Manufacturing Execution Systems Market Size, Share & Industry Analysis, By Vendor Type (Pure Play and Enterprise Integrators), By Component (Software and Service), By Deployment (On-Premise, Cloud, and Hybrid), By Industry (Oil & Gas, Automotive, Food Processing, Healthcare & Pharmaceuticals, Electronics & Semiconductor, and Others (Metal & Mining, etc.)), and Regional Forecast, 2026 – 2034

Manufacturing Execution Systems Market (2026-2034)

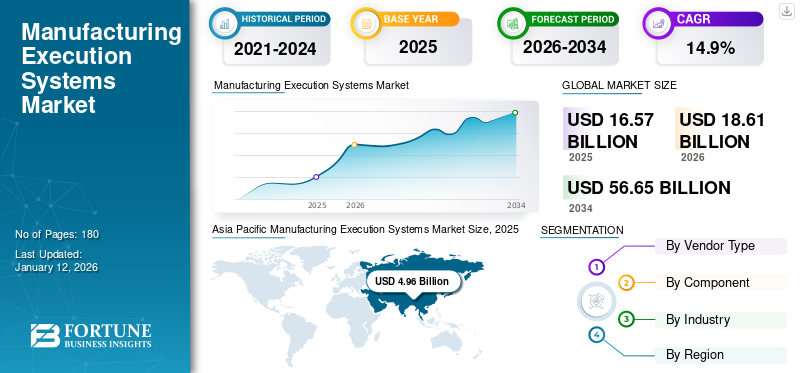

The global manufacturing execution systems market size was valued at USD 16.57 billion in 2025 and is projected to grow from USD 18.61 billion in 2026 to USD 56.65 billion by 2034, exhibiting a CAGR of 14.9% during the forecast period. Asia Pacific dominated the manufacturing execution systems market with a market share of 30.0% in 2025.

Since the late 90s, Manufacturing Execution Systems (MES) have been offering capabilities to improve efficiency in manufacturing. However, the increasing adoption of cloud technology in 2010 has pushed the integration of new technologies that extended the potential of the digital era. MES is one such part of Industry 4.0 that evolved into different ERP and SCADA-integrated software to maximize manufacturing efficiency and reduce time for production. MES serves as the backbone that helps achieve Industry 4.0 outcomes. The global market is showcasing robust growth owing to increasing demand for data and analytics for manufacturing processes, promoting operational efficiency and productivity in assembly lines and production.

Global Manufacturing Execution Systems Market Overview

Market Size:

- 2025 Value: USD 16.57 billion

- 2026 Value: USD 18.61 billion

- 2034 Forecast Value: USD 56.65 billion

- CAGR: 14.9% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific is expected to hold the highest market share with a share of 30.0% in 2024.

- Component Segment Leader: Services lead the component mix, accounting for the largest revenue share

- Industry Leader: Automotive is the fastest-growing industry segment during the forecast period

Industry Trends:

- Increasing integration of Industry 4.0 and IoT capabilities to enable manufacturing digitalization

- Strong demand for MES software solutions, partnerships, and ERP integrations enhancing digital manufacturing workflows

- Expansion of cloud and hybrid deployment models alongside on‑premise installations for scalability and flexibility

Driving Factors:

- Escalating implementation of Industry 4.0 in production facilities globally, particularly in Asia Pacific

- Increasing demand for connected supply chains and operational efficiency across manufacturing industries

- Rise in outsourcing of software and services, driving demand for Software + Services MES models

- Major industry players (Siemens, Rockwell Automation, Honeywell, AVEVA, Dassault Systèmes, SAP, Oracle, GE Digital, Critical Manufacturing) are expanding globally through partnerships and solutions integration

The COVID-19 pandemic incurred significant changes to the manufacturing execution systems industry, pushing manufacturers to accelerate digital initiatives, such as Industry 4.0 Automation, for operation resilience and agility. The crisis exposed criticalities and vulnerabilities in supply chain and production processes, highlighting the need for enhanced responsiveness and vulnerability. All these factors boosted the demand for MES adoption as companies strive for more flexible and easily integrated solutions for their system that improve process efficiency.

IMPACT OF GENERATIVE AI

Leveraging AI Capabilities to Enhance Operational Analytics

Generative AI across the industry is revolutionizing the efficiency of MES with predictive capabilities that help optimize maintenance operations through predictive analytics and automate critical decision-making processes. By analyzing a vast amount of operation data, generative AI enables manufacturers to anticipate bottlenecks in production. Leveraging these AI capabilities improved overall operational efficiency and optimized resource allocation. This technology facilitates the creation of adaptive MES solutions that are easy to learn and train on historical data, ensuring continuous improvement and innovation.

MARKET TRENDS

Cloud MES and Machine Learning Shaping Advanced Analytics Trend

Cloud technology has been heavily adopted across manufacturing enterprises, leveraging advantages, such as integration flexibility, storage scalability, and accessibility to various API and connection protocols. Manufacturers can quickly deploy machine learning (ML) models on cloud MES that enable data sharing across geographies and departments. These features of MES help train Machine Learning (ML) models, increasing manufacturer's adoption of advanced analytics. Thus, leveraging cloud MES capabilities helps to shape advanced analytics and grow market size in the long term.

- For instance, according to a Forrester 2022 study, an investment made by an organization on an industry cloud implementation solution could project to realize USD 2.6 million at net present value, which could benefit a Return on Investment (ROI) of almost 283% over three years.

- For instance, in April 2024, Microsoft Corporation, a leading software solution provider, announced a manufacturing data solution in Microsoft Fabric that utilizes data ingestion from factory domain data through cloud-based MES. The solution allows the user to maximize the value of factory data, uncovering operational insights for production optimization.

MARKET DYNAMICS

Market Drivers

IoT Capabilities and Integration of Industry 4.0 Drive Manufacturing Digitalization

Integrating the Internet of Things (IoT) into the MES equipment is a game changer for the industry. The IoT sensors and receivers embedded in machines and shop floor equipment generate real-time data that offers deep insights into production processes. The adoption of Industry 4.0 promotes the capabilities of IoT that drive the digitalization of connected and intelligent manufacturing systems with real-time big data analytics and enhance decision-making. These capabilities of IoT drive manufacturing execution systems market growth during the forecast period.

- For instance, in October 2023, Critical Manufacturing, a subsidiary of ASMPT and a leading Industry 4.0 solution provider, demonstrated advanced MES functionality at SEMICON Europa. The advancement aims to easily integrate operations, drive digitalization, increase productivity, and optimize Information Technology (IT) across the semiconductor production value chain.

Market Challenges

Complex Integration and High Initial Cost Hampers Adoption

MES implementation is a transformative process for every enterprise and manufacturing organization. One significant challenge with implementing MES is integrating this complex interface with existing ERP, SCADA, and PLC systems. Many operating companies have legacy systems that are hard to collate with modern manufacturing execution systems. If integration is possible, they are highly complex, costly, and time-consuming for the manufacturer. Thus, resistance to change and lack of user adoption due to complexities are the modern industry challenges that hamper the MES’s substantial adoption.

Market Opportunities

Leveraging Digitalization and Deep Insights in Operations Drive Opportunities

MESs are the perfect technology balance between modern analytics and Industry 4.0, where the data generated from each IIoT system in a manufacturing operation helps gain deeper insights. This data is stored within data warehouses by the MES, which helps maintain long-term productivity through more informed decision-making for the businesses. Thus, prominent players across the industry leverage opportunities by digitizing traditional ERP systems through data insights and analytics that help businesses gain advantage through operational productivity, predictive analytics, and forecasting. These advancements curated opportunities for key players bolstering manufacturing execution systems market share.

- For instance, in April 2023, Daneli, a leading technology integrator, announced a strategic collaboration agreement with AWS to help manufacturers deploy fully supported automation solutions that assimilate anomaly inspection. The collaboration aims to deliver end-to-end automation solutions to mutual customers, harnessing the power of data in real time.

SEGMENTATION ANALYSIS

By Vendor Type

Diverse Product Offerings and Simple Integration Drive Business for Enterprise Integrators

Based on vendor type, the market is classified into pure play and enterprise integrators.

Enterprise integrators acquire the largest market share due to their easy-to-integrate product offerings, and a flexible business structure that molds in customization to their portfolio and adds a competitive edge over pure play vendor. The segment is likely to capture 72.86% of the market share in 2026.

However, pure-play vendors showcased robust CAGR growth by introducing diverse product offerings in their MES ecosystem, accelerating manufacturing execution systems industry growth during the forecast period. This manufacturing execution system industry segment is anticipated to grow with a CAGR of 15.40% during the forecast period (2025-2032).

- For instance, in March 2023, AVEVA, a global industrial software provider, announced its portfolio-wide transition to a subscription-based model. The business model will accelerate access to modern solutions and customer dynamic needs, spanning a mix of cloud, on-premises, and hybrid solutions to optimize the industrial lifecycle.

By Component

Increasing Support Offerings and Long-Term Association Drive Service Revenue

Based on component, the segments are classified as software and service.

The service segment is set to grow progressively, acquiring the largest market share as prime players, such as GE Digital, SAP, and others, offer long-term service support for their continuous innovation and VR capabilities. The segment is estimated to gain 57.87% of the market share in 2026.

At the same time, the MES software segment observes a vigorous CAGR owing to crucial advantages, such as customized production of highly tailored products focused on delivering high productivity with speed and affordability. All these factors are potential vital drivers for market growth. The software segment is likely to register a substantial CAGR of 15.90% during the forecast period (2025-2032).

- For instance, GE Aviation, a prominent aeronautics company, leverages the capabilities of GE Digital MES to gain deeper visibility of their processes by helping plants be 1.95% more productive in the year 2023. Their on-time delivery improved by 10 points compared to last year’s baseline.

By Deployment

Enhance MES Capabilities and Data Security Concerns Support On-Premise Deployment

Based on deployment, it is further classified as on premise, cloud, and hybrid.

On-premise category is still prevalent with largest market share, dominating deployment segment. It is highly preferred in the highly regulated and traditional manufacturing firms seeking on premise solution for improve MES capabilities and more to enhance data security. This segment is estimated to capture 46.37% of the market share in 2026.

While, the on premise segment is experiencing slower growth due to rising preference for cloud solutions. Cloud deployment is showcasing highest CAGR gaining higher adoption due to its scalability, reduced upfront cost, and easy remote arrangements. This segment will grow with a considerable CAGR of 16.00% during the forecast period (2025-2032).

Hybrid solution segment to gain more attraction due to its flexibility and balanced product offerings.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Growing EV sector and Need for Process Optimization Drive the Automotive Segment Growth

The industry segment is further classified into the following categories: oil & gas, automotive, food processing, healthcare & pharmaceuticals, electronics & semiconductor, and others (metal & mining, etc.).

The automotive industry is set to showcase the highest growth, attaining the highest CAGR due to expanding possibilities and competition in new-age modern electric vehicles. The automotive industry uses MES for operation management, information management, and integration gateways for various plants. These modern capabilities help improve process line optimization, which results in production productivity. The segment held 28.16% of the market share in 2026.

Electronics and semiconductor industry to showcase a progressive CAGR growth owing to increasing adoption of AI across electronics and semiconductor chipsets. Manufacturers of the electronic components are focusing on integrating advance MES solution to tackle supply chain bottlenecks and smooth process line operations.

The healthcare & pharmaceuticals industry is set to showcase steady CAGR as medicines and pharma companies focus on developing automated process lines to reduce medicine and medical devices production time with advanced MES-integrated manufacturing.

Oil and gas is another primary industry utilizing MES capabilities to reduce the risk of capital loss with a more optimized inventory management and supply chain analytics system.

Food processing and other segments are forecasted to showcase significant growth owing to the increasing count of food processing and packaged food companies. These companies demand more equipped process lines focusing on sustainability and minimum wastage.

MANUFACTURING EXECUTION SYSTEMS MARKET REGIONAL OUTLOOK

From the regional ground, the market is classified into Europe, Asia Pacific, South America, North America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Manufacturing Execution Systems Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The manufacturing execution system industry in Asia Pacific dominated the market with a revenue share of USD 18.61 billion in 2026 and USD 16.57 billion in 2025. The region leads the manufacturing execution systems market share with exponential growth due to rapid industrialization in the semi-urban and urban areas, demanding modernization in production units. Also, increasing Foreign Direct Investments (FDI) receded by high consumption of consumables and growing surplus income fosters manufacturing execution systems market growth. The manufacturing execution system industry in India is set to gain USD 0.59 billion in 2026, while Japan is expected to reach USD 0.83 billion in the same year.

Download Free sample to learn more about this report.

The manufacturing execution system industry in China is witnessing high growth, acquiring the largest market share in the Asia Pacific region due to its dominance in industrial production, which demands real-time production data for advanced analytics to optimize business complexity and operation management to bolster long-term market growth. India is witnessing progressive growth and fostering FDI and industrial development, helping the market grow. However, Japan, South Korea, and the Rest of Asia Pacific are observed to grow significantly, supported by growing investments by small and medium-sized enterprises SMEs in upgrading cloud MES and advanced analytics. China is foreseen to hold USD 3.45 billion in 2026.

North America

North America is this second largest market and is anticipated to gain USD 5.15 billion in 2026, registering a CAGR of 14.40% during the forecast period (2025-2032). North American manufacturing execution systems industry will observe progressive growth, holding a significant market share due to its advanced research capabilities and demand for advanced data engineering to optimize production and manufacturing capabilities. Technology partnerships back the demand for technology to enhance manufacturing capabilities, such as product management, operation management, and supply chain management. The manufacturing execution system industry in U.S. is likely to hold USD 3.71 billion in 2026.

South America

The manufacturing execution system industry in South America will foster stagnant growth due to stable investment for new manufacturing and food processing facilities that fulfill domestic demand and support the implementation of manufacturing execution systems in the long term.

Europe

Europe is the third largest market expected to gain USD 4.98 billion in 2026. The region is set to showcase steady growth owing to manufacturers' and organizations' emphasis on promoting more sustainable manufacturing with the help of advanced manufacturing execution systems, which are the prime market drivers. The manufacturing execution system industry in U.K. is set to be worth USD 1.33 billion in 2026. Countries, such as Germany, Italy, the U.K., and others are utilizing MES capabilities to extend their production optimization and operation management during the forecast period. The manufacturing execution system industry in Germany is estimated to be valued at USD 1.50 billion in 2026, while France is predicted to grow with a value of USD 0.71 billion in 2025.

Middle East & Africa

The Middle East & Africa is the fourth largest market and is anticipated to acquire USD 1.47 billion in 2026. Middle East & Africa manufacturers emphasize implementing MES for manufacturing modernization and upgrading their production facilities. These integrations could benefit manufacturer's economic uncertainty with more optimized supply chain and operation management. The manufacturing execution system industry in GCC is expected to reach a valuation of USD 0.82 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Emphasis on Adding Advanced Technologies to Product Portfolio

Advanced technologies and continuous innovation to extend the capabilities of manufacturing execution systems are critical concerns for players. Many players are trying to enlarge their product offerings with a more comprehensive product mix that is more flexible and helps consumers transition from traditional MES technology to advanced MES. These market strategies help businesses extend their market reach in a prolonged period.

- For instance, in October 2023, AVEVA, a global industrial software provider, launched AVEVA Advanced Analytics to help boost operation efficiency and meet dynamic sustainability KPIs. The cloud-based software enables no code software as a service solution, delivering actionable insights based on industry operations data. Advanced analytics is built on the compiled advantages of both the AVEVA data hub and PI Systems.

Major Players in the Manufacturing Execution Systems Market

GE Digital, Rockwell Automation, Siemens, SAP, and ABB are the most prominent players in the market. The global manufacturing execution systems market is moderately fragmented, with the top 5 players accounting for around 21-23% of the market share.

Top Manufacturing Execution Systems Companies Analyzed:

- Siemens AG (Germany)

- Rockwell Automation (U.S.)

- Honeywell International Inc. (U.S.)

- Aveva (Schneider Electric) (France)

- Dassault Systèmes (France)

- SAP SE (Germany)

- GE Digital (U.S.)

- Critical Manufacturing (Portugal)

- Infor MES (U.S.)

- Oracle Corporation (U.S.)

- Mitsubishi Electric (Japan)

- Emerson Electric Co. (U.S.)

- ECI Software Solutions (U.S.)

- Aptean (U.S.)

- IFS AB (Sweden)

- Oracle Corporation (U.S.)

- QAD Inc. (U.S.)

- MES Solutions GmbH (Germany)

- 42Q Sanmina Corporation (Japan)

- IBaset (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: Critical Manufacturing, a leading provider of manufacturing execution systems, partnered with Loftware, a leading cloud-based labeling and artwork management company. The partnership aims to bring expertise, set a new standard for integrating labeling with MES, and offer ample solutions that deliver enhanced productivity and quality and reduce errors.

- June 2024: Critical Manufacturing, a unit of ASMPT, announced an expansion strategic alliance with RoviSys to expand the company's collaboration to Southeast Asia, Taiwan, and Japan. The company considers RoviSys a capable system integrator, demonstrating its expertise in successfully deploying Critical Manufacturing MES to customers.

- October 2023: AVEVA, a prominent leader in the industrial MES business, announced a strategic collaboration with Microsoft that further strengthens the company's data integration platforms with AI. The companies collaborate to organize data from various domains to extend AI applications and green software initiatives.

- September 2023: Rockwell Automation partnered with BIC to drive digital transformation with standardization of the production process by implementing the PLEX MES solution as a pilot project in one BIC production facility. By leveraging the capabilities of PLEX, BIC is standardizing processes and paperless systems.

- July 2023: Critical Manufacturing, a prominent industrial software provider, announced an expansion to Mexico for multi-site operation and to strengthen its Latin America presence. Critical Manufacturing has acknowledged the growing trend of the establishment of production facilities. To cater to this growing demand, it identified an opportunity to provide ample support and foster stronger partnerships to grow in this region.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on critical aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.9% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vendor Type, Component, Industry, and Region |

|

Segmentation |

By Vendor Type

By Component

By Deployment

By Industry

By Region

|

|

Key Market Players Profiled in the Report |

Siemens AG (Germany), Rockwell Automation (U.S), Honeywell International Inc.(U.S), Aveva (Schneider Electric) (France), Dassault Systèmes (France), SAP SE (Germany), GE Digital (U.S.), Critical Manufacturing (Portugal), Infor MES (U.S.), and Oracle Corporation (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 56.65 billion by 2034.

In 2025, the market was valued at USD 16.57 billion.

The market is projected to grow at a CAGR of 14.9% during the forecast period.

The service segment is expected to lead the market.

IoT capabilities and integration of Industry 4.0 drive manufacturing digitalization, which are the key factors driving market growth.

Siemens AG, Rockwell Automation, Honeywell International Inc., Aveva (Schneider Electric), Dassault Systèmes, SAP SE, GE Digital, Critical Manufacturing, Infor MES, and Oracle Corporation are the top players in the market.

Asia Pacific region is expected to hold the highest market share.

By industry, the automotive segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us