North America Temporary Power Market Size, Share & Industry Analysis, By Fuel Type (Diesel, Gas, Renewable, and Others), and By End-user (Oil & Gas, Utilities, Construction, Shipping, Mining, Manufacturing, and Others), Regional Forecast, 2025-2032

North America Temporary Power Market Size

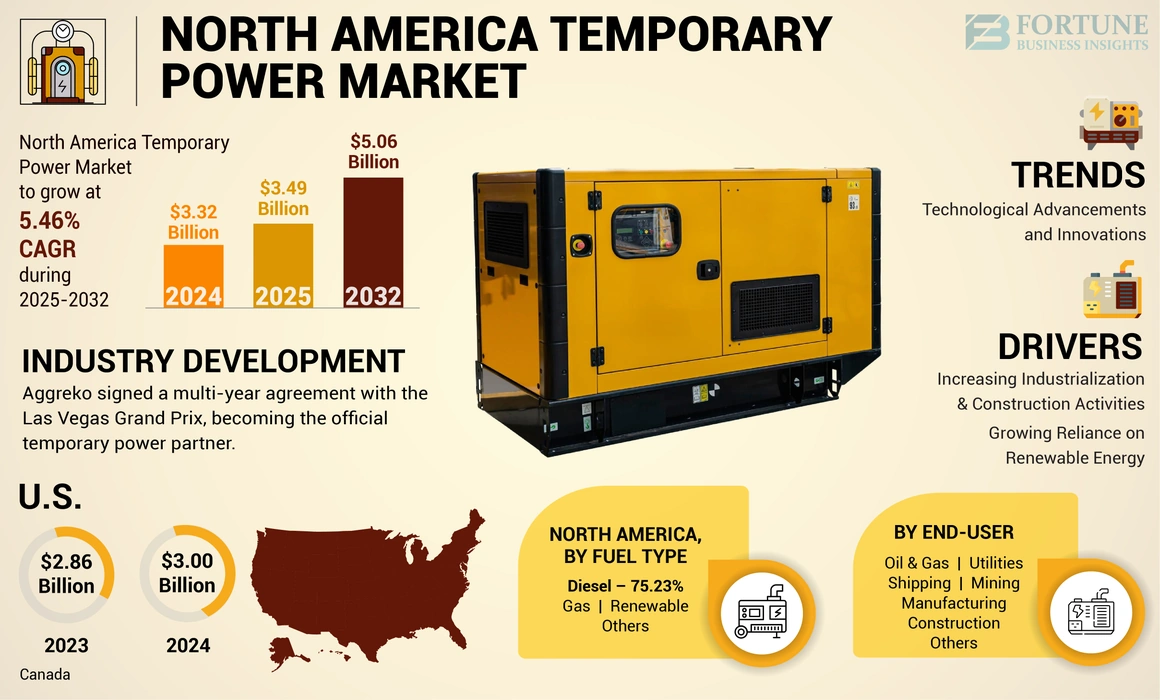

The North America temporary power market size was valued at USD 3.32 billion in 2024. The market is projected to grow from USD 3.49 billion in 2025 to USD 5.06 billion by 2032, exhibiting a CAGR of 5.46% during the forecast period.

A temporary power supply is most feasible where there is no permanent power connection. It is an independent source of electric power generated either by generators, UPS, or batteries that supplies continuous power and saves valuable production hours, causing a reduction in economic losses. Today, online trading is thriving due to the internet and digitization, which has increased the number of data centers that require an uninterruptible power supply.

The outbreak of the COVID-19 pandemic in the first quarter of 2020 had a temporary negative impact on the global energy market. Partial and full lockdowns in various countries indirectly or directly affected multiple industries, disrupting supplier operations, project completion, supply chains, and product marketing initiatives. For example, Doosan Bobcat North America had to suspend operations at its manufacturing facilities temporarily due to the impact of COVID-19. At the industrial level, the temporary power market faced several challenges due to decreased resources and manpower. Long-term lockdowns halted several construction and industrial projects in different countries of North America. Governments seeking post-pandemic recovery strategies are creating opportunities for the markets to stimulate economic growth and address climate concerns.

North America Temporary Power Market Trends

Technological Advances and Innovations Are Shaping the Market Outlook

Advanced solar-first battery generators are transforming the North America temporary power market. Technological advances are a key factor driving the market’s growth. Leading companies in this sector are focusing on providing technologically advanced solutions, such as solar-first battery generators to increase sales. These portable generators are temporary energy solutions that provide long-distance power in difficult operating conditions. It is a sustainable solution suitable for a variety of applications where stationary power is available, thus creating demand for temporary power.

The Biden administration's anti-inflation law accelerated energy storage development across the U.S. Increasing solar and wind capacity is augmenting the need for battery storage systems, and the Inflation Act provides an Investment Tax Credit (ITC) for stand-alone storage facilities for the first time. Power plant-scale battery capacity was approximately 9 GW as of the end of 2022, approximately half of which was solar energy and storage. 40 GW of storage capacity will be installed by the end of 2025. California requires utilities to install energy storage systems, while increased solar capacity in Texas is improving the storage business models. Moreover, developers are seeking faster grid infrastructure and grid connections and, in many other markets, benefit from the approval of the government.

Download Free sample to learn more about this report.

North America Temporary Power Market Growth Factors

Increasing Industrialization and Construction Activities to Stimulate Temporary Power Market Progress

Rapid industrialization and urbanization have increased construction activity significantly. Manufacturing and commercial activities, such as the development, repair, renovation, and maintenance of power infrastructure need backup power for carrying out continuous industrial and construction activities. There is an ever-increasing demand for a reliable source of power to avoid heavy production losses. This power supply helps users to access utilities, such as electricity and water for construction activities.

Throughout a construction project, power requirements are critical for different operations at the construction site. Back-up power is essential for industrial construction activities as it provides reliable and secure power, and operates power tools, heavy machinery, life safety & networking equipment, servers, fans, pumps, and other machines. It also allows the lighting for construction projects that are essential for night-time operations. Establishing a permanent power connection at the site of a construction project is usually time-consuming and quite complex. Therefore, temporary or backup power solutions are the best alternative to power construction sites until a permanent energy supply is established.

Infrastructure activities are facing power supply shortages, and the number of planned events is expanding. Rapidly growing demands for fuel efficiency, improved power supply, and minimized operating costs have significantly increased the need for temporary power supply. This type of energy supply is also finding robust demand among various end-user categories, such as refurbishment, mining, and utilities to meet energy requirements in a cost-effective and hassle-free manner, thus accelerating the North America temporary power market growth.

Growing Reliance on Renewable Energy Augments Market Progress

Increasing dependence on renewable energy sources is driving the growth of the market. Temporary energy plays an important role in the renewable energy sector by providing power to keep wind turbines running. It also supplements renewable energy supplies by providing backup power when renewable energy sources are unavailable. The green energy sector currently faces two major challenges: weather-related fluctuations and storage of the energy produced, which is not always possible and results in wastage. Temporary energy benefits renewable energy systems throughout the system's lifecycle, not just when there is little wind or sunlight. It also ensures reliable power supply and slows economic downturns.

For instance, during the commissioning and construction of a wind farm, small-scale backup power is required to assemble the turbines and test and stabilize the system. A temporary or backup power supply allows the system to connect to the grid at almost full capacity, contributing to the grid from the beginning and increasing profitability. Later, this power supply can keep the site up and running in the face of planned or unplanned interruptions. In offshore wind farms, such as those in the German North Sea, the harsh and highly corrosive environment has a significant impact on the system’s lifespan. In these cases, back-up power is used to operate auxiliary loads within the turbine, such as heaters and dehumidifiers. In addition, temporary electricity is used to power the hydraulic pumps that rotate the turbine rotors when there is no wind.

With the exception of biofuels, the reliance on renewable energy sources means there are distinct limitations to their output capacities and ability to deliver a consistent energy supply. It is the innovations in temporary power that are enabling renewables to play a greater role in the global energy mix, helping the transition to a greener, lower-carbon future.

RESTRAINING FACTORS

Strict Emission Regulations by Governments to Hamper Market Growth

The use of diesel generators can lead to the emission of large amounts of greenhouse gases in a relatively short period and is often accompanied by air pollutants. These include nitrogen oxides that contribute to noise pollution and poor air quality, emission of carbon monoxide, particulate matter, and sulfur. Generators used for backup power can produce noise and emissions, both of which can be disruptive and negatively impact the environment.

The U.S. EPA formed its first national emissions standards for new stationary diesel engines. According to the New Source Performance Standards (NSPS), all new diesel engines must meet the emission standards approximately equal to the EPA-established emissions standards for non-road and marine mobile vehicles. All diesel engines in use at different units require certification to meet equivalent emission standards. In general, emissions of particulate matter and nitrogen oxides must be reduced by more than 90%.

North America Temporary Power Market Segmentation Analysis

By Fuel Type Analysis

Diesel Fueled Systems Gain Major Traction Owing to Easy Availability and High Efficiency

Based on fuel type, the market is segmented into diesel, gas, renewable, and others.

The diesel segment held the largest North America temporary power market share and is expected to dominate the market over the forecast period. Easy availability, low cost, and high efficiency are some factors that are believed to contribute to the growth of this segment. Additionally, diesel is used for various applications in the manufacturing sector, further driving the growth of this segment.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Temporary Power System Widely Used in Utility Sector Due to Limited Power Supply in Emerging Markets

Based on end-user, the market is segmented into oil & gas, utilities, construction, shipping, mining, manufacturing, and others.

The utility segment held the largest market share. It is projected to dominate the market over the forecast period owing to limited power supply in emerging markets. This segment includes telecommunications, transportation, wastewater, and other activities. Poor infrastructure, increasing number of rehabilitation projects in remote areas, and frequent power outages are the factors expected to further drive the segment’s growth.

The oil & gas segment is estimated to hold the second-largest market share during the forecast period. Due to increasing oil demand, governments are focusing on exploring new oil and gas resources. Remote areas and extraordinary climates are characteristic of numerous oil and gas projects. With distant servicing stations and constrained staff, safe and reliable power equipment is a top priority, where this power is utilized.

COUNTRY INSIGHTS

The U.S. dominates the temporary power market in North America owing to rapid industrialization, increasing data centers, and technological developments that require safe, reliable and continuous power supply. In order to avoid economic loss at such sites, continuous power supply is required.

Similarly Canada is experiencing an increase in demand for temporary power supply, for numerous construction projects and outdoor events to temporary power outages and emergency situations in different parts of the country.

Key Industry Players

Industry Players Focus on Implementation of Efficient Power Supply to Improve Sales

In terms of the economic landscape, the North America temporary power market portrays the presence of recognized and emerging market players. The rising focus on the adoption of an efficient power supply and increasing emphasis on carbon emission reduction has allowed these companies to streamline their acceptance, which has significantly improved their sales and volume shipments.

LIST OF TOP NORTH AMERICA TEMPORARY POWER COMPANIES:

- Aggreko (U.K.)

- Vertiv (U.S.)

- United Rentals (U.S.)

- Ashtead Group (U.K.)

- Caterpillar Inc. (U.S.)

- Smart Energy Solutions (UAE)

- APR Energy (U.S.)

- Energyst (U.K.)

- Cummins Inc. (U.S.)

- Kohler Power(U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Aggreko signed a multi-year agreement with the Las Vegas Grand Prix, becoming the official temporary or backup power supply partner. Under the agreement, Aggreko is expected to power both domestic and international broadcasts as well as critical track lighting at 16 locations throughout the circuit. Moreover, it will provide energy and climate control at a wide variety of locations, including temporary hospitality structures, team hospitality spaces, and offices.

- October 2023: Vertiv launched Liebert APM2, which is a new energy-efficient and scalable power solution, adding to its Uninterruptible Power Supply (UPS) systems portfolio. The Liebert APM2 is compatible with lithium-ion and VRLA batteries and also features a design that can scale from 30kW to 600 kW in a single unit. It is a CE-certified UPS system made available in 400V in Europe, Latin America, the Middle East, Africa, and Asia, including India and China.

- January 2023: Aggreko announced an agreement with Ryder Cup 2023, held in September 2023 to become the official temporary energy supplier. Aggreko provided power and HVAC for all the events, from hospitality to both the opening and closing ceremonies. This was the fifth time Aggreko supported the European leg of the competition, having previously supplied temporary energy to the 2006, 2010, 2014, and 2018 editions.

- September 2022: Caterpillar Inc. launched its Cat XQ2280 power module, which is its single-engine mobile power solution with a power capacity above 560 kW. This temporary power system complies with the U.S. EPA Tier 4 Final emission standards. The Cat XQ2280 power module provides up to 2 MW of standby power or 1,825 kW of prime power. This makes it ideal for healthcare facilities, data centers, municipal infrastructure, wastewater treatment plants and other utilities, mining & quarry sites, and other large-scale applications.

- January 2022: Kohler Co. acquired Heila Technologies, which is a global leader in engines, power generation, and clean energy. Heila Technologies’ hardware and software solutions will be integrated with Kohler’s residential and industrial generators and energy storage systems to expand and diversify the portfolio of Kohler Temporary Power systems.

REPORT COVERAGE

The research report offers an in-depth analysis of the market and focuses on its key aspects. Also, it provides vital insights into the latest industry developments and analyzes the technologies being adopted rapidly across the region. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.46% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Fuel Type

|

|

By End-user

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 3.32 billion in 2024.

The market is expected to exhibit a CAGR of 5.46% during the forecast period of 2025-2032.

By fuel type, the diesel segment leads and accounts for a considerable share of the market.

Cummins Inc. and Caterpillar Inc. are among the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us