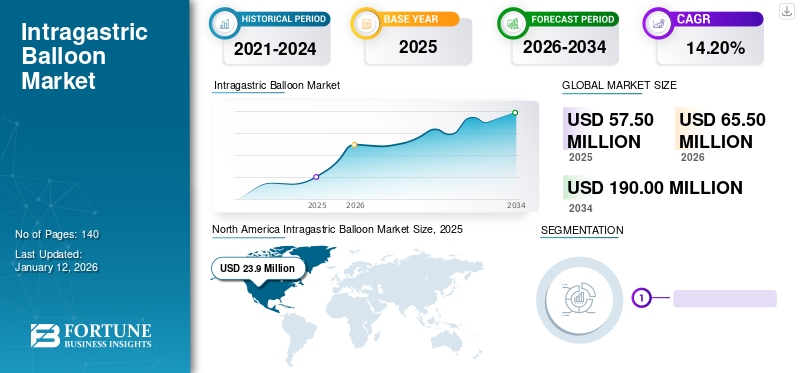

Intragastric Balloon Market Size, Share & Industry Analysis, By Product Type (Single, Dual, and Triple), By Administration (Pill and Endoscopy), By Filling Material (Saline-Filled and Gas-Filled), By End-user (Hospitals & Clinics, Outpatient Surgical Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global intragastric balloon market size was valued at USD 57.5 million in 2026 and is projected to grow from USD 65.5 million in 2026 to USD 190 million by 2034, exhibiting a CAGR of 14.20% during the forecast period. North America dominated the intragastric balloon market with a market share of 41.60% in 2025.

An intragastric balloon placement is a non-surgical weight loss procedure and is considered safe and cost-effective compared to surgical procedures. The growing concern about obesity and the prevalence of the obese population across the globe is one of the predominant factors raising the demand for these balloons.

- According to the 2022 data published by the World Health Organization, an estimated 1.00 billion people are obese worldwide.

Moreover, obesity increases the risk of developing a range of non-communicable diseases such as cardiovascular disease, diabetes, stroke, hypertension, and various types of cancers. In order to mitigate the risk of these diseases, the governments of many nations are raising awareness among the population to manage obesity, which is likely to increase the adoption of these products in the coming years.

In addition, shifting preference among the target population toward effective, non-invasive or minimally invasive methods for obesity management and growing approval for these products are a few other factors supporting market growth.

Global Intragastric Balloon Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 57.5 million

- 2026 Market Size: USD 65.5 million

- 2034 Forecast Market Size: USD 190 million

- CAGR: 14.20% from 2026–2034

Market Share:

- Region: North America dominated the market with a 41.60% share in 2025. The region's growth is driven by the high prevalence of obesity and a strong preference among patients and clinicians for technologically advanced, minimally invasive weight loss products.

- By Product Type: The single balloon segment held the largest market share in 2024. This is due to the wide availability of single balloon products, an increasing number of regulatory approvals, and their rising adoption rate among patients seeking non-surgical weight loss solutions.

Key Country Highlights:

- Japan: As a key market in the fast-growing Asia Pacific region, demand is increasing due to a rising patient population, growing awareness among both healthcare professionals and patients regarding new technologies, and the launch of new weight loss programs.

- United States: The market is driven by a high prevalence of obesity, affecting around 20% of the population. There is also a significant and growing adoption of the procedure, with an estimated 4,100 intragastric balloon surgeries performed in 2021.

- China: As part of the Asia Pacific region, which is projected to have the highest growth, the market is expanding due to a large and growing patient population dealing with obesity and increased awareness about minimally invasive weight loss options.

- Europe: The market is propelled by sedentary lifestyles leading to a higher obesity rate, increasing government initiatives to manage the public health impact of obesity, and growing investment in research and development for new minimally invasive weight loss procedures.

COVID-19 IMPACT

Market Growth Declined Amid Pandemic Due to Reduced Patient Visits

The market observed a negative growth during the pandemic. A multitude of factors, such as the implementation of stringent lockdown, decrease in patient visits, decline in bariatric procedures, and temporary halt in elective surgeries amid the pandemic, impacted the market negatively.

- For instance, according to an article published in the NCBI in 2022, there was a 14.8% decline in bariatric procedures in the U.S. in 2020 compared to the previous year.

The companies operating in the market also witnessed a decline in their revenues during the pandemic. One of the prominent players, Apollo Endosurgery, witnessed a decline of 12.2% in its revenue owing to a decrease in elective procedures and reduced patient access to treatments during the pandemic.

However, the market regained normalcy in post-pandemic due to ease in restrictions and the resumption of elective surgeries.

Intragastric Balloon Market Trends

Shifting Preference Toward Swallowable Gastric Balloon Capsules

The rising prevalence of obesity and related complications is facilitating the demand for less complicated procedures among the population for weight loss. In order to cater to the growing demand for a safe and effective weight loss treatment, the key manufacturers in the market are shifting their focus to introduce intragastric balloon capsules. These capsules can be administered orally without any endoscopic procedure, surgery, or anesthesia.

- For instance, in September 2022, Allurion Technologies Inc. launched the swallowable gastric balloon in India.

Moreover, unlike other devices that are administered endoscopically, the capsule balloons do not require a removal procedure as the balloon deflates and passes out through the bowel after a few months. Thus, increasing patient preference for gastric balloon capsules and the launch of these products augment the growth of the market.

Download Free sample to learn more about this report.

Intragastric Balloon Market Growth Factors

Growing Prevalence of Obesity Coupled with Increasing Complications Associated with Bariatric Surgery Augments the Demand

Obesity is one of the growing concerns across the globe, leading to various chronic disorders such as hypertension, diabetes, and others. Shifting preference for a sedentary lifestyle among the population living in developed and metropolitan areas, along with less physical activities, is leading to a high burden of obesity among the population in the world.

- According to the 2022 World Obesity Atlas published by the World Obesity Federation, an estimated 1 billion people across the globe will be living with obesity by 2030.

In addition, the growing complications associated with bariatric surgeries, such as anastomotic obstruction, hernia, ulcers, strictures, leakages, and others, are raising the demand for safe and effective products among patients.

- As per the 2021 data published by the American Society for Metabolic and Bariatric Surgery, the risk of major complications associated with bariatric surgery is about 4.0%.

Thus, the rising burden of obesity, along with the increasing risk of complications associated with weight loss surgeries, is supporting the global market growth.

Rising Research & Development to Launch New Products to Augment Market Growth

The increasing prevalence of obesity across the globe is raising the demand for minimally invasive and effective procedures to reduce weight among patients. To cater to the propelling demand, scientists and manufacturers are investing extensively to launch new products in the market.

- For instance, in April 2019, researchers from Nanyang Technological University and National University Hospital, Singapore, collaborated to develop a self-inflating weight loss balloon, Endopil. The product is anticipated to launch in Singapore in 2024.

Thus, increasing R&D initiatives to launch new products in the market is likely to fuel market growth in the upcoming years.

RESTRAINING FACTORS

Growing Product Recalls May Hamper Brand Presence, Hindering Market Growth

Despite the increasing inclination toward intragastric balloons and the launch of new products, the rise in voluntary recalls of a few products due to various complications is limiting their adoption. This further leads to consumer preference for other alternative treatment products, thereby hampering the market growth.

- For instance, in February 2019, the Endball – Systeme de Ballon Intra-gastrique and Reshape Medical Intragastric Balloon were no longer licensed for selling in Canada by the Government of Canada. The license for these two products was canceled due to the potential risk of gastric & esophageal perforation, acute pancreatitis, and spontaneous balloon overinflation associated with these balloons.

In addition, the high cost of intragastric balloon procedures in developing nations is restricting their access and adoption, thereby slowing the market growth.

Intragastric Balloon Market Segmentation Analysis

By Product Type Analysis

Single Segment Dominated Owing to Wide Availability

Based on product type, the market is categorized into single, dual, and triple.

The single intragastric balloon segment is projected to dominate the market with a share of 73.44% in 2026 due to the large availability of these products in the market. Furthermore, increasing approval of single balloons, and the rising adoption of these products are promoting segment growth.

The dual segment is anticipated to gain momentum in the upcoming years due to its increasing efficiency in weight loss compared to other products. According to a 2021 study published in the American Journal of Surgery, 31.6% of excess weight loss was due to dual intragastric balloon compared to other weight loss methods such as diet and exercise. Furthermore, dual balloons reduce the risk of movement and mimic the stomach's shape for improved weight loss.

To know how our report can help streamline your business, Speak to Analyst

By Administration Analysis

Endoscopy Segment Dominated the Market Owing to Growing Product Approvals

Based on administration, the market is segmented into endoscopy and pill.

The endoscopy segment is expected to lead the market, accounting for 79.85% of the total market share in 2026 and is projected to continue its dominance in the upcoming years. The advancement in endoscopic technologies is improving the intragastric balloon procedure. In addition, endoscopic technologies are cost-effective and less invasive compared to bariatric surgeries, compelling companies to develop new endoscopy-based products. Furthermore, companies seeking approval for these devices are also promoting the segment’s growth.

- For instance, in October 2021, Spatz Medical received U.S. FDA approval for a saline-filled product that uses an endoscope for administration.

The pill segment is anticipated to witness lucrative growth during the forecast period. The growing preference for non-invasive products, increasing number of research activities to develop new and advanced products, and rising investment by companies to develop and introduce pill-based balloons in new geographical areas are supporting the growth of the segment.

- For instance, in 2020, Allurion Technologies, Inc. raised USD 34.0 million in a funding round led by Romulus Capital and Novalis LifeSciences. The company aimed to expand its international presence by using the fund.

By Filling Material Analysis

Saline-Filled Segment Dominated Due to Increase in Product Approvals

Based on filling material, the market is segmented into saline-filled and gas-filled.

The saline-filled segment is anticipated to hold a dominant market share of 76.03% in 2026 owing to its wide availability, high efficiency, and growing adoption of these products among the patient population. Furthermore, players are seeking approval and launching new products in different countries to cater to the rising demand for these products. Thus, all the factors mentioned are propelling the segment’s growth.

- For instance, in October 2022, Allurion received approval from the Brazilian Health Regulatory Agency (ANVISA) for its saline-filled product.

The gas-filled segment is anticipated to witness lucrative growth in the forthcoming years owing to its fewer side effects compared to the saline-filled balloons. In addition, companies are investing heavily to develop less harmful gas-filled balloons, augmenting segment growth.

By End-user Analysis

Hospitals & Clinics Segment Dominated Owing to Increase in Bariatric Procedures

Based on end-user, the global market is segmented into hospitals & clinics, outpatient surgical centers, and others.

The hospitals & clinics segment is forecast to represent 61.98% of the total market share in 2026. The dominance is attributed to the increasing patient preference to seek treatment from hospitals due to the various benefits offered by these healthcare settings. Furthermore, an increasing number of hospitals offering advanced bariatric procedures globally is also bolstering the segment growth.

- For instance, in October 2023, NYC Health + Hospitals/Bellevue received the re-accreditation as the metabolic and bariatric surgery center.

REGIONAL INSIGHTS

Based on region, the market is divided into Europe, North America, Asia Pacific, and the rest of the world.

North America Intragastric Balloon Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

The growing prevalence of obesity and shifting preference toward technologically advanced products is one of the predominant factors driving the market growth in the region. The U.S. market is projected to reach USD 24.4 billion by 2026.

- According to the report published by the Centers for Disease Control and Prevention in 2023, the prevalence of obesity in the U.S. is estimated to be around 20%.

Furthermore, the increasing popularity and the growing adoption of the product in the region are a few other factors contributing to regional growth.

- As per the 2023 data published by the American Society for Metabolic and Bariatric Surgery, an estimated 4,100 intragastric balloon surgeries were performed in 2021 in the U.S.

Europe

Europe held the second position in the global market in 2022. The increasing preference for a sedentary lifestyle leading to obesity among the population, growing initiatives launched by the government to manage obesity, and increasing investment to promote research and development to develop minimally invasive procedures for weight loss are some factors supporting the market growth in the region. The UK market is projected to reach USD 4.7 billion by 2026, while the Germany market is projected to reach USD 6 billion by 2026.

Asia Pacific

Asia Pacific is projected to grow at the highest CAGR during the forecast period. The increasing patient population in the region, growing awareness among healthcare professionals and patients regarding new technologies, and the launch of a few weight loss programs in the region are a few factors contributing to the growth of the market. The Japan market is projected to reach USD 2.9 billion by 2026, the China market is projected to reach USD 2.1 billion by 2026, and the India market is projected to reach USD 1.5 billion by 2026.

- For instance, in July 2020, Allurion Technologies, Inc. expanded its footprints in Asia with the launch of the Gastric Balloon weight loss program, Elipse.

List of Key Intragastric Balloon Market Companies

Strong Geographical Presence of Apollo Endosurgery and Allurion Technologies, Inc. to Contribute to the Leading Shares

The global market is consolidated with a few players, including Apollo Endosurgery, and Allurion Technologies, Inc., among others. The growing focus of the key players to expand their product portfolio to new indications, increase their geographical footprints, and launch new products are some factors contributing to their high revenue share. In addition, a strong distribution network and brand presence of these companies in the market aid in the high market share.

- For instance, in March 2021, Apollo Endosurgery received the U.S. FDA breakthrough device designation for the product Orbera with a BMI ranging from 30-40 kg/m2 for treating patients suffering from noncirrhotic nonalcoholic steatohepatitis.

Some other companies, such as Spatz Medical, Lexel SRL, Reshape Lifesciences, and others, are continuously engaging in inorganic business activities to establish their footprints in emerging nations.

LIST OF KEY COMPANIES PROFILED:

- Allurion Technologies, Inc. (U.S.)

- Apollo Endosurgery Inc. (U.S.)

- ReShape Lifesciences, Inc. (U.S.)

- Spatz Medical (U.S.)

- Lexel SRL (Argentina)

- Medispar NV (Belgium)

- Endalis (France)

- Districlass Medical (France)

- Silimed Brazil (Brazil)

- Suzhou Shenyun Medical Equipment Co., Ltd (China)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Allurion completed patient enrollment in its AUDACITY trial. The study is a pivotal trial designed to support the U.S. FDA approval of the gastric balloon developed by the company.

- September 2023: ReShape Lifesciences, Inc. entered into a royalty-bearing license agreement with Biorad Medisys, Pvt. Ltd. (Biorad) to develop, commercialize, and distribute Obalon gastric balloons in Pakistan, India, Nepal, Sri Lanka, and other Asia Pacific countries. Through this agreement, the company aimed to strengthen its presence in developing nations.

- June 2023: Allurion collaborated with Medtronic to extend its AI-powered weight loss program in Central and Eastern Europe and the Middle East & Africa (CEMA). The program combines the Allurion balloon procedure-less gastric balloon for weight loss with the Allurion Virtual Care Suite.

- April 2020: Allurion submitted the pre-market approval (PMA) application to the U.S. FDA for its gastric balloon, Elipse.

- May 2019: Spatz Medical announced the clinical trial result of its adjustable gastric balloon. According to the result, the average success rate of the spatz3 balloon was 83.0% compared to other non-adjustable balloons, with a 39.7% success rate.

REPORT COVERAGE

An Infographic Representation of Intragastric Balloon Market

To get information on various segments, share your queries with us

The global intragastric balloon market research report delivers a detailed market analysis and market sizing. It focuses on key aspects such as new product launches and technological advancements. In addition, it includes an overview of all the segments and key industry developments such as mergers, partnerships, and acquisitions. Moreover, it covers regional analysis of different segments, key trends, and company profiles of prominent market players, the competitive landscape, and the impact of COVID-19 on the market. Besides these, the report offers an overview of market opportunities. The report further encompasses qualitative and quantitative insights that contribute to the growth of the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.20% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Administration

|

|

|

By Filling Material

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 65.5 million in 2026 to USD 190 million by 2034.

In 2025, North America stood at USD 57.5 million.

The market is projected to expand at a CAGR of 14.20% during the forecast period.

By product type, the single segment led the market in 2025.

The key factors driving the market growth are the high prevalence of obesity across the globe, shifting preference for non-invasive and minimally invasive bariatric procedures, low cost of intragastric balloon procedures, and launches of new products, among others.

Apollo Endosurgery and Allurion Technologies, Inc., among others, are some of the major players in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic