Philippines Edible Oils & Fats Market Size, Share & COVID-19 Impact Analysis, By Type [Oils (Palm, Coconut, Soybean, and Others) and Fats (Butter, Tallow, Margarine, and Others)], By Source (Plant and Animal), By End-Use (Food Service and Retail), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

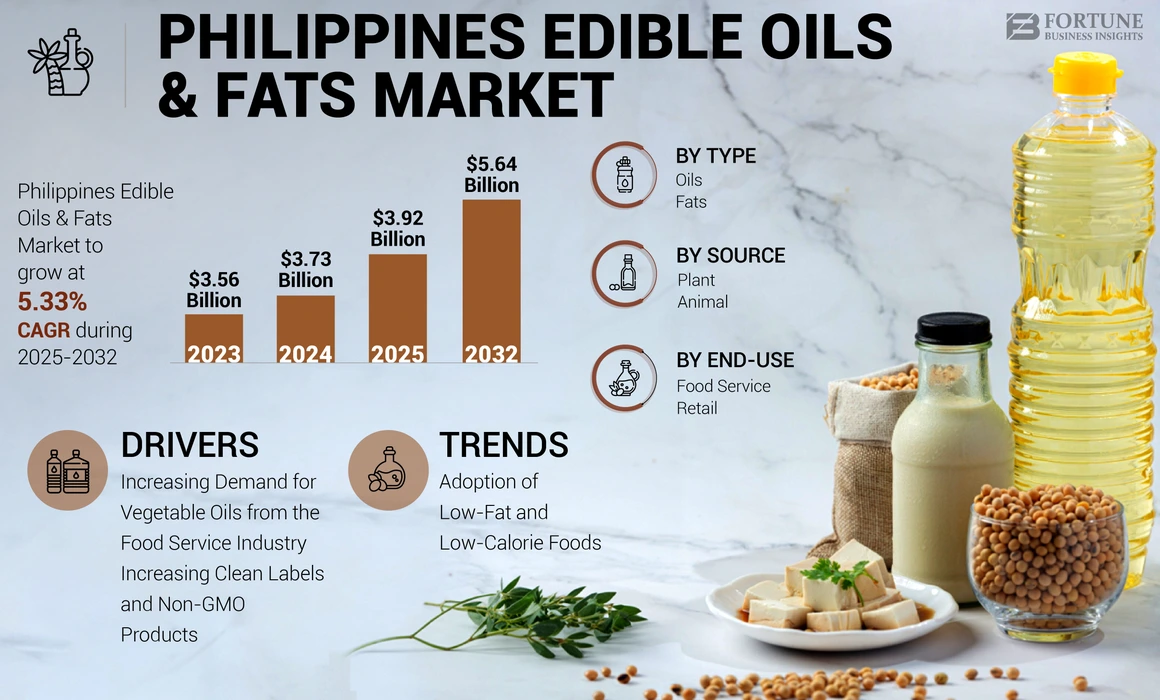

The Philippines edible oils & fats market size was valued at USD 3.73 billion in 2024. The market is projected to grow from USD 3.92 billion in 2025 to USD 5.64 billion by 2032, exhibiting a CAGR of 5.33% during the forecast period.

Increase in consumption of oils and fats across the world is attributed to factors such as expansion of the food industry and an increase in per-capita consumption of oils & fats due to a significant rise in population. Cooking oils are an indispensable ingredient in various culinary preparations, and with consumers' changing food preferences, consumption of edible oils & fats in the Philippines has been rising over the years. Edible oil manufacturers are focusing on delivering affordable, fortified cooking oil to cater to the consumer demand for economical cooking oils, especially in developing countries where consumers are price-conscious.

Furthermore, the growing health consciousness among consumers is leading to the increased demand for organic, clean-label, and fortified cooking oils. The growing production and processing of organic oilseeds will positively impact the Philippines edible oils & fats market growth.

COVID-19 IMPACT

Declined Demand for Edible Oils from Commercial Sector Affected Market Growth

The COVID-19 pandemic drastically changed the global markets and significantly affected different industries, including food service. During the pandemic, heavy restrictions on dine-in food services prompted consumers to stay home. Hence, many hotels and restaurants were partially or fully closed. During the pandemic's initial months, logistics restrictions and labor shortages became producers' top concerns. Many producers, particularly Small & Medium-sized Enterprises (SMEs), had to stop or halt their production. Despite the pandemic, the governments of several regions issued an emergency notice to allow the transportation and circulation of essential agricultural products.

During the COVID-19 crisis, from 2020 to 2021, there was a decrease in the import of palm oil to the Philippines from Malaysia. One major factor was that due to COVID-19-related restrictions and lockdowns, the food service industry came to a standstill and the demand for edible oils & fats from this sector decreased drastically. Oilseed shortage was not a big problem in the Philippines. The seed sector is highly globalized, and seeds may pass through multiple countries for breeding, production, processing, and packaging. Most of the seeds needed for the March, April, and May sowing seasons to grow spring crops, such as corn, soybeans, and spring wheat in the northern hemisphere and autumn crops in the southern hemisphere had arrived before the travel restrictions took effect in the country.

As the outbreak was well controlled in the Philippines and transportation restrictions were lifted in a few months, the demand for oilseed increased to make the most of the short farming season and high oilseed prices.

Philippines Edible Oils & Fats Market Trends

Adoption of Low-Fat and Low-Calorie Foods is Emerging as a New Trend in the Philippines

The low-fat and low-calorie food trends are expected to rapidly impact the developing countries in different ways against well-defined public health goals and increased government intervention. The World Health Organization (WHO) recommends that the total fat intake be less than 30% of total calories and that saturated fat intake not exceed 10%. This will lead to the widespread demand for low-fat food products, thereby contributing to the market growth during the forecast period.

The Philippines is also emerging as an important market for the low-fat butter industry due to rising demand, growing population, and increasing living standards in terms of healthy eating. In addition, constant product innovations by local companies will drive the market growth.

For instance, Fonterra’s brand “Anchor” sells 600+ products in over 80 countries, mainly across six dairy categories. In January 2023, it launched its innovative product in Malaysia and the Philippines. It provides nutritional, organic dairy products, such as milk, butter, and others. Thus, the increasing trend of low-fat food consumption is expected to drive the Philippines market growth during the forecast period.

Download Free sample to learn more about this report.

Philippines Edible Oils & Fats Market Growth Factors

Increasing Demand for Vegetable Oils from the Food Service Industry to Drive Market Growth

The food service sector is one of the major industries in the Philippines. With the growing number of fast-food restaurants and fine/casual dining establishments, the food service sector is gaining traction and expanding considerably.

The fast-food chains hold a massive share in the Philippines foodservice industry. The demand for vegetable oils, such as palm oil, coconut oil, corn oil, and soybean oil, from the food service industry is growing constantly with the rising popularity of fast food among millennials.

According to the Philippine Statistics Authority, in 2021, consumer spending on food and beverages in the Philippines was valued at over USD 106.97 billion, which increased by 16.8% from USD 91.58 billion in 2019. This data shows that the demand for foods and beverages is expected to increase yearly due to a rise in the number of fast-food restaurants in the country. The major players in the food service industry in the Philippines are Jollibee, McDonald's, and KFC. These manufacturers follow the trend and provide food products according to the customer's needs. Therefore, the rising number of fast-food restaurants in the Philippines will fuel the consumption of edible oils & fats, especially palm oil.

Increasing Clean Labels and Non-GMO Products to Boost Demand for Edible Oils & Fats

Clean label and non-GMO ingredients are natural ingredients with no additives or preservatives. Clean-label products are more sustainable and eco-friendly than conventional food products and have gained popularity over the last few years. The demand for foods with no added color or preservative is rising in the domestic Philippines market with the awareness about the quality of organic products and benefits of consuming organic/clean label food. As consumers demand clean-labeled and minimally-processed foods, manufacturers are launching clean-label oil in the Philippines market.

Food additive manufacturers are also incorporating the production of organic additives to help develop clean-label products. These additives find application in various food products including dressings, white cooking sauces, ready-to-eat meals, and other foods. As a result, food and beverage manufacturers are reformulating their products to meet the changing consumer demand for natural and organic ingredients.

In recent years, the escalating incidences of food-related allergies among adults and children have changed consumer food preferences to shift to clean-label and non-GMO food products. Hence, rising demand for natural vegetable oils and the launch of healthier edible oils & fats in the Philippines market are expected to augment the market's growth in the coming years.

RESTRAINING FACTORS

High Dependence on Imports May Hamper Market Progress

A major challenge for the Philippines edible oils & fats market development is price fluctuation, especially increase in the price of raw materials heavily imported from Indonesia and Malaysia. According to the Malaysia Palm Oil Board, the Philippines is Asia's second-largest importer of palm oil from Malaysia. With a total population of 115 million, the consumption of edible oils & fats was at 1.65 million MT in 2020 and increased to 1.70 million MT in 2021.

In the Philippines, domestic soybean oil production constitutes a minimal share of soybean oil consumption due to the small amount of soybean produced. Hence, a significant portion of soybean in the Philippines is imported. The Philippines' primary sources of soybean imports are the U.S., Brazil, and Argentina. It is used for both food and industrial applications.

According to the FAO, in 2019, the Philippines imported 11,846.58 metric tons of sunflower oil, which increased to 14,828.49 metric tons in 2020. The import increased due to high demand for oil from the food services sector for grilling, frying, and baking. Therefore, to respond to the increasing oil demand, imports of vegetable oils are growing, affecting the end price, and hampering the consumption of edible oils & fats.

Philippines Edible Oils & Fats Market Segmentation Analysis

By Type Analysis

Palm Oil to Witness Robust Sales due to Huge Demand from the Commercial Food Service Industry

Based on type, the market is segmented into oils and fats. The oils segment is further segmented into coconut, palm, soybean, and others, while in the fats segment, butter, margarine, tallow, and others are considered. Out of all the segments, the palm oil segment holds the largest Philippines edible oils & fats market share. The rising demand for palm oil to manufacture processed foods, confectionery products, and baked goods due to its easy availability, low cost, and taste-enhancing properties is projected to aid the segment’s growth during the forecast period. According to the Malaysian Palm Oil Board (MOAP), palm oil is the most consumed form of oil in the Philippines and accounted for more than 60% of the total volume of vegetable oils consumed in the country in 2021. With the increasing demand for palm oil, this segment is expected to dominate the market in future. The coconut oil segment holds the second-largest share in the market.

To know how our report can help streamline your business, Speak to Analyst

By Source Analysis

Rising Consumption of Vegetable Oils to Fuel Adoption of Plant Sources

Based on source, the market is bifurcated into plant and animal. The plant segment holds the largest market share due to the flourishing demand for vegetable/plant-based oils, such as coconut, soybean, palm, and others across the country’s food industry and for industrial applications. Moreover, plant-based oils have a variety of health benefits including reduced risk of cardiovascular disease, improved metabolism & digestion, lower risk of breast cancer, and providing the body with omega-3 fatty acids. These benefits of plant oils make them the preferred choice for healthier cooking.

Over the last few years, butter and margarine have been made with plant-based sources derived from coconut and soy milk. The application of plant-based oils & fats in health supplements has increased significantly in recent years. Products, such as coconut butter, are used in food products due to their health benefits. Furthermore, butter and margarine are used in local cuisine to enhance the flavor and taste.

Animal fats are derived from cows, pigs, chickens, and fish. Fats, such as tallow, lard, and grease are derived from animals, and cooking butter is usually made from goat, cow, and sheep milk. Compared to other fats, such as those derived from olive oil or coconut oil, animal fats are usually cheaper and give the food a delicious taste. Therefore, the demand for animal-based oils & fats will increase during the forecast period.

By End-Use Analysis

Retail Channel is expected to dominate the Market Owing to the Large Consumption of Edible Oils & Fats in Household

On the basis of end-use, the Philippines market is sub-segmented into food service and retail. The retail stores have witnessed remarkable growth in the year 2022 and is expected to retain its dominance in the upcoming years. As it is evident from the figures, more than half (70.66%) of the sales of edible oils & fats happened through retail stores in Philippines for the year 2022. Cooking oil is a basic necessity for making food, making it a most preferred choice. Modern-day grocery stores are the most preferred retail channels for purchasing essential household items. Grocery retail appeal to tech-savvy customers by offering online platforms and mobile applications for ease in ordering and delivery processes. Online stores are slowly gaining popularity among consumers as it provides the ease of purchasing products from the comfort of their home. Hence, this retail channel is expected to grow significantly in the upcoming period.

The food service sector is also increasing in the Philippines due to the increase in the income of the consumer and tourism activity

KEY INDUSTRY PLAYERS

Companies to Focus on Strategic Acquisitions and Partnerships to Gain Competitive Edge

Various regional and international players are consistently developing advanced strategies to gain competitive advantage. Many companies are forming merger & acquisition and partnership & collaboration strategies to enable their growth in the market. For instance, in August 2019, NutriAsia started a campaign named "Bring Your Own Bottle" to support the company's vision of a more environmentally sustainable world. Through this campaign, the company encouraged customers to bring clean, reusable plastic bottles and refill them with their favorite NutriAsia food condiments and products such as soy sauce, UFC banana catsup, Golden Fiesta cooking oil, and Datu Puti vinegar.

List of Top Philippines Edible Oils & Fats Companies:

- NutriAsia (Philippines)

- International Oil Factory (Baguio Oil) (Philippines)

- Oleo Fats (Philippines)

- Cargill, Inc. (U.S.)

- Marca Leon (Philippines)

- Fuji Oil Co. Ltd. (Japan)

- CIIF Oil Mills Group (Philippines)

- Wilmar International Limited (Singapore)

- Archer Daniels Midland Company (U.S.)

- Arla Foods amba (Denmark)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 – OFI strengthened ties with the Polish business partner and brand Mlekovita. It received an 18-container shipment of milk products from the Polish brand. OFI exclusively distributes its products in the Philippines market. OFI and PTIA took the opportunity to discuss possible import and export projects between Oleo-Fats and other Polish companies. Mlekovita will also help OFI in other segments, such as cooking oil and baking, and help OFI increase its market share in the coming years.

- December 2021 – Cargill introduced trans-fatty acids as food producers sought ways to help improve consumer diets. It supported its customers by committing to remove iTFAs from its entire global edible oils & fats portfolio. This helped Cargill provide its customers with products that comply with the World Health Organization's (WHO) recommended standard of a maximum of 2 grams of industrially produced trans-fatty acids per 100 grams of fats/oils.

- May 2021 - Dairy co-operative Arla Foods invested USD 8.2 million to expand a local production facility to meet the increasing demand for its products from consumers. Arla had undertaken a project at its site in Troldhede Dairy, built two new ripening warehouses, and installed new cheese equipment, and a drainage room. Thus, the expansion resulted in a new production method that will help Arla improve its product quality over time.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product sources, types, and leading end-uses of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.33% from 2025 to 2032 |

|

Unit |

USD Billion |

|

Segmentation |

By Type

|

|

By Source

|

|

|

By End-Use

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 3.73 billion in 2024.

The market is likely to record a CAGR of 5.33% over the forecast period of 2025-2032.

The plant segment is expected to lead the market due to the growing consumption of vegetable oils in the Philippines.

Increasing demand for vegetable oils in the food service industry will drive the market growth.

Some of the top players in the market are Archer Daniels Midland Company, Cargill, Inc., and Oleo Fats.

High dependence on imports may hamper the market growth in the Philippines.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us