ITSM Market Size, Share & Industry Analysis, By Deployment (On-premises and Cloud), By Enterprise Type (Large Enterprises and SMEs), By Application (Configuration & Change Management, Operations & Performance Management, Incident Management, Problem Management, and Others), By Industry (BFSI, IT & Telecommunication, Government & Public Sector, Retail & Consumer Goods, Healthcare, Manufacturing, Media & Entertainment, and Others), and Regional Forecast, 2025–2032

KEY MARKET INSIGHTS

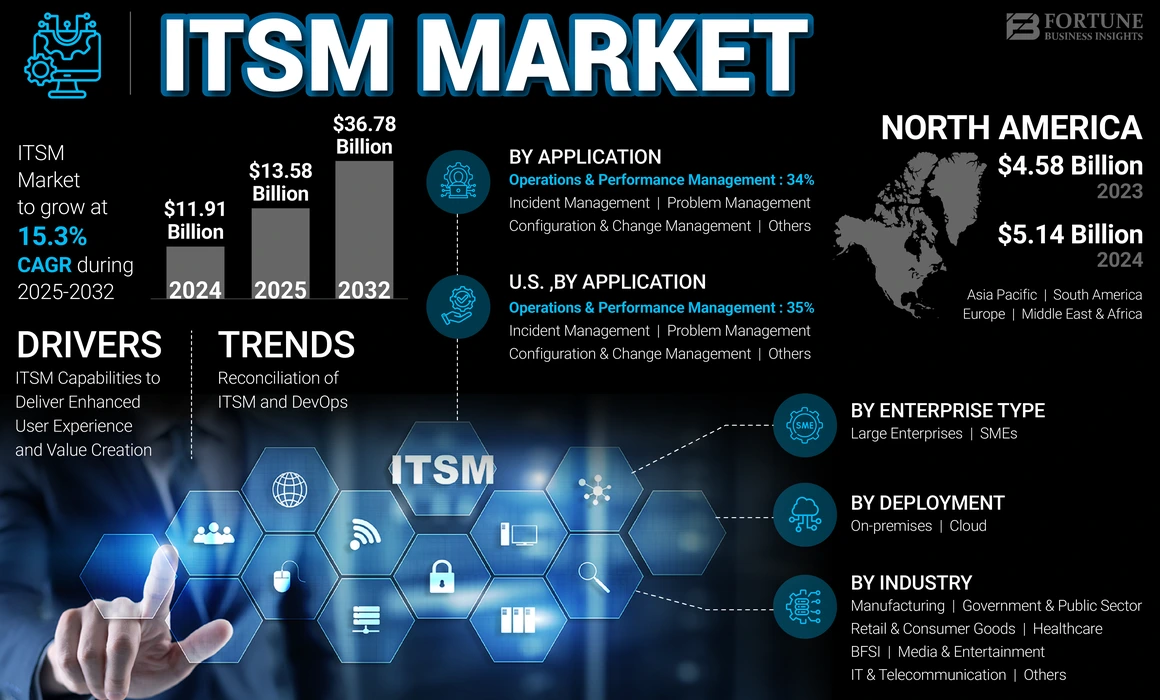

The global ITSM market size was valued at USD 11.91 billion in 2024. The market is projected to grow from USD 13.58 billion in 2025 to USD 36.78 billion by 2032, exhibiting a CAGR of 15.3% during the forecast period. North America dominated the global market with a share of 43.16% in 2024.

IT Service Management (ITSM) refers to organizations' activities, processes, and strategies to design, deliver, manage, and improve IT services they provide to their customers or end-users. This service focuses on aligning IT services with the needs of the business and ensuring that the IT infrastructure and services support its goals and objectives. The market is poised for continued growth after COVID-19, driven by the capability of IT service management to deliver enhanced user experience and value creation. As more companies recognize the value of IT-related services, adoption rates are expected to rise, further accelerating the market’s expansion. Moreover, the market is highly competitive and becoming increasingly saturated, with strong competition from established players, such as ServiceNow, BMC Software, Open Text Corporation, and IBM Corporation, and newer entrants, such as Freshworks and Ivanti. This can lead to price wars and pressure on profit margins.

IMPACT OF GENERATIVE AI

Growing Demand for Predictive Analytics for Incident Management to Boost Market Growth

Generative AI can automate the process of ticket creation and resolution by analyzing historical data and generating responses to common IT issues. This can help reduce the workload on IT service desks and improve end-user response times. This technology can analyze ITSM performance metrics and generate reports or recommendations for areas of improvement. It can also identify inefficiencies in service delivery and generate optimization strategies, allowing IT departments to improve operational efficiency. Also, gen AI technology can analyze IT infrastructure data to generate risk assessments, predicting potential vulnerabilities or security threats. This can help IT teams take proactive steps to secure systems and minimize risks, especially in areas, such as network security, patch management, and data protection. For instance,

- In December 2023, Atlassian integrated a novel generative AI capability, which is available across its Jira software services for managing IT and DevOps workflows. The team of Domino’s Pizza uses Atlassian Intelligence to boost its productivity.

MARKET DYNAMICS

Market Drivers

ITSM Capabilities to Deliver Enhanced User Experience and Value Creation to Drive Market Progress

IT service management helps enterprises stay focused on formalizing and centralizing work operations and developing user-friendly employee experiences that transform business priorities. Aligning employee operations with strategic business purposes, depending on data and analytics to enhance proficiencies, and reinforcing collaborations among departments, employees, company, and customers can aid in faster workflows and procedures, thereby saving money and time. Hence, IT organizations are trying to direct their interest in employee experience to accomplish better overall productivity. For instance,

- As per BMC insights 2024, improving employee experience is a rising focus in IT service management, with 67% of enterprises recognizing the importance of improved employee experiences.

- According to an AXELOS survey in 2022, 48% of enterprises believed that their IT service management competencies were “good” or “great”, 27% were “reaching there”, and 22% had “felt need to improve.”

Such enhanced capabilities help enterprises deliver better employee experience, which will propel the market progress.

Market Restraints

High Initial Deployment Cost and Lack of Skilled Resources May Hinder Market Growth

IT service solutions can require significant upfront investment in software, hardware, training, and consulting services. Budget constraints may limit organizations’ ability to invest in IT service management initiatives, particularly for smaller businesses and non-profit organizations. In addition, these solutions require skilled professionals with expertise in service design, process automation, and cybersecurity. The shortage of skilled resources can hinder organizations’ ability to implement and maintain effective IT service management practices. Thus, this factor is expected to hinder the market growth.

Market Opportunities

Integration of AIOps into IT Service Management to Create Numerous Business Opportunities for Market Players

The incorporation of AIOps into IT service management provides various benefits for users. AIOps can automate mundane and repetitive tasks, greatly minimizing the manual work operations of IT teams. It can enhance operational productivity by offering real-time insights and faster issue resolution. Thus, the usage of AIOps delivers numerous benefits and opportunities for enterprises. For instance,

- As per Rezolve Insights 2023, approximately 60% of enterprises are presently making use of AI-driven IT service management tools to improve their service desk functions. AI-based automation in ITSM can minimize incident resolution times by almost 50%. Around 75% of IT service management specialists believe that AI would considerably influence IT service management by 2025.

- In February 2024, BMC announced the expansion of its ESM (Enterprise Service Management) and AIOps competencies by unifying artificial intelligence and machine learning through observability, automation of IT operations, identifying patterns, and predicting potential issues before their occurrence.

Such advancements for the incorporation of IT service management into AIOps present various market opportunities for vendors.

Market Trends

Reconciliation of IT Service Management and DevOps to be Key Market Trend

ITSM and DevOps are apparently at odds with one another. The former emphasizes structure, control, and governance of services, while the latter prevents traditional controls from developing additional development variations at a faster pace. However, like most frameworks, the unification of IT service management and DevOps principles can deliver benefits to all enterprises in deploying rapid changes, irrespective of causing interruptions to operational surroundings. For instance,

- In February 2024, Techstrong Group announced the launch of the Techstrong IT service management community platform to fill the gap between Agile, ITSM, and DevOps. The new platform seamlessly incorporates Agile, DevOps, and IT service management approaches into a combined resource for IT experts. This provides a holistic methodology that manages the entire IT life cycle.

DevOps and IT service management both benefit more from working together. Hence, both solutions can be more effective and offer enhanced service to their users. DevOps, as an operational and cultural shift, promotes customer-driven tasks and end-to-end accountability. Thus, the reconciliation of DevOps and IT service management can provide enterprises with numerous prospects and hence, is a key trending factor in the market.

The COVID-19 pandemic positively impacted the market as remote work became the norm during this period. There was an increased demand for IT service solutions that enable remote support, collaboration, and service delivery. Organizations had to quickly modify their IT service management processes to support remote teams and ensure business continuity. As businesses continue to navigate the evolving landscape, IT service management solutions will enable agility, resilience, and efficiency in the post-pandemic world.

SEGMENTATION ANALYSIS

By Deployment

Growing Need for Cost Efficiency and Scalability Drove Demand for Cloud-based ITSM Solutions

Based on deployment, the market is classified into on-premises and cloud.

The cloud-based IT service management segment captured the largest market share in 2023, and it is expected to continue its dominance by recording the highest CAGR over the forecast period. Cloud-based IT service management solutions offer high scalability, allowing businesses to easily scale up or down their operations based on their needs. Organizations can adjust their resources and services as per the fluctuating demand without investing in additional hardware. This cost-efficient pricing model eliminates the need for upfront capital investment in hardware and software, reducing the Total Cost of Ownership (TCO) and improving cost predictability.

The on-premises segment is expected to showcase moderate growth during the forecast period. On-premises IT service management solutions allow for deep customization to fit an organization’s unique needs. Businesses can integrate the system with other on-premises software and legacy systems more easily than with cloud-based platforms. For businesses with stringent security and compliance requirements, on-premises solutions provide a higher level of data control and security. Sensitive information can be kept within the organization’s firewall, reducing the risk of external data breaches or unauthorized access.

By Enterprise Type

Increasing Demand for IT Service in Complex IT Environment Fuels Adoption of ITSM Solutions in Large Enterprises

Based on enterprise type, the market is bifurcated into large enterprises and SMEs.

The large enterprises segment captured the largest market share in 2023 as they have complex IT infrastructures with diverse technologies, applications, and systems. IT service management solutions help these organizations manage and optimize their IT services, ensuring smooth operations and alignment with their business goals. These solutions also enable them to standardize their IT processes, workflows, and procedures across different departments, business units, and geographical locations. This standardization promotes consistency, efficiency, and compliance with internal policies and industry regulations.

The SMEs segment is expected to record the highest CAGR in the coming years. Many SMEs have smaller, less specialized IT teams compared to those of large enterprises. Thus, they prefer IT service management platforms that offer out-of-the-box functionality and do not require extensive customization or management. Also, SMEs are increasingly using this solution as they are quick to deploy, with minimal configuration and support for remote or hybrid working environment.

By Application

Growing Need for Centralized Management and Improved Visibility Fuels Product Demand in Operations & Performance Management Applications

Based on application, the market is divided into configuration & change management, operations & performance management, incident management, problem management, and others (asset management).

The operations & performance management segment captured the largest market share in 2023. IT service management solutions provide a centralized platform for managing operation and performance management applications, allowing organizations to track, monitor, and optimize their IT infrastructure and services from a single interface. These solutions offer greater visibility into the operation and performance management applications, enabling organizations to track Key Performance Indicators (KPIs), identify trends, and generate reports to support decision-making and strategic planning.

The problem management segment is expected to record the highest CAGR in the coming years as it aims to identify and eliminate the root cause of incidents, preventing them from recurring in the future. Furthermore, IT service management platforms typically integrate problem management with a knowledge base, allowing teams to document solutions and workarounds for known problems. This knowledge base can be accessed by the IT staff or end-users to resolve similar issues quickly in the future.

To know how our report can help streamline your business, Speak to Analyst

By Industry

Surge in Demand for High-quality IT Services to their internal users Propelled Adoption of DRaaS Solution in IT & Telecommunication

Based on industry, the market is categorized into BFSI, IT & telecommunication, government & public sector, retail & consumer goods, healthcare, manufacturing, media & entertainment, and others (energy & utility and education).

The IT & telecommunication segment captured the highest market share in 2023 as IT service management solutions enable organizations in the IT & telecom industry to deliver high-quality IT services to their internal users, customers, and partners. Features, such as problem management, change management, incident management, and asset management help organizations maintain service excellence and meet customer expectations. The IT & telecommunication industry is highly competitive, and customer experience is a key differentiator.

The healthcare segment is expected to record the highest CAGR during the forecast period. The adoption of Electronic Health Records (EHR) is increasing in this industry, driving the need for robust IT service management solutions to effectively manage and support EHR systems. This solution helps healthcare organizations ensure the availability of patient health information, confidentiality, and integrity, while facilitating secure access to and sharing of medical records among healthcare providers.

ITSM MARKET REGIONAL OUTOOK

North America

North America ITSM Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest ITSM market share in 2024 as it is a hub of technological innovation with many organizations leveraging advanced IT service management solutions to streamline their IT operations, improve service delivery, and enhance customer satisfaction. The region is seeing rapid adoption of artificial intelligence, machine learning, and automation technologies within IT service management to streamline processes, reduce costs, and enhance efficiency. The U.S. and Canada have a mature IT market with high levels of digital transformation across industries, such as healthcare, finance, and retail. This will drive significant demand for IT service management solutions to manage complex IT environments. North America is home to many leading IT service management vendors and service providers, offering a wide range of solutions and services to meet the diverse needs of organizations in the region. For instance,

- In March 2023, ServiceNow, a U.S.-based company, unveiled a novel “Now Platform Utah” platform to expand its portfolio. This platform is built to help organizations generate quick outcomes and future-proof their businesses.

These factors are expected to fuel the ITSM market growth in the region.

Download Free sample to learn more about this report.

Organizations in the U.S. are placing a greater emphasis on improving both internal and external customer experiences. IT service management platforms that offer self-service portals, Chatbots, and automation tools to resolve issues quickly are becoming more popular across the country. Moreover, key players operating in the U.S. are engaged in strategic partnerships and collaborations to strengthen their business growth across the country.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to record the highest CAGR during the forecast period. The region is a hub for IT outsourcing and managed services, which will boost the adoption of IT service management platforms to manage large IT environments and ensure service quality. For example, Singapore’s Smart Nation initiative emphasizes the use of IT service management solutions to manage IT services and improve the delivery of public services. Many countries in Asia Pacific are experiencing rapid digitalization across industries, driven by factors, such as increasing internet penetration & smartphone adoption, and the rise of e-commerce. These solutions help organizations manage and optimize their IT services to support digital transformation initiatives. For instance,

- In August 2022, iZeno, a Logicalis Company, became the first official partner of Atlassian, specializing in IT service management in Asia Pacific. The company’s solution offers superior services to enhance customer satisfaction.

South America

The adoption of this solution is growing significantly in South America as the IT infrastructure in South American countries is developing rapidly. This is leading to greater demand for IT service management to manage and optimize these infrastructures, particularly in industries, such as telecommunications, banking, and retail. Countries, such as Brazil, Argentina, and Chile are leading the way in the adoption of IT service management, with a focus on improving IT governance, service automation, and customer service management. These factors will play an important role in fueling the market growth in the region during the forecast period.

Europe

In Europe, the adoption of IT service management is growing at a prominent pace as organizations across the region are prioritizing delivering high-quality services and exceptional customer experiences to remain competitive. IT service management enables organizations to align IT services with their business needs, improve service delivery efficiency, and enhance overall customer satisfaction. In Europe, digital transformation is a key driver for the adoption of IT service management solutions across industries. Enterprises are increasingly implementing these solutions to streamline IT operations, enhance efficiency, and support automation. For instance,

- In March 2023, EasyVista, a provider of automated IT service management solutions, launched its XLA (Experience Level Agreement) module to expand IT infrastructure and operations (I&O) teams and measure the performance of IT teams.

Middle East & Africa

The Middle East & Africa is expected to showcase noteworthy growth during the forecast period. Government initiatives and investments in smart city projects across the region are boosting the adoption of advanced IT service management solutions to manage complex IT infrastructures. Governments in the Gulf states are increasingly adopting this solution as part of their national strategies aimed at diversifying their economies and enhancing public services. For example,

- The UAE’s Vision 2021 and Saudi Arabia’s Vision 2030 include initiatives to digitize public services, implement smart governance, and modernize IT management. These factors will play an important role in propelling the market growth in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players Are Focusing On Partnership and Acquisition Strategies to Expand Their Services

Key players are focusing on expanding their geographical presence by presenting industry-specific services. They are focusing on entering strategic acquisitions and collaborations with regional players to maintain their dominance. They are also launching new solutions to increase their consumer base. An increase in R&D investments for product innovations is enhancing the market’s expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

Major Players in the ITSM Market

To know how our report can help streamline your business, Speak to Analyst

Key players in the market are focused on developing novel IT service management platforms to meet customer and organization needs. Launching advanced technologies, such as AI-based platforms can assist players in sustaining their business competence. The global market is consolidated, with the top 5 players accounting for around 48% of the market share.

Long List of Companies Studied:

- ServiceNow (U.S.)

- Efecte (Finland)

- Freshworks, Inc. (U.S.)

- Flexera Software, Inc. (U.S.)

- BMC Software, Inc. (U.S.)

- Open Text Corporation (Canada)

- IBM Corporation (U.S.)

- Ivanti (U.S.)

- Broadcom, Inc. (U.S.)

- Atlassian Pty Ltd. (Australia)

- SolarWinds (U.S.)

- Zendesk (U.S.)

- Sys Aid (Israel)

- EASYVISTA (U.S.)

- HaloITSM (U.K.)

- TeamDynamics (U.S.)

- IFS (Sweden)

- TOPdesk (U.S.)

- Aisera (U.S.)

- Alemba (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: IBM announced the release of the Maximo Application Suite v9.0. The new version features advanced AI-driven predictive maintenance, a redesigned user interface for improved usability, and enhanced IoT integration for better data analytics and asset monitoring.

- May 2024: EasyVista revealed that Bianchi Bicycles had chosen its IT service management platform to enhance the management of its IT resources and requirements. This decision came in response to Bianchi’s significant growth, which included operational and commercial expansion, new manufacturing locations, international branches, and a global e-commerce platform.

- April 2024: BMC acquired Netreo, a company specializing in intelligent and secure IT network and application visibility solutions. The acquisition will enable the BMC Helix platform to offer an open, comprehensive AIOps and observability solution to its customers.

- February 2024: Flexera Software acquired Snow Software. This acquisition is expected to allow customers to create more value from technology investment and enhance their IT team’s capability to serve their customers.

- October 2023: Ivanti released its new capabilities for the “Ivanti Neurons platform.” This platform was released to enhance the digital employee experience, improve vulnerability prioritization, and provide scalability to customers. Also, this platform will allow IT and security teams to have a complete view of their IT estate.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as ServiceNow, Freshworks Inc., BMC Software, Inc., and Flexera Software, Inc. are entering merger and acquisition agreements with technology providers. Along with acquisitions, these high-performing companies are regularly entering strategic collaborations and partnerships to improve their IT service management solutions and marketing capabilities. Also, through these strategies, the companies can gain potential customers by expanding their business. Major global players are signing partnership, merger, acquisition, and collaboration agreements with several IT service management solution providers to increase their customer base for their business growth. For instance,

- In January 2024, Freshworks Inc. engaged in a strategic partnership with Amazon Web Services (AWS). Through this collaboration, the company aims to develop and expand its customer support, sales, and IT team’s capabilities on AWS.

Thus, the growing focus on strategic partnerships is expected to create a lucrative opportunity for the market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and prominent applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 15.3% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

ServiceNow (U.S.), Efecte (Finland), Freshworks Inc. (U.S.), Flexera Software, Inc. (U.S.), BMC Software Inc. (U.S.), Open Text Corporation (Canada), IBM Corporation (U.S.), Ivanti (U.S.), EasyVista (U.S.), Atlassian Pty Ltd (Australia), etc. |

Frequently Asked Questions

The market is projected to reach a valuation of USD 36.78 billion by 2032.

In 2024, the market was valued at USD 11.91 billion.

The market is expected to record a CAGR of 15.3% during the forecast period.

By industry, the IT & telecommunication segment led the market in 2024.

The capabilities of IT service management to deliver enhanced user experience and value creation will drive the market progress.

ServiceNow, Freshworks Inc., Flexera Software, Inc., Open Text Corporation, Ivanti, IBM Corporation, and Atlassian Pty Ltd. are the top players in the market.

North America held the highest market share in 2024.

By industry, the healthcare segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us