Procurement Analytics Market Size, Share & Industry Analysis, By Deployment Mode (On-Premise and Cloud), By Application (Supply Chain Management, Risk Analytics, Spend Analytics, Vendor Management, Contract Management, and Others), By Enterprise Type (Large Enterprises and Small & Medium Enterprises (SMEs)), By End-user (Manufacturing, Retail and Consumer Goods, BFSI, Transportation and Logistics, Healthcare and Life Sciences, and Others), and Regional Forecast, 2026-2034

Procurement Analytics Market Size

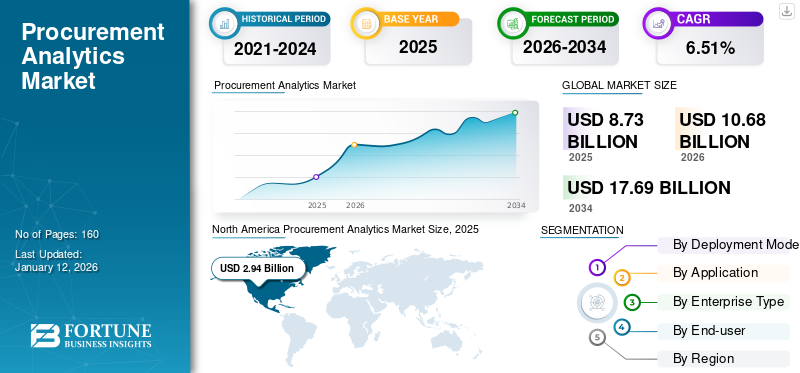

The global procurement analytics market size was valued at USD 8.73 billion in 2025. The market is projected to be worth USD 10.68 billion in 2026 and reach USD 17.69 billion by 2034, exhibiting a CAGR of 6.51% during the forecast period. North America dominated the global market with a share of 33.65% in 2025.

Procurement analytics is the collection and analysis of procurement data to provide business insights and help in effective decision-making. It can be used for the management of resources, strategy planning, business development, market research, and other areas.

The procurement analytics market growth can be credited to several factors, such as increasing business expenditure on marketing and advertising activities, the evolution of customer intelligence, and the proliferation of channels for communicating with customers. The enormous need for contract and compliance management by organizations is another factor that contributes to the high market share across the globe.

The COVID-19 pandemic impacted procurement and supply chain operations and was assessed and resolved by enterprises across the globe. Procurement analytics companies and suppliers collaborated through innovation programs to evaluate new opportunities for revenues and profits.

Moreover, the adoption of AI and automation into procurement analytics provides advanced technologies into new data sources and enriches, cleans, and monitors information. AI techniques provide ongoing monitoring of data changes and trends to identify new suppliers, price changes, unusual orders, early contract expiration, and risk patterns.

For instance, the procurement management feature in its newest software has been renewed by ServiceNow to manage additional field tasks. ServiceNow's objective is to streamline procurement processes in and across the supply chain.

Procurement Analytics Market Trends

Rising Demand for Procurement Automation and Digitization is the Latest Trend

To speed up the procurement process, automate manual work, and increase productivity, businesses have started using strategic sourcing tools, predictive analytic capabilities, and supplier collaboration tools. The merging of digitization and automation allows procurement optimization for maximum accuracy and efficiency. It can transform from a slow, manual process into a strategic function that drives business growth, adds value to services, and enhances customer satisfaction. As a result of the widespread distribution of companies, it is increasingly vital that large and small organizations assess and adapt digital procurement automation tools to remain innovative and retain their market share.

As enterprises take an intentional approach to digitizing work from outdated processes, the advent of procurement automation affects the fields such as procuring, contract management, vendor relationships, payments, and others. According to Pantavanij, in 2023, the trend for using technology and digitization of operations would continue to gain pace from procurement to payment. Thus, the rising demand for digitization is bolstering the use of procurement analytics services and solutions.

Download Free sample to learn more about this report.

Procurement Analytics Market Growth Factors

Rapid Transformation in the Use of Consumer Intelligence for the Product to Aid Market Growth

The market is driven by a transformation in the deployment of consumer intelligence. It can serve as a game changer for companies wanting to make smart purchasing decisions. This enables procurement organizations to optimize cost, mitigate risk, and focus on developing strategic partnerships with suppliers to ensure the long-term sustainable benefits of public procurement.

Consumers and businesses are searching for solutions to minimize risk exposure and improve compliance. It enables enterprises to open up new opportunities for success in a challenging economic environment. In addition, in a rapidly changing business landscape, it allows firms to gain a competitive advantage and drive operational efficiency and sustainable growth.

RESTRAINING FACTORS

Data Inconsistency Issues May Hamper the Market Growth

Procurement firms provide a high amount of information on suppliers and raw materials, which are often distributed between various systems, processes, or geographical areas. There are different formats of data stored within various systems, which can be difficult to use. A combination of data from various sources may be complicated, which could affect the procurement analysis. Therefore, the quality of the procurement analysis may be affected by the discrepancies in the data.

Moreover, businesses have various factors that create inconsistency, such as a lack of data, difficulty in evaluating the organization's supplier network, and the concern for supply chain visibility being spread across departments.

Inconsistency in data may affect business decisions and company productivity, as analysis of procurement is dependent upon the information source and its quality. Moreover, companies may have two or more copies of identical data, which could affect their storage and computation. Thus, problems related to data accuracy and consistency may hinder market growth.

Procurement Analytics Market Segmentation Analysis

By Deployment Mode Analysis

On-premise Segment Dominated the Market Owing to the Data Security Feature

Based on deployment mode, the market is segmented into on-premise and cloud. In terms of market share, the on-premise segment dominated the market in 36.31% 2026. On-premise solutions need an enterprise to purchase a subscription or a copy of the software. The segment expansion is influenced by factors such as data security due to information stored on-premise and local security control. Moreover, support and accessibility in the organization have improved as on-premise software requires dedicated IT staff.

The cloud segment is expected to grow at the highest CAGR during the forecast period. Cloud services can be offered through a network connection to the cloud. The segment growth can be credited to the rising need for visibility between organizations to identify and resolve issues before affecting the analysis of operations. Cloud platforms are useful for companies that have stringent budgets to invest in security. Cloud deployment is growing as cloud-based procurement analytics solutions are easy to upgrade and manage.

By Application Analysis

Supply Chain Management Segment Dominated as the Product Deployment Helps Enhance Operational Efficiency

By application, the market is divided into supply chain management, risk analytics, spend analytics, vendor management, contract management, and others. With regard to market share, the supply chain management segment dominated the market in 16.76% 2026. Several end-users, including manufacturing, retail and consumer goods, healthcare, and others, use supply chain management applications. The solution provides data-driven insights that help enhance the operational efficiency and effectiveness of the supply chain. This enables them to make informed decisions regarding the optimization of their supply chains, demand planning and forecasting, inventory optimization, and supplier performance. Moreover, the integration of procurement analytics in supply chain processes enables enterprises to gather relevant data from various enterprise systems and external sources, which further processes the data through cleansing, statistical modelling, machine learning algorithms, and data visualization tools, helping businesses gain valuable insights.

The risk analytics segment is expected to grow at the highest CAGR during the forecast period. Due to complications of business, it has become difficult to manage large volumes of information and identify potential risks. With increase in data, business difficulties have amplified and decision-making has become more complex. This has led to a growing use of risk analysis applications by most businesses to simplify data collection and reduce complexity. This factor is driving the segment expansion.

By Enterprise Type Analysis

Large Enterprises Segment Dominated due to Rising Product Usage for Vendor Management

By enterprise type, the market is divided into small & medium enterprises (SMEs) and large enterprises.

In terms of market share, the large enterprises segment dominated the market in 37.08% 2026. Large enterprises use more enhanced strategic procurement analytics tools. These tools have functions related to contract management and supplier management, as well as the functionalities such as suppliers' self-service portals and catalogs. Large enterprises are implementing procurement analytics that enable them to easily manage a large number of vendors.

The Small & Medium Enterprises (SMEs) segment is expected to significantly grow at the highest CAGR during the forecast period. SMEs bear various expenses associated with the acquisition of software and license-based services. Therefore, procurement analytics is rapidly adopted by these companies. Moreover, the solution also helps to reduce operational and capital costs, which leads to a rise in investment. Thus, the adoption is expected to increase market growth opportunities in the coming years.

By End-user Analysis

Manufacturing Segment Dominated Owing to Need for Timely Product Delivery

By end-user, the market is divided into manufacturing, retail and consumer goods, BFSI, transportation and logistics, healthcare and life sciences, and others. Out of these, the manufacturing segment dominated the market in 17.57% 2026. Due to globalization, manufacturers have recognized that advanced research in procurement analysis is essential to ensure the delivery of the product at the right price and time. To identify problem areas and improve machine efficiency, sensors are being deployed for collecting and analyzing Internet of Things (IoT) data. As procurement analytics deals with the planning of sourcing, production, product material, and distribution, it is useful for planning these factors and increasing the profitability of the manufacturer.

The retail and consumer goods segment is expected to grow significantly at the highest CAGR during the forecast period. To assess user behavior and to define the layout and content of product landing pages for attracting visitors and generating a sale, retailers are using retail analytics for procurement. Moreover, procurement analysis is used regularly by large consumer goods companies and organized retail outlets since it gives a data-based analysis of consumers' expenditures and behavior.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Regionally, the market is divided into South America, Europe, North America, the Middle East & Africa, and the Asia Pacific.

North America Procurement Analytics Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 2.94 billion in 2025 and USD 3.47 billion in 2026. The United States market is projected to reach USD 1.54 billion by 2026. As per the study, North America accounted for a major procurement analytics market share in 2024. The growth can be attributed to the early adoption of technologies such as analytics and the digitization of processes in the region. The regional growth is also expected to be driven by an increase in expenditure on risk management, supply chain analysis, and vendor analytical solutions. In addition, the leading players in the region continue to update and innovate their product portfolios. For instance,

- In June 2022, PartsSource launched a supply chain risk monitoring and visual formulary control to help customers enhance supply chain resilience and equipment uptime.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Japan market is projected to reach USD 0.45 billion by 2026, the China market is projected to reach USD 0.50 billion by 2026, and the India market is projected to reach USD 0.33 billion by 2026. Asia Pacific is expected to expand significantly at the highest CAGR during the forecast period. In the region, data analytics is enhancing the operations of governments and businesses. Technologies to improve the functioning and supply chain management are being integrated by countries such as India and China. The market growth in the region is also supported by the increasing use of IoT and data analytics in manufacturing processes.

The Middle East & Africa market is poised to witness the second-highest CAGR during the forecast period. Rapid innovation and digitization of data in the region led to a proliferation of procurement analysis technologies.

Key Industry Players

Companies Announce Mergers & Acquisitions, Product Development, and Partnership Strategies to Promote Reach

Leading companies operating in the global market emphasize providing better insights into the operational efficiency of businesses. These companies also focus on acquiring small and local firms to expand their business presence. Moreover, strategic partnerships, leading investments in device technologies, and mergers and acquisitions help increase the procurement analytics solution and services demand.

List of Top Procurement Analytics Companies:

- SAP (Germany)

- Oracle Corporation (U.S.)

- SAS Institute (U.S.)

- GEP (U.S.)

- Coupa Software Inc. (U.S.)

- Rosslyn Data Technologies Plc (U.K.)

- Simfoni (U.S.)

- JAGGAER (U.S.)

- Corcentric, Inc. (U.S.)

- Ivalua Inc. (France)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Corcentric and International Motorcoach Group, a motorcoach operator network in North America, announced that Corcentric’s Fleet Procurement Services through IMG’s procurement spending has risen to levels after the COVID-19 pandemic.

- November 2023: Ivalua announced a partnership with Sourcing Champions, a procurement consulting firm, by integrating Ivalua’s comprehensive S2P platform with the aim of enabling organizations in the Netherlands to increase procurement effectiveness through procurement digitalization.

- October 2023: SAP SE introduced a new business in its inclusive spend management and business network solutions with AI and user experience innovations to help customers control costs, moderate risk, and increase productivity.

- October 2023: Zip, an intake-to-pay platform provider, partnered with Oracle by integrating Oracle’s NetSuite platform to increase team members' adoption of procurement processes, allowing them to increase their NetSuite deployments and improve spend visibility.

- June 2023: Ivalua, a player in spend management, announced that ArcelorMittal, a steel manufacturer, expanded the partnership by growing the scope of its currently deployed solution. In addition to securing its supply chain, ArcelorMittal is reducing the risk of disruption through Ivalua. ArcelorMittal is particularly benefiting from the supply chain collaboration solution developed by Ivalua as a way of bridging the supply chain gap with its ERP suppliers to guarantee continuity.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies and prominent end-users of the product. Besides, it offers insights into market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.51% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Mode

By Application

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

According to a study by Fortune Business Insights, the market is projected to reach USD 17.69 billion by 2034.

In 2025, the market value stood at USD 8.73 billion.

The market is projected to grow at a CAGR of 6.51% during the forecast period.

Based on end-user, the manufacturing segment is expected to lead the market.

The rapid transformation in the use of consumer intelligence for the product is driving the market growth.

SAP, Oracle Corporation, SAS Institute, GEP, Coupa Software Inc., Rosslyn Data Technologies Plc, Simfoni, JAGGAER, Corcentric, Inc., and Ivalua Inc. are the top players in the global market.

North America is expected to hold the largest market share during the forecast period.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us