LiFSI for Lithium Battery Electrolyte Market Size, Share & Industry Analysis, By Type (Purity 99.9% and Purity 99.99%), By Application (Power Electrolyte, Consumer Electrolyte, and Energy Storage Electrolyte), and Regional Forecast, 2026-2034

LiFSI for Lithium Battery Electrolyte Market Size

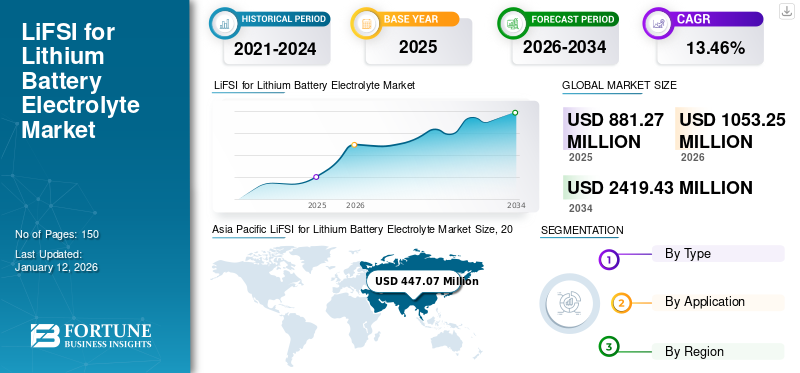

The global LiFSI for lithium battery electrolyte market size was valued at USD 881.27 million in 2025 and is projected to grow from USD 1,053.25 million in 2026 to USD 2,419.43 million by 2034, exhibiting a CAGR of 13.46% during the forecast period. Asia Pacific dominated the global market with a share of 50.73% in 2025. The Li fsi for lithium battery electrolyte market in the U.S. is projected to grow significantly, reaching an estimated value of USD 427.32 million by 2032.

LiFSI is an electrolyte solution that enhances the performance and longevity of lithium batteries. With its superior conductivity and stability, LiFSI maximizes energy density while ensuring the safety and reliability of the battery systems. Additionally, LiFSI advanced formulation promotes efficient ion transfer, which leads to the optimization of the battery performance and power output. The electrolyte solution offers exceptional chemical stability, minimizing side reactions and prolonging battery life.

Lithium-ion batteries record a high demand for portable electronic devices and, more recently, power tools. Its success has resulted in properties that combine high energy density with excellent charge retention. Lithium-ion batteries are currently the leading contender for electric storage systems in Plug-in Hybrid Electric Vehicles (PHEVs). Li-ion batteries presently available have much room for improvement. In particular, questions about the safety of commonly used liquid electrolytes have been raised. The electrolyte salt LiPF6 currently used in almost all commercial Li-ion batteries has poor thermal stability and is prone to degradation reactions leading to the formation of HF. Lithium imide salts are a potentially good alternative to LiPF6 that can improve electrolytes' thermal and chemical stability in Li-ion batteries.

During the COVID-19 pandemic, the lockdowns and government restrictions caused temporary shutdowns or reduced operations in manufacturing facilities producing LiFSI and other battery components. In addition, the disruption in the supply chain across the globe also caused delays in the movement of raw materials and finished products, further hampering the LiFSI for lithium battery electrolyte market growth. Furthermore, the decline in the demand for Electric Vehicles (EVs) and consumer electronics, due to economic uncertainties and reduced consumer spending, also resulted in the slowdown of LiFSI for lithium battery electrolytes.

LiFSI for Lithium Battery Electrolyte Market Trends

Ongoing R&D in Battery Technology is Improving the Performance and Cost Effectiveness of LiFSI Based Electrolyte

Researchers are vigorously exploring ways to improve the ionic conductivity of LiFSI-based electrolytes, leading to faster charging times, longer battery life, and improved overall efficiency in lithium-ion batteries. The exploration of new material combinations for both LiFSI and other electrolyte components is ongoing. This can help enhance thermal stability, wider operating voltage windows, and higher battery energy densities.

Researchers are exploring ways to make LiFSI for lithium battery electrolytes environmentally friendly throughout their life cycle, including production, usage, and disposal. Establishing industry-wide standards for LiFSI quality and performance can contribute to market growth by ensuring product consistency and facilitating wider adoption. Overall, R&D activities are addressing existing challenges in LiFSI technology and are creating new possibilities for future applications. Thus, the ongoing research and development in battery technology for improving the performance and cost-effectiveness of LiFSI electrolytes is expected to have a positive impact on the LiFSI for lithium battery electrolyte sector over the forecast period.

Download Free sample to learn more about this report.

LiFSI for Lithium Battery Electrolyte Market Growth Factors

Rapid Expansion of EV Market is a Major Factor Driving LiFSI for Lithium Battery Electrolyte Demand

LiFSI offers higher thermal stability than traditional electrolytes, meaning it can endure higher temperatures without igniting. This is crucial for ensuring the safety of EV batteries, especially considering the potential for overheating during operation or fast charging. LiFSI for lithium battery electrolytes exhibits lower flammability than other options, further mitigating fire hazards in case of accidents or battery malfunctions. This aspect is critical for ensuring passenger safety and preventing catastrophic vehicle fires.

Batteries containing LiFSI electrolytes tend to have a longer lifespan due to reduced degradation. This translates to fewer battery replacements for EVs, which benefits both car owners (reduced maintenance costs) and the environment (less waste generation). LiFSI for lithium battery electrolytes can contribute to faster-charging capabilities in batteries, which is crucial for improving the user experience and practicality of EVs. Faster charging times can address concerns about "range anxiety" and make EVs more appealing to a broader range of consumers. This opens doors for the potential development of batteries with higher energy densities, potentially leading to more extended-range capabilities for EVs in the future.

Therefore, enhanced safety, improved lifespan and range, and potential for future advancements make LiFSI a highly attractive and sought-after technology in the rapidly growing EV market. As the demand for EVs continues to rise, LiFSI is expected to remain a major driver in the LiFSI for lithium battery electrolyte market in the foreseeable future.

Growing Need for Efficient Energy Storage Solutions for Renewable Energy Integration to Drive Product Adoption

LiFSI offers superior thermal stability and lower flammability compared to traditional electrolytes. This is crucial for ensuring the safety of large-scale energy storage systems, which can store significant amounts of energy. LiFSI-based batteries tend to have a longer lifecycle, reducing the need for numerous replacements and lowering maintenance costs for energy storage systems. This translates to a lower cost of ownership and a more sustainable solution in the long run.

Similar to other applications, the wider operating voltage window of LiFSI allows for the potential development of batteries with higher energy density. This translates to the storage of more energy in the same volume, making it more efficient for large-scale storage applications. LiFSI's potential for faster charging and discharging capabilities could also benefit certain applications such as grid balancing or ancillary services.

The growing necessity for efficient and reliable energy storage solutions, driven by the emphasis on integrating renewable energy sources, is increasing demand for LiFSI for lithium battery electrolytes. LiFSI's unique properties in terms of safety, lifespan, and potential for higher energy density make it a promising technology for this crucial application, and it is expected to play a major role in the future of renewable energy integration.

RESTRAINING FACTORS

Compatibility Issues Represent Significant Hurdle for the Adoption and Growth of LiFSI Electrolytes in Batteries

Integrating LiFSI electrolytes into existing battery designs might require modifications to accommodate its specific properties. This could involve changes to electrode materials, separator design, or overall battery architecture. Such modifications may necessitate extensive testing and validation to ensure safety, performance, and durability, prolonging the development process and delaying market entry.

Introducing LiFSI electrolytes might require adjustments to manufacturing processes in battery production facilities. Manufacturers may need to invest in new equipment or modify existing processes to ensure proper handling and integration of LiFSI electrolytes. This optimization process can be time-consuming and costly, slowing down the scale-up of production and adoption in the market.

LiFSI electrolytes may interact differently with other battery system components, such as current collectors, binders, and additives. Compatibility issues could arise, leading to performance degradation, safety concerns, or reduced battery lifespan. Addressing these compatibility issues may require iterative testing and refinement, adding complexity and time to the development cycle and subsequently limiting the growth of the market.

LiFSI for Lithium Battery Electrolyte Market Segmentation Analysis

By Type Analysis

Based on type, the market is divided into purity 99.9% and purity 99.99%.

The purity 99.9% segment dominates the LiFSI for lithium battery electrolyte market share with 71.90% in 2026. Lithium bis(fluorosulfonyl)imide (LiFSI) has a purity of 99.9% white powder and high lithium ion conductivity. It has high stability (does not decompose below 200°C), good hydrolysis stability, excellent low temperature, and environmental friendliness, among other properties. Therefore, it is considered an important electrolyte material in new energy materials such as lithium-ion batteries.

For the practical use of FSI-based alkali metal salts and ILs in LIBs and RLMBs, a large-scale synthesis route for battery-grade (purity >99.99%) FSI-based salts is a prerequisite. Still, it is currently a major challenge in academia and industry.

Purity 99.99 is growing at the fastest rate in the market owing to its high performance than the other segment. The demand for purity 99.99 is considerably increasing in electric vehicles due to the growing transition toward cleaner energy sources of energy.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Based on application, the market is segmented into power electrolyte, consumer electrolyte, and energy storage electrolytes.

The energy storage electrolyte segment is the leading segment in the market with market share of 63.24% in 2026. Ultra-pure LiFSI (lithium bis(fluorosulfonyl)-imide) is suitable as an additive in battery electrolytes or as the main salt for energy storage, improving lithium-ion batteries' capacity, stability, and service. Combining expertise in fluorine and industrial processes, researchers are developing ultra-pure lithium salt LiFSI, which will help significantly increase batteries' capacity, strength, and lifetime.

With growing research in the industry, power energy and battery density are improving with power electrolytes, and consumer electrolyte applications are increasing.

The consumer electrolyte is witnessing the fastest growth in the market due to the rising demand for consumer electronics globally. The demand for longer lithium-ion battery life, fast charging, and high energy density is considerably growing in consumer electronics like smartphones, laptops, tablets, and others, subsequently leading to the segment’s growth in the market.

REGIONAL INSIGHTS

The global market has been analyzed across five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific LiFSI for Lithium Battery Electrolyte Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 447.07 billion in 2025 and USD 538.35 billion in 2026. Asia Pacific is a dominant region and holds the largest LiFSI for lithium battery electrolyte market share. The region is also anticipated to witness the fastest growth during the forecast period. With the increased use of batteries in many industries, such as automotive, solar, electronics, and data centers, Asia Pacific is the market leader. China is projected to be the dominant country in the region, accounting for the largest share of electronic sales. In recent years, solar and wind energy use has increased significantly in India. In addition, the use of lithium-ion batteries is expected to increase due to a rise in the use of electric cars and the favorable policies of the Chinese. Further, government policies are anticipated to positively influence the growth of the lithium battery electrolyte market during the forecast period. The spread of telecommunications services allows China's battery electrolyte industry to flourish. The Japan market is projected to reach USD 63.92 million by 2026, the China market is projected to reach USD 253.69 million by 2026, and the India market is projected to reach USD 54.93 million by 2026.

Europe

Europe also holds a notable share of the market as the region’s many countries are global leaders in selling solar cells (rooftop and ground) and electric cars, which require lithium batteries for energy storage and propulsion systems. In Europe, research institutes such as Fraunhofer ISI are working to increase the efficiency of lithium-ion batteries. In the current development, several fluorinated salts, such as LiFSI or LiPO2F2, play an important role, which, in addition to the usual LiPF6, can decisively influence the behavior of electrolytes at high temperatures. Current and future developments also concern stability at high cell voltages > 4.2 V, which is already the peak for smartphones (4.45 V) and may also be the case for electric cars. Another topic of electrolyte development is compatibility with Si anodes. Here again, approaches involving additives such as LiDFBOP or FEC lead to a stronger SEI on the surface of the particles. The UK market is projected to reach USD 35.26 million by 2026, while the Germany market is projected to reach USD 60.68 million by 2026.

North America

North America is the second leading region with the growing research & development in EV and battery systems. In North America, Capchem USA entered into a non-binding letter of intent with Indorama Ventures, one of the world's leading petrochemical producers. It plans to jointly build and operate factories to produce lithium-ion battery chemicals for Indorama Ventures petrochemical complex on the U.S. Gulf Coast. The proposed joint venture plants will supply the lithium-ion battery industry in North America. The product portfolio comprises ethylene carbonate, dimethyl carbonate, ethyl methyl carbonate, diethyl carbonate, and battery electrolyte. The technology used in the proposed plants will be licensed by Capchem, which has a carbonated solvent plant in China and a mature manufacturing process. The U.S. market is projected to reach USD 218.84 million by 2026.

Latin America and the Middle East & Africa

In Latin America and the Middle East & Africa, new developments are coming up with growing investments across Saudi Arabia and the UAE, among other countries, on a large scale, which is expected to proliferate market growth for LiFSI for lithium battery electrolytes.

KEY INDUSTRY PLAYERS

Nippon Shokubai Corporation to Account for a Noteworthy Market Share Owing to its Extensive Projects

Nippon Shokubai holds a notable position in the market through several key initiatives. Firstly, the company has invested significantly in research and development to enhance the efficiency, stability, and safety of LiFSI, crucial for high-performance lithium-ion batteries. They have also expanded their production capacity to meet the increasing demand, particularly from electric vehicle manufacturers. Moreover, Nippon Shokubai has entered into strategic partnerships with several other companies to expand its product portfolio. For instance,

In May 2022, Nippon Shokubai and Arkema are teaming up to conduct feasibility studies and establish a joint venture for building an industrial plant. This facility will produce ultrapure LiFSI electrolyte salts, essential components for electric vehicle battery cells.

List of Top LiFSI for Lithium Battery Electrolyte Companies:

- Nippon Shokubai Corporation (Japan)

- Chunbo Chem Corporation (South Korea)

- Chem Spec (China)

- Capchem (China)

- Tinci (China)

- HSC Corporation (China)

- Yongtai Tech (China)

- DFD New Energy Technology Co. Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Guangzhou Tinci Materials Technology, a China-based supplier of electrolytes and electrolyte chemicals for lithium batteries, shared plans to invest USD 280 million to build a plant in Morocco for the production and sale of lithium-ion battery materials. Yicai Global, its Singapore unit, would construct the plant. A plant in North Africa will help Tinci explore the European market, given that Morocco has significant phosphorite ore resources.

- July 2023: With more than a dozen lithium-ion battery plants under construction, the fast-growing U.S. battery industry is attracting producers of the electrolyte. This liquid carries lithium ions from one end of the battery to the other when they are used. Capchem announced plans to build a USD 120 million electrolyte plant in southern Ohio. Meanwhile, Dongwha Electrolyte broke ground on a USD 70 million facility in Tennessee that can produce more than 70,000 tons of electrolytes annually. Soulbrain is constructing a USD 75 million electrolyte plant in Indiana to serve a nearby battery plant.

- October 2022: Guangzhou Tinci Materials Technology Co. Ltd. (Tinci) shared plans to invest in an expansion project that would add 100,000 metric tons per year of recycling processing capacity for LFP batteries and 300,000 metric tons per year of production capacity for lithium battery electrolyte solutions. The project would entail an investment of around USD 188.27 million. It would be implemented through Fuding Kaixin Battery Materials Co. Ltd. (Kaixin), the company’s sub-subsidiary.

- August 2021: Indorama Ventures Public Company Limited (IVL), a global chemical company for sustainability, and Capchem Technology USA Inc. (Capchem USA) entered a non-binding agreement to explore the possibility of building and operating a world-class lithium-ion battery solvent plant at one of IVL's petrochemical plants on the U.S. Gulf Coast. The planned plant would supply the North American lithium-ion battery industry, fueled by significant growth in Electric Vehicle (EV) development.

- August 2021: Yongtai Technology planned to acquire 150 million of Yongtai High-tech to improve the layout of lithium materials. On August 13, Yongtai Technology and Yongjing Technology signed the "Equity Transfer Agreement". The company had planned to use its capital of about USD 21.2 million to acquire the 15% stake in Yongjing Technology. After the acquisition, the company would hold a 75% stake in Yongtai High-tech, and Yongjing Technology would no longer hold Yongtai High-tech's stake.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.46% from 2026 to 2034 |

|

Unit |

Value (USD Million), Volume (MT) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the global market size was USD 881.27 million in 2025.

The global market is projected to record a CAGR of 13.46% during the forecast period.

The Asia Pacific market size stood at USD 447.07 million in 2025.

The energy storage electrolyte segment leads by holding a dominating share of the global market.

The global market size is expected to reach USD 2,419.43 million by 2034.

The rapid expansion of the EV market and the growing need for efficient and reliable energy storage solutions, particularly for renewable energy integration, are key drivers.

Nippon Shokubai, Chunbo Chem Corporation, Chem Spec, Capchem, and Tinci, among others, are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us