Pulse Oximeter Market Size, Share & Industry Analysis, By Product Type (Fingertip Oximeters, Handheld Oximeters, Tabletop Oximeters, and Others), By Technology (Conventional and Smart), By Age Group (Adults and Pediatrics), By End-user (Hospitals and Ambulatory Surgical Centers, Clinics, Home Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

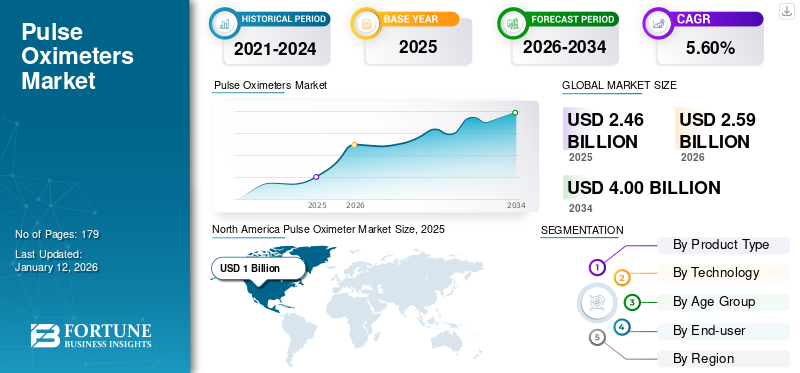

The global pulse oximeter market size was valued at USD 2.46 billion in 2025. The market is projected to grow from USD 2.59 billion in 2026 to USD 4 billion by 2034, exhibiting a CAGR of 5.60% during the forecast period.North America dominated the pulse oximeters market with a market share of 40.70% in 2025. Moreover, the U.S. pulse oximeters market size is projected to grow significantly, reaching an estimated value of USD 1.34 billion by 2032, driven by increasing prevalence of diseases such as chronic bronchitis, and increasing adoption of advanced technologies.

Hypoxemia is a condition where oxygen in the blood of a person decreases. If not detected and treated at an early stage it can lead to acute respiratory failure. Pulse oximeters help in monitoring the oxygen saturation in the blood. Hypoxemia can be caused due to anemia, asthma, bronchitis, Acute Respiratory Distress Syndrome (ARDS), congestive heart failure, and others. The increasing prevalence of these diseases has been fueling the demand for the product in hospitals and homecare settings.

- For instance, as per data published by the Journal of Cardiac Failure in 2023, 6.7 million Americans aged 20 and above suffered from heart failure. This number is expected to rise to 8.5 million by 2030.

Moreover, the prevalence of diseases, such as heart problems, respiratory disorders, and others, are more common in older populations. Therefore, the increasing geriatric population has been boosting the adoption of pulse oximeters in homecare settings.

The product demand significantly increased during the COVID-19 pandemic in 2020, as these devices were vastly used in hospitals and at-home care settings to monitor the blood oxygen levels of patients suffering from COVID-19. However, after the COVID-19 pandemic in 2022 and 2023, the market experienced a decline in its value due to the low demand for these devices.

Global Pulse Oximeter Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.46 billion

- 2026 Market Size: USD 2.59 billion

- 2034 Forecast Market Size: USD 4 billion

- CAGR: 5.60% from 2026–2034

Market Share:

- North America dominated the pulse oximeter market with a 40.70% share in 2025, driven by the rising prevalence of chronic respiratory disorders, rapid adoption of home healthcare devices, and a strong presence of key market players.

- By product type, tabletop oximeters are expected to retain the largest market share, supported by the increasing number of hospital admissions for respiratory disorders such as COPD and the growing demand for continuous patient monitoring systems.

Key Country Highlights:

- United States: Market growth is fueled by a high incidence of chronic respiratory diseases, increasing adoption of advanced monitoring technologies, and expanding home healthcare usage.

- Europe: Growth is supported by mandatory screening of critical congenital heart defects (CCHD) in newborns using pulse oximeters and the steady improvement of hospital infrastructure.

- China: Rising awareness regarding the early diagnosis of respiratory disorders, coupled with significant investments in healthcare infrastructure, drives pulse oximeter adoption.

- Japan: The country's focus on integrating advanced patient monitoring devices within hospitals and the rising demand for non-invasive technologies are key growth factors.

Pulse Oximeter Market Trends

Increasing Focus of Market Players on Mergers and Acquisitions to Strengthen their Position in the Market

The COVID-19 pandemic created huge awareness about pulse oximeters, which significantly increased their demand. However, apart from COVID-19, these devices are also important in monitoring the blood oxygen levels of patients suffering from diseases such as acute respiratory disorders, congestive heart failure, and others. The increasing prevalence of these diseases has been significantly fueling the market growth.

Additionally, market players such as Zynex, Inc. and Masimo have increased their emphasis on growth strategies such as mergers, acquisitions, and collaborations to strengthen their position in the market.

- For instance, in December 2021, Zynex, Inc., acquired Kestrel Labs, Inc., a patient monitoring technology company. The acquisition would help Zynex Inc. add several laser-based pulse oximetry monitoring products to its portfolio.

Moreover, many market players are developing new products to treat various chronic respiratory disorders, which is expected to drive market growth in the coming years.

- For instance, in January 2021, Tyto Care announced the introduction of its U.S. FDA-cleared fingertip oximeter (SpO2).

The launch of such devices is expected to boost the market in the coming years.

- North America witnessed a pulse oximeters market growth from USD 0.91 Billion in 2023 to USD 0.96 Billion in 2024.

Download Free sample to learn more about this report.

Pulse Oximeter Market Growth Factors

Surge in Prevalence of Chronic Respiratory Disorders to Favor Market Growth

In recent years, chronic respiratory diseases such as asthma, Chronic Obstructive Pulmonary Disease (COPD), lung cancer, cystic fibrosis, sleep apnea, and occupational lung diseases have been the leading causes of death globally. Furthermore, the high and middle-income countries are highly affected by congenital heart defects and COPD.

- For instance, as per data published by the Centers for Disease Control and Prevention (CDC), around 14.2 million individuals suffered from COPD in the U.S. in 2021.

Oxygen saturation is an important parameter in COPD and other chronic respiratory diseases. The oximeter measures oxygen saturation or the percentage of hemoglobin saturated with oxygen in arterial blood to diagnose COPD.

The rising incidence of Congenital Heart Defects (CHDs), COPD, and other respiratory diseases in infants and the geriatric population has increased the demand for various new products.

- For instance, as per a research study published by Frontiers Media S.A. in 2023, the incidence of Congenital Heart Disease (CHD) was 17.8 in 1,000 live births in the hospitals of Jordan.

Such a high prevalence of chronic respiratory diseases requiring measuring has been fueling the market growth.

Emerging Government Guidelines and Recommendations on Product Use to Bolster Market Growth

Governments across various countries mandated continuous monitoring for the oxygen saturation level of patients suffering from chronic respiratory disorders. Government guidelines and recommendations on pulse measuring devices have been implemented in developed and developing countries. Moreover, increasing oximeters for anesthesia monitoring during surgeries across developed countries have contributed to the market growth.

Pulse Oximetry Screening (POS) helps detect chronic diseases such as CHDs, hypoxemia, and other disorders, thereby eliminating the risk of severe complications in newborns. Such benefits of POS have increased the product adoption in healthcare settings. Moreover, the infants born preterm are at a higher risk of getting heart and breathing problems. Therefore, the increasing number of preterm births has also been fueling the demand for pulse oximeters, including infant pulse oximeters.

- For instance, as per data published by the CDC, in 2021, there was at least one preterm birth in every 10 births.

The increasing awareness about patient safety during surgery and anesthesia in developing countries has resulted in realigning the prerequisites of critical care departments. This has mandated the hospitals to include oximeters for monitoring patients' oxygen saturation.

Such recommendations and implementation of various guidelines by government organizations for the use of oximeters are expected to increase the demand for these devices. This is expected to propel the market growth during the forecast period.

RESTRAINING FACTORS

Rising Inaccuracies and Limitations Associated with the Product Usage to Hinder Product Adoption

Despite the increasing adoption of pulse measuring devices globally, the inaccuracies associated with the product are expected to limit the market growth in the coming years. There are several factors that affect the accuracy of oximeters, such as poor circulation, skin temperature, skin thickness, fingernail polish, and dark skin pigmentation.

They have a higher error rate in patients with dark skin pigmentation. Many studies have shown that the device results in inaccurate readings among African-American patients.

- For instance, according to a study conducted by the Michigan Medical School in January 2021, black patients were likely to have low oxygen levels that were missed by the device. The study confirmed that sometimes when the product read 94%, the actual blood oxygen saturation was much lower for a black patient.

In recent times, many government bodies and the FDA released guidelines for these inaccuracies in oximeters.

- For instance, the new guidelines released by the U.S. FDA in February 2021 state that if an FDA-cleared pulse oximeter results in 90%, the blood's true oxygen saturation (SPO2) is generally between 86-94%.

Such inaccuracies associated with the product are expected to limit the market growth during the forecast period.

Pulse Oximeter Market Segmentation Analysis

By Product Type Analysis

Tabletop Oximeters Segment Held a Major Share Due to Growing Burden of COPD

Based on product type, the market is segmented into fingertip oximeters, handheld oximeters, tabletop oximeters, and others.

The tabletop oximeters segment held the highest pulse oximeter market with a share of 40.54% in 2026 and is anticipated to expand at a substantial CAGR during the forecast period. The large percentage of the segment is attributed to the increasing number of hospitalizations and the high prevalence of respiratory disorders such as asthma and COPD.

- According to the Global Initiative for Chronic Obstructive Lung Disease (GOLD) Report 2021, the global COPD grade 2 prevalence was 10.1%, with 11.8% prevalence in men and 8.5% in women. Such a high prevalence of COPD globally is expected to increase hospital admissions, fueling the demand for measuring devices.

The fingertip oximeters segment is projected to expand at the highest CAGR during the forecast period. This segmental growth is attributed to a sudden increase in the adoption of these products during the COVID-19 pandemic. Moreover, the growing adoption of such devices for the home monitoring of respiratory disorders such as asthma and COPD is expected to drive its demand in the future.

- The Fingertip Oximeters segment is expected to hold a 17.6% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Technology Analysis

Conventional Segment to Dominate Market due to Increasing Adoption of Wired Oximeters

Based on technology, the market is segmented into conventional and smart.

The conventional segment accounted for the largest market with a share of 79.15% in 2026 and is expected to expand at a substantial CAGR during the forecast period. An increase in the adoption of wired measuring devices and the growing demand for continuous patient monitoring in hospitals are expected to drive the expansion of the conventional segment during the forecast period. Furthermore, the surge in prevalence of various respiratory disorders that require continuous patient monitoring in hospitals and clinics drives the segment growth.

- For instance, NHS Digital data shows that in 2020-21, approximately 1.17 million people in England have been diagnosed with COPD, which was around 1.9% of the population. Such a high prevalence in England is expected to increase the demand for conventional products in the coming years.

The smart segment is anticipated to expand at the highest CAGR during 2025-2032. The growth is attributed to a rise in the adoption of connected devices such as wireless measuring devices and the increasing need for continuous patient monitoring in home care and ambulatory settings. Furthermore, the growing focus of market players to launch smart devices is expected to contribute to the segmental growth during the forecast period.

By Age Group Analysis

Adults Segment to Hold the Largest Market Share Due to Increasing Prevalence of Chronic Respiratory Disorders

Based on age group, the market is segmented into adults and pediatrics.

The adults segment held the largest market share contributing 92.28% globally in 2026 and is projected to expand at a substantial CAGR during the forecast period. The segmental growth is attributed to the increasing prevalence of chronic respiratory diseases such as asthma and COPD among the adult population. In addition, factors such as the high prevalence of COVID-19 among the adult population and growing hospitalizations of adult patients requiring continuous patient monitoring are expected to drive the segmental growth in the coming years.

The pediatrics segment is projected to expand at the highest CAGR during the forecast period. The growth of the pediatrics segment is attributed to the increasing incidence of COVID-19 among the pediatric population. Moreover, the rising prevalence of asthma in children is expected to increase the adoption of products during the forecast period.

- For instance, as per the Global Asthma Report of 2022, the GAN phase 1 survey included 101,777 children globally. Around 9.1% of the surveyed children were affected with asthma symptoms.

Such a high prevalence of asthma is expected to boost the demand for pediatric pulse-measuring devices during the forecast timeframe.

By End-user Analysis

Hospitals and Ambulatory Surgical Centers Segment to Continue Dominance Due to Increasing Patient Admissions

Based on end-user, the market is segmented into hospitals and ambulatory surgical centers, clinics, home healthcare, and others.

In 2026, the hospitals and ambulatory surgical centers segment held the highest market share accounting for 62.93% in 2026 and is expected to expand at the highest CAGR over 2024-2032. The segment’s growth is attributed to the increasing number of hospital admissions requiring continuous patient monitoring systems. Moreover, the rising number of hospitals coupled with the increased patient admissions to treat COPD and asthma are expected to drive the product demand over the projection period.

- For instance, according to the National Ambulatory Medical Care Survey of 2018 published by the CDC, the percentage of visits to office-based physicians with COPD indication was 4.1% of the total visits and patient visits to the emergency department with COPD indication was 873,000. Such high patient visits are expected to fuel the segmental growth during the forecast timeframe.

The home healthcare segment is expected to expand at the second-highest CAGR during the forecast period (2024-2032). The segmental growth is due to the escalating awareness regarding the home monitoring of oxygen levels and increasing launches of measuring devices by market players for homecare settings. Moreover, a sudden increase in the demand for fingertip measuring devices during the COVID-19 pandemic is expected to contribute to segmental growth over the coming years.

REGIONAL INSIGHTS

In terms of geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Pulse Oximeter Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1 billion in 2025 and USD 1.05 billion in 2026 and is estimated to sustain its position over the forecast period. The rapid adoption of wireless pulse oximeters and the increasing product usage in home healthcare is expected to contribute to the market growth in the region. Moreover, a growing number of patients suffering from chronic respiratory diseases, the surge in hospital admissions and ASCs, and a strong presence of players are anticipated to drive the pulse oximeter market growth. The U.S. market is projected to reach USD 0.97 billion by 2026.

Europe holds the second position in the market and recorded the second largest market share in 2023. The region is foreseen to grow at a moderate CAGR over the projected timeframe. The region’s growth is credited to the increasing prevalence of CCHD in newborns and the mandate to screen CCHD in newborns with oximetry in hospitals. Furthermore, the improvement in healthcare infrastructure resulting in the increased number of hospitals in Europe ultimately drives the demand for new products. The UK market is projected to reach USD 0.12 billion by 2026, while the Germany market is projected to reach USD 0.15 billion by 2026.

- For instance, according to Interweave Textiles Ltd., as of October 2021, there were around 1,229 hospitals in the U.K. This number included both private hospitals and NHS trust managed hospitals.

Asia Pacific is anticipated to exhibit the highest CAGR over the projected timeframe. The region’s growth can be credited to the strong focus on improving hospital infrastructure, increasing awareness about the diagnosis of chronic respiratory disorders, and rising COVID-19 cases. The Japan market is projected to reach USD 0.12 billion by 2026, the China market is projected to reach USD 0.14 billion by 2026, and the India market is projected to reach USD 0.11 billion by 2026.

Latin America and the Middle East & Africa are projected to grow at a lower CAGR over the forecast timeframe. The growth rates are credited to the rising healthcare expenses, improvement in healthcare infrastructure, and rising awareness of efficient patient monitoring devices for chronic disorders.

Key Industry Players

Diversified Product Portfolio Coupled with Strong Distribution Network to Maintain Market Position for Medtronic and Masimo

The market was highly consolidated before the COVID-19 pandemic. However, due to the high demand for pulse measuring devices during the pandemic, many small and local players entered the market.

Masimo and Medtronic are prominent players in the market and accounted for the major market share in 2024. The substantial market share is credited to the diversified product portfolio and strong direct and indirect presence. Additionally, the introduction of technologically advanced products is one of the major factors anticipated to strengthen the position of these companies in the market.

In May 2022, Medtronic received the U.S. FDA approval for its Nellcor Oxysoft SpO2 sensor. The approval is expected to strengthen its Nellcor pulse oximeter product portfolio.

Other key market players such as Koninklijke Philips N.V. and NIHON KOHDEN CORPORATION held substantial shares of the market. Moreover, Nonin is one of the key players operating in the market due to the strong portfolio of various technologically-advanced devices. The other key players are focusing on multiple strategies to increase their market share during the forecast timeframe.

LIST OF TOP PULSE OXIMETER COMPANIES:

- GE HealthCare (U.S.)

- Masimo (U.S.)

- VYAIRE (U.S.)

- Nonin (U.S.)

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- Smiths Medical (ICU Medical Inc.) (U.S.)

- Beurer (Germany)

- NIHON KOHDEN CORPORATION (Japan)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – Masimo received the Food and Drug Administration (FDA) approval for its pulse oximeter MightySat Fingertip.

- November 2022 – BioIntelliSense, Inc. added skin color sensitivity to its pulse oximeter sensor chipset. With this advancement, the oximeter can measure blood oxygen saturation level accurately irrespective of the skin tone.

- December 2021 – Telli Health announced the delivery of its first U.S. FDA certified and approved 4G cellular-connected SpO2 oximeter. This oximeter and its remote patient monitoring devices helped track COVID-19 patients during the pandemic.

- August 2021 – Nihon Seimitsu Sokki Co. Ltd. increased its production capacity of Pulse Oximeter to 1.5 times the level observed at the end of 2020. This production capacity expansion is intended to help COVID-19 patients recuperating at home.

- June 2021 – DetelPro expanded its product portfolio with the launch of its product Oxy10 pulse oximeter.

REPORT COVERAGE

The research report provides a detailed competitive landscape and market dynamics. It focuses on key aspects, such as technological advancements, and the prevalence of major pulmonary diseases, including asthma, and COPD. Besides this, the report provides information related to new product launches and key industry developments such as mergers and acquisitions. In addition, the report includes insights into industry trends and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.60% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Technology

|

|

|

By Age Group

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global pulse oximeter market stood at USD 2.46 billion in 2025 and is projected to reach USD 4 billion by 2034.

The market is expected to exhibit a CAGR of 5.60% during the forecast period (2026-2034).

North America led the pulse oximeter market in 2025, with a 40.70% share.

The rising prevalence of chronic respiratory disorders and a strong government focus to mandate monitoring devices for various chronic diseases are the key factors driving the market growth.

Masimo and Medtronic are the top players in the market.

In 2025, tabletop oximeters held the largest market share due to high hospital usage, while fingertip oximeters are expected to grow fastest due to their portability and rising homecare demand.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us