Soy Derivatives Market Size, Share & Industry Analysis, By Type (Soy Meal, Soy Oil, Soy Milk, Soy Flour, and Others), Application (Animal Feed [Poultry, Swine, and Others], Food [Baked Goods, Meat Alternatives, and Others], and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

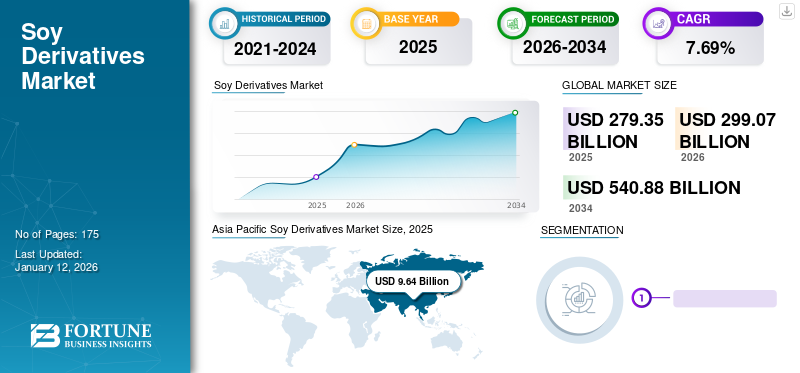

The global soy derivatives market size was USD 279.35 billion in 2025 and is projected to grow from USD 299.07 billion in 2026 to USD 540.88 billion by 2034 at a CAGR of 7.69% over the 2026-2034 period. Asia Pacific dominated the soy derivatives market with a market share of 3.45% in 2025.

Moreover, the soy derivatives market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 83.17 billion by 2032, driven by increasing consumer shift towards vegan and vegetarian diet.

The demand for soy derivatives is expected to continue growing in the coming years, owing to various factors. The growth in population figures, rising consumption of meat and soy-based health products, and growing demand for biodiesel as a fuel alternative are anticipated to drive the global soy derivatives industry in the forthcoming years.

The massive closure of industries and the logistical bottlenecks have also affected livestock farmers and, in turn, soybean producers since meat production represents the major purchaser for this industry. But the rising demand for plant-based protein sources can support the steady growth of the industry. Moreover, the current U.S.-China trade war has been an essential factor in reshaping the soybean trade flows globally since the United States represents around 40% of the total soybean exports to China. This conflict could lead to unexpected impacts on the market.

The global market is festering due to the novel coronavirus. Labor shortages and logistic limitations have become top trepidations for companies. However, with the high level of COVID-19 cases in key producing economies, the soybean industry continues to operate, with farmers in Brazil, Argentina, and the United States crushing record amounts of soybeans. Nevertheless, logistical bottlenecks have limited the crushing, transport, and export of the crop. But, farmers in these countries stored their production to sell it later when market conditions recovered, given the reduced crop demand and impact of the lockdown. Presently, the situation has improved with the decreasing number of new confirmed cases. As the pandemic is well controlled and transportation restrictions are lifted in recent months, the production of several soy derivatives will increase in the coming period.

Global Soy Derivatives Market Overview

Market Size:

- 2025 Value: USD 279.35 billion

- 2026 Value: USD 299.07 billion

- 2034 Forecast Value: USD 540.88 billion, with a CAGR of 7.69% from 2026–2034

Market Share:

- Asia Pacific dominated the soy derivatives market with a market share of 3.45% in 2025 and is expected to maintain growth due to rising demand for plant-based protein and increased soy consumption across the food and feed industries.

- The animal feed segment is expected to hold an 83% share in 2025.

Key Country Highlights:

- U.S.: The soy derivatives market size is projected to reach USD 83.17 billion by 2032.

- Japan: The soy derivatives market is expected to reach USD 3.59 billion by 2025.

- India: Projected to witness a strong CAGR of 7.55% during the forecast period.

- Europe: Anticipated to grow at a CAGR of 7.78% during the forecast period.

Soy Derivatives Market Trends

Fortification of Products is a Prominent Trend

Traditional soy derivatives have nutritional properties and some health benefits. The increasing interest of companies in the fortification and addition of functional ingredients can encourage consumers to opt for the product. Fortified products provide benefits beyond basic nutrition and may play a vital role in reducing or minimizing the risk of certain diseases. The rising number of fortified products in the retail market is expected to drive the global market. For instance, in April 2024, Yeo Hiap Seng, a Singapore-based company, launched its new soy milk. The newly launched Immuno Soy Milk, fortified with vitamin B6 and Zinc, improves users' immune systems. The new beverage is available through several sales channels across Singapore and Malaysia.

Download Free sample to learn more about this report.

Soy Derivatives Market Growth Factors

Increasing Livestock Production to Spur Product Demand

Soybean plays a significant role as an important plant-based protein source to increase the nutrition of the community because, in addition to being safe for health, it is also relatively cheap compared to the source of animal protein. According to Eurostat, by the end of 2022, approximately 134 million pigs, 75 million bovine animals, and 70 million sheep and goats were produced in Europe. Soybean is one of the few complete protein plant-based foods with nine essential amino acids. For this reason, it has become a crucial source of human and animal protein. Approx. 70-80% of its cultivation is used for animal feed and the remaining is destined for direct human consumption. The demand for soybeans is presently tied to global meat consumption and is likely to grow in the upcoming years, owing to the rising livestock production across the globe.

Surging Soybean Production and Rising Expenditure on R&D to Drive Growth

China is one of the leading soybean consumers globally, and the country imports most of it from North America. Hence, the increasing focus of the government on technical assistance to surge these yields in China can help meet the demand for soy while reducing the land pressure in other parts of the world. Though, with millions of small farmers involved, improving production practices will be a significant challenge. Furthermore, several initiatives taken by the Chinese government can help increase the area under soybean cultivation. For instance, in December 2022, the Chinese government stepped up to promote regional grain production. Under this plan, the government issued a subsidy worth approximately USD 5.75 million to the farmers of rice, soybean, and corn. The rising production of this crop can drive the global market in the near future.

The investment in research and development activities positively influences the capability of a manufacturer's production technology and its quality. The technological improvement in the process to enhance efficiency enables manufacturers to expand their business capabilities. Furthermore, the rising expenditure on technology for soybean seed breeding and planting to improve productivity and yields of soybean oil and protein is likely to support the market's steady growth.

RESTRAINING FACTORS

High Presence of Unsaturated Fatty Acids in Soy Derivatives to Impede Performance

The demand for soy derivatives will continue to increase over the coming decades. But, a decrease in the agricultural land and declining soil quality due to the use of harmful fertilizers is expected to restrain the market growth in the forthcoming years. Moreover, the high presence of unsaturated fatty acids in soy that are dangerous to human health is predicted to hamper the market growth. The rising usage of biomass and other sugar derivatives such as sucrose for bioplastic manufacturing can also inhibit the soy derivatives market growth.

Soy Derivatives Market Segmentation Analysis

By Type Analysis

Soy Meal Segment to Hold Major Share Backed by Increasing Demand from Animal Feed Industry

On the basis of type, the market is classified into soy meal, soy oil, soy milk, soy flour, and others. The soy meal segment held a dominant soy derivatives market share in 2024. As the global demand for dairy products and cheap meat has grown, the demand for soy meal as a high-protein and affordable livestock feed has also surged in the last few years. The rising demand for meat and increased livestock production across the globe can support the steady growth of the segment. The soy meal segment accounted for 77.90% of the total market share in 2026.

Soy oil is utilized as an ingredient in many baked and fried products and as margarine in many processed and derived products. Furthermore, the growth of the lactose intolerant population and rising demand for plant-based milk are predicted to positively impact the growth of the soy milk segment. Companies operating this market are embarking on the base expansion of their soy protein facility to fulfill the rising demand for plant-based protein. For instance, in May 2023, Kansas Protein Foods LLC, an American plant-based proteins manufacturer, launched Imagic Plant-Based Smoky Breakfast Meat, made from soy flour. This ready-to-eat breakfast product holds halal, kosher & vegan certificates and is available across different sales channels. The increasing popularity of plant-based protein is expected to augment the demand and sales of soy protein.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Food Segment to Grow at the Fastest Pace in Near Future

Based on application, the global market has been categorized into animal feed, food, and others. Soybeans have been grown for many years and most of them are consumed indirectly. The vast majority of soy is milled into high-protein soymeal, which has been mostly utilized in animal feed preparation as it is considered to be one of the cheapest and sustainable sources of proteins. The food segment is predicted to grow at the highest CAGR in the forthcoming years. The rising utilization of soy oil for cooking and other derivatives of soybean, such as soy flour and emulsifier lecithin for the manufacturing of processed foods, including chocolate, ice cream, and baked goods, is predicted to support the growth of the segment. The animal feed segment is expected to hold a 83.50% share in 2026.

Lately, soybean oil has also been used to produce biodiesel, although this occupies a small proportion of the total soy production. But, with the developing science and novel technology, soybean derivatives applications will be increased for industrial applications in the upcoming years.

REGIONAL INSIGHTS

Asia Pacific Soy Derivatives Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Soybeans have been consumed for thousands of years in Asia, but soy consumption has expanded dramatically within the food and feed industry over the last few decades. The increasing demand for poultry and other meat, coupled with the rapid urbanization, surging household income, and the rising expenditure on plant-based food products, has supported the demand for the product in Asia Pacific. Presently, the Asia Pacific held a significant market share, with the market size valued at USD 9.64 billion in 2025 and increasing to USD 10.33 billion in 2026, accounting for 3.45% of the market in 2025.

The rising product acceptability, intense competition, and increasing consumer base have pushed operating companies to strive for competitive advantages through novelties with respect to the delivery of service and product offerings. The local market players are trying to strengthen their footprints in the Asian market by expanding their product portfolios. For instance, in February 2021, Indian health beverage company Life Health Foods launched a new brand, So Good. Under this new brand, the company offers dairy-free plant-based milk, including healthy and nutritious soy drinks.

- The soy derivatives market in Japan is expected to reach USD 3.84 billion by 2026.

- India is projected to reach USD 10.49 billion by 2026.

- The Japan market is projected to reach USD 3.84 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is likely to hold the second-largest share in the market. The increasing consumer shift towards a vegan or vegetarian diet, the rising number of lactose-intolerant people, and continuous innovation in the industry are anticipated to support the steady growth of the American market. The presence of key players, the rising area under soybean cultivation, and easy availability of raw material, i.e. soybean within the region, are likely to positively impact the overall growth scenario. The US market is projected to reach USD 59.29 billion by 2026.

The market in Europe is anticipated to grow at the highest CAGR in the upcoming years. The demand for derivatives of soybean, especially soy meal grew due to the ban on processed animal proteins in animal feed, such as bone meal and meat, due to the bovine spongiform encephalopathy outbreak. It has increased further as fishmeal or another potential animal feed is persistently used in fish farming. Furthermore, the upsurging support for biofuels production is also a factor in soy consumption in the region. The United Kingdom market is projected to reach USD 2.67 billion by 2026, while the Germany market is projected to reach USD 3.09 billion by 2026.

List of Key Companies in Soy Derivatives Market

Focusing on Joint Ventures with Relevant Stakeholders to Help Companies Expand Their Global Reach

The global market is moderately consolidated with the presence of a few prominent players. The increasing popularity of plant-based products and the rising demand for animal feed have significantly led to a surge in the demand for these derivatives. Companies, such as Archer Daniels Midland Company, Bunge Limited, and Cargill Incorporated, are embarking on mergers and acquisitions and joint ventures with relevant stakeholders for product marketing and portfolio broadening.

Key players in the industry are emphasizing their focus on expanding their production capacity to meet the product demand from the different end-use industries. For instance, in November 2023, Cargill Inc., one of the leading global food & feed ingredients manufacturers, invested in expanding and modernizing its soybean crushing and refined oil facility in Sidney, Ohio.

List of Top Soy Derivatives Companies:

- Archer Daniels Midland Company (Illinois, United States)

- Cargill, Incorporated (Minnesota, United States)

- CHS Inc. (Minnesota, United States)

- Bunge Limited (Missouri, United States)

- Louis Dreyfus Company B.V. (Netherlands)

- Wilmar International Ltd. (Singapore)

- AG Processing Inc. (Nebraska, United States)

- DuPont Nutrition and Health (Delaware, United States)

- Noble Group (Hong Kong)

- Tyson Foods (Arkansas, United States)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Louis Dreyfus Company B.V., a French company involved in agriculture & food processing activities, planned to build a soybean processing plant in Ohio. The company aims to build the facility to crush nearly 1.5 million metric tons of soybean annually. The construction will start in early 2024.

- October 2023: Nestle SA, a multinational food and beverages company, launched an instant milk powder product across the Central and West African markets. The Hybrid instant milk products are manufactured from dairy and plant-based sources, i.e., soy.

- February 2023: Nestle S.A., a global food & beverages company, launched its new high-protein drink, “Milo Soy,” made from soy and barley malt extract. The company invested nearly USD 4.09 million in developing and marketing the newly launched product to enter Thailand’s market.

- November 2022: Ag Processing Inc., an American agribusiness company, invested approximately USD 72 million to expand its soybean processing facility in Sergeant Bluff, Iowa, U.S.

- March 2020: A Japanese brand Asahi announced the launch of a plant-based variety of its cultured milk drink Calpis, using soy milk instead of regular milk.

REPORT COVERAGE

The market research report includes qualitative and quantitative insights into the industry. It also offers a detailed analysis of the market size and growth rate for all possible segments. Various key insights presented in the report include an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 7.69% from 2026 to 2034 |

|

Segmentation |

By Application

By Type

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 279.35 billion in 2025 and is projected to reach USD 540.88 billion by 2034.

Registering a CAGR of 7.69%, the market will exhibit promising growth over the forecast period (2026-2034).

Based on the product type, the market is expected to lead during the forecast period.

The increasing demand for poultry and other meat is the key factor driving the market growth.

Archer Daniels Midland Company, Bunge Ltd., Louis Dreyfus Commodities Group, and Cargill Incorporated are a few of the leading players in the market.

Asia Pacific dominated the market in terms of share in 2025.

Based on the application, the animal feed segment holds a major share in the global market.

The fortification of products is the key market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us