Packaging Robots Market Size, Share & Industry Analysis, By Robot Type (Delta Robots, Scara Robots, Cobots, and Others (CRX Robots)), By Operation Type (Pick and Place, Case Packaging, Palletizing, and Others (Handling Products)), By Industry (Food and Beverage, Pharmaceutical, Consumer Goods, Electronics, and Others (Retail)), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

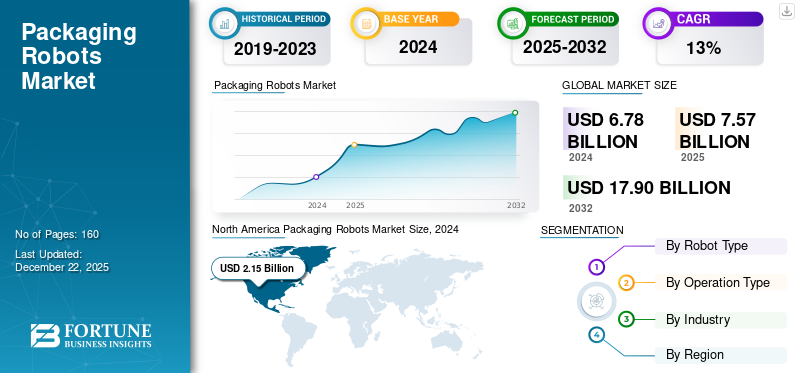

The global packaging robots market size was valued at USD 7.57 billion in 2025. The market is projected to grow from USD 8.50 billion in 2026 to USD 23.49 billion by 2034, exhibiting a CAGR of 13.60% during the forecast period. North America dominated the global market with a share of 31.80% in 2025.

The global packaging robots industry showcases a dynamic interplay of innovation and the growing adoption of automation across material handling and packaging operations in industrial production. The global packaging robot industry thrives on various characteristics such as efficiency, automation, and precision that enhance productivity, leading to reduced operational costs. Modern automation robots that ease packaging and palletizing processes in an industry with the help of modern robotic solutions such as SCARA robotics, delta robots, cobots, and other CRX robots are a catalyst to market growth.

Download Free sample to learn more about this report.

Global Packaging Robots Market Overview

Market Size:

- 2025 Forecast Value: USD 7.57 billion

- 2026 Forecast Value: USD 8.50 billion

- 2034 Forecast Value: USD 23.49 billion

- CAGR: 13.60% from 2026 to 2034

Market Share:

- Regional Leader: North America led global market with a share of 31.80% in 2026.

- Fastest-Growing Region: Asia Pacific is expected to grow at the fastest rate, supported by expanding manufacturing operations and increasing labor costs

- Type Segment Leader: Pick-and-place robots captured the largest market share, driven by adoption in food & beverage, pharmaceuticals, and consumer goods sectors

Industry Trends:

- Rapid growth in use of collaborative robots (cobots), especially for SMEs due to affordability and ease of deployment

- Documented use of SCARA and delta robots for high-speed and precision packaging tasks

- Rise in demand for automated palletizing, case-packing, and sorting applications to meet e-commerce, F&B, and pharma sector needs

Driving Factors:

- Increased focus on speed, accuracy, and hygiene in modern packaging environments, especially in F&B and pharmaceuticals

- Ongoing pressure to reduce labor costs and tackle workforce shortages through automation

- Expansion of warehouse automation and smart manufacturing infrastructures, notably in Asia Pacific

- Technological advancements including AI, machine vision, and IoT-enabled packaging systems enabling flexibility and precision

The COVID-19 pandemic initially incurred a short-term pause in sales of robots, but post-pandemic conditions have accelerated the adoption of modern automation technologies. The growth is due to the increasing interest of manufacturers in robotic solutions to minimize human contact and enhance operational continuity. This shift has led to a significant rebound in industrial automation, with more advanced technologies driving investment in robotic solutions.

IMPACT OF GENERATIVE AI

Extending Packaging Capabilities With Generative AI Robotics Drive Investments

Generative AI technology facilitates enhanced decision-making, leading to reduced material wastage and improved efficiency in the supply chain. Data garnered from production and sorting processes by these AI robots could help reveal deep insights and could use these statistics to inform real-time format changes to packagers. This development can optimize packaging lines with more recoverable packing materials and design or select packages that consumers are more likely to recycle. Thus, the integration of AI robotics into packaging automation and growing investment by prime e-commerce players has extended capabilities to develop a profitable business in the long term.

- For instance, in March 2024, Amazon, a global e-commerce giant, invested USD 7.7 million in AI-powered robots. Glacier, an AI-based robotic tech player, received this investment to improve sorting processes at Amazon’s Material Recovery Facility (MRF). This provides more actionable insights to select recyclable materials for packaging and accomplish climate sustainability goals.

MARKET DYNAMICS

Market Trends

Integration of Machine Learning (ML) Capabilities to Robots Shape New Industry Trends

AI integration into modern packaging solutions is a growing trend in the industry that enhances efficiency and accuracy through Artificial Intelligence (AI) and Machine Learning (ML). Integrating ML and AI into packaging robotics could improve productivity by optimizing more optimized operation that allows faster and more accurate packaging processes. Advanced ML capability could enable real-time monitoring, enhance packaging quality, reduce cycle times, and improve throughput. Thus, by leveraging these ML capabilities packaging industry could achieve more agility, enhance product quality, significantly improve productivity, and operational costs reduction. These factors are promoting product adoption, thereby significantly increasing packaging robots market share during the forecast period.

- For instance, in March 2022, Covariant, a leading robotics company, partnered with KNAPP, a technology partner, to develop AI-powered robotic solutions and expand market presence. Covariant launched the ‘’Pick-it-Easy’’ robot, an AI-diven pick-and-place system, designed to increase warehouse and packaging solution efficiency.

Market Drivers

Booming E-Commerce Sales Drive Market Growth

Since the pandemic, the e-commerce industry has grown exponentially, driving a high demand for packaging solutions across various product categories. Companies have increasingly adopted reliable automated solutions such as robotic handling, packaging, and delivery systems, to support their growth in this competitive landscape. This reliable e-commerce robotic solution helps in automating repetitive tasks, faster order fulfillment, and precise delivery, which are critical factors in the competitive e-commerce industry. Additionally, robots provide error-free and improved reliable quality of packaging that ensures uniformity in packaging. These benefits help reduce operational costs by labor cost reduction and minimal material wastage, supporting the packaging robots market growth as e-commerce continues to flourish.

- For instance, in January 2022, FedEx, the world’s largest shipping company, announced the launch of an AI-powered intelligent sorting robot in collaboration with Dorabot. The sorting robot deployment showcased the company's push to handle booming e-commerce shipments.

Market Restraints

Lower Technical Skill and Integration Complexities May Restraint Market Growth

Competent players offering robotic solutions in the packaging sector are facing challenges with technology deployment due to low technical skills among end users. Technical complexities in integrating robotic packaging solutions into existing production lines have primarily limited their adoption across medium and small scale enterprises. Additionally, high purchasing costs and limited technical knowledge in operating packaging robots are limiting adoption across the packaging industry.

Market Opportunities

Customization and Flexibility With Technological Advancements Create Ample Opportunities

Global rising interest of budding businesses to integrate robotic solutions to cut expenses in operations supports the expanding packaging robot industry. Furthermore, increasing demand for tailored packaging solutions to fulfill manpower requirements is driving technological advancements such as optical sorting, 3D vision, and precise and sustainable packaging. These technical capabilities of modern packaging robots create ample opportunities for manufacturers to increase the packaging robots market over the long term.

- For instance, in August 2023, Blueprint Automation, a prominent industrial automation supplier, launched a BPA spider 300v case loading system. This system includes two delta-style pattern packaging robots engineered for both packaging and contract packaging solutions, providing flexibility in speed formats for handling various products types.

SEGMENTATION

By Robot Type Analysis

Growing Cobots Retains Its Dominance Owing to Enhanced Operational Efficiency

Based on robot type, the market is classified into delta robots, scara robots, cobots, and others (CRX robots).

Ever since their introduction of Cobots is leading the segment and have been a well-known category as traditional-style industrial robots that focuses on delivering enhanced operation efficiency with their lightweight design and easy-to-program capabilities. Cobots account for the largest sub-segment in the market, holding a 33.29% market share in 2026. Cobots offer an affordable way to automate repetitive tasks for small and medium enterprises (SMEs), while larger manufacturers benefit from their modular deployment.

Scara robots are set for growth due to their growing deployment for high-speed and assembly tasks. Scara robots enable three dimensional movement in productions lines improving productivity for manufacturers and assembly operators.

Demand for delta robots and other robots with different gripper type will grow steadily during the study period, driven by their suitability for precise linear packaging and automated palletizing tasks.

By Operation Type Analysis

Optimized Pick and Place Dominates Operation due to Precise Sorting Demand

By operation type, the market is divided into pick and place, case packaging, palletizing, and others (handling products).

Pick and place is the leading segment by most robot categories in the packaging industry, needing precise handling and speed. The pick-and-place application segment holds the largest market share, accounting for 34.35% in 2026. Additionally, increasing advancements in sorting and packaging products for the ecommerce sector are driving the demand for pick and place robots.

Palletizing robots are showcasing progressive growth owing to their growing applications in large-scale product packaging. Also, growing investment by warehouse facilities on robotics for improving logistics, palletizing operation is supporting the segmental growth.

Other robots and case packaging robots are observing steady growth owing to limited applications in medium and small-scale assembly line packaging.

To know how our report can help streamline your business, Speak to Analyst

By Industry Analysis

Increasing Demand from End Users Bolsters Consumer Goods Segment

By industry, the market is classified into food and beverage, electronics, pharmaceuticals, consumer goods, and others (retail).

The consumer goods segment is dominating the industry with highest CAGR owing to rising demand from end users for high-speed packaging, case packaging, and efficient pick-and-place solutions, which bolsters demand for packaging robots. The consumer goods segment represents the largest end-use industry, holding a 34.82% market share in 2026.

The food and beverages segment is progressively growing, fueled by rising demand for packaged foods and drinks and increasing fast food culture.

Pharmaceuticals, electronics, and other segments are showing steady progress owing to increasing investment by new vendors and manufacturers for automating production and packaging lines.

PACKAGING ROBOTS MARKET REGIONAL OUTLOOK

North America

North America Packaging Robots Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America robotic packaging robot market is dominating the global market share owing to the strong presence of established food and consumer goods manufacturers that are investing heavily in automating production and packaging solutions. North America robotic packaging robot market with a size of USD 2.41 Billion in 2025. The market observes robust growth, driven by technological advancements and the rapid adoption of robotic packaging solutions across all levels of manufacturing.

The U.S. is the dominating country in North America owing to its well-established presence of major manufacturers contributing majorly to the domestic and international consumables market. Canada and Mexico are set to follow the U.S. by increasing their share in the processing of food and consumer goods. The U.S. market is projected to reach USD 1.28 Billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is growing exponentially, showcasing the highest compound annual growth rate (CAGR) owing to its rapid industrialization and a surge in new entrepreneurs targeting the FMCG segment. Manufacturers in countries such as China, India, Japan, and other Asia Pacific countries are focusing on streamlining production processes, driving demand for robotic packaging solutions. The Japan market is projected to reach USD 0.58 Billion by 2026, the China market is projected to reach USD 0.7 Billion by 2026, and the India market is projected to reach USD 0.5 Billion by 2026. As of 2024, the Asia Pacific region is set to surpass North America in the FMCG sector, further extending the potential demand for robotic solutions across the e-commerce sector.

South America

South America is showcasing a gradual growth as local manufacturers seek to modernize existing facilities with new technologies. Increasing investments to expand manufacturing and logistics through robotic packaging process automation are supporting the growth of the packaging robots industry. The UK market is projected to reach USD 0.41 Billion by 2026, while the Germany market is projected to reach USD 0.35 Billion by 2026.

Europe

Europe is witnessing a steady progress, with more emphasis on sustainability and automation driving market growth. Domestic robotic packaging manufacturers are focusing on developing advanced robotics to meet sustainability and environmental goals, which is promoting packaging robots adoption across the region.

Middle East & Africa

The Middle East & Africa is significantly adopting robotic packaging products due to increasing investment in infrastructure and manufacturing. Additionally, government initiatives promoting automation as an economic diversion strategy are helping the increased packaging robots adoption.

COMPETITVE LANDSCAPE

Key Industry Players

Continued Research on Advanced Product Development Extend Key Players' Potential

Key players across the robotic packaging segment are focused on developing more advanced products that optimally reduce operation time by dynamically adjusting to varying print requirements and formats. Additionally, key players continued research and development at integrating AI and ML technologies are key factors extending the potential of manufacturers in the global packaging robot market.

- For instance, in February 2024, Omron Corporation, a leading automation solution provider, announced the introduction of TM S series collaborative robots that combine faster joints and expanded safety features. The new robots are designed to enable a more flexible and productive workspace that can handle a variety of tasks, including assembly, machine tending, and packaging.

Fanuc Corporation, ABB Ltd, Yasakawa Electric Corporation, KUKA AG, and Omron Corporation are the largest players in the market. The global packaging robot market is moderately consolidated, with the top 5 players accounting for around 29% of the market share.

List of Companies Studied:

- ABB (Switzerland)

- Syntegon Technology GmBH (Germany)

- YASKAWA ELECTRIC CORPORATION (Japan)

- Universal Robots (U.S.)

- Mitsubishi Electric Corporation (Japan)

- NACHI-FUJIKOSHI CORP. (Japan)

- Doosan Robotics (South Korea)

- Comau SpA (Italy)

- KUKA AG (Germany)

- Krones Group (Germany)

- FANUC CORPORATION (Japan)

- Schubert Group (Germany)

- DENSO CORPORATION (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Omron Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Premier Tech, a Canadian robotic solution provider, launched a new product line in its TOMA collaborative robot system. The system combines the Fanuc CRX-30IA Collaborative arm robot with Premier MOVN Software, optimizing collaboration and simulation for packaging and palletizing operations.

- January 2024: SORMA Group, a leading industrial automation and robotics solution provider, launched a new box-filling robot designed to facilitate the placing of packs in boxes, improving post-harvest through automation.

- November 2023: ABB, a leading robotics and industrial solution provider launched SCARA robots IRB 930 to transform pick-and-place assembly operations. The company expanded its SCARA robot portfolio with this new robot, delivering a 10% increase in throughput by handling more and heavier workpieces due to their 200% stronger pushdown capability.

- March 2023: Yasakawa Motoman, a prominent robotic solution manufacturer, launched an advanced MoToPick4 software solution, empowering quick development of custom solutions for high-speed picking applications. MoToPick 4 provides precise control and coordination, accommodating speeds of up to 1M/Sec.

- May 2023: Tecman Robot, a prominent robotics solution provider launched TM30S Robotic arm heavy payload AI Collaborative Robot. The new robot is an extension to the TM AI Cobot series capable of carrying loads of up to 35 kg with a reach of 1702mm. The robot comes with a built-in smart machine vision system and a 3D camera.

INVESTMENT ANALYSIS AND OPPORTUNITIES

- July 2024: FANUC America unveils its new robotics and automation campus built with an investment of USD 110 million spread over 67 acres of land. The expansion is focused on growth strategy and meeting consumer demand by increasing its presence in the U.S. The strategic investment showcases FANUC's steadfast commitment to automation and the robotics industry.

- June 2023: ABB, a leading industrial automation and robotics solution provider, has opened a new robotics packaging and logistics headquarters located in Alpharetta, Georgia. The strategic investment of USD 22 million to support a complete range of customer needs and develop AI enabled robotic solutions in the logistics and packaging industries.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Robot Type

By Operation Type

By Industry

By Region

|

|

Key Market Players Profiled in the Report |

FANUC CORPORATION (Japan), ABB Ltd (Switzerland), YASAKAWA ELECTRIC CORPORATION (Japan), KUKA AG (Germany), Omron Corporation (Japan), Universal Robots (U.S.), Kawasaki Heavy Industry Co. Ltd (Japan), DENSO CORPORATION (Japan), Mitsubishi Electric Corporation (Japan), and Syntegon Technology GmBH (Germany). |

Frequently Asked Questions

The market is projected to reach USD 23.49 billion by 2034.

In 2025, the market was valued at USD 7.58 billion.

The market is projected to grow at a CAGR of 13.60% during the forecast period.

By operation type, the pick and place segment leads the segment.

Increasing demand for experiential learning platforms and access to remote locations across the globe are the key factor driving market growth.

Fanuc Corporation, ABB Ltd, Yasakawa Electric Corporation, KUKA AG, Omron Corporation, Universal Robots, Kawasaki Heavy Industry Co. Ltd, Denso Corporation, Mitsubishi Electric Corporation, and Syntegon Technology GmBH. are the top players in the market.

North America dominated the global market with a share of 31.80% in 2025.

By industry, the consumer good is expected to grow with a highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us