Sciatica Treatment Market Size, Share & Industry Analysis, By Type (Acute and Chronic), By Drug Class (Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Corticosteroids, Antidepressants, and Others), By Distribution Channel (Hospital Pharmacies and Retail & Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

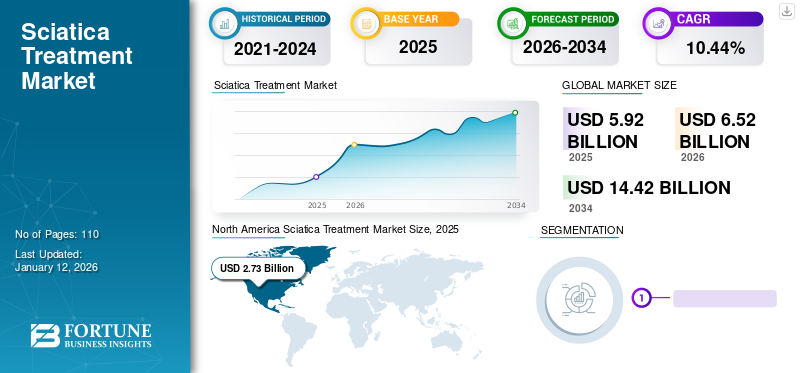

The global sciatica treatment market size was valued at USD 5.92 billion in 2025 and is projected to grow from USD 6.52 billion in 2026 to USD 14.42 billion by 2034, exhibiting a CAGR of 10.44% during the forecast period. North America dominated the sciatica treatment market with a market share of 46.1% in 2025.

Sciatica (lumbar radicular pain) refers to pain, weakness, numbness, or tingling in the lower back radiating toward the legs caused by injury to or pressure on the sciatic nerve. The prevalence of sciatica is increasing globally owing to the rising incidence of herniated disks or overgrowth of spinal bone among the population. The increasing adoption of over-the-counter drugs, such as corticosteroids, antidepressants, and opioids for the treatment of sciatica pain, propels the growth of the market.

- According to an article published by Hindawi Limited in 2022, the annual incidence of an episode of Sciatica ranges from 1.0% to 5.0% in the global population. The lifetime incidence varies from 13% to 40%.

Similarly, the awareness of chronic sciatica treatment among the general population, such as epidural steroid injections and analgesics, is increasing across the globe. Also, major market players are now emphasizing clinical trials for the introduction of sciatica treatment drugs in the market. These factors will augment the treatment adoption among patients, further driving the market growth.

Sciatica Treatment Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 5.92 billion

- 2026 Market Size: USD 6.52 billion

- 2034 Forecast Market Size: USD 14.42 billion

- CAGR: 10.44% from 2026–2034

Market Share:

- North America dominated the global sciatica treatment market with a 46.1% share in 2025, driven by rising awareness of chronic back pain, increased prescription rates for NSAIDs and opioids, and the presence of major pharmaceutical players focused on developing advanced pain management therapies.

- By drug class, Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) held the largest market share in 2026, supported by widespread availability, high patient preference for over-the-counter pain relief, and frequent prescriptions by healthcare professionals.

Key Country Highlights:

- Japan: Rising elderly population and growing cases of spinal stenosis and lumbar radiculopathy are contributing to increased demand for non-opioid sciatica treatments. Government healthcare reforms emphasizing pain management guidelines further support market growth.

- United States: High volume of opioid prescriptions for chronic low back pain, increased awareness campaigns, and large-scale clinical trials (e.g., SP-102 by Scilex Holding) are enhancing the treatment landscape. Government initiatives to curb opioid misuse are also fostering the development of safer alternatives.

- China: Increased incidence of disc herniation and aging-related nerve compression, coupled with greater adoption of online pharmacies and hospital infrastructure expansion, is fueling market growth. Rising participation in clinical research and awareness of minimally invasive therapies is also notable.

- Europe: Market growth is supported by a high prevalence of sciatica (13–40%) and growing investment in pain management programs. The U.K. and Germany are actively promoting non-opioid pain treatments and implementing clinical care standards for lower back pain.

COVID-19 IMPACT

Dearth in Patient Hospital Visits Amid COVID-19 Pandemic Hampered Market Growth

The COVID-19 pandemic outbreak hampered the growth of the market in 2020. The global lockdowns and trade restrictions imposed by government authorities across the globe led to the partial or complete lockdown of pharmaceutical production facilities. This led to a decline in manufacturing and sales of over-the-counter and prescription drugs among the population. Moreover, the number of sciatica treatment prescriptions decreased owing to limited patient visits across healthcare settings for COVID-19-related diseases.

- According to Abbott's annual report estimates in 2020, the pharmaceuticals segment witnessed a decline in revenue of 4.1% in 2020 as compared to 2019.

However, after the COVID-19 pandemic, the volume of patients seeking treatment for chronic diseases increased across hospitals and medical clinics due to the relaxation of the global restrictions in 2021. The increase in patient visits to health services led to a rise in demand for sciatica treatment across the globe. Moreover, key players witnessed growth in sales of prescription drugs among patients.

- According to statistics published by the Office of Health Strategy in November 2022, the total number of patients visiting emergency departments in Connecticut hospitals increased from 1.28 million in 2020 to 1.30 million in 2021. As per the similar source, about 25% of the patient’s health visits were due to significant conditions, such as urinary tract infection, chest pain, low back pain, and dizziness.

Sciatica Treatment Market Trends

Awareness Programs by Regional and National Authorities

The lifetime prevalence of sciatica among the general population is high owing to increased incidence of pathological conditions, such as nerve compression, disc herniation, disc prolapse, lower back muscle spasms, spinal stenosis, and loss of lumbar lordosis. Thus, increased prevalence has led to high awareness among the general population regarding its clinical symptoms and associated risk factors, catering to its treatment adoption.

- According to a research study published by Majdi Hashem et al. in January 2022, out of 3,764 respondents involved in this study, more than half of the study participants (68%) were aware of sciatica symptoms, such as pain, numbness, tingling sensations extending from the lower back to the toes, and weakness of leg and foot muscles and 65.5% were aware that age, nature of work, and weight are risk factors for sciatica.

Moreover, the rise in the number of awareness programs by health institutions and healthcare professionals for managing clinical conditions associated with chronic lower back pain has enhanced the patients' knowledge of sciatica treatment. Similarly, the increase in the presence of disease treatment modalities, such as epidural steroid injections and non-opioid medications across healthcare settings, has catered to the global sciatica treatment market growth.

- According to data published by NCBI in August 2023, the NIH Back Pain Consortium (BACPAC) Research Program, a network of 14 funded entities, was launched as a part of the HEAL initiative to help address limitations surrounding the diagnosis and treatment of chronic lower back pain in the U.S.

Download Free sample to learn more about this report.

Sciatica Treatment Market Growth Factors

Growing Number of Strategic Initiatives by Key Players to Boost Market Development

The prevalence of lower back pain associated with sciatica is rising across the globe. The over-the-counter drugs, such as NSAIDs and pain relievers, provide short-term relief for patients suffering from sciatica. Moreover, the treatment market lacks FDA-approved treatments specifically for patients suffering from long-lasting sciatica pain.

Thus, several emerging players are now focusing on the research and production of new medications with prolonged efficacy and extended-release formulations for treating chronic forms of sciatica. Thus, the rising number of research trials for developing advanced medications will accelerate market growth.

- For instance, in March 2022, Scilex Holding Company announced the final results for SP-102 (SEMDEXA) efficacy and safety from its pivotal phase 3 clinical trial program for sciatica pain management.

Moreover, the rising prevalence of lumbar radiculopathy demands safe treatment interventions with lasting effects to limit the healthcare and socioeconomic burden among the population. Therefore, the growing presence of new sciatica treatment-specific medications will boost the adoption of this treatment among patients, further propelling the market growth.

RESTRAINING FACTORS

Side Effects Associated with Chronic Sciatica Treatment to Restrict Market Growth

Chronic back and leg pain is a leading cause of disability and results in a significant health care expenditure among the population. Moreover, chronic pain associated with several disorders, such as sciatica, increases healthcare costs, length of hospital stay, morbidity, and mortality in high-income and low-income countries globally.

- According to statistics published by Cureus in November 2022, sciatica treatment accounts for significant medical expenses annually, which are USD 617.2 million in direct costs and almost USD 4.93 billion in indirect costs in the U.K.

- According to an article published by NCBI in 2023, on average, a total cost of USD 2.2 billion per population in a country and USD 1,226.25 per patient were reported annually due to lower back pain.

Also, treatment modalities for managing sciatica, such as corticosteroids, epidural steroid injections (ESI), or spine surgery, have limited long-term benefits and may cause significant morbidity. Moreover, general side effects and potential complications associated with sciatica treatment, such as meningitis and epidural abscess, among others, limit its adoption by healthcare professionals, further restraining market growth.

- According to data published by the Korean Society of Anesthesiologists in 2021, Kang et al. surveyed complications of 825 patients treated with dexamethasone epidural drugs. About 4.8% of the patients showed systemic side effects of corticosteroids, including facial flushing (1.5%), urticaria (0.8%), and insomnia (0.8%).

Sciatica Treatment Market Segmentation Analysis

By Type Analysis

Chronic Segment Leads Market with High Adoption of Steroid Medications

Based on the type, the global market is segmented into acute and chronic.

The chronic segment held a dominant share of the market with a share of 71.47% in 2026. The dominant share was due to the rise in the prevalence of chronic sciatica among the general population and the growing adoption of epidural injections and opioids to treat the disorder across healthcare settings.

- According to a research study published by SpineThera, Inc., in September 2023, approximately 3.5 million lumbar transforaminal epidural injections were performed annually in the U.S. to manage sciatica pain.

The acute segment is expected to grow substantially during the forecast period. The segment's growth is attributed to the high incidence of lumbar disc herniation and nerve compression among the population and rising awareness of sciatica disease globally.

To know how our report can help streamline your business, Speak to Analyst

By Drug Class Analysis

Nonsteroidal Anti-Inflammatory Drugs Segment Dominates Owing to Rise in Number of NSAIDs Prescriptions for Sciatica Treatment

Based on drug class, the market is segmented into Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), corticosteroids, antidepressants, and others.

The Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) segment held the highest share of the global market, accounting for 44.17% in 2026. The higher share was due to the rising prevalence of lower back pain among the global population and the rising consumption of pain relievers to manage pain-associated acute sciatica among the global population. Moreover, rising prescriptions of NSAID medications by healthcare professionals across hospitals and clinics further augment the segment growth.

- As per statistics published by Harvard Health Publishing in October 2020, about 15.0% of the U.S. population takes an NSAID regularly, and more than 30.0 billion doses are taken each year.

The corticosteroids segment is anticipated to grow at the highest CAGR from 2025 to 2032. The growing demand for epidural steroid injections for treating chronic back pain across healthcare settings and the rising emphasis of key players on the introduction of injectable steroids for pain management is expected to propel segment growth during the forecast period.

By Distribution Channel Analysis

Retail & Online Pharmacies Segment Growth Led by High Out-of-Pocket Expenditure on Prescribed Drugs

On the basis of distribution channel, the market is segmented into hospital pharmacies and retail & online pharmacies.

The retail & online pharmacies segment dominated with the highest share 80.52% in 2026. The growing number of retail and e-commerce channels globally and increasing out-of-pocket spending for retail prescription drugs among patients drive the segment growth. Moreover, the easy availability and cost-effective presence of a range of medications for pain management across retail channels boost the segment's growth.

- According to data published by PETERSON-KFF Health System Tracker in September 2023, retail prescription drug spending per capita in the U.S. increased from USD 101 in 1960 to USD 1,147 in 2021.

The hospital pharmacies segment is expected to grow at a significant CAGR from 2025 to 2032. The segment growth is attributed to a rising number of patient admissions for treatment across healthcare organizations, further propelling the demand for medications.

REGIONAL INSIGHTS

The global market scope is classified across regions, such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Sciatica Treatment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global sciatica treatment market with a size of USD 2.73 billion in 2025. The growth is due to the increasing awareness of sciatica management across healthcare settings and the demand for prescription drugs among the population. Moreover, the increasing number of drug prescriptions by healthcare professionals further caters to the region’s sciatica treatment market growth. The U.S. market is estimated to reach USD 2.93 billion by 2026.

- According to data published by Sorrento Therapeutics, Inc., in December 2021, annually, more than 40.0% of U.S. opioid prescriptions are for the treatment of Chronic Low Back Pain (CLBP).

Europe

Europe is anticipated to expand at a moderate CAGR during the forecast timeframe. The growth is due to the increasing prevalence of sciatica among the European population and the increasing number of patients visiting healthcare settings for pain management associated with sciatica. The UK market is estimated to reach USD 0.27 billion by 2026, while the Germany market is estimated to reach USD 0.41 billion by 2026.

- According to data published by the National Institute for Health and Care Excellence (NICE) in 2020, the lifetime prevalence of Sciatica among the U.K. population ranges from 13-40%.

Asia Pacific

Asia Pacific is anticipated to witness robust growth during the forecast period. The rising incidence of lower back pain among the population and increasing government initiatives for early clinical management of the population suffering from acute episodes of lower pain are anticipated to propel the regional market growth in the coming years. The Japan market is estimated to reach USD 0.28 billion by 2026, the China market is estimated to reach USD 0.24 billion by 2026, and the India market is estimated to reach USD 0.17 billion by 2026.

- For instance, in September 2022, the Australian Commission on Safety and Quality in Health Care released its ‘Low Back Pain Clinical Care Standard’. The new clinical care standard provides evidence-based guidance to help clinicians deliver the best care for the population suffering from low back pain.

Latin America and the Middle East & Africa regions are expected to register a substantial CAGR during the forecast period due to increasing demand for pain management drugs among patients and the rising emphasis of key players on expanding their distribution channels.

List of Key Companies in Sciatica Treatment Market

Expansion of Product Portfolio by Key Players Leads to their Dominance

The global market in 2024 is consolidated with significant players from the pharmaceutical industry, such as Abbott, Pfizer Inc., and Bayer AG. The growth of key companies in the global market is attributed to the high emphasis on launching advanced medications for pain management and a strong focus on expanding their product offerings across developing regions.

- In May 2022, Bayer AG announced the expansion of its over-the-counter products specific to Indian consumer needs from its global portfolio and launched new line extensions of its pain management brands, such as Saridon and Supradyn, in India.

Similarly, other players, such as Sorrento Therapeutics, Sorrento Therapeutics, and ESTEVE, are emphasizing inorganic growth strategies, such as collaborations and acquisitions with existing players and clinical research studies for the development of new drugs, which is expected to boost their global sciatica treatment market share.

LIST OF KEY COMPANIES PROFILED:

- Pfizer Inc. (U.S.)

- Abbott (U.S.)

- Bayer AG (U.S.)

- Endo International plc. (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- GSK plc. (U.K.)

- Novartis AG (Switzerland)

- Bristol Myers Squibb (U.S.)

- Amneal Pharmaceuticals LLC. (U.S.)

- Sorrento Therapeutics (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2023: Sollis Therapeutics, Inc. announced the phase 3 clinical trial study to evaluate the efficacy and safety of clonidine micropellets for treating pain associated with lumbosacral radiculopathy in adults.

- November 2022: Cassowary Pharmaceuticals Pty Ltd, a spin-off company of the University of Queensland, announced the development of a new range of hyper-targeted medications to treat debilitating and chronic pain conditions associated with cancer, Sciatica, post-herpetic neuralgia, and osteoarthritis, among others.

- August 2022: Olinvyk (oliceridine), manufactured by Trevena, Inc., an opioid agonist, was approved by the Food and Drug Administration (FDA) for the management of moderate to severe acute pain in adults.

- July 2022: Vertex Pharmaceuticals Incorporated announced plans to advance the selective NaV1.8 inhibitor VX-548 for treating neuropathic pain into phase 3 clinical trials in the fourth quarter of 2022.

- May 2022: Researchers at the Oklahoma State University Center for Health Sciences and the University of Arizona Health Sciences created an innovative partnership to combat the opioid crisis and to discover and develop modern therapeutics for the treatment of chronic pain, with help from decades of chemistry research conducted by Purdue Pharma.

REPORT COVERAGE

This market research report provides a detailed competitive landscape and market dynamics. It focuses on crucial aspects such as the global prevalence of sciatica disease, disease type, and drugs in the market. Furthermore, the report provides information on key industry developments and detailed market segmentation by disease type and distribution channel. In addition, the report includes insights related to the regional market and the impact of COVID-19 on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.44% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Drug Class

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 6.52 billion in 2026 to USD 14.42 billion by 2034.

In 2025, the North America market size stood at USD 2.73 billion.

The market will exhibit steady growth at a CAGR of 10.44% during the forecast period (2026-2034).

The rising prevalence of sciatica globally and the rising treatment demand among the population are the key drivers of the market.

Abbott, Bayer AG, and Pfizer Inc. are the market top players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us