Military Laser Range Finder Market Size, Share & Industry Analysis, By Type (Handheld and Observation System), By Range (Up to 10 km, 10-15 km, and Above 15km), By Application (Weapon Guidance and Detection), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

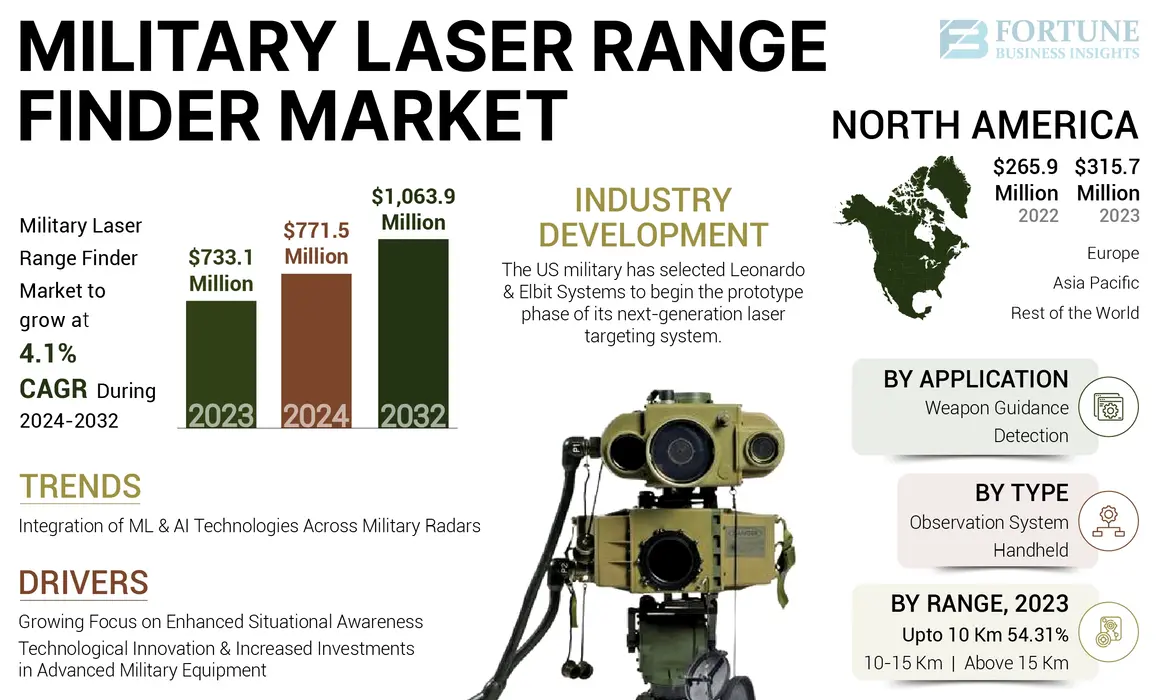

The global military laser range finder market size was valued at USD 733.1 million in 2023. The market is projected to grow from USD 771.5 million in 2024 to USD 1,063.9 million in 2032 at a CAGR of 4.1% during the 2024-2032 period. North America dominated the military laser range finder market with a market share of 43.06% in 2023.

A military laser range finder is a device used by armed forces to calculate distances to targets or objects of interest. It is designed to operate in a variety of environments and applications, including handheld, mounted on tripods, helmets, firearms, or vehicles. Military laser rangefinders are used to enhance the targeting accuracy of infantry weapons, bombs, missiles, and artillery, as well as for reconnaissance, target finding, and situational awareness.

Modernization of military equipment is stimulating market expansion, particularly with advancements in military laser rangefinder systems. These systems enhance aiming capabilities and weapon sights for laser-guided munitions, missiles, and artillery, increasing demand for portable devices carried by armed forces.

During the COVID-19 pandemic, the industrial sector, specifically manufacturers of laser rangefinders, experienced significant challenges. Output rates plummeted due to a lack of funding and raw materials shortages. The pandemic led to severe disruptions in manufacturing operations for military laser range finder. Lockdowns and restrictions caused a sharp decline in production rates, resulting in shortages of both raw materials and financial resources necessary for manufacturing. Many nations redirected their budgets toward immediate COVID-19 response efforts, which limited funding available for defense expenditures, including military laser range finder. This shift caused a notable drop in demand and growth rates within the market.

Military Laser Range Finder Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 733.1 million

- 2024 Market Size: USD 771.5 million

- 2032 Forecast Market Size: USD 1,063.9 million

- CAGR: 4.1% (2024–2032)

Market Share:

- North America dominated the global military laser range finder market with a 43.06% share in 2023, driven by major defense contractors (Lockheed Martin, Northrop Grumman, Elbit Systems) and significant modernization programs in the U.S. and Canada.

- By type, handheld laser range finders lead due to their portability and widespread use by infantry and special forces, while observation systems are projected to post the fastest growth due to integration in surveillance and fire control systems.

Key Regional Highlights:

- North America: Largest share due to high defense budgets and procurement programs. The U.S. Army’s IDIQ contract to Northrop Grumman for the Common Infrared Countermeasure (CIRCM) system highlights ongoing investments in advanced targeting solutions.

- Europe: Growth fueled by modernization initiatives in France, Germany, and the U.K., with companies like Thales, Safran, and Leonardo focusing on AI-enabled targeting systems and long-range detection.

- Asia Pacific: Expected to record fastest growth owing to rising defense spending in China, India, and South Korea. Shift toward laser-guided munitions and precision targeting systems supports adoption.

- Rest of the World: Increasing defense procurement in Middle East (Saudi Arabia, UAE) and Latin America (Brazil) to enhance situational awareness and precision strike capabilities.

Military Laser Range Finder Market Trends

Integration of Machine Learning and Artificial Intelligence (AI) Technologies Across the Military Radars Propels Market Growth

Artificial Intelligence (AI) and Machine Learning (ML) is enhancing the performance of military laser range finder in several ways:

- Improved Accuracy: AI algorithms can automatically detect and track targets, even in complex environments, improving the accuracy of the laser rangefinder. For example, Elbit Systems' XACT-640 laser rangefinder uses AI to automatically detect and track targets.

- Enhanced Target Identification: AI can help identify targets more effectively by analyzing the reflected laser light and distinguishing between different types of targets. This enhances the overall precision and reliability of the laser rangefinder.

- Increased Speed: AI can process data faster than humans, allowing for quicker target acquisition and tracking. This is particularly useful in high-stress environments where speed and accuracy are critical.

- Noise Reduction: AI can help reduce noise in the laser signal, which improves the overall performance and accuracy of the rangefinder. For instance, "noiseless" IR sensors can boost laser rangefinder performance by reducing interference.

- Real-Time Processing: AI can process data in real-time, enabling the laser rangefinder to adapt quickly to changing environments and provide more accurate and reliable measurements.

- North America witnessed military laser range finder market growth from USD 265.9 Million in 2023 to USD 315.7 Million in 2024.

These advancements in AI are significantly enhancing the performance of military laser range finder, making them more effective and reliable tools for various military applications.

Download Free sample to learn more about this report.

Military Laser Range Finder Market Growth Factors

Technological Innovation and Increased Investments in Advanced Military Equipment to Boost Market Growth

Military laser range finder are attracting significant investments in advanced military equipment, driven by the need for improved accuracy, speed, and target identification. This trend is fueled by the integration of Artificial Intelligence (AI) and Machine Learning (ML) into these devices, which enhances their capabilities. Additionally, the miniaturization and lighter weight of these rangefinders make them more portable and easier to use for soldiers on the move. Some key examples of these advancements include:

- Elbit Systems' XACT-640 Laser Rangefinder: This device uses AI to automatically detect and track targets, even in complex environments.

- Leonardo DRS's Lightweight Laser Designator Rangefinder (LLDR): This rangefinder weighs only 3.5 pounds, making it more portable and easier to use.

- Lockheed Martin's Sniper Advanced Targeting Pod (ATP): This system has a range of over 25 kilometers and can accurately measure distances within 1 meter.

These advancements are expected to drive the military laser range finder market growth, particularly in regions where there is a strong focus on modernizing military equipment and enhancing surveillance and attack capabilities.

Growing Focus on Enhanced Situational Awareness to Propel Market Growth

The military's growing focus on enhanced situational awareness is propelling the market growth of military laser range finders. These devices play a crucial role in modern warfare by providing accurate distance measurements, improving targeting accuracy, and aiding in mission planning.

Laser rangefinders are commonly used by infantry, special forces, aircraft, and vehicles for reconnaissance, target finding, and enhancing situational awareness. They are often integrated into weapons systems such as rifles and artillery to assist in target engagement. Modern laser rangefinders offer advanced features such as target tracking, ballistic calculations, and digital displays, enhancing their utility in the field. The military deploys a range of laser rangefinders designed to meet specific operational requirements. These devices utilize laser technology to accurately determine distances between the user and a target, even in adverse conditions such as rain, mist, and fog. The use of coded laser pulses also helps reduce the effects of jamming.

As the military transitions to 1550 nm covert illuminators, Short-Wave Infrared (SWIR) cameras facilitate this shift without rendering current illuminators obsolete. SWIR cameras can detect all three targeting/range-finding lasers commonly used on the battlefield (850 nm, 1060 nm, and 1550 nm), thereby enhancing situational awareness. The integration of laser rangefinders with advanced technologies, such as night vision goggles and thermal imaging systems, allows a comprehensive understanding of the battlefield environment, enabling military personnel to make informed decisions and effectively engage targets.

As a result, the military's growing emphasis on enhanced situational awareness is driving the demand for advanced laser rangefinder technology. These devices provide accurate distance measurements, improve targeting accuracy, and aid in mission planning, making them an essential tool in modern warfare.

RESTRAINING FACTORS

Difficulty in Utilization in Extreme Weather Conditions to Hamper Market Growth

Military laser rangefinders can face difficulties in extreme weather conditions, which can limit their effectiveness and reliability in certain situations. Some key challenges include:

- Achieving precise targeting in adverse weather such as fog, rain, or extreme temperatures.

- Maintaining accuracy and performance when exposed to mud, dust, sand, humidity, and other harsh environmental factors.

However, many military-grade laser rangefinders are designed to be rugged and durable enough to withstand these challenges. Features such as shock-resistant rubber outer shells, recessed components, and waterproofing help protect sensitive optics and electronics. Manufacturers are also constantly working to improve the resilience and performance of their products for use in extreme environments. Ongoing research and development aims to make military laser rangefinders lighter, stronger, and more reliable under the most challenging conditions.

Despite these environmental challenges, advancements in materials, design, and manufacturing ensure that modern military laser rangefinders deliver precision targeting and measurement even in adverse weather.

Military Laser Range Finder Market Segmentation Analysis

By Type Analysis

Handheld Range Finders Dominate the Market due to their Wide Usage in Military Forces

By type, the market is divided into handheld and observation system. The handheld segment held the largest market share in 2023. The demand for handheld laser rangefinders in the military sector is significant. Handheld laser rangefinders are essential tools for military operations, providing accurate and quick measurements for purposes such as target designation, range finding, and reconnaissance. They are widely used by military forces globally due to their precision, portability, and ease of use in various environments and situations.

The observation system segment is expected to experience fastest growth during 2024-2032. The demand for observation systems in military laser rangefinders is significant, particularly for applications that require precise distance measurement and target location. Military laser range finders play critical roles in various operations, including, observation and target location, fire control systems, and 3-D modeling.

By Range Analysis

Significant Demand of Range Finders with Up to 10 km Range Fuels Segment Growth

By range, the market is divided into up to 10 km, 10-15 km, and above 15 km. The up to 10 km segment held the largest market share in 2023. The demand for military laser rangefinders that can measure distances up to 10 kilometers is significant in the defense sector. These devices are used for various military operations, including reconnaissance, fire control, and surveillance.

- The up to 10 km segment is expected to hold a 54.31% share in 2024.

The above 15 km segment is expected to experience fastest growth during the 2024-2032 period. The demand for military laser rangefinders with a range above 15 km is expected to grow significantly in the future. This segment is anticipated to expand due to the increasing use of advanced military equipment and surveillance systems, particularly in airborne warfare and surveillance applications.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Detection Segment Leads owing to Major Players Focus on Developing Advanced Detection Technologies

By application, the market is divided into weapon guidance and detection. The detection segment dominated the market in 2023, driven by the demand for advanced targeting and tracking capabilities in defense applications. The market is expected to grow significantly over the forecast period, with key players focusing on developing advanced detection technologies.

The weapon guidance segment is expected to experience fastest growth during the 2024-2032 period. The demand for weapon guidance in military laser rangefinders is a significant driver of growth in the military laser rangefinder market. This demand is fueled by the increasing use of laser technology in weapon systems, particularly in weapon guidance and detection applications across the global level.

REGIONAL INSIGHTS

The global market is segmented based on region into North America, Europe, Asia Pacific, and the rest of the world.

North America Military Laser Range Finder Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America is projected to capture the largest military laser range finder market share. The region is expected to dominate the global market during the forecast period due to increasing demand for the product. Leading manufacturers such as Elbit Systems, Lockheed Martin and others are focusing on building their product portfolio and expanding their business in the global market.

In Europe, the military laser rangefinder market is expected to experience significant growth in the coming years. The increasing adoption of advanced technologies and modernization of military equipment are driving factors for the European military laser rangefinder market. European countries are investing in technological advancements to improve the accuracy, speed and target identification capabilities of their military laser range finder.

Asia Pacific’s military laser rangefinder market is expected to grow significantly due to increased spending on defense and demand from China, India, and South Korea. The region is witnessing a shift toward more advanced and technologically sophisticated warfare, which includes the use of laser-guided weapons and precision targeting systems. This trend is driving the adoption of military laser range finder.

The rest of the world is witnessing a significant increase in demand for advanced military technology, including laser rangefinders, to enhance the precision and effectiveness of military operations. Governments in the rest of the world are investing heavily in their defense sectors, which is driving the demand for advanced military equipment such as laser rangefinders.

KEY INDUSTRY PLAYERS

Leading Companies are focused on Military Contracts to Increase their Market Share

Some of the major companies operating in the global military laser range finder market growth are Northrop Grumman Corporation, Thales SA, Safran SA¸ Teledyne FLIR LLC, Elbit Systems Ltd., Leonardo S.p.A., Lockheed Martin Corporation, Hensoldt AG, Collins Aerospace and L3Harris Technologies contributing significantly to the growth and development of the industry. For instance, In May 2021, The U.S. Army has granted a five-year, Indefinite Delivery/Indefinite Quantity (IDIQ) contract worth USD 959.1 million to Northrop Grumman (NG), a developer of military and aerospace systems, for the full-rate production of the Common Infrared Countermeasure (CIRCM) system.

LIST OF TOP MILITARY LASER RANGE FINDER COMPANIES:

- L3Harris Technologies, Inc., (U.S.)

- Safran (France)

- ELBIT SYSTEMS LTD (Israel)

- Hensoldt AG (Germany)

- Northrop Grumman Corporation (U.S.)

- Lockheed Martin Corporation (U.S.)

- Collins Aerospace (U.S.)

- FLIR Systems, Inc. (U.S.)

- Thales (France)

- Leonardo S.P.A. (Italy)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 – The US Army Space and Missile Defense Command (SMDC) awarded BlueHalo a USD 95.4 million contract to develop advanced prototype Directed Energy (DE) or laser weapon systems. The award is part of the Laser Technology Research and Optimization Program (LARDO), implemented through the nation's Aerospace and Missile Technology Consortium (AMTC).

- December 2023 – nLIGHT Inc. was selected to provide a High-Energy Laser (HEL) to support the prototype work of the U.S. Army Rapid Capabilities Critical Technologies Office (RCCTO) Directed Energy Maneuver Short-Range Air Defense (DE M-SHORAD). A laser technology company was awarded a USD 34.5 million contract to develop the solution. nLIGHT signs a subcontract with KORD Technologies LLC for the completion of the laser system within 18 months.

- November 2023 – The US military selected Leonardo and Elbit Systems to begin the prototype phase of its next-generation laser targeting system called Joint Effects Targeting System II (JETS II). The initiative aims to produce futuristic binoculars that troops could use on the battlefield to scout enemy positions and coordinate strikes.

- October 2023 – Lockheed Martin has been awarded a contract to develop and supply up to four 300 kW-class laser weapon systems for the US Army's Indirect Fire Capability High Energy Laser (IFPC-HEL) prototype program. Under the contract, Lockheed Martin will deliver two prototypes of a 300 kW class Indirect Fire Protection High Energy Laser (IFPC-HEL) with the choice of two accessories.

- December 2022 – Lockheed Martin and Rafael Advanced Defense Systems, Ltd. entered into a cooperative agreement covering the joint development, testing and production of High Energy Laser Weapon Systems (HELWS) in the United States and Israel. The future joint development is based on assets independently developed by RAFAEL and the Defense Research and Development Department (DDR&D) of the Ministry of Defense as part of the IRON BEAM project.

REPORT COVERAGE

The research report provides an overview of the market trends, competitive landscape, market competition, product pricing, market status and key industry developments. Apart from the factors mentioned above, the market report covers several direct and indirect factors that have influenced the global market size in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 4.1% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Type

|

|

By Range

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 733.1 million in 2023 and is projected to reach USD 1,063.9 million by 2032.

The market is anticipated to registering a CAGR of 4.1% during the forecast period (2024-2032).

By type, The handheld segment leads and dominated the market in 2023.

North America holds the largest share of the market.

As per analysis, the rest of the world is anticipated to grow rapidly during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us