Seafood Processing Equipment Market Size, Share & Industry Analysis, By Equipment (Gut and Scale Equipment, Filleting Equipment, Cutting Equipment, Skinning Equipment, Smoker and Drying Equipment, Packaging Equipment, and Others), By Mode of Operation (Automatic and Manual and Semi-automatic), By Seafood Type (Fish, Crustaceans, Mollusks, Cephalopods, and Others), and Regional Forecast, 2026-2034

SEAFOOD PROCESSING EQUIPMENT MARKET OVERVIEW AND FUTURE OUTLOOK

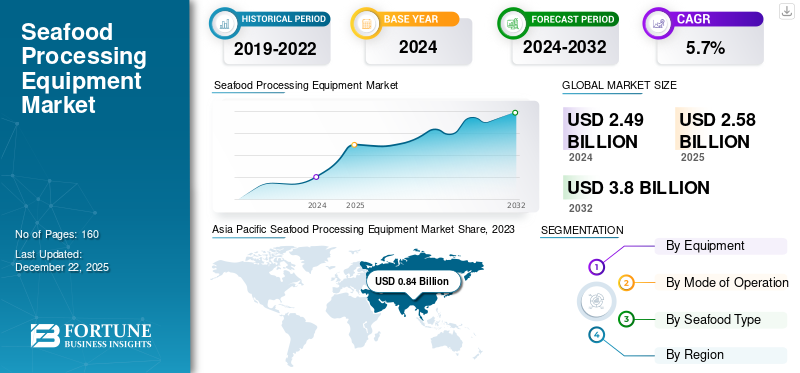

The global seafood processing equipment market size was valued at USD 2.58 billion in 2025. The market is projected to grow from USD 2.69 billion in 2026 to USD 4.44 billion by 2034, exhibiting a CAGR of 6.50% during the forecast period. Asia Pacific dominated global market with a share of 35.20% in 2025.

Seafood processing equipment is used to handle and process seafood products such as fish, crustaceans, mollusks, and cephalopods. These machines are designed for performing various stages of seafood processing such as cleaning, gutting, scaling, filleting, skinning, drying, canning, and packaging. This equipment is very important in maintaining food safety standards and improving the speed and accuracy of operations.

The rising import and export of seafood, including fish, mollusks, and cephalopods, among others, across the globe has raised the demand for these machines in various applications in the seafood industry, fueling market growth. For instance, according to Invest India, seafood exports registered a 30% growth from 2020 to 2023. Such a huge growth in the export of seafood across the globe boosts the demand for such equipment.

Download Free sample to learn more about this report.

Global Seafood Processing Equipment Market Overview

Market Size:

- 2025 Value: USD 2.58 billion

- 2026 Value: USD 2.69 billion

- 2034 Forecast Value: USD 4.44 billion

- CAGR: 6.50%

Market Share:

- Regional Leader: Asia Pacific dominated the global market with a major shares, driven by strong aquaculture production and seafood consumption

- Product-Type Leader: Filleting equipment held the dominant share, supported by demand for ready-to-eat and filleted seafood products

- Seafood-Type Leader: Fish was the largest processed category of shipments, followed by crustaceans and mollusks

Industry Trends:

- Widespread use of filleting machines due to rising popularity of value-added seafood

- Gutting & scaling equipment experiencing accelerated growth driven by automation and aquaculture expansion

- Adoption of automated filleting lines of systems deployed and packaging automation for efficiency

- Emphasis on stainless-steel, hygienic design compliant with industry standards dominating new equipment models

Driving Factors:

- Expanding aquaculture, seafood retail, and cold-chain infrastructure supporting equipment uptake—especially filleting and packaging systems

- Efficiency gains from automation—with automated lines reducing waste, increasing capacity, and improving sanitation

- Investment in hygenic design standards and certifications driving demand for advanced processing machinery

- Regional demand surges, particularly in Asia Pacific, due to infrastructural growth in cold storage and processing facilities

The seafood processing equipment market is driven by rising global demand for seafood such as fish, crustaceans, and mollusks from individuals, driven by its nutritional value and health benefits. According to the SeafoodSource report, the global trade of seafood consumption is projected to increase by 5% from 2024 to 2032. Additionally, rising health awareness among the population about the consumption of seafood and related food creates the demand for processing machines, contributing to seafood processing equipment market share.

The COVID-19 pandemic had a significant impact on the seafood processing equipment market owing to halted manufacturing activities, shortage of labor workforce, and supply chain disruption of raw materials, which restricted the growth of the market. However, post-pandemic, demand for fish and other seafood types accelerated, owing to increased health and safety standards that became mandatory across many regions. This shift has provided lucrative opportunities for the growth of the seafood processing equipment market.

IMPACT OF TECHNOLOGY ON MARKET

Automation in Systems and Sustainable Energy Technology to Drive Market Growth

Seafood processing has been revolutionized by automated systems, which have decreased the need for manual labor, accelerated operations, and improved production efficiency. This is particularly important in activities such as cutting, filleting, scaling, and packaging, where accuracy and efficiency are essential. Moreover, many seafood processing plants are adopting renewable energy technologies, such as solar or wind power, to run equipment, contributing to reduced operational costs and carbon footprints. For instance, in October 2023, the Central Institute of Fisheries Technology (CIFT), India, developed solar-based dryers used to dry seafood such as fish, salmon, and prawns. These dryers have a capacity range of 10 to 500 KG of seafood items, which used for improving the shelf life of seafood products. All such factor enhancing the growth of the market.

MARKET DYNAMICS

Market Trends

Technological Advancements in Products to Fuels Market Growth

The major manufacturers such as JBT Corporation, Durr AG, and Nordic Seafood and among others are engaged in introducing technological advancements such as IoT, AI, and machine learning to improve efficiency, reduce labor costs, and ensure consistent product quality. Automation is particularly useful for tasks such as filleting, gutting, skinning, and packaging. Moreover, there is growing emphasis on sustainable processing techniques that minimize waste and environmental impact, which promotes energy efficiency and water recycling technology. For instance, in May 2023, Marel introduced its new Crown Jewel filleting machine for fish processing, which is IoT-enabled and equipped with extensive sensor capabilities.

Market Drivers

Rising Seafood Demand Among Population Drives Market Growth

Rising seafood consumption is one of the primary factors driving the seafood processing equipment market. Consumers around the world are becoming more health-conscious, increasingly incorporating seafood into their diets due to its high nutritional value, including omega-3 fatty acids, proteins, vitamins, and minerals. Moreover, rising disposable incomes have led to increased spending on seafood, further boosting demand. For instance, according to Trading Economics, the net disposable income of India increased by 8.4% in 2023 compared to 2022. In addition, growth in the aquaculture sector across the globe has fueled the demand for such equipment for processing seafood. According to the source of BiAnnual Food Outlook, global fish and aquaculture production is anticipated to grow by 1.2% in 2022 as compared to 2021. All such factor creates the demand for seafood processing equipment and drive market growth.

Market Restraints

High Capital Investment Costs to Restrict Market Growth

Seafood processing equipment integrated with smart sensors and advanced technology tends to be more costly, creating barriers for small and medium-sized enterprises. The upfront costs of acquiring, installing, and maintaining modern equipment, combined with the need for infrastructure upgrades and the associated financial risks, create substantial barriers. Without sufficient financing options or assurances of quick ROI, many businesses delay these investments, which ultimately hinders market expansion and technological progress. For instance, the cost required for seafood processing equipment can range from USD 10,000 to USD 500,000, varied from user to user.

Market Opportunities

Growth in Developing Nations and Rising Government Investment to Boost Market Growth

The rising consumption of seafood in the region such as Asia Pacific, Latin America, and Africa, is rising demand for seafood processing equipment, which in turn is driving the growth of the market. In addition, many governments in developing regions are investing in infrastructure and providing subsidies to improve local seafood processing capabilities. Companies in the market can capitalize on these initiatives by expanding their presence in these regions. For instance, according to the Ministry of Commerce & Industry India, the Indian government planned to invest around USD 2,394.7 million in expanding the fisheries sector across India from 2024 to 2029. All such factors provide lucrative opportunities for processing equipment manufacturers.

SEGMENTATION

By Equipment Analysis

Filleting Equipment Dominates the Market owing to the Rising Popularity of Ready-to-Eat Among Population

Based on equipment, the market is classified into gut and scale equipment, filleting equipment, cutting equipment, skinning equipment, smoker and drying equipment, packaging equipment, and others. Others consist of grinders and specialized cleaning equipment.

The filleting equipment dominated the market share by 24.90% in 2026 owing to the rising demand for high-quality fish fillets and rising popularity of ready-to-eat seafood products, which fuels the market growth. Moreover, rising urbanization and increasing disposable income of the population, have further driven demand for such equipment.

Gut and scale equipment is anticipated to grow at the highest growth rate during the forecast period, owing to need for automation in seafood processing to reduce labor costs and growth in the aquaculture industry, which drives the growth of the market.

Cutting equipment, skinning equipment, and smoker & drying equipment are projected to experience potential growth during the forecast period. This growth is owing to factors such as rising demand for pre-portioned seafood and growing concerns about sustainability and resource efficiency, pushing companies to invest in energy energy-efficient equipment.

Packaging equipment is projected to grow moderately during the forecast period, owing to global demand for convenience foods, including pre-packaged seafood, which is driving the need for efficient packaging solutions.

Others consist of grinders and specialized cleaning equipment. This segment is projected to grow decently owing to stringent government regulations regarding food safety and hygiene, which are driving the adoption of advanced solutions and supporting market growth.

To know how our report can help streamline your business, Speak to Analyst

By Mode of Operation Analysis

Automatic Machine Dominated the Market Owing to Various Benefits Associated With It

Based on mode of operation, the market is segmented into automatic and semi-automatic & manual.

The automatic machine led the market of 66.51% in 2026 and is projected to grow at significant growth due to factors such as continuous advancements in technology, including robotics, artificial intelligence, and machine learning. These innovations lead to the development of more efficient and precise processing equipment, which enhance operational efficiency, improve product quality, and reduce waste. The segment is likely to acquire 66% of the market share in 2025.

The semi-automatic and manual segment is anticipated to grow moderately during the forecast period, owing to factors such as less cost compared to fully automatic machines. Moreover, enhancements in quality control practices and rising demand for seafood processed foods across the globe, are driving demand for these types of equipment, contributing to market growth.

By Seafood Type Analysis

Fish Dominate the Market Owing to Rising Consumption of Fish Among Population Drive Growth

Based on seafood type, the market is classified into fish, crustaceans, mollusks, cephalopods, and others.

The fish seafood dominated the market in 2023 and is projected to witness substantial growth during the forecast period. This growth is driven by rising consumption of fish in countries such as India, China, and the U.K., which in turn, rises the demand for filleting machines, skinning machines, and packaging machines, thereby fueling market growth. The segment is likely to hold 46.40% of the market share in 2026.

Crustceans is projected to grow at a significant growth rate during the forecast period due to rising consumer awareness of the health benefits of seafood along with the growth of aquaculture, contributing to the robust growth of the market. Increased awareness of the nutritional benefits of crustaceans, such as high protein content and omega-3 fatty acids, creates demand for seafood processing equipment. The segment is anticipated to show a CAGR of 5.5% during the forecast period.

Mollusks and cephalopods are projected to grow moderately, owing to the rising disposable income among end users. As spending on purchasing mollusk and cephalopods increases, so does the demand for processing equipment.

Others consist of seaweed and kelp. This segment is anticipated to grow decently, as seaweed is a good source of protein widely adopted in food products and cosmetics. Such products subsequently raise the demand for this equipment and contribute positively to the market share.

SEAFOOD PROCESSING EQUIPMENT MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and South America.

ASIA PACIFIC

Asia Pacific Seafood Processing Equipment Market Share, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is anticipated to dominate the market and is expected to experience the highest growth during the forecast period. The region led the market with a value of USD 0.87 billion in 2024, and in 2023, the market value stood at USD 0.84 billion. It is owing to rising disposable income and rapid urbanization, leading to rising consumption of fish and seafood across countries such as South Korea, India, Japan, and other Asia Pacific countries. According to the Australian Bureau of Statistics, the net disposable income of Australia increased by 3.7% in 2023 compared to 2022. Such growth in disposable income enhances the demand for such equipment, contributing positively to the seafood processing industry. The market value for India is likely to be USD 0.11 billion and Japan is anticipated to be USD 0.16 billion in 2026.

China to Dominate Owing to It Being the Larger Producer and Consumer of Seafood Globally

China is the largest producer and consumer of seafood globally. The China market value is expected to be USD 0.35 billion in 2026. A rising consumer awareness of the health benefits of seafood drives the need for effective processing solutions. Moreover, the growth of aquaculture in China creates a continuous demand for efficient processing equipment to handle and process various seafood types, such as crustaceans, mollusks, and fish. For instance, the according to the source of The Maritime Executive, the production of aquaculture in China increased by 4% in 2023 as compared to 2022.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe region is projected to be the second-largest market with a value of USD 0.75 billion in 2025 and expected to grow steadily owing to its strong seafood consumption culture, particularly in countries such as Norway, Spain, France, and Italy. The region is also anticipated to exhibit the second-fastest CAGR of 4.9% during the forecast period. The growing health awareness around seafood consumption has further boosted the demand for seafood processing equipment market. In addition, rising spending on fishery and aquaculture seafood products across Europe surges the demand for such equipment and fuels market growth. The U.K. market value is likely to hit USD 0.15 billion in 2026. Meanwhile, Germany market value is expected to be USD 0.2 billion in 2026 and France is projected to be USD 0.11 billion in 2025.

For instance, according to the Source of the European Union, household spending on fishery and aquaculture products increased by 11% in 2022 compared to 2021.

North America

North America region is projected to be the third-largest market with a value of USD 0.65 billion in 2025 and to grow at a moderate rate due to growth in aquaculture production and rising adoption of the product. For instance, according to the Food and Agriculture Organization, aquaculture production in North America increased by 3.6% in 2023 compared to 2022. The increasing demand for convenient and ready-to-eat seafood products is driving investments in processing equipment that can efficiently produce such items.

The U.S. market is expected to be USD 0.45 billion in 2026, driven by factors such as increasing demand for seafood products and greater awareness of the health benefits of seafood, leading to increased demand for processed seafood products and contributing to market growth.

Middle East & Africa

The Middle East & Africa region is projected to grow steadily, owing to rising consumption of fish, crab, and other seafood from GCC, South Africa, and African countries. This growing demand is creating the demand for the product, which is fueling market growth. The GCC market value is estimated to be USD 0.05 billion in 2025.

South America

South America is anticipated to be the fourth-largest market with a value of USD 0.16 billion in 2025 and to grow moderately during the forecast period. Increasing consumer demand for high-quality, fresh, and ready-to-eat seafood products which enhances the demand for advanced processing and packaging equipment to maintain product quality and extend shelf life.

KEY INDUSTRY PLAYERS

Major Players are Key Strategies to Intensify their Market Position

Market players such as JBT Corporation, Carsoe Group A/S, CTB Inc, Marel, GEA Group Aktiengesellschaft, and BAADER Group are engaged in product launches, agreements, and acquisitions as key strategies to strengthen their competitive positions. For instance, in June 2024, BAADER Group launched a new 180/Pro fillet machine for processing fish, salmon, and crabs. It has smart controls in which a machine's computer screen easily controls fish species and sizes. Such a new machine in the product portfolio improves of seafood processing equipment, all drives the market growth.

List of Key Companies Studied:

- JBT Corporation (U.S.)

- Carsoe Group A/S (Denmark)

- BAADER Group (Germany)

- CTB Inc (U.S.)

- Coastline Equipment Inc (U.S.)

- Marel (Iceland)

- Subzero (Grimsby) Ltd (U.K.)

- GEA Group Aktiengesellschaft (Germany)

- Optimar A/S (Norway)

- Bettcher Industries Inc (U.S.)

- Buhler Group (Switzerland)

- Durr AG (Germany)

- Schaefer Technologies Inc (U.S.)

- Nordic Seafood (Denmark)

- Euro Baltic (Denmark)

- Aquabounty Technologies (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: BAADER Group signed an agreement with Nordic Aqua, based in Norway, aimed at improving its product portfolio across China market.

- July 2024: Marel Showcased a new series of automated solutions for fish processing equipment at the Fish Congress & Fish Expo in Brazil, which was held from 24 to 26 September 2024.

- May 2024: Carsoe signed a partnership with Froyanes, a Norwegian company specializing in fish processing solutions. This partnership aimed to bring automation into the seafood processing plant. The acquisition was done to improve the product portfolio of crab processing machines.

- Apr 2024: Carsoe launched a new V16 vertical plate freezer for storing and preserving seafood products. It is an automatic freezing machine used in both onboard seafood factories and land-based seafood factories. It offers features such as space-saving, a hygiene system, and easy to handle.

- December 2022: BAADER Group launched the SKAGINN 3X non-pressure freezing equipment for seafood items such as fish, groundfish, and aquaculture. It features include less processing time, energy efficiency, and faster freezing time. It can store and freeze 20 to 100 tons in a container at a time.

- March 2021: Proseal, a subsidiary of JBT Corporation, launched a new GTe range of sealing systems. These machines are used to process a wide range of fish, mollusks, and other seafood, reduced food wastage and superior quality protection.

REPORT COVERAGE

The report provides an in-depth analysis of the seafood processing equipment market. The report also provides market estimation and forecast based on equipment, mode of operation, seafood type, and regions. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 6.50% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

|

Segmentation |

By Equipment, By Mode of Operation, By Seafood Type and By Region |

|

|

Segmentation |

By Equipment

By Mode of Operation

By Seafood Type

By Region

|

|

|

Key Market Players Profiles in the Report |

JBT Corporation (U.S.), Carsoe Group A/S (Denmark), BAADER Group, CTB Inc. (Germany), Coastline Equipment Inc (U.S.), Marel (Iceland), Subzero (Grismby) Ltd (U.K.), GEA Group Aktiengesellschaft (Germany), Optimar A/S (Norway), and Bettcher Industries Inc. (U.S.) |

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 0.91 billion in 2025.

In 2034, the market is expected to reach USD 4.44 billion.

The market is projected to grow at a compound annual growth rate (CAGR) of 6.50% during the forecast period.

The filleting equipment segment is expected to lead the market over the forecast period.

Growth in the consumption of seafood across the globe is a key factor fueling market growth.

JBT Corporation, Carsoe Group A/S, BAADER Group, CTB Inc, Coastline Equipment Inc, Marel, Subzero (Grismby) Ltd, GEA Group Aktiengesellschaft, Optimar A/S, and Bettcher Industries Inc are the leading companies in this market.

Asia Pacific dominate the region owing to rising growing consumer awareness about eating healthy, and rising consumption of seafood across Asia Pacific.

Technological advancements in products to fuels the market growth.

Based on seafood type, fish sector led the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us