Lime Market Size, Share & Industry Analysis, By Type (Quick Lime and Hydrated Lime), Application (Agriculture, Building Material, Mining & Metallurgy, Water Treatment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

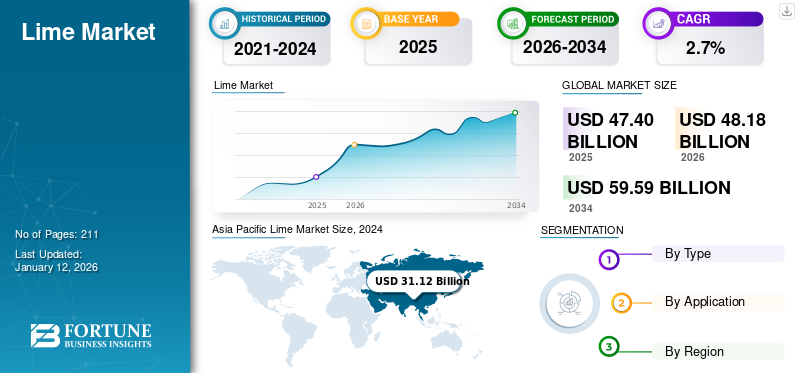

The global lime market size was valued at USD 46.68 billion in 2025. The market is projected to grow from USD 47.40 billion in 2026 to USD 56.64 billion by 2034, exhibiting a CAGR of 2.7% during the forecast period. Asia Pacific dominated the lime market with a market share of 66.51% in 2025.

Lime, also known as calcium hydroxide, is one of the major chemicals consumed globally. It is a calcium-containing inorganic mineral composed of oxide and hydroxide compounds. In the calcination process, raw materials such as limestone and chalk are exposed to high temperatures above 800⁰C, which breaks the carbonate compound into highly caustic calcium oxide or quicklime and releases carbon dioxide.

According to the National Lime Association, the primary application of the product is in steel production. It acts as a flux promoter and separates impurities such as silica and phosphorus by forming slag. It is also added to the basic oxygen furnaces and electric arc furnaces. Further, the product is widely used in industries such as construction, agriculture, and chemical manufacturing. In construction, it is an essential ingredient in cement and plaster, improving durability and workability. In agriculture, the product is used to neutralize soil acidity, enhancing crop growth and soil health.

The product utilization to treat wastewater and flue gases is increasing as it can capture impurities such as lead and SOx gases. The stringent pollution control regulations in the U.S., China, and India are expected to raise the application of these products during the forecast period. Lhoist Group, Graymont Limited, and Mississippi Lime Company are the key players operating in the market.

Lime is a critical chemical for key end-use industrial applications such as construction, metallurgy, chemicals, and environmental. Therefore, many countries try to ensure their supply is regulated despite the COVID-19 pandemic. However, the pandemic caused a strict lockdown on mining and transportation of minerals. This critically affected the product’s supply chain in China, India, and Brazil.

GLOBAL LIME MARKET KEY TAKEWAYS

Market Size & Forecast:

- 2025 Market Size: USD 47.4 billion

- 2026 Market Size: USD 48.18 billion

- 2034 Forecast Market Size: USD 59.59 billion

- CAGR: 2.7% from 2026–2034

Market Share:

- Asia Pacific led the global lime market in 2024 with a share of 66.67%, supported by high demand from steel, paper, construction, and water treatment industries across China, India, and Southeast Asia. The regional market grew from USD 31.45 billion in 2023 to USD 31.12 billion in 2024.

- By type, quick lime dominated the market in 2024, driven by its extensive usage in steelmaking, chemical processing, and construction materials.

- By application, the mining & metallurgy segment held the largest share in 2024, as lime remains vital for impurity removal in steel production and mineral processing. The agriculture segment is expected to hold a 3.4% share in 2024.

Key Country Highlights:

- United States: The U.S. lime market is projected to expand steadily due to rising water treatment infrastructure and growing demand from the construction and chemical sectors. Around 17 million tons of lime were produced in 2023, supported by 28 domestic companies.

- China: As the world’s largest steel producer and consumer of lime, China plays a pivotal role in global lime demand. Environmental regulations and industrial expansion are key drivers.

- India: Increased infrastructure development, urbanization, and agriculture sector needs are fueling lime usage, particularly in construction and soil conditioning.

- Germany: Lime consumption is supported by the growth of the automotive and steel sectors, as well as strict EU environmental compliance driving demand in wastewater and flue gas treatment.

- South Africa: Mining remains a major contributor to lime demand, particularly in ore beneficiation and water treatment.

- Brazil: The country’s expanding construction and steel manufacturing industries are boosting regional lime consumption, aided by industrial recovery and infrastructure investments.

Lime Market Trends

Growing Demand from Chemical and Manufacturing Industries to Propel Growth

Lime has proved to be a versatile chemical, with its application expanding in a myriad of industries. While its primary application is in the metallurgy industry, it is experiencing increasing demand from the chemical and manufacturing industries. The product is used for manufacturing calcium carbide, sodium alkali, cyanamide, and propylene glycol. It also finds application in manufacturing products such as magnesia, citric acid, and calcium magnesium acetate. Moreover, it is used to manufacture glycerin, citrates, caseinates, nitrates, phenolates, and stearates.

In manufacturing industries, the product has a high demand from refractory, sugar, and paper manufacturers. In refractory manufacturing, about 3% of the product solution is added during the sintering or fusion process to stabilize zirconium oxide production. In sugar refining, the hydrated product is used to alter the sugarcane juice pH. Further, it is used to purify sugar from sources such as maple or sorghum, although these are produced in much smaller quantities. On the other hand, in paper production, the product is used in the pulping process to control the pH level and whiteness of the paper by removing the impurities from the raw pulp.

The wide range of product applications in numerous industries shall be the key factor for manufacturers to gain novel pathways in the near future that will favor the global lime market growth. Asia Pacific witnessed a lime market growth from USD 31.45 billion in 2023 to USD 31.12 billion in 2024.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Expansion of Steel Industry to Fuel Market Growth

Lime is primarily used in the production of steel. It is used as a fluxing agent in electric arc furnaces and basic oxygen furnaces. The product removes impurities such as silica, phosphorus, and sulfur. It is also used to enhance the refractory life of the furnaces. Amongst several product applications in the steel industry, the following three are the key reasons behind the significant importance given to it in the industry:

- In the blast furnace, limestone granular is used together with finely ground lime to convert ore into pig iron, which is then processed into steel.

- Lime is a fluxing agent that removes impurities from steel to make it better quality.

- It is also applied to enhance the refractory life in the furnaces.

The demand for steel products has increased in past years due to the growing efforts of governments in China, India, Brazil, and South Africa to build strong infrastructure and residences for the rising population in these countries. According to the World Steel Association, steel production reached 1.89 billion metric tons in 2023. The large amount of steel production is the key driving factor for market growth.

Stringent Legal Framework for Environment Protection to Aid Market Growth

According to the World Health Organization (WHO), by 2025, half of the world’s population will be living in water-stressed areas. Contaminated water is a major transmission of dysentery, diarrhea, typhoid, and cholera. The WHO estimates that contaminated drinking water causes more than 470,000 deaths each year. Therefore, to reduce the effect of polluted water, governments and organizations, such as the U.S. EPA and the UN, have approved a legal framework regarding the quality standards for drinking water. Furthermore, industries are obliged to check their waste outlets to lessen their impact on the environment.

The hydrated product can alter the acidity of mining and industrial wastewater and remove toxins such as nitrogen and phosphorus. Therefore, lime precipitation is used in tertiary processes in which phosphorus is precipitated as complex calcium phosphates along with other suspended and dissolved solids. Removal of nitrogen and phosphorus helps prevent algae buildup in surface waters. Due to these factors, the product demand is projected to be driven by stringent environmental conservation obligations.

Increasing Dependence on Treated Water in Metro Cities to Increase Product Demand

Over the past few years, the rate of urbanization has increased owing to job availability in metro cities. Thus, youngsters and professionals are moving to these cities to earn their livelihood. This has created an unprecedented situation for the municipal water corporations. Therefore, government authorities have established water treatment plants to meet consumers' daily requirements. Municipal water treatment plants often use high calcium quicklime, and high calcium hydrated lime for their wastewater treatment process.

Additionally, these products are used to adjust pH and remove suspended solids from wastewater. Further, the calcium hydroxide can be used in combination with aluminum and iron salts to promote coagulation and flocculation of suspended solids. With the help of these processes, the pH level of wastewater can easily be controlled to the desired level. The chemical reactions are fast; therefore, they help manage the wastewater. Hence, the increasing urbanization and immigration of youngsters to the metro cities are boosting the demand for treated water and driving product usage.

Market Restraints

High Carbon Footprint of Product to Impede Growth

Limestone is primarily used to manufacture lime, where it is heated to form calcium oxide and carbon dioxide from calcium carbonate. Carbon dioxide generated during the production of lime is also one of the greenhouse gases. The emission of greenhouse gases has created effects such as the increase in global temperatures and the melting of glaciers, which have led to calamities such as floods and an increase in the height of oceans.

Mild exposure to carbon dioxide has effects such as nose irritation, throat, sneezing, chest pain, and shortness of breath. Moreover, chronic exposure causes silicosis, a progressive lung disease, and exposure to dust may aggravate existing skin and/or eye conditions. Such effects on human and environmental health have been a key reason for consumers seeking alternative calcium hydroxide solutions.

Market Opportunities

Rising Market for Specialty Lime Products Is Anticipated To Create Market Opportunity

The high material purity criteria and precision necessary for the manufacturing of pharmaceuticals and electronics are driving the increased demand for nano-lime, high-purity lime, and custom-engineered lime mixtures. These advanced lime products enable extremely precise applications like specialty chemical synthesis, sterile pharmaceutical manufacture, and semiconductor processing. Investments in ultra-pure and tailored lime solutions are being driven by technological improvements as well as increasing regulatory demands for materials with superior performance and environmental friendliness.

As a result, the market is expected to expand significantly, with lime producers ready to seize opportunities in the high-tech industry.

Segmentation Analysis

By Type

Quick Lime Segment to Remain Dominant Due to Rising Use in Manufacturing Sector

Based on type, the market is segmented into quick lime and hydrated lime.

Quick lime accounted for the dominant lime market share of 7.09% in 2026, due to the heavy demand from the manufacturing sector. This product type is widely used in industries such as steelmaking, construction, chemical processing, and water treatment. Despite its benefits, handling this type requires caution as it can cause severe burns upon contact with skin and eyes.

Hydrated ones are primarily employed in the flue gas treatment or desulphurization process across several coal fire plants, glass & cement industries, and waste incinerators. It filters or catalyzes the particles emitted after combustion, including HCl, SOx, and NOx emissions. In water treatment, the hydrated product helps neutralize acidity, soften water, and remove impurities such as heavy metals and organic contaminants. This is likely to favor the growth of the segment during the forecast period.

By Application

To know how our report can help streamline your business, Speak to Analyst

Mining & Metallurgy Segment to Hold Largest Share owing to Rising Steel Industry

Based on application, the market is segmented into agriculture, building material, mining & metallurgy, water treatment, and others.

In this market, mining & metallurgy segment held the dominant share in 2024. The growth is primarily contributed to the surging steel industry. According to the European Lime Association, the steel industry is the largest consumer of calcium hydroxide and currently utilizes more than 35% of the products produced worldwide. It is used to beneficiate copper ore and make alumina and magnesia in aluminum and magnesium manufacture. In steel production, quicklime is used in blast and electric arc furnaces to purify molten steel by forming slag, which absorbs unwanted impurities. In addition, hydrated product is used in the flotation process for mineral separation, helping to extract valuable metals such as copper, zinc, and gold from ores. The segment is poised to capture 38.83% of the market share in 2026.

Lime is used in the agricultural industry to improve soil pH to support high crop yield. It further improves the soil structure by reducing the surface crusting, diminishing erosion, and enhancing aeration and water withholding capacity. The use of calcium hydroxide improves water percolation and root penetration, supporting the crops to negate climatic and environmental changes, including floods and drought. It also reduces the toxicity of elements such as aluminum and manganese, which can be harmful to crops. A report by the University of California mentions adding calcium hydroxide in a ratio of 1 – 2.3 tons per acre to increase the presence of calcium and regulate the pH of agricultural soil. Owing to all these factors, the segment's growth is projected to be noteworthy during the forecast period.

- The agriculture segment is expected to hold a 3.4% share in 2024.

In the construction industry, the product is a fundamental component used in various building materials due to its binding and strengthening properties. One of the primary uses of calcium hydroxide in construction is in the production of cement, mortar, and plaster, where it acts as a stabilizer and enhances workability. In addition, the product is utilized in the treatment of industrial and mining wastewater. With pollution control regulations getting stringent in the U.S., China, and India, the need for the product is expected to grow for water treatment applications during the forecast period.

The building segment is likely to grow with a considerable CAGR of 17.2% during the forecast period (2025-2032).

Lime Market Regional Outlook

Asia Pacific

Asia Pacific Lime Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific market value stood at USD 31.53 billion in 2025 and USD 31.98 billion in 2026 and is expected to hold the largest share of the market during the forecast period. This is attributed to the presence of China in the region, where the concentration of industries is very high. China is estimated to reach a value of USD 29.17 billion in 2026. Industries such as iron and steel, paper, and water treatment are very huge in the Asia Pacific. Furthermore, the focus of India and other Southeast Asian countries on infrastructure development is going to be a vital factor in the rapid market growth in the region. India is set to hold USD 0.76 billion in 2026, while Japan is set to be valued at USD 1.27 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the third largest market anticipated to be worth USD 3.56 billion in 2026. The market in this region is projected to expand in the near future. Increasing infrastructural development and water treatment activities in the region will surge the market growth. According to the Mineral Commodity studies by the U.S. government, in 2023, around 17 million tons of lime was produced in the U.S., with around 28 companies operating in North America. The U.S. market is set to reach USD 3.24 billion in 2026.

Europe

Europe is the second largest region set to be valued at USD 8.48 billion in 2026, registering a CAGR of 2.0% during the forecast period (2025-2032). The growth of the market in Europe is associated with the expansion of steel manufacturing and the surging automotive industry. The U.K. market is expanding, projected to reach a market value of USD 5.07 billion in 2025. Furthermore, the paper and plastic industries in the region have expanded their demand to treat wastewater and flue gases. This presents an excellent growth opportunity for the market players. Germany is poised to grow with a valuation of USD 2.95 billion in 2026, while France is projected to be valued at USD 9.05 billion in the same year.

Middle East & Africa

The utilization of calcium hydroxide is projected to grow in the Middle East & Africa due to its petrochemical industry usage. It is used in the production of many organic compounds, such as stearates and phenolates. Therefore, the market has obtained immense traction in the region. Also, rising demand from the mining industry in Africa is anticipated to be the key driver for market growth. South Africa is estimated to gain USD 1.95 billion in 2026.

Latin America

Latin America is the fourth largest market expected to hit USD 2.19 billion in 2026. The expanding steel and construction sector in Latin America shall be the critical factor behind the growth of the market in the region.

Competitive Landscape

Key Industry Players

Prominent Companies Focus on Expansion and Acquisition Strategies to Maintain their Market Position

Expansion and acquisition are important strategies used by market-leading companies to maintain their positions. Mississippi Lime Company is one of the leading companies operating in the market. The company supplies its products to construction, chemical, environmental, and water treatment industries. The company has about ten manufacturing sites, six dedicated distribution sites, and six MLDs trucking sites. To serve the consumer demand for novel, high-quality hydrated product, the company has acquired Valley Minerals, a single-site dolomitic quicklime producer based in Bonne Terre, Missouri, in 2022.

LIST OF KEY LIME COMPANIES PROFILED

- Carmeuse (Belgium)

- Lhoist Group (Belgium)

- Graymont Limited (Canada)

- Mississippi Lime Company (U.S.)

- United States Lime & Minerals Inc. (U.S.)

- Afrimat (South Africa)

- Linwood Mining & Minerals Corporation (U.S.)

- Minerals Technologies, Inc. (U.S.)

- Cheney Lime & Cement Company (U.S.)

- Pete Lien & Sons, Inc. (U.S.)

- Sigma Minerals Ltd. (India)

- Cornish Lime (U.K.)

- Brookville Lime (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2024 – Mississippi Lime Company (MLC) has invested in constructing a state-of-the-art, sustainable kiln at its newly acquired lime operation in Bonne Terre, Missouri. The construction began in early 2024, and commissioning will be completed by 2026.

- September 2023 – Lohist Group announced its decision to expand its lime production capacity in Texas, U.S. The purpose of the production expansion was to establish the company’s business presence in the U.S. and maximize its revenue from the lime segment.

- September 2023 – Graymont Limited announced its plans to expand its business in Southeast Asia. For this, the company acquired Compact Energy, a major lime processing facility in Malaysia. Through this move, the company is expected to produce 600,000 tons of quicklime and 170,000 tons of hydrated lime annually.

- September 2023 – Carmeuse and Tallman Technologies Inc. announced a strategic partnership to enhance the lime injection offerings. Together with Carmeuse’s expertise in raw materials and lime handling and Coperion’s expertise in dense phase conveyance, Tallman Technologies will bring design and engineering expertise in supersonic injection to enable Carmeuse to offer a complete lime injection system from truck offloading.

- May 2020 – Lohist North America received a permit from the Texas Commission on Environmental Quality to construct a novel energy-efficient lime kiln at its facility in New Braunfels, Texas. The regulatory approval shall support the company's capacity expansion and help serve customers in North America at a lower turnaround time.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, types, and applications. Also, it offers insights into key market trends and highlights vital industry developments. In addition to the factors mentioned above, the scope of the report encompasses various factors contributing to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Volume (Million Ton), Value (USD Billion) |

|

Growth Rate |

CAGR of 2.7% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 48.18 billion in 2026 and is projected to reach USD 59.59 billion by 2034.

In 2026, the market value stood at USD 31.98 billion.

The market will register a CAGR of 2.7% during the forecast period of 2026-2034.

The mining & metallurgy application led the market in 2026.

The expansion of the steel industry is set to be the key factor in driving the market.

Carmeuse, Lhoist Group, and Graymont are the leading players in this market.

Increasing chemical and manufacturing industries, and rising dependence on treated water in metro cities are the factors driving product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us