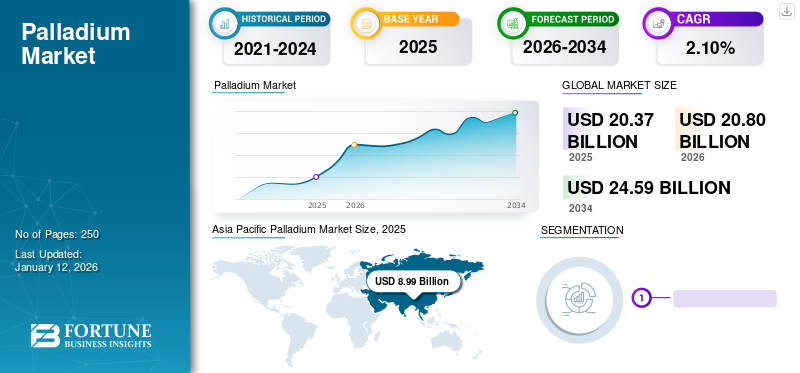

Palladium Market Size, Share & Industry Analysis, By Source (Mined and Recycled), By End-use Industry (Automotive, Electronics, Chemical & Petroleum, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The palladium market size was USD 20.37 billion in 2025. The market is expected to grow from USD 20.8 billion in 2026 to USD 24.59 billion by 2034 at a CAGR of 2.10% during the forecast period. Asia Pacific dominated the palladium market with a market share of 44.00% in 2025.

Palladium is a chemical element and a member of Platinum Group Metals (PGMs), a group of rare precious metals. Its high melting point and corrosion resistance have made it an ideal ingredient in many industrial processes. The industrial uses of this element range from catalytic converters, chemicals, and dental to jewelry. Its most common use is in automotive catalytic converters, which help reduce the carbon emissions from automotive engines. The ability to ensure effective chemical reactions throughout a vehicle’s life cycle has made palladium an irreplaceable catalyst in catalytic converters. It is also an important raw material in certain stages of semiconductor manufacturing, specifically in MultiLayer Ceramic Capacitors (MLCCs). Owing to its unique physical and chemical properties, it is used in many areas and has become an indispensable part of today's world. The factors mentioned above are projected to propel the market growth during the forecast period.

Global Palladium Market Overview

Market Size:

- 2025 Value: USD 20.37 billion

- 2026 Value: USD 20.8 billion

- 2034 Forecast Value: USD 24.59 billion, with a CAGR of 2.10% (2026–2034)

Market Share:

- Asia Pacific dominated the market with a 44.00% share in 2025.

- Major demand arises from automotive catalytic converters and electronics (e.g., MLCCs).

Key Country Highlights:

- Russia accounts for ~42% of global production.

- U.S.: Major importer; impacted by sanctions on Russian supply.

- Europe: Demand supported by Euro 6d emission standards and shift from diesel to gasoline/hybrid cars.

- Asia Pacific: Largest consumer due to automotive and electronics manufacturing dominance.

- South Africa: Key producer and home to major companies like Anglo American and Impala Platinum.

COVID-19 IMPACT

Low Automotive Production Due to Lockdown Measures amid Pandemic Decreased Demand

The spread of the COVID-19 pandemic forced almost every government to impose lockdowns to limit its impact on large populations. During the lockdown, business activities were halted, resulting in lower industrial production. The Coronavirus outbreak created various short-term and long-term impacts on the market. Suspension of mineral production and lower demand from end-use industries decreased the sales in the market. Major consumer industries, such as automotive, were among the most affected by the pandemic. Nearly 80% of automotive companies across the world reported a negative impact on their 2020 revenue. Palladium is a crucial ingredient in automotive catalytic converters, and it experienced a similar decline in demand during the pandemic. However, the market also experienced a fast recovery due to increased automotive production and heightened demand for semiconductors in 2021.

Palladium Market Trends

Trend of Vehicle Hybridization to Drive Market Growth

Amid questions raised on an electric vehicle's sustainability, hybrid vehicles were designed to offer the best gasoline and electric-powered engines. Hybrid vehicles reduce the high dependence on electricity and lithium-ion batteries and also decrease the risks associated with them. The ability to offer improved fuel efficiency and reduced emissions has made hybrid vehicles one of the best solutions in the global automotive market. According to the Bureau of Transportation Statistics, hybrid vehicles captured around 5% of the global light vehicle market in 2022. As per the market trends analyzed by Fortune Business Insights, the hybrid vehicle market is projected to record an annual growth rate of 7% during the forecast period. Growing emphasis on hybrid vehicles will drive its consumption.

Download Free sample to learn more about this report.

Palladium Market Growth Factors

Higher Usage of Platinum Group Metals in Vehicles to Fuel Market Growth

Despite the decline in vehicle production and sales, its negative impact on the market was partially offset by the increased consumption of Platinum Group Metals (PGMs). Per auto catalyst and per vehicle catalytic consumption were primarily driven by tightened regulations on carbon emissions. The introduction of Worldwide Harmonized Light Vehicle Test Procedure (WLTP) is a new testing method for vehicle emissions that was introduced in Europe and Japan in September and October 2019. This testing procedure requires more rigorous testing by specifying longer distances and durations. The test is also performed by increasing the vehicle’s weight, faster acceleration, and tests that must be conducted at different altitudes and temperatures. These developments have forced automakers to adopt more advanced exhaust treatment systems and use more PGMs per catalytic converter. A similar trend can be observed in China due to the tightening of environmental regulations as part of China 6B's nationwide rollout in 2019. The China 6b standard is based on emission control practices developed in the U.S. and the European Union and certain additional requirements. A stringent vehicle emission regulatory landscape across all the leading economies will accelerate the global market growth over the assessment period.

RESTRAINING FACTORS

Russia-Ukraine War Conflict to Effect Supply Demand Equation

The global supply chain of this element is heavily dependent on Russia. In 2022, Russia alone accounted for around 42% of the global mine production and was the leading exporter. There is limited production capacity worldwide to fill the gap in case of a short-term supply shortage from Russia. In addition, the price of this element continued to rise during the war and reached all-time highs in 2021. However, uncertain political situations kept prices highly volatile from February 2022. As per the U.S. International Trade Commission, in 2022, the U.S. sanctioned restrictions against Russian imports, worsening the overall supply-demand equation. A similar trend can be observed in European nations where several end-use industries are reportedly focusing on diversifying their products from Norilsk Nickel, a Russian mining and smelting company. The extent of disruption in supplies will depend on the overall course of the ongoing conflict. Therefore, until the imposed restrictions ease up, the market and associated industries are poised to suffer.

Palladium Market Segmentation Analysis

By Source Analysis

Growing Demand For Per Vehicle PGM to Drive the Demand for Mined Segment

Based on source, the palladium market is segmented into mined and recycled. The recycled segment is expected to record a faster CAGR than the mined segment as the demand for a circular economy has increased the need for recycled products. Growing environmental awareness and rising demand for green hydrogen have also contributed to the segment’s expansion. Palladium can be recycled infinitely without losing its intrinsic properties. Recycling reduces the overall cost and carbon emission, thereby driving its demand.

The mined segment accounted for the largest market share of 70.38% in 2026 and is poised to maintain its dominance throughout the assessment period. The segment’s growth is due to its increasing per-vehicle consumption and rising demand from other end-use industries.

By End-use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

High Utilization in Automotive to make it a Largest Consumer in The Market

Based on end-use industry, the palladium market is segregated into automotive, electronics, chemical & petroleum, and others. The automotive segment dominated the global palladium market with a share of 81.06% in 2026. It is the best converter among platinum group metals. Therefore, it is highly used in petrol and hybrid automobile exhaust fumes to reduce carbon emissions. However, the rising inclination toward electric vehicles is decreasing the demand for ICE-based vehicles, which may hamper product sales during the forecast period.

Palladium also finds applications in electronics for various purposes, such as MultiLayer Ceramic Capacitors (MLCCs), hard disks, and hybridized integrated circuits. Chemical and petrochemical industries generate moderate demand for this metal. In these industries, it is used as an industrial catalyst in hydrocracking, terephthalic acid production, and hydrogen peroxide purification. Apart from the above-listed industries, it is utilized in dental, jewelry, and agricultural equipment, which will further help the market grow.

REGIONAL PALLADIUM MARKET ANALYSIS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Palladium Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific was valued at USD 9.2 billion in 2026. Sales of this element are growing steadily as this region is a hub of many industries where palladium metal is utilized. Asia Pacific is the hub for automotive, chemical, and electronics industries. As a result, this region has become a highly lucrative market as compared to other regions. It is also the world's largest automotive producer, accounting for over half of the global production in 2022. It is largely utilized in the automotive industry, which is expected to boost the regional market’s growth. The Japan market is projected to reach USD 1.86 billion by 2026, the China market is projected to reach USD 5.3 billion by 2026, the India market is projected to reach USD 2026, and the South Korea market is projected to reach USD 0.81 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Globally, it is mostly produced in Russia and South Africa. As per the U.S. Geological Survey, collectively, these countries accounted for nearly 80% of the global production in 2022. Russia is the world's largest exporter, accounting for almost one-third of the U.S. imports. In the market study by Fortune Business insights, the U.S. is identified as one of the prominent countries in this market.

Europe is projected to grow moderately over the forecast period. The regional market’s growth is supported by the declining share of diesel cars and increased production of gasoline and hybrid cars. The market share of diesel cars in Europe fell from 20% to 16% in the past few years. As a result, gasoline cars created moderate demand for palladium in the region during the historical period. As per the government's new stringent policies, all passenger cars are required to meet the Euro 6d standards, which will drive the product’s demand in the region in the upcoming years. The UK market is projected to reach USD 0.9 billion by 2026, while the Germany market is projected to reach USD 1.47 billion by 2026.

Latin America and the Middle East & Africa markets are projected to grow moderately during the assessment period. Generous growth in industries such as automotive and chemical will mainly drive the market’s progress in these regions.

List of Key Companies in Palladium Market

Rapid Capacity Expansion to Become Key Strategy among Market Giants

Anglo American Platinum Limited, Sibanye-Stillwater, Impala Platinum Holdings Limited, Ivanhoe Mines Ltd., and Nornickel are identified as the key manufacturers in the global market. Market leaders, such as Nornickel have invested in exploring new market opportunities to drive sales over the coming years. In addition, many companies are investing in recycling plants to meet the increasing demand for sustainable products in automotive and green hydrogen applications.

LIST OF KEY COMPANIES PROFILED IN PALLADIUM MARKET:

- Anglo American Platinum Limited (South Africa)

- Heraeus (Germany)

- Impala Platinum Holdings Limited (South Africa)

- Ivanhoe Mines Ltd. (Canada)

- Nornickel (Russia)

- New Age Metals Inc. (Canada)

- Northam Platinum Holdings Limited (South Africa)

- Platinum Group Metals Ltd. (Canada)

- Sibanye-Stillwater (South Africa)

- Southern Palladium Limited (Australia)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Nornickel plans to develop a palladium catalyst to tap the future potential of electrolysis technology for water disinfection. As per the company’s plan, the development phase of the catalyst may be completed by the end of 2023.

- February 2022: Heraeus Precious Metals formed a joint venture with BASF that will be built in Pinghu, China, to recover the precious metals from automotive catalysts.

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on crucial aspects, such as leading companies, sources, and end-use industries. Also, it provides quantitative data regarding volume and value, market analysis, research methodology for gathering market data, and insights into the latest market trends, vital industry developments, and the competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors contributing to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Growth Rate |

CAGR of 2.10% from 2026-2034 |

|

Segmentation |

By Source

|

|

By End-use Industry

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 20.8 Billion in 2026 and is projected to reach USD 24.59 Billion by 2034.

The market will exhibit a CAGR of 2.10% during the forecast period of 2026-2034.

By end-use industry, the automotive segment is leading the market in 2026

Rising product usage in vehicles will drive market growth.

China held the highest share of the market in 2026.

Anglo American Platinum Limited, Impala Platinum Holdings Limited, Ivanhoe Mines Ltd., Nornickel and Sibanye-Stillwater are the top players in the market.

Rising inclination toward green hydrogen may create lucrative growth opportunities for key players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us