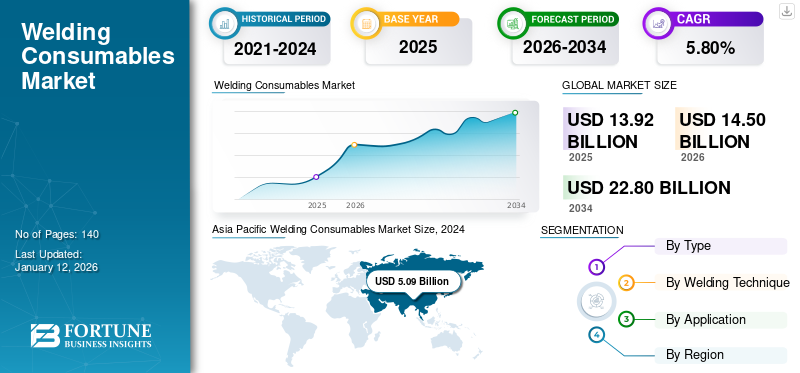

Welding Consumables Market Size, Share & COVID-19 Impact Analysis, By Type (Stick Electrodes, Solid Wires, Flux-cored Wires, and SAW Wires & Fluxes), By Welding Technique (Arc Welding, Resistance Welding, Oxy-fuel Welding, Solid State Welding, and Others (Electron Beam Welding)), By Application (Automotive, Building & Construction, Heavy Engineering, Railway & Shipbuilding, Oil & Gas, and Others (Aerospace)), and Regional Forecast, 2026-2034

Welding Consumables Market

The global welding consumables market size was valued at USD 13.92 billion in 2025. The market is projected to grow from USD 14.50 billion in 2026 to USD 22.80 billion by 2034, exhibiting a CAGR of 5.3% during the forecast period. The Asia Pacific dominated global market with a share of 38.40% in 2025.

Welding consumables are flux and filler metals used during the welding process. Filler metals are melted to form a strong bond between two metals while flux prevents heated metals from oxidizing during the process. Copper, nickel, ilmenite, rutile & aluminum are some of the basic minerals used in the manufacturing of these consumables. These consumables help to ensure cost-effective welding, protect the molten weld from impurities in the air, and prevent porosity from forming in the weld pool. As a result, they are common in the construction, automotive, energy, shipbuilding, and aerospace sectors.

Global Welding Consumables Market Overview

Market Size:

- 2025 Value: USD 113.92 billion

- 2026 Value: USD 14.50 billion

- 2034 Forecast Value: USD 22.80 billion, with a CAGR of 5.80% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific accounted for approximately USD 5.34 billion in 2025, representing the largest regional share, driven by strong demand in industrialized countries like China, India, and South Korea

- Fastest‑Growing Region: Asia Pacific is expected to grow rapidly during the forecast period due to robust infrastructure development and increasing industrial activity

- End‑User Leader: The automotive segment leads demand for welding consumables, especially with the adoption of robotic and automated welding in manufacturing

Industry Trends:

- Solid Wires Dominate: Solid wires held the largest share by type in 2024 due to their efficiency, strong weld performance, and suitability for MIG welding

- Rise of Arc Welding: Arc welding remains the dominant technique, supported by Industry 4.0 initiatives and widespread use in smart manufacturing

- Technological Innovation & Smart Materials: Advancements such as hyperfill solutions and life‑tracking consumables are enhancing productivity and material efficiency

Driving Factors:

- Automotive & Smart Manufacturing: Growing use of automation and robotics in automotive and heavy engineering industries is boosting demand for welding consumables

- Infrastructure & Industrial Expansion: Increasing construction and industrial development, particularly in emerging markets, is accelerating market growth

- Volatility in Raw Material Supply: Fluctuating prices and availability of key raw materials such as steel and alloys impact production costs and supply chain planning

China, the pandemic's epicenter and key industrial base, significantly delayed global corporate operations and led to disruptions in regional and global value chains. The market collapse caused by COVID-19 due to factory closures, supply chain disruptions, and the global economic downturn also impacted market growth and expansion.

Additionally, the consumables industry for welding is also facing some major disruption in their business and manufacturing operations. According to the American Iron & Steel Institute Data, the U.S. steel mills reduced production and they worked at roughly 50% capacity, compared to 80% in the previous year. Furthermore, steel output in Europe decreased by 50% due to lack of new orders, decreasing by roughly 75%.

With an increasing tendency toward combining two different metals, the need for bespoke and novel metal designs/shapes, increased fabrication, and uses in other intensive industries, such as manufacturing, automotive, and oil & gas, the market is exploding. Furthermore, the introduction of different welding technologies, such as resistance spot and plasma welding, and the widespread implementation of robotic welding solutions are the primary drivers of market expansion.

Welding Consumables Market Trends

Utilization of Smart Materials in the Welding Industry to Bolster Market Growth

Energy-efficient and ecologically friendly "smart" materials are gaining traction in the market. There is a growing understanding of how materials perform at the atomic level to combine two dissimilar metals without compromising their strength, corrosion resistance, or other performance properties. Additionally, the smart material has an embedded computer chip to track weld life and provide a multi-functional design. Additionally, incorporating such materials consumes less energy and reduces pre- and post-heating processes. Manufacturers, product designers, and welders benefit from integrating such technology to improve the entire manufacturing cycle.

Furthermore, the integration of smart materials in welding processes enhances efficiency and facilitates real-time monitoring and predictive maintenance, leading to reduced downtime and increased productivity. These advancements in materials science and technology are revolutionizing various industries, from automotive to aerospace, by enabling lighter, stronger, and more sustainable designs. With continuous research and development, the potential applications of smart materials in welding are expected to expand, driving further innovation and market growth over the coming years.

Download Free sample to learn more about this report.

Welding Consumables Market Growth Factors

Increase in the Application of Welding Robots fuels the Market Growth

A surge in the use of welding robots acts as a significant driver propelling the welding consumable market. Welding robots are renowned for their exceptional precision and effective mitigation of safety concerns. Moreover, their capacity for precise repeatability significantly reduces the time required for the mass production of various items. Manufacturers also attest that employing welding robots optimizes quality while simultaneously minimizing manufacturing costs. Furthermore, their ability to facilitate easy offline program generation and seamless importation of third-party paths enables customers to swiftly transition solid models from the digital realm to real-world applications.

Additionally, the growing adoption of automation in welding processes enhances efficiency and opens up avenues for advanced applications, such as adaptive welding techniques and collaborative robotics. This trend is reshaping the landscape of the welding consumables market, as industries increasingly embrace automation to improve productivity, quality, and safety standards. As technology continues to evolve, the integration of welding robots is anticipated to become even more widespread, further driving market expansion and innovation.

RESTRAINING FACTORS

Volatility in Supply of Raw Materials to Hinder Market Growth

Raw material price inconsistency is a key issue restricting the growth of the industry. Steel, aluminum, graphite, iron, and a variety of other raw materials are used to make these consumables. In addition, changes in trade rules, imbalances in the supply and demand ecology, volatility in foreign currency rates, and heightened geopolitical threats are all contributing to price fluctuations in these resources. This has a negative influence on manufacturers and affects the cost of consumables manufacturing, forcing manufacturers to cut profit margins to remain competitive in the global market. Apart from that, the industry is being restrained by an increase in workplace accidents due to a scarcity of competent welders.

Furthermore, the welding consumables industry is facing challenges due to the retirement of experienced personnel and a shortage of competent people. Welding-intensive businesses, such as heavy engineering, automotive, and construction, are suffering as a result of this predicament. The scarcity of competent welders has ramifications in other industries. As a result, these constraints are posing challenges to the welding industry and limiting the market growth.

Welding Consumables Market Segmentation Analysis

By Type Analysis

Solid Wires Segment Holds Major Share Due to Increasing Utilization in Various Applications

Based on type, the market is classified into solid wires, flux-cored wires, stick electrodes, and SAW wires & fluxes.

The solid wires segment is forecast to represent 36.83% of total market share in 2026. This wire is expected to be the first choice for new entrants due to its high deposition rate, efficiency of work execution, and production of clean and strong welds. Solid wires are frequently used in many end-user industries for Metal Inert Gas (MIG) welding. The welding consumables industry is now focusing on simple and cost-effective welding solutions to protect work pieces from the external environment. A single line plays an important role as it prevents oxidation; the mild steel solid wire is plated with copper, which improves conductivity and extends the life of the weldment.

Furthermore, the flux-cored wires segment is anticipated to develop with a promising pace owing to the increased demand from several end-use industries. In addition, the increasing preference for cored wires in the construction and shipbuilding industries is expected to increase the global demand for these wires.

Moreover, stick electrodes are intended for use in welding operations involving mild and low alloy steel due to their inexpensive cost and a wide range of uses in end-use industries, and thus they are favored over other consumables.

The acceptance of SAW wires & fluxes is projected to increase attributed to their properties that allow the welding to withstand high temperatures, resist corrosion, and high-thickness materials.

To know how our report can help streamline your business, Speak to Analyst

By Welding Technique Analysis

Arc Welding to Have Substantial Growth due to Rising Smart Factories and Industry 4.0

Based on welding technique, the market is further categorized into arc welding, resistance welding, oxy-fuel welding, solid state welding, and others (electron beam welding).

The obvious advantage provided by the arc welding across multiple end-use industries is increasing the viability of the welding application in automotive, heavy engineering, and overall manufacturing industry. The prominence of the robotic arc welding in manufacturing facilities and other industries is one of the critical factors boosting the sales of welding consumables over the forecast period. The new processes will enable a better joint and help to achieve safer, lighter, eco-friendly, and stronger structures through these welds.

Moreover, the resistance welding segment witnessed a considerable rise as it involves applying force and passing of an electric current through the metal workpiece to heat and melt the area defined by the electrode and/or workpiece.

Additionally, the oxy-fuel welding segment is projected to have a remarkable increase in the upcoming years. This is owing to its utilization of fuel gases and pure oxygen to increase the flame temperature for the local melting of the workpiece.

Furthermore, the solid state welding is expected to have a sluggish growth as it includes the use of temperatures below the melting points of base materials.

By Application Analysis

Heavy Engineering Industry to Grow Moderately due to Rising Smart Factories and Industry 4.0

Based on application, the market is further divided into automotive, building & construction, heavy engineering, railway & shipbuilding, oil & gas, and others (aerospace).

Due to building of factories that are high-end, such as smart factories, Industry 4.0, broad use of robotic welding across different industries, and the evolution of new technologies, the heavy engineering segment is predicted to increase at a modest rate in the next few years.

The building & construction industry is growing fast due to government efforts for infrastructure development, restructuring of current residential and commercial projects, and increased foreign direct investment in developed and developing countries.

The automotive segment is expected to provide a considerable boost to the sales of welding consumables due to the increasing introduction of robotic, automated welding solutions offered by the established welding solution providers. Moreover, evolution and transition of automotive manufacturers into industry 4.0, landmark changes in the manufacturing facilities are collectively bolstering the growth of application of welding across the automotive sector.

Railways are expected to rise steadily in the next few years as a result of increased investment in current and new transportation projects, growing disposable income, and government measures to improve connectivity. With the growing use of two different metals in this industry, the adoption of robotic solutions to create essential portions of ships, and the rising momentum of corrosion-resistant underwater chamber welding, shipbuilding is expected to expand at a slower rate.

REGIONAL INSIGHTS

The report's scope comprises five major regions, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific Welding Consumables Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 5.34 billion in 2025 and USD 5.61 billion in 2026, due to the presence of welding consumables companies in developed and developing countries such as China, India, and South Korea. Furthermore, the regional market is being driven by a large intake of capital and high adoption of smart technologies such as robotic welding. The Japan market is expected to reach USD 1 billion by 2026, the China market is expected to reach USD 2.31 billion by 2026, and the India market is expected to reach USD 1.66 billion by 2026.

According to the India Brand Equity Foundation (IBEF), leading domestic firms in the technology, manufacturing, and construction industries are investing outside of India, which will fuel market growth in the future. For example, Larson & Turbo (L&T) is continually investing in power equipment manufacture, whereas Bharat Heavy Electrical Limited (BHEL) intends to sell its goods to Syria and Vietnam.

To know how our report can help streamline your business, Speak to Analyst

After Asia Pacific, North America is projected to lead the global market share over the forecast period. Being the pioneer in technological advancements, and huge investments in the research and development operations by the companies in this particular region is spurring market sales across North America. Moreover, most market players with promising market share across the globe have established manufacturing facilities across the North America region, making it one of the leading manufacturing hubs of the products aiding the market growth. The U.S. market is expected to reach USD 2.39 billion by 2026.

Europe is likely to demonstrate continuous market expansion during the forecast period due to the region's fully developed marketplaces for consumables suppliers. The European Union is taking stringent actions regarding increasing pollution levels across the region, which is resulting in producing environment-friendly products. This is leading the consumables manufacturing companies to produce efficient products that can help in reducing the pollution level in the coming future and contributing toward increasing the global market share. The UK market is expected to reach USD 0.46 billion by 2026, while the Germany market is expected to reach USD 0.94 billion by 2026.

The Middle East & Africa region is expected to increase significantly as a result of the rising demand for automobiles and the availability of raw resources in the region's car and transportation sectors. The government of Saudi Arabia has launched a project named Vision 2030, under which various international investors are expected to invest in several sectors, including construction, IT, logistics, tourism, and many more. This results in the market growth of welding consumables in the country, which is ultimately influencing the regional growth of the market.

Latin America is likely to grow at a modest rate due to the adoption of modern welding technologies, the government's concentration on infrastructure development, and the expansion of large manufacturers' production facilities across the area to serve the unattended market.

KEY INDUSTRY PLAYERS

Leading Market Players are Emphasizing on Training Welders Professionally to Create a Strong Brand

Various welding groups and governmental entities are collaborating with key manufacturers to train welders with modern technology. Weld Australia, for example, is collaborating with the federal and state governments, and different Technical and Further Education (TAFE) institutions around the country to teach new welders and upskill existing welders.

The manufacturers are also trying to strengthen their positions in the emerging market across Asia Pacific region. The companies are striving to strengthen supply chains across those markets and are also trying to reinforce their direct customer reach to increase penetration across those geographies. Diversification of the existing product portfolio and introduction of novel equipment and consumables are identified as the organic development strategies of the market players operating in the market at a global level.

LIST OF TOP WELDING CONSUMABLES COMPANIES

- Lincoln Electric (U.S.)

- KOBE STEEL, LTD (Japan)

- ESAB (U.S.)

- CS HOLDINGS CO., LTD. (Korea)

- Hyundai Welding Co., Ltd (U.S.)

- Panasonic Corporation (U.S.)

- Fronius International GmbH (Austria)

- RME MIDDLE EAST (UAE)

- voestalpine BÖHLER Edelstahl GmbH (Austria)

- Tianjin Golden Bridge Welding Materials Group International Trading Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- August 2023: Air Water America Inc., a subsidiary of Air Water Inc., a Japanese industrial gases supplier headquartered in New Jersey, U.S. The company acquired the business of Phoenix Welding Supply LLC, a leading welding products and independent gas supplier. The acquisition will expand the business of Air Water in Northeast and Midwest U.S.

- May 2023: Introtech, a prominent welding solution provider, launched its fully automated powerful, cutting edge welding solution for offshore manufacturers that need to work with large structures.

- February 2023: Miller Electric Mfg. LLC, which is considered as one of the prominent manufacturers of welding equipment and consumable products, has recently unveiled its Copilot collaborative welding system. This system will enable welders to achieve better quality of welding and optimize the use of consumables enabling the users to meet with augmented demand.

- December 2022: Renteca emphasizes operator safety by introducing innovative welding safety equipment. Their Advanced arc control enhances pulse welding arcs, ensuring a more stable and robust arc even at low arc lengths. This feature helps improve welding performance and reduces heat input, offering additional safety benefits for operators.

- July 2022: Lincoln Electric, which is a U.S. based provider of welding consumables and equipment, has recently launched its newly developed Power MIG 215 MPi Multi-Process Welder. The welder is designed to have economical advantage and also does have a robust design.

REPORT COVERAGE

The research report offers an in-depth analysis of the industry and focuses on key factors such as leading companies, type, welding technique, and leading applications of the product. Besides, the report provides insights into the market trends and highlights key industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Welding Technique

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was valued at USD 14.50 billion in 2026.

The market is likely to grow at a CAGR of 5.80% during the forecast period of 2026-2034.

Within the type segment, solid wires segment is expected to be the leading segment in the market during the forecast period.

The Asia Pacific market size stood at USD 5.34 billion in 2025.

Multiple applications of welding technology and demand in the automotive industry are fueling the market growth.

Lincoln Electric, KOBE STEEL, LTD, ESAB, CS HOLDINGS CO., LTD., Hyundai Welding Co., Ltd, Panasonic Corporation, Fronius International GmbH, RME MIDDLE EAST, voestalpine BoHLER Edelstahl GmbH, and Tianjin Golden Bridge Welding Materials Group International Trading Co., Ltd are the top companies.

The U.S. dominated the market in terms of unit sales in 2025.

Volatility in supply of raw materials to hinder market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us