Rocket Hybrid Propulsion Market Size, Share & Industry Analysis, By Component (Combustion Chamber, Igniter System, Nozzle/Pump, Propellant, and Others), By End Use (Commercial and Military & Government), By Application (Space Launch Vehicle and Spacecraft), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

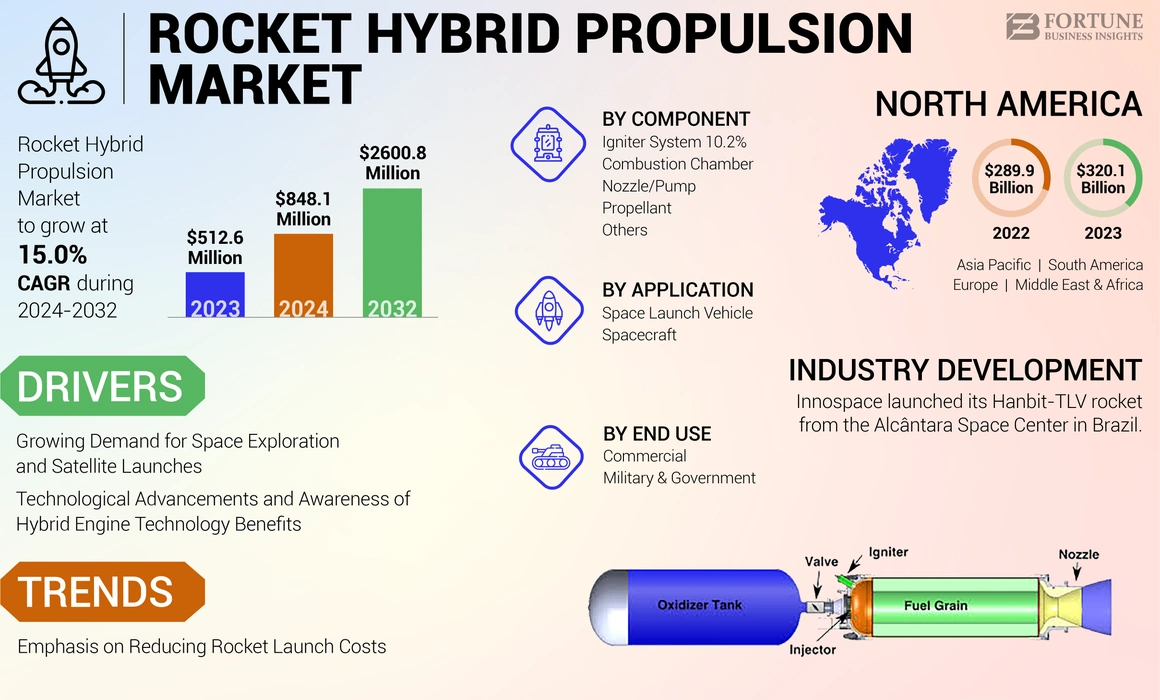

The global rocket hybrid propulsion market size was valued at USD 512.6 million in 2023 and is anticipated to expand to USD 2,600.8 million by 2032, with a projected CAGR of 15.0% during the forecast period, starting from USD 848.1 million in 2024. North America dominated the rocket hybrid propulsion market with a market share of 62.45% in 2023.

The propulsion system of a rocket that uses two or more sources of propulsion in a single design is called rocket hybrid propulsion. The propellants used are in two different states of matter, one solid and the other in liquid or gaseous form.

Hybrid rockets combine solid and liquid propellants for propulsion that features a combustion chamber with solid fuel, a pressure vessel for liquid oxidizer, and a valve to control their interaction. When ignited, the liquid oxidizer flows into the chamber, vaporizes, and reacts with the solid fuel, creating thrust. This setup typically uses liquid oxidizers for better performance and allows for high-energy solid fuels like Hydroxyl-Terminated Polybutadiene (HTPB), which can incorporate additives such as lithium or aluminum to enhance efficiency. Overall, hybrid rockets offer a safer, simpler, and more controllable alternative to traditional solid or liquid rocket systems.

The use of rocket hybrid propulsion systems in satellite launch vehicles has experienced substantial growth in recent years, driven by the increasing number of satellite launches worldwide. The rocket hybrid propulsion market share is expanding as more companies and space agencies recognize the benefits of hybrid systems. Satellite launch vehicle manufacturers across the globe have shown a growing preference for incorporating hybrid propulsion into their rockets. This trend is primarily due to the enhanced safety features and improved implementation of hybrid propulsion systems in satellite launch operations.

The advantages offered by hybrid propulsion, such as improved safety and simplified design compared to traditional propulsion systems, have made it an attractive choice for satellite launch vehicle manufacturers. As more companies and nations invest in satellite technology, the demand for reliable and safe launch vehicles has increased, further driving the adoption of hybrid propulsion systems in the rocket industry.

The COVID-19 pandemic significantly impacted the hybrid rocket propulsion market, primarily through delays in research and development, manufacturing, and testing processes. Numerous projects faced schedule slips due to workforce restrictions, facility closures, and supply chain disruptions. However, the market gained momentum due to the rise in rocket launches and the expansion of space exploration programs.

Rocket Hybrid Propulsion Market Overview & Key Metrics

Market Size & Forecast:

- 2024 Market Size: USD 848.1 million

- 2025 Market Size: USD 1,011.3 million

- 2032 Forecast Market Size: USD 2,600.8 million

- CAGR: 15.0% from 2025–2032

Market Share:

- North America dominated the rocket hybrid propulsion market with a 62.45% share in 2023, driven by strong R&D investments and the presence of key players such as Firehawk Aerospace, Sierra Space, and Virgin Galactic.

- By component, combustion chambers led the market, owing to demand for efficient thrust chambers like Sierra Space’s VORTEX® designs that support reusability and cost savings.

Key Country Highlights

- United States: Leads the North American market with growing reusable hybrid rocket programs and strong commercial launches, supported by collaborations between Raytheon, Firehawk Aerospace, and NASA initiatives.

- China: Boosting hybrid propulsion with initiatives like the Long March 6A hybrid rocket, part of its increasing satellite launch frequency and focus on cost-effective orbital access.

- India: ISRO’s hybrid motor testing using HTPB and LOX highlights India’s shift toward hybrid propulsion for future space missions and cost-efficient satellite launches.

- Germany: HyImpulse’s SR75 hybrid rocket launch reflects Europe’s growing commercial small-satellite launch segment and adoption of paraffin-liquid oxygen propulsion systems.

Rocket Hybrid Propulsion Market Trends

Trend of Reducing Rocket Launch Costs

Companies have started using reusable rockets, significantly lowering launch costs. Moreover, they are investing heavily in the development of ways to conduct frequent launches and reduce the launch costs and making space access more affordable. The aerospace industry is increasingly focusing on operational efficiencies and new technologies to further reduce costs. The rise in satellite launches, and a growing emphasis on sustainable space exploration practices drives the rocket hybrid propulsion market growth.

- North America witnessed rocket hybrid propulsion market growth from USD 189.9 Million in 2022 to USD 320.1 Million in 2023.

Innovations such as the development of hybrid engines are being explored to decrease the operational costs associated with launches. Hybrid propulsion systems utilize solid fuels, which are generally less expensive to manufacture and store compared to liquid fuels. The design of hybrid rockets typically requires less complex infrastructure than liquid propulsion systems. This simplicity can lead to lower operational costs as fewer specialized facilities and equipment are needed for launch operations. The development of reusable hybrid rockets, such as India's RHUMI-1, demonstrates the potential for cost savings through the repeated use of launch vehicles. Therefore, such a trend of cost reduction per launch over time to make space access more affordable is expected to drive the growth of the rocket hybrid propulsion market during the forecast period.

Download Free sample to learn more about this report.

Rocket Hybrid Propulsion Market Growth Factors

Rise in Demand for Satellite Launches and Space Exploration to Propel Industry Expansion

There is a surge in the number of satellite launches for various applications such as broadband satellite internet, earth observation, surveillance, and others. According to Space Foundation, the global launch activity reached record levels for the third consecutive year, with 223 launch attempts and 212 successful launches in 2023. The commercial launch activity surged by 50% compared to 2022. The U.S. experienced a 33% increase in launch attempts, while China, India, and Japan also reported heightened activity. A rise in the number of space explorations is driving the demand for innovative propulsion solutions as countries aim to conduct various space missions. Various players operating in the rocket space agencies are driving innovation in aerospace technology.

Moreover, payload deployment observed significant growth, with over 2,800 satellites launched into orbit, marking a 23% increase in 2023 over the previous year. An increase in the number of satellite launches and advancements in space exploration missions are major drivers for the hybrid rocket propulsion market. As more countries invest in space programs and commercial space applications expand, the demand for reliable and efficient launch vehicles is increasing. Hybrid rockets offer advantages such as improved safety, simplified design, and the ability to throttle thrust, making them an attractive option for satellite launch vehicles.

Technological Advancements and Benefits of Hybrid Engine Technology to Impel Market Growth

Rapid technological advancements in rocket hybrid propulsion systems are fueling market growth. Innovations such as the development of high-energy solid fuels, 3D-printed components, and reusable rocket technologies are improving performance and reducing costs. The ability of hybrid rockets to incorporate high-energy additives such as aluminum or lithium into the solid fuel enhances their specific impulse.

Hybrid rockets generally do not experience high-frequency combustion instabilities that often affect liquid rockets. This has been recorded as the solid fuel grain disrupts acoustic waves that would otherwise bounce back in an open combustion chamber of a liquid engine. Unlike solid rocket engines, hybrid rocket motors can be easily throttled and shut down at any point during flight. However, the range of throttling is somewhat limited compared to liquid propellant systems.

In a hybrid rocket engine, combustion is primarily constrained by the diffusion of the evaporated solid propellant through the boundary layer into the flame zone, where it mixes with the oxidizer stream in the combustion port and ignites. This process results in limited mixing and necessitates a relatively large surface area as the regression rate of the solid fuel is low. The limited mixing of the oxidizer and solid fuel reduces the likelihood of catastrophic combustion failures. As the solid fuel and liquid oxidizer are stored separately, the risk of accidental ignition is minimized. This characteristic enhances the overall safety of hybrid rockets compared to liquid rockets, which increases the demand for hybrid rocket propulsion systems.

RESTRAINING FACTORS

High Development and Manufacturing Costs May Hamper Industry Expansion

The initial expenses associated with the development and manufacturing of hybrid rocket propulsion systems are significant. This can cause a barrier for both new entrants and existing competitors, making it difficult to invest in cutting-edge technologies and bring products to market. These costs include extensive research and development, testing, and manufacturing of advanced technologies.

As a result, only well-funded companies or those with substantial backing can afford investments in hybrid propulsion, limiting competition and innovation within the industry. Moreover, high manufacturing costs can lead to increased prices for hybrid rocket propulsion systems, making them less attractive to potential customers compared to alternative propulsion technologies.

Rocket Hybrid Propulsion Market Segmentation Analysis

By Component Analysis

Combustion Chamber Segment Holds Largest Share Due to Rise in Development of Efficient and Safe Chambers

On the basis of component, the market is classified into combustion chamber, igniter system, nozzle/pump, propellant, and others.

The combustion chamber segment holds the largest share of the market as it plays a vital role in the performance and functionality of rocket hybrid propulsion systems. As players in the aerospace industry aim to enhance the efficiency of propulsion systems, the design and optimization of combustion chambers have become critical. Various companies are focusing on the improvement of combustion efficiency, such as optimizing flow dynamics and heat transfer within the chamber. For instance, Sierra Space Corporation provides advanced combustion chambers for hybrid engines called VORTEX® thrust chambers that enable significant cost savings and reusability. It helps the engine provide superior performance and reliability gains.

- The igniter system segment is expected to hold a 10.2% share in 2023.

The propellant segment is anticipated to be the fastest growing and is estimated to grow significantly over the forecast period. The propellant commonly is made of a combination of solid fuel and a liquid oxidizer, which are critical for the combustion process that generates thrust. Classical hybrid rockets commonly use polymeric fuels such as HTPB (Hydroxyl-Terminated Polybutadiene), HTPE (Hydroxyl-terminated polyether), and PE (Polyethylene). Paraffin wax is another fuel typically used in hybrid motors. The demand for efficient, safe, and effective propellant combinations is expected to propel the segment growth, which makes it a largest contributor to market revenue.

To know how our report can help streamline your business, Speak to Analyst

By End Use Analysis

Commercial Segment Dominates Due to Increase in Popularity of Hybrid Rockets for Satellite Launches

On the basis of end use, the market is classified into commercial and military & government.

The commercial segment dominates the market owing to a rise in the development, testing, and launch of rockets with hybrid engines. Companies operating in this segment are actively engaging in the development and launch of hybrid rockets through various initiatives and projects. Moreover, numerous companies are launching hybrid rockets for technology testing and demonstration purposes. For instance, in April 2024, Gilmour Space, an Australia-based rocket company, announced its plans to conduct the launch of its Eris orbital launch vehicle in 2024. Gilmour’s main hybrid rocket engine, Sirius, would power the first and second stages of the Eris rocket to orbit. Such developments encourage future commercial missions which drive the market growth.

The military & government segment is estimated to exhibit the fastest growth over the forecast period. Many countries are increasing their defense budgets, which includes investments in advanced aerospace technologies. This increase in funding may support the demand for rocket hybrid propulsion systems as they are considered as a viable option for military applications, including satellite launches and missile systems. In addition, there is a rise in the number of collaborations between military organizations and aerospace companies to launch hybrid propulsion technologies, which fuels the growth of the segment. For instance, the Brazilian Air Force, through the Department of Aerospace Science and Technology (DCTA) showed involvement in the development and oversight of the inertial navigation system (SISNAV) that will be tested aboard the HANBIT-TLV hybrid rocket. This collaboration allowed Brazil to enhance its aerospace technology capabilities while providing Innospace with a platform for testing its propulsion systems.

By Application Analysis

Space Launch Vehicle Holds Leading Position with Increase in Satellite Constellations Launches

On the basis of application, the market is classified into space launch vehicle and spacecraft.

The space launch vehicle segment holds the largest share of the market due to a rise in the number of launches to deploy satellites in space for various applications such as earth observation and others. As more countries and companies invest in space exploration and satellite technologies, the need for reliable and efficient launch systems is increasing. Global orbital launches have reached 223 in 2023, surpassing the 186 launches in 2022 by almost 20%. Moreover, new launch vehicles have started to become operational while various companies are starting to effectively scale up their launch frequency. To achieve this, satellite launch vehicle manufacturers are increasingly incorporating rocket hybrid propulsion systems which is expected to drive the growth of the segment.

In addition, the spacecraft segment is projected to exhibit the fastest growth during the forecast period as there is an increase in focus for use of space planes for space travel. As human spaceflight becomes more prevalent, there is a growing need for propulsion systems that prioritize safety and reliability. Hybrid rockets have advantages such as reduced risks associated with propellant handling and the ability to throttle and restart engines, making them attractive options for crewed spacecraft.

REGIONAL INSIGHTS

On the basis of region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Rocket Hybrid Propulsion Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

In 2023, North America emerged as the leading region with a valuation of USD 320.1 million, driven by various technological advancements in the design of propulsion systems for rockets. Key players such as Firehawk Aerospace Inc., Sierra Space Corporation, HyPrSpace, Virgin Galactic and others are expected to fuel market growth in the region. Market research indicates that the propulsion systems market is poised for significant growth due to increasing investments in space technologies in North America.

Collaborations between manufacturers and investments in hybrid rocket propulsion technologies in the region are further accelerating the adoption of these systems. For instance, in May 2022, Raytheon Missiles & Defense partnered with Firehawk Aerospace for the research and development of future hybrid rocket propulsion technologies. Such partnerships and investments demonstrate the growing acceptance and potential of hybrid rocket propulsion in the aerospace industry. As a result of these factors, manufacturers are increasingly incorporating rocket hybrid propulsion into their product offerings, recognizing its advantages in terms of safety, performance, and cost-effectiveness compared to traditional propulsion systems.

Moreover, there is a surge in the development of rocket hybrid propulsion systems which is significantly boosting the market in Asia Pacific. For instance, in March 2022, China successfully launched its first hybrid rocket, the Long March 6A. The Long March 6A is a medium-sized rocket, measuring 50 meters in height and weighing 530 tons. It features three liquid-fueled core boosters and four solid-fueled boosters, allowing it to leverage the strengths of both fuel types.

Various space agencies and companies are actively involved in the hybrid rocket engine market. The region is anticipated to become one of the major players in the propulsion market, driven by increasing investments in space programs and advancements in rocket technology.

For instance, in September 2022, the Indian Space Research Organisation (ISRO) successfully tested a 30 kN hybrid motor at the ISRO Propulsion Complex (IPRC) in Mahendragiri. This hybrid motor utilized Hydroxyl-terminated Polybutadiene (HTPB) as the solid fuel and Liquid Oxygen (LOX) as the oxidizer, marking a significant advancement in propulsion technology. Furthermore, the market for propulsion technologies for rockets is expected to grow significantly in the region driven by the demand for space launch services and advancements in rocket motor technologies.

European governments and space agencies are increasingly supporting the development of rocket hybrid propulsion technologies. Initiatives aimed at enhancing Europe’s capabilities in space exploration and satellite deployment are expected to drive investment and research in hybrid rocket systems. For instance, in May 2024, HyImpulse, a German manufacturer of commercial launch vehicles, successfully launched its first rocket, the SR75, from the Koonibba Test Range in Australia. This 12-meter-long, single-stage hybrid rocket is designed to transport small satellites weighing up to 250 kg to an altitude of approximately 250 km. The SR75 utilizes a novel propulsion system that combines solid paraffin (candle wax) and liquid oxygen as fuel.

Such launches encourage further investment and interest from both commercial and governmental entities resulting in increased research and development in hybrid propulsion systems.

In addition, countries in the Middle East & Africa are increasingly investing in their space programs to enhance national capabilities and foster technological advancements. According to the 2023 annual report by Space in Africa, several African countries have made significant investments in space programs, particularly in satellite projects. The report highlights that 15 African nations, including Angola, South Africa, Djibouti, and Kenya, have collectively invested over USD 4.71 billion in 58 satellite projects. Furthermore, the report projects that an additional 105 satellites are scheduled for launch by 2026. UAE and South Africa are making significant strides in space exploration and satellite launches, creating a favorable environment for rocket hybrid propulsion systems.

KEY INDUSTRY PLAYERS

Key Players Focus on Development of Technologically Advanced Products and Acquisition Strategies to Increase Market Share

Prominent market players are prioritizing the advancement of their product offerings. Players operating in the rocket propulsion sector include major aerospace companies and emerging startups, all competing to innovate and capture market share. The development of a diverse range of solutions and heightened investment in research and development are key factors contributing to the market dominance of these players. Major players in the rocket hybrid propulsion market include the China Aerospace Science and Technology Corporation and Environmental Aeroscience Corporation. Furthermore, within the industry, major players are embracing both organic and inorganic growth approaches, including mergers and acquisitions as well as the introduction of new products, to sustain their competitive edge.

List of Top Rocket Hybrid Propulsion Companies:

- Firehawk Aerospace Inc. (U.S.)

- Novart Space Technologies (Turkey)

- Sierra Space Corporation (U.S.)

- Virgin Galactic (U.S.)

- Pulsar Fusion (U.K.)

- HyPrSpace (France)

- Raytheon Missiles & Defense (U.S.)

- HyImpulse (Germany)

- INNOSPC (Germany)

- Gilmour Space Technologies (Australia)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: India launched its first reusable hybrid rocket ‘RHUMI- 1’, developed by the Tamil Nadu-based start-up Space Zone India with Martin Group, from Thiruvidandhai. RHUMI-1 rocket contains a hybrid motor that uses the advantages of both liquid and solid fuel propellant systems to improve efficiency and reduce operational costs.

- June 2024: Innospace, a South Korean startup focused on hybrid space rocket development, successfully launched its Hanbit-TLV rocket from the Alcântara Space Center in Brazil. The Hanbit-TLV is an 8.4-ton, single-stage rocket measuring 16.3 meters in height, designed to test the company’s hybrid rocket motor.

- May 2024: German company HyImpulse launched its SR75 rocket from Southern Launch’s Koonibba Test Range in South Australia. This launch is notable as it is the first from the newly established permanent facilities at the test range, developed in partnership with the Koonibba Community Aboriginal Corporation. The SR75 rocket, measuring 11.5 meters, was part of the "Light this Candle!" mission, aimed at testing HyImpulse's hybrid rocket motor.

- April 2024: Gilmour Space, an Australian rocket company, launched its Eris orbital launch vehicle in 2024, with preparations underway following the extensive testing of its components. The Eris rocket features a three-stage design, with the first and second stages powered by Gilmour’s Sirius hybrid rocket engines. This hybrid propulsion system is designed to enhance the rocket's performance while reducing operational costs.

- July 2022: Florida-based Vaya Space entered into a contract with NASA to demonstrate its hybrid rocket engines and aerospace components at the Stennis Space Center and Kennedy Space Center. The focus of the contract is on hybrid rocket engines capable of producing over 22,000 pounds of thrust.

- May 2022: Raytheon Missiles & Defense, subsidiary of Raytheon Technologies Corporation invested in Firehawk Aerospace to collaborate on the development of hybrid rocket propulsion technologies. Firehawk Aerospace specializes in creating low-cost, high-performance hybrid rocket engines that combine solid and liquid propellants. This hybrid design enhances safety by reducing the risk of accidental detonation and lowers costs compared to traditional engines.

REPORT COVERAGE

The report provides a detailed analysis of the industry and focuses on important aspects such as key players, component, platform, end-user, and applications depending on various regions. Moreover, the research report offers deep insights into the commercial satellite market trends, competitive landscape, market competition, product pricing, and market status and highlights key industry developments. Furthermore, it encompasses several direct and indirect factors that have contributed to the sizing of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 15.0% from 2024 to 2032 |

| Segmentation |

By Component

|

|

By End Use

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 512.6 million in 2023 and is projected to reach USD 2,600.8 million by 2032.

The market is anticipated to grow at a CAGR of 15.0% over the forecast period (2024-2032).

By component, the combustion chamber segment leads the market due to increased focus of industry players on the development of efficient chambers.

Firehawk Aerospace Inc. is one of the leading players in the market.

North America dominated the market in terms of share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us