Rolling Dies Market Size, Share & COVID-19 Impact Analysis, By Product Type (Rolling Flat Dies, Thread Rolling Cylindrical Dies, Rotary Type Thread Rolling Dies, Rack Type Rolling Dies, Trimming Dies, Round Dies, Others (Drill Point Dies)), By End-User (Automotive, White Goods, Medical, Cutlery, Consumer Electronics, General Engineering, Others (Marine)) and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

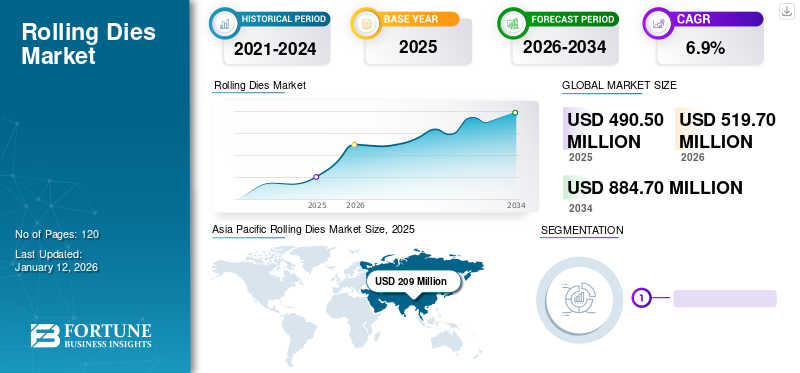

The global rolling dies market size was valued at USD 490.5 million in 2025. The market is projected to grow from USD 519.7 million in 2026 to USD 884.7 million by 2034, exhibiting a CAGR of 6.9% during the forecast period. The Asia Pacific dominated global market with a share of 42.6% in 2025. The rolling dies market in the U.S. is projected to grow significantly, reaching an estimated value of USD 98.1 Mn by 2032, driven by the technological advancements and adoption in metal industry.

Rolling dies are thread-forming dies frequently utilized during the assembly of cameras and watches. They find common use in auto lathes for creating small screws. Threads are formed by material deformation using three thread rollers installed with a 1/3 pitch difference between each roller. These dies serve as attachments in rod threading machines and are designed to be attachments for thread-rolling machines. Utilizing rolling-dies, external threads or splines can be cold-formed onto rotating workpieces by pressing a hardened die into them.

Global Rolling Dies Market Overview

Market Size:

- 2025 Value: USD 490.5 million

- 2026 Value: USD 519.7 million

- 2034 Forecast Value: USD 884.7 million

- CAGR (2025–2032): 6.9%

Market Share:

- Regional Leader: Asia Pacific held approximately 42.6% market share in 2025

- Fastest-Growing Region: Asia Pacific, driven by automotive, electronics, and industrial expansion

- Top End-User Segment: Automotive industry is the largest consumer, with strong demand in general engineering and consumer electronics

Industry Trends:

- Precision & Durability: High-precision, long-life dies are in demand for automotive and electronics manufacturing

- Customization: Rising need for personalized and complex metal components in various industries

- EV & Lightweighting: Growth in electric vehicles and lightweight metal parts boosts demand for specialized rolling dies

- Advanced Coatings: Use of PVD, DLC, and other coatings to extend die life and reduce maintenance

Driving Factors:

- Technological Advancements: CNC machining, CAD/CAM, and automation improve die quality and production efficiency

- Metallurgy Innovation: New alloys and surface treatments enhance performance and lifespan

- Industrial Growth: Expansion in automotive, white goods, medical, and consumer electronics sectors

- Productivity & Cost Efficiency: Automation and mass production drive adoption in high-volume manufacturing

Furthermore, a wide range of industries, including automotive, consumer electronics, white goods, cutlery, and medical, frequently employ rolling-dies. Consequently, the market may experience significant growth as these components are often used in the production of various metal components. The increasing desire among consumers for personalized products has heightened the demand for personalized metal components. Rolling-dies enable the production of these customized products with intricate shapes and sizes. The rising demand for commercial vehicles is another factor boosting the market's expansion, as these dies play a crucial role in the production of these vehicles.

COVID-19 IMPACT

Supply Chain Disruptions Impacted Market Growth during Pandemic

The global market for rolling-dies experienced a slight decline during the COVID-19 pandemic. However, the market's growth was ultimately restored following a reduction in COVID-19 cases and the easing of lockdown restrictions. During that time, rolling-dies were a critical component used in the manufacturing of various parts of heavy machinery across numerous industrial verticals.

Industrial rolling-dies find application in the automotive, consumer electronics, and manufacturing sectors. The market relies on a global supply chain for raw materials, components, and equipment. The pandemic caused disruptions in transportation and logistics, leading to delays in the delivery of materials and components. Consequently, this resulted in production slowdowns and difficulties in meeting customer demand.

LATEST TRENDS

High Precision and Durability of Rolling Dies are Notable Market Trends

High precision and durability of rolling-dies are already major trends in the global automotive market, and it is likely that this trend has continued or even intensified in recent years. The automotive industry places a strong emphasis on the quality and efficiency of manufacturing processes. High precision ensures that parts are produced with tight tolerances and minimal defects. This level of precision is crucial for achieving optimal performance and safety in vehicles.

With advancements in technology, automotive manufacturers have access to more sophisticated machinery and manufacturing processes. These technologies enable the production of rolling-dies with higher precision and durability, allowing them to handle larger production volumes and maintain consistent quality. The increasing adoption of Electric Vehicles (EVs) has driven the demand for specialized rolling-dies to produce unique components for electric drivetrains.

Download Free sample to learn more about this report.

DRIVING FACTORS

Technological Advancements in Metals Industry to Drive Market Growth

Technological advancements in various metals, such as iron, steel, copper, and aluminum, have significantly contributed to the growth of the market. Innovations in metallurgy have led to the development of high-performance alloys and materials that are more durable, wear-resistant, and can withstand higher temperatures. These advancements have allowed rolling-dies to be manufactured with superior materials, enhancing their longevity and performance. The use of automation in die manufacturing enables the production of rolling-dies with greater precision and accuracy. Computer Numerical Control (CNC) machining, 3D printing, and advanced tooling techniques have optimized the design and fabrication of these dies, resulting in higher-quality end products. Advanced technologies have made it easier to create custom-designed rolling-dies to meet specific industry requirements.

With Computer-Aided Design (CAD) and simulation software, manufacturers can rapidly prototype and refine rolling-dies, catering to diverse customer needs and applications. Furthermore, the integration of automation and robotics has significantly boosted productivity in rolling die production. Automated processes ensure consistent quality, reduce lead times, and enable mass production, meeting the growing demand from various industries. Moreover, technological advancements in surface coatings and treatments have improved the wear resistance and durability of rolling-dies. Techniques such as thermal spraying, PVD (Physical Vapor Deposition), and DLC (Diamond-Like Carbon) coatings have extended the lifespan of these forms of dies, minimizing their downtime and maintenance costs.

RESTRAINING FACTORS

Frequently Changing Cost of Raw Material Hinder Market Growth

This market, involved in the manufacturing of metal products through rolling processes, can be significantly affected by frequent changes in the cost of metals and raw materials. These dies are essential tools used in the metal rolling process, where metal sheets or bars are passed through a set of rollers to reduce their thickness and shape them into the desired form. The cost of production for these dies is directly influenced by the cost of the metals and raw materials used in their construction. When these costs fluctuate frequently, it becomes challenging for manufacturers to maintain stable pricing for rolling-dies, impacting their profitability and competitiveness.

The volatile cost of metals and raw materials can lead to erratic pricing for finished metal products. This can create uncertainty for businesses and consumers, leading to fluctuations in demand for rolling-dies. Manufacturers may hesitate to invest in expensive types of dies during periods of high material costs, potentially slowing down the growth of the market. Frequent changes in material costs make it difficult for manufacturers to plan their production and manage their inventory effectively. They may face challenges in estimating the correct quantity of rolling-dies to produce, which can result in either excess inventory or shortages during periods of high demand, thereby restraining the rolling dies market growth.

SEGMENTATION

By Product Type Analysis

Rolling Flat Dies Gains Momentum, Fueled by its Pioneering Role in Cold-Forming Thread Processes

By product type, the market is classified into rolling flat dies, thread rolling cylindrical dies, rotary type thread rolling dies, rack type rolling dies, trimming dies, round dies, and others (drill point dies). The rolling flat dies segment is experiencing the highest CAGR as it is the oldest process of cold-forming threads. During this process, the workpiece is inserted using a pusher blade between the two flat dies, where cold forming takes place. The thread is then created in one working stroke. Since these flat dies utilize one stationary and one moving die to cold-form the external threads, these factors further contribute to the dominance of rolling flat dies.The thread rolling cylindrical dies segment will account for 24.05% market share in 2026.

The rotary type thread rolling dies segment is witnessing significant growth. This growth is attributed to their accurate ground thread forms, with these dies typically available in two-die or three-die configurations. They usually operate through a combination of radial movement.

The rack type rolling dies segment may exhibit considerable growth during the forecast period as they are primarily used for the production of automotive parts. These dies are applied for fast, large volume production of parts with involute splines.

By End-User Analysis

Automotive Sector Commands Leadership, Leveraging Roll Forming for Weight and Cost Efficiency

Based on end-user, the market is categorized into automotive, white goods, medical, cutlery, consumer electronics, general engineering, and others (marine). The automotive segment is anticipated to dominate the rolling dies market with a share of 25.96% of 2026. To meet legal requirements related to CO2 pollution and fuel consumption, the automotive industry has placed a strong emphasis on weight reduction. Roll forming technology can assist in weight and cost reduction simultaneously. Parts that were previously stamped are now produced through roll forming, making it more significant in the automotive industry.

The general engineering segment is expected to expand significantly. The segment’s growth is attributed to the growing use of the roll-forging process, an effective way to create long or thin metal parts. The design of the rolling die is a complex issue due to the intricate relative motions of the dies and forging pieces.

The consumer electronics market is predicted to exhibit substantial growth during the forecast period. The need for personalized products has increased the demand for personalized metal components, and rolling-dies are essential in producing these complexly shaped and sized personalized products.

Additionally, white goods, medical devices, cutlery, and other industries (marine) frequently utilize rolling-dies.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The report's scope comprises five major regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific holds the largest market share.Asia pacific dominated the market with a valuation of USD 209 billion in 2025 and USD 222.7 billion in 2026. This growth is driven by the expansion of the automotive, aerospace, and consumer electronics sectors. Firstly, the flourishing automotive industry in India, Japan, and South Korea has acted as a major catalyst in the demand for rolling-dies. Additionally, the rising production of automobiles, fueled by increasing consumer purchasing power and urbanization, has led to a surge in the demand for metal components. These dies play a crucial role in shaping and forming components such as chassis, engine parts, and body panels, thereby driving the growth of the regional market.

Asia Pacific Rolling Dies Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe

Europe accounted for the second-largest market revenue share in 2024 owing to several key factors. The steady rise in industrialization across the region has led to an increased demand for metalworking and machining processes. Rolling dies play a crucial role in shaping and forming metal components used in various industries, such as automotive, aerospace, and construction, among others.

North America

North America is also experiencing significant growth due to investments made in numerous industries, including automotive, consumer electronics, white goods, cutlery, and medicine. This is anticipated to fuel market growth. The recent growth trend of rolling-dies has generated high consumer demand in North America, becoming the main growth-promoting factors. These variables are expected to drive growth in the North American region during the forecast period.

Middle East & Africa

The Middle East & Africa market has seen substantial growth, primarily attributed to the expansion of the automotive, oil & gas, and marine sectors. The oil & gas sector has emerged as a major driving force in this region, leveraging its abundant reserves to significantly impact the global energy market.

South America

South America is expected to witness considerable growth during the forecast period. This is mainly due to the significant development observed in various sectors in the region, including marine, general engineering, and agriculture. As these industries expand, there is a growing need for metal components, which will increase the demand for these types of dies in the region.

KEY INDUSTRY PLAYERS

Major Companies to Access Untapped Customer Base Using Cost-Effective Strategies

Prominent players in the market have held a significant market share for quite some time. With a large number of domestic and international players, the market is highly fragmented. OSG Corporation leads the market, followed by other key players that include Union Tool Co., Fastener Industries Inc., Brinkman International Group, Inc., and PROFIROLL TECHNOLOGIES GMBH, accounting for almost one-third of the market share.

List of Key Companies Profiled:

- OSG Corporation (Japan)

- CJWinter (Brinkman International Group, Inc). (U.S.)

- Union Tool Co. (Japan)

- Fastener Industries Inc. (U.S.)

- PROFIROLL TECHNOLOGIES GMBH (Germany)

- Mayes and Warwick Limited (U.K.)

- Tesker Manufacturing Corporation (U.S.)

- Kinefac Corporation (U.S.)

- Hieber & Maier GmbH (Germany)

- Heroslam (Spain)

KEY INDUSTRY DEVELOPMENTS:

- January 2021 – Heroslam SAL made an investment plan of USD 3.1 million to boost its production capacity and meet the increasing demand for thread rolling solutions across several countries. The expansion of their manufacturing facilities was aimed at meeting the growing product demand in several industries, such as automotive, aerospace, and energy.

- December 2020 - YAMAWA Taps Co. Ltd. & YAMAWA Precision Co. Ltd (Aizu Plant & Fukushima Plant) were merged with YAMAWA Manufacturing Co., Ltd. This collaboration was intended to facilitate further rationalization of production and provide a better and more balanced supply to the global market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.9% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product Type, End-User, and Region |

|

Segmentation |

By Product Type

By End-User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 884.7 million by 2034.

In 2025, the market was valued at USD 490.5 million.

The market is projected to record a CAGR of 6.9% during the forecast period.

By product type, the rolling flat dies segment is expected to lead the market.

Technological advancement in metals industry is driving the growth of the market.

OSG Corporation, Brinkman International Group, Inc., Union Tool Co., Fastener Industries Inc., PROFIROLL TECHNOLOGIES GMBH, Mayes and Warwick Limited, Tesker Manufacturing Corporation, Kinefac Corporation, Hieber & Maier GmbH, Heroslam are the top players in the market.

Asia Pacific is expected to hold the largest market share.

By end-user, the automotive segment is expected to register a remarkable CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us