Inspection Equipment Market Size, Share & COVID-19 Impact Analysis, By Type (Fully Automatic Machine, Semi-automatic Machine, and Manual Machine), By Product (Vision Inspection System, Leak Detection System, X-ray Inspection System, Checkweighers, Metal Detector, Software, and Others), By End User (Food & Beverages, Pharmaceuticals, and Others), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

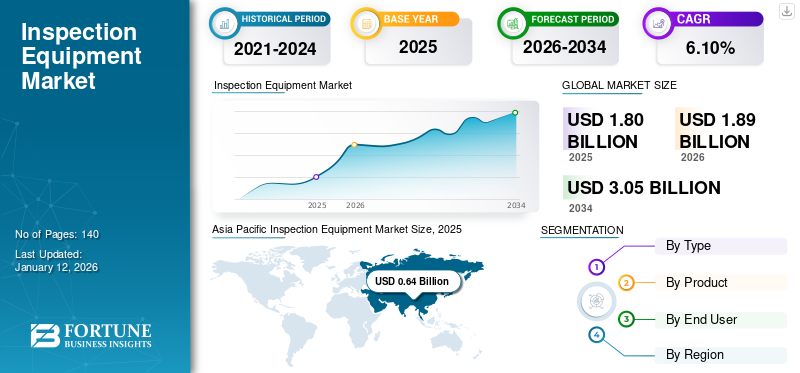

The global inspection equipment market size was valued at USD 1.8 billion in 2025 and is projected to grow from USD 1.89 billion in 2026 to USD 3.05 billion by 2034, exhibiting a CAGR of 6.10% during the forecast period. The Asia Pacific dominated global market with a share of 35.60% in 2025.

Inspection is a more important assessment used in every manufacturing plant. It is used for rejecting errors and improving the quality of goods from the production line. New technologically advanced inspection systems overcome the problems that arise from traditional methods. By using this system, it reduces the overall manufacturing lead time and production costs. Vision inspection systems, X-ray inspection systems, leak detection systems, and checkweighers are some of the products used in inspection procedures in processing plants.

The growth in pharmaceuticals and food & beverages sectors creates the demand for these systems for checking purposes, subsequently driving the growth of the market during the forecast period. For instance, according to the Indian Economic Survey 2021, the pharmaceutical industry in India is projected to grow by 54.8% from 2021 to 2024. In addition, the growing aging population globally and the increasing prevalence of infectious and chronic diseases among the population fuel the demand for examination devices, boosting the market growth. For instance, in 2019, 254 million Chinese people were aged 60 or more and are projected to grow by 402 million by 2040. Such a rise in the aging population in China is expected to fuel inspection equipment demand, boosting the inspection equipment market growth.

COVID-19 IMPACT

Creation of Productive Opportunities for Service Providers Globally During COVID-19 Pandemic

The COVID-19 impact resulted in a decline in the net sales of systems in the short term in 2020. Also, manufacturers faced difficulties in collecting raw materials and disrupting the supply chain cycle of this equipment. After the first quarter of 2020, the increasing demand for this equipment from food & beverages and pharmaceutical sectors fueled the growth of the market. Also, many manufacturers and manufacturing plants reopened their facilities in the second quarter of 2020. For instance, in April 2020, Detection Technology Plc opened a new manufacturing facility in Shanghai, China. Also, major manufacturers registered growth in the net sales of manufacturers of these machines, which fuels the growth of the market. For instance, the net sales of Thermo Fisher Scientific Inc grew by 26.1% from 2019 to 2020.

Inspection Equipment Market Trends

Technological Advancements in the Product Portfolio of Several Companies

Recent years have recorded a growing stringency of regulatory authorities concerning the quality and safety of products being manufactured and the need to avoid financial losses due to product packaging issues. Also, increasing focus on effective production and curbing manual inspection are factors that lead to a growing number of players operating in the market to develop effective automated systems. Also, major manufacturers are investing in research & development to intensify the market competition and also to increase their market share.

Key players such as Mettler Toledo, Prescient Technologies, KLA Corporation, and others are engaged in offering camera-based inspection systems for food & beverages, consumer electronics, pharmaceutical, and semiconductor industries. For instance, Prescient Technologies offers camera-based inspection equipment. The solutions have two dimensions and three-dimension machine vision systems used for robot guidance, quality control, sorting, and automated inspection equipment. The equipment is used across various end-user industries such as automation, robotics, consumer goods, and electronics industries. Such an increase in product launches is expected to drive the adoption of semiconductor metrology and inspection equipment.

Download Free sample to learn more about this report.

Inspection Equipment Market Growth Factors

Growing Awareness Regarding Checking the Quality of Goods to Bolster Market Growth

Stringent government regulations and increasing awareness about the standard and quality of food products are projected to fuel the growth of the market. In addition, rising security concerns and growth in the microelectronics sectors are factors that drive the growth of the market. Furthermore, a rising count of checkpoints throughout the manufacturing processes fuels the demand for inspection equipment. In this concern, biotechnology companies, medical devices, and pharmaceutical device manufacturers are adopting checkweighers, vision inspection systems, x-ray inspection systems, and others for various levels of packaging and production operations. These machines are installed in labeling, packaging, filling, sealing, and weighing operations in the manufacturing sector. Such a growth in awareness regarding checking the quality of goods is estimated to augment the market.

RESTRAINING FACTORS

Huge Capital Investments and High Installation & Maintenance Costs to Restrain Market Growth

The high initial capital investment and high costs associated with installation and maintenance costs are factors that may restrain the market growth. For instance, these systems require an investment of around USD 5,000 to USD 20,000, which varies from one industry to another. This consists of inspection costs, integration of sensors costs, and installation costs which increases the total ownership cost of inspection equipment. Moreover, residential as well as commercial end-users will purchase lower priced units, which causes restraints in the market growth. Also, the investment cost required for the systems is not affordable for smaller companies, and lack of stringent regulations in developing countries, driving the market growth.

Inspection Equipment Market Segmentation Analysis

By Type Analysis

Fully Automatic Machine Segment to Hold Dominant Market Share Due to Increasing Demand from Healthcare Sector

By type, the market is segmented into fully automatic machine, semi-automatic machine, and manual machine.

The fully automatic machine segment accounted for the largest market share of 44.44% in 2026 with the highest CAGR during the forecast period. This is due to the growing demand for quality requirements and reduced errors in inspection procedures, which creates the demand for these equipment among end users fueling the market growth.

The semi-automatic machine segment is projected to grow with potential growth during the forecast period, owing to increasing demand from the pharmaceutical and food & beverages sectors. The equipment can be used to find defects in the manufacturing sectors. Particulates, missing caps, crimp defects, missing stoppers, and glass cracks are some of the defects that can be collected from processing plants.

The manual machine segment registered decent growth with a CAGR of 5.0%, owing to the adoption of these systems among various end users.

By Product Analysis

Checkweighers to Dominate the Market Due to Increasing Penetration among End Users

Based on product, the market is classified into vision inspection system, leak detection system, x-ray inspection system, checkweighers, metal detector, software, and others.

The checkweighers segment dominates the market share of 31.22% in 2026 and is expected to grow at a CAGR of 6.1% over the forecast period. The surge is due to a rise in adoption of this system among the food and beverages sector. Also, increasing demand for autonomous checkweigher systems with common load cell technology fuels the segment growth.

The vision inspection system segment is anticipated to grow with the highest CAGR of 6.6% during the forecast period. This is due to features such as reduced human errors, lower cost, increased throughput, and the detection of flaws generated from the manufacturing sector.

The leak detection system and x-ray inspection systems segments are expected to grow at a considerable pace over the projected period. The surge is due to the rising adoption of these systems across the food and beverages, medical, and pharmaceutical sectors.

The metal detector and software segments are anticipated to grow with a moderate growth rate over the study period. This is on account of increasing penetration of these systems across manufacturing plants at packaging applications.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Food and Beverages Segment to Dominate the Market owing to Growing Consumer Awareness about Quality

Based on end user, the market is classified into food & beverages, pharmaceuticals, and others (automotive, commercial).

The food & beverages segment is set to dominate the market share of 56.61% in 2026 with a CAGR of 6.0% during the forecast period. This is owing to increasing awareness about quality checks of products and quality assurance in the food and beverages sectors.

The pharmaceutical segment is set to grow at a moderate pace with a CAGR of 5.4% over the study period owing to increasing quality checks in the pharmaceutical sectors. In addition, the adoption of metal detectors, checkweighers, and x-ray inspection systems are some of the machines used in the pharmaceutical sector.

The others segment consists of automotive and commercial. It is estimated to exhibit decent growth during the forecast period. The rise is due to the growing demand for 2D inspection systems and 3D inspection systems across the automotive sector for the inspection of material cracks.

REGIONAL INSIGHTS

The regional analysis comprises five major regions, North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Inspection Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 0.64 billion in 2025 and USD 0.68 billion in 2026. Asia Pacific has the largest inspection equipment market share and is anticipated to grow with the highest CAGR of 6.3% during the forecast period. The rise is owing to the surging demand for this system across the automotive, dairy processing, and food & beverage sectors across India, Japan, China, and other countries. Additionally, an increasing awareness about standard quality check across manufacturing premises is expected to boost the market growth. The Japan market is projected to reach USD 0.1 billion by 2026, the China market is projected to reach USD 0.37 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

Increasing Investments by the Chinese Government in Pharmaceutical and Food & Beverages Sectors to Accelerate Market Growth

Manufacturing is the main hub of the Indian economy. There are many manufacturing plants that currently exist in China. Also, the Chinese government is planning to invest in the pharmaceutical and food & beverages sectors, creating the demand for these systems and propelling the market growth. For instance, according to The China Projects, Chinese pharmaceutical companies are investing USD 14.99 million in the construction of new pharmaceutical plants. Such an investment in the pharmaceutical sector aids the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

North America

North America ranks second in terms of growth rate and revenue with a CAGR of 5.9% during the forecast period. Also, key players, such as Thermo Fisher Scientific Inc, Mettler Toledo, and others, are engaged in offering inspection equipment for various industry verticals. For instance, in September 2021, Mettler Toledo launched a new metal detector system M30 R-Series GC for use across the food and beverages sector. It is a smart and automated machine used among small as well as large enterprises. Such factors drive the growth of the market. The U.S. market is projected to reach USD 0.46 billion by 2026.

Europe

The Europe market is expected to grow at a substantial growth rate over the forecast period. The rise is due to increasing technological advancement in these machines such as Artificial Intelligence (AI) and IoT-based machines, which provide lucrative opportunities for key players. For instance, in February 2021, Syntegon Technology GmbH installed the first fully automated inspection equipment with AI-enabled features. The solution was adopted in end-user industries such as food, beverages, and medical sectors. Such factors surge the demand for these systems across Europe. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.19 billion by 2026.

South America and the Middle East & Africa

Besides, South America and the Middle East & Africa are projected to grow with decent growth during the forecast period. The rise is on account of strong growth in the medical sector, the aging population across the region, and investment in new manufacturing facilities. All such aforementioned factors are set to drive the growth of the market across the Middle East and South America regions.

KEY INDUSTRY PLAYERS

Key Players Focus on Strengthening their Market Share by Offering Tech-enabled Products

Major players operating in the global market are focusing on adopting key developmental strategies such as product launches, acquisitions, mergers, and business expansion to intensify the market competition and also to improve the market share by distributing product portfolio through diversified locations with good competitive landscape.

For instance, in February 2021, Mettler Toledo introduced a new X-38 pipeline X-ray inspection equipment. The machine provides pumped food products with the in-line inspection. This machine can be used to inspect contaminants such as metal, glass, and mineral stones. Such factors are expected to drive the growth of the market.

LIST OF TOP INSPECTION EQUIPMENT COMPANIES

- Thermo Fisher Scientific Inc (U.S.)

- MinebeaMitsumi Inc (Japan)

- Mettler Toledo (U.S.)

- Bizerba SE & CO KG (Germany)

- Wipotec Osg GmbH (Germany)

- Syntegon Technology GmbH (Germany)

- Sartorius AG (Germany)

- Shanghai Tofflon Science & Technology (China)

- ACG (India)

- Antares Vision S.p.A. (Italy)

KEY INDUSTRY DEVELOPMENTS

- January 2024 – Optel Group acquired the track and trace unit of Korber Business Area Pharma, a subsidiary of Korber AG. The acquisition was done for improving the product portfolio of inspection systems for agrochemical and pharmaceuticals premises.

- November 2024 – Mettler Toledo launched a new track & trace check weighing combo system for small as well as medium business size for cosmetics and pharmaceuticals. The system offers various advantages such as compactness, improved productivity, and flexibility while manufacturing operations.

- April 2021 – Wipotec Osg GmbH launched a new quality control system solution HC-A-V checkweigher with a visual inspection. It is suitable for a wide variety of consumer packaged goods and food and beverages sectors.

- January 2021 – Cognex Corporation launched a new In-Sight 3Dl-4000 vision inspection system. The solution was equipped with technologies, such as 3D laser displacement technology and camera-enabled devices, designed for end industries such as food & beverages, automotive, medical devices, and electronics sectors. The solution is quick-to-install, accurate, and cost-effective.

- July 2020 – Thermo Fisher Scientific Inc launched 1,000 selectscan metal detector systems designed for personal care, cosmetics, and food manufacturers. The machine comes equipped with features such as a high level of safety and security.

REPORT COVERAGE

The research report provides a detailed analysis of the industry and focuses on key aspects such as leading companies, technology types, and leading product applications. Besides, it offers insights into the current inspection equipment market trends and highlights driving forces and opportunities for technological development, advancements, and competitive benchmarking. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Product

By End User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size stood at USD 1.8 billion in 2025.

In 2034, the market is expected to be worth USD 3.05 billion.

The market is anticipated to grow at a CAGR of 6.10% over the forecast period (2026-2034).

Asia Pacifics market size was valued at USD 0.64 billion in 2025.

Within the type segment, the fully automatic machine segment is expected to lead the market during the forecast period.

An increasing number of inspection checkpoints through manufacturing plants is expected to drive the market growth.

Thermo Fisher Scientific Inc, MinebeaMitsumi Inc, Santorius AG, Wipotec Osg GmbH, and Bizerba SE & Co. KG are the top players in the market.

The major players hold approximately 30% -35% of the market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us