Medical Device Leak Testing Market Size, Share & Industry Analysis, By Test Type (Pressure Decay, Vacuum Decay, Tracer Gas, and Others), By Application (Cardiology, Urology, Orthopedics, Minimally Invasive Surgery/General Surgery, Diabetes Care, and Others), By Product Type (Catheters, Blood Devices, Bags, Implantable Devices, Capital Equipment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

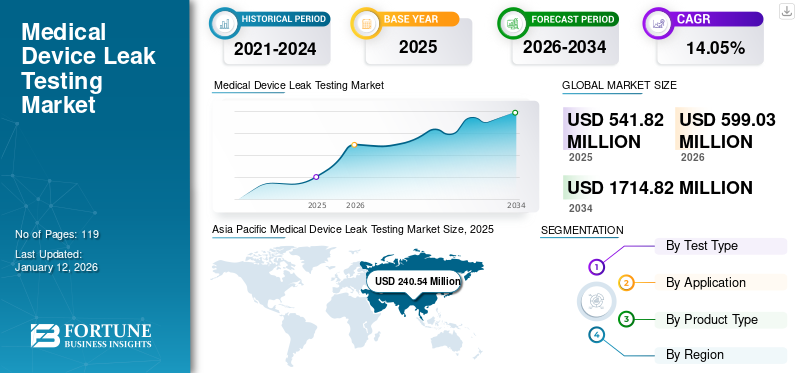

The global medical device leak testing market size was valued at USD 541.82 million in 2025. The market is projected to grow from USD 599.03 million in 2026 to USD 1,714.82 million by 2034, exhibiting a CAGR of 14.05% during the forecast period. Asia Pacific dominated the medical device leak testing market with a market share of 44.40% in 2025.

Medical device leak testing is one of the mandatory tests to detect the leak rate in various medical devices, including catheters, bags, blood devices, implantable devices, and others. There are various types of leak tests available for these medical devices for distinct applications, including cardiology, urology, and orthopedics, among others. Increasing prevalence of chronic conditions resulting in growing diagnosis and treatment rate, further supporting the demand for medical devices in the market. Growing demand for medical devices is further contributing to the increasing number of product launches among key players in the market.

- For instance, in August 2022, ATEQ Leaktesting launched a low-priced, four-channel leak tester that allows to remove one channel for service or calibration and continues to leak test with the remaining channels, with an aim to widen its product portfolio.

Along with this, the increasing focus of key players on mergers and acquisitions among the other prominent players operating in the market to strengthen their presence is expected to spur market growth.

Global Medical Device Leak Testing Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 541.82 million

- 2026 Market Size: USD 599.03 million

- 2034 Forecast Market Size: USD 1,714.82 million

- CAGR: 14.05% from 2026–2034

Market Share:

- Asia Pacific dominated the medical device leak testing market with a 44.40% share in 2025, driven by the growing demand for medical devices, increasing number of minimally invasive surgeries, and rising approvals for technologically advanced medical devices.

- By test type, Pressure Decay is expected to retain its largest market share owing to its distinct advantages such as ease of automation, integration into production processes, and simplicity over other methods.

Key Country Highlights:

- United States: Increasing prevalence of urological and cardiovascular disorders is driving demand for advanced leak detectors, with key players launching innovative leak testing instruments.

- Europe: Rising geriatric population and prevalence of orthopedic disorders are boosting demand for innovative medical devices, thereby fostering leak testing adoption among manufacturers.

- China: Surge in demand for medical devices such as catheters and pacemakers, coupled with increasing product launches, is augmenting the number of leak tests performed in the region.

- Japan: Growing focus on minimally invasive surgical procedures and stringent regulatory mandates for medical device safety are accelerating the adoption of leak testing solutions.

COVID-19 IMPACT

Growing Research Amid COVID-19 Pandemic Had a Positive Impact on Global Market

The COVID-19 outbreak had a positive impact on the market globally. During the pandemic, there was an increase in inpatient and outpatient admissions in hospitals, clinics, and others. Increased patient population resulted in increased demand for certain medical devices, such as bags, blood devices, among others. According to interviews with several key opinion leaders (KOLs), it was reported that there was an increase in the demand for medical devices during the pandemic, resulting in almost threefold increase in the production capacity.

- For instance, in May 2020, Philips announced the doubling of its production capacity for hospital ventilators, and other medical devices to cater the growing demand for these medical devices.

Moreover, the huge demand for medical devices resulted in an increased number of leak tests performed during the pandemic. Additionally, few industry players launched innovative leak detectors with an aim to cater the demand among medical device manufacturers. An increasing number of launches, along with approvals among key players supported the growth of the market for medical device leak testing during the pandemic.

This, along with, the top medical device leak testing product manufacturers, received government orders to increase their leak testing for catheters, and other devices during the pandemic, which aided in the growth of these tests among key players.

- In April 2020, Bexen Medical received an order from the governor of Spain to manufacture sanitary materials, catheters, face masks, and other products, all of which tested with ATEQ leak testers on Mondragon machines.

However, there was a slight decline in demand in 2021 due to bulk purchasing of these devices during the pandemic among hospitals, clinics, and others, which resulted in fewer leak tests being performed in the market.

Medical Device Leak Testing Market Trends

Increasing Number of Regional Service Providers for Medical Device Testing

The demand for medical device leak testing is growing due to increasing stringency of regulatory bodies toward safety and efficacy of these devices. The rising demand for these devices, along with growing outsourcing of these devices to the leak testing service providers is resulting in an increasing number of regional service providers globally.

Additionally, increasing outsourcing for these devices to providers due to the high cost of leak testers' installment, maintenance costs among medical device manufacturers provides economic benefits to manufacturers. Therefore, increasing outsourcing of these devices to leak test service providers is further leading the emergence of key players investing in the market.

- For instance, during our primary research, revealed in a KOL interview, we discovered a shift in the global market landscape. While there were few prominent players initially, the rising demand has led to the emergence of several new companies. Our findings indicate that the robust efforts of these newcomers are supporting significant growth in market shares globally.

Thus, an increasing number of key players investing in the market for medical device leak testing, along with growing number of launches and approvals for innovative leak testers among key players, are expected to spur market growth in the coming years.

Download Free sample to learn more about this report.

Medical Device Leak Testing Market Growth Factors

Increasing Production of Medical Devices Globally to Boost Market Growth

The increasing prevalence of chronic conditions globally is increasing the number of patient admissions resulting in growing diagnosis, and treatment rates among patients. Increasing diagnosis and treatment rate further resulting in the growing adoption of medical devices, such as catheters, pacemakers, ventilators, and others, along with efforts into R&D activities to develop and introduce novel medical devices in the market.

- For instance, according to a 2023 article published by Glasgow Caledonian University, there are around 90,000 people using catheters in the U.K.

Additionally, growing demand for medical devices is driving the focus of key players on expansion of their production facility, further resulting in growing demand for leak testers for these devices in the market.

- For instance, in September 2023, Zeus Company Inc., inaugurated its new catheter production facility in Minnesota with an advanced R&D facility lab to design, develop, and test the catheters.

Moreover, the growing number of users of these medical devices is favoring the rising penetration of these devices, such as catheters, ventilators, and others, among the healthcare settings in both developed as well as emerging countries.

- For instance, according to a blog published by ATEQ Leaktesting, around 275,000 testers of the company’s testers are installed in more than 5,000 customers globally.

Thus, the increasing demand for medical devices, along with the expansion of their production facility among these medical device manufacturers is expected to boost the adoption of leak testing for these devices during the forecast period.

RESTRAINING FACTORS

High Costs Associated with Leak Testing Procedures to Limit Market Growth

Despite the growing demand for leak testing in medical devices globally, certain factors are restricting the growth of the market. Among them are the high costs associated with these procedures, specifically for critical medical devices.

The higher cost associated with medical device leak testing products, including purchasing, installation, and maintenance, among others, is one of the major challenges faced by small and mid-sized medical device manufacturers to procure, install and undergo testing on-site. Also, for large-scale manufacturers, the cost associated with product testing increases owing to their large production volume of these devices, thus expected to hinder the adoption of technologically advanced products, especially in emerging countries.

Similarly, technologically advanced testers providing helium testing, hydrogen testing, among others are expensive, due to which medical device manufacturers stick to the conventional leak test methods, which affects the accuracy and efficiency of medical devices that are tested. Also, medical device manufacturers in many countries tend to test medical devices in batches or samples owing to high costs, leading to less penetration of these testers by small-scale manufacturers.

- For instance, according to ESS Inc., the average cost of air leak testers for endoscopes ranges around USD 270-350.

Therefore, high cost associated with medical device leak testing devices along with challenges associated with leak testing methods, is expected to hinder the adoption of these leak tests for medical devices in the market.

Medical Device Leak Testing Market Segmentation Analysis

By Test Type Analysis

Pressure Decay Segment Leads Due to its Certain Distinct Advantages over Other Methods

By test type, the market is segregated into pressure decay, vacuum decay, tracer gas, and others.

The pressure decay segment held the highest share with an 43.73% in 2026. Simplicity, ease of automation, and easy integration into production/assembly processes, among others, are some of the major factors contributing to segmental dominance. These distinct advantages of the pressure decay method are further resulting in the rising focus of key players to launch products with pressure decay technology to leak test, thus supporting the growth of the segment.

However, the vacuum decay segment is expected to grow at a considerable CAGR during the forecast period. Growing adoption, along with leak testing being a mandated procedure prior to regulatory approval of a product is resulting in growing demand for this method in the market.

The tracer gas segment is also growing due to increasing technological advancements among key players to launch advanced products with hydrogen, and helium leak testing methods among others. This method is further gaining popularity owing to certain factors, including its allowance of testing the enclosed parts under vacuum, among others, thus fueling the growth of the segment in the market.

- For instance, in February 2022, Hokuriku Denki Kogyo developed a hydrogen leak detector sensor with an aim to increase its product offerings for tracer gas leak detectors in the market.

By Application Analysis

Increasing Prevalence of Urological Disorders Supported Urology Segment Expansion

Based on application, the market is segmented into cardiology, urology, orthopedics, minimally invasive surgery/general surgery, diabetes care, and others.

The urology segment accounted for the highest market with a share of 30.52% in 2026. The increasing prevalence of urological disorders requiring catheterization is increasing the number of inpatient and outpatient admissions in hospitals and specialty clinics. Furthermore, increasing patient admissions is also leading to growing diagnosis and treatment rate, further supporting the rising number of launches for medical devices, thus enabling the key players to focus on R&D activities to launch innovative leak test instruments in the market.

The cardiology segment is also growing owing to increasing demand for implantable devices, such as pacemaker, implantable cardioverter defibrillator, among others. This, along with growing adoption of leak tests in these products among medical device manufacturers is expected to spur the demand of novel leak detectors in the market.

- For instance, according to a 2022 article published by National Center for Biotechnology Information (NCBI), it was reported that approximately the number of individuals with implantable pacemakers is around 0.5 to 3.0 million in the U.S.

The orthopedics segment is growing owing to an increasing geriatric population, resulting in a rising patient population suffering from orthopedic disorders, such as osteoarthritis and rheumatoid arthritis, among others. Increasing patient population is further contributing to increasing diagnosis and treatment rate for these diseases resulting in the growing adoption of medical devices, thus contributing to growing number of leak tests being performed among various medical device and pharmaceutical companies.

- For instance, according to a 2022 article published by BioMed Central, it was reported that approximately 400,000 hip arthroplasty procedures are performed each year in China.

Moreover, the minimally invasive surgery/general surgery segment is growing owing to the increasing number of surgical procedures being performed among the patient population. This, along with increasing preference toward minimally invasive surgical procedures among patients is also resulting in a growing number of surgeries, thus contributing to the growth of the segment.

Additionally, diabetes care and other segments are also growing due to increasing diagnosis and treatment procedure rates, resulting in increasing demand for medical devices among patients. This, along with growing focus of key players to launch innovative medical devices that require leak testing prior to approval, is expected to spur the demand for leak tests in these devices, thus contributing to the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

By Product Type Analysis

Catheters Segment Dominated Market Owing to Increasing Product Launches

Based on product type, the market is segmented into catheters, blood devices, bags, implantable devices, capital equipment, and others.

The catheters segment dominated this market with a share of 33.48% in 2026. Increasing focus of medical device manufacturers to launch innovative medical devices, such as catheters and others, is resulting in growing adoption of leak tests. Increasing adoption of leak tests among these medical device manufacturers prior to submitting their product for approval from regulatory bodies, is expected to foster the growth of the segment.

- For instance, in June 2023, Biotronik launched Oscar Multifunctional Peripheral Catheter, intended for dilation of stenotic segments in peripheral vessels.

Blood devices, implantable devices, and bag segments are also growing due to increasing prevalence of cardiovascular, and other disorders, resulting in a growing number of key players launching implantable devices, and bags. Increasing number of launches further supports the growing number of leak tests being performed in these medical devices, thus contributing to the growth of the segment in the market.

- For instance, according to 2023 data published by Centers for Disease Control & Prevention (CDC), it was reported that about 1 in 20 adults aged 20 and older suffers from cardiovascular diseases.

Additionally, capital equipment and other segments are also growing due to increasing admissions for intensive care units leading to increasing demand for medical devices. This, along with increasing demand for ventilators, and other capital equipment within hospitals is also to support the increasing number of leak tests being performed in the market.

REGIONAL INSIGHTS

The global market scope is classified across regions, such as North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Medical Device Leak Testing Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific stood at USD 267.11 million in 2026. The regional dominance is mainly owing to the growing demand for medical devices among patients in this region. This, along with growing number of general and minimally invasive surgical procedures among patients, is resulting in increasing number of launches, and approvals for medical devices, thus increasing the number of leak tests being performed in the market. The Japan market is projected to reach USD 33.42 billion by 2026, the China market is projected to reach USD 156.01 billion by 2026, and the India market is projected to reach USD 9.34 billion by 2026.

- For instance, in June 2022, Medtronic received approval for its product, Micra AV Transcatheter, world’s smallest pacemaker, with an aim to launch technologically advanced pacemaker among the patient population.

North America

North America is also growing owing to the increasing prevalence of certain urological and cardiovascular disorders among patients in the U.S. Along with this, growing demand for innovative leak detectors in the market is driving the focus of key players to launch advanced products in the market. The U.S. market is projected to reach USD 165.05 billion by 2026.

- For instance, in January 2020, Cincinnati Test Systems launched Sentinel 3520 Series with an aim to increase its product offerings for leak and flow test instruments.

Europe

Europe is growing in the market. Some of the factors contributing to growth are increasing geriatric population, prevalence of orthopedic disorders among patients, and others. Increasing prevalence is supporting the growing treatment rate, further increasing demand for innovative medical devices, thus fueling the adoption of leak testing among the medical devices, and pharmaceutical players in the market, thus fostering the growth in this region. The UK market is projected to reach USD 16.46 billion by 2026, while the Germany market is projected to reach USD 49.1 billion by 2026.

Rest of the world

Moreover, the rest of the world is growing owing to increasing research and development activities for medical devices, leading the focus of key players to launch innovative leak detectors in the market. This, along with growing awareness and increasing stringency of regulations for medical device leak testing, is expected to drive the medical device leak testing market growth over the forecast period.

List of Top Medical Device Leak Testing Companies

Increasing R&D Activities Among Major Players is Responsible for the Dominant Share

The current market scenario of the medical device leak testing industry is semi-consolidated, with a few prominent players operating in the market with a robust and diversified product portfolio. Increasing product launches and approvals, along with strong focus on Cincinnati Test Systems to expand its geographical reach to developing countries, is anticipated to support the growing share in the market.

- For instance, in March 2021, Cincinnati Test Systems established state-of-the-art manufacturing facility to the TASI product integrity with an aim to expand its geographical reach in India.

Also, increasing efforts of certain other players, such as ATEQ Leaktesting to manufacture and introduce innovative leak detectors in the market to expand their product offerings. This is expected to foster their global medical device leak testing market share during the forecast period.

Moreover, few other players, such as InterTech Development Company, Zaxis Inc., among others, are also growing owing to their robust and diversified product portfolio for medical device leak detectors, along with increasing focus on acquisitions, and collaborations among key players, contributing to the growth of the market globally.

List of Top Medical Device Leak Testing Companies:

- ATEQ Leaktesting (U.S.)

- Zaxis Inc. (U.S.)

- FasTest (U.S.)

- InterTech Development Company (U.S.)

- Uson, L.P. (U.S.)

- Pfeiffer Vacuum GmbH (Germany)

- Cincinnati Test Systems (U.S.)

- LACO Technologies (U.S.)

- Alliance Concept (France)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Uson, L.P. partnered with PAC, one of the leading global manufacturers of analytical instruments for laboratories and online process applications with an aim to serve their distinct customer segments, along with focusing on delivering new products.

- May 2022: Pfeiffer Vacuum GmbH established a new leak detection and vacuum technology facility in Indianapolis, Indiana with an aim to strengthen its leak detection capabilities.

- September 2021: Cincinnati Test Systems updated its Sentinel Blackbelt with new features, with an aim to create the most powerful and multi-functional single-channel benchtop leak tester in the market.

- May 2021: ATEQ Leaktesting partnered with Acro Engineering, expert in equipment and process validation, industrial automation and design of medical equipment with an aim to expand its reach to Central America.

- February 2020: Cincinnati Test Systems integrated its TracerMate II Leak test instrument into a portable test system with an aim to tackle the most challenging microleak test including HVAC and refrigeration systems.

REPORT COVERAGE

The global medical device leak testing market report provides a detailed market overview and market segmentation on the basis of test type, application, and product type and focuses on key aspects such as company profiles, SWOT analysis, and applications. Besides this, it offers insights into the market dynamics, trends and highlights strategic market growth analysis. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.05% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Test Type

|

|

By Application

|

|

|

By Product Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 599.03 million in 2026 to USD 1,714.82 million by 2034.

In 2025, Asia Pacific stood at USD 240.54 million.

The market will exhibit steady growth at a CAGR of 14.05% during the forecast period (2026-2034).

Based on test type, the pressure decay segment is leading the market.

The increasing R&D activities, growing number of product launches, technological advancements, are some of the key drivers of the market.

ATEQ Leaktesting, Cincinnati Test Systems, and InterTech Development Company, among others, are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us