North America Feed Fertilizer Market Size, Share & COVID-19 Impact Analysis, By Type (Urea {Granular and Prilled}, Mono and Di Calcium Phosphate, Potassium Carbonate, Potassium Sulfate, Potassium Chloride, and Others) and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

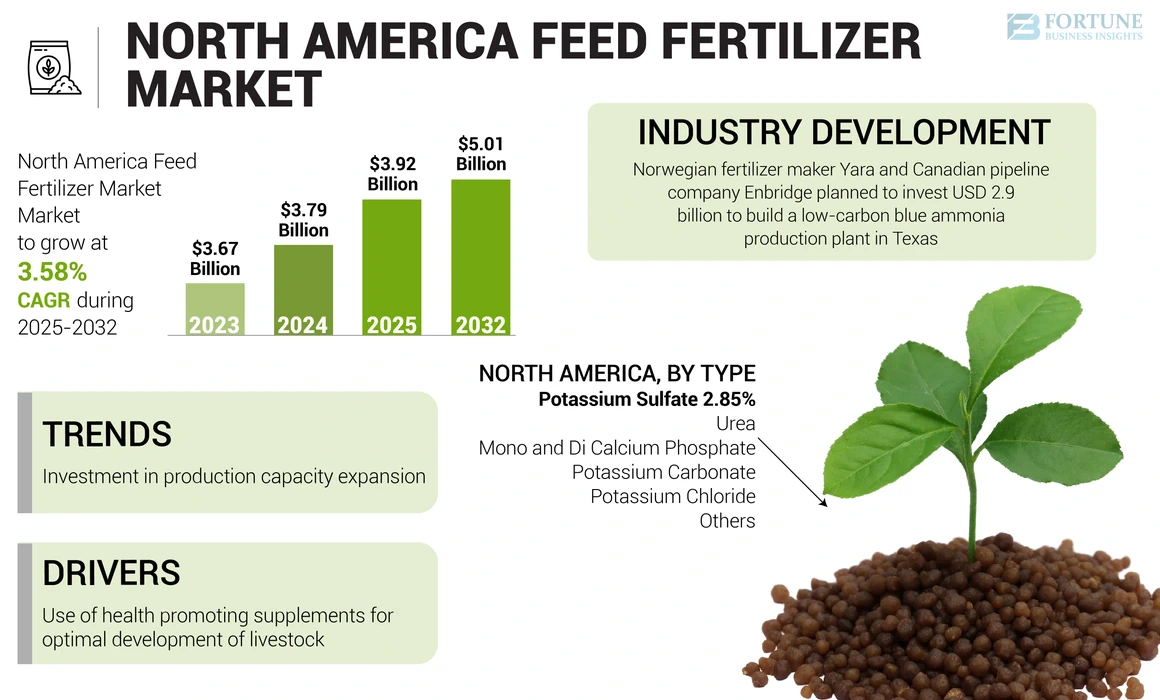

The North America feed fertilizer market size was USD 3.79 billion in 2024. The market is projected to grow from USD 3.92 billion in 2025 to USD 5.01 billion by 2032, exhibiting a CAGR of 3.58% during the forecast period.

Feed fertilizers are largely used as a part of animal nutrition to improve the quality of feed produced from animals or to enhance the animal's performance and health such as strengthening the digestibility of feed materials. Nowadays, owing to the high cost of feed grains and other high-protein grains, the use of products such as urea as a protein source, which is very cost-effective in many cattle diets, is expected to increase.

North America Feed Fertilizer Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 3.79 billion

- 2025 Market Size: USD 3.92 billion

- 2032 Forecast Market Size: USD 5.01 billion

- CAGR: 3.58% from 2025–2032

Market Share:

- The U.S. dominated the North America feed fertilizer market in 2024, driven by its vast livestock population and widespread use of feed-grade urea and phosphates for balanced animal nutrition.

- By type, urea held the largest market share in 2024 due to its cost-effectiveness and high nitrogen content, making it the most preferred alternative protein source in cattle diets.

Key Country Highlights:

- United States: With over 91.9 million cattle and a high volume of poultry and hogs, the U.S. drives demand for feed fertilizers such as urea, mono and di calcium phosphate, and potassium chloride.

- Canada: Feed consumption rose to 28.9 million tons in 2021; local companies like Agrium Inc. and Potash Corporation are investing in feed fertilizer production for domestic and international markets.

- Mexico: Growing livestock population and climate-driven grain shortages are prompting greater demand for imported feed fertilizers and encouraging market expansion opportunities.

COVID-19 IMPACT

Disruption in Raw Material Availability and Access Negatively Impacted Market Growth During Pandemic

Supply chain disruptions in the animal husbandry sector significantly impacted the market growth. In the early stages, most manufacturing facilities were forced to shut down to prevent the spread of the virus. Production facilities were closed due to labor shortages, a decrease in the availability of raw materials, and to maintain proper social distancing and prevent virus spread. Many farmers stockpiled animal feed products in anticipation of potential shortages. Various concerns, such as increased shortages of trucks, reduced number of deliveries, and reduced market access for fertilizer manufacturers, influenced the farmers to stock their animal feed supplies. Hence, this move immediately spiked the demand for animal feed ingredients. According to C.O. Bank, a financial services company, feed prices in the U.S. increased by 12% in 2021 compared to 2020. Canada and Mexico, which depend on importing mineral feed fertilizers from other countries, suffered significant product shortages during the pandemic. Hence, the North America feed fertilizer market growth was dampened during the pandemic, and its lingering effect on the supply chain, product prices, and product availability continues today.

LATEST TRENDS

Download Free sample to learn more about this report.

Investment in Production Capacity Expansion to Meet Growing Demand and Support Market Growth

Animal feed manufacturers are emphasizing product portfolio enlargement to meet the growing demand for high-quality animal nutrition products among animal farm owners. In June 2022, Nutrien Ag Solutions planned to increase its fertilizer production capability due to structural changes in the global energy, fertilizer, and agriculture markets. The company planned to increase its potash production capability to 18 million tonnes annually by 2025 through existing low-cost capacity supported by world-class global logistics infrastructure. Furthermore, the growing demand for meat products and fish such as prawns, shrimp, and tuna among consumers in the region is prompting animal farm owners to invest heavily in high-quality feed products to maintain the optimum health of animals. Products such as mono and di calcium phosphate are some of the essential nutrients required for animal growth. Thus, the demand for such products is expected to increase in the future.

DRIVING FACTORS

Use of Health Promoting Supplements for Optimal Development of Livestock

Feed-grade fertilizers, consisting of urea, potassium carbonate or sulfate, mono and di calcium phosphate, have emerged as an effective source of protein in cattle diets. There is an urgent necessity to address the adequate presence of essential supplements in the animal's daily diets, which helps in optimal digestion of animal food, stimulates bone and muscle growth, and enhances the ruminants' fertility rate and overall growth. Several studies have shown the impact of nitrogen, phosphorus, calcium, and other essential minerals in animal diets and the importance of such products in animal diets. Thus, the health boosting properties of such products increase their importance and adoption rate among farm owners in providing balanced animal nutrition.

- According to the National Library of Medicine 2020, a study was conducted to understand the effects of slow-release urea supplementation (Optigen) on the performance of beef cattle. Results showed that dietary supplementation of slow-release urea supplementation strengthens performance & profitability and reduces the environmental impacts of beef cattle production.

RESTRAINING FACTORS

Hike in Natural Gas Prices to Impede the Market Growth

Natural gas is one of the most efficient sources of energy in modern farming, as it is commonly used to produce two types of fertilizers, ammonia and urea. However, the price of natural gas in the U.S. has risen exponentially due to the Russia-Ukraine conflict, decreased electricity production, shift toward natural gas consumption, and other macroeconomic factors. Such strong market demand and the gap in production have contributed to higher gas prices. This has impacted the operations of feed fertilizer manufacturing companies, leading to higher product prices.

- According to "CNN Business," 2022, a finance business newspaper, the price of natural gas underwent a hike of around 7%, the highest hike observed since 2008. Moreover, the prices soared by 70% during the COVID-19 pandemic in 2020 but eventually settled in mid-phase, and now again witnessing a strong price spike.

The reduced amount of natural gas available for sale in the domestic market has led to disruptions in the North America feed fertilizer market growth.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Urea is the Leading Type as it is One of the Economical Sources of Nitrogen for Animal Species

Based on type, the market is segmented into urea, mono and di calcium phosphate, potassium carbonate, potassium sulfate, potassium chloride, and others. Urea is one of the most important elements used to produce a wide variety of animal feed additives and supplements. Feed-grade urea is the leading and most effective source of protein in cattle diets as it improves the protein level of the finished feed, which, when consumed by the animals, helps to boost the metabolism and enhances the appetite of the ruminants. Also, urea is a cheaper nutrition source than other high-cost grain-based diets, which helps the product become the most preferred alternative to protein sources.

Besides this, the mono and di calcium phosphate segment also witnessed strong growth in its use across animal farms. These ingredients are mainly used due to their high calcium and phosphorus content, which helps in strong bone tissue and skeleton formation in ruminants. These phosphate supplements play a vital role in strengthening the animals' reproduction cycle and preventing abnormal bone development.

The role of potassium carbonate has also significantly emerged as its inclusion in the animal diet helps improve the animal's performance and enhance bone strength, thereby meeting their nutritional standards, including proper anion/cation balance.

COUNTRY INSIGHTS

To know how our report can help streamline your business, Speak to Analyst

The U.S. is the major consumer of animal feed fertilizer, and was valued at USD 2.66 billion in 2024 due to a large variety of animals in the country. As per data provided by the U.S. Department of Agriculture (USDA), the country has a cattle population of 91.9 million, 373 million egg laying chickens, and 72.5 million hogs and pigs in its inventory in 2022. A deficiency of essential minerals and nutrients in the animal diet can significantly hamper their health. For instance, a deficiency of nitrogen, phosphorus, and calcium minerals in the animal diet can cause reduced egg yield in chickens and reduced growth rates in pigs. Incorporating animal feed products such as urea, feed phosphates, including mono calcium and di calcium phosphates, potassium chloride, and others helps provide balanced nutrition to animals. Hence, the demand for such products is expected to continue to increase in the future.

Animal farm owners' adoption of feed fertilizers in Canada is also increasing rapidly. As per data provided by the Association de nutrition animal du Canada, the overall animal feed consumption in the country has increased from 28.8 million tons in 2020 to 28.9 million tons in 2021. The demand for high-quality feed products is increasing steadily among animal farm owners in the country. Thus, major fertilizer companies such as Canadian Agrium Inc. and Potash Corporation are investing in developing feed fertilizers for domestic and international markets.

Mexico is another country where the demand for feed fertilizers is growing rapidly due to increased animal population over the past few years. As per data provided by FAOSTAT, the population of cattle in the country has increased from 7 million in 2017 to 8.4 million in 2022. Similarly, the pig population in the country also increased from 17.2 million in 2017 to 18.92 million in 2021. The country depends on importing feed products from other countries, and thus it is susceptible to market fluctuations caused by foreign exchange exposure and feed price volatility. Furthermore, severe droughts in different parts of the country have also impacted grain production and hampered regional product prices. Hence, other feed substitutes, such as animal feed fertilizer manufacturers, are witnessing an opportunity to expand their presence in the region. Therefore, this market in Mexico is expected to grow in the future.

KEY INDUSTRY PLAYERS:

Manufacturers are Ramping up Production Capabilities to Expand Product Offerings and Increase Sales

The major companies operating in the North America market are Nutrien Ltd., the Archer Daniels Midland Company, C.F. Industries Holdings Inc., and EuroChem Group AG, among others. The demand for nitrogen, phosphorus, and potassium-based feed is surging in this market, and the market players are formulating feeds with essential nutrients to gain a competitive advantage. Furthermore, due to ammonia's high protein source and price effectiveness, there is a rising demand for urea-based feed applications, compelling manufacturers to elevate the production of urea-based fertilizers. The players in the market also construct new fertilizer facilities in order to cater to the demand. For instance, in August 2022, the Archer-Daniels-Midland Company announced the opening of a new fertilizer terminal and blender in St. Paul, Minnesota. The new plant helps strengthen ADM's position in providing high-quality fertilizer for various agricultural applications.

LIST OF KEY COMPANIES PROFILED:

- Nutrien Ltd.(Canada)

- The Archer-Daniels-Midland Company (U.S.)

- C.F. Industries Holdings, Inc. (U.S.)

- EuroChem Group AG (Switzerland)

- Kent Nutrition Group (U.S.)

- OCP Group (Morocco)

- Pestell Minerals & Ingredients Inc. (Canada)

- The Mosaic Company (U.S.)

- Wego Chemical Group (U.S.)

- Yara International ASA (Norway)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Norwegian fertilizer maker Yara and Canadian pipeline company Enbridge planned to invest USD 2.9 billion to build a low-carbon blue ammonia production plant in Texas.

- December 2022: OCP Group, Morocco's phosphates and fertilizer producer, invested USD 12.3 billion to increase fertilizer production using renewable energy by 2027.

- August 2022: The Archer-Daniels-Midland Company, an American multinational food processing and commodities trading corporation, opened a new fertilizer terminal blender in Minnesota, U.S. The new facility would help boost the access and availability of high-quality fertilizer across the northern U.S. Corn Belt and western Canada.

- May 2022: Mitsui & Co., Ltd., a business conglomerate in Japan, partnered with C.F. Industries to develop a greenfield ammonia production facility in the U.S. The new facility would produce blue ammonia leveraging carbon capture and sequestration processes to reduce carbon emissions by more than 60% compared to conventional ammonia.

- September 2019: EuroChem Group AG, one of the leading fertilizer companies, announced a multi-year agreement with Houston-based (APF) in the U.S. to supply fertilizers to their blending business.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the North America feed fertilizer market share, size, and growth rate for all possible market segments. Various key insights presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion), Volume (1,000 Tonnes) |

|

Growth Rate |

CAGR of 3.58% from 2025 to 2032 |

|

Segmentation |

By Type

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the North America market size was valued at USD 3.79 billion in 2024.

The market is projected to grow at a CAGR of 3.58% during the forecast period (2025-2032).

Urea is expected to be the leading type in the North America market.

Health promoting factors of the supplements will boost the demand for ruminant or cattle feed, which drives the market growth.

Nutrien Ltd., C.F. Industries Holdings, Inc., and the Mosaic Company are a few of the top players in the North America market.

U.S. is expected to hold the highest market share throughout the forecast period.

Hike in natural gas prices and animal feed costs impedes the growing potential in the U.S. market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us