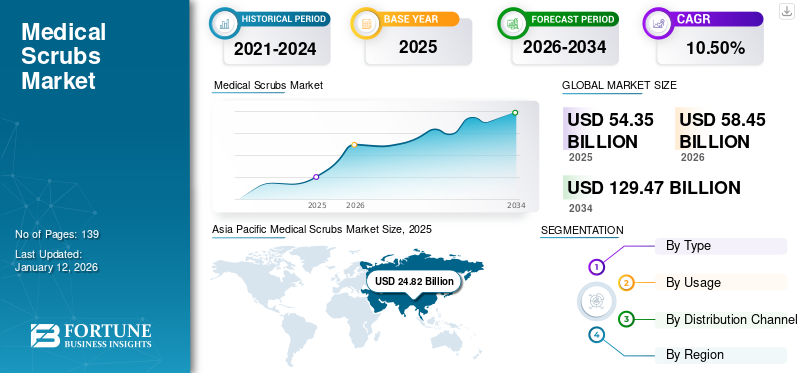

Medical Scrubs Market Size, Share & Industry Analysis, By Type (Medical Uniforms and Nursing Scrubs), By Usage (Disposable and Reusable), By Distribution Channel (Business-to-Consumer (B2C) [Online, and Retail Store], and Business-to-Business (B2B), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global medical scrubs market size was valued at USD 54.35 billion in 2025. The market is projected to grow from USD 58.45 billion in 2026 to USD 129.47 billion by 2034, exhibiting a CAGR of 10.50% during the forecast period. Asia pacific dominated the medical scrubs market with a market share of 45.67% in 2025.

Medical scrubs are protective garments designed to be worn by healthcare professionals, such as physicians and nurses, among others. The garment was originally a gown but now it includes the shirts, pants, jumpsuits, jackets, and caps worn by those who prepare for surgery. These medical garments are an essential part of infection control in the healthcare industry. As healthcare workers come into contact with a variety of germs and microorganisms daily, they must have protective clothing that can act as a barrier against these pathogens.

Furthermore, the market is fragmented with the presence of key players, such as FIGS, INC., O&M Halyard, Superior Group of Companies, and BARCO UNIFORMS, among others. Several market players started enhancing their brand image and customer accessibility by introducing community initiatives and opening new physical stores globally.

-01.webp)

- For instance, in April 2024, FIGS, INC. revealed that it recycled over 40,000 scrubs from healthcare professionals through a recycling initiative (“Scrubs That Don't Suck”) to celebrate Earth Month.

Furthermore, healthcare agencies and governing bodies in various countries are focusing on improving the healthcare infrastructure, with the aim of providing at-par healthcare facilities to patients. These efforts resulted in the rapid expansion of the healthcare resources and personnel in these countries. This rapid increase in the number of healthcare professionals is further associated with the rise in demand for medical clothing.

The surgical scrubs are essential attire for healthcare professionals such as surgeons, support staff, nurses, operating room technicians, and anesthesiologists in the operating theater. an increasing number of surgical procedures, which is anticipated to enhance the usage and demand for medical apparel.

- For example, as per the data provided by the World Bank Group, the number of surgical procedures (per 100,000 population) in Germany was 12,188 in 2012, which increased to 19,124 in 2022.

Global Medical Scrubs Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 54.35 billion

- 2026 Market Size: USD 58.45 billion

- 2034 Forecast Market Size: USD 129.47 billion

- CAGR: 10.50% from 2026–2034

Market Share

- By Type: Medical uniforms held the largest market share in 2024, fueled by increased surgical procedures and a focus on preventive care in hospitals. Nursing scrubs also gained notable traction, driven by expanding global nursing staff and growing investments in medical attire in emerging markets.

Key Country Highlights

- Japan: Rapid innovation in medical apparel, such as anime-inspired scrub designs and antimicrobial fabric, is supporting market growth. Collaborations like Classico Inc.’s "YOUR HERO" collection have elevated brand visibility.

- United States: Strong demand for stylish, functional, and antimicrobial scrubs is driving the market. Key players like FIGS, BARCO UNIFORMS, and Kindthread continue to innovate and expand retail presence. The B2C channel is surging due to increased online sales and new store openings.

- China: Medical apparel production is booming, offering low-cost scrub options globally. However, lack of reimbursement policies leads to high out-of-pocket expenses, creating a parallel market for used scrubs via platforms like “Made in China.”

- Brazil: With healthcare spending accounting for 9.1% of GDP and over 6,600 hospitals, Brazil presents strong demand. Continued expansion of healthcare personnel supports consistent market growth.

- United Kingdom: NHS policies for standardized uniforms and active overseas nurse recruitment are fostering demand. Contracts with firms like Alsico UK support large-scale distribution of scrubs.

MARKET DYNAMICS

Market Drivers

Increasing Hospital Admissions and Surgical Procedures is Projected to Boost Product Demand

The increasing number of hospital admissions resulting from the increasing elderly and unwell population is fueling the need for medical clothing among healthcare workers. Furthermore, the rising number of inpatient admissions due to chronic and acute illnesses has resulted in a corresponding rise in the total number of surgical interventions conducted globally.

- For instance, as per the data provided by the National Center for Biotechnology Information (NCBI) in April 2022, around 13.7 million adults aged 65 and older are admitted to hospitals each year in the U.S. Of these, 67.0% of admissions are due to medical issues, 25.0% for surgical procedures, and 6.0% for injuries.

Furthermore, the rise in surgical procedures has amplified the need and utilization of medical scrubs in healthcare settings. In an operating room, surgical scrubs are essential for surgeons and assisting personnel, such as nurses, circulating nurses, O.T. technicians, anesthesiologists, and others.

- For instance, in November 2022, the National Health Service (NHS) revealed that between 2021 and 2022, 35.0% of babies were delivered by cesarean. Additionally, the NHS initially put a cap on C-sections, aiming to limit them to around 20% of all deliveries. However, according to an article published by Russell-Cooke LLP in March 2022, the NHS scrapped the limit on C-section numbers, reflecting the increasing number of surgeries.

Thus, the increasing surgical procedures and number of hospital visits are expected to increase the consumption of medical apparel during the forecast period.

Rapidly Developing Healthcare Infrastructure and Increasing Number of Healthcare Professionals in Emerging Countries to Augment Market Growth

Emerging countries, including India, China, Brazil, and other Southeast Asian and Middle Eastern countries, are focusing on improving the healthcare infrastructure. The aim is to provide high-quality healthcare facilities that will lead to a rise in medical tourism.

According to the International Trade Administration report released in March 2023, Brazil played a crucial role in the Latin American healthcare sector by allocating approximately 9.1% of its GDP toward healthcare. During this period, the nation possessed 6,642 hospitals featuring 532,645 beds, 88,000 additional healthcare services, 502,000 doctors, and 331,000 dental professionals.

A rise in healthcare spending is expected to fuel the development of new healthcare establishments, increasing the demand for medical clothing, thus aiding market growth.

- For instance, as per the data provided by Al Arabiya in June 2023, Saudi Arabia will need an additional 175,000 doctors, nurses, and other healthcare workers by the end of 2030 to tackle shortages and meet the healthcare requirements of its growing population.

Rising Hospital-acquired Infections Boosting Adoption of Antimicrobial Scrubs

The increasing use of medical uniforms and scrubs by healthcare institutions globally to prevent infection and cross-contamination is the major factor driving market growth. Moreover, several market players have started integrating antimicrobial technology into medical scrub fabric to assist healthcare providers in decreasing hospital-acquired infections.

- For example, in October 2022, Ouragins, a company specializing in medical apparel, reinvented its medical scrub material using its ThreadFusion technology, an antimicrobial technology. This technology enabled the integration of Copper into the medical scrub material, which demonstrated the ability to eliminate 99.0% of germs within 2 hours of touching the scrub surface.

Market Restraints

Lack of Reimbursement is Hindering Market Growth

The adoption of medical clothes in healthcare settings is rising due to the growing incidence of Hospital-Acquired Infections (HAIs) and the availability of functional scrubs. Nonetheless, the higher cost of stylish and practical medical attire leads to greater personal expenditure for healthcare personnel. The notable rise in the use of surgical scrubs in hospitals to prevent Hospital-Acquired Infections (HAIs) has majorly contributed to its increased cost.

In nations such as the U.S., Canada, the U.K., Germany, France, and Australia, reimbursement policies help offset these costs.

- For example, as per an article published by Happythreads LTD. in May 2022, in Ireland, nurses can claim up to USD 1,264, and doctors can claim USD 1,199 tax back on uniforms over four years.

However, such reimbursement policies are still lacking in developing countries such as China, India, Brazil, Indonesia, and Africa. This leads to increasing out-of-pocket spending by healthcare workers and has increased the demand for used scrubs and medical clothing in these countries.

- For instance, large e-commerce platforms are selling used nursing scrubs, which is a cost-effective option for buyers but comes with multiple disadvantages, such as infection risk, contamination potential, and non-compliance with regulations. “Made in China” is an e-commerce platform that sells used products in China.

- In India, Etsy is an e-commerce platform that sells used scrub suits.

Other Restraining Factor

- Competition from Alternative Workwear: The presence of alternative options for surgical scrubs, such as lab coats and disposable gowns, affects the market share of scrubs in the medical apparel industry.

Market Opportunities

Growing Adoption of E-Commerce Platforms for Medical Purchases to Generate Opportunities for Market Players

The market observes a growing need from medical professionals for medical scrubs with advanced features such as antimicrobial and moisture-wicking properties. This rising demand presents significant opportunities for market players by leveraging online sales channels. Moreover, branded uniforms contribute to fostering a positive organizational culture and identity. Online sales provide healthcare professionals with easier and more direct access to medical apparel, including scrubs, which is convenient and is anticipated to fuel market growth throughout the forecast period.

- For instance, in May 2021, BARCO UNIFORMS revealed the opening of BarcoMade.com, its e-commerce website. This online store simplifies the process for busy healthcare workers to purchase and discover more about their preferred Barco scrubs rather than visiting physical stores.

Market Challenges

Hazardous Effects of Scrubs on Environment is Considered as a Major Challenge for Market Players

The medical scrubs market faces several challenges, such as environmental concerns associated with microplastics. Regular washing of scrubs may result in microplastics contaminating water systems, potentially impacting sales if left unaddressed.

- For instance, as per the data provided by ETHOS in November 2022, the need for frequent washing due to work requirements positions scrubs as one of the top contributors to microplastic pollution throughout their life cycle and disposal phase.

The growing availability of low-cost scrubs manufactured overseas has been heightening price competition among industry competitors. Moreover, stringent rules surrounding fabric fluid resistance and infection control standards further restrict the possibilities for innovation in scrub designs.

- For example, various Chinese wholesale companies and online platforms, such as Apparelnbags, are selling medical uniforms, including scrubs, at lower prices. The scrub uniforms available at the Apparelnbags platform range from USD 8.0 to 12.0.

Other Market Challenges

The scrubs market faces several challenges due to price sensitivity and lack of standardization, which can significantly affect manufacturers, suppliers, and healthcare institutions.

In regions with restricted healthcare budgets, institutions often prioritize purchasing lower-cost scrubs to meet their budgets, which can lead to a compromise in quality. For instance, a public hospital in a low-income area might opt for inexpensive, low-quality scrubs to save costs.

The lack of standardized requirements in certain regions can lead to regulatory challenges, making it difficult for manufacturers to ensure compliance with varying local standards. This may result in legal challenges or the need for costly adjustments. Also, without standardization, manufacturers may struggle to establish credibility and trust in the market.

MEDICAL SCRUBS MARKET TRENDS

Increasing Focus of Market Players to Develop Fashionable Products to Propel Market Expansion

Medical students, physicians, nurses, and other healthcare personnel require various medical clothes that are perfect in design, appearance, comfort, and safety while fulfilling all necessary criteria. To cater to this demand, numerous companies are introducing trendy and innovative product lines featuring greater variety and style.

Along with the emphasis on incorporating trending fashion into medical apparel, manufacturers are also adding essential parts to the scrubs, such as multiple pockets, which makes them more functional.

- For example, in February 2023, Fabletics, Inc. introduced Fabletics Scrubs, a line of activewear scrubs aimed at healthcare workers in the medical clothing industry. The company created this scrub based on information from approximately 6,500 healthcare experts. The company distributed around 25,000 scrub sets to healthcare professionals in the U.S. as part of the launch.

Additionally, several market players are emphasizing the launch of fancy medical scrub suits for healthcare professionals.

- For example, in July 2024, Simply Scrubs started providing animated animal-printed scrub suits, shirts, and pants for healthcare professionals across South Africa.

Furthermore, increasing partnerships among market players for the development of advanced and more fashionable medical clothing products are some of the latest trends expected to boost market growth in the future.

Other Market Trends

Fashion-forward Designs: The growing demand for stylish and customizable scrubs among healthcare professionals is considered an important market trend.

- For example, companies such as Febris have a strong focus on providing customizable logos on scrub shirts.

Sustainability and Eco-Friendly Materials: There is an increasing preference for scrubs made from recycled textiles and organic substances. Most market players initiated strategic collaborations to manufacture new medical apparel from recycled old ones.

- For example, in April 2024, FIGS, INC. announced its partnership with RoadRunner, a company offering contemporary waste and recycling solutions, to recycle used scrubs and transform them into new products.

Various market players have started utilizing antimicrobial and moisture-wicking fabrics to manufacture medical apparel. Additionally, companies have also started selling medical apparel on e-commerce platforms to provide customers with a wide range of options at competitive pricing.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic had a positive impact on the market in 2020. Due to the increased cases of COVID-19 infection several healthcare professionals focused on the adoption of hygiene practices to prevent the spread of disease. The antimicrobial properties of scrub suits played an important role in protecting healthcare professionals against pathogens during the pandemic.

The market witnessed substantial growth in 2021, driven by increasing collaborations between industry players. For example, in February 2021, Superior Group of Companies announced its collaboration with SanMar Corporation via its healthcare apparel line, WonderWink.

The increasing efforts by market players, including strategic acquisitions, partnerships, and new product launches, positively influenced the market in FY 2022 and 2023.

- For example, in September 2022, BARCO UNIFORMS partnered with Skechers to introduce Skechers by Barco, a special limited edition collection of medical clothing, in honor of Breast Cancer Awareness Month. The partnership aims to inspire hope and provide assistance to those impacted, incorporating the involvement of healthcare professionals.

Furthermore, the market is expected to grow at an accelerated pace in the coming years due to the increasing number of surgical procedures across the globe.

SEGMENTATION ANALYSIS

By Type

Medical Uniforms Segment Dominated Due to Rise in Surgical Operations

Based on type, the market is categorized into medical uniforms and nursing scrubs.

The medical uniforms segment captured the largest share 84.20% in 2026 as a result of healthcare professional’s increased emphasis on preventive care. The increasing hospitalization rates and the rise in surgical operations are boosting the need for medical uniforms. Moreover, a heightened emphasis on preventive care by healthcare professionals and the rapid advancement of healthcare infrastructure are the primary factors boosting the adoption of medical uniforms and the growth of this segment.

- For instance, as per the data provided by the World Bank Group in October 2024, the number of surgical procedures (per 100,000) performed in Canada was 6,128 in 2021.

On the other hand, the nursing scrubs segment accounted for a considerable market share in 2024. The growth of the segment is mainly attributed to the rapidly developing healthcare infrastructure, the rising global nursing workforce, and the growing focus on medical attire in developing nations. These factors are influencing the growing need and acceptance of medical and nursing scrubs.

- For instance, in April 2023, the U.K. Swansea Bay University Health Board (SBUHB) located in Wales announced that it would recruit 900 nurses from abroad over the next 4 years to fulfill the shortage.

- Additionally, according to a report published by the Nursing and Midwifery Council in May 2022 revealed that the Nursing and Midwifery Council’s register has grown by 96.7%. The increase is from 26,403 to 758,303, which includes nearly 705,000 nurses, over 40,000 midwives, and nearly 7,000 nursing associates.

The increasing initiatives by market players to introduce new collections of medical apparel are supplementing segmental growth during the forecast period.

- For example, in April 2024, Fabletics introduced its scrubs collection in the U.K. market after a successful debut in the U.S.

To know how our report can help streamline your business, Speak to Analyst

By Usage

Reusable Segment Led due to Its Cost Efficiency and Strength

On the basis of usage, the market is divided into disposable and reusable.

The reusable segment dominated the global market share 96.82% in 2026 and is expected to grow at the highest CAGR during the forecast period. The dominant share is primarily attributed to the significant adoption of reusable nursing scrubs by healthcare practitioners owing to their unique advantages over disposable ones. This includes cost efficiency, strength, and lifespan, which leads to a reduced environmental footprint and improved sustainability.

This growth is further supported by market players’ emphasis on launching innovative reusable medical apparel, aiding the segment's growth during the forecast period.

- In November 2021, Livinguard introduced a clothing line featuring permanent self-disinfecting scrubs, and underscrubs, made with its EPA-registered bacteria-eliminating fabric. These products consistently eliminate bacteria and are hypoallergenic and gentle on the skin while preserving their effectiveness through multiple washes.

The disposable segment is expected to grow at a considerable CAGR from 2025-2032 as disposable medical scrubs provide clinical benefits, such as its ability to prevent cross-contamination. The adoption of disposable scrubs results in lower operational expenses linked to reusable options.

Furthermore, the use of electrospinning technology in the manufacturing of nonwoven polymer fibers has enhanced comfort and provided better protection against fluids and pathogens in healthcare environments. The improved comfort and safety offered by this technology have made disposable scrubs a favored option for healthcare professionals.

- For example, as reported by KNYA in June 2022, disposable scrubs represent a significant investment for doctors, nurses, or other healthcare workers. This is due to their comfort and superior fabric that enables them to be worn for extended periods.

By Distribution Channel

Business-to-Business (B2B) Segment Led Fueled by Growing Collaborations Between Companies and Healthcare Facilities

Based on distribution channel, the market is divided into Business-to-Consumer (B2C) and Business-to-Business (B2B). The Business-to-Consumer (B2C) segment is further sub-segmented into online and retail store.

The Business-to-Business (B2B) segment dominated the market by accounting for the major global medical scrubs market share in 2024. The presence of prominent companies that tie up with healthcare institutions and universities to provide medical uniforms is expected to boost the segment’s growth in the coming years.

- For instance, in October 2024, Medline Industries, LP partnered with Kaweah Health, a California-based hospital, to provide medical and surgical supplies in a multi-year prime vendor agreement, aiming to increase operational efficiency. The medical supply includes surgical scrubs and other healthcare apparel.

The Business-to-Consumer (B2C) segment is expected to grow at the highest CAGR from 2025-2032. The B2C segment includes online and retail stores. The growth of the segment is mainly attributed to the increasing focus of major players on opening new retail stores to expand their product sales and enhance their market presence.

- For instance, in May 2024, FIGS, INC. launched a new "Extremes" collection with advanced fabrics and higher prices, accompanied by a campaign featuring healthcare professionals in extreme environments. The brand is also expanding its physical presence with plans to open a second store, maintaining control over its brand experience by avoiding wholesale partnerships.

MEDICAL SCRUBS MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Medical Scrubs Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 24.82 billion in 2025 and USD 27.15 billion in 2026. This region held the largest market share due to the expanding healthcare sector. The region is projected to sustain its dominance owing to the growing focus of market players on the development of innovative medical clothing products. The enhanced manufacturing abilities of the medical textile sector in the area at an affordable price have significantly contributed to the region’s market expansion. These abilities enabled manufacturers to launch their products on a global scale. The Japan market is projected to reach USD 6.96 billion by 2026, the China market is projected to reach USD 7.05 billion by 2026, and the India market is projected to reach USD 3.28 billion by 2026.

- For instance, in May 2022, Medikabazaar, a leading B2B platform in India, launched NEXAGE, a high-end scrub brand for contemporary healthcare professionals in the nation. The scrubs are available in various colors and fabric types for healthcare professionals.

Additionally, the growing strategic collaborations among market players for the development and launch of new medical apparel are further driving market growth in Asia Pacific.

- In November 2024, Classico Inc. launched a collaboration with Ultraman Tiga to create scrub tops and pants, embodying the concept of "YOUR HERO" and aiming to empower healthcare professionals. These scrubs, designed to inspire both doctors and patients, are available at Classico stores.

North America

North America accounted for a considerable share of the market in 2024 due to the presence of advanced healthcare infrastructure in this region. The region’s medical scrubs market is expected to continue growing throughout the forecast period, driven by the high adoption rate of medical apparel among healthcare professionals in the U.S. and Canada. The U.S. market is projected to reach USD 8.28 billion by 2026.

In addition, the growing demand for nursing scrubs with enhanced functionality has created business opportunities for new market entrants in the U.S. To bolster their market presence, numerous companies are focusing on the launch of innovative products with distinctive designs, aiding in market expansion in the U.S.

- For example, in August 2023, Kindthread announced the launch of White Cross CRFT, a new collection of scrubs suits in the U.S. market.

Europe

Europe held a moderate market share in 2024 owing to the increasing strategic alliances between surgical scrubs distributors and government authorities for the distribution of medical uniforms in healthcare facilities. The introduction of national healthcare uniform projects, which promote cultural sensitivity and standardize clinical uniforms, is also contributing to the market growth in the region. The UK market is projected to reach USD 1.7 billion by 2026, and the Germany market is projected to reach USD 3.71 billion by 2026.

- For example, in February 2023, Alsico UK, the workwear manufacturer in the U.K., received a national healthcare uniform contract. As per this contract, the company would provide standardized medical uniforms to the National Health Service (NHS) staff working in clinical roles in England.

The implementation of policies for the reimbursement of protective equipment in the region has contributed to the growing adoption of medical apparel, including scrubs. In addition, the growing emphasis by market players on infection control strategies through the provision of antimicrobial medical apparel is driving market growth in this region.

Latin America and Middle East & Africa

The medical scrubs market in Latin America and the Middle East & Africa is expected to grow at a steady growth rate throughout the forecast period. The market growth in these regions is largely attributed to the developing healthcare infrastructure and the growing number of healthcare professionals.

Additionally, the enforcement of regulations mandating scrub suits as uniforms is another significant factor driving market growth.

- For example, according to an article released by justneedles.ae in March 2023, Dubai's medical professionals adopted a standard policy that mandates scrub suits as their uniform. Certain hospitals have enforced stringent regulations regarding their identity colors, whereas others have permitted staff to select their hues.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Focus on Opening New Stores to Enhance their Product Offerings

The market consists of key companies such as FIGS, INC., Superior Group of Companies, and V.F. Corporation, among others, offering a wide range of reusable and disposable scrubs. These players hold a significant share as they are focused on opening new physical stores to enhance their product offerings.

- In September 2024, FIGS, INC. opened its second retail store, the Rittenhouse Community Hub, in Philadelphia to enhance its customer reach by offering medical apparel, including surgical scrubs.

Moreover, BARCO UNIFORMS, Febris, Classico Inc., Kindthread, and other players are focusing on various strategic initiatives, such as the opening of new stores and product launches.

- For example, in November 2024, Classico Inc. opened an official online store for individual customers and teams in Malaysia, Thailand, Singapore, and Hong Kong, allowing Classico's innovative scrubs, nurse uniforms, medical coats, and more to be delivered directly to medical professionals in more countries and regions.

List of Key Medical Scrubs Companies Profiled

- FIGS, INC. (U.S.)

- O&M Halyard (U.S.)

- Superior Group of Companies (U.S.)

- BARCO UNIFORMS (U.S.)

- V.F. Corporation (U.S.)

- Kindthread (U.S.)

- ANSELL LTD. (Australia)

- Medline Industries, LP (U.S.)

- Cardinal Health (U.S.)

- Mölnlycke Health Care AB (Sweden)

- Classico Global (Japan)

KEY INDUSTRY DEVELOPMENTS

- July 2024 - FIGS, INC. sponsored medical apparel for the U.S. healthcare medics and professionals from 26th July to 11th August 2024 during the Olympic and Paralympic Games in Paris. Each volunteer received a kit containing red, white, and blue scrubs, a jacket, a jumpsuit, and accessories to wear throughout the games.

- February 2023 - TAARA, an online retailer, introduced a line of high-quality, sustainable scrubs tailored for healthcare professionals. These scrubs are crafted from bluesign-approved fabric derived from recycled materials and adhere to Oeko-tex standards.

- December 2022 - FIGS, INC. initiated an Ambassador Program, which aided them in forming business relationships with healthcare professionals.

- October 2022 - Kindthread relaunched its premier retail company, Scrubs & Beyond, featuring a newly enhanced website and new in-store offerings.

- May 2022 - Classico, a medical apparel brand in the U.S., launched "Scrub Canvas Club, “a new line of surgical scrubs designed with Pokemon characters. These scrubs are reusable and made from twill-weave fabric with anti-static threads woven into the backside.

REPORT COVERAGE

The global medical scrubs market analysis report provides a detailed competitive landscape and market insights. It focuses on key aspects such as competitive landscape, type, usage, distribution channel, and region. In addition to the global medical scrubs market size, it offers insights into the market drivers, trends, COVID-19 impact, and other key insights. Furthermore, this report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.50% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Usage

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 58.45 billion in 2026 and is projected to reach USD 129.47 billion by 2034.

In 2025, the market value stood at USD 24.82 billion.

The market will exhibit steady growth at a CAGR of 10.50% during the forecast period (2026-2034).

By type, the medical uniforms segment led the market.

Increasing hospital admissions and surgical procedures, rapidly developing healthcare infrastructure, and rising hospital-acquired infections are the key driving factors of the market.

FIGS, INC., Superior Group of Companies, and V.F. Corporation are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us