Laser Marking Machine Market Size, Share & Industry Analysis, By Product Type (Fiber Laser, Diode Laser, Solid-State Laser, CO2 Laser, and UV Laser), By Mobility Type (Fixed and Portable), By Material Type (Metal, Glass, Plastics, Ceramics, and Others), By End Use (General Industries, Automotive, Aerospace, Packaging, Healthcare, Electronics & Semiconductor, and Others), and Regional Forecast, 2026 – 2034

Laser Marking Machine Market Size

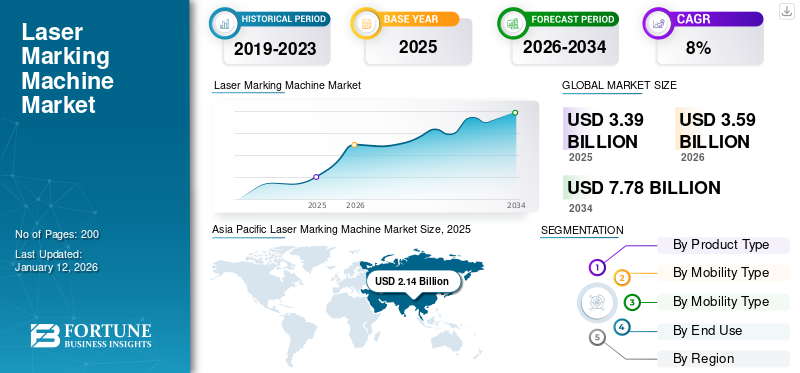

The global laser marking machine market size was valued at USD 3.39 billion in 2025 and is projected to grow from USD 3.59 billion in 2026 to USD 7.78 billion by 2034, exhibiting a CAGR of 10.20% during the forecast period. The Asia Pacific dominated global market with a share of 63% in 2025.

Laser marking machines are industrial equipment that allows the marking of brands, numbers, and logos on different materials. The laser marking technology uses a focused beam of light to create permanent marking using fiber lasers, CO2 lasers, and other types. Laser marking is used for various applications, some of these include ablation, engraving, annealing, and etching. Industrial components, machines, automotive parts, and consumer electronics all require laser marking for easy identification and tracking of components. High growth in the manufacturing sector and demand for electronics products propels the market growth. Several government investments and tax reforms are surging the growth of semiconductor manufacturing in emerging and developing economies. For instance, in 2022, the Chinese government announced the “Made in China 2025” goal to make China self-sufficient in semiconductor production and chip manufacturing. Similar investments and supportive policies are influencing the market share across regions.

Global Laser Marking Machine Market Overview

Market Size:

- 2025 Value: USD 3.39 billion

- 2026 Value: USD 3.59 billion

- 2034 Forecast Value: USD 7.78 billion, with a CAGR of 10.20% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific dominated the market with a 63% share in 2025, driven by the establishment of electric vehicle (EV) manufacturing facilities and surging demand for precise marking solutions in the aerospace, medical device, and semiconductor industries.

- Fastest-Growing End-User: The Electronics & Semiconductor sector is projected to grow at the highest CAGR, fueled by rising demand for electronic products, increased investment in chip manufacturing, and the need for durable and precise component marking.

- Product Type Leader: Fiber lasers hold the largest market share due to their versatility in marking a wide range of materials, including metals, plastics, and ceramics, making them a cost-effective solution for mass production across various industries.

- Material Type Leader: The Metals segment commands the highest revenue share, as industries like automotive, aerospace, and general manufacturing require accurate and durable markings on metal parts that can withstand harsh environments and high temperatures.

Industry Trends:

- Software-based Solutions Penetrating the Market: Manufacturers are developing advanced, user-friendly software to integrate with laser marking machines. These solutions offer enhanced features, such as built-in settings for various materials, making the marking process more convenient and efficient for operators.

Driving Factors:

- Durable Markings in Semiconductor Manufacturing: The global push toward Industry 4.0, coupled with significant government and private investment in the semiconductor sector, is boosting the demand for robust and precise marking on electronic components.

- Rising Demand from the Electric Vehicle (EV) Sector: The expanding EV market is fueling the need for laser marking on various components, including batteries, engine parts, and serial numbers, due to the technology's non-contact, high-precision capabilities on multiple surfaces.

- Increased Accessibility for SMEs: A growing number of market players has led to more competitive pricing, reducing the overall per-unit cost of laser marking machines and expanding their adoption among small and medium-scale businesses.

Laser marking machines are experiencing strong growth across industries such as automotive, aerospace, healthcare, and general manufacturing. Customer preference toward sustainable and cost-efficient commute options is influencing the demand for electric vehicles. Furthermore, key policy changes for electric vehicle deployment are generating strong growth for EVs, further boosting the market for laser marking solutions. For example, the government of Australia has announced a national electric vehicle strategy to improve road transport solutions that target zero emissions in April 2023. Automotive manufacturers are increasingly preferring laser marking machines for electric vehicle components and parts marking. The vehicle’s model number, serial number, brand name, and logo marking are all performed using laser machines. These marking machines are used on metal, plastic, and a variety of other surfaces, making them a preferred choice in the automotive industry. Manufacturers have also started using laser marking machines on batteries to mark codes, serial numbers, and model names. Moreover, the rising number of players in the market has reduced the overall per-unit price for the product, resulting in the expansion of the laser marking machine market among medium and small-scale businesses.

The economic fall due to the COVID-19 pandemic severely impacted the market and other related products. Temporary halts at manufacturing facilities, supply chain disruptions, and political turmoil in a few countries have all impacted the market growth post-pandemic. However, the wide range of applications across industries, including electronics, automotive, general manufacturing, and packaging, has bolstered the market growth. The market is projected to display robust growth as a result of non-contact processes, high speed, and precise marking on various materials, including metals and plastics.

Laser Marking Machine Market Trends

Software-based Solutions are Penetrating Market through Varied Material Processing

With the advent of automation and tech-integrated solutions, market participants are developing software services for the manufacturing industry. The new software solutions are convenient for operators owing to user-friendly design and new advancements in the laser marking machines. For instance, Cajo Technologies, a Finland-based machine manufacturer, introduced laser marking software CajoSuite for the manufacturing sector in 2023. The new software has several advanced features, including built-in settings for varied types of materials such as polymers.

Download Free sample to learn more about this report.

Laser Marking Machine Market Growth Factors

Durable Markings in Semiconductor Manufacturing to Generate Strong Growth for the Market

Transformation in the manufacturing sector with the advent of Industry 4.0 is enhancing the productivity of manufacturing facilities. Increasing investment and supportive policies in the electronics and semiconductor industry are further reshaping the production processes. For instance, Saudi Arabia’s National Industrial and Mining Information Center has issued more than 1,300 new industrial licenses with a total investment exceeding USD 21 billion. Modern manufacturing is propelling the demand for efficient manufacturing processes, boosting the laser marking machine market growth. Across industries, laser marking machines are gaining huge traction with high demand for durable and robust markings on products.

RESTRAINING FACTORS

High Initial Costs and Skilled Workforce Requirements Hinders Market Growth

Comparatively, price-sensitive end-users might limit the market growth owing to their initial cost. Moreover, operating and programming laser marking machines requires specific skills and training for the operator. Laser marking machines require huge space and are heavy, making them a difficult choice for manufacturers with constrained workspaces.

Laser Marking Machine Market Segmentation Analysis

By Product Type Analysis

Fiber Lasers Secure the Largest Market Share Due to the Different Wavelengths Generated

By product type, the market is segmented into fiber laser, diode laser, solid state laser, CO2 laser, and UV laser.

Fiber lasers cater to the largest laser marking machine market share, followed by CO2 lasers. Fiber laser marking machines have a wide range of applications, such as dental and medical device marking, jewelry marking and engraving, PCB, industrial parts and components marking, and others. Fiber lasers also allow the marking of varied types of materials, including metals, plastics, ceramics, leather, and others. Owing to the wide array of presence across industries and marking on different types of materials, the market is experiencing huge demand for fiber lasers across geographies. Laser marking machines act as a cost-effective solution for mass production across sectors. The Fiber Laser segment is expected to account for 48.47% of the market in 2026.

Diverse industry applications owing to high production demands in key sectors such as general manufacturing, aerospace, automotive, and electronics will surge the fiber laser marking machines market during the forecast period. Fiber marking machines will experience strong growth during the forecast period. Other laser types, such as CO2 lasers and Solid-State lasers, are anticipated to experience steady growth during the projected period as a result of emerging low-power fiber laser systems in the market.

To know how our report can help streamline your business, Speak to Analyst

By Mobility Type Analysis

Fixed Laser Marking Machines Account for Maximum Market Share Owing to their Application in Manufacturing Processes

By mobility type, the market is further classified into two segments: fixed and portable. Fixed laser marking machines to account for a significant revenue share in the market.

Laser machines offering precise and permanent marking solutions occupy large spaces and are required to be placed at specific locations in industrial applications. The fixed machines offer a wide variety of marking applications such as logo, brand, date, and series number on varied materials, including plastic, metals, and others. Fixed machines dominate the market owing to its high processing speeds, enhanced productivity, and minimized cost. Wide range of application areas in electronic components, electric lines, and semiconductor products are further surging the market demand for fixed laser machines across geographies. The Fixed segment is anticipated to hold a dominant market share of 66.57% in 2026.

Handheld or portable machines are emerging as the preferred solution for laser marking in diverse industry sectors. Handheld machines to witness highest growth across industry application. Compact-sized machines, along with high energy efficiency and user-friendly design, are all expected to boost the portable segment growth.

By Material Type Analysis

Metals Segment Dominates with its Competence to Withstand Harsh Environments

By material type, the market is diversified into metals, glass, plastics, ceramics, and others. Other segments include wood, leather, and paper.

Metals contributed the highest revenue share in the market, followed by plastics in 2023. Several end-use industries, such as automotive, general manufacturing, aerospace, electronics, and others, require laser marking on materials that are primarily metals or plastics. For example, automotive parts such as engine blocks, bearings, and levers demand accurate and precise marking that can withstand harsh environments and high temperatures. In 2026, the Metal segment is projected to lead the market with a 61.84% share.

Materials such as plastics, glass, and ceramics will experience stagnant growth over the forecast period. Plastic material has low heat conductivity characteristics allowing laser marking process to be processed at a faster pace. Owing to this plastic material to hold second largest revenue share followed by metals.

By End Use Analysis

Heavy Capital Investment to Boost the Demand for Laser Marking Applications in General Industries

By end use segment, the market is categorized into general industries, automotive, aerospace, packaging, healthcare, electronics & semiconductors, and others. Other segments include jewelry and personalized products.

General industries segment dominates the market in terms of market share, followed by the electronics and semiconductor sectors. Rising capital expenditure across a wide range of industries, including general manufacturing, electronics and semiconductors, and automotive, are surging the growth of laser markers. According to industry experts, value added in Industry Products and Services accounted for approximately USD 1.0 trillion in 2024. Automation across industrial facilities to boost cost-effective product manufacturing, surging the demand for laser marking solutions. Therefore, general industries contributed to over one-third of the total market revenue with a share of 32.59% in 2026.

Electronics & semiconductor end-use sectors are projected to depict the highest CAGR during the forecast period. Emerging technologies, rising disposable income, and changing consumer preferences are all boosting the demand for electronic products. For instance, Global Semiconductor Sales displayed double-digit growth of 16.3% in February 2024 in comparison to 2023. Increasing investment in semiconductor manufacturing and high demand for tech-enabled solutions are all responsible for laser marking machines market growth. For instance, an American chip company, Micron, announced its investment in India for the assembly and testing of semiconductor chips in Gujarat. The investment amounts to USD 825 million, and it is estimated that the facility will open by 2025.

REGIONAL INSIGHTS

Asia Pacific Laser Marking Machine Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The market is studied across North America, Europe, South America, Asia Pacific, and the Middle East and Africa. Asia Pacific dominates with escalating market demand followed by North America.

Industries such as aerospace, medical devices, general manufacturing, packaging, and semiconductors have surging demand for precise and durable marking solutions on their products. Markings in terms of brand name, serial number, logos, and batch number help to differentiate and identify products. Establishment of manufacturing facilities for electric vehicles across developing and emerging countries in Asia Pacific to witness strong growth during the forecast period, impacting the market demand. For instance, China’s Chery Auto and Spain’s EV Motors have signed an agreement to establish a new manufacturing facility and develop electric vehicles. Rapid growth in EV batteries is further expanding the market. These machines are finding their innovative application in EV battery cells because of their non-contact and high precision output. Owing several such factors, Asia Pacific to lead the market demand for laser machines.

Asia Pacific

China’s laser marking machine caters to the highest market share in Asia Pacific. The country experienced strong growth due to the rising industrial equipment and automotive vehicle production across the country. Several small and medium-scale enterprises prefer laser machines for marking applications and declining machine prices. There is a robust demand for laser machines in varied sectors, including consumer electronics, industrial manufacturing, and automotive. Mixed demand from key sectors such as automotive and electronics is projected to impact the growth trajectory of the machines. For instance, China Integrated Circuit Industry announced its aim to raise about USD 40 billion for the semiconductor sector in September 2023. The investment is subject to boost chip manufacturing in China, which is surging the growth of marking solutions in the country. A few sectors, such as healthcare and defense, are generating strong demand for high-precision marking machines, boosting the market growth in China. Similarly, several supporting initiatives, public and private investments, and the establishment of manufacturing and industrial hubs in India are anticipated to boost product sales. The Japan market is forecast to reach USD 0.23 billion by 2026, the China market is set to reach USD 1.19 billion by 2026, and the India market is likely to reach USD 0.42 billion by 2026.

North American

North American countries, including Mexico and Canada, are estimated to experience steady growth in the market. Political tensions between the U.S. and China are primarily responsible for shifting the electronics manufacturing landscape to Mexico and other countries. Electronics manufacturing growth across Mexico and other North American countries is a prominent factor surging the sales of laser marking machines. The U.S. market is estimated to reach USD 0.46 billion by 2026.

Europe

Europe will witness significant growth in the market owing to strong demand from the automotive sector as electric vehicles are observing considerable development in the region. For instance, According to the European Environment Agency, electric car registrations accounted for about 22% of the total cars registered in 2022. Automobile parts and components such as batteries, engines, glass, and mirrors require permanent and durable markings of brands, logos, and serial numbers, among others. The marking systems provide no contact and precise marking solutions on varied types of materials, including metals, glass, and plastics. The UK market is expected to reach USD 0.08 billion by 2026, while the Germany market is anticipated to reach USD 0.17 billion by 2026.

Rest of The World

Growing industrial activity in South American countries, including Argentina and Brazil, is responsible for the growth of marking solutions. Several players are expanding their presence in the market, providing a wide range of products and competitive pricing for end-users. Increased investment in the metalworking and electronics sector will further generate strong market growth in the region.

The Middle East & Africa is projected to witness substantial growth as a result of rising investment in robots and semiconductor manufacturing. According to industry experts, the Middle East will attract over USD 125 billion in investments in manufacturing robotic hardware solutions by 2025. Investments and supportive subsidies for manufacturers are all expected to bolster the market demand during the forecast period.

Key Industry Players

Cost-effective marking Solutions and New Product Launches to Penetrate Key Participants

The market is fragmented, with a significant number of players across different regions. The emergence of new players, especially the emerging players in China, has further increased market competition across the globe and impacted the overall pricing of the machines. Key players in the market are also focusing on introducing efficient and superior-quality products. With rising demand for user-friendly design and high-performing machinery, the key players in the market are introducing new laser machines. These machines allow non-contact marking on varied materials and also enable engraving and cutting applications. Market participants are also developing software-based solutions that can be integrated with marking machines.

List of Top Laser Marking Machine Companies:

- Coherent Inc. (U.S.)

- IPG Photonics Corp (U.S.)

- Keyence Corporation (Japan)

- Hans Laser Technology Co. Ltd. (China)

- Trumpf (Germany)

- Huagong Tech Co. Ltd. (China)

- Videojet Technologies Inc. (U.S.)

- Tro Group (U.K.)

- Novanta Inc. (U.S.)

- 600 Group (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: FOBA introduced two new laser marking systems at the International Manufacturing Technology Show IMTS in Chicago. The two series FOBA M1000 and M2000 provided various functionalities, including an integrated camera.

- September 2022: Epilog Laser introduced a new fusion maker laser system for varied industry applications. The new machine withstands heavy use and high-volume production and performs laser marking, engraving, and cutting processes on varied materials.

- July 2022: Hitachi Industrial Equipment Systems acquired Telesis Technologies in 2022 to strengthen its product portfolio across geographies. Telesis Technologies is engaged in the development and manufacturing of marking equipment with the help of laser technologies.

- May 2022: Gravotech launched its LW2 laser marking workstation. The industrial machine is designed to boost the productivity and efficiency of production facilities.

- April 2022: Hitachi Industrial Equipment Systems announced its 100% acquisition of Photon Energy GmbH to expand its product portfolio for marking solutions in laser technologies.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Mobility Type

By Material Type

By End Use

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 7.78 billion by 2034.

In 2025, the market was valued at USD 3.39 billion.

The market is projected to grow at a CAGR of 10.20% during the forecast period.

Fiber laser marking machines are dominating the market owing to their wide range of industry applications and larger wavelengths.

Precise and durable markings across industries are boosting the market growth.

Coherent Inc., IPG Photonics Corp., Keyence Corporation, and Hans Laser Technology Co. Ltd. are few of the top players in the market.

Asia Pacific leads the market, with China accounting for the largest market share.

The electronics & semiconductor segment are anticipated to grow with the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us