Sterilization Equipment Market Size, Share & COVID-19 Impact Analysis, By Product Type (Thermal Sterilizers {Dry-heat Sterilizers and Moist-heat Sterilizers}, Chemical/Gas Sterilizers {Hydrogen Peroxide Sterilizers, Ethylene Oxide Sterilizers, Nitrogen Dioxide Sterilizers, and Others}, and Others), By End-user (Hospital & Specialty Clinic, Pharmaceutical & Medical Device Manufacturers, and Others), and Regional Forecast, 2026-2034

Sterilization Equipment Market Size

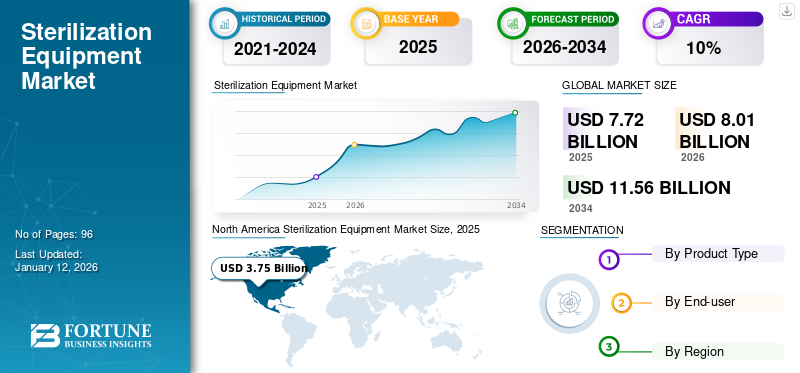

The global sterilization equipment market size was valued at USD 7.72 billion in 2025. The market is projected to grow from USD 8.01 billion in 2026 to USD 11.56 billion by 2034, exhibiting a CAGR of 4.70% during the forecast period. North america dominated the sterilization equipment market with a market share of 48.56% in 2025.

Sterilization equipment are used for decontaminating the equipment and consumables used in hospitals, biopharmaceutical companies, research institutes, and other healthcare facilities.

Hospital-acquired infections (HAI), such as urinary tract infections (UTI) and surgical site infections, can be caused to patients if the equipment used during the treatment process is not sterilized properly. The burden of HAI has been increasing significantly across the globe.

- For instance, as per the data published by the World Health Organization (WHO) in May 2022, out of every 100 patients in acute-care hospitals in high-income countries, seven patients tend to get hospital-acquired infection (HAI). Similarly, in low and middle-income countries, this number is 15. Moreover, on average, 1 in every ten patients diagnosed with hospital-acquired infection dies.

Such high mortality rates due to hospital-acquired infections have increased the demand for proper sterilization of equipment and consumables used in hospitals and other healthcare facilities. Sterilizers such as ethylene oxide sterilizers, autoclaves, and others are used for the sterilization process. The increasing demand for efficient sterilization is anticipated to fuel the market for sterilization equipment over the forecast period. Moreover, the increased research activity conducted by pharmaceutical and biotechnological companies for biologics development has also been fueling the demand for sterilizers to prevent contamination.

Sterilization Equipment Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 7.72 billion

- 2026 Market Size: USD 8.01 billion

- 2034 Forecast Market Size: USD 11.56 billion

- CAGR: 4.70% from 2026–2034

Market Share:

- North America dominated the sterilization equipment market with a 48.56% share in 2025, driven by high healthcare expenditure, a strong hospital network, and increased awareness of hospital-acquired infections (HAIs). The U.S. alone houses over 6,100 hospitals, supporting robust demand for sterilization technologies.

- By product type, Chemical/Gas Sterilizers are expected to retain the largest market share in 2025, fueled by the strong demand for low-temperature sterilization technologies such as ethylene oxide and hydrogen peroxide sterilizers. These methods are especially suitable for heat-sensitive materials and are widely used in hospitals and for medical device sterilization.

Key Country Highlights:

- Japan: Market growth is driven by the country’s advanced medical infrastructure, increasing elderly population, and rising prevalence of hospital-acquired infections. Demand for low-temperature sterilization, especially for robotic and endoscopic tools, is growing steadily.

- United States: The market benefits from substantial investment in hospital infrastructure and stringent regulatory guidelines to reduce HAIs. Programs led by the CDC and HHS aim to improve sterilization compliance across healthcare facilities. The country also leads in biologics R&D, which boosts sterilizer demand in pharmaceutical manufacturing.

- China: Growing government investment in healthcare infrastructure and pharmaceutical innovation under the “Healthy China 2030” initiative is boosting demand for sterilization systems. Expansion of hospital capacity and biopharmaceutical R&D is further supporting market growth.

- Europe: Market expansion is supported by rising awareness of HAIs and regulatory requirements to control infection spread in hospitals. Countries like Germany, the U.K., and France are investing in upgrading hospital sterilization infrastructure, while biopharma companies continue to grow their production capacities.

COVID-19 IMPACT

Market Experienced Slow Growth during COVID-19 Pandemic due to Supply Chain Disruption

Due to the COVID-19 pandemic, the market experienced slow growth during 2020. After the COVID-19 outbreak, the demand for sterilizers increased significantly in hospitals and other healthcare facilities in order to control the increasing spread of the virus. However, market players were not able to fulfill the demands. This was due to the lockdown restrictions imposed to control the spread of the virus, causing supply chain disruption. As a result, the market experienced slow growth during this period.

However, in the third quarter of 2020, when lockdown restrictions were lifted, market players increased their focus on fulfilling the demand for sterilization systems. Due to this, market players experienced significant growth in 2020.

- For instance, Steris generated a revenue of USD 685.9 million in 2020 from its applied sterilization technologies, experiencing a growth of 9.4% from the prior year.

Moreover, the market grew significantly in 2021 as the demand for sterilization systems increased due to increased awareness about sterilization at hospitals, clinics, and ambulatory surgical centers. Market players also experienced growth in the revenue generated by their sterilizer product portfolio due to the surge in the demand for these devices.

- For instance, Steris generated a revenue of USD 853.0 million in 2021 from its applied sterilization technologies portfolio, experiencing an increase of 24.4% from the prior year.

Sterilization Equipment Market Trends

Incorporation of Advanced Technology to Spur Market Growth

Sterilization is a crucial process in healthcare facilities to sterilize, clean, and disinfect medical equipment and biological specimens. The conventional methods used for sterilization are ethylene oxide, heat sterilization, and hydrogen peroxide sterilization. However, there are certain limitations associated with these conventional methods, such as the risk of specimen damage due to high temperatures, long processing hours, and the addition of harmful chemicals.

In order to overcome these limitations, market players have increased their focus on adopting advanced technology. Ozone and vaporized hydrogen peroxide sterilization are examples of advanced low-temperature sterilization methods. These methods are suitable for sterilizing heat-sensitive products such as endoscopes and robotic-sensitive products.

Other technologies that are being incorporated into sterilization methods are robots and automation. These technologies include robotic-assisted sterilization, decontamination, and inventory management systems. There are various advantages associated with using these methods, which have been fueling its demand, such as efficiency, accuracy, and minimal human error. Many companies have increased their focus on autonomous disinfection robot launches.

- In January 2021, ZETABANK. Co., Ltd., a Korean robotic manufacturer, launched a line of autonomous mobile disinfection robots.

- North America witnessed a growth from USD 4.95 Billion in 2023 to USD 5.41 Billion in 2024.

Download Free sample to learn more about this report.

Sterilization Equipment Market Growth Factors

Increasing Prevalence of Hospital-Acquired Infection to Fuel the Demand for Sterilization Equipment

The prevalence of hospital-acquired infections (HAI), such as sepsis, urinary tract infections, and surgical infections, are increasing significantly worldwide. For instance, as per the study published by the National Center for Biotechnology Information (NCBI) in 2022, the global urinary tract infection (UTI) increased by 60.4% from 252.3 million in 1990 to 404.6 million in 2019.

Moreover, according to the same study, global deaths due to UTI increased by 140.2% from 1990 to 236,790 in 2019. Hospital-acquired infection can be caused due to the use of unsterilized medical equipment such as catheters. Such high mortality rates have raised concerns about patients’ safety. Several government regulatory bodies globally have announced guidelines to control the prevalence of these infections.

- For instance, in the U.S., in 2008, the Health and Human Services (HHS) Steering Committee was established to prevent hospital-acquired infection. The Steering Committee, program officials, and scientists across HHS developed an Action Plan to prevent HAI in acute care hospitals.

The increasing prevalence of hospital-acquired infection and increasing government initiatives to prevent its spread have fueled the demand for sterilization systems, thereby fueling the sterilization equipment market growth.

Increasing Development of Biological Products to Fuel Market Growth over the Forecast Period

Biologics are therapeutic entities composed of proteins or nucleic acids manufactured from natural sources such as humans, animals, or microorganisms. The increasing prevalence of chronic diseases has increased the demand for biological therapeutics due to their efficiency. Many drug manufacturers are strategizing for new drug approvals and research and development of biological drugs.

- For instance, according to data published by the National Center for Biotechnology Information (NCBI), in 2021, the U.S. FDA approved 50 drugs, making it the fourth-best year after 2018. Whereas in 2019, 48 novel drugs received FDA approval. The approved biological drugs observed a growth of 4.2% in 2021 compared to 2019.

Moreover, cell and gene therapy products are observed to be an emerging treatment for genetic diseases, cancer, and infectious diseases. As per the U.S. FDA, 32 cell and gene therapy drugs are approved till June 2023. The growth and development of viral delivery systems have emerged as effective tools for gene manipulation and gene therapy approaches. Hence, this encourages the R&D to develop cell and gene therapy products.

The types of equipment and consumables involved during the biologics development and manufacture must undergo sterilization to prevent contamination. Hence, the increasing approval and development of biological therapeutics has expanded the growth of the sterilization equipment industry globally.

RESTRAINING FACTORS

Lack of Skilled Workforce and High Installation Cost to Hinder Market Growth

The increasing prevalence of hospital acquired infections and rising awareness about sterilization during biologics manufacturing has fueled the market growth. However, factors such as the lack of a skilled workforce for operating sterilization restrict the adoption of sterilization equipment.

The lack of a skilled workforce for sterilization can lead to inappropriate sterilization. In many cases of sterilization, the medical device's Instructions for Use (IFU) manual is not followed properly, resulting in inappropriate sterilization. All these factors can cause hospital-associated infections in patients treated with these devices.

Moreover, the installation of sterilizing equipment can be quite costly. For instance, the cost of a 3AV model autoclave with a volume of 249 liters starts at USD 28,000.0. Similarly, the cost of a 26AV model autoclave with a capacity of 430 liters starts from USD 35,000.0. Sometimes, it is not feasible for a small private healthcare facility, research institute, or pharmaceutical company to install these devices due to budget constraints.

Therefore, the high costs associated with these sterilizing devices and the lack of a skilled workforce could hinder the market.

Sterilization Equipment Market Segmentation Analysis

By Product Type Analysis

Chemical/Gas Sterilizers Segment’ Dominance is owed to its Advantages over Other Sterilizers

Based on product type, the market is segmented into thermal sterilizers, chemical/gas sterilizers, and others. The thermal sterilizers segment is further classified into dry-heat sterilizers and moist-heat sterilizers. Similarly, chemical/gas sterilizers are further sub-segmented into hydrogen peroxide sterilizers, ethylene oxide sterilizers, nitrogen dioxide sterilizers, and others.

- The chemical/gas sterilizers segment is expected to hold a 72.84% share in 2026.

Chemical/gas sterilizers dominated the market by accounting for a significant global sterilization equipment market share by 72.84% in 2026 and are expected to grow at a strong CAGR during the forecast period. The growth of the segment is attributed to the strong sales of ethylene oxide sterilizer systems. Moreover, chemical sterilization provides sterilization at low temperatures, which helps maintain the integrity of the product being sterilized. These sterilizers effectively sterilize a broad range of products, such as polymers, medical devices, resins, and natural materials, among others. Such advantages associated with these sterilizers are responsible for the segment’s growth.

Thermal sterilizers are anticipated to grow at a substantial CAGR during the forecast period. Thermal sterilizers, such as autoclaves, are used to sterilize test tubes, beakers, and other products used in research laboratories. Therefore, the increasing focus of biopharmaceutical companies and academic institutes on the research and development of therapeutics is responsible for the growth of this segment during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Hospital & Specialty Clinic Segment Leads Due to Rising Hospital-Acquired Infection Globally

Based on end-user, the market is sub-segmented into hospital & specialty clinic, pharmaceutical & medical device manufacturers, and others. The hospital & specialty clinic segment dominated the market in 2024. This growth is attributed to the increased prevalence of hospital-acquired infection globally. The segment is expected to hold 61.36% of the market share in 2026.

- For instance, the Centers for Disease Control (CDC) estimated that every year, 1.7 million people are infected with hospital-acquired infection, and around 99,000 of the infected patients die each year. Such a high burden of these infections has increased the demand for effective sterilization, fueling the segment's growth.

The pharmaceutical & medical device manufacturers segment is expected to grow at a substantial CAGR of 10.3% during the forecast period. The segment's growth is attributed to the increased expenditure by the pharmaceutical and biotechnology companies on drug development.

- For instance, as per the Indian Economic Survey 2021 analysis, Indian pharmaceutical companies spend around 7.2% of their total turnover on research and development. The expenditure on R&D is likely to increase due to the introduction of novel product patents, and companies need to develop new drugs to boost sales. Moreover, in the year 2021, Lupin had the highest amount of spending on R&D, with USD 171.5 million.

REGIONAL INSIGHTS

Based on region, the market has been studied across North America, Europe, Asia Pacific, and the rest of the world.

North America Sterilization Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the global market in 2026 by capturing a significant market share of USD 3.88 billion, in 2025, the regional value stood at USD 3.75 billion. The region’s growth is attributed to the increasing healthcare expenditure and the strong presence of hospitals in the country. The U.S. market size is estimated to be USD 3.67 billion in 2026.

- For instance, as per the Fast Facts on U.S. Hospitals – 2023 report published by the American Hospital Association, there are around 6,129 hospitals in the U.S. Out of these, 5,157 are community hospitals, and 206 are federal government hospitals.

Europe

Europe accounted for a substantial share in 2024. The regional market value is likely to be USD 3.09 billion as the second-largest market with a second-largest CAGR of 25.8% during the forecast period. The regional market’s growth is attributed to the increasing prevalence of hospital-acquired infections and the rising awareness of these infections in the region. The market size in U.K. is expected to be USD 0.38 billion in 2026. On the other hand, Germany is likely to be USD 0.49 billion in 2026, France is projected to be USD 0.42 billion in 2025.

- For instance, according to the European Centre for Disease Prevention and Control, around 4.0 million patients are estimated to acquire healthcare associated infection every year.

Asia Pacific

Asia Pacific is anticipated to be the third-largest market with a value of USD 2 billion and to grow at a significant CAGR during the forecast period. The growth of the regions’ sterilization equipment sector is attributed to the increasing investment by pharmaceutical and biotechnology companies for new therapeutics development and increasing awareness about infectious diseases. The market in China is expected to be at USD 0.31 billion in 2026, whereas India is likely to stand at USD 0.23 billion and Japan is projected to hit USD 2.03 billion in 2026.

The market in the rest of the world is expected to grow at a substantial CAGR during the forecast period. The growth is attributed to the increasing prevalence of infectious diseases such as human immunodeficiency virus (HIV) in emerging countries. Moreover, increasing government initiatives in these countries for the installation of sterilization devices at healthcare facilities.

KEY INDUSTRY PLAYERS

Increasing Focus of Players on the Expansion of their Product Portfolio to Promote Market Growth

Market players such as STERIS, Getinge AB, and 3M are among the significant players in the global market. Their growth is attributed to an increased focus on strengthening its sterilizer product portfolio.

- For instance, in June 2023, STERIS acquired laparoscopic instrumentation, surgical instrumentation, and sterilization containers from BD, a medical technology, to strengthen its product portfolio.

Other market players, such as ASP, Andersen Sterilizers, and Noxilizer Inc., have been focusing on commercializing products to enhance the efficiency of their sterilizers.

- For instance, in August 2021, ASP commercialized STERRAD VELOCITY, a biological indicator that gives results in less than 15 minutes. This commercialization aimed to increase the efficiency of hydrogen peroxide sterilization.

List of Top Sterilization Equipment Companies:

- STERIS (U.S.)

- Getinge AB (Sweden)

- ASP (U.S.)

- 3M (U.S.)

- Cardinal Health (U.S.)

- MMM Group (Germany)

- MATACHANA (Spain)

- Andersen Sterilizers (U.S.)

- Noxilizer Inc. (U.S.)

- Continental Equipment Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023 – Andersen Sterilizers, along with its sister company, Andersen Scientific, a contract sterilization specialist, were awarded the first master file from FDA 510(k) in the Ethylene Oxide (EO) Sterility Change Master File Pilot Program.

- March 2023 – Getinge AB acquired Ultra Clean Systems Inc., an ultrasonic cleaning technologies manufacturer. This acquisition aimed to enhance its product offerings in North America.

- September 2021 – Steris launched integrated Vaporized Hydrogen Peroxide (VHP) biodecontamination systems for reducing 6-log bioburden in GMP biopharmaceutical, research, and medical devices.

- September 2020 – Steris collaborated with the Association for the Advancement of Medical Instrumentation (AAMI) and medical industry leaders. Together, they worked on developing a free publication discussing practices and strategies that are best for sterilizing medical devices and packaging.

- September 2020 – MATACHANA and Allentown formed a strategic alliance together. With this alliance, MATACHANA enhanced its distribution of sterilizers in the U.S., U.K., and Switzerland.

REPORT COVERAGE

The market research report provides a detailed competitive landscape. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new solution launches in the market. Furthermore, the report covers regional analysis of different segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.70% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is projected to grow from USD 8.01 billion in 2026 to USD 11.56 billion by 2034.

In 2025, the market value stood at USD 3.75 billion.

The market is predicted to exhibit a CAGR of 4.70% during the forecast period of 2026-2034.

By product type, the chemical/gas sterilizers segment leads the market.

Rising prevalence of hospital-acquired infection, surgical procedures, and increasing investment in R&D by pharmaceutical and biotechnological companies fuel market growth.

STERIS, Getinge AB, and 3M are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us