Solid-State Battery Market Size, Share & Industry Analysis, By Type (Single Layer and Multi-Layer), By Application (Consumer Electronics, Electric Vehicles, Medical Devices, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

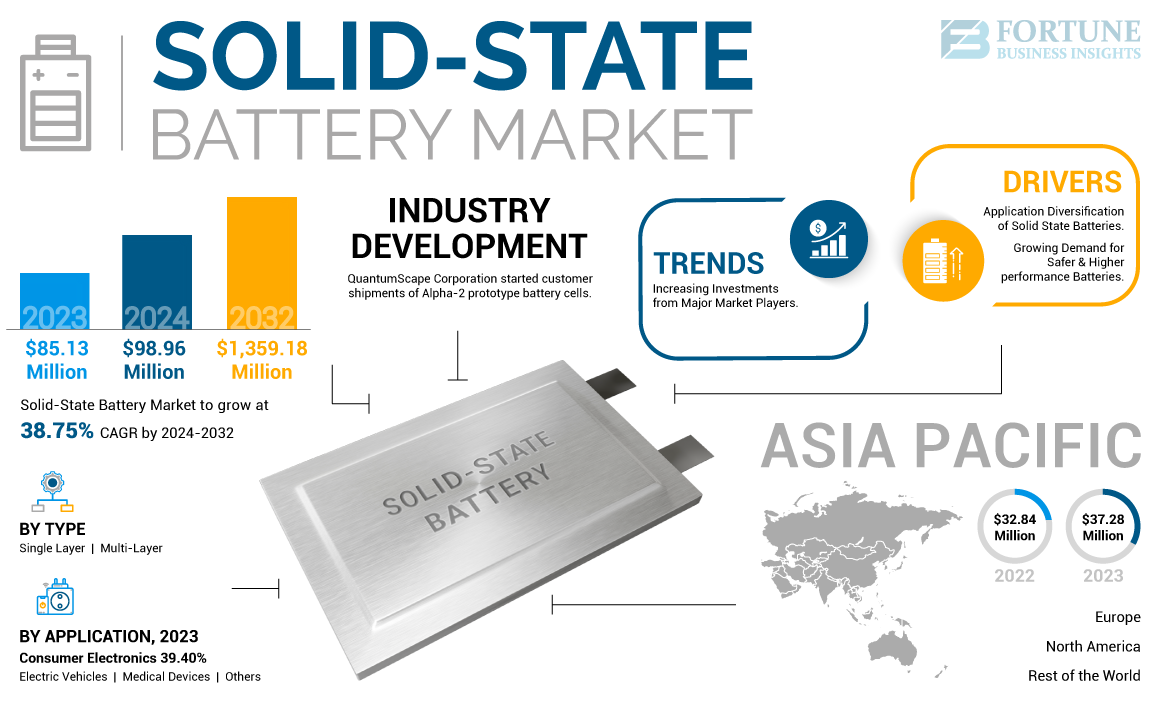

The global solid-state battery market size was valued at USD 98.96 million in 2024 and is projected to grow from USD 119.00 million in 2025 to USD 1,359.18 million by 2032, exhibiting a CAGR of 41.61% during the forecast period. Asia Pacific dominated the global market with a share of 43.76% in 2024.

A solid-state battery is one of the newest technologies that uses a solid electrolyte instead of liquid electrolytes made from materials such as ceramics, glass, or polymers. The solid-state design aims to overcome safety issues, such as the risk of fires or explosions in lithium-ion batteries, and improve energy density and performance. These batteries are considered the next generation of energy storage solutions due to their potential for higher energy density, longer lifespan, and improved safety compared to traditional lithium-ion batteries. This has sparked significant interest from industries ranging from consumer electronics to Electric Vehicles (EVs) and renewable energy storage. While there have been advancements, widespread commercialization is still early. Most solid-state batteries are currently in the prototype or pilot production phase.

Global Solid‑State Battery Market Overview

Market Size:

- 2024 Value: USD 98.96 million

- 2025 Value : USD 119.00 million

- 2032 Forecast Value: USD 1,359.18 million, with a CAGR of 41.61% from 2025–2032

Market Share:

- Regional Leader: Asia Pacific dominated the market with approximately 43.76% share in 2024

- Fastest‑Growing Region: Asia Pacific continues to lead growth given rising adoption in consumer electronics, EVs, and investment support

- End‑User Leader: The Consumer Electronics segment held the largest application share in 2024—notably ahead of electric vehicles and medical devices

Industry Trends:

- Accelerating investments and government support: Major automotive and battery firms (Toyota, BMW, QuantumScape, CATL, BYD) are increasing R&D and production plans, backed by government-backed funding and Massive capital deployment

- Rapid move toward mass production: Key regions such as Japan, Europe, China, and Taiwan gear up for SSB commercialization post‑2025

- Diversified applications: Expanding use across EVs, consumer electronics, medical devices, and grid storage due to solid-state batteries’ safety, longevity, and compactness

- Minimal pandemic disruption: The COVID-19 impact was limited, mostly delaying R&D investments and supply chain upgrades without altering growth trajectory

Driving Factors:

- Critical demand for safer, higher-performance batteries: Solid electrolytes reduce fire risks and support higher energy density, longevity, and charging speeds than conventional lithium‑ion technologies

- Broadening application diversity: Adoption across sectors—consumer devices, EVs, medical implants, and renewable storage—is fueling market expansion

- Government funding and strategic initiatives: Government programs (e.g., China backing CATL, BYD, etc.) are injecting significant capital into SSB commercialization path

- Technological progress toward manufacturability: Advances in single-layer vs. multi-layer designs, improved materials, and prototype production pave the way to scaling

The COVID-19 pandemic effect on the global solid-state battery market was minimal as the impact was related to a delay in investment in R&D projects of this technology. Moreover, the shortage of skilled laborers disrupted the supply chain and manufacturing operations due to the global lockdown, leading to delays in numerous projects. Furthermore, the increasing adoption of the autonomous industrial sector and EVs is likely to impact the global solid-state battery market positively.

Solid-State Battery Market Trends

Increasing Investments from Major Market Players along with Government Support for R&D

The market is witnessing a surge in investments from established companies and startups. Major players investing in the R&D of solid-state batteries include automotive manufacturers, battery manufacturers, and technology firms. Toyota, BMW, and QuantumScape are actively investing in research and development.

In March 2024, the Chinese government announced that it would invest over USD 830 million in a government-led initiative to advance Solid-State Battery (SSB) technology, with six companies listed to receive state funding. Some major companies are eligible for this government funding and support, including CATL, the world's largest battery manufacturer, and major automakers BYD and Geely. Alongside CATL, BYD, competing with Tesla as the world's largest EV seller, battery manufacturer, and automakers FAW, SAIC, and Geely, have been selected for the initiative.

Most companies across the globe planned to mass produce solid-state batteries in Japan (2025-2030), Europe (2025-2026), mainland China, and Taiwan (2023). The market will likely take off after 2025. Some of the major players announced their launch of SSB with big investments, such as Toyota's plans to spend USD 13.5 billion to develop electric vehicle battery technology by 2030. Volkswagen invested in a U.S. battery firm named QuantumScape, which announced its plans to introduce its first SSB by the end of 2024. The Samsung Advanced Institute of Technology has developed an SSB that can be charged/discharged over 1,000 times with 800 km of mileage on a single charge. Hyundai plans to invest USD 100 million into SolidEnergy Systems, which utilizes a process developed at the Massachusetts Institute of Technology.

Download Free sample to learn more about this report.

Solid-State Battery Market Growth Factors

Growing Demand for Safer and Higher-performance Batteries to Fuel Market Growth

The growing demand for safer and higher-performance batteries is a significant driver for expanding the solid-state batteries market. Traditional lithium-ion batteries, while widely used, have limitations in terms of safety, such as the risk of fire and explosion, and performance concerns, such as energy density and charging speed. Solid-state batteries use solid electrolytes instead of liquid ones, which reduces the risk of leakage, overheating, and fire hazards associated with flammable liquid electrolytes used in conventional batteries.

They have higher energy densities as they are designed to store more energy in the same volume or weight compared to traditional batteries. This is crucial for applications requiring long-lasting power in a smaller space, such as electric vehicles. The automotive industry, particularly electric cars, is a major growth driver in the market. As automakers strive to increase driving range and reduce charging times for EVs, solid-state batteries are a promising solution. Moreover, governments across the globe promote electric vehicle adoption through incentives and regulations, further fueling the demand for advanced battery technologies, such as solid-state batteries. Other sectors, such as consumer electronics and renewable energy storage, are also exploring the potential of solid-state batteries to meet their energy storage needs more effectively.

Application Diversification of Solid-State Batteries across Different Sectors to Propel Market Expansion

Initially, solid-state battery applications were focused mainly on consumer electronics and rising demand for electric vehicles. Solid-state batteries have been explored for various applications, including medical devices, aerospace, and grid energy storage. The ability to operate in extreme temperatures and offer higher energy densities makes them versatile across different sectors. In the medical field, solid-state batteries provide a reliable power source for critical medical devices such as pacemakers and defibrillators. Their compact size allows for easier integration into smaller, implantable medical devices. Solid-state batteries can be smaller and thinner, making them ideal for smartphones, smart cards, wearables, wireless sensors, and other portable electronics. They have a longer lifespan and degrade slower than conventional batteries, enhancing the durability of devices.

Moreover, as these battery packs can store large amounts of energy and can be deployed for grid-scale energy storage, improving the stability and efficiency of renewable energy sources, they can play a vital role in power generation and transmission systems in different sectors. The diversification across these sectors not only increases the overall demand but also fosters innovation and technological advancements in the market. As these batteries become more cost-effective and scalable, their adoption is expected to grow rapidly, driving further demand across various industries.

RESTRAINING FACTORS

Manufacturing Complexity and High Costs are the Major Challenges before Commercialization

Globally, there are increasing research and development projects and investments for all-solid-state batteries to achieve better safety, higher power and energy density, and wider operating temperature energy storage than conventional lithium-ion batteries. However, several challenges related to solidifying batteries remain to be addressed before the technology is ready for widespread commercialization. Producing solid-state batteries at scale and at a competitive cost is challenging due to the complexity of manufacturing processes and the materials involved.

The primary concerns are manufacturing costs, developing higher-capacity and higher-voltage cathodes, better anodes, and integrating thicker films into a solid-state geometry. Currently, thin-film solid-state batteries are fabricated using vacuum-based deposition techniques, such as RF and DC magnetron sputtering. Traditionally, larger batteries rely on more conventional deposition processes, such as slurry coating and calendaring. Therefore, more complex equipment is currently required for solid-state battery manufacturing, and the cost of fabricating these cells is very high. For instance, using contemporary technologies to scale up from milliamp-hour micro batteries to 1 amp-hour cells of a cell phone would cost thousands of dollars per battery. Scaling up the production of solid-state batteries while maintaining consistency and quality poses significant challenges. Manufacturing processes must be refined and automated to reduce costs and improve efficiency.

Solid-State Battery Market Segmentation Analysis

By Type Analysis

Single Layer Battery Dominates Market Owing to Its Simpler and Compact Structure

The market is segmented based on type into single-layer and multi-layer. The single-layer battery segment currently holds the major share of the market. These batteries typically feature a simpler structure with all components in one compact unit, offering advantages in manufacturing scalability and cost-efficiency.

On the other hand, multi-layer solid-state batteries utilize stacked or laminated structures, allowing for greater flexibility in optimizing power output and capacity while accommodating diverse applications from consumer electronics to electric vehicles.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Holds Major Share of Market Due to Better Power Delivery & Feasibility

Based on application, the market is segmented into consumer electronics, electric vehicles, medical devices, and others. The consumer electronics segment, followed by electric vehicles, holds a major share of the market. In consumer electronics, the demand for compact, long-lasting power sources with improved safety profiles drives the adoption of solid-state batteries, offering the potential for thinner devices and longer usage times without compromising safety.

Electric vehicles stand as the second largest segment in application due to the need for high-energy-density batteries that can withstand rigorous use and fast charging cycles, thereby enhancing driving range and performance while reducing weight and space requirements. These driving factors underscore EVs as one of the leading applications in solid-state batteries, given their potential to address long-range electric vehicle concerns and improve overall vehicle efficiency and sustainability in the rapidly growing electric mobility market.

Moreover, medical devices benefit from the stable performance and reduced risk of leakage in the case of solid-state batteries, which is critical for applications where reliability and safety are of greater importance.

REGIONAL INSIGHTS

Asia Pacific is Leading due to Increased Demand for Safer and More Efficient Batteries

The market has been studied geographically across five central regions: North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Solid-State Battery Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the leading region in the global market, followed by North America. In the region, especially in Japan and South Korea, solid-state batteries are widely applied in consumer electronics, including smartphones and wearable devices. The demand for safer, more efficient batteries in this technologically advanced market is a key driver.

In North America, particularly in the U.S., the leading application for solid-state batteries is in Electric Vehicles (EVs). With companies such as Tesla driving innovation in battery technology, there's a strong emphasis on enhancing range, safety, and performance in EVs, aligning with national goals of reducing carbon emissions and promoting sustainable transportation.

In Europe, there's a robust regulatory framework to reduce greenhouse gas emissions, and solid-state batteries are prominently used in EVs and renewable energy storage systems. The focus on environmental sustainability and energy independence drives the adoption of solid-state batteries to support clean energy initiatives.

In the rest of the world, which includes Latin America and Africa, solid-state batteries find applications in off-grid renewable energy solutions and medical devices, where reliability and longevity are critical. Overall, while EVs dominate in America and Europe due to environmental and technological advancements, consumer electronics play a pivotal role in Asia Pacific, and diversified applications cater to specific regional needs in the rest of the world.

KEY INDUSTRY PLAYERS

Key Players Drive Innovation and Strategic Partnerships to Develop Batteries for EVs

The global solid-state battery market competitive landscape consists of large-scale and emerging players developing solid-state batteries across the global market value chain. Companies are focusing on increased R&D for innovations in solid-state batteries to meet future requirements and to commercialize as soon as possible. Key players like Toyota are aiming to launch EVs with solid-state batteries as early as 2030. Moreover, Volkswagen announced that it would strategically collaborate with QuantumScape, a company they heavily invest in, to develop solid-state batteries specifically for EVs.

List of Top Solid-State Battery Companies:

- QuantumScape Battery, Inc. (U.S.)

- Solid Power Inc. (U.S.)

- Ilika (U.K.)

- Blue Solutions (France)

- Ampcera (U.S.)

- ProLogium Technology CO., Ltd. (Taiwan)

- BrightVolt, Inc. (U.S.)

- Hitachi Zosen Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Blue Solutions collaborated with the CNRS, the Collège de France, and Sorbonne University to develop the next generation of solid-state batteries in a two-year contract. This agreement illustrates the shared commitment to innovation and the pursuit of advanced energy solutions essential to the transition. It aims to mainly focus on hybrid electrolytes to improve range and enhance the safety of solid-state batteries.

- May 2024: Blue Solutions announced that it would develop and produce next-generation batteries for electric vehicles in Brittany and the Grand Est region, specifically in Alsace. The full-scale production is planned to start by 2030. This initiative aims to create nearly 1,500 jobs by 2032, which is supported by an investment of more than USD 2.38 billion.

- March 2024: QuantumScape Corporation announced that it had started customer shipments of Alpha-2 prototype battery cells, which is significant in delivering QSE-5, QuantumScape's first planned commercial product. The six-layer Alpha-2 prototype is more energy-dense than the earlier 24-layer A0 prototype. This is primarily due to higher-loading cathodes and more efficient packaging that optimizes the materials and space within the cell. These improvements in energy and power densities of Alpha-2 prototypes indicate that QSE-5 can push the boundaries of solid-state battery performance.

- September 2023: Blue Solutions signed a Memorandum of Understanding (MOU) with Foxconn, the world's largest electronics manufacturing services provider, and its subsidiary, SolidEdge Solution Inc., to jointly develop a solid-state battery ecosystem. The partnership agreed to combine their expertise and technologies to design and produce solid-state cell batteries for two-wheeled vehicles. Specifically, they will use Blue Solutions' innovative Gen4 technology and SolidEdge Solution's materials to equip two-wheeled vehicles to serve the target markets.

- August 2022: Hitachi Zosen Corporation and National Research and Development Agency Japan Aerospace Exploration Agency carried out a demonstration experiment for the charge and discharge operation of all-solid-state lithium-ion batteries which are installed in the Japanese Module-Kibo on the International Space Station (ISS). Along with the demonstration, they confirmed their performance in the space environment, thus marking the world's first success of its kind.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on crucial aspects such as major key players, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 41.61% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per Fortune Business Insights study, the market size was at USD 98.96 million in 2024.

The market is likely to grow at a staggering CAGR of 41.61% over the forecast period (2025-2032).

Based on application, the consumer electronics segment is leading the market.

The market size of Asia Pacific stood at USD 43.30 million in 2024.

Growing demand for safer and higher-performance batteries and application diversification of solid-state batteries are the key factors driving the market growth.

Some of the top players in the market are QuantumScape Battery, Inc., Solid Power, Inc., Dyson, and Ilika, among others.

The global market size is expected to reach USD 1,359.18 million by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us