For instance, in January 2022, RingCentral, Inc., a cloud-based video collaboration provider, launched a new education product portfolio to support hybrid learning for educational institutes.

Global Video Conferencing Market Overview

Market Size:

- 2025 Value: USD 37.29 billion

- 2026 Value: USD 41.62 billion

- 2034 Forecast Value: USD 65.72 billion, with a CAGR of 5.90% from 2026–2034

Market Share:

- Regional Leader: North America held a 30.40% market share in 2025, driven by strong adoption in the U.S. and Canada, supported by key players such as Microsoft Corporation, Zoom Video Communications, and Cisco Systems.

- Fastest-Growing Region: Asia Pacific is projected to grow at the highest CAGR during the forecast period, driven by increased demand for video communication in education, research, and digitalization across SMEs.

- End-User Leader: The IT & Telecom segment dominated the market in 2024 due to heavy investments in advanced technologies and early adoption of video conferencing solutions.

Industry Trends:

- Generative AI Integration: Advanced AI capabilities are enhancing personalized virtual communications and engagement during meetings, as seen in Zoom’s AI chatbot feature rollout.

- Rising Adoption of Video Banking: Financial institutions are increasingly using video conferencing for customer service and loan processing, improving productivity and customer engagement.

- Hybrid Learning & Remote Work: Educational institutions globally are adopting video conferencing platforms to facilitate remote and hybrid learning models accelerated by the COVID-19 pandemic.

Driving Factors:

- Increasing Preference for Remote and eLearning: Educational institutions are expanding remote learning capabilities, using video conferencing to deliver content globally and locally.

- Integration of Advanced Technologies: AI, IoT, and cloud technologies are driving improvements in video collaboration tools and user experience.

- Corporate Demand to Reduce Travel Costs: Organizations adopt video conferencing to enable faster decision-making and reduce expenses related to travel.

- Strategic Collaborations & Product Innovations: Companies like RingCentral, Qualcomm, and Cordoniq are launching new video conferencing solutions to address evolving market needs.

- Growing Demand in Banking & Financial Sectors: Video banking solutions are increasingly adopted to improve customer service efficiency amid labor shortages.

Various business events, such as international seminars, trade shows, investor presentations, product launches, and so on, were affected by the COVID-19 pandemic. Consequently, market growth has been positively influenced by the implementation of video conferencing solutions such as Teams, Zoom, and others by corporate organizations to host such events. According to the Wired U.K., Zoom Video Communications, Inc. had around 2.22 million active monthly users in 2020.

IMPACT OF GENERATIVE AI

Advanced Capabilities of Generative AI for Personalized Virtual Communications Fueled Market Growth

The challenge of maintaining engagement and productivity is a frequent problem in traditional video conferencing. However, generative AI has the capabilities of intelligent automation. With the help of generative AI, organizations in virtual meetings have started to offer purpose-driven expertise and personalized content, supporting active learning.

Furthermore, through advanced language processing capabilities, virtual communication can be revolutionized by generative AI. In December 2023, Zoom stated that it started testing a feature that allows users to chat with a generative AI bot during and after meetings. This will help users gain a better understanding of the content they are viewing.

Video Conferencing Market Trends

Rising Adoption of Video Banking to Aid Market Augmentation

The market growth is expected to be stimulated by a growing trend toward the deployment of video banking solutions as the usage of online banking increases. Using video banking services allows customers to save time and money. In addition, the solution contributes to improving employee productivity, fostering customer engagement, and providing security communications channels. As a result, video conferencing solutions are increasingly being used by customer service personnel, loan officers, financial advisers, and others in the banking and finance industry. To meet the growing demand for video communications services in the banking and financial sector, key providers are developing new products. For instance,

- In December 2022, California-based Eltropy introduced a new video banking communication tool for financial institutes facing labor shortage issues. Banks such as Coastal Heritage Bank in Massachusetts improved their customer services and relationships with clients by adopting such tools.

Thus, the rise in video banking will boost global market growth.

Download Free sample to learn more about this report.

Video Conferencing Market Growth Factors

Increasing Preference for Remote and eLearning to Drive Market Growth

Institutions, schools, universities, and K-12 have adopted conferencing solutions to facilitate distance learning as a substitute for traditional classrooms. The pandemic's impact has accelerated the collaborations of educational institutions with video communication services to expand remote learning. As a result, educational institutions are implementing software to enhance the learning experience for students. For instance,

- In January 2023, an England-based European School of Osteopathy announced a collaboration with YuJa Enterprise Video Platform to deliver its course content internationally and locally through the video conferencing platform.

Furthermore, software programs including Adobe, Microsoft Office, and others, assist users in accessing online classes from their personal smart devices. It also allows administrators to share displays, papers, and files with their students while they are teaching. Thus, with such initiatives, the global video communication industry will drive video conferencing market growth.

RESTRAINING FACTORS

High Initial Cost of Hardware Solutions and Privacy Concerns to Inhibit Market Growth

Due to its ability to work across several applications simultaneously, the market is rapidly expanding. However, market growth for SMEs will be limited by the high cost of installing hardware solutions. In addition, the adoption of hardware solutions and data protection software to secure the transfer of data is leading to high deployment costs. Moreover, market growth is expected to be hindered by concerns related to the security of identity and information, and data privacy.

Video Conferencing Market Segmentation Analysis

By Component Analysis

Hardware Segment Dominates Due to Increased Demand for Conferencing Solutions

Based on component, the market is segmented into hardware and software.

In terms of market share, the hardware segment dominated the market share of 16.04% in 2026. This is due to the increasing demand for conferencing solutions such as Skype, Microsoft Teams, Zoom, and others across various industries, driving market growth. Logitech's conferencing room solutions include rail bar, rally plus, Logitech scribe, Logitech tap IP, and Logitech select, among others.

By Conference Type Analysis

Rising Demand for Higher Quality Video Communication Tools to Boost Telepresence System Growth

Based on conference type, the market is categorized into telepresence systems, integrated systems, desktop systems, and service-based systems.

The telepresence system is expected to register the highest CAGR during the forecast period. Telepresence systems, via videoconferencing, use various technical means to eliminate distance between users. Utilizing high-quality video communication tools, they facilitate seamless interaction between users in a conference room. This system employs cutting-edge technology, allowing the conference to be broadcast in high-quality audio and video.

In terms of market share, the desktop systems segment dominated the market share of 7.74% in 2026. The desktop system is a highly versatile, dependable, and cost-effective video communication solution. Moreover, these desktop systems are widely used in a variety of industries including education, media and entertainment, and aerospace and defense, among others.

By Deployment Analysis

On-premises Segment Dominated owing to Rising Demand for High Security

Based on deployment, the market is divided into the cloud and on-premises.

In terms of market share, the on-premise segment dominated the market in 2024. The increasing adoption of on-premises solutions by large enterprises in response to the need for maintaining data security systems and information security concerns is contributing to segment expansion.

The cloud segment is anticipated to register the highest CAGR during the forecast period, owing to the rising adoption of cloud computation. The growing adoption of cloud-based software solutions provides encrypted and password-protected data transfer, thus ensuring secured communications.

By Enterprise Type Analysis

Large Enterprise’s Growing Investments in Communication Solutions Drives Segment Growth

By enterprise type, the market is divided into small & medium enterprise and large enterprise.

In terms of market share, large enterprise dominated the market in 2024. Increasing use of solutions to foster collaboration among employees located in different locations is expected to drive this segment. Video communication solutions enable large enterprises to improve their operational efficiency and deliver a better client experience.

The SMEs segment is anticipated to register the highest CAGR during the forecast period. These solutions are expected to improve SMEs customer relationships, communication between sales teams, the launch of new products at distant locations, and other activities.

By Application Analysis

Small Rooms Segment Leads the Market Owing to its Cost-Effectiveness

Based on application, the market is classified into small rooms, middle rooms, large rooms, and huddle rooms.

In terms of market share, the small rooms segment held the largest video conferencing market share of 9.31% in 2026. The increased demand for video communication solutions for small rooms is attributed to its low cost and ease of use. It allows users to conduct online conferences by connecting their computer, mobile device, or other peripheral devices without requiring any additional hardware.

The huddle rooms segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is driven by the increasing use of software-based solutions. Additionally, the demand for ad hoc communication between teams and a growing number of open workplaces contribute to the segment’s growth. Moreover, the proliferation of low-cost, high-definition video conferencing solutions, further fuels the growth of this segment.

To know how our report can help streamline your business, Speak to Analyst

By Industry Analysis

IT & Telecom Segment to Dominate Due to Investments in Advance Technologies

Based on industry, the market is categorized into IT & telecom, government, healthcare, manufacturing, BFSI, education, media & entertainment, and others.

In terms of market share in 2024, the IT & telecom segment dominated the market, owing to enterprises’ heavy investment in cutting-edge technologies. The sector has been an early adopter of the solution and has significantly supported the IT industry in facilitating remote working during the pandemic. To reduce delays caused by the lack of communication channels, governments worldwide are implementing video conferencing technology and increasing their IT budgets.

The BFSI segment is expected to register the highest CAGR during the forecast period. With the rise of digitization, customer-specific solutions are gaining momentum in this sector. To address long queues in banks and time-consuming tasks, banks have started attending video-enabled customer servicing sessions, and this trend will continue over the forecast period.

REGIONAL INSIGHTS

Based on geography, the market is fragmented into five major regions such as North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America

North America Video Conferencing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 11.33 billion in 2025 and USD 12.37 billion in 2026. The region benefits from large and experienced workforces capable of developing and implementing such solutions. Early adoption of emerging technologies, as well as the presence of major key companies such as Microsoft Corporation, Zoom Video Communications, Inc., Cisco Systems, Inc., and others, is driving demand for these conferencing solutions in the U.S. and Canada. This is expected to boost the North America market growth. The U.S. market is projected to reach USD 9.32 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is predicted to grow at the highest CAGR during the forecast period. The rise in demand for video communications solutions for automated processes in the education and research sectors contributes to this growth. The presence of a significant number of SMEs and a growing interest in digitalization solutions in the region is likely to display immense market growth potential.

Europe is predicted to grow at a significant growth rate. The availability of a large number of video collaboration solutions and services has contributed to market expansion in this region. Furthermore, increasing corporate investments in research and development are likely to boost Europe market share in the near future. The UK market is projected to reach USD 2.7 billion by 2026, and the Germany market is projected to reach USD 2.26 billion by 2026.

Middle East & Africa

The Middle East & Africa is predicted to grow at a substantial growth rate. This expansion may be attributed to the local government's increasing investment in innovative technologies such as 5G, machine learning (ML), artificial intelligence (AI), cloud, and others. Similarly, with the increasing IT budgets.

South America

South America to showcase steady growth rate during the forecast period. This is due to stable growth in the number of online seminars, workshops, and conferences within the region.

Key Companies in Video Conferencing Industry

Market Players are Using Merger & Acquisition, Partnerships, and Product Development Strategies to Expand their Business Reach

Major industry players operating in the market are emphasizing providing enhanced video collaboration services to enhance their market presence and attract new customers. These companies prioritize acquiring small and local firms to expand their business reach. Moreover, mergers & acquisitions, leading investments, and strategic partnerships contribute to an increased demand for the product.

List of Key Companies Profiled:

- Avaya, LLC (U.S.)

- AVer Information, Inc. (Taiwan)

- BlueJeans by Verizon (U.S.)

- Cisco Systems, Inc. (U.S.)

- Huawei Technologies Co. Ltd. (China)

- Logitech International S.A. (Switzerland)

- Microsoft Corporation (U.S.)

- Panasonic Corporation (Japan)

- Polycom, Inc. (Plantronics, Inc.) (U.S.)

- Zoom Video Communications, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Zerify Inc., announced collaboration with SpeakSpace, LLC to boost its sales and increase brand recognition. The company offers cybersecurity solutions for video conferencing that help businesses in having secured communication.

- February 2023: RingCentral, Inc., announced that it had entered into an expanded and extended strategic partnership with Avaya, Inc. They agreed to extend its multiyear partnership with an improved and aligned incentive structure to accelerate the migration to Avaya Cloud Office.

- February 2023: Qualcomm Technologies, Inc. launched a new video conferencing solution with artificial intelligence capabilities to offer more immersive communication. The solution eliminates distractions and enhances user participation.

- January 2023: New York-based Cordoniq, a smart video collaboration platform provider, announced a new offering for enterprise businesses to access secured video conferencing solutions beyond standard solutions.

- November 2022: Owl Labs, a video conferencing solutions provider, announced an investment of USD 25 million in Series C and collaborated with HP. This funding was used by Owl Labs to support the development of its products and to increase their global reach.

REPORT COVERAGE

The market report highlights leading regions worldwide to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry trends and analyzes technologies rapidly deployed globally. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Conference Type

By Deployment

By Application

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 65.72 billion by 2034.

In 2026, the market value stood at USD 41.62 billion.

The market is projected to grow at a CAGR of 5.90% during the forecast period.

In 2026, the hardware segment led the market.

The increasing adoption of remote learning solutions is expected to drive market growth.

Avaya, LLC, AVer Information, Inc., BlueJeans by Verizon, Cisco Systems, Inc., Huawei Technologies Co. Ltd., Logitech International S.A., Microsoft Corporation, Panasonic Corporation, Polycom, Inc. (Plantronics, Inc.), Zoom Video Communications, Inc., among others are the top players in the market.

North America dominated the global video conferencing market with a share of 30.40% in 2025.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Information & Technology

Clients

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us