Spacecraft Avionics Market Size, Share & Industry Analysis, By Orbit Type (LEO, MEO, and GEO), By Satellite Type (CubeSat and Small Satellite, Medium Satellite, and Heavy Satellite), By Component (Command & Data Handling Systems, Motor Control Electronics, Processors and Memory, GPS Receiver, and Others), By End-User (Commercial, Defense, and Civil & Government) and Regional Forecasts, 2024-2032

KEY MARKET INSIGHTS

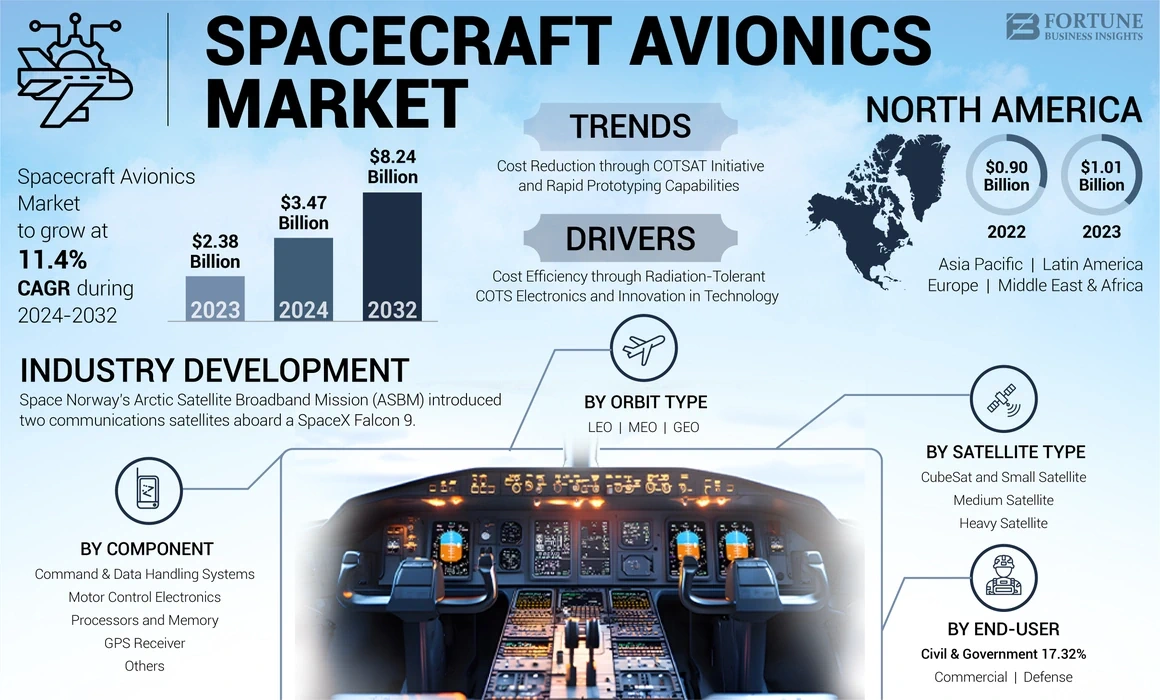

The global spacecraft avionics market size was valued at USD 2.38 billion in 2023. The market is projected to grow from USD 3.47 billion in 2024 to USD 8.24 billion by 2032, exhibiting a CAGR of 11.4% during the forecast period. North America dominated the spacecraft avionics market with a market share of 42.44% in 2023.

The computing devices responsible for controlling and operating a spacecraft, such as its flight, navigation, and communications, are known as spacecraft avionics. These systems enable the commanding and control of the spacecraft during flight operations, managing spacecraft data, facilitating communication, and supplying electrical power to the spacecraft. Additionally, the spacecraft's attitude is regulated by avionics. These systems help to manage a spacecraft's trajectory and facilitate command and flight control throughout flight activities. They consist of multiple components that serve as the spacecraft's "intelligence."

The involvement of major key players such as Airbus, L3Harris Technologies, Inc., National Aeronautics and Space Administration (NASA) and so on within the market drives the future potential capabilities and aids the significant growth of the market.

Spacecraft Avionics Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 2.38 billion

- 2024 Market Size: USD 3.47 billion

- 2032 Forecast Market Size: USD 8.24 billion

- CAGR: 11.4% from 2024–2032

Market Share:

- North America dominated the spacecraft avionics market with a 42.44% share in 2023, driven by high defense spending, NASA’s ongoing satellite and deep-space programs, and rapid adoption of radiation-tolerant COTS electronics.

- By orbit, LEO captured the largest share and is expected to grow fastest due to rising satellite launches and constellation programs. CubeSat and small satellites lead by satellite type owing to cost-effectiveness and shared launch opportunities.

Key Country Highlights:

- United States: Major driver with NASA’s USD 2.4 billion Earth science budget in 2024 and significant defense satellite investments.

- India: New Space Policy 2023 and USD 3 billion allocation for space contracts aim to reduce foreign satellite reliance.

- China: Leading in satellite launches (60 missions planned in 2023) with large-scale investments in space-based ISR capabilities.

- Europe: ESA budget of USD 8.37 billion in 2024 fuels satellite and exploration programs, with France and Germany at forefront.

SPACE EXPENDITURE

Increasing Development and Launch of Satellites Fuels Market Progression

Several interconnected factors contribute to the rise in global space spending, including advancements in technology, increased private investment, and a greater understanding of the strategic significance of space. The expansion is fueled by progress in satellite and rocket technology, which improves communication, navigation, and Earth observation capabilities. The growing dependence on space-based technologies in sectors such as retail and disaster management also drives this growth.

For instance, in 2023, Based on a report from Space Foundation.org, the total global space budget reached USD 570 billion in 2023, marking a 7.4% increase from the revised sum of USD 531 billion in 2022. This increase aligns with the industry's five-year CAGR of 7.3% and is almost twice the size of the space economy from the previous decade.

The expense of sending satellites into space has dropped by almost ten times in the last twenty years, making it more financially viable for both government and private organizations to participate in space missions. Additionally, there has been an unprecedented increase in private funding in the space industry. Governments are promoting involvement from the private sector in space endeavors. For instance, in India, the government established New Space India Limited (NSIL) in 2019 to capitalize on the commercial space market. In April 2023, the Indian Space Policy was ratified to enable private sector engagement in the space industry.

Moreover, a greater number of countries are venturing into space, leading to a more diverse investment landscape. Luxembourg and Australia have launched ambitious space initiatives and developing economies are also beginning to allocate resources for space research and development.

Looking ahead, there are plans for a significant number of satellite launches worldwide from 2024 to 2032, indicating a robust trajectory for the global space industry.

Get comprehensive study about this report by, Download free sample copy

MARKET DYNAMICS

MARKET DRIVERS

Cost Efficiency through Radiation-Tolerant COTS Electronics and Technological Innovation Drives Market Growth

The use of radiation-resistant Commercial Off-The-Shelf (COTS) electronics in spacecraft avionics is a key driver, as it reduces costs while upholding performance and dependability. This is especially important as space missions become more demanding and financial limitations tighten. Using Commercial Off-The-Shelf (COTS) electronics can lead to significant cost reductions in comparison to conventional radiation-hardened parts. Smart Backplane technology makes it possible to employ regular COTS modules in radiation-heavy settings, cutting down overall system expenses by approximately 70-75%, while still meeting mission reliability standards.

For instance, in August 2024, Military researchers in the U.S. required fresh testing approaches for radiation-induced Single-Event Effects (SEE) on high-reliability next-generation electronics.

MARKET RESTRAINTS

High Costs for Testing and Qualification and Complex Integration of Subsystems Can Hinder Market Growth

Integrating avionics into spacecraft involves various challenges and disadvantages that can impact performance, reliability, and cost. While using Commercial Off-The-Shelf (COTS) electronics can lower costs, integrating these components into avionics systems still requires significant investment in testing and qualification processes to ensure reliability in space conditions.

Additionally, the need for specialized components that can withstand harsh environments can drive up costs, making budget management a critical concern for many missions. Integrating various avionics subsystems such as Command and Data Handling (CDH), Flight Software (FSW), and communication systems can be complex. Each subsystem must be compatible with others, requiring careful planning and design to ensure interoperability. This complexity increases the risk of integration errors, which can jeopardize mission success.

MARKET OPPORTUNITIES

Integration of AI and ML and Increased Demand for Autonomous Operations Bolster Market Growth

The global spacecraft avionics market growth is propelled by significant innovation driven by emerging technologies and evolving mission requirements.

The integration of AI and machine learning into avionics systems presents a transformative opportunity. These technologies can enhance automation in navigation, fault detection, and data analysis, allowing spacecraft to operate with greater autonomy. This is particularly beneficial for long-duration missions where real-time human oversight is limited.

For instance, Orbit Aerospace was awarded a USD 1.8 million contract from AFWERX to utilize artificial intelligence for the detection and management of anomalies in hypersonic flight. The company is creating machine-learning tools to ensure more dependable flight operations across all flight envelopes. In Orbit's goal is to facilitate the transportation of cargo to and from space stations, particularly as return journeys through Earth's atmosphere occur at hypersonic speeds, In Orbit's engineers are enthusiastic about leveraging artificial intelligence to enhance the reliability of vehicles.

As the demand for autonomous operations increases, there is a growing opportunity to develop advanced avionics for Unmanned Aerial Vehicles (UAVs) and spacecraft. These systems can facilitate safer and more efficient operations in complex environments, such as Urban Air Mobility (UAM) scenarios and deep-space exploration missions.

MARKET CHALLENGES

Complexity of Satellite Constellations and SWaP-C Constraints Pose as a Major Barrier

Smaller spacecraft, such as CubeSats, face unique challenges related to SWaP-C (Size, Weight, Power and Cost) constraints. These systems often balance reduced costs with the need for reliability and performance, leading to trade-offs that can impact mission success.

The rise of satellite constellations introduces complexities in avionics design related to inter-satellite communications, synchronization, and coordinated operations. Ensuring that multiple satellites can operate cohesively adds layers of complexity to mission planning and execution.

As avionics systems evolve, there is a growing need for updated certification frameworks that can make provision for new technologies so that safety standards are met. This evolution poses challenges for both manufacturers and regulatory bodies.

Moreover, prolonged exposure to microgravity can impact the performance of both equipment and crew members. Avionics systems must be designed to account for these effects to ensure operational reliability during extended missions.

The challenges faced by spacecraft avionics are multifaceted, encompassing technological advancements, operational requirements, and environmental considerations.

SPACECRAFT AVIONICS MARKET TRENDS

Cost Reduction through COTSAT Initiative and Rapid Prototyping Capabilities

The development of the Cost Optimized Test of Spacecraft Avionics and Technologies (COTSAT) is expected to significantly influence market growth during the forecast period. This initiative focuses on reducing costs while enhancing the reliability and performance of spacecraft avionics, making it a pivotal factor in the evolving aerospace landscape.

COTSAT focuses on reducing the expenses associated with developing and constructing spacecraft technologies while facilitating quick prototyping. The initial prototype spacecraft, referred to as CheapSat, represents the first in a potential series of cost-effective spacecraft designed for conducting scientific experiments and demonstrating new technologies. The spacecraft platform is engineered to support affordable access to space for various remote-sensing payloads while maintaining a flexible architecture that can handle potential Space Life Sciences payloads.

- North America witnessed spacecraft avionics market growth from USD 0.90 Billion in 2022 to USD 1.01 Billion in 2023.

COTSAT aims to showcase how spacecraft design costs can be significantly reduced and to create techniques and technologies for maximizing the reuse of spacecraft hardware and software, and related technology in future missions. This strategy will facilitate quick response capabilities by leveraging advancements in rapid prototyping.

Download Free sample to learn more about this report.

SEGMENTATION

By Orbit Type Analysis

LEO Poised for Rapid Growth with Rising Demand for Satellite Launches

Based on orbit type, the market is divided into LEO, MEO, and GEO. LEO captured the largest global spacecraft avionics market share in 2023 and is anticipated to register the fastest CAGR during the forecast period. The growing demand from major end-users toward launching satellites in the LEO orbit is expected to drive market growth. Factors contributing to the growth in satellite launches in LEO include operational efficiency, technological advancements, and economic considerations. For instance, in April 2022, LeoStella launched its BlackSky Global 20 satellite into LEO for a space-based intelligence company that delivers real-time imagery.

By Satellite Type Analysis

CubeSat and Small Satellites Leadership Driven by Cost-Effectiveness and Launch Efficiency

By satellite type, the market is divided into cubesat and small satellite, medium satellite, and heavy satellite. Cubesat and small satellites dominated the global spacecraft avionics market in 2023 and is anticipated to exhibit the fastest CAGR during the forecast period. CubeSats and small satellites are significantly cheaper to build and launch compared to traditional satellites. Their compact size allows them to share rides on larger rockets as secondary payloads, effectively reducing overall launch expenses, which contributes to the growth of the segment.

Moreover, as the space industry continues to evolve, factors such as flexibility in applications, technological advancements, and increased accessibility for various stakeholders are poised to play a significant role in shaping the future of space exploration and utilization. For instance, in July 2024, Firefly Aerospace successfully deployed eight CubeSats into orbit as part of a mission funded by NASA using the company’s Alpha rocket's inaugural flight. The deployment of the CubeSat began approximately 35 minutes after the upper stage of the rocket was shut down, in line with Firefly's timeline, and was expected to take around 11 minutes to complete.

By Component Analysis

Others Segment Led the Market Due to High Demand for Enhanced Connectivity

As per component, the market is categorized into command & data handling systems, motor control electronics, processors and memory, GPS receiver, and others.

Others segment dominated the spacecraft avionics market in 2023. Others segment includes the navigation system, threat protection system, performance monitors data acquisition and so on. Increasing demand from various major customers for swift satellite applications to enhance connectivity and data transmission solutions, navigation systems is expected to drive market growth. For instance, in January 2023, Central European Institute of Technology launched its BDSAT-2 communication satellite for HAM and radio activities. The intricate design and integration of these components are fundamental to a satellite's ability to perform its intended functions in space, catalyzing growth in the segment.

By End-User Analysis

The Demand of Satellites Are Proliferate from Defense Sector as National Security Concerns Aid the Market Growth

By end-user, the market is fragmented into commercial, defense, and civil & government. Defense is estimated to be the fastest growing segment during the forecast period of 2024-2032. The growing interest in satellite investments by defense end-users is driven by several strategic and technological factors. These investments are crucial for enhancing national security, improving operational capabilities, and leveraging advanced technologies.

- The civil & government segment is expected to hold a 17.32% share in 2023.

The rise in satellite investments by defense end-users reflects a multifaceted trend influenced by the need for enhanced surveillance, secure communication, precise navigation, and the benefits of technological advancements. As nations continue to prioritize national security amid evolving threats, the role of satellites will become more critical in shaping modern defense strategies. For instance, in March 2024, over the next few years, India intends to allocate approximately USD 3 billion for contract awards related to space, aiming to diminish its reliance on foreign satellites and enhance its counter-space capabilities.

To know how our report can help streamline your business, Speak to Analyst

PORTERS FIVE FORCES ANALYSIS

- Threat of Substitute: Moderate: - The rise of alternative technologies, such as advanced Commercial Off-The-Shelf (COTS) components and software-defined systems, poses a potential threat to traditional avionics. As these substitutes become more cost-effective and technologically advanced, they may attract customers away from established avionics systems.

- Bargaining Power of Supplier: Moderate to High: - The avionics market relies on a limited number of specialized suppliers for critical components, which can increase their bargaining power. Suppliers with unique technologies or capabilities can exert more influence over pricing and terms, impacting manufacturers' costs.

- Bargaining Power of Buyer: Moderate to High: - Major customers, such as government agencies and large aerospace manufacturers, possess significant bargaining power due to their purchasing volume. Buyers increasingly demand tailored solutions that meet specific operational needs, leading to intense negotiations over pricing and terms.

- Threat of New Entrant: Low to Moderate: - Developing advanced avionics systems requires significant investment in research, development, and manufacturing capabilities, creating a financial barrier that can deter new entrants. In addition, stringent regulations and certification processes for avionics systems present additional hurdles for new companies trying to enter the market.

- Competitive Rivalry: Moderate to High: - The market is characterized by intense competition among established players such as Boeing, Thales Group, and Lockheed Martin. These companies continuously innovate to maintain market share, and the rapid pace of technological advancement necessitates ongoing investment in research and development, further intensifying competition.

SPACECRAFT AVIONICS MARKET REGIONAL OUTLOOK

By geography, the market for spacecraft avionics is studied across North America, Asia Pacific, Europe, Middle East & Africa, and Latin America.

North America Spacecraft Avionics Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest share of the global spacecraft avionics market. The region is witnessing a surge in investment driven by technological advancements, increased demand for satellite launching by commercial and private sectors, and significant defense spending. Increased government expenditures on defense are propelling growth in the defense sector. The U.S. Department of Defense continues to invest heavily in defense space programs with advanced avionics capabilities, which is catalyzing market growth. In addition, commercial, private, and government entities are also heavily increasing their investment in space programs in the U.S. For instance, in April 2024, NASA allocated USD 2.4 billion to its Earth science program to support missions and activities. It promotes Earth systems science and enhances the availability of information for reducing natural hazards, backing climate action, and overseeing natural resources.

Asia Pacific is estimated to be the fastest-growing region during the forecast period. China, India, Japan, and Australia are focused on significant investment in the space industry. Governments are recognizing the strategic importance of space for national security. While China, India, and Australia are enhancing their capabilities to independently monitor regional threats without relying on foreign technologies. In addition, the rise of private companies in the space sector, particularly in China, India, and Japan, is also noteworthy as commercial ventures are starting to supplement government efforts. For instance, in January 2023, after more than 50 launches in 2022, the China Aerospace Science and Technology Corporation (CASC) announced that the Chinese government planned to launch 60 space missions and more than 200 spacecraft in 2023.

Europe is projected to be the second-fastest growing region during the forecast period. European governments are recognizing the importance of space technology for economic recovery and resilience, leading to increased investments in space technologies. Germany and France are also increasing their budgets for space exploration and satellite technology development. For instance, the ESA's (European Space Agency) budget for 2024 is USD 8.37 billion, with funding allocated to mandatory and optional programs. Member states contribute to mandatory programs based on their Gross National Product (GNP), with ESA investing in each member state through industrial contracts for space programs.

The remainder of the globe encompasses the Middle East & Africa and Latin America. During the study period, growth in the Middle East & Africa will be moderate. This growth is attributed to the increased focus on space sector development and the launch of ambitious space programs in Israel, Saudi Arabia, and the UAE. For instance, in March 2023, Israel Aerospace Industries (IAI) launched the Ofeq 13 earth observation satellite, focusing on radar imaging for landscapes and geographical areas analysis for the Israel Ministry of Defense.

In Latin America, countries are primarily concentrated on space services and space-related equipment. Market growth in the region is anticipated to be fueled by an uptick in contracts for space launches in Brazil, Argentina, and Colombia. For instance, in July 2024, Argentina joined NASA's Artemis Accords, becoming the 28th country to do so. The Artemis Accords are designed to encourage peaceful space exploration, with a focus on the Moon. This agreement highlights the importance of working together in space exploration and sets out guidelines for international collaboration, safety, and openness in space endeavors.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Players Focus on Technological Advancements to Enhance Performance Across Various Applications

Leading players in the spacecraft avionics market are prioritizing technological advancements to enhance performance across various applications. By focusing on standards such as integrating AI, improving connectivity solutions, and enhancing navigation capabilities, the industry is poised for significant growth and innovation in the coming years. For instance, in April 2024, the increasing requirements of missions require reliable, technologically advanced, and cost-efficient solutions with a proven track record of performance. L3Harris offers a complete set of avionics, such as communication systems, range safety receivers, power distribution, data acquisition, flight computers, and navigation capabilities.

LIST OF KEY SPACECRAFT AVIONICS COMPANIES PROFILED:

- Airbus (Netherlands)

- Moog Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Raytheon Technologies Inc. (U.S.)

- TSD-Space (Italy)

- National Aeronautics and Space Administration (NASA) (U.S.)

- Southwest Research Institute (SwRI) (U.S.)

- Safran S.A. (France)

KEY INDUSTRY DEVELOPMENTS

- November 2024: China’s AVIC has gained a contract from the China Manned Space Agency to create a winged, reusable spacecraft known as Haolong. The purpose of this reusable spacecraft is reportedly to transport cargo to China’s Tiangong space station.

- September 2024: A research satellite was sent into orbit by Iran using a rocket constructed by the Revolutionary Guards. The Chamran-1 satellite was put into a 550-kilometer (340-mile) orbit by the Qaem-100 satellite carrier, and its initial signals have been successfully received.

- August 2024: Space Norway's Arctic Satellite Broadband Mission (ASBM) launched two communications satellites aboard a SpaceX Falcon 9. Space Norway, a state-owned enterprise, offers satellite communication services and infrastructure for government, defense, and commercial industries. The ASBM satellites, constructed by Northrop Grumman, are designed to deliver broadband communications services across the North Pole and high-latitude regions.

- July 2024: Turkey's inaugural domestically constructed communications satellite, Turksat 6A, was sent to geostationary orbit by SpaceX Falcon 9 rocket. Managed by state-owned satellite operator Turksat, Turksat 6A, is equipped with Ku- and X-band transponders. It offers satellite TV and communication services across sections of Europe, the Middle East, and Asia, encompassing four nations not previously covered by Turksat.

- May 2024: Brazil and China announced a joint meteorological satellite project at the Sino-Brazilian High-Level Commission for Coordination and Cooperation (Cosban) meeting in Beijing, marking a new phase in their space collaboration. Another joint project between Brazil and China, the Cbers-6 radar satellite, which is scheduled to be launched in 2028, is also making progress. Unlike previous Sino-Brazilian satellites, which captured still images, this smaller and more advanced satellite utilizes radar technology.

REPORT COVERAGE

The report provides an in-depth market analysis. It comprises all major aspects, such as R&D capabilities, supply chain management, competitive landscape, and optimization of the manufacturing capabilities and operating services. Moreover, the report offers insights into the global market trends, growth analysis, and size and highlights key industry developments. In addition to the above-mentioned factors, it mainly focuses on several factors that have contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 11.4% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Orbit Type

|

|

By Satellite Type

|

|

|

By Component

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 2.38 billion in 2023.

The market is likely to grow at a CAGR of 11.4% over the forecast period (2024-2032).

By orbit type, the LEO segment is anticipated to lead the market during the forecast period.

The market size of North America stood at USD 1.01 billion in 2023.

Lowering spacecraft avionics costs through radiation-tolerant COTS electronics is a key factor driving the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us