North America Organic Fertilizers Market Size, Share & Industry Analysis, By Source (Animal Origin, Plant Origin, and Mineral Origin), By Form (Dry Form and Liquid Form), By Crop Type (Field Crops, Orchard Crops, Fruits and Vegetables, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

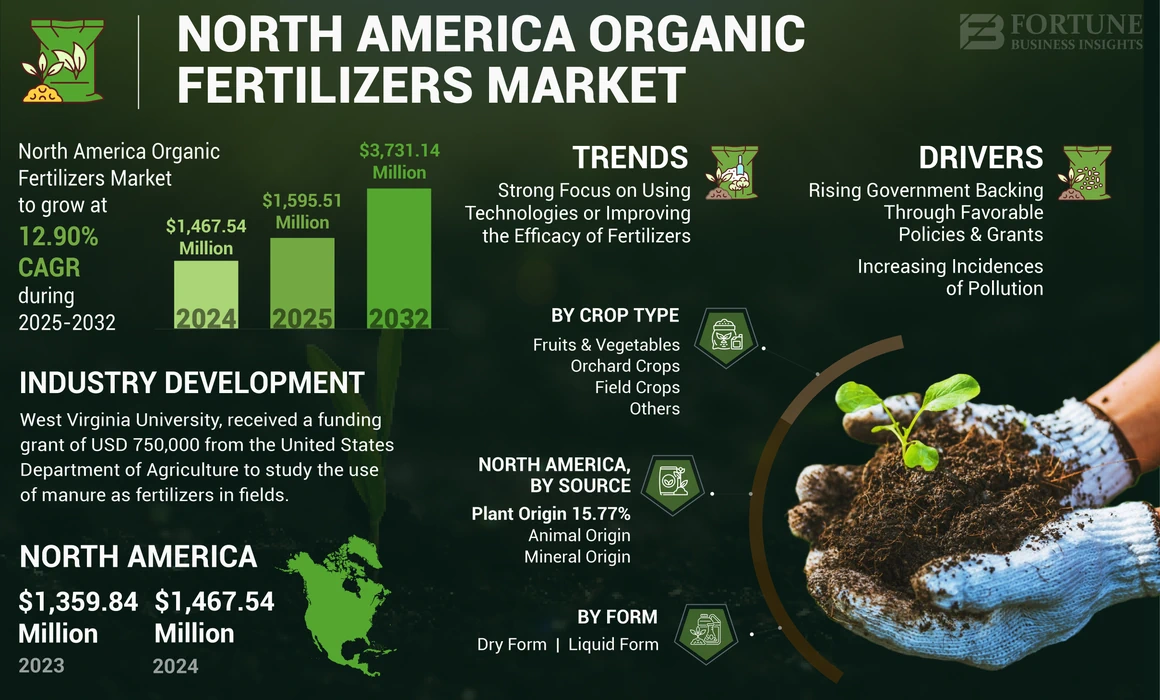

The North America organic fertilizers market size was valued at USD 1,467.54 million in 2024 and is projected to grow from USD 1,595.51 million in 2025 to USD 3,731.14 million by 2032, exhibiting a CAGR of 12.90% during the 2025-2032 period.

Organic fertilizers are naturally produced fertilizers formed through the fermentation and decomposition of organic materials such as food waste and animal excreta. These fertilizers are used to strengthen crop yield and soil health to support future organic crop production. Similar to human consumption, plants also need nutrients for their growth and development. While the soil typically contains specific nutrients, their absence negatively affects the growth of plants, leading to increased usage of natural fertilizers across the region. Moreover, owing to the surging notable environmental benefits, the popularity of organic cultivation is growing all over the region since it is a suitable replacement for synthetic fertilizers. In addition, widespread awareness of organic farming further contributes to the usage of natural fertilizers.

During the COVID-19 pandemic, the market faced several hurdles in production and transportation processes. The supply chain disruptions, transportation challenges, and scarcity of raw materials impacted the manufacturing process of eco-friendly fertilizers. However, the increasing demand for organic crops boosted the natural fertilizers production as well as their usage in 2020-21. Owing to high consciousness regarding health concerns, the majority of the population switched to sustainably produced crops, which in turn escalated the North America organic fertilizers market growth.

North America Organic Fertilizers Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 1,467.54 million

- 2025 Market Size: USD 1,595.51 million

- 2032 Forecast Market Size: USD 3,731.14 million

- CAGR: 12.90% from 2025–2032

Market Share:

- The animal origin segment is expected to dominate the North America organic fertilizers market in 2025, driven by its easy affordability and high content of essential nutrients such as nitrogen, phosphorus, and potassium that improve soil health and structure.

- By form, the dry form segment secures the largest share due to better solubility, ease of transport and storage, and flexibility in application.

- Field crops held the highest market share among crop types in 2025, due to high consumption of organic fertilizers in the cultivation of grains, pulses, and cereals across the U.S. and Canada.

Key Country Highlights:

- United States: Government initiatives such as the Agricultural Resilience Act and funding grants (e.g., USD 4.4 million to Northstar Lime LLC and USD 2.5 million to Dairy Dreams) support organic fertilizer production and infrastructure.

- Mexico: As a major exporter of organic crops like coffee, mango, and avocado to the U.S., Mexico is witnessing increased organic fertilizer use to support trade.

- Canada: High demand for organic field crops like cereals and oilseeds fuels the use of animal-origin and dry-form organic fertilizers across the country.

North America Organic Fertilizers Market Trends

Strong Focus on Using Technologies for Improving the Efficacy of Fertilizers is the Current Trend

Technological advancements to enhance the efficacy of natural fertilizers are the prominent trend in the industry. The experts in the agricultural sector are investing in innovations to strengthen the precision rate of fertilizers. Innovations, including refined production methods and nutrient delivery systems, can help to upgrade the efficiency of organic solutions. These advanced technologies will be beneficial in overcoming certain limitations linked with natural fertilizers, such as the slow release of nutrients. Such advancements will fuel the overall North America organic fertilizers market share.

Download Free sample to learn more about this report.

North America Organic Fertilizers Market Growth Factors

Rising Pollution Cases to Escalate the Utilization of Organic Fertilizers

The synthetic fertilizer industry has been booming in convincing farmers that their products are required to boost and maintain yields. However, it is a fact that the extensive use of chemical fertilizers since World War 2 drastically improved crop productivity at a high cost. The over-reliance on industrial fertilizers and farming methods has hampered the soil’s structure and fertility. As a result, this increases the chances of pollution, which can be avoided by using sustainable solutions. According to a study by the Union of Concerned Scientists (a non-profit organization) in 2020, the excess nitrogen runoff from fields contaminated water bodies (Mid-Western Corn belts) and drinking water across the Mississippi River Basin. This contamination has further reached Mexico, where it ultimately created a “dead zone,” which harms the marine ecosystem. In addition, other researchers also claimed that the widespread use of chemicals could also increase “eutrophication” across the U.S. Thus, in order to contribute to sustainable agriculture, collaborative efforts among governments, organizations, and key players are crucial. For instance, in 2020, the Agricultural Resilience Act proposed to help U.S. farmers tackle climate change by investing in renewable energy sources and improving crop production. Moreover, ARA will fuel the funding for agroecological research, which can also increase the importance and utilization of natural solutions.

Increasing Government Backing Through Favorable Policies and Grants to Support Market Growth

The U.S. government is highly focused on their region’s development and assists their growth. Incentives or grants offered by the government aim to improve their business operations, leading to high profits. Similarly, the American Government is offering grants/funding to farmers across the nation in order to encourage the production of natural fertilizers and replace the use of chemical solutions. For instance, in October 2023, Northstar Lime LLC, a Minnesota, a U.S.,-based company, offered around USD 4.4 million in grants to expand their processing line of nutrient alternatives and fertilizers. The goal of the company is to offer an alternative organic fertilizer that can meet around 50% of the overall nitrogen needs required by local row crops from 2023 to 2024. Moreover, in the same year (October 2023), Dairy Dreams, a Wisconsin, U.S.-based firm, proposed a grant of USD 2.5 million to expand their production infrastructure for a nutrient concentration system as well as a pelleting system that converts manure to fertilizers. This expansion aims to enhance access to organic pellets and liquids.

RESTRAINING FACTORS

Varying Efficacy and Long Registration Process Can Inhibit the Acceptability Rate Amongst Farmers

The registration and approval of organic fertilizers pose significant hurdles, contributing to the overall organic cost. The majority of the farmers seek quality certifications to produce and supply organic goods. Achieving these certifications requires assessing organic inputs such as feed or fertilizers, which can qualify the manufacturer to be certified. For instance, the Organic Materials Review Institute (OMRI), an international-based non-profit organization, ensures thorough analysis of inputs. After assessing all the quality parameters, they are listed in the OMRI product list. This will benefit farmers and ease the certification process. However, the main drawback of this OMRI process is its reviewing process, which takes several months. Another major challenge faced by farmers is the surging prices of natural fertilizers. Compared to synthetic fertilizers, natural fertilizers tend to be higher priced, primarily due to their composition and processing methods.

North America Organic Fertilizers Market Segmentation Analysis

By Source Analysis

Animal Origin Segment to Dominate the Market Due to its Easy Affordability

Based on source, the market is segmented into animal origin, plant origin, and mineral origin. Among these sources, the animal origin products are expected to hold the largest market share in the North America organic fertilizer market. Products made up of animal byproducts include blood meal, fish emulsion, and fish meal among others. They are rich in major nutrients such as nitrogen (N), phosphorus (P), potassium (K), calcium (Ca) and others which are essential for the healthy growth of plants. These nutrients also help to improve the soil health and structure, improve soil organic matter, and increase the water retention capacity of soil. Their easy availability and affordability compared to other origins further add up to market growth.

Among the plant-based sources, seaweed extracts, alfalfa meal, and others are used for manufacturing organic fertilizers. However, the high cost of production associated with some of the plants, such as seaweeds and variation in nutrient availability are some of the reasons behind their lower acceptance in the market. This may lead to higher application of fertilizers in the soil to make up for the lower availability of nutrients in the soil. However, with rapid technological advancements taking place in the field of organic fertilizer production, their efficacy is expected to increase in the future. The use of mineral fertilizers is also increasing in the region as they effectively help reduce nutrient deficiency in the soil. Improper use of these fertilizers can lead to soil overnutrition or soil deficiency. Thus, several guidelines are being developed based on research studies to guide the farmers in adopting the correct quantities of each fertilizer variety to meet the soil and crop needs.

To know how our report can help streamline your business, Speak to Analyst

By Form Analysis

Dry Form Segment Secures the Largest Market Share Owing to their Better Solubility

Based on form, the market is segmented into dry form and liquid form. The dry form segment accounts for the largest share of the North America organic fertilizers market. Several animal, mineral, and plant based fertilizers are available in dried forms, such as powder and pellets. The adoption rate of such fertilizers is high as they are easier to store and transport from one area to another. As these products come in soluble form and can be mixed with water based on necessity, the application of nutrients is easier and more flexible. Dry or pellet organic fertilizers may also be applied to the soil to ensure that there is a slow and constant release of fertilizers on the soil. However, such fertilizers need to be stored in moisture-free areas to ensure that their quality is not hampered.

Conversely, it is difficult to store liquid fertilizers, and several precautions have to be taken to ensure that they are stored safely. If stored under incorrect temperatures and areas, the product can freeze or evaporate, which in turn will impact the quality of the final product. However, as these fertilizers are already available in liquid form, they can be readily absorbed by the soil and can be used for crops that require faster nutrient uptake. Hence, based on the necessity of the soil and crops, the farmers have the option to choose the different forms of fertilizer available in the market.

By Crop Type Analysis

Field Crops Segment Holds the Highest Market Share due to their High Consumption

Based on crop type, the market is segmented into field crops, orchard crops, fruits & vegetables, and others. Among these crop types, the field crops account for the highest market share. In the U.S. and Canada, organic fertilizers are widely used for cultivating major crops such as grains, pulses, and cereals. The harvesting area of field crops, especially oilseeds, has increased in the past few years, leading to increased demand for natural fertilizers for the cultivation of field crops.

Apart from field crops, natural fertilizers are also used for the cultivation of orchard crops, fruits, and vegetables such as oranges, apples, cherries, prunes, peaches, pears, berries, grapes, tomatoes, onions, potatoes, and others. The increasing acceptance of organic fruits and vegetables and their growing consumption among consumers is one of the significant factors that is prompting farmers to adopt organic fruit cultivation and, in turn, boost the sales of organic fertilizers in the North America region. However, drastic climate change in the region and increasing inflation may be some of the reasons for the market’s slow growth in the last few years. However, increasing consumer demand and growing government support toward organic farming are expected to boost market growth in the future.

Cultivation of other crops, such as coffee, herbs, and lentils, is also growing, especially in Mexico, and it is expected to continue in the future. Mexico is one of the largest exporters of organic coffee, mango, avocado, and other products to the U.S. The growing organic crops-related trade activities between these countries are also expected to support the market’s growth further.

COUNTRY INSIGHTS

On the basis of region, the market is segmented into the U.S., Canada, and Mexico.

The U.S. is the leading country in North America, contributing to a 70.85% share in 2024. The U.S. market is considered to be the focal point of organic farming, which leads to a high utilization of organic fertilizers segment. As a key component of organic farming, these natural fertilizers contribute primarily to the use of natural fertilizers due to safety concerns. Nowadays, the majority of individuals are adopting healthy food practices and are inclined toward sustainably sourced products. This demand fuels the production of organic products, which further drives the demand for eco-friendly fertilizers. According to the United States Department of Agriculture (USDA), a government agency, the acreage of organic cultivation reached 3.6 million acres in 2021 from 2.04 million acres in 2020. All such instances boost the growth of North America organic fertilizers market.

Canada secures the second position in the market primarily due to the high spending power on organic agriculture products. According to the Canada Organic Trade Association, a non-profit organization, Canadians spend nearly USD 8.13 billion on organic purchases, which is an increase of 14.9% since 2017. The organic cultivation movement emerged in the 1950s in a Canada province; however, considerable development occurred nearly in the 1970s. In the current scenario, the Canadian organic sector is growing dramatically compared to the non-organic agri-sector. For instance, in 2020, the overall number of organic food operators (processors and producers) increased to 1,415 organic food operators in Ontario (Canada Organic Trade Association). Such a spike in organic farming will enhance the use of natural fertilizers. Thus, this growth in organic food operators is dominating the demand for natural fertilizers in the country.

Mexico is growing at a slow pace compared to the U.S. and Mexico and is projected to fuel at a higher pace in the future. Mexico is recognized as the second most obese country globally. Thus, the Mexican Government is focusing on reversing this scenario by educating the population about healthier eating. Apart from this, the country is also considered a strong exporter of coffee, cocoa, avocados, and sesame seeds, and it exports the majority of its produce to the U.S. market. Hence, domestic organic fertilizer manufacturers, as well as multinational manufacturers, have the opportunity to expand their presence in the region.

List of Key Companies in North America Organic Fertilizers Market

Major Players Emphasis on Partnerships and Sustainability Goals to Boost their Market Growth

The prominent players in the market include Darling Ingredients Inc., SQM, K+S Aktiengesellschaft, and Hello Nature (Italpollina S.p.A.), which focuses on expanding their market reach by collaborating with significant players. Additionally, a growing number of consumers are seeking sustainably sourced products, contributing to the market growth. With the help of strategic initiatives (partnerships and sustainability/certifications), companies engaged in organic farming can achieve substantial growth in the coming years, which can promote the growth of North America organic fertilizers market.

List of Key Companies Profiled:

- Darling Ingredients Inc. (U.S.)

- Sustane Natural Fertilizer Inc. (U.S.)

- California Organic Fertilizers Inc. (U.S.)

- SQM (Chile)

- Sigma AgriScience (U.S.)

- True Organic Products, Inc. (U.S.)

- Cascade Agronomics, LLC (U.S.)

- Organic AG Products (U.S.)

- Hello Nature (Italpollina S.p.A.)

- Purely Organic Products LLC (U.S.)

- K+S Aktiengesellschaft (Germany)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Perfect Blend, an Othello, the U.S. based natural fertilizers company, received a grant of USD 2.6 million, which can help in increasing their production facility. This grant was used to manufacture natural fertilizers made from raw manure and fish waste. Thus, this investment would help boost local production in Washington state, which would be helpful for local growers.

- October 2022: West Virginia University, a research institute based in Virginia, U.S., received a funding grant of USD 750,000 from the United States Department of Agriculture (USDA). The team of researchers used this grant to study the use of manure as fertilizers in fields. More specifically, the team is looking for solutions that can minimize the attack of pathogens and insects.

- May 2021: Darling Ingredients Inc., announced their collaboration with the University of Wageningen, a University in the Netherlands, to spread awareness regarding organic fertilizers amongst farmers. With the help of this collaboration, a study was conducted to analyze the efficacy of natural fertilizers manufactured by the former company. Moreover, the main aim of the study was to enhance soil resilience by converting organic residuals into valuable ingredients for horticulture.

- March 2020: Sigma AgriScience, a fertilizer firm in the U.S., entered into a partnership with Mirmichi Green, a producer of sustainable products, to develop biotechnologies for agriculture and turf markets. Moreover, via this strategic collaboration, the company would also manufacture soil amendments and other natural fertilizers for their customers.

- January 2019: Darling Ingredients Inc., a U.S.-based company operating in the organic fertilizers field, expanded its production capacity by opening a new plant in Turlock, California. This was the second plant of Darling’s brand, Nature Safe, which focuses on producing 35,000 tons of natural fertilizers annually.

REPORT COVERAGE

The market report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the market sizing and growth rate for all possible market segments. Various key insights presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 12.90% from 2025 to 2032 |

|

Segmentation |

By Source

|

|

By Form

|

|

|

By Crop Type

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was valued at 1,467.54 million in 2024.

The market is projected to grow at a CAGR of 12.90% during the forecast period (2025-2032).

The animal origin segment is expected to be leading in the global market.

Rising pollution cases and increasing government backing through favorable policies and grants are the key factors supporting market growth.

Darling Ingredients Inc., SQM, and Hello Nature (Italpollina S.p.A.) are some of the top market players in the global market.

The U.S. leads the North American region.

Varying efficacy and long registration process are the major factors that inhibit the acceptability rate amongst farmers.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us