Logistics Automation Market Size, Share & Industry Analysis, By Component (Hardware, Software, and Services), By Logistics Type (Sales Logistics, Production Logistics, Recovery Logistics, and Procurement Logistics), By Application (Transport Management, Warehouse Management, Labor Management, and Others), By Enterprise Type (SMEs and Large Enterprises), By Industry (Retail & E-Commerce, Healthcare & Pharma, Food & Beverages, Aerospace & Defense, Energy & Utility, Automotive, and Others), and Regional Forecast, 2026 – 2034

LOGISTICS AUTOMATION MARKET SIZE AND FUTURE OUTLOOK

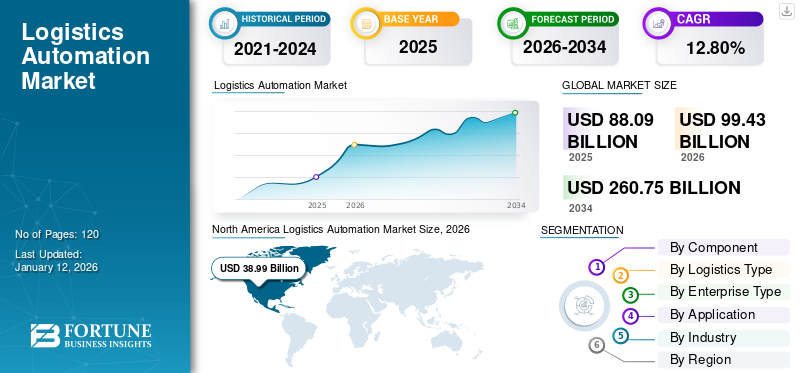

The global logistics automation market size was valued at USD 88.09 billion in 2025. The market is projected to grow from USD 99.43 billion in 2026 to USD 260.75 billion by 2034, exhibiting a CAGR of 12.80% during the forecast period. North America dominated the market with a share of 39.60% in 2025.

Logistics automation refers to the use of advanced technology to optimize and streamline various aspects of the supply chain, thus improving accuracy and increasing efficiency in logistics operations.

The components considered in this scope include various hardware and software for different purposes, such as autonomous drones for delivery, automated guided vehicles (AGVs) for material handling, robotic arms, and predictive analytics software for automated storage and retrieval systems (AS/RS). It also encompasses conveyor belts, demand forecasting and inventory management equipment, and other types that can handle tasks such as sorting, picking, packing, and shipping.

The COVID-19 pandemic severely impacted the supply chain globally. During the pandemic, lockdowns across the globe slowed down the flow of raw materials and finished products, which disrupted the manufacturing and logistics operations. In the first quarter of 2020, the supply chain was disrupted, and the market showed a slight decline. Despite the uncertain economic environment, 92.0% of businesses did not stop investing in technology during the pandemic. This highlighted the importance of digital supply chains, which helped companies overcome disruptive forces and respond quickly to volatile supply and demand conditions.

However, after the partial opening of the supply chain and logistics industry in the last quarter of 2020, the market witnessed a healthy growth rate, which is expected to remain the same in the upcoming years.

IMPACT OF GENERATIVE AI

Generative AI is Transforming the Logistics Industry by Optimizing Processes and Improving Efficiency

Generative Artificial Intelligence (AI) is emerging as a transformative force across industries, including logistics. Generative AI can generate data, innovate, and reshape traditional logistics processes. These capabilities make it a valuable tool for logistics companies looking to enhance their operations and improve overall customer satisfaction. It can automate repetitive and tedious tasks and allow businesses to run on a predictive, proactive, and forward-looking model.

Here are several ways in which generative AI contributes to logistics transformation:

- Route Optimization: GenAI helps set up efficient transportation plans and optimize delivery routes by analyzing current traffic conditions, historical data, and other relevant factors. It can generate dynamic routing that can adjust instantly to delays and disruptions, reducing delivery time and improving overall efficiency.

- Customized Logistics Solutions: AI plays a vital role in customization by tailoring services and experiences to individual business needs. It also helps to analyze diverse data sources for understanding customer behavior and preferences. As per an industry expert, around 90% of consumers expect two to three-day delivery fulfillment as the baseline, with 30% of shoppers expecting same-day delivery. From delivery schedules and personalized routing to dynamic pricing and understanding return patterns and customer feedback, AI can help businesses build loyalty, enhance customer satisfaction, and differentiate themselves in a competitive market.

Logistics Automation Market Trends

Rapid Growth of E-commerce Emerges as a Latest Trend in the Market

The rapid growth of the e-commerce market is a growing trend that is providing enormous opportunities for market players. According to industry experts, the size of the global e-commerce logistics market is expected to grow to USD 858.89 Billion (770.79 billion Euros) by 2026. This growth is majorly influenced by the rise in online sales, which significantly increases the demand for efficient shipment management.

Furthermore, the integration of digital technologies into the logistics ecosystem allows the end users to manage their shipments efficiently. The rise of the e-commerce market directly helps in resolving all logistics-related concerns. As the industry progresses, target audiences demand transparent customer service.

Moreover, with the help of technologies such as data analytics, AI, and IoT, end users can have a complete overview of factors such as inventory management, supply chain performance, and customer insights. This strategy enhances the overall logistics ecosystem. Thus, e-commerce growth is expected to reshape the market in the coming years.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Digital Transformation Across Logistic Companies is Driving Market Growth

Digital transformation has been a key aspect for logistic companies in recent years, enabling them to modernize outdated systems, deliver automated operational processes, and provide better customer experiences. There is an increasing investment in advancements across both warehousing and transportation technologies. As the digital world expands, it has become essential for market players to invest in automation technologies such as cloud, IoT, and data analytics. Companies that fail to keep up with digital technologies would face the risk of falling behind their competitors. As per the survey by Accenture, 75% of logistics company leaders believe that neglecting digital capabilities would endanger their business.

Digital transformation helps businesses to embrace agile and responsive operations through data-driven insights. This approach allows companies to adapt to changing market demands and unforeseen disruptions swiftly. Logistic companies can forecast demand fluctuations, allocate resources, and enable proactive adjustments through predictive modeling and real-time data analytics. Furthermore, technologies, including machine learning and AI, enable dynamic route optimization, allowing agile adjustments in response to traffic, weather conditions, or other unforeseen events. Therefore, digital transformation among enterprises is driving the logistics automation market growth.

Market Restraints

Lack of Appropriate Infrastructure, High Initial Investments & Costs, Regulatory Concerns, and Geopolitical Issues Hinder Market Growth

The restraining factors of the market include lack of appropriate infrastructure, high initial investments and costs, regulatory concerns, and geopolitical issues. In countries such as South America and Africa, existing infrastructure is not favorable, and the lack of investments in infrastructure upgrades further hinders market growth. Implementing automated logistics systems requires significant investment in technology and training, and many small and mid-sized companies globally fail to invest due to budget constraints, impacting the market growth.

In addition, regulatory & compliance issues and geopolitical concerns such as the Russia-Ukraine war, trade disputes, sanctions, tariff measures, and others have created an environment of constant uncertainty for players in the market. The historic exit of the U.K. from the European Union due to Brexit has impacted global logistics as a redefinition of trade and customs relations between Europe and the U.K. has generated a series of logistical obstacles. Thus, insufficient infrastructure in South America and Africa, along with high initial costs, restricts logistics automation for smaller companies, thus hindering market growth.

Market Opportunities

Rapid Adoption of Advanced Technologies to Boost Market Growth

The rapid adoption of advanced technologies to create lucrative opportunities for market players in the coming years. Here are some of the technologies:

Dynamic Power Transfer Technologies: One of the most significant trends in logistics automation pertains to the incorporation of dynamic power transfer technologies. In contrast to conventional charging methods that necessitate robots to halt for recharging, dynamic power transfer facilitates Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) to receive uninterrupted power while in motion.

IoT: The modernization of logistics is being facilitated by the Internet of Things (IoT), which offers real-time visibility and operational control. IoT devices have the capability to monitor the status, location, and condition of goods across the supply chain, leading to improved inventory management efficiency and reduced risk of material damage or loss.

Autonomous Vehicles: Autonomous vehicles, such as drones and self-driving trucks, are revolutionizing the logistics sector by facilitating swifter and more dependable deliveries.

Robotics and Automation: The use of robotics and automation in the field of logistics is expected to speed up, as more advanced robots with the ability to perform a variety of tasks such as picking, packing, sorting, and transportation are being developed.

Artificial Intelligence and Machine Learning: Artificial Intelligence (AI) and Machine Learning (ML) are becoming more and more integrated into logistics operations in order to streamline processes and improve decision-making.

SEGMENTATION ANALYSIS

By Component

Hardware Segment Dominated the Market Majorly Due to Growing Adoption of AGVS And Robots to Automate Logistics Process

By component, the market is segmented into hardware, software, and services.

The hardware segment dominated the market with 48.60% of revenue share in 2026 and is expected to register the highest CAGR during the forecast period. The demand for hardware, including autonomous mobile robots, AGVs, and other devices, is increasing, as these technologies can automate significant parts of the logistics process. Robots can be used for packing and picking orders, loading and unloading trucks, while AGVs can be used to transport goods around distribution centers or warehouses.

The software segment is estimated to grow significantly during the forecast period. Software plays a crucial role in streamlining and optimizing various aspects of the logistics process. The software integrates with existing systems to automate processes and ensures seamless data flow. According to technology surveys, around 41% of companies have started investing in logistics automation software to ease the process of documentation during shipment. Therefore, the factors mentioned above are boosting the logistics automation market share.

By Logistics Type

Demand for Production Logistics for Improving Profitability to Propel the Segment Growth

By logistics type, the market is segmented into sales logistics, production logistics, recovery logistics, and procurement logistics.

The production logistics is expected to grow with the highest CAGR of 16.00% during the forecast period. To improve profitability, businesses are focusing on optimizing the production process. Production logistics control and manage movements of inventories within manufacturing sites to ensure the optimal flow of materials throughout the value chain. Production logistics helps SMEs maintain business standards and reduce the likelihood of defects and errors in the production process.

Sales logistics dominated the market in 2026. Sales logistics holds 34.06% of the market share, as it plays a vital role in e-commerce and is a key differentiator for companies. It involves managing logistics, capital flow, and information flow to transfer the ownership of products to customers. Sales logistics is the most essential part of the supply chain as it includes delivering or moving products to the end consumer. It comprises inventory management, vendor management, order management, and shipping management.

By Enterprise Type

SMEs Segment to Lead Owing to Growing Demand for Logistics Automation Solutions to Enhance Efficiency

By enterprise type, the market is divided into large enterprises and SMEs.

The SMEs segment is expected to grow at the highest CAGR of 15.73% during the forecast period. SMEs are increasingly adopting logistics automation solutions to reduce logistics costs and enhance efficiency. Automation solutions can help SMEs to scale operations and productivity significantly.

Large enterprises dominated the market in 2026 as automation solutions allow large enterprises to augment their operations and reduce inefficiencies and errors that usually come with manual labor. According to experts, around 75% of large enterprises are planning to implement intelligent robots to automate their logistics processes. Around 59.27% of the market share in 2026 is acquired by large enterprises segment.

By Application

Transport Management Segment Dominated the Market Owing to the Growing Need to Improve Delivery Times

By application, the market is divided into transportation management, warehouse management, labor management, and others.

Transport management dominated the market in 2026. Cost concerns are a significant issue in logistics transportation. Therefore, logistics automation is integrated with the ERP system to access the address book automatic storage and handle fuel surcharges and accessories. This integration eliminates the need to enter the data manually and leads to cost reduction and enhanced product transportation. The adoption of automation solutions is increasing in transport management to reduce transportation costs, increase visibility of the supply chain, and improve delivery times. The transport management segment accounts for 37.28% of the market share in 2026.

Warehouse management is expected to grow with the highest CAGR of 15.60% during the forecast period. Automation solution helps to automate tasks, including picking and shipping. These systems speed up the movement of goods and reduce the risk of errors and the amount of manual handling of heavy items and repetitive activities. Additionally, automation helps to minimize the risk of workplace injuries and increases workforce satisfaction.

By Industry

Surge in Usage of Logistics Automation Solutions for Precise Deliveries Led to the Retail & E-commerce Segment

By industry, the market is divided into retail & e-commerce, healthcare & pharma, food & beverages, aerospace & defense, energy & utility, automotive, and others.

Retail & e-commerce dominated the market in 2024. Automation of the logistics process is significant for e-commerce and retail as it enhances efficiency and speeds up the supply chain. Automation allows faster and more precise deliveries and optimizes operations through advanced data capture and analysis. In 2023, around 75% of internet users ordered goods online in Europe, and it is estimated that online sales will reach around USD 1.5 Trillion (1.4 trillion euros) by 2027. Retail & e-commerce segment holds 26% of the revenue share in the global market.

Healthcare and pharma are estimated to register the highest CAGR of 18.80% during the forecast period. Automation solutions in logistics streamline and organize business processes and provide intelligent insights that positively impact decision-making, driving growth and understanding the pain points. Automation helps to guarantee the exact and timely delivery of products in the best condition. As a result, healthcare providers can enhance patient care and boost efficiency within hospitals.

To know how our report can help streamline your business, Speak to Analyst

LOGISTIC AUTOMATION MARKET REGIONAL OUTLOOK

The market is studied across the regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further classified into leading countries.

North America Logistics Automation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market in 2025, maintaining its leading position in the logistics sector. The logistics industry is poised for substantial growth due to significant economic activities and the support of the flow of goods across borders. Shifts influence this growth in global trade dynamics and the adoption of advanced technologies for automating logistics processes. The rising demand for advanced AI and the rapid adoption of generative AI across North American countries to transform the logistics industry is driving market growth in the region. The U.S. is one of the largest and most advanced markets for automated solutions globally. Sectors including retail, food and beverages, and healthcare are the largest source of demand for logistics automation solutions. In the U.S., companies use generative AI to forecast disruptions in the supply chain, such as route deviation, potential breaches of Service Level Agreements, and unexpected weather anomalies. As per a recent survey by Locus, around 69% of businesses reported lacking visibility over their supply chain. Therefore, to overcome this challenge, the adoption of generative AI applications such as control towers' real-time fleet tracking is increasing, enabling businesses to identify potential delays and take necessary action before they impact revenue. The U.S. market estimated to hit USD 29.22 billion in 2026.

South America

The market is witnessing growth in South America due to factors such as digital transformation in logistics and supply chains as well as technological advancements. South America has experienced significant economic growth in the last decade by heavily exporting commodities, and in 2023, the market achieved a significant milestone, reaching a value of USD 2,129.2 million. The government in South America is investing in infrastructure to expand and technify the port, road, and airport network in the region. Also, digitalization in logistics procedures and simplifying regulations are significant reasons for driving market growth.

Europe

Europe is the third-largest market accounting for USD 18.77 billion in 2026, is driven by a substantial rise in digital transformation among industries, industry 4.0 and IoT. As per YouGov, around 33% of logistics companies in the region have started implementing digital transformation strategies, and companies have a clear vision of technologies and digital megatrends that will significantly impact the logistics sector. As per the recent survey conducted, around 71% of respondents think of cloud service, 63% of respondents think IoT, and 58% of respondents think Big Data plays a significant role in logistics. The Digital Transport and Logistics Forum is bringing together private and public stakeholders from various logistics and transport communities to support the European Commission in promoting digital transformation in the logistics sector.

The U.K. market projects significant market size of USD 2.53 billion, with Germany estimated to hit USD 3.4 billion and France anticipated to display USD 3.06 billion in 2025.

Middle East & Africa

The market of Middle East & Africa is accounting to USD 9.69 billion in 2026, with the second-largest CAGR of 15.31% during the forecast period. As e-commerce activity peaked during COVID-19, the significance of building a more consumer-centric and purpose-driven supply chain became obvious. According to Accenture research, nearly 80% of customers in UAE and Saudi Arabia have switched to online shopping. The e-commerce market in the Middle East is estimated to reach USD 49 billion by 2025. As a result, organizations are investing more in automation to serve their customers better. Also, as the region focuses on smart cities and industry 4.0, logistics automation is becoming one of the top trends in the Middle East & Africa. The UAE shows the market size of USD 1.76 billion in 2025.

Asia Pacific

The Asia Pacific region is expected to be the second-largest growing market with a value of USD 26.02 billion in 2026 for logistics automation owing to its rapidly expanding e-commerce industry. The rapid expansion of the e-commerce sector demands advanced logistics solutions to meet customer expectations, with autonomous last-mile delivery at the forefront of this transformation. As the logistics revolution continues, consumers are looking for flexible delivery options. As per HERE Technologies Asia Pacific on the Move Report, around 82% of e-commerce companies in the region are expressing their need for end-to-end tracking of all shipments. Additionally, around 33% of logistics companies are planning to buy drones to enhance their services, and 45% of logistics companies will invest in logistics asset-tracking solutions to improve customer experience.

The Chinese market projects significant market size of USD 5.17 billion, with India estimated to hit USD 2.52 billion and Japan anticipated to display USD 4.55 billion in 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Major Players Focus on Developing Advanced Products to Strengthen Their Market Positions

Key players operating in the market constantly seek relevant acquisitions of prominent technology providers with the aim of delivering their clients with advanced and enhanced tools. Along with acquisitions, these high-performing companies regularly enter into strategic collaborations and partnerships to improve their product knowledge and marketing capabilities. These strategies enhance overall product functionality, expand the product portfolio, and enhance client experience.

To know how our report can help streamline your business, Speak to Analyst

Even though the market is fragmented, it consists of well-known and established players. The market is gaining traction owing to the increasing relevance of sustainability goals and the e-commerce market. Moreover, the integration of new-age technologies in the logistics sector is driving the overall market.

KEY LOGISTICS AUTOMATION COMPANIES PROFILED:

- Daifuku Co., Ltd. (Japan)

- Honeywell International Inc. (U.S.)

- TGW Logistics Group (Austria)

- Toyota Industries Corporation (Japan)

- KUKA AG (Germany)

- SSI SCHAEFER Group (Germany)

- Jungheinrich AG (Germany)

- KION Group AG (Germany)

- Murata Machinery, Ltd (Japan)

- Knapp (Austria)

- ABB (Switzerland)

- Dematic (U.S.)

- BEUMER GROUP (Germany)

- WITRON Logistik (Germany)

- One Network Enterprises (U.S.)

- Toshiba Corporation (Japan)

…and more

KEY INDUSTRY DEVELOPMENTS:

- May 2024: The Toyota Industries Corporation introduced a new Toyota Automated Logistics Group with the aim of housing its present subsidiary, Toyota L&F, alongside Bastian Solutions, Vanderlande, and viastore. With this, the company expects to expand its reach in all integrated and automated projects across the globe.

- March 2024: The Hyundai Movex signed a USD 14.96 million contract with EcoPro BM Co. with the objective of providing a logistics automation system in January. The company is expected to start in March and be completed by 2026.

- February 2024: Dematic entered into a partnership with Groupe Robert, a Canadian Logistics company. The partnership aimed to open an automated cold storage facility. The facility has a high-capacity Automated Storage and Retrieval System with 130-foot tall cranes for managing frozen and fresh foods.

- January 2024: Honeywell entered into a partnership with Hai Robotics to deliver high-density and flexible storage and retrieval solutions to distribution centers. The partnership aimed to integrate Honeywell’s Momentum Warehouse Execution software with Hai’s innovative robotics technology.

- November 2023: Knapp, an automation solution provider, partnered with Biogena, an Austrian Health Product company, to automate the processing of international shipping.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as prominent companies, product types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights the competitive landscape. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, Logistics Type, Enterprise Type, Application, Industry, and Region |

|

Segmentation |

By Component

By Logistics Type

By Enterprise Type

By Application

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to record a valuation of USD 260.75 billion by 2034.

In 2025, the market was valued at USD 88.02 billion.

The market is projected to record a CAGR of 12.80% during the forecast period.

By component, the hardware segment led the market in 2025.

Digital transformation across logistics companies is a key factor driving market growth.

Honeywell International, Murata Machinery, Ltd., KUKA AG, and KION Group AG are the top players in the market.

North America generated the maximum revenue in 2025.

By industry, the healthcare & pharma segment is expected to grow with the highest CAGR during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us