Mexico Portable Water Pipe Market Size, Share & Industry Analysis, By Material (Plastic Pipes, Metal Pipes, Concrete Pipes, and Others), By Diameter (Below 12 Inches, 12 Inches to 48 Inches, 49 to 84 Inches, and Above 84 Inches), By Installation (New and Rehabilitation), By Application (Agriculture, Construction, Mining, Municipal Water Supply, and Others), By End User (Residential, Government, and Industrial), and Country Forecast, 2025-2032

Mexico Portable Water Pipe Market Size

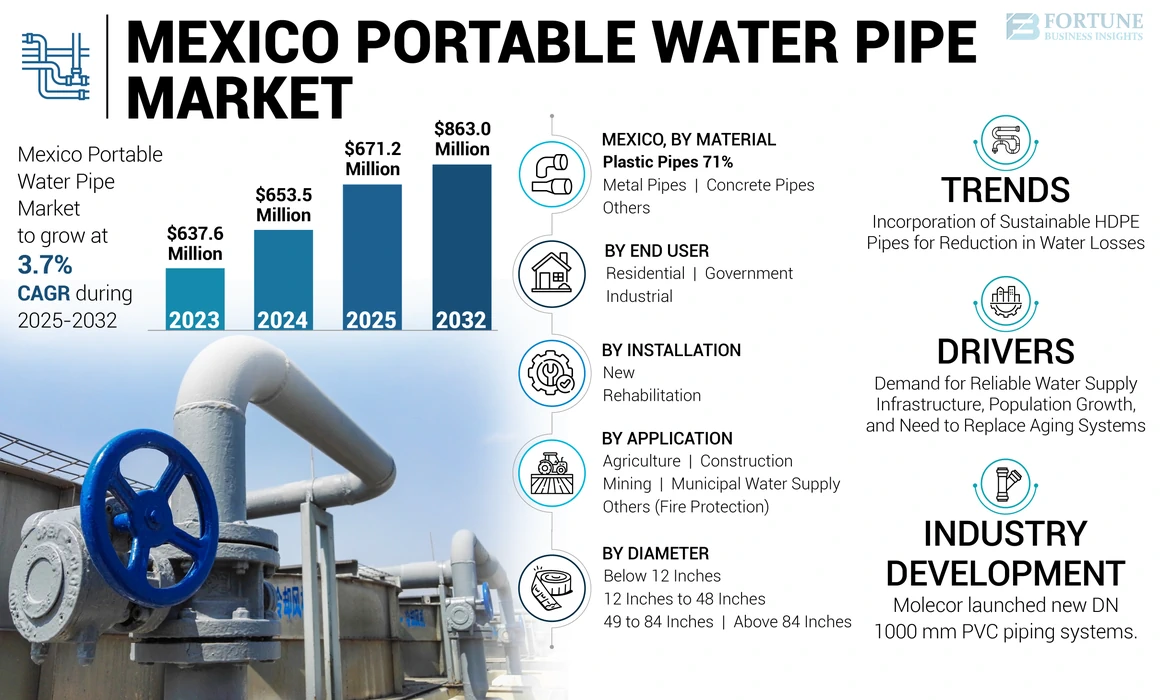

The Mexico portable water pipe market size was valued at USD 653.5 million in 2024. The market is projected to grow from USD 671.2 million in 2025 to USD 863.0 million by 2032, exhibiting a CAGR of 3.7% during the forecast period.

Portable water pipes, also called flexible pipes, are designed for temporary water transportation and distribution applications. These pipes are found in a wide range of applications, such as agriculture, construction, oil gas, mining, municipal water supply, irrigation systems and fire protection. In addition, this type of pipe is utilized in various industrial settings, such as water transfer, cleaning, and temporary cooling systems. They are generally manufactured by materials such as plastic, metal, and concrete materials.

Rapid urbanization has outpaced the development of adequate water distribution networks, leading to water shortages and disruption in numerous cities in the country. This factor has created surging demands for reliable and scalable water supply solutions, including portable water pipe systems that can be quickly deployed to meet the growing demand in urban centers. For instance, According to macroTrends, in 2022, Mexico’s rural population was reported at 23,843,271 people, reflecting a decrease from the previous year’s figure of 24,053,703. The data also stated that the average rural population declined by 0.9% in 2022 as compared to 2021.

Moreover, government initiatives and investment in water distribution systems are anticipated to drive the growth of the market. For instance, in 2024, Mexico is actively seeking solutions to its water challenges through a series of initiatives led by the National Water Commission (CONAGUA). The government has committed a substantial investment of USD 5 billion to fund fifteen priority projects aimed at addressing issues such as drought and water scarcity. These projects encompass the construction of dams, aqueducts, and irrigation districts in various regions across the country. Rising awareness about water and sanitization issues in Mexico is creating the demand for portable pipes for efficient handling of water resources across the country. Furthermore, around 57% of the households in Mexico suffer from water problems. These factors drive the growth of the market.

The COVID-19 pandemic negatively impacted the growth of the market owing to halted manufacturing activities, disruptions in the supply chain of plastic raw materials, and fluctuations in raw material prices. These factors restricted the growth of the market during the pandemic.

Mexico Portable Water Pipe Market Trends

Incorporation of Sustainable HDPE Pipes for Reduction in Water Losses to be an Emerging Trend

Mexico's portable water pipe infrastructure is aging, and deterioration of traditional pipe materials leads to frequent leaks, breaks, and water losses. To address this issue, there is a growing trend toward the use of sustainable and resilient materials such as high-density polyethylene (HDPE) pipes. HDPE pipes offer several advantages over traditional materials, making them an attractive choice for portable water networks. Furthermore, these pipes have excellent leak-resistance properties due to their fusion-welded joints, which create a seamless and watertight connection. This feature helps minimize water losses during distribution, a significant concern in regions facing water scarcity. All these factors are the latest trends in the market.

Download Free sample to learn more about this report.

Mexico Portable Water Pipe Market Growth Factors

Rising Demand for Reliable Water Supply Infrastructure, Population Growth, and Need to Replace Aging Systems to Aid Market Growth

The country’s overall population growth has contributed to the increasing demand for water infrastructure. With a larger population, the need for water for domestic, industrial, and agricultural purposes has increased substantially. The product offers a cost-effective and flexible solution to bring water to underserved communities, ensuring access to clean water for drinking, sanitation, and other essential needs. For instance, according to statistics from the National Autonomous University of Mexico, a significant portion of the country’s population faces severe water scarcity and inadequate sanitation, with only 58% having daily access to running water and 14% receiving water 24 hours a day, while millions lack access to potable water and sanitation services. These pipes also offer a reliable and cost-effective way to ensure uninterrupted water supply during the transition to new, more efficient distribution networks. All such factors drive the growth of Mexico portable water pipe market.

RESTRAINING FACTORS

Diverse and Rugged Terrain May Pose Logistical Challenges for Pipe Installation, Restraining Market Growth

Mexico's diverse geography presents a significant obstacle in the installation and maintenance of water pipes. The country's rugged terrain, characterized by mountainous regions, steep slopes, and remote areas, makes it logistically challenging and costly to lay down and maintain water distribution networks. Transporting materials, equipment, and personnel to these areas can be arduous, requiring specialized techniques and resources. In addition, harsh environmental conditions, such as extreme temperatures and precipitation patterns, can accelerate the deterioration of pipes, necessitating frequent repairs and replacements. All such factors restrain the growth of the Mexico portable water pipe market.

Mexico Portable Water Pipe Market Segmentation Analysis

By Material Analysis

Plastic Pipes Segment Dominated Due to Adoption in Construction and Agriculture Sectors

Based on material, the Mexico market for portable water pipe is classified into plastic pipes, metal pipes, concrete pipes, and others. The others segment consists of clay and fiberglass pipes.

The plastic pipes segment dominated the market in terms of revenue share in 2024, and the same segment is expected to grow at a significant CAGR of 3.8% during the forecast period, owing to its ability to offer several advantages such as length, durability, flexibility, robustness, and its popularity among end users. In addition, the rising demand for plastic pipes from the construction and agriculture sectors is set to drive the segment growth. All these factors drive the growth of the plastic pipe market.

The metal pipes and concrete pipes segments are projected to grow at a steady rate during the forecast period, owing to rising demand for metal and concrete pipes for pipeline projects across irrigation and construction activities in Mexico.

The others segment includes clay and fiberglass water pipes. This segment is anticipated to grow moderately, owing to rising demand for such pipes in the fire protection and construction sectors. Moreover, government investment in irrigation and modernization projects further fuels the segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Diameter Analysis

Usage of Below 12 Inches Pipes in Rehabilitation Projects to Spur Segment Growth

Based on diameter, the market is divided into below 12 inches, 12 inches to 48 inches, 49 to 84 inches, and above 84 inches.

The below 12 inches segment dominated the market in terms of revenue share in 2024 and the same segment is anticipated to witness substantial growth during the forecast period, owing to its utilization in the agriculture and construction sectors. In addition, it is used in both new pipeline installation and rehabilitation projects.

The 12 inches to 48 inches and 49 to 84 inches segments are projected to grow steadily during the forecast period due to rising pipeline projects and government investment in improving water infrastructure across Mexico, which is expected to fuel the growth of the market.

The above 84 inches segment is projected to grow at moderate growth during the forecast period. This can be credited to the usage of these pipes in big projects such as dam pipelines, large-scale irrigation projects, and construction projects. These factors are anticipated to bolster the Mexico portable water pipe market growth.

By Installation Analysis

Rising Establishment of New Pipeline Projects to Bolster the Segment Growth

Based on installation, the Mexico market for portable water pipe is categorized into new and rehabilitation.

The new segment led the market in terms of revenue share in 2024 and is anticipated to grow at the highest CAGR during the forecast period, owing to the rising construction of new pipeline projects in Veracruz, Oaxaca, and Guerrero based in Mexico, which fuels the market growth. Moreover, in January 2024, the government of Mexico planned to invest around USD 5.58 billion for construct a new water pipeline project in Latina Republic, with a support of 22. Million inhabitants across Mexico.

The rehabilitation segment is set to register moderate growth during the forecast period due to the government's plan to invest in the rehabilitation of existing pipeline projects in Mexico. These factors contribute to the market growth.

By Application Analysis

Mining Segment Leads Owing to Growing Demand for Metal and Plastic Pipes

In terms of application, the market is divided into agriculture, construction, mining, municipal water supply, and others.

The mining segment led in terms of revenue share in 2024. This can be credited to the importance of the mining sector in Mexico, which creates the demand for such pipes for efficient water transportation. The rising demand for plastic and metal pipes from the mining sector is further slated to contribute to the substantial Mexico portable water pipe market share.

The construction segment is anticipated to expand at the highest growth rate during the forecast period, owing to rising demand for portable pipes from construction pipeline projects. Moreover, government investment in the construction sector subsequently drives the growth of the market.

Moreover, increasing demand for such pipes from municipal corporations and fire protection services is further anticipated to fuel the market growth during the forecast period.

By End User Analysis

Government Segment Led Owing to Growing Municipal Infrastructure

Based on end user, the market is segmented into residential, government, and industrial.

The government segment dominated the market in terms of revenue share in 2024 and is set to maintain its dominance during the forecast period, owing to many pipeline projects undertaken through government investments, rising municipal infrastructure, and growing wastewater treatment facilities. Moreover, according to the Mexico government association, Mexico government planned to invest around USD 3.44 billion for construct a new sewage treatment plan. Such a new investment by government provides lucrative opportunities for the growth of market.

The industrial segment is anticipated to grow at a steady rate during the forecast period, owing to rising demand for pipes from mining, manufacturing, and water-related infrastructure.

The residential segment is anticipated to witness moderate growth during the forecast period, owing to the main concern of water scarcity in Mexico. To improve the water infrastructure, the government has invested in improving water infrastructure, which is driving the growth of the Mexico portable water pipe market.

COUNTRY INSIGHTS

By region, the Mexico market for portable water pipe has been studied across Northern Mexico, Central Mexico, and Southern Mexico.

The central Mexico region is anticipated to dominate the market and same region is growing with substantial growth rate during the forecast period, owing to growth in the construction and agriculture sector in Mexico, which in turn, creates the demand for such pipes, driving the growth of the market. For instance, in 2022, the government of Mexico planned to invest around USD 583.7 million in an irrigation installation and rehabilitation project in Sonora, Mexico. The project rehabilitates 23,333 hectares of irrigation applications. It started in 2022 and is projected to be completed by 2024. All such factors have contributed positively to the market growth.

KEY INDUSTRY PLAYERS

Major Players Adopt Acquisition and Partnership Strategies to Boost the Competition

Pipe manufacturers such as Policonductos S.A. de C.V., Molecor, TKP, Saint Gobain PAM, and others are engaged in adopting partnerships and acquisitions to strengthen the market competition and also improve their geographical footprints. For instance, in February 2023, TKP got a contract to replace a pipe for an irrigation project and water treatment plant in Hermosillo, Sonora, Mexico. The pipe was made of HDPE material and the total quantity required for the irrigation project is 3,800 m. All such factors drive the market growth.

List of Top Mexico Portable Water Pipe Companies:

- Saint-Gobain PAM (France)

- Orbia (Mexico)

- Future Pipe Industries (UAE)

- Molecor (Spain)

- Policonductos (Mexico)

- WexPIPE (Mexico)

- TKP Inc (U.S.)

- Valtic S.A. de C.V. (Mexico)

- Villacero S.A. de C.V. (Mexico)

- Tubasol (Spain)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Molecor launched new DN 1000 mm PVC piping systems. It is an innovative solution used for water transportation and water infrastructure applications. These pipes feature a high diameter of 1000 mm, a long durable life of around 50 years and reduce overall installation and maintenance costs for hydraulic infrastructure.

- April 2024: PAM dispatched two shipments of pipes (DN800) for a major project in Romania whose objective was to reinforce and extend an existing grey cast iron pipeline that was over 100 years old.

- February 2024: Molecor showcased its new PVC pipes for construction projects at Camino Real Polanco Hotel in Mexico. The company showcased the AR and EVAC+ series of PVC portable pipes for fire protection and construction applications. These pipes have several advantages, such as fire protection, three-layer protection, and suitability for the most complex building projects.

- February 2021: Orbia, a global leader in specialty products and innovative solutions for building and infrastructure, health care delivery, precision agriculture, and data communications, entered a new partnership with the Resilient Cities Networks.

- November 2020: TKP, a subsidiary of Fluidos Industriales Mexicanos S.A. de C.V., got an electrical power cable projection project at Veracruz, Mexico. These pipes have features such as impact resistance, crush resistance, and resistance to tension.

REPORT COVERAGE

The Mexico portable water pipe market report covers a detailed depth analysis of the type, material type, install type, functionality, application, and end user. It provides information about leading players offering the product and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, trends analysis, SWOT analysis, and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019 – 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 – 2032 |

|

Historical Period |

2019 – 2023 |

|

Growth Rate |

CAGR of 3.7% from 2025 to 2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Material

By Diameter

By Installation

By Application

By End User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 653.5 million in 2024.

Fortune Business Insights says that the market is slated to reach USD 863.0 million by 2032.

Growing at a CAGR of 3.7%, the market is anticipated to exhibit strong growth during the forecast period.

Rapid urbanization, population growth and rising demand for replacement of old pipes in infrastructure drive the growth of the market.

Saint-Gobain PAM, Orbia, Future Pipe Industries, Molecor, Policonductos, WexPIPE, TKP Inc, Valtic S.A. de C.V., Villacero S.A. de C.V., and Tubasol are top companies in the Mexico market for portable water pipe.

Based on our analysis, Central Mexico is set to capture highest market share.

By material, the plastic pipes segment is expected to hold a significant CAGR during the forecast period.

By installation, the new segment is expected to hold the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us