MENA Retail Market Size, Share & Industry Analysis, By Product (Food, Beverage, & Grocery, Apparel & Accessories, Personal Care & Healthcare, Home Care, Home Décor & Furniture, Consumer Electronics & Household Appliances, and Others), By Retail Channel (Supermarket/Hypermarket, Convenience Stores, E-Commerce, and Others), By Type of Retail Format (Store Chains and Independent Stores), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

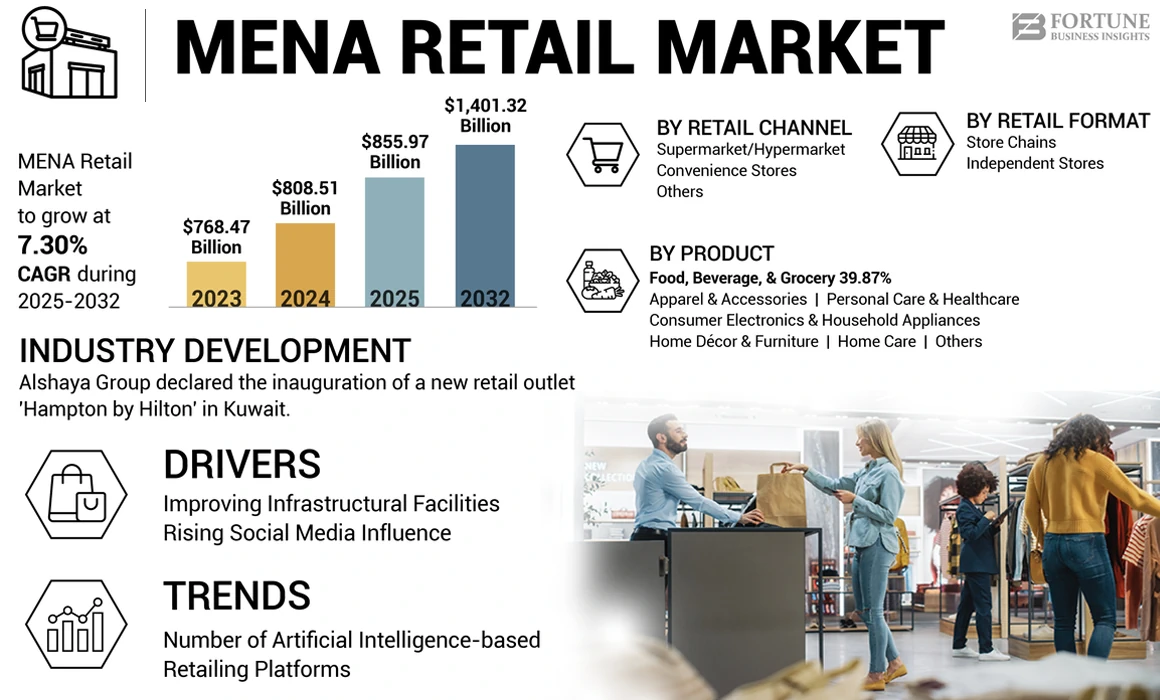

The MENA retail market size was valued at USD 808.51 billion in 2024. The market is projected to grow from USD 855.97 billion in 2025 to USD 1,401.32 billion by 2032, exhibiting a CAGR of 7.30% during the forecast period.

The Middle East and North Africa (MENA) retail industry is a diverse and dynamic sector influenced by cultural, economic, and technological factors. This region includes a wide range of economies, from the wealthy Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia to developing economies such as Egypt and Morocco.

The increasing adoption of technological upgrades, combined with striving government plans and regulations, are all contributing to a highly attractive MENA retail sector. For instance, in 2022, Amazon Web Services (AWS) expanded its base in the Middle East region by bringing new infrastructure development to the UAE. This new region service focused on providing local consumers more choice and flexibility to utilize advanced cloud technologies to run their workloads and secure data locally, along with serving end users with even lower latency.

The COVID-19 pandemic presented numerous supply chain challenges for the MENA retail market, disrupting global trade, causing supply shortages, and impacting logistics operations. The pandemic disrupted manufacturing operations and raw material supplies in many MENA countries, leading to shortages of products and services. Middle East retailers experienced difficulties sourcing essential goods such as personal protective equipment (PPE), cleaning supplies, and medical devices, as well as non-essential items such as electronics, apparel, and home goods. Furthermore, lockdowns, travel restrictions, and border closures disrupted transportation networks and logistics operations, causing delays in shipments and increased transportation costs.

MENA Retail Market Trends

Increasing Number of Artificial Intelligence-based Platforms to Favor Market Expansion

Al-based shopping platforms track customer purchasing patterns & behavioral insights and provide custom product recommendations to platform users. An increase in the number of shopping platforms enabled with Al and VR technologies, providing streamlined and personalized shopping experiences to customers, favors product demand across the region. Furthermore, governmental support in the development of technologically enabled warehouses to help market players optimize their inventory operators creates newer business growth opportunities in the Middle Eastern region.

For instance, in February 2023, The Saudi Authority for Industrial Cities and Technology Zones (Modon) signed a public-private sector partnership (PPP) agreement to establish, develop, and operate 14 smart warehouses in Jeddah, Saudi Arabia.

Download Free sample to learn more about this report.

MENA Retail Market Growth Factors

Improving Infrastructural Facilities to Fuel Market Growth

The rising number of grocery stores offering diverse categories and price ranges of consumer products drives product consumption and favors the MENA retail market growth. Moreover, governmental financial support in the development of the infrastructural facilities will increase the number of shops, increasing the MENA retail market share during 2024-2032. Furthermore, a growing number of home décor and furniture shops providing luxury products and emerging home décor product replacement trends drive product sales regionwide.

For instance, in 2024, Apparel Group, a Middle Eastern apparel company, expanded its presence in the Middle East by opening 19 new stores in India, UAE, KSA, and Qatar.

Rising Social Media Influence to Trigger Product Demand

The rising influence of social media on consumers significantly boosts the demand for consumer products in the MENA region. Social media platforms, such as Facebook, Instagram, YouTube, and others, have become powerful tools for sharing compelling images, stories, and videos that highlight the benefits of the usage of consumer goods. Growing social media penetration is likely influence customers to purchase products from shops, favoring the market growth during 2024-2032. According to a journal published by the University of Maine on Social Media Statistics in 2023, there are 4.8 billion users of social media, which accounts for 59.9% of the global population and 92.7% of all internet users worldwide.

RESTRAINING FACTORS

Supply Chain Costs to Increase Product Prices and Limit Consumer Spending

Industry stakeholders face challenges in supplying raw material/finished/semi-finished goods or services due to the incidences of war, poor infrastructural facilities, and lack of transportation facilities in the North Africa and Middle East regions. These incidents incur additional supply chain costs to product manufacturers and distributors, forcing companies to increase the food and grocery product prices to maintain business revenues. Escalating grocery product prices could further lead to a decline in consumer discretionary spending, restraining the market growth.

MENA Retail Market Segmentation Analysis

By Product Analysis

Food, Beverage, & Grocery Segment led due to Rising Demand for Organic and Sustainable Food & Beverages Products

By type, the market is segmented into food, beverage, & grocery, apparel and accessories, personal care and healthcare, home care, home décor and furniture, consumer electronics and household appliances, and others.

The food, beverage, & grocery segment dominated the market in 2023 owing to the rapidly growing population, leading to higher food consumption levels across the country. The segment's growth is also being driven by increasing food service distributors’ provision of natural, vegan, and sustainable ingredient-based food & beverage products through their channels. In addition, increasing consumer preference for organically made healthy food items favors the segmental growth across the Middle Eastern region.

The consumer electronics & household appliances segment is expected to grow significantly during the forecast period owing to the rising adoption of innovative and user-friendly consumer electronic items, including smartphones, smartwatches, and laptop devices, coupled with a growing product replacement trend accelerating consumer electronic segmental revenues across MENA region. In addition, an increasing number of specialty electronics stores offering discounted consumer products & home appliances are driving product consumption across the region. For instance, in August 2023, Hisense International, a global home appliances company, expanded its presence by opening two production facilities, three flagship stores, and newer offices in the Levant, GCC, and North African geographies.

To know how our report can help streamline your business, Speak to Analyst

By Retail Channel Analysis

Supermarket/Hypermarket Segment led the Market due to Emerging Trend of Impulse Buying of Products among Consumers

Based on retail channel, the market is segmented into supermarket/hypermarket, convenience stores, e-commerce, and others.

The supermarket/hypermarket segment dominated the global market share in 2023 owing to the higher consumer demand for food & beverage and grocery products in supermarket stores across the Middle East and North Africa, including ShopRite, Carrefour Group, and LuLu Group International. Furthermore, the increasing trend of impulse buying of grocery products from supermarkets and growing trend of stockpiling of consumer goods among Middle Eastern households drives supermarket/hypermarket segment revenues across the region.

Attractive discounts accelerates product sales, notably through online shopping. The e-commerce segment is growing rapidly owing to the increasing need for industry participants to enhance the customer experience by offering a broad spectrum of product categories. Prospective industry participants will emphasize e-commerce sales to stay competitive over the forecast period.

The others segment is expected to witness significant growth during the forecast period. Other segments cover the market analysis of various distribution channels, including chain stores, pharmacies, and discounted stores. Price-conscious consumers prefer buying personal care products at discounted prices. Increasing inflation in the Middle Eastern economies and growing consumer preference for cost-effective beauty products are the factors driving product demand at discount stores. The availability of an extensive portfolio of personal care products at mass merchandising shops is supporting product sales in these settings.

By Type of Retail Format Analysis

Independent Stores Segment Dominated due to Increasing Number of Stores

Based on type of retail format, the market is segmented into store chains and independent stores.

The independent store's segment dominated the market share in 2023 owing to the increasing number of independent stores in these countries supporting the sales of consumer products in these countries, driving the growth of independent stores segment. According to the USDA Foreign Agricultural Services, the number of bakalas (independent stores) in Saudi Arabia increased to around 40,000 in 2021, 4.1% up over 2016.

The store chains segment is also expected to witness noteworthy growth in the coming years. This is owing to the increasing number of store chains and franchising firms operating in the MENA retailing industries, driving product consumption from these store chains in the region. For instance, in June 2023, Carrefour Group, a French supermarket chain, launched 50 new stores in Israel. Other supermarket chains, including Spar (The Netherlands) and 7-Eleven (U.S.), also expanded their presence in Israel.

Country Insights

The MENA market covers various countries, including Saudi Arabia, UAE, Qatar, Kuwait, Egypt, and Algeria.

The market can be characterized by a mixture of advanced technology adoption and a more profound indulgence of local consumer behaviors and preferences. MENA retailers are likely to diversify their offerings to include a more comprehensive array of goods and services, including those tailored to local preferences and cultures. Moreover, retailers are expected to increasingly localize their operations to cater to the specific tastes and preferences of the MENA market. For instance, in September 2023, Louis Philippe, a premium menswear brand under Aditya Birla Group, an Indian multinational conglomerate, expanded its brand presence in the Middle East region with the inauguration of a new outlet in the UAE.

KEY INDUSTRY PLAYERS

Key Players Focus on Online Expansion to Stay Competitive

Intense competitive rivalry characterizes the MENA market. The presence of prominent players leverages their strong brand presence and loyalty to be abreast of the competition. In recent years, market players have focused on expanding online presence as one of their key strategies to stay competitive. For instance,

- In June 2021, Alshaya Group, a Dubai, UAE-based fashion and distribution company, launched a new app for American Eagle + Aerie, a brand of American Eagle, a U.S.-based clothing company, in Egypt and Qatar.

List of Key Companies Profiled:

- Alshaya Group (Kuwait)

- Al Futtaim Retail (UAE)

- BinDawood Stores (Saudi Arabia)

- Alghanim Industries (Kuwait)

- LuLu Group International (UAE)

- Chalhoub Group (UAE)

- AZADEA Group (UAE)

- Al Tayer Group (UAE)

- Landmark Group (UAE)

- Apparel Group (UAE)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Alshaya Group, a Kuwait-based franchise operator, announced the inauguration of a new outlet 'Hampton by Hilton' in Kuwait. The outlet showcases 110 modern and stylishly designed bedrooms, with modern amenities, including a complementary hot breakfast and a fully-equipped gym.

- May 2024: Al-Futtaim, a Dubai, UAE-based conglomerate, launched its IKEA brand at Dalma Mall in Abu Dhabi, UAE. The launch of this store aimed to cater to the needs and tastes of the local community.

- March 2024: Lulu Group International, an Abu Dhabi, UAE-based multinational conglomerate, inaugurated its new hypermarket in Dubai Outlet Mall. The new outlet features different products under various segments, including fresh food, grocery, bakery, dairy, electronics, and home appliances.

- November 2023: CHALHOUB GROUP, a Dubai, UAE-based luxury goods distributor, established a partnership with Inter Parfums, Inc., a perfume distributor in the UAE, Kuwait, Saudi Arabia, Egypt, and Bahrain. This partnership encourages CHALHOUB GROUP to expand its presence for fragrance products in the Middle East region.

- April 2023: BinDawood Stores, a Saudi Arabia-based distributor, announced its plans to open around 6-7 new supermarkets, hypermarkets, and express stores in the same year. The company aimed to expand its presence in the main cities of Saudi Arabia.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product analysis, retail channels, and type of retail format. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.30% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Retail Channel

|

|

|

By Type of Retail Format

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the worldwide market was USD 808.51 billion in 2024 and is anticipated to reach USD 1,401.32 billion by 2032.

Growing at a CAGR of 7.30%, the market will exhibit steady growth over the forecast period.

By product, the food, beverage, & grocery segment dominated the market.

Improving retail infrastructural facilities is a crucial factor favoring market expansion throughout the forecast timeframe.

Landmark Group, Alshaya Group, Al-Futtaim, Lulu Group International, Chalhoub Group, and BinDawood Stores are the leading industry participants.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us