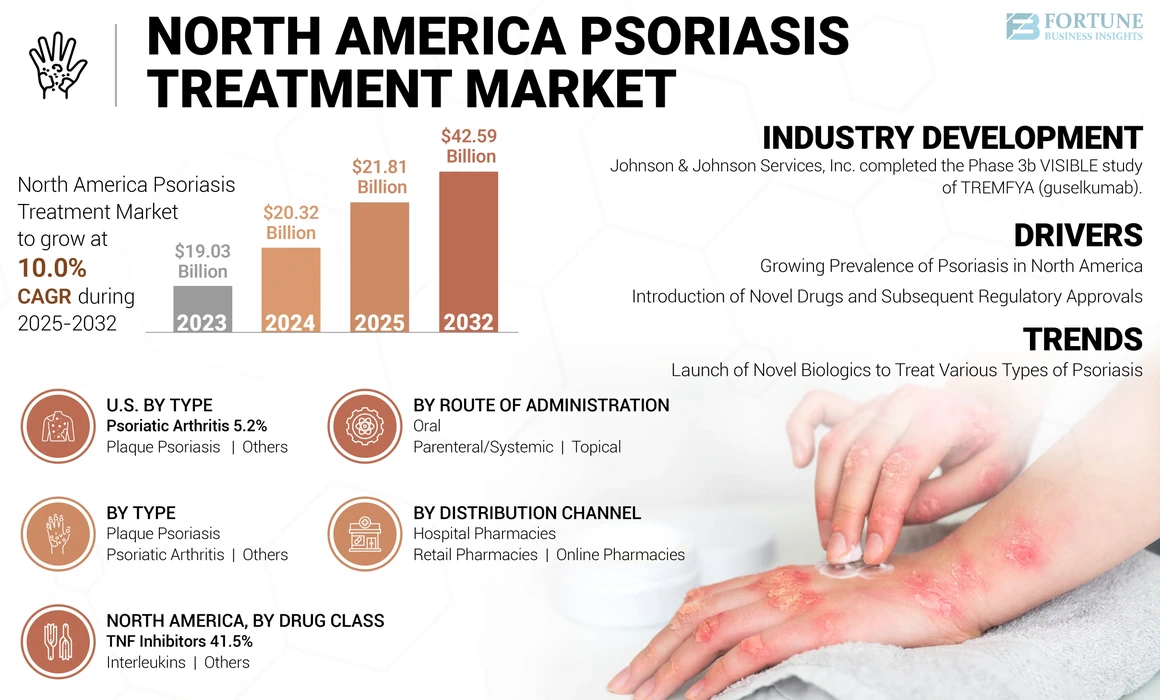

North America Psoriasis Treatment Market Size, Share & Industry Analysis, By Drug Class (TNF Inhibitors, Interleukins, and Others), By Type (Plaque Psoriasis, Psoriatic Arthritis, and Others), By Route of Administration (Oral, Parenteral/Systemic, and Topical {Branded and Generics}), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The North America psoriasis treatment market size was valued at USD 20.32 billion in 2024. The market is projected to grow from USD 21.81 billion in 2025 to USD 42.59 billion by 2032, exhibiting a CAGR of 10.0% during the forecast period.

Psoriasis is a chronic disorder that causes skin inflammation, leading to the formation of thick, discolored skin covered with scales. These thick, scaly areas are called plaques. There are several different types of psoriasis, such as plaque psoriasis, inverse psoriasis, pustular psoriasis, and others. Dermatologists use different types of medications for the treatment of psoriasis, including corticosteroids, synthetic vitamin D, calcineurin inhibitors, TNF inhibitors, and others.

The rising incidences of psoriasis across the North America region are fueling the demand for effective treatment. In addition, the growing awareness regarding this disease and its impact on the patient’s life encourages people to seek treatment. These are some of the factors driving the market growth.

Furthermore, the increasing regulatory approvals and product launches for the treatment of psoriasis are some of the additional factors contributing to market growth. In addition, the rising focus of the key players on the expansion of their psoriatic drugs pipeline are some of the factors expected to bolster the growth of the market during the forecast period.

- In November 2023, the U.S. Food and Drug Administration approved Amgen's biosimilar version of Johnson & Johnson's Stelara, a popular therapeutic for various inflammatory conditions, including psoriasis.

- For instance, in June 2023, Eli Lilly and Company acquired DICE Therapeutics, Inc. to expand its immunology pipeline. This acquisition provided the company access to DC-806, a promising oral pill undergoing mid-stage trials for treating psoriasis, bolstering its portfolio.

The North America psoriasis treatment market experienced a slower growth in 2020 as compared to 2019 due to COVID-19 pandemic. The major players, such as Novartis AG and Pfizer, Inc., operating in the market reported slower growth in 2020. Furthermore, the market growth in 2021 was supported by an increase in the use of teledermatology for online consultation.

- For example, a study conducted by the American Academy of Dermatology in 2021 showed that about 70.0% of the surveyed dermatologists believed that teledermatology would continue to treat various skin disorders after the post-pandemic period.

Furthermore, due to an increase in product launches for the treatment of psoriasis, the market experienced considerable growth in 2022. The market is projected to grow at a substantial rate throughout the forecast period owing to the increasing number of clinical trials for the development of effective medicines for psoriasis.

North America Psoriasis Treatment Market Trends

Launch of Novel Biologics to Treat Various Types of Psoriasis is Considered a Significant Market Trend

In recent years, the market has witnessed various significant trends that are influencing psoriasis treatment’s evolution. Among these notable trends are the rising adoption of biologic therapies, heightened attention on precision medicine for psoriasis treatment, and expansion of efforts in topical treatment choices. In addition, the growing interest in combination therapies, an elevated focus on patient-centered care, and advancements in phototherapy technologies such as narrowband UVB and targeted phototherapy are some of the significant trends in the market.

Furthermore, the rising demand for advanced biologics targeting psoriasis has resulted in the introduction of new products and the development of robust drug pipelines.

In addition, clinical trials related to the development of novel treatments for psoriasis are being conducted by several operating companies.

- For instance, in March 2023, LEO Pharma A/S and ICON plc entered a strategic collaboration aimed at bolstering the execution of clinical trials in medical dermatology. The partnership’s objective is to facilitate access to cutting-edge clinical trials and support the launch of new medications.

Such initiatives by industry players to address psoriasis treatment needs are estimated to boost the North America psoriasis treatment market growth during the forecast period.

Download Free sample to learn more about this report.

North America Psoriasis Treatment Market Growth Factors

Growing Prevalence of Psoriasis in North America to Boost Market Growth

A significant contributor to market expansion in the North America region is the increased prevalence of psoriasis. As a result, there is a higher demand for safe and efficient therapeutic solutions to address this condition.

- For instance, approximately 7.6 million people in the U.S. are affected by psoriasis, based on data provided by the National Institutes of Health in August 2021.

Furthermore, the growing occurrence of psoriasis coupled with rising awareness amongst individuals regarding early disease management is expected to drive a notable increase in the demand for innovative products. To enhance awareness, both industry players and government entities are implementing various initiatives.

- For instance, in June 2023, the American Academy of Dermatology Association initiated an innovative project aimed at enhancing outcomes for individuals with pustular psoriasis. The organization is dedicated to discovering innovative methods to enhance patient care.

- Similarly, in order to raise awareness regarding psoriasis disease and its treatment, the Canadian Association for Psoriasis Patients celebrates, National Psoriatic Arthritis Awareness Day on October 19 and World Psoriatic Arthritis Awareness Day on October 29.

Therefore, the growing prevalence of psoriasis coupled with the demand for effective drugs is projected to support market growth during the forecast period.

Introduction of Novel Drugs and Subsequent Regulatory Approvals to Support Market Expansion

The growing prevalence of psoriasis has increased the need for innovative treatment options. Market players are intensifying their efforts to develop and commercialize new medications to align with evolving market requirements. Notable companies such as Amgen Inc., UBC, and Eli Lilly and Company, among others, have introduced innovative therapies targeting various types of psoriasis in recent years.

- For instance, in October 2023, UCB, a global biopharmaceutical company, received approval from the U.S. FDA for BIMZELX (bimekizumab-bkzx) to treat moderate to severe plaque psoriasis in adults.

As a result, market growth in the region is also expected to be driven by a strong pipeline of products developed by industry players coupled with favorable regulatory conditions in the U.S. and Canada.

RESTRAINING FACTORS

High Cost of Psoriasis Treatment and Side Effects of the Treatment Restraining Market Growth

In North America, the dermatology sector is driven by various factors such as environmental shifts, and short-term challenges such as humidity, heat, and pollution lead to changes in the development of psoriasis. In addition, the steep rise in drug prices, even for generic options, has been notable over recent decades.

The increasing expenses associated with treating psoriasis are anticipated to pose a hindrance to the market expansion. Psoriasis treatments can be very expensive. According to the National Psoriasis Foundation, one in three patients with psoriasis is unable to pay for their treatment.

- For instance, as per the data provided by JAMA Dermatology in February 2024, the annual cost of biologics for treating psoriasis in the U.S. ranges from USD 1,664 to USD 79,277, and these prices do not align with the clinical benefits.

Furthermore, adverse effects, treatment resistance, and long-term safety concerns limit their widespread use and efficacy, ultimately restricting the market growth.

Thus, the combination of the factors mentioned above is expected to limit the market growth to a certain extent.

North America Psoriasis Treatment Market Segmentation Analysis

By Drug Class Analysis

TNF Inhibitors Segment Held Largest Share Due to Growing Research and Development Activities for Psoriasis Treatment

Based on drug class, the market is divided into TNF inhibitors, interleukins, and others.

The TNF inhibitors segment held the maximum market share in 2024 and is anticipated to experience positive growth throughout the forecast period. The increasing research initiatives for the development of novel TNF inhibitors for the treatment of psoriasis is one of the factors contributing to the segment’s growth.

Moreover, different manufacturers are pursuing the development of such biologics, which is poised to increase segmental growth over the forecast period.

- For instance, in February 2021, Fresenius Kabi AG introduced IDACIO in the Canadian market for the treatment of multiple chronic inflammatory conditions, including psoriasis.

The interleukins segment accounted for the second-largest market share in 2024. The increase in the number of studies conducted in North America to evaluate the effectiveness of interleukins in the treatment of psoriasis is one of the reasons for the growth of this segment.

- For instance, in October 2020, Eli Lilly and Company announced a series of long-term and retrospective analyses on Taltz, belonging to the category of interleukins, demonstrating the effectiveness of treatment for adults with active psoriatic arthritis.

Furthermore, the others segment held a minimal market share in 2024. The others segment includes drugs belonging to the category of T-cell inhibitors and tyrosine kinase 2 (TYK2) inhibitors. The growth of this segment is attributed to the increasing launches of drugs belonging to the class of T-cell inhibitors. In addition, the increasing regulatory approvals of T-cell inhibitors for the treatment of psoriasis are poised to support the growth of the segment in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Surging Prevalence of Plaque Psoriasis to Boost the Segment Growth

Based on type, the market is segmented into plaque psoriasis, psoriatic arthritis, and others.

The plaque psoriasis segment accounted for the maximum portion of the North America psoriasis treatment market share in 2024 and it is anticipated to experience positive growth throughout the forecast period. The segment is experiencing significant growth largely due to the growing prevalence of plaque psoriasis in North America. In addition, plaque psoriasis is the most common type of psoriasis, and it comprises up to 80% to 85% of the total psoriasis cases.

On the other hand, the psoriatic arthritis segment held the second largest market share in 2024, owing to increasing cases of psoriatic arthritis in North American countries. Furthermore, increasing regulatory approvals for the drugs utilized in the treatment of psoriatic arthritis is another factor responsible for the segment’s growth.

- For example, in December 2021, Novartis AG announced that it has received the U.S. FDA approval for Cosentyx, the first and only fully human biologic to treat psoriatic arthritis in children and adults.

Furthermore, the others segment accounted for the lowest market share in 2024. The rising cases of different types of psoriasis, such as guttate psoriasis, erythrodermic psoriasis, and inverse psoriasis across North America, are one of the factors driving segmental growth.

By Route of Administration Analysis

Increasing Regulatory Approvals Favors the Dominance of the Parenteral/Systemic Segment

On the basis of route of administration, the market is divided into oral, parenteral/systemic, and topical.

The parenteral/systemic segment held the maximum share in the market in 2024. The increasing regulatory approvals for parenteral psoriasis therapy are slated to drive segmental growth throughout the forecast period.

- For instance, in October 2023, Novartis AG announced that the U.S. FDA approved its intravenous (IV) formulation of Cosentyx for the treatment of psoriatic arthritis.

The oral segment is expected to register a significant CAGR during the forecast period.

The growth of the segment is primarily due to increasing oral product launches for psoriasis treatment.

On the other hand, the topical segment held a minimal market share in 2024. The segmental growth is primarily attributed to increasing regulatory approvals for topical products.

- For instance, in May 2022, the U.S. FDA approved Dermavant’s VTAMA (tapinarof) topical cream for the treatment of plaque psoriasis.

By Distribution Channel Analysis

Hospital Pharmacies Segment Led Due to Increasing Demand for Psoriasis Drugs through this Channel

By distribution channel, the market is categorized into hospital pharmacies, retail pharmacies, and online pharmacies.

The hospital pharmacies segment held the maximum market share in 2024 and it is anticipated to register a significant CAGR throughout the forecast period. The growth of the segment is primarily due to the increasing hospitalizations for psoriasis treatment.

- For instance, as per the data provided by the Dermatology Advisor in September 2021, the incidence of hospital admission with a primary or secondary diagnosis of psoriasis was 52 per 100,000 people in 2018 in the U.S.

In addition, the retail pharmacies segment held a considerable share in the market in 2024. The increasing patient preference to procure their prescription medication refills at retail pharmacies is one of the factors responsible for the segment’s growth.

Furthermore, the online pharmacies segment held a minimal market share in 2024. The segment’s growth is mainly attributed to the convenience of purchases of prescription medications, easy access to a wider range of therapeutics, and ease of delivery.

COUNTRY INSIGHTS

By country, the market is bifurcated into the U.S. and Canada.

The U.S. held the largest psoriasis treatment market share in 2024, generating a revenue of USD 18.74 billion. The U.S. market is anticipated to experience significant growth throughout the forecast period due to the development of new psoriasis drugs, coupled with the increasing regulatory approvals for psoriasis medications.

- For instance, in June 2021, Novartis AG announced that it had received U.S. FDA approval for Cosentyx, with the objective of treating moderate to severe plaque psoriasis in children. This helped the company enhance its customer base across the world.

To know how our report can help streamline your business, Speak to Analyst

In addition, the Canada market is estimated to witness significant growth throughout the forecast period. The growth of this market in Canada is largely due to the increasing regulatory approvals for psoriasis drugs.

- For instance, in February 2022, UCB Canada Inc. announced that its product BIMZELX (bimekizumab injection) was approved by Health Canada for the treatment of severe plaque psoriasis.

Key Industry Players

Abbvie Inc. Held the Maximum Share Due to Focus on New Product Developments

Abbvie Inc. held the top position in the North America psoriasis treatment market in 2024, trailed by Janssen Pharmaceutical (J&J) and Amgen Inc. Abbvie’s emphasis on strategies such as acquisitions & partnerships and new product developments strengthened its market position across the North America. Combined with this, the increasing regulatory approvals for psoriasis products have enabled the company to hold a leading position in the market.

- For instance, in January 2022, AbbVie, Inc. received the U.S. FDA approval for its drug, SKYRIZI (risankizumab-rzaa), for the treatment of psoriatic arthritis.

Furthermore, other players operating in the market, such as Pfizer Inc., Merck & Co., Inc., and LEO Pharma A/S, are focusing on research and development activities for the launch of new biologics for the treatment of psoriasis. This is poised to lead to the expansion of their product portfolio in the market.

- In July 2023, LEO Pharma A/S entered a research collaboration and license agreement with X-Chem, Inc., with an aim to discover and develop novel treatments for dermatological indications, including psoriasis.

List of Top North America Psoriasis Treatment Companies:

- AbbVie, Inc. (U.S.)

- Novartis AG (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Pfizer, Inc. (U.S.)

- LEO Pharma A/S (Denmark)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Evelo Biosciences, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 - Johnson & Johnson Services, Inc. completed the Phase 3b VISIBLE study of TREMFYA (guselkumab), evaluating its efficacy in the treatment of severe scalp psoriasis. This study's results were presented at the Maui Derm Hawaii conference in 2024.

- October 2023 - Pfizer, Inc. announced that the U.S. FDA approved ABRILADA (adalimumab-afzb) as an interchangeable biosimilar of Humira for the treatment of psoriasis.

- July 2023 - AbbVie, Inc. announced that its drug, SKYRIZI (risankizumab), exhibited promising results than Apremilast for treating plaque psoriasis in a phase 4 head-to-head study.

- December 2021 - Amgen Inc. announced the positive clinical outcomes from the phase 3 clinical study of Otezla, which was evaluated for the treatment of moderate to severe plaque psoriasis.

- July 2020 - Johnson & Johnson Services, Inc. announced that it has received the U.S. FDA approval for the drug ‘Stelara’ to treat mild to moderate plaque psoriasis in children aged 6-11 years.

REPORT COVERAGE

The North America psoriasis treatment market analysis report provides a comprehensive analysis of the North America market dynamics. Besides this, it offers insights related to the COVID-19 impact on the market. Furthermore, the key sights presented in the report are pipeline analysis by key players, the prevalence of psoriasis in key countries, key mergers, acquisitions, partnerships, and company profiles. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 10.0% from 2025-2032 |

|

Segmentation |

By Drug Class

|

|

By Type

|

|

|

By Route Of Administration

|

|

|

By Distribution Channel

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the North America market stood at USD 20.32 billion in 2024 and is projected to reach USD 42.59 billion by 2032.

The market is slated to exhibit steady growth at a CAGR of 10.0% during the forecast period.

In 2024, the market value stood at USD 18.74 billion.

Based on type, the plaque psoriasis segment led the market in 2024.

The increasing prevalence of psoriasis and increasing funding initiatives for research and development activities are some of the factors boosting market growth.

Abbvie Inc., Johnson & Johnson Services, Inc., Amgen Inc., and Novartis AG are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us