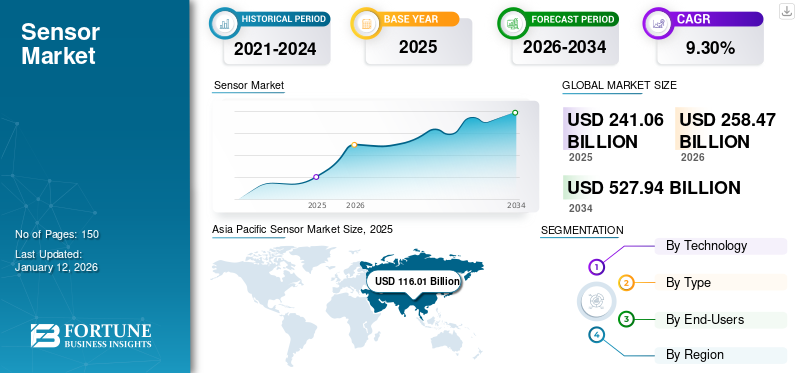

Sensor Market Size, Share & Industry Analysis, By Technology (MEMS, CMOS, and Others), By Type (Radar Sensors, Touch Sensors, Temperature and Humidity Sensors, Biosensors, Level Sensors, Pressure and Flow Sensors, Optical Sensors, Image Sensors, and Others), By End-Users (Consumer Electronics, Automotive, Biomedical and Healthcare, Industrial, Aerospace and Defense, and Others), and Regional Forecast, 2026 - 2034

Sensor Market Size

The global sensor market size was valued at USD 241.06 billion in 2025 and is projected to grow from USD 258.47 billion in 2026 to USD 527.94 billion by 2034, exhibiting a CAGR of 9.30% during the forecast period. Asia Pacific dominated the global market with a share of 44.60% in 2025.

A sensor is a device that can detect and respond to certain types of input from the physical environment. Motion, heat, pressure, light, moisture, or any other environmental phenomena could be the specific input.

The market growth is expected to be driven by the increasing demand for wearable or electronic devices and the rapid emergence of Internet of Things (IoT) and automation. In many applications, such as medicine, industrial, consumer electronics, and automotive, among others, IoT-connected devices have unlocked enormous opportunities for sensors. It was estimated that there were about 30.0 billion network-connected devices and connections by the end of 2023, up from around 18.4 billion in 2018, according to Cisco's yearly Internet report. An increase in IoT devices is anticipated to drive the growth of this market. Moreover, the focus on energy efficiency and sustainability is fostering a growing potential for market.

The COVID-19 pandemic negatively impacted the sensor industry due to severe lockdowns, a decrease in sales of products, and the suspension of vehicle production. Several industry manufacturers began covering up for their losses due to disturbed supply chain and declining sales. Furthermore, key market players are spending money and increasing their production capacity to take advantage of cutting-edge sensing technologies.

IMPACT OF GENERATIVE AI

Advanced-Data Capabilities of Generative AI to Boost Market Expansion

The sensors can collect huge amounts of data on machine health and performance, which could be used to train generative AI models for the production of synthetic maintenance reports. Generative AI can help detect possible machine failures and problems before they occur, thus reducing disruption and increasing operational efficiency through the production of new data that is comparable to existing inputs. The use of AI in existing sensing technologies represents a significant step forward, enabling industries to move from reactive maintenance to proactive maintenance, thereby maximizing the efficiency and lifespan of critical systems.

Sensor Market Trends

Rapid Adoption of Energy Efficient and Sustainable Products is a Key Trend

The increasing focus on sustainability is a major change in today's sensor development, with manufacturers focusing their efforts on reducing energy consumption and extending the lifespan of sensors. The wider commitment to minimize the impact of product manufacturing and use on the environment is in line with this strategic focus. The existing manufacturers are contributing to a total sustainability drive in the technology sector by integrating energy efficiency technologies and design practices.

This approach helps address environmental issues and also responds to the market demand for environmentally responsible solutions. A commitment to balance technology innovation with environmental responsibility, which will shape the future development of this essential technology, is demonstrated by integrating sustainability considerations in sensor design.

Download Free sample to learn more about this report.

Sensor Market Growth Factors

Increasing Demand for Wearable or Electronic Devices to Aid Market Growth

Sensor technology plays a major role in the use of wearables and consumer electronics, including computers, smartwatches, fitness trackers, and health monitors. These devices are connected to several sensors to track and monitor user activities, health parameters, and biometric data. The wearables generally include sensors such as accelerometers, heart rate monitors, and GPS modules.

Users are becoming more aware of the monitoring of their activity level, heart rate, sleep patterns, and caloric intake. Sensors on wearables are collecting real time data, allowing users to gain insight into their health and fitness. The increasing emphasis on personal health and fitness has led to the increased demand for wearables.

RESTRAINING FACTORS

High Cost of the Product to Hinder Market Expansion

The cost of sensors, especially for some advanced technologies, has been a significant barrier to its adoption. The complexity of manufacturing processes or the use of expensive materials has led to an increase in production costs for sensors with superior features, high precision, and specific requirements. The product adoption on price-sensitive markets has been hampered by the significant costs involved.

Sensor Market Segmentation Analysis

By Technology Analysis

Major Integral Role of MEMS in Sensor Technology Boosted the Market Growth

Based on technology, the market is segmented into MEMS, CMOS, and others.

In terms of market share, the MEMS segment dominated the market in 2026, accounting for 54.36% of the total market share. MEMS is the integration of mechanical elements, sensors, and electronics into a single chip. MEMS allows sensors to be miniaturized, making them more cost-effective and suitable for a wide range of applications. This miniaturization allows sensors to be fitted in a variety of devices and systems, which enables them to have compact designs. The evolution of MEMS technology has resulted in enhanced sensitivity, reduced power consumption, improved integration, and the development of new advanced types of MEMS sensors. The market growth is driven by the growing use of MEMS technology and developments in its technologies.

The CMOS segment is anticipated to register the highest CAGR during the forecast period. CMOS sensors are used primarily for the production of images in computer cameras, security camera systems, and video cameras. There are also barcode readers, telescopes, and scanners that use these electronic components. Due to the low manufacturing costs of CMOS, it is possible to manufacture inexpensive consumer electronics. It used in robotics, machine vision, and embedded imaging applications.

By Type Analysis

Major Integral Role of Radar Sensors in Autonomous Driving Boosted the Market Growth

Based on type, the market is segmented into radar sensors, touch sensors, temperature and humidity sensors, biosensors, level sensors, pressure and flow sensors, optical sensors, image sensors, and others.

In terms of market share, the radar sensors segment dominated the market in 2026, accounting for 21.55% of the total market share due to their integral role in autonomous driving and ADAS. They play a crucial role in enhancing vehicle safety and performance by providing precise and reliable data about the surrounding environment.

The biosensors segment is projected to grow at the highest CAGR during the forecast period. In industrial applications such as imaging, monitoring of microbial activity, and analysis of food, nanotechnology-enhanced biosensors are highly profitable. In addition, owing to the growing popularity of point-of-care testing methods, an increased need for effective biosensors is emerging. Consequently, biosensor features are increasing the sensor market share.

By End-Users Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment Dominated the Market Due to Changes in Consumer Preferences and Continuous Development of Technology

Based on end-users, the market is segregated into consumer electronics, automotive, biomedical and healthcare, industrial, aerospace and defense, and others.

In terms of market share of 29.28% in 2026, the consumer electronics segment dominated the market due to enhanced device functionality, user experience, and new forms of interaction. With advances in technology and changes in consumer preferences, demand continues to evolve, which has led to innovation in its design and implementation.

The biomedical and healthcare segment is anticipated to expand at the highest CAGR during the forecast period. It is revolutionizing the segment by improving patient safety, continuous monitoring, and personalized treatments. Therefore, they are widely used in medical devices for the diagnosis, prevention, monitoring, and treatment of diseases and injuries in intensive care units, laboratories, dental practices, hospital wards, general practitioners' offices, and in-home care products.

REGIONAL INSIGHTS

On the basis of geography, the market is subdivided into North America, Europe, South America, the Middle East & Africa, and Asia Pacific.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific held a major share in the market in 2024. The region is a major electronics invention hub, with countries such as Japan and China at the forefront of technologically advanced manufacturing and innovation excellence. In addition, the promise of smart cities in Asia's technology sector is attracting interest. According to a recent report from Equinix, "Shifting Asia," UBS estimates that the Asia Pacific region will account for around 40% of global market growth in smart cities projects by 2025, amounting to USD 800 billion. To sustain the growth of the digital market in the Asia Pacific region, rapid urbanization is driving growth in IT build-up and interconnection bandwidth.

Asia Pacific Sensor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Europe market is estimated to expand at the highest rate during the analysis period. The regional market expansion is driven by the rising adoption of sensors for improved vehicle performance and compliance due to stringent emission and safety rules. Europe's focus on sustainability, which is being driven by the increasing adoption of electric vehicles, has also been a driver for the regional sensor market growth.

The North America market is expected to record the second-highest growth rate during the forecast period. This growth is attributed to a proliferation of smartphones, a rise in e-commerce platforms, and digital transformation.

The Middle East & Africa market is expected to register a significant growth rate in the market during the forecast period. This growth is attributed to the high usage of sensors in the oil and gas industry and the growing adoption of 5G technology and intelligent devices, escalating the market demand in the region.

The South America market is poised for a significant growth during the forecast period. The expansion of the need for high-speed data transmission, the advent of 5G technologies, and the proliferation of IoT are key factors contributing to this growth.

KEY INDUSTRY PLAYERS

Market Players Use Product Developments, Partnerships, and Merger & Acquisition, Strategies to Expand Their Business Reach

Key industry players are providing advanced sensors to help users in their safety and monitoring. These companies prioritize the acquisition of local and small firms for expanding their business reach. Moreover, leading investments, mergers, acquisitions, and strategic partnerships contribute to an increase in demand for sensor-based products.

List of Top Sensor Companies:

- Siemens AG (Germany)

- NXP Semiconductors (Netherlands)

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated (U.S.)

- Analog Devices, Inc. (U.S.)

- STMicroelectronics (Switzerland)

- Bosch Sensortec GmbH (Germany)

- Microchip Technology Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- OMRON Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Texas Instruments launched the latest sensors designed to enhance the intelligence and safety of cars. The A5442WR 77GHz mm-wave radar sensors can be used in satellite radar architectures allowing higher levels of autonomy by refining sensor fusion and decision-making in ADAS.

- October 2023: LEM International SA and TDK Corporation signed a growth agreement on custom TMR dies for next-gen integrated sensors. This collaboration further helps TDK's TMR technology penetrate the industrial and automotive markets, two sectors in which LEM has considerable expertise, notably concerning growing segments such as solar converters, energy storage, or motor drives.

- August 2023: Texas Instruments, a player in the advancement of sensing technologies, introduced new sensing technology that enables engineers to streamline their designs while enhancing accuracy. The latest products include the lowest drift isolated Hall Effect Current Sensor for high voltage systems, designed for a wide range of common voltage and mode temperatures.

- April 2023: Siemens AG launched SIBushing, a smart and intelligent cable coupling bushing together with the SICAM FCM and an indicator of shortcircuits and earth disturbances.

- February 2022: STMicroelectronics released the latest Intelligent Sensor Processing. The device consists of a digital signal processor (DSP) and a MEMS sensor that can run AI algorithms on the same silicon.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, leading types, and end-users. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By Type

By End-Users

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 527.94 billion by 2034.

In 2025, the market value stood at USD 241.06 billion.

The market is projected to grow at a CAGR of 9.30% during the forecast period.

By end-user, the consumer electronics segment is the dominant segment and also led the market in 2025.

The increasing demand for wearable or electronic devices is set to aid market growth.

Siemens AG, NXP Semiconductors, Infineon Technologies AG, Texas Instruments Incorporated, Analog Devices, Inc., STMicroelectronics, Bosch Sensortec GmbH, Microchip Technology Inc., Honeywell International Inc., and OMRON Corporation are the top sensor companies in the global market.

In 2025, Asia Pacific held the largest market share.

The Europe market is expected to exhibit the highest growth rate during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us