North America Centrifugal Water Pump Market Size, Share & COVID-19 Impact Analysis, By Pump Type (Axial Flow, Radial Flow, and Mixed Flow) By Stage (Single Stage and Multistage), By Application (Submersible Pump and Above-Ground Pumps), By End-user (Residential, Commercial, Industrial, Agriculture, and Distribution/Water Utility) and Regional Forecast, 2025-2032

North America Centrifugal Water Pump Market Size

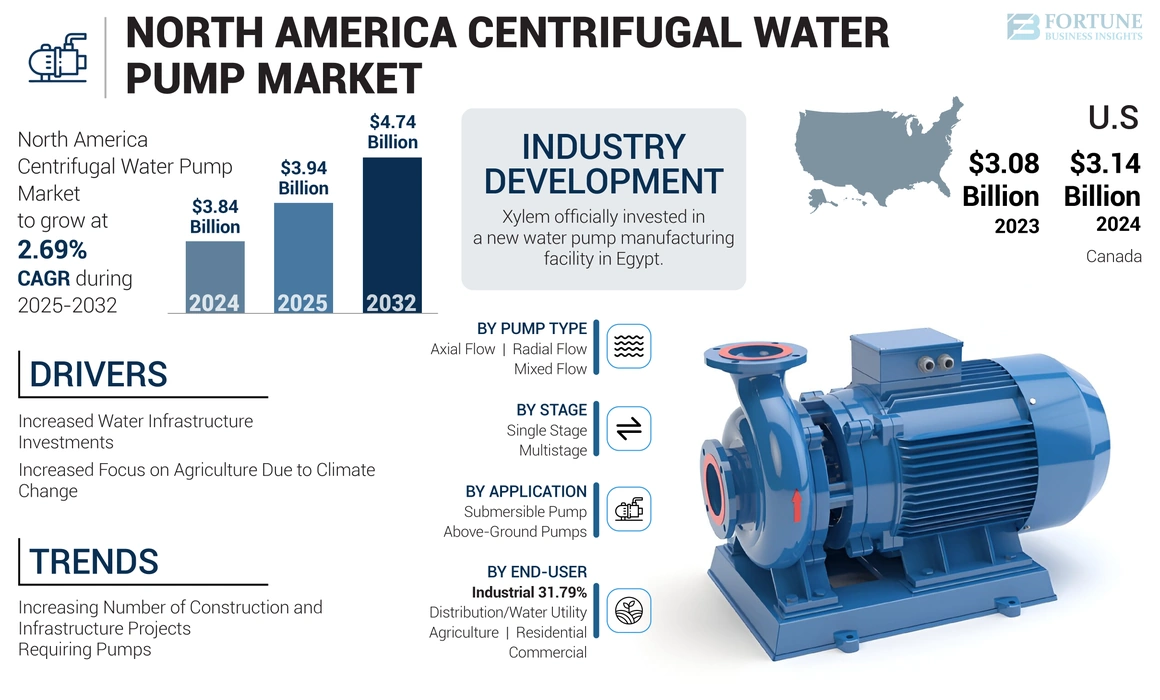

The North America centrifugal water pump market size was valued at USD 3.84 billion in 2024. The market is projected to grow from USD 3.94 billion in 2025 to USD 4.74 billion by 2032, exhibiting a CAGR of 2.69% during the forecast period.

Centrifugal water pumps operate on the principle that a rotating impeller inside the pump casing accelerates the water, creating a centrifugal force that drives it outward. As a result, the water is pushed through the pump and discharged into the connected pipes, enabling consistent and efficient water circulation in various applications such as drainage, irrigation, and water supply systems.

COVID-19 IMPACT

Pandemic Had a Mixed Impact Due to a Reduction in Consumer Spending and a Stimulus Package for Water Infrastructure in Agriculture

The COVID-19 pandemic had both negative and positive impacts on the growth of the North America centrifugal water pump market share. The commercial, real estate, and manufacturing sectors experienced slowdowns due to lockdowns and decreased consumer spending, leading to reduced demand for centrifugal water pumps. Additionally, construction projects were hindered, resulting in decreased orders for pumps used in building systems.

Furthermore, the U.S. Department of Agriculture (USDA) Agricultural Marketing Service (AMS) sought inputs through public comments and listening sessions regarding the potential development of new grants and a new food purchase program. The COVID Stimulus Package, part of the Consolidated Appropriations Act of 2021, allocated no less than USD 1.5 billion for debts and subsidies to mid-sized and small distributors or food processors, farmers' markets, seafood processing facilities, processing vessels, and others to respond to COVID-19. The funding also provided for the acquisition and distribution of agricultural and food products. This stimulus package for water infrastructure in agriculture helped them recover from COVID-19 and propelled the North America centrifugal water pump market growth.

North America Centrifugal Water Pump Market Trends

Increasing Number of Construction and Infrastructure Projects Requiring Pumps is a Key Trend

The growing number of construction and infrastructure development projects will surge the demand for water pumps. For instance, according to the Associated General Contractors of America, the U.S. Census Bureau released monthly spending estimates stating that in February 2022, construction spending in the U.S. increased for the 12th successive month to USD 1.70 trillion, a rise of 0.5% for the month and 11.2% year-over-year. Private residential construction surged 1.1% in February and 16.6% over 12 months.

In addition, in December 2023, the U.S. Environmental Protection Agency (EPA) announced that 55 new projects in 20 states would be invited to apply for approximately USD 5.1 billion in loans under the Water Infrastructure Finance and Innovation Act. These funds will be used to invest around USD 12 billion in clean water and consumption water infrastructure projects in communities across the U.S.

Download Free sample to learn more about this report.

North America Centrifugal Water Pump Market Growth Factors

Increased Water Infrastructure Investments to Drive Market Growth

According to the Environmental Protection Agency (EPA), the U.S. has experienced underinvestment in water infrastructure for an extended period. Insufficient water infrastructure poses a threat to Americans. The Bipartisan Infrastructure Law is set to invest USD 50 billion in the EPA to enhance U.S. wastewater, stormwater, and drinking water infrastructure. It is one of the largest investments in water that the federal government has ever made. This historic investment comprised of

- USD 15 billion to the Drinking Water SRF for Lead Service Line Replacement

- USD 11.7 billion to the Drinking Water State Revolving Fund (SRF)

- USD 5 billion to Water Infrastructure Improvements for the Nation (WIIN) Grants to address emerging contaminants

- USD 4 billion to the Drinking Water SRF for Emerging Contaminants

- USD 1.7 billion for Geographic Programs.

- USD 267 million for the National Estuary Program, Gulf Hypoxia Program, and more.

There are still 6 to 10 million lead service lines in towns and cities across the U.S., with many located in low-income neighborhoods. Due to the funding provided by the Bipartisan Infrastructure Law, millions of American families will no longer have to worry about the dangerous health hazards from lead and other contaminants in their water. These developments and investments are expected to drive the North American market growth.

Increased Focus on Agriculture Due to Climate Change to Propel Market Growth

In line with the Biden-Harris Administration’s dedication to making Western communities more resilient to the impacts of climate change and drought, the U.S. Department of Agriculture introduced new strategies and investments to help farmers and ranchers conserve water, mitigate climate change, and build drought resilience in the West, supported in part by funding from the Inflation Reduction Act.

The Western Water and Working Lands Framework for Conservation Action, administered by the USDA's Natural Resources Conservation Service (NRCS), is a comprehensive, multi-state approach designed to tackle critical water and land management issues across 17 Western States. This represents the most recent Framework for Conservation Action issued by NRCS, providing guidance, support, and coordination to address resource concerns and threats spanning state boundaries. The framework outlines criteria for identifying vulnerable agricultural landscapes and offers 13 strategies to aid NRCS state leaders, water resource managers, and producers in addressing priority challenges.

Under this new framework, the Water SMART Initiative will allocate USD 25 million to support three new priority areas and 37 existing ones, aiding communities and producers in the Western region. These funds complement projects led by irrigation districts, water suppliers, and other organizations that receive Water SMART program funds from the Department of Interior's Bureau of Reclamation. This factor is poised to propel the demand for water pumps.

RESTRAINING FACTORS

Presence of Alternatives May Hinder Market Growth

The centrifugal water pump industry faces a challenging landscape due to the increasing presence of alternative technologies, potentially hindering market growth. Technological developments and a growing focus on energy efficiency and sustainability are driving this shift.

One major alternative to traditional centrifugal water pumps is the presence of reciprocating and rotary pumps. These pumps offer accurate control and are often preferred in applications where precision is crucial, such as in the pharmaceutical and chemical industries.

Furthermore, the rise of smart pump systems with IoT (Internet of Things) technology adds another layer of competition. These intelligent systems offer predictive maintenance, real-time monitoring, and other features, making them highly attractive for industries looking to enhance their operations.

North America Centrifugal Water Pump Market Segmentation Analysis

By Pump Type Analysis

Radial Flow is the dominating segment Driving Transformation in This Market

Based on pump type, the market is categorized into axial flow, radial flow, and mixed flow.

The radial flow is anticipated to be the fastest-growing segment in North America during the forecast period, owing to the fact that it discharges liquid perpendicular to the main pump shaft. This type of pump is ideal for many pressure and flow applications, offering numerous advantages such as efficient water flow and versatility.

On the other hand, mixed flow pumps have specific applications where other pump types have less potential. Mixed-flow centrifugal water pumps are a type of centrifugal pump that combines characteristics of both axial and radial flow pumps.

By Stage Analysis

Greater Efficiency of Multistage Pumps to Foster Segment Growth

Based on stage, the market is bifurcated into single stage and multistage.

The multistage segment dominates the North American centrifugal water pump market. The individual stage itself comprises one impeller. The multistage centrifugal water pump, on the other hand, utilizes multiple impellers and is far more efficient than the single stage. These pumps have the exclusive ability to generate progressively higher pressures through the addition of each stage while consistently maintaining the flow range at a given speed.

Single-stage centrifugal pumps are versatile for various applications and suitable for flow rate requirements and moderate pressure. They are simple in structure, stable in operation, and easy to maintain.

By Application Analysis

Above-Ground Pumps Segment to Dominate Due To Consistency and Efficiency

Based on application, the market is divided into submersible pump and above-ground pumps.

The above-ground pumps segment is expected to dominate the North American market during the forecast period. In above-ground scenarios, these pumps find utility in residential, agricultural, and industrial sectors. They effectively draw water from wells, tanks, or reservoirs, providing a consistent supply for irrigation, firefighting, or domestic applications. In addition, the compact design guarantees easy installation, and their robust construction ensures reliability even under challenging environments.

Centrifugal water pumps developed for submersible applications are a cornerstone of underwater fluid management. These pumps, engineered for dependability and effectiveness, operate submerged in water, pushing fluid to the surface.

By End-user Analysis

Developing Food & Beverage Industry to Spur Industrial Segment Growth

On the basis of end-user, the market is divided into residential, commercial, industrial, agriculture, and distribution/water utility.

The industrial segment dominates the North American market. Centrifugal pumps are primarily used for industrial applications because they can typically pump large volumes of liquid at very high flow rates. Additionally, they can vary the flow rates over a wide range. The developing dairy, food & beverage, and chemical industries are greatly impacting the industrial segment's growth. It is also used in the distribution/water utility sector. Some of the developments that might propel the market are as follows: for instance, on July 1, 2021, the House passed the INVEST in America Act, which would sanction various new Environment Protection Agency (EPA)-administered grant programs for drinking water or wastewater infrastructure.

To know how our report can help streamline your business, Speak to Analyst

By Country Analysis

The North American centrifugal water pump market has experienced significant growth in recent years, with the U.S. dominating the major market share. Several developments are creating an ideal environment for the growth of the U.S. market. For instance, in October 2023, the Environmental Protection Agency (EPA) made a USD 336 million investment to boost wastewater infrastructure enhancements across New York State.

According to the National Statistical Office (Statistics Canada), in February 2023, investment in residential building construction surged 1.1% to USD 15.0 billion, with single-family home investment (+1.3%; +USD 102.8 million) contributing the most to the growth. These numbers imply a positive environment for this market in Canada's residential sector.

Key Industry Players

Franklin Electric is one of the Leading Players in the Production and Marketing of Water and Energy Transportation Systems and Components

Franklin Electric's centrifugal pumps adhere to Department of Energy standards. These centrifugal pumps are manufactured from different metallurgies to cater to specific application requirements. The products find usage in diverse applications such as water supply and treatment, pressure boosting, water recirculation, wash down, and irrigation.

Xylem is also one of the major water technology providers, helping several consumers solve the world's toughest water challenges in industrial, utility, and others.

- In May 2023, the U.S.-based global water solutions company Xylem officially invested in a new water pump manufacturing facility in Egypt. A statement from the ministry said the plant would produce split-case centrifugal pumps and end suction pumps in the first phase, requiring an investment of 300 million Egyptian pounds (USD 9.7 million).

LIST OF TOP NORTH AMERICA CENTRIFUGAL WATER PUMP COMPANIES:

- Grundfos (U.S.)

- Wilo (Italy)

- Pedrollo S.p.A (Italy)

- Franklin Electric (U.S.)

- Pentair (U.S.)

- Zoeller (U.S.)

- SPX Flow (U.S.)

- Xylem Inc. (U.S.)

- Verder Liquids (Netherland)

- Phantom Pumps (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: Sulzer and Siemens LDA announced a digital collaboration aimed at enhancing the digital value proposition for large centrifugal pumps. The partnership involves integrating their respective IoT platforms, BLUE BOX, and SIDRIVE IQ, to provide a comprehensive solution. This collaboration, formalized through a letter of intent, seeks to improve equipment dependability and reduce operational costs for operators of large centrifugal pumps.

- October 2022: Grundfos, a global market leader in advanced pump solutions and water technology, inaugurated its state-of-the-art plant in Serbia. This extension adds 17.000 sqm to its facilities in the country. The company has expanded its plant in Indjija, Serbia, and the expanded plant will serve a global market, primarily including circulator pumps, domestic wastewater pumps, domestic pressure boosters, and Integrated Water Circuits (IWCs).

- August 2022: The Wilo Group announced its intent to acquire two specialists in wastewater treatment in Germany. The multinational technology group Wilo took over FSM Frankenberger GmbH & Co. KG in Pohlheim and WSM Walower Stahl- und Maschinenbau GmbH in Walow. Both companies specialize in technologies for mechanical cleaning and treatment of wastewater.

- April 2022: SPX Flow Company a leading provider of process solutions for the nutrition, health and industrial markets has broadcasted the successful closing of its acquisition by an affiliate of Lone Star Funds.

- June 2020: Sulzer's close-coupled end suction (CPE) pump range received certification from NSF61 and NSF372 for utilization in drinking water applications. This energy-efficient range of end-suction single-stage centrifugal pumps now meets the highest standards required for delivering potable water. It complies with the energy efficiency norms applicable to all industries globally. The CPE pump has been engineered to cater to different process needs found in various sectors.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading product applications. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 2.69% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Pump Type

|

|

By Stage

|

|

|

By Application

|

|

|

By End-user

|

Frequently Asked Questions

Fortune Business Insights study shows that the North America market was valued at USD 3.84 billion in 2024.

The North America market is projected to grow at a CAGR of 2.69% during the forecast period.

Based on application, the above-ground pumps segment is expected to hold the dominating share during the forecast period.

The North America market size is expected to reach USD 4.74 billion by 2032.

The growing demand for increased water infrastructure investments is driving the market growth.

Grundfos, Xylem Inc., Pentair, and Franklin are some of the major players actively operating across the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us