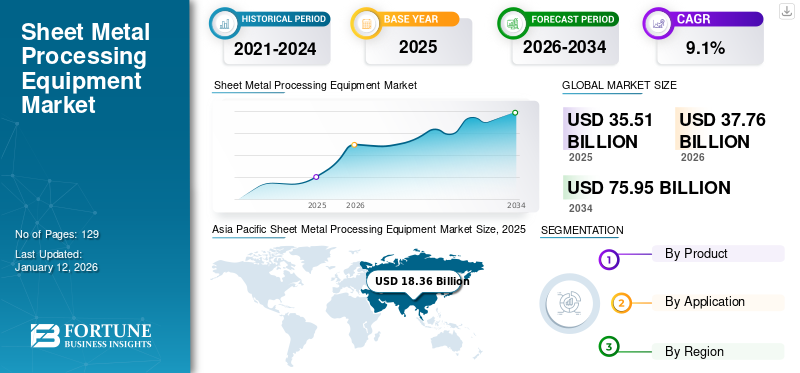

Sheet Metal Processing Equipment Market Size, Share & Industry Analysis, By Product (Cutting, Forming, Bending, Punching, Milling, and Others (Grinding, etc.)), By Application (Automotive, Machinery & Fabrication, Construction, Transportation, and Others (Utensils, etc.)), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global sheet metal processing equipment market size was valued at USD 35.51 billion in 2025. The market is projected to grow from USD 37.76 billion in 2026 to USD 75.95 billion by 2034, exhibiting a CAGR of 9.1% during the forecast period. Asia Pacific dominated the sheet metal processing equipment market with a share of 51.7% in 2025.

The global sheet metal processing equipment industry is witnessing tremendous growth with rapid technological advancements and evolving industry demands. The market for this equipment is backed by the increasing demand for precision metal work in various sectors, such as automotive, construction, and other fabrication activities in aerospace and other transportation industries. Manufacturers are seeking efficiency and industrial automation leading to the adoption of advanced process technologies in the sheet metal industry.

The COVID-19 pandemic significantly disrupted economies and production capabilities globally, leading to temporary shutdowns and decreased demand in particular segments. However, the crisis also acted as a catalyst for the industry 4.0 technologies owing to the renewed emphasis on modern equipment to fulfill market demands and fresh order for infrastructure development and fabrication industry. As the industry recovers, the focus on improving productivity and quality is expected to increase, paving the way for sustained growth.

Impact of Generative AI

Improving Productivity and Reducing Cost through AI is Game Changer for Manufacturers

Generative AI technology has been the most advanced modernization in the sheet metal industry, with AI-enabled Computer Numerical Control (CNC) machines offering efficiency, productivity, and reduced labor costs. Companies are emphasizing more on enhancing precision cutting and AI-enabled design that controls the operation of machinery, enabling businesses to achieve these business Key Performance Indicators (KPIs). Thus, AI automation enables improved productivity by eliminating repeatability in manufacturing processes. This allows AI to enable optimization in cutting paths, improving productivity, and reducing material wastage for sheet metal process businesses in the long term.

- For instance, in September 2023, Machina Labs announced the general availability of its deployable system. This portable robotic system can be easily deployed with other robots without disturbing existing production facilities. This AI-enabled robot digitally forms and cuts metal and custom composite parts. The company has a unique offering for tools, research and development, rapid prototyping, and the capability to produce complex sheet metal parts.

MARKET DYNAMICS

Market Trends

Integration of Machine Learning Systems on Chips (MLSoC) is Shaping Modern Industry Trends

The swift evolution of rapidly growing AI innovation is shaping the new industry trends that extend the integration of advanced SoC chipsets on AI-enabled machinery. These machineries are capable of improving productivity in production lines with automated and optimized AI algorithm that significantly reduces cost and minimizes wastage. Also, MLSoC chipsets are capable of performing complex machine operations and design planning, significantly reducing operation time by optimizing cutting paths and reducing waste in the sheet metal fabrication process. Furthermore, MLSoC chipsets, with the help of AI, are capable of adjusting any framework, model, network, sensor, and modality that optimizes energy efficiency and deliver fidelity intelligence to users. Thus, the integration of MLSoC chipsets equipped with AI software shapes modern industry trends that will influence sheet metal processing equipment market share in the long term.

- For instance, in July 2024, TRUMPF, a high-tech company, and Sima.ai, a software-centric company, agreed on a strategic partnership to develop lasers with Artificial Intelligence (AI). This new equipment will bring SiMa Ai software excellency and TRUMPF process expertise to users with modern MLSoC Chipset. The capabilities include integrating features and systems such as marking, cutting, welding, and powder metal 3D printers.

Download Free sample to learn more about this report.

Market Drivers

Emphasis on Advanced Material Processing and Infrastructure Investment to Drive Market Growth

The modern fabrication industry is observing a dynamic push across the market as customers demand more advanced materials in sectors such as automotive, aerospace, or some complex infrastructure projects. Thus, manufacturers are emphasizing more on developing equipment that can identify material characteristics by scanning them and automating the design, planning, and process execution. Also, increasing investment in infrastructure projects by government authorities, energy, and capital goods companies across developing countries is driving sheet metal processing equipment market growth and demand in the long term.

- For instance, in May 2024, Evology Manufacturing, an established contract manufacturer with 30+ years of experience, adopted Figur G15, a patented Digital Sheet Forming (DSF) technology that shapes sheet metal directly from the digital file without any expensive custom tools, stamping press, molds and dies.

Market Challenges

Higher Initial Set-up Costs and Tariffs are Limiting Product Expansion

Competent players offering advanced equipment are struggling with low adoption as end users across various sectors are struggling with their production backlogs and financial pressure on the cash flow. Companies are focusing on increasing their market production capability. However, higher initial set cost is a major restraint for market growth. Also, global geopolitical tensions and trade conflicts impact the global supply chain of the industry as manufacturers have to bear heavy tariffs on the equipment. All these factors result in weak demand in the global market for standard machines and less adoption among end users. Companies are not ready for transformative changes as they are uncertain about the future and feel reluctant to invest in new technology.

Market Opportunities

Budding Electric Vehicle Sector and Concerns for Sustainability Create Plenty of Opportunities

Sheet metal processing equipment, which is by far the major segment utilizing a lot variety of machinery for processing activities, has a major application in the automotive sector. Additionally, the electric vehicle segment is the major category that pushed the demand for advanced sheet metal process machines in the long term. Furthermore, sustainability concerns and increasing investments in renewable energy and sustainable development across North America and Europe have created ample opportunities for sheet metal equipment. This equipment has a major adoption in the fabrication of windmills, solar panel frames and structures, and other fabrication projects. These sustainable applications of the equipment drive opportunities for businesses to expand potential and sheet metal processing equipment market size in the long term.

- For instance, in January 2024, EuroTranciatura Mexico, part of the Italian industrial giant Euro group, inaugurated its third production facility in Queretaro National Park, Mexico. The new facility is entirely dedicated to the production of sheet metal packages for electric vehicle traction motors. The company will invest USD 55 million over four years.

SEGMENTATION ANALYSIS

By Product

Bolstering Precision Sheet Metal Cutting Operation Drive Product Demand

The product segment is broadly classified into cutting, forming, bending, punching, milling, and others (grinding, etc.)

Across product segments, cutting is witnessing the highest growth, with the largest market share owing to end users adopting modern CNC sheet metal cutting machines that can deliver precision cuts, efficient productivity, and higher productivity. Also, global emphasis on sustainability has promoted the use of laser cutting and waterjet technologies that can reduce emissions and energy usage and minimize wastage in cutting operations. The segment is set to capture 40.97% of the market share in 2026.

Forming and bending are following growing trends of sheet metal machine adoption due to the growing application of forming machines in roll and stretch forming for various infrastructure projects. Further, bending this roll product to a designed shape has supported the demand for bending machines across the industry. The bending segment is likely to grow with a CAGR of 8.60% during the forecast period (2026-2034).

Punching, milling, and other machines’ demand is set to grow steadily as companies are demanding upgrading their existing facilities with new automated production facilities.

By Application

To know how our report can help streamline your business, Speak to Analyst

Demand for Vehicles and Upgradation in Production Lines Supported Automotive Segment’s Growth

The application segment is further classified as automotive, machinery & fabrication, construction, transportation, and others (utensils, etc.)

The automotive segment is dominating the application segment owing to rising demand for electric vehicles across end users. Also, the growing application of sheet metal process machines in manufacturing parts and components that need efficiency and precision bolsters demand for sheet metal processing equipment. The segment held 41.37% of the market share in 2026.

The machinery and fabrication segment is showcasing progressive growth due to rising investments in infrastructure projects and machinery demand in production facilities due to upgradation.

The construction, transportation, and others (utensils, etc.) segments showcase steady growth as companies focus on sturdy construction and weak demand for public transportation infrastructure projects.

SHEET METAL PROCESSING EQUIPMENT MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Sheet Metal Processing Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 18.36 billion in 2025 and USD 19.60 billion in 2026. The region is dominating the global market share owing to its prevailing presence of established fabrication and manufacturing giants investing heavily in high-tech automated and remote-controlled machines. The bolstering demand is supported by the growing investments by automotive manufacturers to upgrade existing facilities to modern sheet metal equipment that can deliver extra precision and productivity while maintaining sustainability. Furthermore, growing emphasis on infrastructure development to improve public facilities and commute in urban development is bolstering demand for machines across giants such as China, Japan, and developing countries, mostly India, South Korea, and other Asia Pacific countries. India is set to be valued at USD 2.49 billion in 2026, while Japan is expected to gain USD 2.38 billion in the same year.

China is dominating the Asia Pacific market with its dominant industrial base and easy production capabilities, which provide an upper edge in producing modern sheet metal process machines at affordable and convenient prices. Also, high domestic demand for processing equipment and growing capital goods investment by manufacturers and production facilities are bolstering demand in the long term. China is anticipated to acquire USD 9.95 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is expected to hold the largest revenue share of the market valued at USD 11.19 billion, registering a CAGR of 8.09% during the forecast period (2026-2034). North American market is showcasing progressive growth as local manufacturers seek to increase investment to expand manufacturing and fabrication of metal structures across various sectors such as automobile parts, metal door fabrication, and solar panel structure fabrication. Also, players operating in the North American sheet metal fabrication business are focusing on expanding market reach with more advanced and automated sheet metal process machines supporting the sheet metal processing equipment industry growth. The U.S. market is projected to reach a market value of USD 7.79 billion in 2026.

Latin America

Latin America is the fourth largest market estimated to be worth USD 0.46 billion in 2026. The Latin American market is growing steadily, with manufacturers increasing their investment in new production facilities for fabrication and automotive parts manufacturing. This will significantly support the monumental growth of automotive and infrastructure development in this region. Countries such as Brazil and Mexico are also playing a critical role with lucrative FDI policies and tax benefits to support this development.

Europe

Europe is the third largest market set to grow with a value of USD 6.10 billion in 2026. Europe is witnessing stable progress due to greater emphasis on sustainability and automation. The U.K. market continues to grow, anticipated to hit USD 1.31 billion in 2026. Domestic sheet metal equipment manufacturers are focusing on developing advanced robotics to meet sustainability and environmental goals, thereby driving sheet metal process equipment adoption across this region. Germany is set to be worth USD 2.11 billion in 2026, while France is foreseen to hold USD 0.67 billion in 2025.

Middle East & Africa

Middle East & Africa regions are significantly adopting robotic metal processing machines due to increasing investment in infrastructure and manufacturing. Also, the government’s promotion of automation as an economic diversion strategy is helping increase the adoption of sheet metal process machines. However, the unstable economy and geopolitical tensions in the MEA region impacted the investment in this region. The GCC market is forecasted to stand at USD 0.23 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Emphasis on Research and Portfolio Expansion Extended Key Players Market Potential

Key industry players operating in the sheet metal processing equipment segment have shifted the focus to developing more advanced automated products that can optimally mold machine operations to material characteristics. These capabilities help key players extend market potential through a broad product portfolio equipped with advanced MLSoC, AI, and other automation capabilities.

- For instance, in September 2024, Tomotek, a leading industrial machinery supplier, introduced its new X Series CNC routers, which can process oversized sheets. The machine is designed especially for marine engineering. The system can be configured with knife accessories and coolant for processing solid aluminum sheets and extrusions to SeaDEK PE/EVA and Marine Carpet.

List of Companies Studied:

- Trumpf GmbH + Co. KG (Germany)

- Amada Co., Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- LVD Group (Belgium)

- Bystronic AG (Switzerland)

- KUKA AG (Germany)

- FANUC Corporation (Japan)

- Haas Automation, Inc. (U.S.)

- Okuma Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- ESAB (U.S.)

- Schuler AG (Germany)

- Gasparini (Brazil)

- Schenchong (China)

- Peddinghaus Corporation (U.S.)

- JMT (U.S.)

- Salvaghini (Italy)

- CIDAN Machinery Group (Sweden)

- Tennsmith (U.S.)

- KNUTH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Murata Machinery, a prominent industrial machinery manufacturer, introduced a combination of punch presses and fiber laser systems for MF3048HL. The machine integrates the benefit of punch operation with laser cutting technology, thus eliminating the need for separate set-ups or material transfers between machines.

- October 2023: Amada, a leading sheet metal processing equipment provider, introduced a three-dimensional laser integrated system, “ALCIS.” The machine is equipped with blue and fiber lasers that can perform various operations, such as cutting, welding, and layered manufacturing. The two lasers support high speed and high-quality processing of heavy reflecting materials, such as copper, and the torch can be selected as per the machining application and material.

- March 2023: During the INTECH exhibition, TRUMPF, a leading industrial solution provider, presented its new laser blanking solution, TruLaser 8000 Coil Edition, which can easily process up to 25 tons of coiled metal sheets without human intervention. The solution is customized especially for automotive suppliers and manufacturers, switch cabinet manufacturers, elevator manufacturers, and ducting system manufacturers.

- February 2023: Amada Co. Ltd., a prominent sheet metal processing equipment machine manufacturer, announced the EGB series sheet bending machines that are equipped with a newly developed worker support function and servo drive system that enable an operator to perform sheet metal bending easily. Additionally, the EGB Series is equipped with a tablet that displays real-time video of the butting area.

- February 2023: Amada Co. Ltd., a prominent player in the sheet metal processing equipment industry, announced the expansion of its welding product portfolio with three models in the “FLW” series of welding robots. Amada fiber laser welding robots ensure ease of operation, which can save space and energy. The new robots are equipped with newly developed NC equipment that makes it possible to use facial recognition to activate the operation screen.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 9.1% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product, Application, and Region |

|

Segmentation |

By Product

By Application

By Region

|

|

Key Market Players Profiled in the Report |

Fanuc Corporation (Japan), Amada Co. Ltd. (Japan), Yasakawa Electric Corporation (Japan), KUKA AG (Germany), Okuma Corporation (Japan), Schuler AG (Germany), Bystronics AG (Switzerland), LVD Group (Belgium), Mitsubishi Electric Corporation (Japan), and Schenchong (China). |

Frequently Asked Questions

The market is projected to record a valuation of USD 75.95 billion by 2034.

In 2026, the market was valued at USD 37.76 billion.

The market is projected to grow at a CAGR of 9.1% during the forecast period.

The automotive sector is expected to lead the application segment in the global market.

Emphasis on advanced material processing and infrastructure investment drives market growth.

Fanuc Corporation, Amada Co. Ltd., Yasakawa Electric Corporation, KUKA AG, Okuma Corporation, Schuler AG, Bystronics AG, LVD Group, Mitsubishi Electric Corporation, and Schenchong are the top players in the market.

Asia Pacific dominated the sheet metal processing equipment market with a share of 51.7% in 2025.

By product, the cutting segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us