Small Launch Vehicle Market Size, Share and Industry Analysis, By Propulsion (Solid, Liquid, and Hybrid), By Capacity (Up to 100 kg, 100-500 kg, 500-1000 kg, and 1000 -2000 kg), By Launch Platform (Land, Air, and Sea) By End User (Government, Commercial, and Military), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

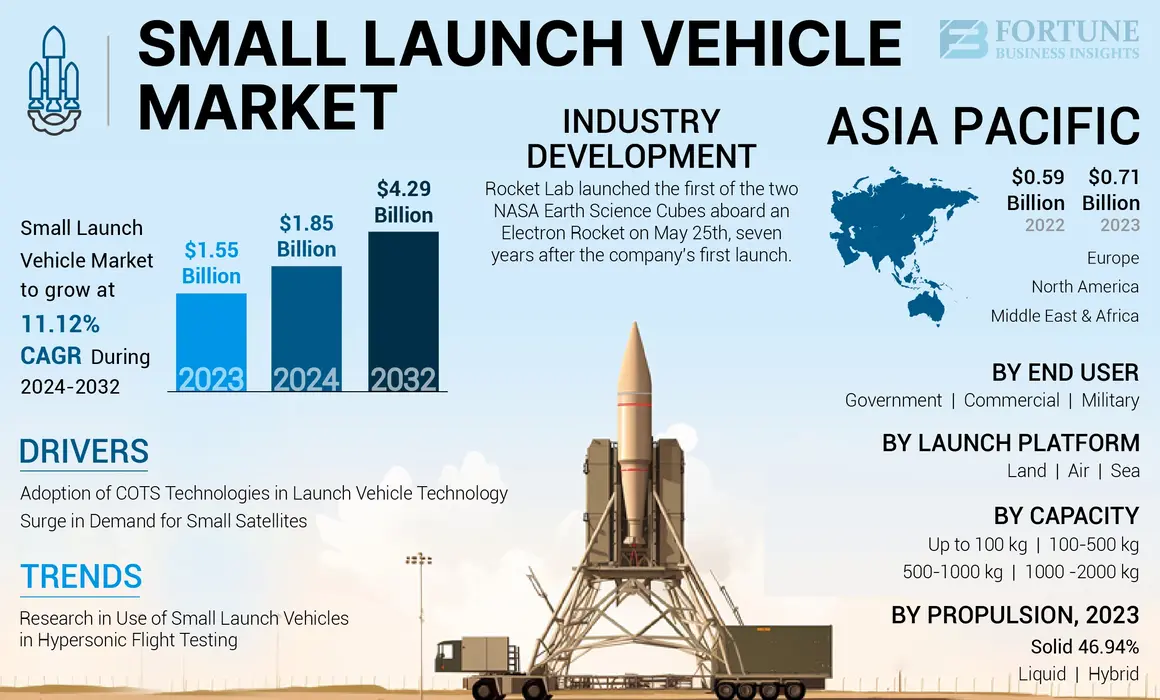

The global small launch vehicle market size was valued at USD 1.55 billion in 2023. The market is projected to grow from USD 1.85 billion in 2024 to USD 4.29 billion by 2032, exhibiting a CAGR of 11.12% during the forecast period. Asia Pacific dominated the small launch vehicle market with a market share of 45.81% in 2023.

A Small Launch Vehicle (SLV) is a type of vehicle designed to transport payloads of up to 2,000 kilograms into the Low Earth Orbit (LEO) according to the classification of NASA. These vehicles are classified based on their payload capacity, with the SLV category specifically targeting smaller payloads, making them ideal for launching small satellites. Moreover, small launch vehicles have gained significant attention in recent years due to the growing demand for satellite constellation, particularly for telecommunications, earth observation, and scientific research.

SLVs offer a more cost-effective and flexible option compared to the traditional heavy lift rockets, allowing satellite operators to launch on-demand rather than relying on larger, shared missions.

Furthermore, the development of SLVs is being driven by advancements in rocket technology, miniaturization of satellites, and emergence of new space players, among others. Companies, such as Rocket Labs and Virgin Orbit, among others, are focused on developing innovative designs to reduce cost significantly. Applications of SLVs are diverse and expanding. They support scientific missions, including space weather monitoring, climatic research, and technology demonstrations. As the space industry continues to evolve, the role of dedicated small launch vehicles is expected to grow, thereby facilitating access to space for a broader range of users and enabling space exploration.

The COVID-19 pandemic significantly impacted the small launch vehicle market in several ways. The global supply chain was heavily disrupted, affecting the availability of critical components needed for SLVs. This resulted in increased lead times for parts and materials, further delaying production and launch timelines. Additionally, many companies faced shutdowns or reduced workforce capacities, leading to postponed launch schedules.

GLOBAL SMALL LAUNCH VEHICLE (SLV) MARKET OVERVIEW

Market Size & Forecast

- 2023 Market Size: USD 1.55 billion

- 2024 Market Size: USD 1.85 billion

- 2032 Forecast Market Size: USD 4.29 billion

- CAGR: 11.12% from 2025–2032

Market Share

- Asia Pacific dominated the small launch vehicle market with a 45.81% share in 2023, driven by strong national space programs, commercial satellite deployment, and increasing investments from countries like India and China.

- By propulsion type, the liquid segment is expected to retain the largest market share in 2025 due to higher efficiency and better controllability during launches.

Key Country Highlights

- India: ISRO’s growing focus on SSLV and international collaborations support strong domestic and regional demand.

- China: Expansion of commercial launch providers and government-led missions boost SLV development.

- United States: Advancements by private firms such as Rocket Lab and Firefly Aerospace drive innovation and reusable SLV technology.

- Germany: Companies like Isar Aerospace are emerging as European leaders in commercial small satellite launches.

- United Kingdom: Increasing development of eco-friendly launch systems by firms like Skyrora strengthens local SLV capabilities.

- Australia: Strategic partnerships with ISRO and investment in sovereign launch solutions foster market entry.

- UAE: Space program initiatives and technology collaborations contribute to Middle East participation in SLV launches.

Small Launch Vehicle Market Trends

Increased Research in Use of Small Launch Vehicles in Hypersonic Flight Testing Are Prominent Market Trends

Hypersonic flight technology is gaining traction for its potential use in both defense and commercial applications. Small launch vehicles, designed to deploy small satellites, can be modified to conduct hypersonic flight tests. This ability allows the evaluation of new materials, systems, and technologies at a low cost as these vehicles can be launched from many places and are designed for rapid deployment. The ability to conduct these tests in a short time from a variety of launch sites increases the operational flexibility required by defense and business enterprises.

The introduction of hypersonic test capabilities in small launch vehicles is in line with the general trends in the NewSpace era, where the boundaries between commercial and military applications are becoming increasingly blurred. With more private companies entering the space launch market, the potential for dual-use technologies is becoming stronger. This situation is particularly relevant in recent geopolitical tensions, where countries are investing in advanced technologies to improve their defense capabilities. As a result, small launch vehicles are anticipated to see an increased demand from the government and commercial sectors, driving innovation and investment in the field.

Download Free sample to learn more about this report.

Small Launch Vehicle Market Growth Factors

Surge in Demand for Small Satellites Will Catalyze Growth of Small Launch Vehicle Market

Small satellites are being increasingly used for a variety of applications, including earth observation, communications, scientific research, and military operations. The ability of these satellites to provide high-resolution images and data has been useful for environmental monitoring, disaster control, and agricultural planning. For example, companies like Planet Labs operate a large number of small satellites that provide daily images of the Earth and improve the ability to monitor changes in the environment and urban development.

Moreover, the growing demand for small satellites, particularly in the nano and micro categories, is a major driver of the small launch vehicle market growth. Small satellites are being used for a wide range of applications, including Earth observation, communication, and scientific research. As the number of small satellite operators increases, so does the need for dedicated and cost-effective launch services.

- In January 2023, Rocket Lab announced that it had secured a contract with Synspective to launch the company's StriX-β synthetic aperture radar satellite on an Electron rocket. This contract highlighted the increasing demand for small launch vehicles to deploy small satellites for Earth observation missions.

- In April 2023, Virgin Orbit successfully launched its LauncherOne rocket from Spaceport Cornwall in the U.K., delivering seven small satellites to the orbit. This launch demonstrated the company's ability to provide responsive and flexible launch services for small satellite operators.

Adoption of COTS Technologies in Launch Vehicle Technology to Significantly Transform Market

Advances in launch vehicle technology have transformed the market through the development of reusable rockets and increasing use of ground-based commercial vehicles. Many companies are exploring similar technologies. For example, in July 2024, the European Space Agency announced that its Ariane 6 is being designed with additional designs that will make it easier to be reused in the future.

Using Commercial-off-the-Shelf (COTS) components provides significant cost savings in development and production. These parts are cheaper to manufacture than other methods, and their wider availability speeds up the development process for new small launch vehicles. For example, the introduction of microelectronics in small satellites has become commonplace, allowing for greater performance at lower costs.

RESTRAINING FACTORS

High Cost Associated With Development and Operation of Small Launch Vehicles to Hamper Market Growth

One of the major constraints of the market is the high costs associated with the development and launch of these vehicles. Despite the growing demand for small satellite launches, the costs associated with developing reliable and efficient small launch vehicles can be a barrier.

The development of small vehicles requires significant investment in research & development, engineering, and testing. Companies must be able to overcome aerospace engineering challenges, including those in propulsion systems, precision manufacturing, and avionics systems. These technical challenges often drive up costs, which can deter new entrants and limit opportunities for startups and small organizations. Additionally, the need for testing and certification adds to the financial burden as companies struggle to ensure the reliability and safety of their vehicles.

Small Launch Vehicle Market Segmentation Analysis

By Propulsion Analysis

Liquid Segment Held Leading Market Share Due to Advancements by Key Players to Improve Costs and Operations

Based on propulsion, the market is segmented into solid, liquid, and hybrid.

The liquid segment held the highest market share in 2023. Recent advances in liquid propulsion technologies, such as the development of reusable engines and use of alternative fuels, such as methane have significantly reduced costs and improved operations. Companies like SpaceX with their “Raptor Rockets” are showing how the innovation of water jets can drive the growth of the market.

The solid segment is estimated to display significant growth during the forecast period. Solid propellant systems are simpler in design and operation compared to liquid systems. They require less complex infrastructure for handling and storage, which can reduce the overall launch costs. This makes solid propulsion a reliable choice for many small satellite constellation launches. Moreover, solid propellants have a long shelf life and are stable under a wide range of conditions. This makes them easier to store and handle, which is particularly advantageous for rapid launch scenarios and military applications.

To know how our report can help streamline your business, Speak to Analyst

By Capacity Analysis

Broad Range of Applications to Make 500-1000 kg Segment Dominate Market Share

The market is divided by capacity into up to 100 kg, 100-500 kg, 500-1,000 kg and 1,000-2,000 kg.

The 500-1,000 kg segment is expected to account for the largest market share during the forecast period of 2024-2032. This payload capacity is ideal for a wide variety of satellite applications, including Earth observation, communication, and scientific research. This versatility makes it attractive to a broad range of customers, including commercial entities, government agencies, and academic institutions. Moreover, the ability to launch multiple satellites in this weight category further makes it a preferred choice among many operators.

The 1,000-2,000 kg segment is predicted to be the fastest-growing segment during the forecast period. Collaborations among space agencies and commercial entities are facilitating the development of larger satellite constellations. For example, partnerships between companies like SpaceX and various government agencies have led to the launch of larger payloads, thereby increasing the demand for launch vehicles capable of carrying above 1,000 kg payloads.

By Launch Platform Analysis

Land Segment Holds Highest Market Share Owing to Better Cost Efficiency than Other Platforms

The market is divided by launch platform into land, air, and sea.

The land segment holds the highest market share due to several compelling factors. Land-based launch facilities are easier and less expensive to construct compared to sea or air platforms. The infrastructure for land launches, such as launch pads, assembly facilities, and support systems can be established with relative simplicity, reducing initial investment costs. Furthermore, fixed land launch sites allow for efficient assembly, fuel handling, and maintenance of launch vehicles. This cost advantage is crucial for small satellite operators who are often working with limited budgets.

The air segment is anticipated to account for a significant market share during the forecast period. Air-based platforms are particularly advantageous for specific applications, such as launching smaller payloads or conducting test flights. They can provide rapid response capabilities for urgent missions or experimental launches, thereby appealing to niche markets. The rise in test flights is a significant factor accelerating the growth of the segment.

By End User Analysis

Government Segment Holds Highest Share Owing to Increasing Launches for Earth Observation and Environmental Monitoring

The market is divided by end user into government, commercial, and military.

The government segment is anticipated to hold the highest market share and record the fastest CAGR during the forecast period. Governments are increasingly relying on small satellites for Earth observation, environmental monitoring, and disaster response. The ability to deploy constellations of small satellites allows for more frequent and detailed monitoring of natural disasters, climate change, and other critical issues, driving the demand for small launch vehicles.

The commercial segment is anticipated to show significant growth during the forecast period. The segment’s rapid growth is due to the increasing demand for small satellites, particularly for communication, Internet of Things (IoT), and remote sensing applications. Companies are launching small satellites in constellations to provide services, such as global internet coverage and data collection, which will drive the need for small launch vehicles.

REGIONAL INSIGHTS

The market is segmented into North America, Europe, Asia Pacific, and the Middle East & Africa.

Asia Pacific Small Launch Vehicle Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest small launch vehicle market share, is the fastest-growing region in the global market, and was valued at USD 0.71 billion in 2023. The region is witnessing a surge in satellite launches, particularly for communication and remote sensing purposes. This trend is supported by national space agencies, such as the Indian Space Research Organization (ISRO) and the China National Space Administration (CNSA). These agencies are investing heavily in SLV capabilities. The emergence of independent private players in the space sector is contributing to innovation and competition, further driving the regional market growth. These companies are focusing on developing cost-effective SLVs tailored for small satellite launches.

North America held a significant market share in 2023. The region is seeing a robust demand for SLVs, driven by commercial satellite operators and government agencies, particularly for deploying small satellites in Low Earth Orbit (LEO) for applications, such as communication and remote sensing. Companies, such as SpaceX and Blue Origin are leading the charge in commercial space exploration, thereby enhancing competition and innovation in the SLV sector. Their advancements in reusable rocket technology have significantly reduced launch costs, making space more accessible.

The market in Europe held the second-largest share in the base year. European companies are investing in advanced technologies, including reusable launch systems and improved propulsion methods, to enhance the efficiency and cost-effectiveness of SLVs. Increased collaboration among European nations and space agencies is fostering a supportive environment for SLV development. Initiatives like the European Space Agency's (ESA) programs are encouraging innovation and funding for new projects.

The Middle East & Africa will witness significant growth during the forecast period. Several countries in the MEA are launching national space programs and initiatives to develop their own satellite capabilities. For example, the United Arab Emirates has made significant investments in its space sector, including the launch of the Hope Probe to Mars. Partnerships with established space agencies and private companies from other regions are facilitating knowledge transfer and technology adoption, which is crucial for developing local SLV capabilities.

KEY INDUSTRY PLAYERS

Key Players Are Focusing On Increasing Launches, Expanding Launch Capabilities, and Strategic Partnerships

The small launch vehicle market is highly fragmented, with several players involved in the development of shelters. Few key players in the market are Rocket Labs, SpaceX, ISRO, and Blue Origin, among others. These companies are actively working on enhancing their capabilities to meet the growing demand for small satellite launches. While established players like SpaceX continue to dominate, emerging companies are exploring innovative solutions to carve out their niches in this competitive landscape. As the market evolves, the focus on cost-effectiveness, reliability, and technological advancements will be crucial for success.

List of Top Small Launch Vehicle Companies:

- Rocket Labs (U.S.)

- SpaceX (U.S.)

- Skyrora (U.K.)

- Relativity Space (U.S.)

- Blue Origin (U.S.)

- United Launch Alliance (U.S.)

- Isar Aerospace (Germany)

- Astra (U.S.)

- Firefly Aerospace (U.S.)

- Indian Space Research Organization (ISRO) (India)

- Gilmour Space Technologies (Australia)

- Galactic Energy (China)

KEY INDUSTRY DEVELOPMENTS:

- August 2024 – NASA added three companies to a contract to launch small satellite missions, including a publicly traded company that had recently been in financial trouble. NASA revealed that it had chosen Arrow Science and Technology, Impulse Space and Momentus Space for its Venture-Class Acquisition of Dedicated and Rideshare deal. This option allowed them to compete for work orders to launch special missions, mostly small satellites willing to take on greater risk in exchange for lower launch costs.

- June 2024 – ISROs signed an agreement for its latest rocket, the Small Satellite Launch Vehicle (SSLV), with the Australian Space Vehicle Corporation to launch a 450 kg satellite into the Low Earth Orbit (LEO). During the Indian Space Forum in New Delhi, the launch services agreement was signed between ISRO’s commercial arm, NSIL, and the Australian company. The Optimus spacecraft, due for launch in 2026, is the largest spacecraft designed and built by Australia. The agreement is part of a broader agreement between the Indian and Australian governments.

- June 2024 – Rocket Lab USA, a global leader in launch services and space systems, announced that it had signed the largest electric launch contract in the company's history – a 10-year deal with a Japanese land surveying company, Synspective.

- May 2024 – Rocket Lab launched the first of the two NASA Earth Science Cubes aboard an Electron Rocket on May 25th, seven years after the company's first launch. The Electron lifted off from Launch Pad 1 in New Zealand at 3:41 am ET after a brief pause due to wind. A 6U cube, part of NASA's Polar Radiant Energy in Space Challenge Experiment, or PREFIRE, was placed within 525 kilometers of the Sun at one time.

- July 2023 – The Indian Space Research Organization (ISRO) planned to move its Small Satellite Launch Vehicle (SSLV) to the private sector amid growing demand for small satellites. The space agency decided to choose an easy way to send small rockets to the industry.

REPORT COVERAGE

The report provides a detailed analysis of the market insights. It focuses on key aspects, such as leading companies, applications, payload capacity, long term & short term contracts, and space launches. Besides this, it offers insights into the market & supply chain trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

CAGR |

11.12% CAGR during the 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Propulsion

|

|

By Capacity

|

|

|

By Launch Platform

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at 1.55 billion in 2023 and is projected to reach USD 4.29 billion by 2032.

Registering a CAGR of 11.12%, the market will exhibit steady growth during the forecast period.

The liquid segment is leading this market.

Rocket Labs, SpaceX, Skyrora, Relativity Space, and Blue Origin are a few top players in the global market.

Asia Pacific dominated the market in terms of share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us