Infant Incubators Market Size, Share & Industry Analysis, By Product (Hybrid, Conventional, and Transport), By Type (Open and Closed), By End-user (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

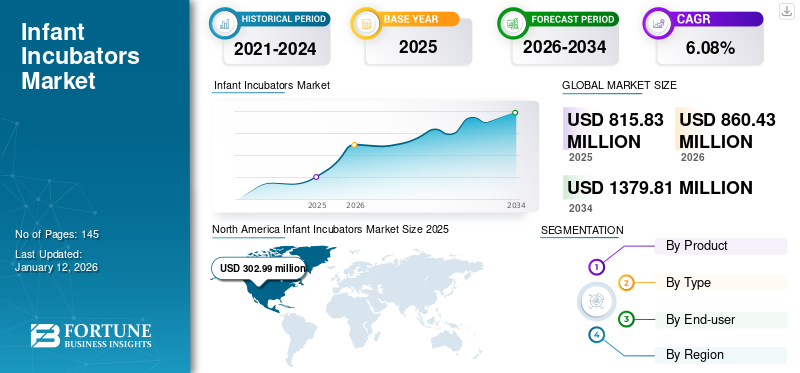

The global infant incubators market size was valued at USD 815.83 million in 2025 and is projected to grow from USD 860.43 million in 2026 to USD 1,379.81 million by 2034, exhibiting a CAGR of 6.08% during the forecast period. North America dominated the infant incubators market with a market share of 37.14% in 2025.

Infant incubators, also known as neonatal incubators, provide a safe environment for infants to grow and prevent neonatal hypothermia. They are used to regulate infants' body temperature, humidity, and oxygen levels. Some incubators can also manage the vital signs of the neonates, such as heart rate. The increasing burden of preterm births has been fueling the demand for neonatal incubators globally.

- For instance, as per the data published by the World Health Organization (WHO), in 2020, around 13.4 million infants were born prematurely, with preterm birth ranging between 4%-16% across different countries.

Drägerwerk AG & Co., GE Healthcare, and Koninklijke Philips N.V. are among the major players in the market that have been focusing on partnerships to enhance their product offerings.

Global Infant Incubators Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 815.83 million

- 2026 Market Size: USD 860.43 million

- 2034 Forecast Market Size: USD 1,379.81 million

- CAGR: 6.08% from 2026–2034

Market Share:

- Region: North America dominated the market with a 37.14% share in 2025. The region's growth is attributed to the strong presence of major market players and an increasing demand for advanced neonatal care solutions in its healthcare facilities.

- By Product: The Conventional segment held the largest market share. This is due to the increasing number of preterm births worldwide and the availability of these products at a comparatively cheaper cost than hybrid or transport incubators.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, the market is driven by the growing burden of preterm births and the continuous improvement of its healthcare infrastructure to support neonatal care.

- United States: The market is fueled by a high and rising rate of preterm births, which reached 10.49% in 2021. Growth is also supported by an increasing number of hospitals with advanced infrastructure, providing specialized neonatal care.

- China: The market is expanding due to the high burden of premature births in the Asia Pacific region and a strong focus on improving healthcare infrastructure to provide better neonatal care facilities.

- Europe: Growth is supported by strategic partnerships aimed at increasing the accessibility of infant incubators. For instance, Central Medical Supplies' initiative to make Comen BQ80 infant warmers available in the U.K. enhances product availability in the region.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Number of Preterm Births Globally has been Fueling the Demand for Infant Incubators

Growing cases of multiple pregnancies and chronic diseases, along with the adoption of a sedentary lifestyle, are contributing to an increase in preterm births. For instance, as per the data published by the World Health Organization (WHO) in May 2023, preterm births can occur due to chronic conditions such as diabetes, high blood pressure, multiple pregnancies, and infections.

As a result, the annual number of preterm births has been growing significantly across the globe.

- For instance, as per the data published by the Centers for Disease Control and Prevention (CDC), in 2021, the preterm birth rate was 10.49% in the US, reflecting a 4.0% increase from the prior year.

The increasing number of preterm births has been fueling the demand for neonatal incubators in healthcare facilities and nursing centers, thereby fueling market growth.

Increasing Government Initiatives to Support Neonatal Care have been Fueling the Adoption of Infant Incubators in Healthcare Facilities

The increasing number of preterm births, along with the increasing awareness regarding neonatal care, has been fueling the demand for efficient neonatal care facilities. In order to fulfill this need, government organizations in many countries have been prioritizing initiatives to support neonatal care.

- For instance, as per the news published in March 2022, the National Health Mission of India provided support to establish Neonatal Intensive Care Units (NICUs)/Sick New-born Care Units (SNCUs) at Medical College and District Hospital levels. Additionally, New-born Stabilization Units (NBSUs) were set up at First Referral Units (FRUs) and Community Health Centres (CHCs) for the care of sick and small babies.

These government initiatives have driven the adoption of advanced technologies in the healthcare infrastructure for better neonatal care, fueling market growth.

Other Drivers:

- Increasing adoption of technological advancement in neonatal care devices has been fueling the market growth.

- Rising awareness of neonatal health has been fueling the adoption of advanced neonatal care equipment.

- Advancements in IoT and smart incubator technology have been fueling the availability of efficient neonatal incubator in the market.

- Rising healthcare expenditure in emerging markets has been fueling the adoption of advanced equipment for neonatal care.

MARKET RESTRAINTS

High Cost of Incubators and Lack of Affordability in the Low-income Countries has been Restricting Market Growth

The increasing number of preterm births and high mortality rate among preterm birth babies have been fueling the demand for neonatal incubators. However, factors such as the risk of infant falls and delayed motor development, among others, are certain limitations associated with the use of these incubators.

Moreover, the costs of these incubators are quite high. For instance, the cost of these incubators in the U.S. can range between USD 1,500.0 to USD 35,000.0. Similarly, in India, these incubators can be between USD 605.0 to USD 1,816.0.

These high costs make neonatal incubators unaffordable for small healthcare facilities in developed countries and emerging countries, such as India and Africa. Therefore, the limitations associated with incubators and their high cost have been limiting their adoption, thereby restricting market growth.

Other Restraints:

- Lack of skilled professionals in underdeveloped countries has been limiting its adoption in those countries.

- Strict regulatory requirements and certification processes limit the launch of new products in the market.

- Limited availability of after-sales services in rural or remote areas limits the adoption of incubators in those areas’ healthcare facilities.

MARKET OPPORTUNITIES

Growing Adoption of Hybrid Incubators With Both Mechanical and Electronic Features to Improve Neonatal Care Facilities

Hybrid incubators combine features such as ventilation, resuscitation, and thermal regulations. The increased adoption of these hybrid incubators will improve neonatal care facilities in the forecast period.

Increasing Focus on Neonatal Health Across Emerging Economies to Fuel Incubators Adoption

The increasing focus of government and regulatory bodies on improving neonatal healthcare facilities with advanced equipment is expected to offer lucrative opportunities for market growth.

MARKET CHALLENGES

Limited Penetration of Advanced Equipment in the Emerging Countries is a Challenging Factor for Market

The development and adoption of advanced technology are increasing globally. However, countries such as Afghanistan, South Africa experience challenges in the adoption of advanced equipment due to poor infrastructure, lack of trained professionals, and economic constraints. Moreover, the high cost of these incubators, along with the stringent regulatory requirements limits their adoption in emerging countries.

Download Free sample to learn more about this report.

MARKET TRENDS

Increasing Advances in Medical Technology to Improve the Efficiency of Neonatal Incubators

Preterm babies, born before 37 weeks, are the most vulnerable group in the neonatal population and require special care to grow and develop outside the womb. Preterm babies are at an increased risk of complications if their temperature is not maintained properly. The increasing number of cases of preterm births has increased the demand for advanced technology to provide effective care for neonates.

Market players have been focusing on the development of advanced incubators to support thermoregulation and critical care for infants.

- For instance, BabyLeo, an infant incubator manufactured by Drägerwerk AG & Co. KGaA, represents the use of advanced neonatal care technology. The device consists of a connected heater, dual-radiant warmer, and heated mattress to provide synchronized and stable temperature regulation. The device offers significant height adjustments variations, making the device more accessible for disabled mothers or those temporarily in wheelchairs.

The increasing emphasis by market players on adopting advanced technologies, such as the integration of IoT-enabled incubators for remote monitoring and the introduction of incubators with better temperature and humidity control, has been fueling the infant incubators market growth.

Other Trends:

Increased Focus on Neonatal Health

Growing awareness regarding neonatal health, especially in emerging countries, has been fueling the number of neonatal intensive care units (NICUs) and specialized care facilities.

IMPACT OF COVID-19

During the COVID-19 outbreak in 2020, the market experienced a growth in its value. The growth was attributed to the increased number of births along with the increased demand for critical care for preterm births and neonates born to severely ill mothers. These incubators helped improve the survival rates of premature infants.

The market grew substantially in 2021 and 2022 due to the increased focus of pediatric hospitals and specialty clinics on improving healthcare infrastructure to restart full-fledged operations at their facilities.

SEGMENTATION ANALYSIS

By Product

Increasing Number of Preterm Birth Worldwide is Responsible for the Conventional Segment’s Growth

On the basis of product, the global market is segmented into hybrid, conventional, and transport.

The conventional segment accounted for the largest infant incubators market share in 2026, representing 62.97% of the market with a size of USD 541.82 million. The segment’s dominance is attributed to the increasing number of preterm births worldwide and the availability of these products at comparatively cheaper costs than other incubators.

- For instance, as per the data published by StatCan, the preterm birth rate in Canada in 2023 was 8.3%, whereas this rate was 7.1% in 1993.

The hybrid segment is expected to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to features, such as resuscitation, offered by hybrid incubators.

The transport segment is expected to grow substantially during the forecast period. The segment’s growth during the forecast period is attributed to the increasing demand for transport incubators for emergency cases.

To know how our report can help streamline your business, Speak to Analyst

By Type

Availability of Open Incubators by Key Players is Responsible for the Segment’s Dominance

Based on type, the market is segmented into open and closed.

The open segment dominated the global market in 2026, accounting for 60.73% of the market with a size of USD 522.53 million. The segment’s dominance is attributed to the presence of key players such as Drägerwerk AG & Co. KGaA offering open incubators in the global market. The increasing focus of these players in increasing the availability of their products globally has been fueling the segment’s growth.

The closed incubators are expected to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to the various advantages associated with these incubators. For example, these incubators offer a stable and sterile environment to the neonates, helping to maintain temperature variation and protect them from infections in the outside environment.

By End-user

Increasing Number of Hospitals with Advanced Facilities Worldwide is Responsible for Hospitals Segment’s Dominance

Based on end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospital segment dominated the market in 2026, driven by the expansion of hospitals with advanced infrastructure offering specialized neonatal care, accounting for 68.25% of the market with a size of USD 587.23 million.

- For instance, as per the data published by the American Hospital Association, in 2022, there were 6,120 hospitals in the U.S., whereas in 2016, the total number of hospitals in the U.S. was 5,534.

The specialty segment is attributed to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to the increasing emphasis of the gynecology and nursing care centers on the adoption of advanced equipment for neonatal care.

INFANT INCUBATORS MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Infant Incubators Market Size 2025 (USD million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2025, accounting for USD 302.99 million of the global market. The strong growth of the market in North America is attributed to the strong presence of market players such as Drägerwerk AG & Co. KGaA and GE HealthCare, along with the increasing demand for advanced neonatal care solutions in healthcare facilities.

The U.S. market accounted for a significant portion of the market share in the North America market in 2024. The segment’s growth is attributed to the growing burden of preterm births, along with the increasing investment in the improvement of the healthcare infrastructure. The US market is projected to reach USD 293.25 million by 2026.

Europe

The market in Europe also accounted for a significant portion of the market share in 2024. The market growth in the region is attributed to the increasing focus of the market players' partnerships to increase the accessibility of incubators in the region. The United Kingdom market is projected to reach USD 33.29 million by 2026, while the Germany market is projected to reach USD 58.09 million by 2026.

- For instance, in February 2023, Central Medical Supplies (CMS) announced the availability of the Comen BQ80 infant radiant warmer, a product by Shenzhen Comen Medical Instruments Co., Ltd. product in the U.K.

Asia Pacific

The Asia Pacific market is expected to grow at a significant CAGR during the forecast period. The growth of the market in the region is attributed to the growing burden of preterm births and improving healthcare infrastructure. The Japan market is projected to reach USD 44.43 million by 2026, the China market is projected to reach USD 41.82 million by 2026, and the India market is projected to reach USD 18.57 million by 2026.

- For instance, as per the data published by the National Institute of Biotechnology Information (NCBI) in 2023, around 12% of infants were born preterm between the years 2019-21.

Latin America and the Middle East & Africa

The market in Latin America and the Middle East & Africa are expected to grow substantially during the forecast period. The market’s growth in these region is attributed to the growing burden of preterm births and rising awareness about neonatal care.

COMPETITIVE LANDSCAPE

Key Market Players

Market Players Focus on Partnerships and Acquisitions to Enhance their Product Offerings

Market players such as Drägerwerk AG & Co., GE Healthcare, and Koninklijke Philips N.V. are among the major players, accounting for a significant portion of the global infant incubators market share. The significant presence of these companies in the market is attributed to their focus on partnerships to enhance their product offerings.

- For instance, in April 2024, Koninklijke Philips N.V. announced its partnership with March of Dimes with an aim to improve prenatal care access in underserved communities.

Moreover, other players, such as Atom Medical Corp. and Bistos Co., Ltd., among others, have been focusing on new product development to enhance their product offerings in the market.

LIST OF KEY MARKET COMPANIES PROFILED:

- Atom Medical Corp. (Japan)

- Bistos Co., Ltd. (Korea)

- Drägerwerk AG & Co. KGaA (Germany)

- GE HealthCare (U.S.)

- Fanem (Brazil)

- Koninklijke Philips N.V. (Netherlands)

- MEDICOR Zrt. (Hungary)

- SS TECHNOMED (P) LTD. (Delhi)

- NOVOS (Turkey)

KEY INDUSTRY DEVELOPMENTS:

- October 2024 – Drägerwerk AG & Co. launched the BabyRoo TN 300 in India, featuring advanced technologies to support emergency resuscitation and care.

- September 2024 – Koninklijke Philips N.V. announced its emphasis on developing an advanced monitoring system and clinical decision support application in partnership with Phoenix Children’s Hospital. Phoenix Children’s Hospital has been a partner of Koninklijke Philips N.V. since 2016.

- November 2021 – An accessible neonatal incubator designed by students from Loughborough University received its first clinical use in a hospital in the U.K.

- June 2021 – Koninklijke Philips N.V. acquired Capsule Technologies, Inc.. With this acquisition, the company strengthened its presence in providing patient care management solutions in hospitals.

- February 2021 – UMBC completed its clinical trial in India for the development of a low-cost infant incubator.

REPORT COVERAGE

The global infant incubators market report provides a detailed competitive landscape and market insights. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new solution launches in the market. Furthermore, the report covers regional analysis of different market segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.08% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product, Type, End-user, and Region |

|

By Product |

|

|

By Type |

|

|

By End-user |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 815.83 million in 2025 and is projected to reach USD 1,379.81 million by 2034.

In 2025, the market value stood at USD 302.99 million.

The market is predicted to exhibit a CAGR of 6.08% during the forecast period.

By product, the conventional segment led the market.

The growing burden of preterm births, along with the increasing focus of the market players on new product launches are key factors fueling market growth.

Drägerwerk AG & Co., GE Healthcare, and Koninklijke Philips N.V. are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us