Wheelchair Market Size, Share & Industry Analysis, By Product (Manual Wheelchairs [Standard and Custom] and Motorized Wheelchairs [Power Assist Wheelchairs {Front Add-on, Rear Add-on, and Wheel Add-on} and Powered Wheelchairs {Standard Powered Wheelchair and Complex Rehab Technology (CRT) Powered Wheelchairs}]), By Age Group (Adults and Pediatrics), By End User (Healthcare Settings {Hospitals & ASCs, Specialty Clinics, Rehabilitation Centers, Long-term Care Centers, and Others}, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

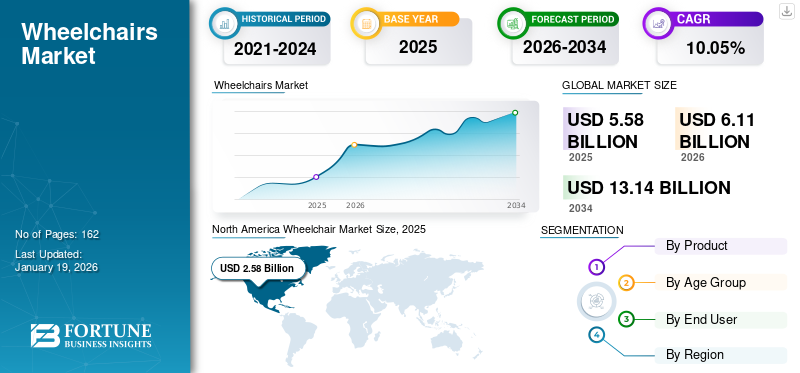

The global wheelchair market size was valued at USD 5.97 billion in 2025. The market is projected to grow from USD 6.25 billion in 2026 to USD 9.56 billion by 2034, exhibiting a CAGR of 5.4% during the forecast period.

Wheelchairs are mobility assistive devices that are used to promote mobility and enhance the quality of life for people with mobility impairment who have difficulty walking. The growing prevalence of mobility disorders among the population is leading to a rising number of disabled people globally, resulting in increasing demand for these devices in the market.

- According to 2024 statistics published by the Centers for Disease Control and Prevention (CDC), more than one in four adults, accounting for nearly 28.7% in the U.S., have some disability.

Furthermore, the rising focus on research and development activities to launch novel products among the major players, such as Permobil and Invacare Corporation, among others, is further contributing to the demand for wheelchairs in the market.

Wheelchair Market Trends

Increasing Shift Towards the Circular Economy Among the Industries Boosted Market Trends

There has been an increasing shift towards the circular economy from linear production models among the industries. This is a new production and consumption model that ensures sustainable growth over time. The growing focus of companies on strategically collaborating with other players to develop circular wheelchairs is a major trend in the industry.

The circular mobility devices maximize the value of the products through their reuse and recycling. Further, market players are shifting their focus to use more recyclable products for the manufacturing of these devices to support the circular economy.

- In March 2022, Etac launched its first circular wheelchair, Etac Cross revive, in partnership with Medux, a Dutch supplier of mobility devices, including wheelchairs, mobility scooters, walkers, and others.

Other Prominent Trends

- Lightweight aluminum and titanium frames reduce user fatigue and improve maneuverability.

- Integration of lithium-ion batteries, improving range and charging efficiency in powered wheelchairs.

- Smart features such as pressure monitoring, posture support, and connectivity are emerging in premium segments.

- Custom seating and modular components address pressure ulcer prevention, a major clinical concern for long-term users.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Rising Prevalence of Mobility Disorders among the Population to Boost the Product Demand

Mobility impairment refers to a wide range of disabilities that restrict the movement of any limbs or affect fine motor ability. The growing prevalence of disability among the general population in countries such as the United States, Japan, the U.K., Germany, and others is leading to a growing demand for mobility devices, including wheelchairs and others.

- According to the 2025 data published by the House of Commons, approximately 16.8 million people in the U.K. had a disability in 2023, representing 25% of the total country population.

The rising number of sports injuries in countries such as the U.S., the U.K., Germany, India, and others is another major factor leading to the growing demand for these devices in the market.

Furthermore, the growing geriatric population prone to mobility disorders, including Parkinson's disease, stroke, traumas, and others, along with a growing number of product launches with technological advancements by the companies, are expected to fuel the global market expansion during the forecast period.

Market Restraints

High Cost Associated with Powered Wheelchairs to Limit Their Adoption in Emerging Countries

The overall cost of wheelchairs, including the procurement and maintenance, among others, especially for the power chairs with innovative features and advancements, is one of the crucial factors anticipated to hinder their adoption among the population in emerging countries.

- According to various articles, the average cost of an electric wheelchair in the U.S. ranges from USD 2,500 to USD 10,000. The other costs, including repairs and maintenance, can range from USD 100 to USD 200 per year. The associated costs for replacement batteries are around USD 350 each, with an average lifespan of two years.

Moreover, the growing concerns related to safety among wheelchair users are another major factor leading to the restricted adoption of these devices in the market.

Therefore, the rising cost of these devices owing to technological advancements in the features and materials used for manufacturing, among others, is anticipated to hamper the global wheelchair market growth.

Market Opportunities

Increasing Aging Population Globally to Offer Lucrative Opportunities for Growth

The rising geriatric population with various injuries, mobility disorders, and others presents an increased addressable population with the demand for mobility solutions, including wheelchairs. This creates a huge opportunity for manufacturers to penetrate the market and increase the market size.

- According to a 2024 article published by the People’s Republic of China, there were nearly 297.0 million people aged 60 and over in China, accounting for approximately 21.1% of the country's total population in 2023.

MARKET CHALLENGES

Emergence of an Established Market for Refurbished Products to Hamper the Demand for New Devices

There is an increasing concern about waste generation from medical devices, such as wheelchairs, and the adverse environmental impacts of the huge amount of waste, which is resulting in increasing awareness regarding the importance of reuse and rental services for mobility devices among manufacturers and distributors in the country.

Major companies operating in the market are expanding their offerings by including refurbishment and rental services of wheelchairs. Moreover, the lower prices of refurbished products compared to new ones are a major factor contributing to the growing adoption of refurbished products or procured products on a rental basis.

- For instance, according to Livewell Today, an e-commerce website that supplies mobility devices, including wheelchairs, mobility scooters, and other mobility aids, the price of a refurbished Insta-Fold electric wheelchair is around USD 1,800-2,250, whereas the recommended retail price of the new product is around USD 1,900-2,800 in the U.K.

Other Prominent Challenges

Limited access in low-income regions and affordability constraints hamper the market growth.

SEGMENTATION ANALYSIS

By Product

Motorized Wheelchairs Segment Dominated Owing to the Growing Product Launches in the Market

Based on product, the market is divided into manual wheelchairs and motorized wheelchairs. The manual wheelchairs segment is classified into standard and custom. The motorized wheelchairs segment is further categorized into power assist wheelchairs and powered wheelchairs. The power assist wheelchairs are further divided into front add-on, rear add-on, and wheel add-on. Additionally, the powered wheelchairs are divided into standard powered wheelchairs and complex rehab technology (CRT) powered wheelchairs.

To know how our report can help streamline your business, Speak to Analyst

The motorized wheelchairs segment accounted for the largest global wheelchair market share in 2025. The growth of the segment can be attributable to the increasing awareness about the benefits of power assist and electric wheelchairs, such as improved efficiency and others. This, along with the rising number of product launches among the major companies, is one of the few major reasons supporting the growth of the segment in the region.

- In July 2025, Etac AB launched Twist by Klaxon, a manual wheelchair power add-on accessory that redefines flexibility and performance in manual wheelchair technology by enabling riders to use Twist in two positions – rear-push and front-pull. This helped the company in strengthening its product portfolio.

The manual wheelchairs segment is expected to grow at a CAGR of 5.0% over the forecast period.

By Age Group

Adults Segment Dominated Fueled by Incidences of Sports Injuries and Mobility Disorders

On the basis of age group, the market is bifurcated into adults and pediatrics.

The adult segment dominated the market in 2025. By age group, the adult segment held the share of 90.8% in 2025. The rising number of adults suffering from various mobility disorders, sports injuries, and traumatic accidents, among others, is leading to a growing demand for mobility aids among the adult population in the market.

- According to 2023 statistics published by the CDC, around 12.2% of U.S. adults have a mobility disorder with serious difficulty walking or climbing stairs.

The segment of pediatrics is set to flourish with a growth rate of 6.4% across the forecast period.

By End User

Homecare Settings Segment Recorded Leading Share Due to Surge in Patient Admissions

Based on end user, the market is segmented into healthcare settings, homecare settings, and others. The healthcare settings are further segmented into hospitals & ASCs, specialty clinics, rehabilitation centers, long-term care centers, and others.

The homecare settings segment dominated the market in 2025. The growing number of homecare settings in countries such as the U.S., the U.K., Germany, and others, leading to increasing patient admissions to these settings, is resulting in a rising demand for these mobility devices in these settings in the market. Along with this, the growing focus of companies to develop and introduce products suitable for home use is another significant factor expected to augment the segment growth. Furthermore, the segment is set to hold a 66.0% share in 2026.

- According to a 2024 article published by Carehome, there are around 16,700 homecare facilities in the U.K., including nursing homes and residential care settings.

In addition, healthcare settings’ end users are projected to grow at a 5.3% CAGR during the forecast period.

Wheelchair Market Regional Outlook

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Wheelchair Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America market held the dominant share in 2024, valued at USD 2.47 billion, and also took the leading share in 2025 with USD 2.58 billion. High adoption of powered and customized wheelchairs, improving reimbursement frameworks, among others, are some of the factors supporting the growth of the market in the region. This, along with a growing number of key players focusing on the development and introduction of new products, is also supporting the growth of the market in the region.

- In November 2025, All Star Wheelchairs launched two new electric wheelchair models designed to meet the full spectrum of mobility needs in the U.S.

U.S. Wheelchair Market

Based on North America’s strong contribution and the U.S. dominance within the region, the U.S. market can be analytically approximated at around USD 2.36 billion in 2026, accounting for roughly 37.7% of global wheelchair sales.

Europe

Europe is projected to record a growth rate of 4.4% in the coming years, which is the second highest among all regions, and reach a valuation of USD 1.47 billion by 2026. Strong focus on rehabilitation, aging population, and assistive-technology standards are some of the factors supporting the growth of the market in the region.

U.K Wheelchair Market

The U.K. wheelchair market in 2026 is estimated at around USD 0.29 billion, representing roughly 4.6% of global wheelchair revenues.

Germany Wheelchair Market

Germany’s wheelchair market is projected to reach approximately USD 0.33 billion in 2026, equivalent to around 5.3% of global wheelchair sales.

Asia Pacific

Asia Pacific is estimated to reach USD 1.54 billion in 2026 and secure the position of the third-largest region in the market. Large unmet need due to population size, growing demand from aging demographics, and improving healthcare access is likely to support the growth of the market in the region. In the region, India and China are both estimated to reach USD 0.14 billion and USD 0.69 billion, respectively, in 2026.

Japan Wheelchair Market

The Japanese wheelchair market in 2026 is estimated at around USD 0.28 billion, accounting for roughly 4.5% of global revenues. Japan has historically reported a relatively high prevalence of mobility diseases, with growing adoption of wheelchairs.

China Wheelchair Market

China’s wheelchair market is projected to be one of the largest worldwide, with 2026 revenues estimated at around USD 0.69 billion, representing roughly 11.1% of global sales.

India Wheelchair Market

The Indian wheelchair market size in 2026 is estimated at around USD 0.14 billion, accounting for roughly 2.3% of global revenues.

Latin America and the Middle East & Africa

The Latin America and Middle East & Africa regions are expected to witness moderate growth in this market space during the forecast period. The Latin America market is set to reach a valuation of USD 0.27 billion in 2026. The growth is due to the gradual growth driven by public health initiatives and NGO-supported mobility programs. In the Middle East & Africa, the GCC is set to reach a value of USD 0.12 billion in 2026.

South Africa Wheelchair Market

The South African wheelchair market is projected to reach around USD 0.05 billion in 2026, representing roughly 0.8% of global revenues.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Rising Focus of the Market Players to Develop and Launch Novel Products to Foster Market Growth

The global market is fragmented, with several players offering a wide product portfolio of various types of wheelchairs for users. Invacare Corporation, Permobil, and Sunrise Medical are some of the prominent players in the market with a wide range of products with customization and features for the users.

Manual Wheelchairs: The major players in the manual wheelchairs market include Invacare Corporation, Sunrise Medical, Permobil, and others. The dominance of these companies is due to certain factors, such as a growing focus on the expansion of their product portfolio in the market. This, along with increasing participation in conferences to showcase their products, is also likely to support the growth of the company in the market.

- In October 2024, Invacare Corporation showcased its portfolio of products and services at the leading European rehabilitation conference, Rehacare in Germany. This helped the company to increase its brand presence.

Power Assist Wheelchairs: The major players in the manual wheelchairs market include Yamaha Motor Co., Ltd., Sunrise Medical, Permobil, and others. These players account for more than 50% of the market share globally.

- Front Add-On – The major players operating in this segment are Sunrise Medical, Triride srl, and others.

- Rear Add-On - The major players operating in this segment are Sunrise Medical, Permobil, and others.

- Wheel Add-On - The major players operating in this segment are Alber GmbH, Yamaha Motor Co., Ltd., and others.

Powered Wheelchairs - The major players in the manual wheelchairs market include Permobil, Invacare Corporation, and others. The growing R&D focus and investments to broaden their product offerings and strengthen their presence in the market are contributing to their increasing market share globally.

LIST OF KEY WHEELCHAIR COMPANIES PROFILED

- Invacare Corporation (U.S.)

- Ottobock (Germany)

- Drive Devilbiss International (U.S.)

- GF Health Products, Inc. (U.S.)

- Etac AB (Sweden)

- Sunrise Medical (Germany)

- Permobil (Sweden)

- Pride Mobility Products Corp. (U.S.)

- Carex (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2024 - Ottobock invested USD 24.4 million in Onward Medical, a European medical technology company creating innovative therapies to restore movement, function, and independence in people with spinal cord injuries.

- June 2024 - Drive Devilbiss International organized a “We Are Drive” campaign with an aim to raise awareness regarding the company’s mobility product portfolio and brand presence in the market.

- June 2024 – Etac AB acquired Klaxon, one of the leading developers of power-assisted devices. The acquisition is aimed at strengthening its manual wheelchair product portfolio.

- March 2024 – Sunrise Medical launched the Allstar A2, an extraordinary multi—sports wheelchair with the aim of strengthening its product portfolio.

- September 2023 - Permobil acquired PDG Mobility, one of the leading players of manual tilt wheelchairs, with an aim to strengthen its manual products portfolio.

REPORT COVERAGE

The report provides a detailed global wheelchair market analysis. It focuses on key aspects, such as market size & market forecast, market segmentation based on product, age group, end user, and competitive landscape. It also gives an overview of the regulatory scenario, insights into the adoption of mobility devices, and an analysis of significant companies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.4% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product, Age Group, End User, and Region |

|

By Product |

|

|

By Age Group |

|

|

By End User |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 5.97 billion in 2025 and is projected to reach USD 9.56 billion by 2034.

The market is projected to grow at a CAGR of 5.4% during the forecast period.

By product, the motorized wheelchairs segment led in 2025.

The key driving factors of the market include the rising prevalence of disability among the population, the growing number of product launches by the companies, and increasing adoption among the patient population.

Sunrise Medical, Invacare Corporation, and Permobil are some of the major players operating in the market.

North America dominated the global market in 2025.

North America was valued at USD 2.58 billion in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us