Insurance Telematics Market Size, Share & Industry Analysis, By Component (Hardware and Software), By Usage Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD)), By Deployment (On-premises and Cloud), By Vehicle Type (Passenger Cars and Commercial Vehicles), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

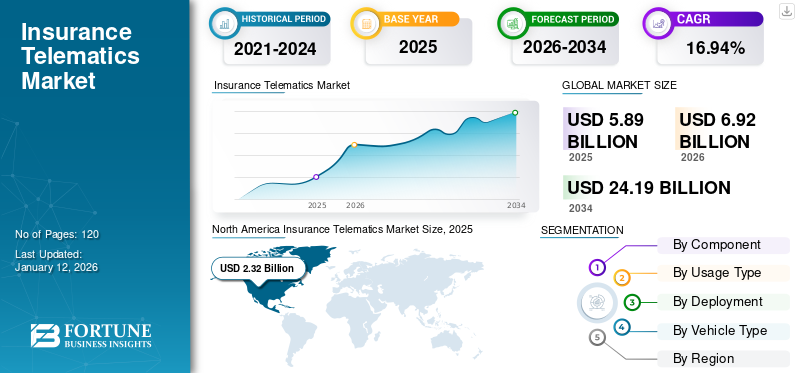

The global insurance telematics market size was valued at USD 5.89 billion in 2025. The market is projected to grow from USD 6.92 billion in 2026 to USD 24.19 billion by 2034, exhibiting a CAGR of 16.94% during the forecast period. North America dominated the global market with a share of 39.34% in 2025.

Insurance telematics system consist of the installation of telematics device or application in vehicle. This system is used in the insurance sector to collect and analyze data related to vehicle usage, driver behavior, and driving habits. It includes the use of blackbox, telecommunication, and GPS technologies to collect real-time data from vehicles. This data is used by insurance telematics companies to assess risk, determine premiums, and offer personalized insurance policies to customers. Further, based on telematics data, insurance companies provide Usage-Based Insurance (UBI) policies that help the vehicle owner to lower premiums and incentives based on their driving skills. This factor plays an important role to drive the market growth during the forecast period. In the scope of work, we have included solutions offered by companies, such as TomTom International BV, MiX Telematics, Telematics Technologies, Trimble Inc., Agero, Inc., Sierra Wireless, and others.

Download Free sample to learn more about this report.

The COVID-19 pandemic has fueled the adoption of digital solutions across various industries, including insurance. Due to COVID-19 restrictions, many people were working from home, due to which many people were driving less. This increased the demand for usage-based insurance policies, which use telematics data to adjust premiums based on driving patterns. This created a lucrative opportunity for insurers to offer personalized and flexible options to customers during the pandemic.

IMPACT OF GENERATIVE AI

Growing Demand for Personalized Insurance Products and Fraud Prevention is Expected to Boost Market Growth

Generative AI technology plays a key role to help insurers to develop more personalized insurance telematics products tailored to individual policyholders’ preferences and needs. Generative AI algorithms analyze telematics data and other relevant information to generate customized insurance policies that offer pricing based on specific risk profiles and coverage and usage patterns. Further, it helps insurance companies to detect and prevent insurance fraud by analyzing telematics data for suspicious patterns. Also, it creates risk scores and predictive models to identify potentially fraudulent claims and alert insurers to investigate further and reduce losses.

Insurance Telematics Market Trends

Increasing Adoption of Usage-Based Insurance (UBI) Aids Market Growth

There is a growing trend toward adoption of Usage-Based Insurance (UBI) policies in developed countries. This method uses telematics data to calculate premiums based on actual driving skills. Insurers are increasingly offering UBI policies to provide more personalized coverage options, reduce accident risks, and promote safe driving habits to policyholders. In addition, insurance telematics technology is significantly being integrated with connected car ecosystems, allowing insurers to access vehicle data directly from onboard systems. This integration allows insurers to provide value-added services such as emergency assistance, vehicle tracking, and remote diagnostics to enhance the customer experience. Thus, these factors play an important role to increase the adoption of insurance telematics systems in connected cars which fuels market growth.

Insurance Telematics Market Growth Factors

Rising Awareness of Road Safety and Environmental Concerns Fuels Market Growth

Growing awareness of road safety issues and environmental concerns are significantly increasing across the globe, which drives demand for solutions that promote safer driving practices and reduces the emission of harmful gases, such as carbon dioxide, carbon monoxide, nitrogen oxide, and other air pollutant gases. Adoption of insurance telematics system can help in addressing these challenges by encouraging safe driving behavior, ecofriendly driving habits, and reducing accidents. Further, regulatory mandates and initiatives such as implementation of Electronic Logging Devices (ELDs) in commercial vehicles are driving the adoption of insurance telematics system in the automotive sector. Insurers are using these regulatory requirements to improve risk assessments and expand their market presence. For instance,

- In September 2023: OCTO telematics launched the Digital Driver Solution available through an app specially designed for drivers. This app encourage drivers for risk free driving without distracting them while driving the vehicle.

RESTRAINING FACTORS

Privacy Concerns and Data Security Risks May Hinder Market Growth

The collection and use of telematics data raise privacy concerns among consumers. Many countries including Germany are against of collecting telematics data without the consent of the driver. As the data such as location information and driving behavior can be misused by the insurer. Moreover, telematics data is prone to unauthorized access, hacking, and security breaches, which could lead risks to policyholder and insurer. Insurers must implement robust data security measures and access controls to protect critical information and ensure compliance with data protection regulations. These factors are expected to hinder the insurance telematics market growth.

Insurance Telematics Market Segmentation Analysis

By Component Analysis

Growing Need of Data Collection and Risk Assessment Drives Demand for Telematics Hardware

Based on component, the market is divided into hardware and software.

Hardware captured a larger market share of 51.43% in 2026, as they collect real time data on vehicle usage, driving behavior, and location. This collected data helps insurers with valuable insights, such as driving patterns, assessing risk accurately, and offer personalized insurance products based on individual driving skills.

Software is expected to grow at the highest CAGR during the forecast period, as telematics software provides policy holders with access to their driving behavior and personalized recommendations to enhance customer experience. Use of mobile apps, interactive dashboards and user friendly interfaces help policy holders to receive feedback and tracking of their driving performance. This improves loyalty and customer satisfaction which leads to long term relationships.

By Usage Type Analysis

Pay-How-You-Drive (PHYD) Holds Dominant Position Due to its Increasing Adoption among Commercial Vehicles

Based on usage type, the market is classified into Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD).

Pay-How-You-Drive (PHYD) captured maximum market share of 38.91% in 2026, as car insurance premium is charged based on driving skills, such as acceleration, braking, speed, and cornering. It is helpful for insurers who drive their vehicles daily or truck drivers by maintaining constant speed, avoiding instant breaking. Thus, premium for such vehicle owner would be calculated based on their driving skills, which fuels market growth.

Pay-As-You-Drive (PAYD) is expected to grow at a highest CAGR during the forecast period, as PAYD insurance decides the premiums based on mileage and driving behavior, rather than traditional factors, such as location and age. This approach helps insurers to provide more personalized pricing to policy holders. By monitoring factors, such as acceleration, speed, mileage and breaking, PAYD inspires drivers to adopt safer driving practices.

To know how our report can help streamline your business, Speak to Analyst

By Deployment Analysis

Rising Demand for Cost-effective and Affordable Cloud-based Telematics Fuels Market Growth

Based on deployment, the market is bifurcated into on-premises and cloud.

The cloud segment captured the highest market share of 35.43% in 2026 and is expected to grow at a highest CAGR. It eliminates the requirement for costly infrastructure maintenance, hardware investments, and software updates, as the system is managed and hosted by a third-party cloud service provider. This reduces initial capital investment and ongoing operational costs for insurance, and makes the system affordable and cost effective.

On the other hand, on-premise telematics system requires significant capital investment in infrastructure, hardware, software and IT resources. Also, they have limited scalability compared to cloud-based solutions.

By Vehicle Type Analysis

Increasing Focus on Personalization and Cost Saving Propels Market Growth

Based on vehicle type, the market is categorized into passenger cars and commercial vehicles.

Passenger cars captured the highest market share of 52.08% in 2026, as many insurance companies offer usage-based insurance policies with telematics devices, which are used to monitor driving behavior. These policies provide discounts for drivers with safe driving skills and saves on premium cost. Also, telematics data allows insurers to assess risk accurately based on driving behavior, which allows insurers to offer personalized insurance policies based on driver’s needs.

Commercial vehicles are expected to grow at the highest CAGR as telematics devices provide valuable data on fleet operations, including fuel consumption, vehicle location, maintenance schedules, and engine diagnostics. This information is used by fleet managers to improve fuel efficiency, optimize routes, and schedule maintenance which leads to cost efficiency and increased productivity.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America Insurance Telematics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 2.32 billion in 2025 and USD 2.69 billion in 2026. As awareness of UBI programs and the benefits of telematics-based insurance is gaining significant popularity among consumers in the region. Commercial vehicles represent a massive portion of the automotive market in the region. Insurers are majorly targeting the automotive sector with telematics-based insurance services designed to the needs of fleet operators, such as cost reduction, fleet management, risk management, and regulatory compliance. The U.S. market is projected to reach USD 1.91 billion by 2026. For instance,

- According to an Insurance Research Council survey, around 45% of U.S. drivers stated that their driving performance has improved after registering in a telematics program provided by their insurer.

Moreover, the region has a relatively mature insurance telematics market with a high level of competition among market players.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The region has experienced noteworthy growth in the automotive market, with an increasing number of vehicles on the roads. This increasing vehicle ownership has created opportunities for insurance companies to provide telematics-based products to a massive customer base. Furthermore, rapid urbanization in many countries of Asia Pacific has led to increased traffic congestion. Adoption of telematics devices can play a key role to help insurers to assess risk and monitor driver behavior which leads to reduction in accidents and insurance claims. The Japan market is projected to reach USD 0.36 billion by 2026, the China market is projected to reach USD 0.47 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026. For instance,

- In 2022, Insurance Regulatory and Development Authority of India (IRDAI) allowed for usage based car insurance policy in India. This facility allows customers to choose between pay as you drive and pay how you drive insurance cover as per their need.

Europe

Europe is anticipated to grow at a significant CAGR in coming years. Many European cities face traffic congestion which drives the demand for telematics-based insurance solutions. These solutions are capable of monitoring driver behavior and help reduce accidents in urban areas. The region has witnessed regulatory initiatives that encourage the adoption of telematics-based insurance solutions. The UK market is projected to reach USD 0.37 billion by 2026, and the Germany market is projected to reach USD 0.36 billion by 2026. For instance,

- The European Union’s (EU) General Data Protection (GDPR) has established guidelines for the collection and use of personal data, providing a framework for insurers to implement telematics solutions while ensuring data privacy and protection.

Middle East & Africa and South America

Rest of the world that includes the Middle East & Africa and South America is expected to showcase prominent growth in the insurance telematics sector during the forecast period. As the telematics-based insurance market is diverse, with different levels of consumer preferences, regulation, and maturity across different countries and regions. Insurers may require to tailor their telematics-based insurance offerings to suit the specific needs and preferences of consumers in each market.

List of Key Companies in Insurance Telematics Market

Key Market Focuses on Partnership and Acquisition Strategies to Expand Their Analytics Services

The leading players in insurance telematics have been expanding themselves through geographical presence by offering services customized for various industries. Major market players are focusing on mergers and acquisitions with regional market players maintaining their dominant positions across various regions. In addition, they are also launching new solutions and constant investments in the R&D activities for product innovations. Therefore, top companies are implementing strategic initiatives to survive in the market competition.

LIST OF KEY COMPANIES PROFILED:

- TomTom International BV (Netherlands)

- MiX Telematics (U.S.)

- Telematics Technologies (Poland)

- Trimble Inc. (U.S.)

- Agero, Inc. (U.S.)

- Safe Truck Sdn. Bhd. (Malaysia)

- Verizon (U.S.)

- Octo Group S.p.A (Italy)

- Sierra Wireless (Canada)

- Masternaut Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: OCTO engaged into a partnership with Jooycar to transform auto insurance in Latin America. This partnership will help the company to strengthen their business and improve driving experience by providing its advanced solutions and vehicle data analysis in Latin America.

- March 2023: Trimble Inc. launched its Mobility telematics portfolio for fleet management. It is the industry’s dwell time metrics that help fleets to make better decisions and utilize their assets efficiently.

- March 2023: OCTO announced to expand its business by opening new office facility in Singapore, as a part of their growth strategy in Asia Pacific. This office facility will provide additional sales support to their current and new customers.

- July 2022: Edelweiss General Insurance has launched India’s first on-demand motor insurance product named Switch. It is a comprehensive product, which covers mobile telematics-based motor policy under the IRDAI’s Sandbox initiative.

- September 2022: MiX Telematics completed acquisition of Trimble’s Field Service Management Business in North America for an amount of USD 7.8 million.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.94% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Usage Type

By Deployment

By Vehicle Type

By Region

|

Frequently Asked Questions

The market is projected to reach USD 24.19 billion by 2034.

In 2025, the market was valued at USD 5.89 billion.

The market is projected to grow at a CAGR of 16.94% during the forecast period.

By vehicle type, the passenger cars segment led the market in 2025.

Rising awareness of road safety and environmental concerns fuels market growth.

TomTom International BV, MiX Telematics, Telematics Technologies, Trimble Inc., Agero, Inc., and Sierra Wireless are the top players in the market.

North America dominated the global market with a share of 39.76% in 2024.

By usage type, Pay-As-You-Drive (PAYD) is expected to grow with a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us