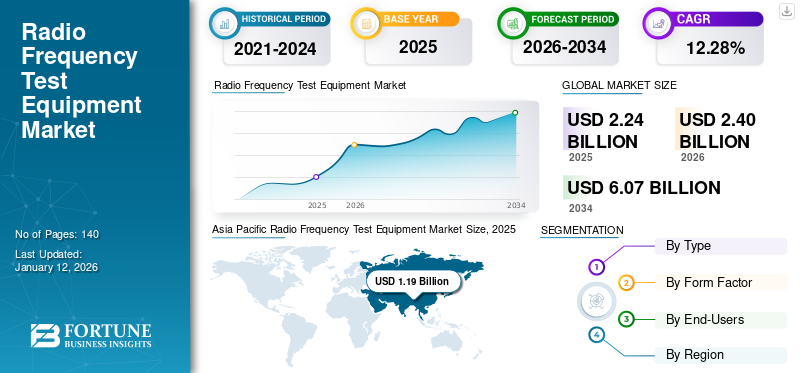

Radio Frequency Test Equipment Market Size, Share & Industry Analysis, By Type (Oscilloscope, Spectrum Analyzer, Signal Generator, Network Analyzer, and Others), By Form Factor (Rackmount, Bench-top, Portable, and Modular), By End-Users (Healthcare, Manufacturing, IT & Telecommunication, Consumer Electronics, Automotive, Aerospace & Defense, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global radio frequency test equipment market size was valued at USD 2.24 billion in 2025 and is market is projected to grow from USD 2.4 billion in 2026 to USD 6.07 billion by 2034, exhibiting a CAGR of 12.28% during the forecast period. Asia Pacific dominated the global market with a share of 31.59% in 2025.

Radio Frequency (RF) test equipment is essential for accurately measuring and testing wireless communication devices of various frequencies. These devices include smartphones, routers, and satellite communication systems. Radio frequency test devices depend on the transmission and reception of radio waves to give the correct result. They allow engineers and technicians to evaluate the performance of wireless devices by measuring their signal quality, frequency response, power output, and other vital parameters. Each radio frequency tool is designed to perform specific tests and measurements. Also, RF testing tools together form a comprehensive suite of equipment for engineers and technicians. With the increasing demand for wireless communication and the constantly evolving technology landscape, the need for accurate and reliable radio frequency testing equipment has increased globally. Furthermore, manufacturers are constantly developing new RF test tools and technologies to help engineers and technicians keep up with the latest advancements in the field. The above mentioned factors are propelling the radio frequency test equipment market growth.

The COVID-19 pandemic impacted various industries and businesses, and the RF test equipment market was no exception. The outbreak disrupted global supply chains, causing delays in delivering raw materials, components, and finished products. This factor increased the lead times and spiked prices of radio frequency test equipment. This slumped the demand for RF test equipment as many industries reduced their spending due to economic uncertainty, which decreased the production for some manufacturers.

However, many engineers and technicians were forced to work remotely due to lockdowns and social distancing measures. This increased the demand for remote testing capabilities and equipment that can be operated remotely. Also, the pandemic increased the demand for certain types of RF test solutions, such as equipment used for testing medical devices, personal protective equipment, and other products related to the pandemic response, expanding the market size.

Radio Frequency Test Equipment Market Trends

Rising Use of RF Test Devices In Automobiles to Drive Market Progress

The use of radio frequency test equipment is becoming increasingly important in the automotive industry as wireless technology and autonomous vehicles are gaining popularity in the global market. RF testing devices are essential for ensuring the safety and performance of these systems and meeting regulatory compliance requirements. Furthermore, modern vehicles are increasingly relying on wireless technologies, such as Bluetooth, Wi-Fi, and cellular networks. Radiofrequency testing equipment ensures that these systems are operating correctly and do not interfere with other critical vehicle systems. Also, this equipment is used to test and validate the performance of automotive safety systems, such as radar-based collision avoidance, adaptive cruise control, and lane departure warning systems. Moreover, the development of autonomous vehicles heavily depends on RF technologies, such as GPS and radar, which will accelerate the RF test equipment market growth.

Download Free sample to learn more about this report.

Radio Frequency Test Equipment Market Growth Factors

Increasing Penetration of 5G-compatible Appliances Will Propel Market Growth

The implementation of 5G wireless technology is expected to increase the use of RF test devices due to the higher frequencies, increased complexity, and denser deployment of network components in the 5G infrastructure. 5G operates at frequencies higher than those of previous wireless technologies, such as 4G and 3G networks. 5G wireless networks are more complex than previous technologies, with more antennas, transmitters, and receivers being installed. This complexity requires a more sophisticated RF test solution to measure and analyze the signal characteristics of each component. Furthermore, 5G networks use massive MIMO (multiple-input, multiple-output) technology, requiring an RF testing device to test multiple antennas simultaneously. 5G technology also utilizes millimeter-wave technology, which operates at extremely high frequencies. RF test solutions operating at these frequencies must validate millimeter-wave components' performance. Furthermore, 5G technology is comparatively new in the market, and novel technology has some uncertainty in its operation. For Instance, sometimes 5G network in 3.7 – 3.98 GHz band may create harmful interference in the aeroplene’s radar altimeter which may lead to plane crash. To detect and resolve these problems in the 5G network RF testing devices are frequently used, which is responsible for boosting the market's growth.

RESTRAINING FACTORS

Requirement of Heavy Capital for R&D Activity Might Hinder Market Growth

The retail price of a radio frequency testing device is much higher than that of other electronics testing and sensing devices. The high initial cost of RF test devices can create a barrier to new customers in the market. For small- and medium-scale customers, the budget allocated for frequency testing devices is limited, restraining the market growth. Furthermore, RF test equipment requires sophisticated technology to measure and test high-frequency signals accurately. Developing such technology requires significant investment in R&D to design and test prototypes.

This high-end technology ensures that the final product meets the required standards of accuracy and reliability. It can also involve significant investment in specialized equipment, software, and highly skilled personnel with RF technology and testing expertise. Moreover, RF test devices must meet stringent regulatory requirements, such as those set by the Federal Communications Commission (FCC) and other regulatory bodies worldwide. Meeting these requirements can be costly and time-consuming and may involve extensive testing and certification procedures, thereby increasing the initial costs and hindering the market growth.

Radio Frequency Test Equipment Market Segmentation Analysis

By Type Analysis

Spectrum Analyzer to Gain Significant Traction Owing to Heavy Use in Telecommunication Industry

Based on type, the market is classified into oscilloscope, spectrum analyzer, signal generator, network analyzer, and others.

The spectrum analyzer segment is predicted to record prominent revenue in the market owing to the heavy use of these devices in the IT & telecommunication industry. In the telecom sector, the penetration of 5G spectrum has been rapidly rising in the last few years, thereby boosting the use of spectrum analyzers. The network analyzer and signal generator segments are also expected to follow the same growth trajectory during the forecast period. Whereas, oscilloscope and others segments showed moderate growth. However, the network analyzer segment is projected to record a strong CAGR during the analysis period, owing to the increasing use of these analyzers to tackle concerns related to the high-speed and low-latency network.

By Form Factor Analysis

Use of Bench-top RF Testing Devices to Increase Due to Heavy Use in Electronics Manufacturing Industry

Based on form factor, the market is classified into rackmount, bench-top, portable, and modular.

The benchtop segment is expected to lead by form factor, contributing 32.53% of the market share in 2026. This is due to the substantial use of bench-top radio frequency testing devices in electronics and semiconductor manufacturing factories. The rackmount and modular segments are also following a similar trend and strengthening their position in the market due to their extensive applications in the automotive and healthcare industries. However, the portable radio frequency test device segment is anticipated to record the highest CAGR during the forecast period due to the increasing use of these instruments in the IT & telecommunication and defense sectors.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

IT & Telecommunication Sector to Hold Prominent Market Position Due to Growing Use in 5G Network

Based on end-user, the market is bifurcated into healthcare, manufacturing, IT & Telecommunication, consumer electronics, automotive, aerospace & defense, and others.

The healthcare industry is anticipated to remain a key end-use segment, representing 21.00% of the total market share in 2026. The rising application of radio frequency testing units in deploying the 5G spectrum is driving the market growth. Furthermore, RF test equipment is used in various devices in telecommunication sector such as spectrum analyzer, network analyzer signal generator and antenna analyzers. It is also used to measure the power and frequency of signals in a given frequency range. However, due to the increasing use of connected vehicle technology and internet of things (IoT) in modern automobiles, the automotive segment is predicted to display the highest CAGR during the forecast period.

The aerospace & defense and healthcare segments are expected to grow at a strong rate as well during the estimated period. The use of RF testing devices is continuously increasing in the healthcare sector. This technology is sometimes used as a standalone treatment for health problems, such as arthritis. The manufacturing and consumer electronics segments are growing at a moderate pace owing to the ongoing development in the industry verticals.

REGIONAL INSIGHTS

Asia Pacific Radio Frequency Test Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominates the global radio frequency testing equipment market by holding a leading position in revenue generation. This is due to the region's effective implementation and adoption of 5G technology. 5G technology service providers are rapidly updating their testing infrastructure, such as RF testing units, to fulfil the requirements of 5G technology. For instance, in July 2022, Rohde & Schwarz launched a comprehensive 5G over-the-air test product to test mmWave and Huge MIMO antennas. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.79 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

China Holds Highest Revenue In the Market Due to Increasing Demand for 5G technology and IoT

China is the leading provider of RF test devices in the global market. The presence of high-end technologies to design, develop, and manufacture radio frequency testing products in China is driving the market. Furthermore, the government of China is continuously increasing its spending on the semiconductor & electronics sector. For instance, in December 2022, the Chinese government approved and allocated a USD 143 billion support package to modernize and promote its semiconductor and electronics industry.

North America

In the North American region, the U.S. generated immense revenue for the market. Also, the U.S. is expected to show the highest CAGR during the forecast period. It is due to the development of advanced technologies in the semiconductor & electronics industry. Also, government authorities are taking the initiative to regulate and strengthen the use of RF testing devices to ensure network security. For instance, in April 2022, the Federal Communication Commission (FCC) introduced new regulations through which market players can presell radio frequency devices, thereby helping promote the adoption of advanced RF test devices. On the other hand, Canada and Mexico are growing moderately due to the increasing use of smartphones and low-latency networks, which are expected to drive the market during the forecast period.

Europe

In Europe, Germany holds a dominant position in the market due to the rising demand for low-latency mobile networks and growing production of connected and autonomous vehicles in the country. However, the U.K. is estimated to record the highest CAGR during the forecast period due to increasing demand for RF testing units for ongoing defense & aerospace projects. France, Italy, and Spain are strengthening their market position. Moreover, key market players in Europe are adopting various strategies to tackle ongoing competition, which is expected to boost the Europe radio frequency test equipment market share. For instance, in February 2022, Viavi Solution Inc. and Rohde & Schwarz partnered to offer an integrated solution to test the Open RAN network. The UK market is projected to reach USD 0.06 billion by 2026, while the Germany market is projected to reach USD 0.08 billion by 2026.

The market is growing moderately in South America and the Middle East & Africa regions due to the regions’ slower adoption and implementation of 5G network technology. Furthermore, the initiatives taken by various government authorities in the Middle East and Africa to promote the implementation of 5G network is responsible for augmenting the demand for RF test devices in the region. For instance, in August 2021, the Saudi Arabia government announced $15 billion in funding for advancing and implementing the 5G network in the kingdom.

KEY INDUSTRY PLAYERS

Anritsu Corporation Holds Highest Market Revenue Due to Availability of High-End R&D Unit

Anritsu Corporation has generated the highest revenue in the global market as the company has an advanced research & development facility. This ultimately improves the quality of the radio frequency test devices. Moreover, Anritsu is a major supplier of RF testing devices to small- and medium-scale industries across the globe. Rohde & Schwarz, Yokogawa Electric Corporation, VIAVI Solutions Inc., Teledyne Technologies Incorporated, National Instruments, Atlantic Microwave Ltd, Chroma ATE Inc., EXFO Inc., B&K Precision Corporation, and others have adopted various strategies, such as partnerships, product launches, and market investments. Also, the key players are investing heavily in research and development to create new and improved RF test equipment that caters to various testing requirements. They are focusing on improving features, such as increased accuracy, faster testing times, and greater flexibility to appeal to customers, thereby propelling the market growth.

List of Top Radio Frequency Test Equipment Companies:

- Anritsu Corporation (Japan)

- ROHDE&SCHWARZ (Germany)

- Yokogawa Electric Corporation (Japan)

- VIAVI Solutions Inc. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- National Instruments (U.S.)

- Atlantic Microwave Ltd (U.K.)

- Chroma ATE Inc. (Taiwan)

- EXFO Inc. (Canada)

- B&K Precision Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2022 - TEVET, a developer of testing and measuring instruments, acquired Liberty GT, a real-time spectrum analyzer, from RADX Technologies, Inc. Through this acquisition, TEVET Inc. can provide real-time radio frequency analysis for various network spectrums.

- June 2022 - Rapidtek, the provider of RF testing solutions, partnered with Amrisoft, a 4G- and 5G-related service provider. Through this partnership, both organisations will develop next-generation RF testing solutions.

- May 2022 - Atlantic Microwave, a prominent supplier of Satcom radio frequency test equipment, had launched its new product, “Modular Bench-top Instrumentation Chassis”. The new product's modular design provides a flexible and scalable solution for the bench-top testing application.

- March 2022 - Microwave Vision Group (MVG) partnered with Anritsu Corporation to develop 5G-specific Over–The–Air (OTA) FT testing solutions. This solution will accelerate error-free 5G utilisation in automobiles.

- February 2021 - Anritsu Corporation, a global provider of radio frequency test equipment and network analyzers, launched a new product, the RF Regulatory Test System ME7803NR. This RF testing product helps with the regulatory compliance testing of 5G communications systems.

REPORT COVERAGE

The global market report provides a detailed market analysis and focuses on critical aspects, such as leading companies, products, and end-users of radio frequency devices. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.28% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Form Factor

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says the market stood at USD 2.24 billion in 2025.

By 2034, the global market is expected to be valued at USD 6.07 billion.

The market is set to exhibit a CAGR of 12.28% during the forecast period of 2026-2034.

Asia Pacific is anticipated to be the dominant region, which stood at USD 1.14 Billion in 2025.

In the end-user segment, the IT & Telecommunication sub-segment is expected to witness the highest CAGR during the forecast period.

Increasing use of RF testing devices in the automotive sector is a critical trend in the global market.

Increasing implementation of 5G technology is driving the market growth.

Anritsu Corporation, Rohde & Schwarz, Yokogawa Electric Corporation, VIAVI Solutions Inc., Teledyne Technologies Incorporated, National Instruments, Atlantic Microwave Ltd, Chroma ATE Inc., EXFO Inc., B&K Precision Corporation, and others are the major companies in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us