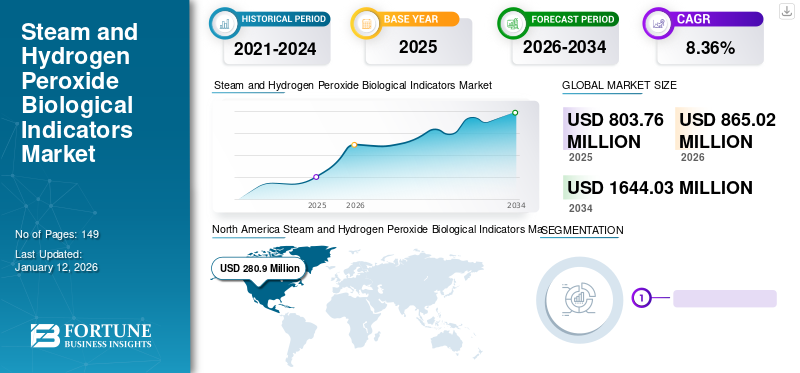

Steam and Hydrogen Peroxide Biological Indicators Market Size, Share & COVID-19 Impact Analysis, By Product Type (Self-contained Vials, Spore Strips, and Spore-suspension), By Application (Pharmaceutical & Medical Device Companies, Healthcare Facilities, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global steam and hydrogen peroxide biological indicators market size was valued at USD 803.76 million in 2025 and is projected to grow from USD 865.02 million in 2026 to USD 1,644.03 million by 2034, exhibiting a CAGR of 8.36% during the forecast period. North America dominated the global market with a share of 34.90% in 2025. Moreover, the U.S. steam and hydrogen peroxide biological indicators market size is projected to grow significantly, reaching an estimated value of USD 387.7 million by 2030, driven by rising incidence of surgical site infection demanding the increased focus on sterilization in healthcare settings.

A Biological Indicator (BI) provides a direct measure of lethality and assurance in the efficacy of a sterilization process. Depending on specific type, biological indicators can be used for various sterilization processes using hydrogen peroxide, steam, ethylene oxide, and other gases.

The growing focus on sterilization in healthcare facilities, food and beverage, and biotechnology and pharmaceutical industries is the primary factor in augmenting the global market's growth. Moreover, stringent government regulations to prevent contamination and new product launches by key players favor the global steam and hydrogen peroxide biological indicators market growth during the forecast period.

Steam and Hydrogen Peroxide Biological Indicators Market Overview

Market Size & Forecast

- 2025 Market Size: USD 803.76 million

- 2026 Market Size: USD 865.02 million

- 2034 Forecast Market Size: USD 1,644.03 million

- CAGR: 8.36% from 2026–2034

Market Share

- North America dominated the steam and hydrogen peroxide biological indicators market with a 34.90% share in 2025, driven by stringent infection control regulations, growing surgical volumes, and rapid adoption of sterilization monitoring protocols across healthcare and pharmaceutical sectors.

- By product type, Self-contained Vials held the largest market share in 2024, attributed to their high reliability, ease of use, and fast result delivery, making them highly preferred in both developed and developing healthcare markets.

Key Country Highlights

- United States: The U.S. market is projected to reach USD 387.7 million by 2030, supported by increasing surgical site infection cases and reinforced sterilization guidelines in hospitals and dental clinics.

- Canada: Weekly use of biological indicators is mandated in dental practices, reflecting a high emphasis on routine sterilization monitoring.

- China & India: Rapid expansion of pharmaceutical and medical device manufacturing industries is fostering high demand for sterilization processes and related biological indicators.

- Japan: Stringent pharmaceutical regulations and aging population drive increased sterilization monitoring across healthcare facilities.

- Germany & U.K.: The region sees strong growth due to aging populations, longer hospital stays, and rising HAIs (Hospital-Acquired Infections), prompting the adoption of biological indicators in hospital sterilization workflows.

COVID-19 IMPACT

Outbreak of COVID-19 Favored Growth in Sales of Products

The emergence of COVID-19 has accelerated the demand for sterilization and disinfectant products across pharmaceutical, biotech, and other companies involved in manufacturing healthcare technologies. The outbreak of COVID-19 has led the biotechnology and pharmaceutical companies to focus more on sterilization monitoring steps that have simultaneously increased the demand for steam and hydrogen peroxide biological indicators.

Additionally, the pandemic has exposed the need for sterilization monitoring in hospitals, dental clinics, and other healthcare facilities before loading medical instruments. The pandemic has also highlighted the importance of sterile and infection-free medical instruments during dental practice and invasive surgical procedures to avoid viral or bacterial Hospital-Acquired Infections (HAIs). Therefore, this led to an upsurge in demand and adoption of steam and hydrogen peroxide biological indicators. Thus, the global market witnessed positive growth in the financial year 2020.

Furthermore, the prominent players operating in the market also witnessed a significant increase in their revenue during the pandemic owing to increase in their product sales.

- For instance, 3M company’s medical solution observed a revenue growth of 25.9% in 2020 compared to the previous years. The medical solution business segment comprises biological and other indicators.

However, the market is expected to grow normally in the post-pandemic period due to various factors such as utilization of already stocked products, rise in surgical procedures, and growing focus to reduce the incidence of surgical site infections, among others.

LATEST TRENDS

Download Free sample to learn more about this report.

Shifting Preference Toward Rapid Biological Indicators is a Prominent Trend in the Market

Pharmaceutical and biotechnology industries are engaged in manufacturing healthcare products and are usually subjected to very strict regulations and standards to ensure the highest levels of sterility. Pharmaceutical industries are launching many parenteral drugs due to the rising prevalence of chronic diseases and the growing demand for them (including heart medications, antibiotics, and analgesics) due to their immediate therapeutic effect. Thus, continuous sterilization and monitoring are essential to facilitate the supply of sterile and safe products.

The increasing demand for rapid biological indicators over conventional products among drug and medical device manufacturers is increasing production efficiency. Conventional biological indicators are primarily self-contained and comprise spore strips, growth media, pH indicators, and others that require at least 72 h to 168 h of incubation for effective results.

However, the lesser result time offered by rapid biological indicators compared to conventional products is anticipated to raise their adoption among consumers. Moreover, the regulatory bodies have also approved rapid biological indicators, further supporting their demand in the coming years.

- For instance, in January 2020, the U.S. FDA approved Sterrad Velocity Biological Indicator, a rapid biological indicator with 15 miss. result time developed by Advanced Sterilization Products (ASP).

STEAM AND HYDROGEN PEROXIDE BIOLOGICAL INDICATORS MARKET GROWTH FACTOR

Growing Focus on Sterilization in Healthcare Facilities to Propel Market Growth

Globally, the chronic diseases’ increasing prevalence, increasing healthcare expenditure, and growing diagnoses have presented a large patient pool undergoing surgical procedures. For instance, according to the article “Action Framework for Safe and Affordable Surgery in the Western Pacific Region (2021–2030), published by the World Health Organization (WHO), there are 313 million surgeries performed every year worldwide.

This creates a huge demand for surgical instruments and reusable devices, such as clamps, scissors, forceps, and others, in healthcare facilities. A major risk of surgical procedures is the inception of pathogenic microbes, leading to a Hospital-Acquired Infection (HAI). To reduce the growing incidence of HAIs, regulatory bodies are focusing on applying various guidelines with an ever-increasing emphasis on sterilization in healthcare settings to ensure the safety of the patients and reduce the costs associated with HAIs. This subsequently leads to higher demand for new and advanced sterilizers by healthcare facilities globally.

The growing demand and adoption of sterilizers drive the demand for monitoring devices, including steam and hydrogen peroxide biological indicators. The factors, combined with innovations in the biological indicators by market players, facilitate the acceptance of these products in the market.

- For instance, in December 2020, STERIS announced the launch of Spordex Self-contained Vials Biological Indicator (SCBI) Ampoules for steam sterilization.

RESTRAINING FACTORS

Presence of Alternate Products to Restrict Market Growth

Biological indicators have always been the foremost method of assessing the sterility of any medical or pharmaceutical environment by using the most resistant microorganism strains. However, alternate products, such as enzyme indicators with distinct functional benefits compared to biological and chemical indicators, are anticipated to limit the adoption of biological indicators.

Unlike the traditional biological indicators, enzyme indicators provide instant results, accurate data capture, are simple and easy to use, and are reasonably priced. Moreover, the enzyme indicates a non-toxicological risk and can be used in any part of the process.

Market players invest in R&D through strategic collaborations and acquisitions and seek approval for steam and hydrogen peroxide biological indicators.

- For instance, in December 2021, the U.S. FDA approved the Instant 20s Indicator, an enzymatic indicator developed by True Indicating LLC. The enzyme indicator is intended to monitor the steam sterilization process at 121° C, 30 minutes (Gravity), 132° C, 4 mins. (pre-vacuum), and 135° C, 3 mins. (pre-vacuum).

All the above factors and the high cost of the steam and hydrogen peroxide biological indicators are restricting their adoption, further hampering the market growth in the forecast period.

SEGMENTATION

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Self-contained Vials Segment to Hold a Dominant Share due to Growing Adoption Rate of Biological Indicators

Based on product type, the market is segmented into self-contained vials, spore strips, and spore-suspension.

The self-contained vials segment dominated the global steam and hydrogen peroxide biological indicators market in 2026, accounting for 67.33% of the market with a size of USD 582.4 million. The dominance is driven by a higher adoption rate in both developed and developing economies due to the various benefits. Self-contained Biological Indicators (SCBIs) provide fast, visible, consistent, and reliable results that assure an effective sterilization process. This coupled with various novel and innovative product launches will boost market growth during the forecast period.

The spore strips segment will hold the second-largest market share during the forecast period. The comparatively lower cost of spore strips leads to higher demand for these products in sterilization monitoring for process challenge devices in small clinics and healthcare facilities.

By Application Analysis

Growing Focus on Sterilization in Healthcare Facilities Enabled Dominance of the Segment

Based on application, the market is segmented into pharmaceutical & medical device companies, healthcare facilities, and others.

The healthcare facilities segment dominated the global market in 2026, accounting for 72.26% of the market with a size of USD 625.1 Million. The segment's dominance is due to the rising number of healthcare facilities emphasizing the sterilization process due to the increasing prevalence of hospital-acquired infections.

- For instance, according to the National Nosocomial Infections Surveillance (NNIS) system estimates, around 5%-10% of patients contract at least one hospital-acquired infection due to contaminated instruments, objects, and other causes.

The pharmaceutical & medical device companies segment accounted for the second-largest market share. Stringent government regulations to prevent contamination and undergo sterilization due to increased product recalls favor market growth in pharmaceutical & medical device companies during the forecast period.

- For instance, in February 2023, the U.S. FDA voluntarily recalled EzriCare Artificial Tears, developed by Global Pharma, owing to potential bacterial contamination. Thus, the need for sterilization and monitoring is increasing to prevent such product contamination.

REGIONAL INSIGHTS

North America Steam and Hydrogen Peroxide Biological Indicators Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America market stood at USD 280.9 million in 2025. North America is expected to dominate the global steam and hydrogen peroxide biological indicators market share during the forecast period. The higher emphasis of healthcare facilities, pharmaceutical, and medical device companies on sterilization is primarily responsible for the region's dominance. The US market is projected to reach USD 287.5 million by 2026.

- For instance, according to an article published by the Journal of the Canadian Dental Association in 2021, in most North American jurisdictions, guidelines for using Biological Indicators (BIs) in general dental practice have recommended testing at least weekly.

Additionally, the constant focus of market players on introducing innovative steam and hydrogen peroxide biological indicators is another major factor responsible for the dominance of North America in the forthcoming years.

Europe is anticipated to register a significant CAGR during the forecast period. A large pool of geriatric patients suffering from chronic disorders associated with longer hospital stays leads to increasing hospital-acquired infections in the region. Therefore, this contributes to the growing emphasis on the sterilization process in healthcare facilities and boosts the demand for sterilization monitoring devices/products, including steam & hydrogen peroxide biological indicators. The UK market is projected to reach USD 33.4 million by 2026, while the Germany market is projected to reach USD 53.8 million by 2026.

Asia Pacific is expected to register the highest CAGR during the forecast period. The rapid growth of pharmaceutical and medical device manufacturing in China, India, and other countries is driving the demand for sterilization in these countries. This simultaneously augments the need for biological indicators and favors market growth during the forecast period. The Japan market is projected to reach USD 55.6 million by 2026, the China market is projected to reach USD 72.3 million by 2026, and the India market is projected to reach USD 41.8 million by 2026.

Latin America and the Middle East & Africa accounted for a comparatively lower market share attributable to less awareness among the population about steam & hydrogen peroxide biological indicators.

KEY INDUSTRY PLAYERS

Strong Portfolio of Mesa Labs, Inc. and 3M to Help Them Lead the Global Market

The global market is consolidated with major players, including 3M, STERIS, ASP, Getinge, and Mesa Labs, Inc., comprising the largest global market share. 3M is the leading player in the global market, with the highest market share in 2024. The company’s dominant position in the global market is attributed to its robust distribution network, a strong portfolio of biological indicators, and a strong brand presence.

Other leading players, such as Steris and Getinge, are engaging in various strategic business activities to expand their product portfolio and geographical presence, contributing to their high market share.

- For instance, in November 2021, Getinge acquired Verrix, a developer of rapid biological indicators for steam sterilization workflow.

Other players such as Tuttnauer, Bioquell, An Ecolab Solution, Terragene, and others continuously engage in strategic expansion initiatives to establish their footprints in emerging regions.

LIST OF KEY COMPANIES PROFILED IN STEAM AND HYDROGEN PEROXIDE BIOLOGICAL INDICATORS MARKET:

- 3M (U.S.)

- STERIS (U.S.)

- Getinge (Sweden)

- Mesa Labs, Inc. (U.S.)

- Tuttnauer (U.S.)

- Bioquell, An Ecolab Solution (U.K.)

- Terragene (Argentina)

KEY INDUSTRY DEVELOPMENTS:

- June 2022- 3M received marketing approval for 3M Attest Rapid Readout Biological Indicator 1295. This biological indicator is designed for routine monitoring of vaporized hydrogen peroxide sterilization processes.

- March 2022- Tuttnauer acquired Prestige Medical Limited, a U.K.-based company specializing in the distribution and manufacturing of sterilization equipment. Through this acquisition, the company aimed to expand its distribution network in selected countries.

- April 2022- Etigam bv announced the discontinuation of hydrogen peroxide biological indicators. Through this decision, the company will likely focus more on steam biological indicators and others and gain market recognition for the continued segments.

- December 2021 – Terragene established a commercial partnership with Keir Surgical Ltd., a Canadian surgical products company. Through this partnership, the company intends to offer its biological indicators for steam and plasma sterilization and instant-read steam biological indicators.

- June 2021– STERIS completed the acquisition of Cantel Medical LLC., a global provider of infection prevention products and services. The acquisition led to the addition of Crosstex biological indicator products to STERIS healthcare and life science segment and strengthened its position in the market.

REPORT COVERAGE

An Infographic Representation of Steam and Hydrogen Peroxide Biological Indicators Market

To get information on various segments, share your queries with us

The market research report provides a detailed market analysis. It focuses on key aspects such as leading companies, product type, and applications. Besides this, it offers insights into market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.36% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product Type, By Application, and By Geography |

|

By Product Type |

|

|

By Application |

|

|

By Geography

|

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 803.8 million in 2025 to USD 1,644.03 million by 2034.

In 2025, the market size in North America was USD 280.9 million.

The market will exhibit steady growth at a CAGR of 8.1% during the forecast period (2026-2034).

By product type, the self-contained vials segment will lead the market.

The growing focus of healthcare facilities & pharmaceutical companies on sterilization and the increasing product launches are the key drivers of the market.

3M, STERIS, ASP, Getinge, and others are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic