Military Wearable Sensors Market Size, Share & Industry Analysis, By Sensor Type (Pulse, SpO2, GPS, Biological, & Body Temperature Sensor), By Component (Microcontroller, RF Module, Bread Board, Wearable Node, Connectors & Wires), By Solution (Smart Textiles/Clothing & Portable Wearables), By Sensor Technology (Infrared, Ultrasonic, Radio Frequency, & Internet of Things (IoT), By Application (Health Monitoring, Chemical or Biological Exposures, Performance Optimization, and Communication & Navigations), By End User (Defense, Law Enforcement, & Health Care), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

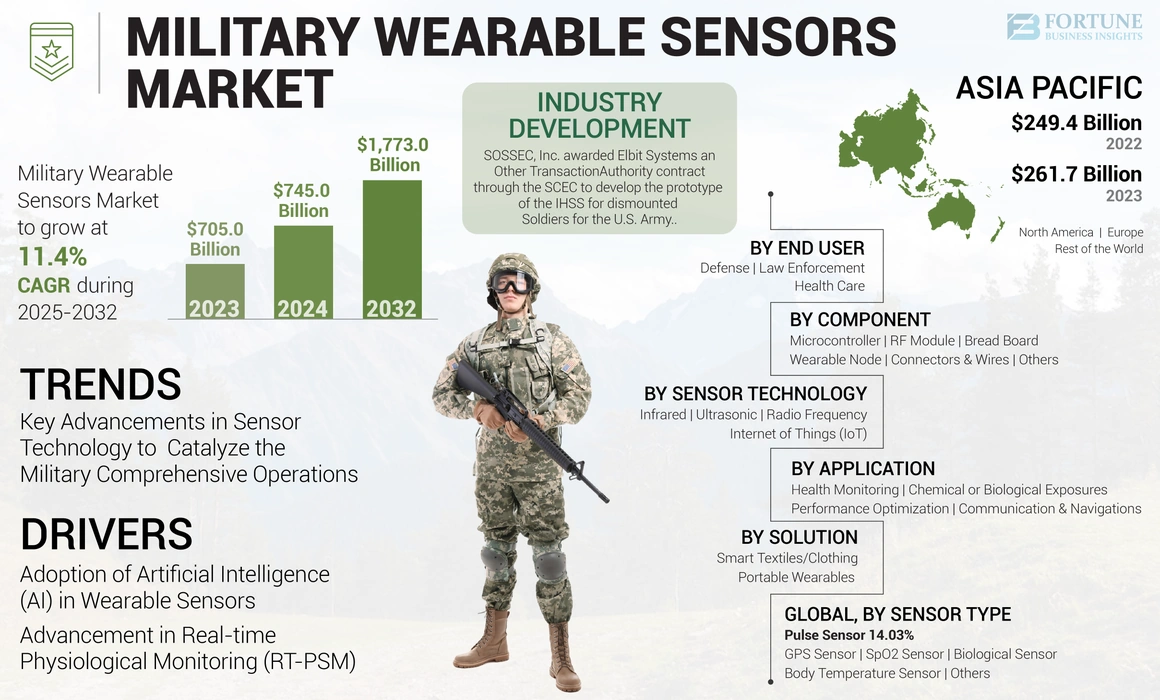

The global military wearable sensors market size was valued at USD 705.0 million in 2023. The market is projected to grow from USD 745.0 million in 2024 to USD 1,773.0 million by 2032, exhibiting a CAGR of 11.4% during the forecast period. Asia Pacific dominated the military wearable sensors market with a market share of 37.12% in 2023.

In the military field, wearable sensors are an integral part of a changing environment where technology intersects with tactical activities. These sensors monitor, capture, and send information concerning soldiers' health, whereabouts, and physical condition instantly, greatly improving operational efficiency, soldier capabilities, and safety during combat. This technology is a vital element of the digital soldier idea, seeking to furnish military personnel with sophisticated instruments that offer a tactical edge in different scenarios and drive market growth.

GLOBAL MILITARY WEARABLE SENSORS MARKET OVERVIEW

Market Size & Forecast

- 2023 Market Size: USD 705.0 million

- 2024 Market Size: USD 745.0 million

- 2032 Forecast Market Size: USD 1,773.0 million

- CAGR: 11.4% from 2024–2032

Market Share

- North America dominated the military wearable sensors market with a 36.22% share in 2023, supported by high defense budgets, integration of advanced soldier modernization programs, and the presence of key defense OEMs.

- By type, the vital sign monitoring sensors segment held the largest market share in 2023 due to increasing emphasis on soldier health, stress, and fatigue tracking during missions.

Key Country Highlights

- United States: Massive investments in integrated soldier systems and battlefield connectivity; DARPA and DoD pilot programs boost demand.

- China: Accelerated adoption of soldier performance tracking tools and wearable tech for modernized PLA forces.

- India: Indigenous development of wearable devices as part of Future Infantry Soldier as a System (F-INSAS).

- Russia: Emphasis on rugged wearable technologies for special forces and Arctic operations.

- UK: Expansion of defense tech collaborations with NATO to deploy real-time health and position sensors.

- Germany: Bundeswehr’s modernization plans involve advanced biometrics and situational awareness wearables.

RUSSIA-UKRAINE WAR IMPACT

Need For Expanding Military Capabilities During War Augmented The Demand For Military Wearables

The military wearable sensors market has been greatly affected by the ongoing conflict between Russia and Ukraine, especially in terms of emerging technologies and defense strategies. This evaluation delves into the repercussions of military wearable sensors and their wider consequences for defense procurement and technology adoption.

The conflict between Russia and Ukraine has caused many countries to reevaluate their defense procurement priorities, resulting in higher military spending and an emphasis on developing self-sufficient defense capabilities. Nations previously dependent on defense equipment from Russia and Ukraine are now placing greater investments in their military technologies, such as wearables.

For instance, the Ukrainian government has been looking to improve its military capabilities by purchasing body armor sensors and helmet sensors from different suppliers. This demonstrates a growing interest in incorporating advanced wearable technologies for improving soldier protection and performance tracking.

Military Wearable Sensors Market Trends

Key Advancements in Sensor Technology to Catalyze the Military Comprehensive Operations to Drive Market Growth

The future of defense operations is being shaped by technological trends in military wearable sensors, which are improving soldier capabilities and health tracking. The market has identified several key trends in this area.

Advancements in Semiconductor Technology: Semiconductor technology is crucial for the development of more functional wearable devices. Recent advancements have led to smaller, lighter, and more efficient sensors that can monitor physiological parameters such as heart rate, body temperature, and movement. Such improvements allow the integration of sensors into clothing, helmets, and wristbands, making them discreet and easier for soldiers to wear in the field.

Integration of Smart Fabrics: The use of smart fabrics is becoming increasingly prevalent in military wearable sensors. These fabrics can incorporate printed electronics, allowing for lightweight and flexible designs that enhance the critical size, weight, and power (SWaP) factors. This trend facilitates the development of wearable devices that are functional and comfortable for long-term wear in various environments.

For instance, in May 2023, the SEMI Technology Community released an RFP with the goal of promoting human performance improvements through advances in wearable transdermal, subcutaneous, and textile-based sensor technologies. Cash awards for chosen projects will range from USD 500,000 to USD 1 million, with support from the U.S. Air Force Research Laboratory (AFRL).

Download Free sample to learn more about this report.

Military Wearable Sensors Market Growth Factors

Increasing Adoption of Artificial Intelligence (AI) in Wearable Sensors Catalyze the Market Growth

Advancements in Artificial Intelligence (AI) are significantly impacting the development of wearable sensor technology to accelerate the global military wearable sensors market share.

AI algorithms can process and examine continuous streams of data from wearable sensors in real time with Internet of Things (IoT) technologies. They can notice patterns, anomalies, and trends in the data, providing immediate insights into the user's health status. Furthermore, this real-time analysis empowers timely interventions and can notify the user of possible health issues, facilitating proactive healthcare.

Machine learning algorithms leveraged by AI allow recognizing subtle changes in physiological parameters and identifying early signs of health issues and undiagnosed conditions are capabilities of wearables. Through continuous learning from user data, AI can create predictive models that help with early detection, allowing for timely medical interventions and potentially enhancing patient outcomes.

For instance, in June 2023, the U.S. Army is looking for innovative technologies from small businesses to create and provide essential solutions in artificial intelligence/machine learning and wearables for Soldiers. The Army Applied SBIR Program announced two Phase I contract prospects, including an initial AI/ML open-topic solicitation. Moreover, this solicitation will provide up to USD 150,000 over three months for small businesses to develop Trusted AI and Autonomy. Furthermore, the Small Business Innovation Research contract opportunity was established by the Army Applied SBIR Program to attract non-traditional businesses not familiar with the program and to expand the defense industrial base.

Advancement in Real-time Physiological Monitoring (RT-PSM) Significantly Enhances Soldier Performance Aid the Market Growth

Real-time physiological monitoring (RT-PSM) significantly enhances soldier performance by providing immediate insights into their health and readiness, which is crucial for operational effectiveness and drives the global military wearable sensors market growth.

RT-PSM systems continuously track various physiological parameters, such as heart rate, body temperature, and stress levels. This individualized data allows precise monitoring of each soldier's physical state, enabling timely interventions to prevent health issues such as heat strain or fatigue which can impair performance during missions.

The actionable insights derived from RT-PSM systems assist military leaders in making informed decisions regarding troop management. By understanding the physiological status of soldiers, leaders can optimize workload distribution, manage rest cycles effectively, and enhance situational awareness within teams. This data-driven approach supports mission planning and execution, ensuring that soldiers are operating at their best.

For instance, in October 2023, the U.K. Armed Forces enhanced battlefield protection with cutting-edge chemical detection sensors. A joint effort led by Strategic Command and a team encompassing all branches of defense will bring wearable personal chemical agent sensors to thousands of individuals in the British Army, Royal Navy, and Royal Air Force. This technology would help identify numerous toxic chemical threats and enable quick implementation of appropriate measures.

RESTRAINING FACTORS

High Cost of Sensors and Several Challenges to Hinder the Growth of the Market

The development and manufacturing of advanced wearable sensors require significant investment in research and development. The specialized components and materials used in these sensors, along with the need for rigorous testing and compliance with military standards, contribute to their high cost. This can be a barrier to widespread adoption, especially in countries with limited defense budgets.

Military wearable sensors must operate reliably in harsh environments, withstanding factors such as extreme temperatures, moisture, dust, and physical stress. Ensuring the durability and consistent performance of these devices is critical for mission success and soldier safety.

However, achieving reliable operation under such demanding conditions present challenges, which can limit the adoption of wearable sensors.

Military Wearable Sensors Market Segmentation Analysis

By Sensor Type Analysis

Body Temperature Sensors Segment Dominated due to its Ability to Detect Heat Injuries

Based on sensor type, the market is divided into pulse sensor, GPS sensor, SpO2 sensor, biological sensor, body temperature sensor, and others.

The body temperature sensor segment dominated the military wearable sensors market in 2023 and is anticipated to be the fastest-growing segment during the forecast period. Increasing monitoring of a soldier's body temperature in critical situations is necessary for detecting early signs of heat injuries such as heat exhaustion and heat stroke, which can be life-threatening.

The GPS sensor segment is estimated to grow significantly in the forecast period. The rise in evolving security threats, the growing demand for GPS sensors for location tracking, emergency response, and situational awareness are the factors bolstering the segment growth. These sensors provide soldiers with crucial navigational aids and real-time updates on their surroundings, supporting market growth.

To know how our report can help streamline your business, Speak to Analyst

By Component Analysis

Microcontroller Segment Dominated due to High Adoption of Microcontrollers for Various Sensor Applications

Based on components, the market is divided into microcontroller, RF module, bread board, wearable node, connectors & wires, and others.

The microcontroller segment dominated the wearable sensors market in 2023 and is anticipated to be the fastest-growing segment at the highest growth rate during the forecast period. The integration of microcontrollers in military wearable sensors is a rapidly evolving field, presenting significant growth opportunities. These technologies enhance soldier safety, operational efficiency, and battlefield effectiveness. Microcontrollers play a crucial role in the functionality of wearable sensors. They process data from various sensors, enabling features such as health monitoring and environmental analysis. Moreover, continuous innovation in sensor technology and microcontroller capabilities will lead to more sophisticated wearable solutions that can adapt to various combat scenarios.

The RF Module segment is estimated to grow significantly in the forecast period. RF modules are essential for enabling the full potential of wearable sensors. Their ability to provide long-range communication, high-speed data transmission, interoperability, robustness, low power consumption, and flexibility makes them a critical component in enhancing soldier safety, health monitoring, and operational effectiveness in the field, catalyzing the potential requirement and growth of the market.

By Solution Analysis

Growth Potential for Smart Textiles in Military Applications is Significant Due to Technological Advancements

Based on solution, the market is divided into smart textiles/clothing and portable wearables.

The smart textile/clothing segment is estimated to grow significantly in the forecast period. The integration of sensors in smart textiles to detect, monitor, and analyze real-time health monitoring, environmental interaction, durability, and washability, enhanced functionality, and so on. Moreover, the lightweight nature of smart textiles enhances soldier mobility and reduces fatigue.

By Sensor Technology Analysis

Military Wearable Sensors Reveals a Dynamic Landscape Characterized by Rapid Advancements Aid Significant Growth Opportunities

Based on sensor technology, the market is divided into infrared, ultrasonic, radio frequency, and Internet of Things (IoT).

The ultrasonic segment dominated the global military wearable sensors market in 2023. Portable devices are a key driving factor for wearable sensors, enabling enhanced functionality, real-time data processing, and improved soldier performance.

The infrared segment is estimated to grow significantly in the forecast period. The integration of sensors in smart textiles to detect, monitor, and analyze real-time health monitoring, environmental interaction, durability and washability, enhanced functionality, and so on. Moreover, the lightweight nature of smart textiles enhances soldier mobility and reduces fatigue.

By Application Analysis

Early Adoption of the Sensors in Various Military and Combat Applications to Enhance the Battlefield

Based on application, the market is divided into health monitoring, chemical or biological exposures, performance optimization, and communication & navigation.

The health monitoring segment dominated the wearable sensors market in 2023 and is anticipated to be the fastest-growing segment during the forecast period. The growing adoption of these sensors to monitoring soldiers health during various terrains and operations. For instance, in April 2023, During the COVID-19 pandemic, the Defense Innovation Unit, also referred to as DIU, collaborated with the private sector to create a wearable device that effectively detected infections.

Communication and navigation are critical components of military wearable sensor systems, enabling real-time data transmission and precise location tracking. The integration of communication and navigation capabilities in wearable sensors has become increasingly significant across various sectors, particularly in military and healthcare applications, catalyzing growth of the segment.

By End User Analysis

Increasing R&D Activities by Various Organizations to Boost Health Care Segment

Based on end user, the market is divided into defense, law enforcement, and healthcare.

The healthcare segment dominated the global military wearable sensors market in 2023 and is anticipated to show significant growth. The growing research and development by various organizations and agencies for sensor advancement to enhance soldier’s performance and track the real time data catalyze market growth.

For instance, Agencies such as the Defense Advanced Research Projects Agency (DARPA) are involved in developing and testing wearable technologies that monitor health indicators and detect illnesses before symptoms appear.

The defense segment is estimated to be the fastest-growing segment during the forecast period from 2024 to 2032. The increasing adoption of the sensors in military forces such as naval, land, and air forces to address the real time physical performance during operations. Moreover, the defense end users of wearable sensors span various branches and roles within the military, each utilizing these technologies to improve health monitoring, situational awareness, and overall operational effectiveness.

REGIONAL INSIGHTS

Regionally, the market is segmented into North America, Europe, the Asia Pacific, and the Rest of World.

Asia Pacific Military Wearable Sensors Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest market share and is likely to remain dominant throughout the forecast period. The Asia Pacific region is a significant player in the wearable sensors market, reflecting a growing demand for advanced technologies to enhance soldier safety and operational efficiency. The increasing adoption of technologies such as augmented reality (AR), biometric sensors, and wireless communication systems is driving regional growth.

North America holds a significant market share in the base year and is estimated to be the fastest-growing region in the forecast period. The region has a strong emphasis on modernizing military capabilities, which includes the adoption of advanced wearable technologies. This modernization is driven by the need to enhance operational efficiency and soldier safety.

The market in Europe is experiencing significant growth, driven by technological advancements and increased spending on military modernization programs in defense capabilities. Europe is the second-fastest growing market for wearable sensors, projected to grow rapidly due to increasing defense expenditures, and countries such as Germany, France, and the U.K. leading investments in wearable technologies that enhance soldier capabilities, health monitoring, and situational awareness.

The Rest of the World market consists of the Middle East & Africa and Latin America is experiencing notable growth driven by various factors, including defense industry modernization initiatives, technological advancements, and regional security challenges.

Key Industry Players

Key Players Are Focusing on the Development of Next Generation Wearable Sensors Through Research and Development to Enhance Their Capabilities

Companies operating in the market is experiencing significant growth driven by advancements in military wearable technology, increasing emphasis on soldier health monitoring. The competitive landscape of military wearable sensors is dynamic and evolving, characterized by significant technological advances and strategic investments. As the military sector continues to prioritize innovation and soldier safety, the market is poised for substantial growth, offering numerous opportunities for key players and new entrants. This strategic emphasis aims to enhance the capabilities of military personnel, improve operational efficiency, and ensure soldier safety in diverse environments. For instance, Thales Group focuses on integrating state-of-the-art sensors and communication systems into cohesive military solutions. In addition, Elbit Systems Ltd, engages in continuous innovation to meet the growing demand for advanced wearable technologies in military applications.

List of Top Military Wearable Sensors Companies:

- ASELSAN AS (Turkey)

- BAE Systems Plc (U.K.)

- Elbit Systems Ltd (Israel)

- Interactive Wear AG (Germany)

- L3Harris Technologies Inc. (U.S.)

- Leidos Holdings, Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- QinetiQ (U.K.)

- RTX Corporation (U.S.)

- TE Connectivity Ltd. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: The U.S. Army is considering using wearable technology to monitor traumatic brain injuries in soldiers assigned to high-risk roles. Additionally, the Army is exploring options for providing additional personal protective gear to personnel, such as instructors, who are regularly exposed to blast pressures.

- January 2024: SOSSEC, Inc. awarded Elbit Systems an Other Transaction Authority contract through the Sensors, Communication, and Electronics Consortium (SCEC) to develop the prototype of the Integrated Headborne Sensor System (IHSS) for dismounted Soldiers in the U.S. Army.

- November 2023: Wearable sensor technology is extensively utilized in contemporary sports stadiums to monitor athletes' vital signs. Various Defense Department agencies and laboratories spent the last decade investigating the potential benefits of wearable technology for soldiers in combat zones. The Pentagon's goal was to acquire a thorough understanding of all current programs and create a strategy for the future of this technology.

- October 2023: A collaborative effort involving a pan-defense team resulted in a contract worth around USD 89 million to enhance the safety of personnel in the British Army, Royal Navy, and Royal Air Force. Thousands of military personnel would soon have access to wearable personal chemical agent sensors, allowing them to swiftly identify various toxic chemical threats and promptly take necessary protective measures.

- May 2023: A wearable device in the shape of a smartwatch was created to alert military personnel to potential illnesses before symptoms appear. The RATE (Rapid Assessment of Threat Exposure) initiative includes integrating sensors into a regular watch and a ring. These sensors send information to a software program that assesses possible infections.

REPORT COVERAGE

The global military wearable sensors market report provides a detailed analysis of the market insights. It focuses on key aspects such as leading companies, different types, materials used, and applications of wearable sensors. Besides this, it offers insights into the global military wearable sensors market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the developed market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 11.4% during the 2024-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Sensor Type

|

|

By Component

|

|

|

By Solution

|

|

|

By Sensor Technology

|

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size is USD 705.0 million in 2023 and is projected to reach USD 1,773.0 million in 2032.

Registering a CAGR of 11.4%, the market is slated to exhibit steady growth during the forecast period.

In terms of end user, the health care segment dominated the market in 2023 owing to the growing demand for versatile health monitoring.

Asia Pacific region captured the largest market share in 2023.

There are several different types of sensors used in their applications, such as pulse sensors, GPS sensors, SpO2 sensors, biological sensors, body temperature sensors, and others.

Health Monitoring, Chemical or Biological Exposures, Performance Optimization, Communication & Navigation, and so on are the key applications of sensors.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us