Menstrual Cups Market Size, Share & Industry Analysis, By Type (Disposable and Reusable), By Material Type (Silicone, Latex, and Thermoplastic Elastomer), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

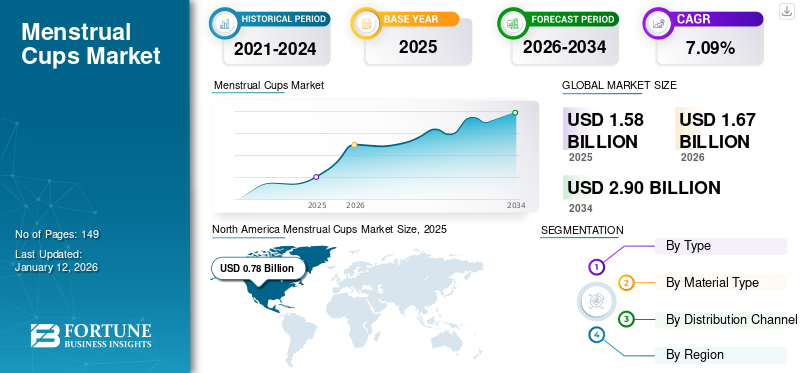

The global menstrual cups market size was valued at USD 1.58 billion in 2025. The market is projected to grow from USD 1.67 billion in 2026 to USD 2.9 billion by 2034, exhibiting a CAGR of 7.09% during the forecast period. North America dominated the global market with a share of 49.30% in 2025.

Menstrual cups are feminine hygiene products that are inserted into the vagina to collect menstrual fluid. These devices are shaped similar to bells or bowls and are made of medical-grade silicone, latex, and thermoplastic elastomer. The products are available in various sizes and can be used as per the requirements of the customers.

In the past few decades, the adoption of these products has staggeringly increased as it is considered a cheaper option compared to other feminine hygiene products such as tampons and sanitary pads. Furthermore, such products are considered a safer option and reduce the risk of bacterial infection. The eco-friendly nature of these devices also contributes to their increasing adoption, boosting market growth over the forecast period.

Furthermore, the prevalence of toxic shock syndrome in women who used tampons has also increased the adoption of reusable products.

- According to an article published in the National Library of Medicine in August 2022, the incidence of toxic shock syndrome is estimated to be around 0.8 to 3.4 per 100,000 in the U.S.

The COVID-19 pandemic harmed the menstrual cup market. As the pandemic began, lockdowns, border closures, panic buying, and stock-outs disrupted the supply chain of feminine hygiene products, impacting both buyers and sellers.. Furthermore, the shortage of labor, raw material, and working capital also impacted the production of menstrual hygiene products, leading to market decline during the pandemic. However, the awareness for natural and reusable menstrual products increased as the restrictions were relaxed due to droppage in COVID-19 cases at the end of 2021. As a result, customers started investing more intently in their intimate, personal, and period care routines, which normalized the market growth in 2021 and 2022.

Global Menstrual Cups Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.58 billion

- 2026 Market Size: USD 1.67 billion

- 2034 Forecast Market Size: USD 2.9 billion

- CAGR: 7.09% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a 49.30% share in 2025. This is driven by a high emphasis on menstrual health management, increasing consumer utilization of eco-friendly products, high awareness among women, and the wide availability of a large number of products.

- By Type: The Reusable segment held the largest market share in 2024. The segment's dominance is attributed to the durability and economic benefits of reusable cups, which can last from six months to a year, thereby generating less solid waste and appealing to environmentally conscious consumers.

Key Country Highlights:

- Japan: Demand is growing as part of the broader Asia Pacific trend toward greater awareness of sustainable menstrual products, driven by digital campaigns and a shift in consumer preferences for eco-friendly alternatives.

- United States: The market is fueled by high awareness of menstrual health and product safety, including concerns over conditions like toxic shock syndrome associated with traditional products. A strong retail presence and strategic partnerships, such as those bringing menstrual cups to thousands of CVS stores, also boost adoption.

- China: Growth in the Chinese market is driven by increasing awareness campaigns for sustainable and reusable menstrual products, which are resonating with a younger, more environmentally aware consumer base in the Asia Pacific region.

- Europe: The market is propelled by rising disposable incomes and a gradual consumer shift toward adopting reusable, eco-friendly products. The strong presence of key regional players continuously innovating their product lines also supports market growth.

Menstrual Cups Market Trends

Strong Emphasis on the Adoption of Eco-friendly Products to Drive the Product Demand

While the importance of creating awareness about menstrual health and hygiene is indisputable, a counter-argument always prevails, which raises the issue of waste generated due to the wide adoption of sanitary pads and tampons. These cups have a comparatively minimal impact on the environment as they are reusable and can be reused for at least six months to one year, making them an eco-friendly menstrual hygiene product.

- In October 2022, Care Form Labs, an Indian Start-up, introduced its green menstrual health brand ‘Onpery’ that has a portfolio of IP-driven redesigned green or sustainable menstrual products like menstrual cups, reusable sanitary pads, liner, period underwear and menstrual disc, intending to improve the user experience concerning usability and comfort.

As these products are reusable, they will bring a significant drop in the plastic waste pollution occurring from disposable sanitary products. This will further contribute to the government initiatives focused on boosting the adoption and development of eco-friendly products for decreasing the solid waste disposal. This is slated to elevate the deployment of such products in the industry, thereby driving the market growth.

Download Free sample to learn more about this report.

Menstrual Cups Market Growth Factors

Availability of Different Types of Products to Propel the Market Growth

A gradual shift toward the adoption of these products has been witnessed globally in the past few years. The increasing awareness among women regarding the attractive benefits of these products is playing a major role in the growing adoption rate. Manufacturers are continuously making efforts in product innovation which can help in providing comfort to women. To provide a personalized experience to their customers, major players have launched these products in different sizes and shapes. In addition, the factors such as cost-effectiveness, sustainability and convenient use of the available products significantly fuel their demand, surging the market growth.

- For instance, in March 2021, Care Form Labs Private Limited redesigned menstrual cups with their innovative user-centered design to make them easy to use and switch. Such initiatives help women across the globe to adopt these products as per their requirements.

- In addition, in December 2022, Emm Technology Ltd received a round of funding of USD 1.0 million. The amount would be used to make advancements in their menstrual cup product by adding an applicator and an app tracking feature.

Continuous innovation by market players to provide technologically advanced products and the availability of these cups in different shapes and sizes steadily drives the adoption of the products, propelling the global menstrual cups market growth.

Rising Number of Government Initiatives to Propel the Adoption of Reusable Cups

Government funding for female menstruation products has expanded considerably over the years. Regulatory organizations across the globe are working to ensure that women have access to feminine hygiene products. As a result, several campaigns and initiatives have been organized to promote the adoption of these cups among menstruating women.

- For instance, according to an article published in the Times of India, the Karnataka state government decided to distribute menstrual cups to all adolescent girls in government schools.

Furthermore, major companies are focusing on launching new campaigns to create awareness regarding the adoption of these cups. The companies are using the digital media platforms to target a large customer base.

- For instance, in June 2023, Sirona Hygiene Private Limited launched a ReuseKaroSaveKaro campaign to raise awareness about the importance of reusability and sustainability in menstrual care and promote eco-friendly alternatives like the Sirona Menstrual Cup.

Such campaigns by government organizations and private players create awareness among women regarding the product adoption, positively influencing the market growth.

RESTRAINING FACTORS

Low Product Penetration in Developing Countries May Hinder the Industry Growth

One of the major factors restraining the growth of the market is the low penetration of these products in developing countries owing to the limited adherence toward menstruation health management. Furthermore, the awareness regarding these products is low in emerging countries, such as India and South Africa, due to the prevailing stigma related to menstruation. Women in developing countries still hesitate to have a conversation about their menstruation health, lowering the adoption of these cups.

Furthermore, the low awareness regarding the usability of such products in these countries also restrains their adoption. Lack of understanding about proper hygiene practices and limited availability of adequate and accessible products make menstrual hygiene management difficult. These factors further lead to the limited availability of these products, particularly in the rural areas of the emerging countries, resulting in lower adoption, thereby hampering the market growth.

Menstrual Cups Market Segmentation Analysis

By Type Analysis

Reusable Segment Dominated Owing to the Advantage of Durability

On the basis of type, the market is segmented into reusable and disposable products. The reusable segment accounted for the largest share of 72.12% in the market in 2026. The dominance of the segment is due to its durability as it can last up to six months to one year, thereby generating less solid waste. The economic benefits associated with reusable cups are anticipated to increase the demand for these products.

Furthermore, the rise in the number of new product launches in the market by major players also contributes to the growth of the segment.

- For instance, in November 2021, The Flex Co. announced the addition of Flex Reusable Disc to its portfolio of sustainable period products.

The disposable menstrual cup segment is anticipated to witness slow growth during the forecast period as consumers are steadily moving toward adopting sustainable period products. Furthermore, the increasing focus of major players to move toward offering eco-friendly products is also one of the reasons contributing to the segment’s slow growth.

To know how our report can help streamline your business, Speak to Analyst

By Material Type Analysis

Launch of Silicone Cups by Major Players to Drive the Segment Growth

Based on material type, the market is segmented into silicone, latex, and thermoplastic elastomer.

The silicone segment dominates the global menstrual cups market share of 47.80% in 2026. The increasing demand for silicone as a material is due to the demand for safe, durable, and non-allergenic products. The material is hypoallergenic in nature, which does not cause irritation once inserted inside the vaginal cavity. Furthermore, major companies have silicone menstrual cups in their product portfolio and are continuously working on launching more advanced products, fueling the growth of the segment.

The thermoplastic elastomer segment is expected to grow with a steady CAGR over the forecast period. There is a significant growth in the adoption of TPE materials for manufacturing these products. Factors such as cost-effectiveness and its ability to be recycled drive the adoption of these products in the market.

The latex segment accounted for a substantial market share in 2024 and is expected to grow significantly over the forecast period of 2025-2032. This growth is attributed to the increasing consumer demand for natural materials due to certain perceived benefits. Moreover, the technological advancements in latex processing might address the concerns regarding allergies and potential health risks, making it a more attractive option for some individuals, which boosts the market growth.

By Distribution Channel Analysis

Retail Pharmacies & Drug Stores Segment to Lead Due to Extensive Product Availability in these Centers

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies.

The retail pharmacies & drug stores segment is projected to hold the largest market share of 40.45% in 2026. The wide availability of these products in retail pharmacies and drug stores is expected to drive the segmental revenue. These pharmacies form strategic partnerships with major market players, thus leading to the segment growth.

- In September 2019, The Flex Company and CVS formed a partnership to introduce eco-friendly period products in over 5,000 CVS stores worldwide.

However, the online pharmacies segment is anticipated to grow at a high CAGR during the forecast period. The growth is due to the initiatives adopted by all the key companies to sell their products on online stores & platforms. Furthermore, people are steadily moving toward buying products online as they can compare multiple products at once and make an informed decision while purchasing.

The hospital pharmacies segment held a considerable market share in 2024 and is expected to witness noteworthy growth during the forecast period. Hospital pharmacies provide convenient options for patients seeking menstrual cups, especially for those admitted to hospitals for other reasons. In addition, hospital pharmacies cater to the specific patient needs and stock menstrual cups suitable for individuals with medical conditions and allergies.

REGIONAL INSIGHTS

On the basis of region, the global market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America Menstrual Cups Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 0.78 billion in 2025. Factors such as high emphasis on menstruation management in the region and increasing utilization of eco-friendly products contribute to the growth of the market in North America. Furthermore, the availability of large of number of products in the region also leads to its increasing adoption rate. The high awareness among women in the region also adds to the growing adoption of these products. The U.S. market is projected to reach USD 0.63 billion by 2026.

Europe

Europe held a significant market share in 2023. The presence of key players in the region is one of the major factors contributing to the market growth. Furthermore, the rising disposable income and the gradual shift toward reusable products are among the factors that offer growth of opportunities for market growth in Europe. The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.1 billion by 2026.

Asia Pacific

Asia Pacific is projected to record the highest CAGR during the forecast period. The growing awareness of sustainable products in the region after the COVID-19 pandemic is one of major factors propelling the regional growth. Furthermore, the large number of initiatives undertaken by government and non-profit organizations to donate these products in developing countries such as India fuels the product adoption in the region. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.08 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

List of Key Companies in Menstrual Cups Market

Strong Product Portfolios of Procter & Gamble, Diva International Inc., Mooncup Ltd, and The Flex Company to Lead to Their Market Dominance

The global market includes a large number of players operating and competing to achieve a dominant position. The market is currently fragmented. However, a few companies, such as Diva International Inc., Mooncup Ltd., and The Flex Company, have established their presence in the market. Owing to their large customer base and wide distribution network, the companies have established a dominant position in the market. Furthermore, these companies are focused on strategic initiatives such as partnerships with retail pharmacies to introduce their products in the market.

Other regional players such as Sirona Hygiene Private Limited and Redcliffe Hygiene Private Limited have launched their wide portfolio of products in developing regions. Through digital campaigns, these companies are creating awareness for the adoption of such products. These initiatives will help the companies gain a strong position in the market over the forecast period.

LIST OF KEY COMPANIES PROFILED:

- Sirona Hygiene Private Limited (India)

- Procter & Gamble (U.S.)

- Mooncup Ltd (U.K.)

- Redcliffe Hygiene Private Limited (India)

- Diva International Inc.(Canada)

- CS Technologies s.r.o. (Czech Republic)

- Anigan (U.S.)

- Me Luna (Germany)

- The Flex Company (U.S.)

- Ruby Cup (U.K.)

- Fleurcup (France)

- INTIMINA (Sweden)

- Saalt (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - The Flex Company broke new ground in women’s health by acquiring Allbodies Inc., a pioneer in reproductive and sexual health education. Since 2016, The Flex Company has sold more than 130.0 million units, overtaking menstrual cups in the U.S. sales.

- September 2023 - Redcliffe Hygiene Private Limited’s brand Pee Safe announced that it had secured USD 3.0 million out of its total round size of USD 6.0 million in a series B funding round. Rainmatter Health and Natco Pharma Limited led this funding.

- February 2023- Mina Foundation and Gift of Givers donated 1,000 menstrual cups in South Africa to eradicate period poverty in their campus.

- January 2023– HLL Lifecare Limited announced the launch of three brands of menstrual cups for women in India and across the globe. The company launched the brands titled “Thinkal”, “Velvet”, and “Cool Cup”.

- August 2022 - Lemme Be announced the launch of Z-Cup, an intelligently designed, sustainable, and affordable menstrual cup made with medical-grade silicone. Z-Cup served as a healthy and new-age alternative to traditional sanitary pad.

- August 2022- The Coupling Foundation announced the launch of menstrual cup kits in South Africa for women and girls who do not have access to quality sanitary products.

- July 2022- The University of Bristol funded a startup for their Cup2 portable menstrual cup cleaning design.

- June 2022 - Sirona Hygiene Private Limited, on the occasion of Menstrual Hygiene Day, donated 5000 menstrual cups to underprivileged menstruators across India. It also provided training over three menstrual cycles and using the cup to ensure adoption.

- June 2022 - Laiqa announced the launch of the Period Cup, a reusable menstrual cup, expanding its range toward more eco-friendly products. The cup was made from 100.0% medical-grade silicone, with no BPA, latex, dyes, phthalates, and plastic.

- March 2021- Essity Aktiebolag announced the launch of Libresse V-cup. The new solution would be added to their existing portfolio of sustainable products.

REPORT COVERAGE

The market research report provides a detailed analysis of the industry. It focuses on key aspects such as disease burden – by key region, COVID-19 impact on the market, an overview of customers, industry trends, competitive landscape, and key mergers, acquisitions & partnerships. Besides this, the report offers insights into the market trends and highlights vital industry dynamics. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the global market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 7.09% from 2026-2034 |

|

Segmentation |

By Type

|

|

By Material Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD 1.67 billion in 2026 to USD 2.9 billion by 2034.

In 2025, the North America market stood at USD 0.78 billion.

Registering a CAGR of 7.09%, the market will exhibit steady growth over the forecast period (2026-2034).

By type, the reusable segment led this market during the forecast period.

The availability of various products and the launch of favorable government initiatives are the major factors driving the growth of the market.

Procter & Gamble, Diva International Inc., Mooncup Ltd, and The Flex Company are some of the major players in the global market.

North America dominated the global market with a share of 49.30% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us