Integrated Servo Motor Market Size, Share & Industry Analysis, By Type (AC and DC), By Voltage (Low, Medium, and High), By End-User (Automotive & Transportation (Excluding EV) {Power Steering Column, Assembly Line Automation, and Others}, Healthcare {Surgical Robots, Imaging equipment, HVAC Systems, Medical Patient-handling Equipment, and Others}, Semiconductor & Electronics {Fluid Dispensing Machines, HVAC Systems, Assembly Lines, and Others}, Industrial Machinery {Conveyor, CNC machine tools, HVAC Systems, Robotic Arms, and Others), and Regional Forecast, 2024-2032

Integrated Servo Motor Market Size

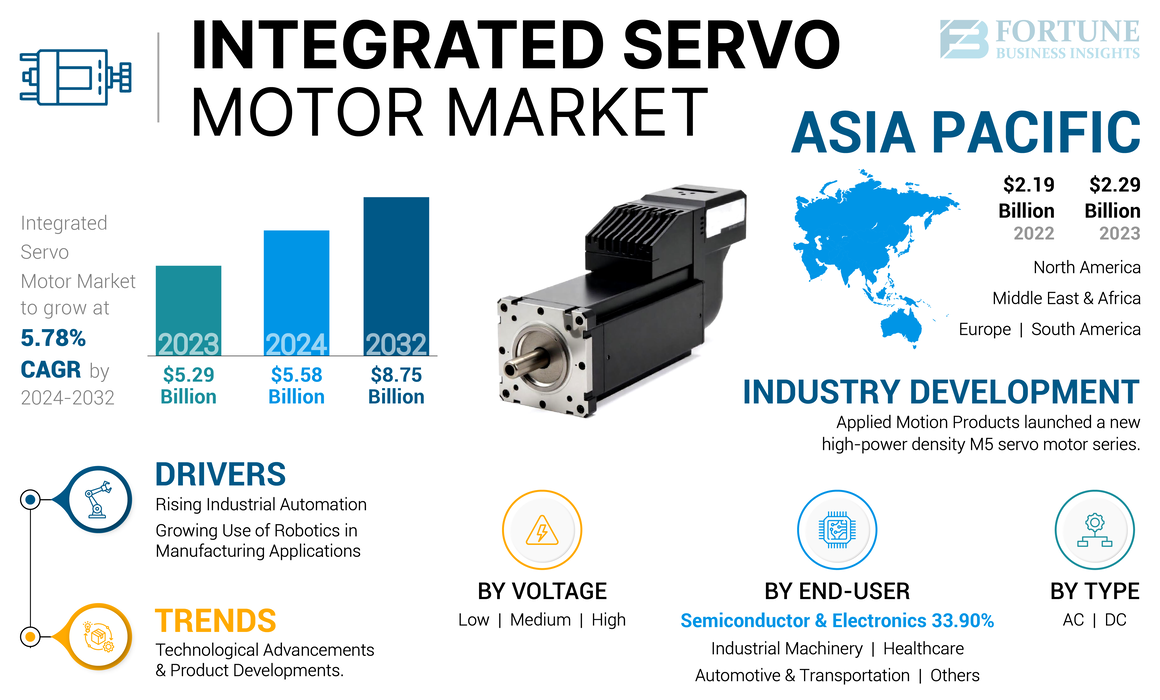

The global integrated servo motor market size was valued at USD 5.58 billion in 2024. The market is projected to grow from USD 5.89 billion in 2025 to USD 8.75 billion by 2032, exhibiting a CAGR of 5.82% during the forecast period.

The global integrated servo motor market is poised to grow owing to an increase in demand for automation from industries such as manufacturing, automotive, packaging, and others to enhance efficiency and productivity. Integrated motors play a crucial role in these automated systems due to their precision and reliability. With the growing prevalence of Industry 4.0, the demand for automation and motion control technologies has seen exponential growth. Integrated servo motors play a crucial role as they are used in conveyors, packaging machines, printing presses, and other automated equipment. The ability to provide precise control by servo motors ensures efficient and reliable operation, improving productivity and reducing downtime.

The COVID-19 pandemic restricted global manufacturing and business prospects owing to the imposition of strict guidelines and regulations by the government of different nations. The supply chain was also disrupted which hampered the availability of raw materials and finished goods to the manufacturer and consumer. The overall industrial output including the end using products also slowed down which lead to the downfall in the demand for servo market.

Integrated Servo Motor Market Trends

Technological Advancements and Product Developments to Augment the Market Growth

The global market is observing new product developments by players. Companies are dedicating their R&D efforts to improve their offerings. For instance, in September 2023, JVL A/S, an integrated servo and stepper motors manufacturer, introduced an innovative high-power integrated servo motor known as the MAC motor®. The offering features a built-in motor, encoder, drive electronics, control electronics with ePLC™, and optional Ethernet or CAN bus integrated into one compact unit.

With active participation from market players and the growing need for motion control systems, the demand for advanced solutions for a range of applications is anticipated to augment the integrated servo motor market growth.

Download Free sample to learn more about this report.

Integrated Servo Motor Market Growth Factors

Rising Industrial Automation is Promoting Adoption of Servo Motors Owing to their Efficiency

Automation has become essential in accordance with growing technological needs in order to improve efficiency and productivity in numerous industries such as manufacturing, healthcare, transportation, and many others. Servo motors help increase productivity, improve product quality, and reduce operational costs by delivering precise and reliable movement control. Owing to their ability to handle high-speed, high-precision, and complex tasks, they have become an essential component of modern industrial automation systems.

Advanced automation systems are flexible and scalable and can meet changing production requirements. This aspect allows manufacturers to promptly respond to market trends and customer demand, ensuring they remain competitive in a dynamic global market. In addition, automation aids in the efficient customization of products, catering to the rising demand for personalized solutions. As servo motors play a crucial role in helping businesses achieve enhanced automation, the market is expected to grow.

Growing Use of Robotics in Manufacturing Applications to Support Market Growth

Manufacturing industries are highly using robotics for a variety of applications such as production and assembly, cutting and welding, material handling, packaging, and others. Robotics help in improving operational efficiency, cost-effectiveness, workplace safety, and product quality. Further, automating mundane tasks enables manufacturers to make optimal use of labor and other resources.

In May 2024, Australia released its first National Robotics Strategy with an aim to build the nation’s strength in robotics and automation technology, improve competitiveness, boost productivity, and support local communities. The government will provide support via the USD 15 billion National Reconstruction Fund, which makes targeted investments to help Australia diversify and transform its industries. It will assist small & medium-sized enterprises (SMEs) and startups in their most challenging development phase under the industry growth program.

Such support by the government is also anticipated to drive the growth of robotics in manufacturing and thereby support market growth.

RESTRAINING FACTORS

High Cost of Servo Motors is Limiting the Growth of the Market

One of the major challenges limiting the growth of the market is the cost factor. Servo systems, along with motors, controllers, and encoders, are usually costlier than simpler systems such as stepper motors. For small businesses or applications, this capital-intensive nature acts as a significant barrier, where cost is a critical factor. In cases where precision and speed are not essential, businesses employ other cost-effective alternatives.

A skilled workforce is required to operate the automated parts of machines, resulting in increased costs of servo motors and drives. Thus, training and development of the workforce is essential for operation. The need for expertise is evolving owing to the ongoing developments of new techniques and industrial technology. Thus, this acts as a challenge for businesses to educate their workforce to continuously match the ever-growing need. Therefore, all these factors mentioned above add to the cost of implementing integrated servo motor solutions, thereby hindering market growth.

Integrated Servo Motor Market Segmentation Analysis

By Type Analysis

AC Servo Motors to dominate the Market owing to their wide adoption in Industrial Sectors

Based on type, the global market is divided into AC and DC.

The AC segment is poised to hold a dominant share in the global integrated servo motor market throughout the period. AC servo motors are broadly used in industrial machines and industrial automation, including CNC machines, automated manufacturing processes, and robotics. These servo motors are driven by alternating current and are generally used in industrial applications owing to their robust nature and ability to handle higher current loads.

DC servo motors have a significant share in the market. These integrated servo motors are used in smaller, precision-based applications such as robotics, positioning systems, and small-scale automation.

By Voltage Analysis

Low Segment Led Owing to its Suitability in a Wide Range of Battery-operated Applications

Based on voltage, the global market is segmented into low, medium, and high.

The low segment held the largest market share in 2023 and is expected to dominate the market share over the forecast period. This voltage is suitable for battery-operated applications such as AGVs, robotics, mobile machinery, and other applications. Low-voltage servo motors offer significant benefits in terms of safety and seamless integration with current electrical systems. Kollmorgen is one of the providers of low voltage servo motors, which offers AKM2G & AKM Low Voltage DC Servo Motors.

High-voltage servo motors come with enhanced responsiveness and accuracy. These motors are able to move quickly and in a precise manner, which makes them suitable for applications that require rapid and accurate movement. These servo motors are used in applications requiring increasing power and torque. Even at higher voltages, they are able to provide more power to the motor, enabling it to generate greater torque and move larger loads with more speed and precision.

By End-User Analysis

Semiconductor & Electronics Segment Dominates Fueled by High Requirement of Integrated Servo Motors in Complex Manufacturing Process

Based on end-user, the global market is segmented into automotive & transportation (excluding EV), healthcare, semiconductor & electronics, industrial machinery, and others.

The majority of the market share is held by the semiconductor & electronics segment, which is expected to dominate the market share during the study period. The manufacturing complexity of semiconductors necessitates the use of machinery with high precision and accuracy, where servo motors play a huge role. Electronics manufacturing is a continuous and demanding process where speed and accuracy are critical, and thus, it fuels the demand for integrated servo motors.

The industrial machinery segment holds the second largest share in the market owing to the increased automation of industrial processes. Automated conveyor systems and automated storage and retrieval systems use integrated servo motors to run and enable smooth operation with large inertial loads.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The global market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Integrated Servo Motor Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region dominated the global integrated servo motor market share valued at USD 2.29 billion in 2023 and USD 2.43 billion in 2024. With the presence of countries such as China, India, and other developing economies, the demand from the manufacturing sector is expected to drive the market growth. Further, various governments in the region are assisting businesses in adopting industrial automation and advanced manufacturing technologies through policies, incentives, and investments. China is foreseen to be valued at USD 1.29 billion in 2025. For instance, the Make in India initiative was adopted by the country in order to transform it into a global manufacturing hub. It supports the development of industries such as automobile, defense manufacturing, food processing, pharmaceuticals, and many others. India is anticipated to hold USD 0.47 billion in 2025, while Japan is predicted to be worth USD 0.11 billion in the same year.

North America is the second largest market anticipated to hold USD 1.46 billion in 2025, exhibiting a considerable CAGR of 6.01% during the forecast period (2025-2032). North America region is well-known for its ability to adopt advanced technologies in a variety of industries. Owing to government support and active participation from market players in the research & development of technologies, the market is expected to observe growth. The region also has a significant presence in the robotics and aerospace industries, where integrated servo motors are vital in applications such as robotic arms, precision machining, and aerospace actuation systems. In addition to having a significant share in the production of large civil aircraft, the growing demand for unmanned aerial vehicles in defense applications is further expected to support the market growth. The U.S. market is estimated to gain USD 1.29 billion in 2025.

Europe is the third leading region poised to be valued at USD 1.08 billion in 2025. Europe is highly regarded for its production of civil aircraft, including helicopters, aircraft engines, parts, and components. The aeronautics industry in Europe is prominent and competitive globally, and it highly focuses on research and development. The U.K. market continues to expand, estimated to reach a market value of USD 0.19 billion in 2025. The growing usage of automation & robotics in aircraft manufacturing is anticipated to fuel the growth of the market in the region. Government initiatives supporting advanced manufacturing technologies, research and development for automation, and provision of financial benefits for adopting energy-efficient solutions are also expected to contribute to the growth of the market in Europe. Germany is set to gain USD 0.24 billion in 2025, while France is expected to hold USD 0.13 billion in the same year.

Latin America region holds immense opportunities in the manufacturing sector. Owing to its proximity to the U.S., many manufacturers prefer Mexico to operate and manage manufacturing activities in the country. This shift would help develop advanced manufacturing in the region and support the growth of the market.

The Middle East & Africa is the fourth largest market likely to be worth USD 0.45 billion in 2025. In the Middle East & Africa, the growing collaborative efforts between governments, regulators, and associations for economic expansion are among the key aspects driving growth in the region's automation and manufacturing sectors. For instance, Saudi Arabia has devised a national industry strategy with the aim of triple the country’s manufacturing sector contribution to GDP by 2030. Giants such as Pirelli, Hyundai, Schneider Electric, and Emerson are opening factories in Saudi Arabia as the country is accelerating plans to manufacture domestically. The GCC market is foreseen to stand at USD 0.32 billion in 2025.

KEY INDUSTRY PLAYERS

Players are Creating Efficient Products to Enhance Their Market Position

Companies are continuously developing more efficient products and providing added benefits such as predictive maintenance and condition monitoring. For instance, in August 2023, Kollmorgen, a motion control systems provider, received ATEX certification and IECEx/cETLus listing for the explosion-proof Goldline EBH 480 Vac servo motor. With this, the company can offer solutions to sectors such as mining, oil & gas refineries, textile mills, and industrial paint booths where flammable gases, mists, or vapors may exist in explosive or ignitable concentrations.

The market is focused on investments and a strong product portfolio by key players such as Applied Motion Products, Yaskawa Electric Corporation, Kollmorgen, and others. Moreover, the companies in the market are developing efficient products in order to improve their position in the market.

List of Top Integrated Servo Motor Companies:

- Danfoss (Denmark)

- Applied Motion Products (U.S.)

- Schneider Electric (France)

- Rockwell Automation (U.S.)

- Delta Electronics (Taiwan)

- B&R Industrial Automation (Austria)

- Kollmorgen (U.S.)

- Servotronix Inc. (Israel)

- Yaskawa Electric Corporation (Japan)

- Siemens AG (Germany)

- Omron Automation (Japan)

- Panasonic (Japan)

- ABB (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Emerson (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In November 2023, Applied Motion Products launched a new high-power density M5 servo motor series. The servo motor features IP65-rated protection and plug-in connectors for easy installation. The company also offers a range of options, including battery-powered or battery-less absolute multi-turn encoders, various frame sizes, and different inertia levels to suit specific application needs. The M5 servo motor series is UL-recognized in the U.S. and Canada.

- In September 2023, Rockwell Automation collaborated with Infinitum to co-develop and distribute a new class of high-efficiency, integrated low voltage drive and motor technology. Both companies aim to enable their customers to reduce their carbon footprint and achieve sustainability by developing a solution that can significantly save energy and cut costs.

- In May 2023, Kollmorgen launched the AKMA servo motor, which employs a hardened anodized aluminum surface, giving machine designers a cost-effective and hygienic option for medium- to heavy-washdown applications. The motor is preferably beneficial for precision motion applications in food & beverage processing and in pharmaceutical & medical packaging operations.

- In May 2023, Siemens launched Sinamics S200, a servo drive system developed for a variety of standard applications in industries such as batteries, electronics, and others. It includes precise servo drive, powerful servo motors, and easy-to-use cables and offers high dynamic performance. It can be used in a wide range of standard applications in the battery, electronics, and other industries. With further integration with a Simatic controller, users get a powerful, future-proof, and robust motion control system.

- In February 2023, Omron announced the launch of the K7DD-PQ Series of advanced motor condition monitoring devices. It helps locate the deterioration and wear of servomotors, machine tools, and other equipment in order to lower inspection efforts and prevent their unexpected failure. The new K7DD-PQ can check the condition of servomotors that regularly change speed and of motors with rapidly changing loads.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/application types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.78% from 2024 to 2032 |

|

Unit |

Value (USD Billion) and Volume (Thousand Units) |

|

Segmentation |

By Type

|

|

By Voltage

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 5.29 billion in 2023.

The market is projected to grow at a CAGR of 5.78% over the forecasted period.

Based on the type, the AC segment holds a dominating market share.

The global market size is expected to reach USD 8.75 billion by 2032.

The growing use of robotics in manufacturing applications is set to support market growth.

Yasakawa Electric Corporation, Kollmorgen, and ABB Machinery are some of the major players that have a business presence across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us